Best MidCap Stocks

|

| In a hurry? Mid Cap Stocks Lists: Performance Trends Table, Stock Charts

Sort midcap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter midcap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter midcap stocks list by size:All MidCap Large Mid-Range Small |

| 12Stocks.com Mid Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 49 (0-bearish to 100-bullish) which puts Mid Cap index in short term neutral trend. The Smart Investing & Trading Score from previous trading session is 63 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested mid cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Top Performing Mid Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Mid Cap Index stocks year to date are

Now, more recently, over last week, the top performing Mid Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Midcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Midcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Midcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| CSL | Carlisle |   | Consumer Staples | 382.03 | 68 | 1.79% | 22.28% |

| UAL | United Airlines |   | Transports | 53.51 | 68 | 1.59% | 29.69% |

| CRUS | Cirrus Logic |   | Technology | 87.31 | 68 | 1.18% | 4.95% |

| CEG | Constellation Energy |   | Utilities | 188.01 | 68 | 0.72% | 60.54% |

| CW | Curtiss-Wright |   | Industrials | 253.49 | 68 | 0.34% | 13.78% |

| JEF | Jefferies Financial |   | Financials | 43.46 | 68 | -2.56% | 7.55% |

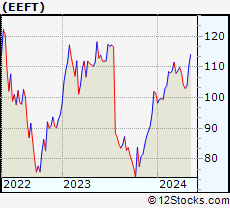

| EEFT | Euronet Worldwide |   | Services & Goods | 103.61 | 68 | -1.95% | 2.09% |

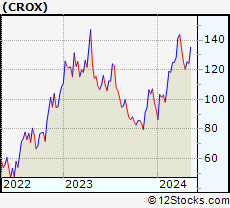

| CROX | Crocs |   | Consumer Staples | 123.51 | 68 | -1.80% | 32.22% |

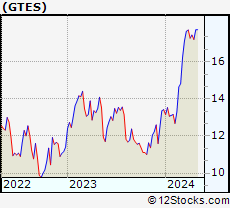

| GTES | Gates Industrial |   | Industrials | 17.45 | 68 | -1.80% | 30.03% |

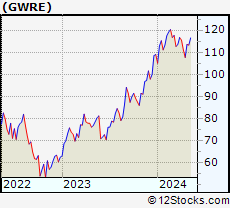

| GWRE | Guidewire Software |   | Technology | 111.98 | 68 | -1.35% | 2.70% |

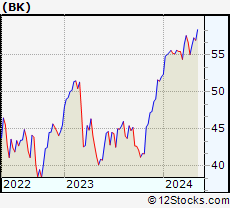

| BK | Bank of New York |   | Financials | 57.18 | 68 | -1.33% | 9.86% |

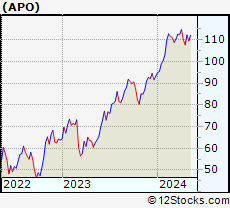

| APO | Apollo Global |   | Financials | 111.88 | 68 | -0.75% | 20.06% |

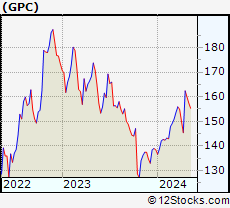

| GPC | Genuine Parts |   | Services & Goods | 161.07 | 68 | -0.45% | 16.30% |

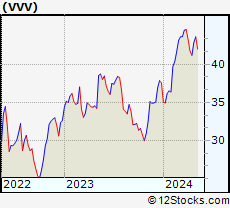

| VVV | Valvoline |   | Energy | 42.52 | 68 | -0.21% | 13.15% |

| AFG | American Financial |   | Financials | 128.71 | 68 | -0.78% | 8.26% |

| HR | Realty |   | Financials | 14.03 | 67 | -2.43% | -18.57% |

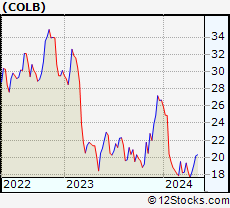

| COLB | Columbia Banking |   | Financials | 19.01 | 67 | -1.04% | -28.75% |

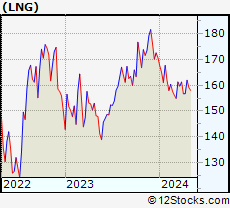

| LNG | Cheniere Energy |   | Energy | 159.36 | 67 | 1.23% | -6.65% |

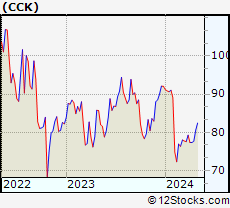

| CCK | Crown |   | Consumer Staples | 79.78 | 67 | 1.21% | -13.37% |

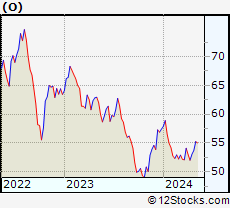

| O | Realty ome |   | Financials | 53.80 | 67 | 0.24% | -6.30% |

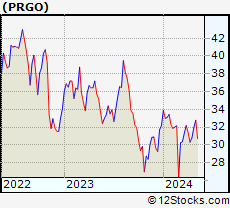

| PRGO | Perrigo |   | Health Care | 31.27 | 67 | 0.13% | -2.83% |

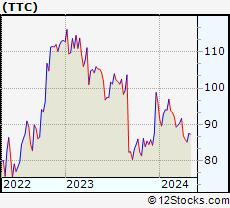

| TTC | Toro |   | Industrials | 86.72 | 67 | -0.55% | -9.66% |

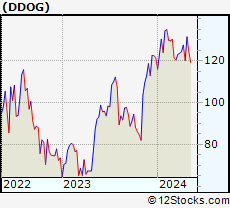

| DDOG | Datadog |   | Technology | 125.21 | 66 | -1.46% | 3.16% |

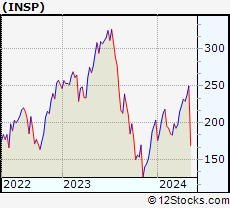

| INSP | Inspire Medical |   | Technology | 231.01 | 66 | -1.36% | 13.56% |

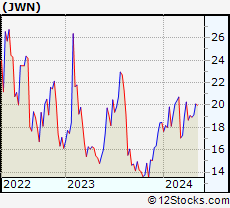

| JWN | Nordstrom |   | Services & Goods | 19.00 | 66 | -1.35% | 2.98% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Midcap Stocks |

| Midcap Technical Overview, Leaders & Laggards, Top Midcap ETF Funds & Detailed Midcap Stocks List, Charts, Trends & More |

| Midcap: Technical Analysis, Trends & YTD Performance | |

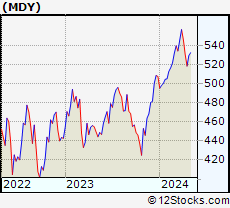

| MidCap segment as represented by

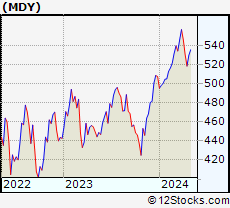

MDY, an exchange-traded fund [ETF], holds basket of about four hundred midcap stocks from across all major sectors of the US stock market. The midcap index (contains stocks like Green Mountain Coffee Roasters and Tractor Supply Company) is up by 4.04% and is currently underperforming the overall market by -1.12% year-to-date. Below is a quick view of technical charts and trends: | |

MDY Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Not Good | |

MDY Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 49 | |

| YTD Performance: 4.04% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Midcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Midcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Midcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Midcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IJH | iShares Core S&P Mid-Cap |   | 57.68 | 61 | -0.33 | 1.94 | 4.06% |

| IWP | iShares Russell Mid-Cap Growth |   | 108.46 | 51 | -0.03 | 2.61 | 3.83% |

| IWR | iShares Russell Mid-Cap |   | 80.27 | 56 | -0.17 | 2.05 | 3.27% |

| MDY | SPDR S&P MidCap 400 ETF |   | 527.86 | 49 | -0.37 | 1.85 | 4.04% |

| IWS | iShares Russell Mid-Cap Value |   | 119.79 | 61 | -0.15 | 1.82 | 3.01% |

| IJK | iShares S&P Mid-Cap 400 Growth |   | 86.74 | 56 | -0.29 | 2.23 | 9.49% |

| IJJ | iShares S&P Mid-Cap 400 Value |   | 111.95 | 51 | -0.57 | 1.27 | -1.83% |

| XMLV | PowerShares S&P MidCap Low Volatil ETF |   | 54.74 | 68 | -0.55 | 1.07 | 2.93% |

| SMDD | ProShares UltraPro Short MidCap400 |   | 11.89 | 39 | 0.46 | -5.36 | -11.69% |

| UMDD | ProShares UltraPro MidCap400 |   | 23.72 | 49 | -1.54 | 5.13 | 6.27% |

| MVV | ProShares Ultra MidCap400 |   | 61.03 | 41 | -0.93 | 3.44 | 5.42% |

| MZZ | ProShares UltraShort MidCap400 |   | 11.75 | 34 | 0.51 | -3.46 | -6.53% |

| MYY | ProShares Short MidCap400 |   | 20.97 | 39 | 1.11 | -1.03 | -2.26% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of MidCap Stocks | |

|

We now take in-depth look at all MidCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort MidCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

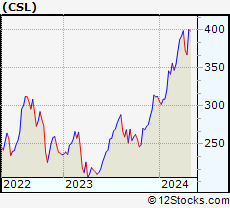

| CSL Carlisle Companies Incorporated |

| Sector: Consumer Staples | |

| SubSector: Rubber & Plastics | |

| MarketCap: 6542.7 Millions | |

| Recent Price: 382.03 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 1.79% Day Change: 6.73 | |

| Week Change: 3.98% Year-to-date Change: 22.3% | |

| CSL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CSL to Watchlist:  View: View:  Get Complete CSL Trend Analysis ➞ Get Complete CSL Trend Analysis ➞ | |

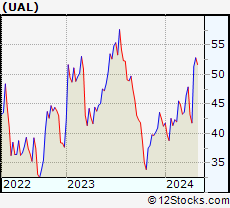

| UAL United Airlines Holdings, Inc. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 8083.25 Millions | |

| Recent Price: 53.51 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 1.59% Day Change: 0.84 | |

| Week Change: 4.15% Year-to-date Change: 29.7% | |

| UAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UAL to Watchlist:  View: View:  Get Complete UAL Trend Analysis ➞ Get Complete UAL Trend Analysis ➞ | |

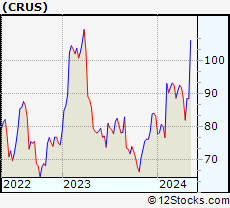

| CRUS Cirrus Logic, Inc. |

| Sector: Technology | |

| SubSector: Semiconductor - Specialized | |

| MarketCap: 3852.6 Millions | |

| Recent Price: 87.31 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 1.18% Day Change: 1.02 | |

| Week Change: 6.45% Year-to-date Change: 5.0% | |

| CRUS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRUS to Watchlist:  View: View:  Get Complete CRUS Trend Analysis ➞ Get Complete CRUS Trend Analysis ➞ | |

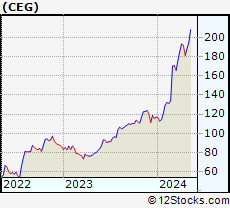

| CEG Constellation Energy Corporation |

| Sector: Utilities | |

| SubSector: Utilities - Renewable | |

| MarketCap: 29600 Millions | |

| Recent Price: 188.01 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.72% Day Change: 1.33 | |

| Week Change: 3.93% Year-to-date Change: 60.5% | |

| CEG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CEG to Watchlist:  View: View:  Get Complete CEG Trend Analysis ➞ Get Complete CEG Trend Analysis ➞ | |

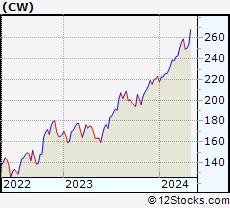

| CW Curtiss-Wright Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 4057.56 Millions | |

| Recent Price: 253.49 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.34% Day Change: 0.85 | |

| Week Change: 1.3% Year-to-date Change: 13.8% | |

| CW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CW to Watchlist:  View: View:  Get Complete CW Trend Analysis ➞ Get Complete CW Trend Analysis ➞ | |

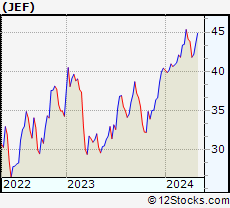

| JEF Jefferies Financial Group Inc. |

| Sector: Financials | |

| SubSector: Investment Brokerage - Regional | |

| MarketCap: 3987.15 Millions | |

| Recent Price: 43.46 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -2.56% Day Change: -1.14 | |

| Week Change: 3.06% Year-to-date Change: 7.6% | |

| JEF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JEF to Watchlist:  View: View:  Get Complete JEF Trend Analysis ➞ Get Complete JEF Trend Analysis ➞ | |

| EEFT Euronet Worldwide, Inc. |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 4809.62 Millions | |

| Recent Price: 103.61 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -1.95% Day Change: -2.06 | |

| Week Change: 0.55% Year-to-date Change: 2.1% | |

| EEFT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EEFT to Watchlist:  View: View:  Get Complete EEFT Trend Analysis ➞ Get Complete EEFT Trend Analysis ➞ | |

| CROX Crocs, Inc. |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Footwear & Accessories | |

| MarketCap: 823.47 Millions | |

| Recent Price: 123.51 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -1.80% Day Change: -2.26 | |

| Week Change: 2.46% Year-to-date Change: 32.2% | |

| CROX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CROX to Watchlist:  View: View:  Get Complete CROX Trend Analysis ➞ Get Complete CROX Trend Analysis ➞ | |

| GTES Gates Industrial Corporation plc |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 2152.36 Millions | |

| Recent Price: 17.45 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -1.80% Day Change: -0.32 | |

| Week Change: 1.45% Year-to-date Change: 30.0% | |

| GTES Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GTES to Watchlist:  View: View:  Get Complete GTES Trend Analysis ➞ Get Complete GTES Trend Analysis ➞ | |

| GWRE Guidewire Software, Inc. |

| Sector: Technology | |

| SubSector: Business Software & Services | |

| MarketCap: 7073.18 Millions | |

| Recent Price: 111.98 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -1.35% Day Change: -1.53 | |

| Week Change: 4.03% Year-to-date Change: 2.7% | |

| GWRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GWRE to Watchlist:  View: View:  Get Complete GWRE Trend Analysis ➞ Get Complete GWRE Trend Analysis ➞ | |

| BK The Bank of New York Mellon Corporation |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 29807.5 Millions | |

| Recent Price: 57.18 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -1.33% Day Change: -0.77 | |

| Week Change: 1.58% Year-to-date Change: 9.9% | |

| BK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BK to Watchlist:  View: View:  Get Complete BK Trend Analysis ➞ Get Complete BK Trend Analysis ➞ | |

| APO Apollo Global Management, Inc. |

| Sector: Financials | |

| SubSector: Diversified Investments | |

| MarketCap: 12706 Millions | |

| Recent Price: 111.88 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.75% Day Change: -0.84 | |

| Week Change: 3.95% Year-to-date Change: 20.1% | |

| APO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add APO to Watchlist:  View: View:  Get Complete APO Trend Analysis ➞ Get Complete APO Trend Analysis ➞ | |

| GPC Genuine Parts Company |

| Sector: Services & Goods | |

| SubSector: Auto Parts Stores | |

| MarketCap: 8605.9 Millions | |

| Recent Price: 161.07 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.45% Day Change: -0.73 | |

| Week Change: -0.81% Year-to-date Change: 16.3% | |

| GPC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GPC to Watchlist:  View: View:  Get Complete GPC Trend Analysis ➞ Get Complete GPC Trend Analysis ➞ | |

| VVV Valvoline Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 2225.94 Millions | |

| Recent Price: 42.52 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.21% Day Change: -0.09 | |

| Week Change: 3.23% Year-to-date Change: 13.2% | |

| VVV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VVV to Watchlist:  View: View:  Get Complete VVV Trend Analysis ➞ Get Complete VVV Trend Analysis ➞ | |

| AFG American Financial Group, Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 5353.82 Millions | |

| Recent Price: 128.71 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.78% Day Change: -1.01 | |

| Week Change: 0.66% Year-to-date Change: 8.3% | |

| AFG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AFG to Watchlist:  View: View:  Get Complete AFG Trend Analysis ➞ Get Complete AFG Trend Analysis ➞ | |

| HR Healthcare Realty Trust Incorporated |

| Sector: Financials | |

| SubSector: REIT - Healthcare Facilities | |

| MarketCap: 3718.84 Millions | |

| Recent Price: 14.03 Smart Investing & Trading Score: 67 | |

| Day Percent Change: -2.43% Day Change: -0.35 | |

| Week Change: 0.5% Year-to-date Change: -18.6% | |

| HR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HR to Watchlist:  View: View:  Get Complete HR Trend Analysis ➞ Get Complete HR Trend Analysis ➞ | |

| COLB Columbia Banking System, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 1868.3 Millions | |

| Recent Price: 19.01 Smart Investing & Trading Score: 67 | |

| Day Percent Change: -1.04% Day Change: -0.20 | |

| Week Change: 3.82% Year-to-date Change: -28.8% | |

| COLB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add COLB to Watchlist:  View: View:  Get Complete COLB Trend Analysis ➞ Get Complete COLB Trend Analysis ➞ | |

| LNG Cheniere Energy, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 9905.15 Millions | |

| Recent Price: 159.36 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 1.23% Day Change: 1.94 | |

| Week Change: -1.61% Year-to-date Change: -6.7% | |

| LNG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LNG to Watchlist:  View: View:  Get Complete LNG Trend Analysis ➞ Get Complete LNG Trend Analysis ➞ | |

| CCK Crown Holdings, Inc. |

| Sector: Consumer Staples | |

| SubSector: Packaging & Containers | |

| MarketCap: 7198.03 Millions | |

| Recent Price: 79.78 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 1.21% Day Change: 0.95 | |

| Week Change: 2.72% Year-to-date Change: -13.4% | |

| CCK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CCK to Watchlist:  View: View:  Get Complete CCK Trend Analysis ➞ Get Complete CCK Trend Analysis ➞ | |

| O Realty Income Corporation |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 17647.4 Millions | |

| Recent Price: 53.80 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 0.24% Day Change: 0.13 | |

| Week Change: 1.43% Year-to-date Change: -6.3% | |

| O Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add O to Watchlist:  View: View:  Get Complete O Trend Analysis ➞ Get Complete O Trend Analysis ➞ | |

| PRGO Perrigo Company plc |

| Sector: Health Care | |

| SubSector: Drug Related Products | |

| MarketCap: 6493.93 Millions | |

| Recent Price: 31.27 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 0.13% Day Change: 0.04 | |

| Week Change: 1.53% Year-to-date Change: -2.8% | |

| PRGO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PRGO to Watchlist:  View: View:  Get Complete PRGO Trend Analysis ➞ Get Complete PRGO Trend Analysis ➞ | |

| TTC The Toro Company |

| Sector: Industrials | |

| SubSector: Small Tools & Accessories | |

| MarketCap: 6426.96 Millions | |

| Recent Price: 86.72 Smart Investing & Trading Score: 67 | |

| Day Percent Change: -0.55% Day Change: -0.48 | |

| Week Change: 1.89% Year-to-date Change: -9.7% | |

| TTC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TTC to Watchlist:  View: View:  Get Complete TTC Trend Analysis ➞ Get Complete TTC Trend Analysis ➞ | |

| DDOG Datadog, Inc. |

| Sector: Technology | |

| SubSector: Application Software | |

| MarketCap: 10653.2 Millions | |

| Recent Price: 125.21 Smart Investing & Trading Score: 66 | |

| Day Percent Change: -1.46% Day Change: -1.86 | |

| Week Change: 4.25% Year-to-date Change: 3.2% | |

| DDOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DDOG to Watchlist:  View: View:  Get Complete DDOG Trend Analysis ➞ Get Complete DDOG Trend Analysis ➞ | |

| INSP Inspire Medical Systems, Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 1239.8 Millions | |

| Recent Price: 231.01 Smart Investing & Trading Score: 66 | |

| Day Percent Change: -1.36% Day Change: -3.18 | |

| Week Change: 0.78% Year-to-date Change: 13.6% | |

| INSP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add INSP to Watchlist:  View: View:  Get Complete INSP Trend Analysis ➞ Get Complete INSP Trend Analysis ➞ | |

| JWN Nordstrom, Inc. |

| Sector: Services & Goods | |

| SubSector: Apparel Stores | |

| MarketCap: 3351.68 Millions | |

| Recent Price: 19.00 Smart Investing & Trading Score: 66 | |

| Day Percent Change: -1.35% Day Change: -0.26 | |

| Week Change: 0.42% Year-to-date Change: 3.0% | |

| JWN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JWN to Watchlist:  View: View:  Get Complete JWN Trend Analysis ➞ Get Complete JWN Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Midcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Kirby [100], HashiCorp [100], Ardagh Metal[100], Teradyne [100], Antero Resources[100], Churchill Downs[100], Dover [100], Tractor Supply[100], Virtu Financial[100], EQT [100], Microchip [100]

Best Midcap Stocks Year-to-Date:

Vistra Energy[88.16%], AppLovin [73.92%], ShockWave Medical[72.7%], EMCOR [62.16%], Constellation Energy[60.54%], Spotify [53.81%], Antero Resources[47.22%], Pure Storage[46.44%], Natera [45.72%], Wingstop [44.17%], CAVA [43.95%] Best Midcap Stocks This Week:

HashiCorp [36.92%], Hasbro [17.55%], Kirby [17.07%], Tandem Diabetes[16.86%], Ardagh Metal[14.9%], First Citizens[14.87%], Antero Resources[14%], Tyler Technologies[13.57%], Teradyne [13.48%], Wabtec [13.19%], Globe Life[13.19%] Best Midcap Stocks Daily:

Kirby [10.99%], HashiCorp [10.69%], First Citizens[9.80%], Tyler Technologies[9.32%], Ardagh Metal[8.82%], TransUnion [8.17%], Teradyne [8.15%], Carrier Global[7.19%], Antero Resources[6.20%], CACI [5.93%], United Rentals[5.45%]

Vistra Energy[88.16%], AppLovin [73.92%], ShockWave Medical[72.7%], EMCOR [62.16%], Constellation Energy[60.54%], Spotify [53.81%], Antero Resources[47.22%], Pure Storage[46.44%], Natera [45.72%], Wingstop [44.17%], CAVA [43.95%] Best Midcap Stocks This Week:

HashiCorp [36.92%], Hasbro [17.55%], Kirby [17.07%], Tandem Diabetes[16.86%], Ardagh Metal[14.9%], First Citizens[14.87%], Antero Resources[14%], Tyler Technologies[13.57%], Teradyne [13.48%], Wabtec [13.19%], Globe Life[13.19%] Best Midcap Stocks Daily:

Kirby [10.99%], HashiCorp [10.69%], First Citizens[9.80%], Tyler Technologies[9.32%], Ardagh Metal[8.82%], TransUnion [8.17%], Teradyne [8.15%], Carrier Global[7.19%], Antero Resources[6.20%], CACI [5.93%], United Rentals[5.45%]

Login Sign Up

Login Sign Up