Best S&P 500 Stocks

|

On this page, you will find the most comprehensive analysis of S&P 500 stocks and ETFs - from latest trends to performances to charts ➞. First, here are the year-to-date (YTD) performances of the most requested S&P 500 stocks at 12Stocks.com (click stock for review):

| Intel Corp 84% | ||

| Caterpillar Inc 38% | ||

| Goldman Sachs 37% | ||

| NVIDIA Corp 37% | ||

| Johnson & Johnson 31% | ||

| JPMorgan Chase 30% | ||

| Google Inc 30% | ||

| Boeing Co 27% | ||

| Microsoft 24% | ||

| Gilead 22% | ||

| Walmart Inc 13% | ||

| Chevron Corp 7% | ||

| Apple Inc 6% | ||

| McDonald's Corp 4% | ||

| Amazon.com Inc 1% | ||

| Starbucks Corp -5% | ||

| Merck & Co Inc -8% | ||

| Quick: S&P 500 Stocks Lists: Performances & Trends, S&P 500 Stock Charts

Sort S&P 500 stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter S&P 500 stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare |

| 12Stocks.com S&P 500 Stocks Performances & Trends Daily Report | |||||||||

|

|

The overall Smart Investing & Trading Score is 90 (0-bearish to 100-bullish) which puts S&P 500 index in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 80 and an improvement of trend continues. | ||||||||

Here are the Smart Investing & Trading Scores of the most requested S&P 500 stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Top Performing S&P 500 Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing S&P 500 Index stocks year to date are

Now, more recently, over last week, the top performing S&P 500 Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in S&P 500 Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the S&P 500 Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in S&P 500 Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| XOM | Exxon Mobil |   | Energy | 111.29 | 20 | -0.63% | 5.60% |

| CVX | Chevron Corp |   | Energy | 153.37 | 50 | -0.78% | 6.99% |

| COP | Conoco Phillips |   | Energy | 93.38 | 40 | -2.18% | -5.14% |

| WMB | Williams Cos |   | Energy | 64.06 | 80 | 0.58% | 16.64% |

| EOG | EOG Resources |   | Energy | 110.40 | 0 | -0.78% | -9.28% |

| KMI | Kinder Morgan |   | Energy | 28.22 | 70 | -0.28% | 3.64% |

| MPC | Marathon |   | Energy | 192.24 | 50 | -0.04% | 37.42% |

| SLB | Schlumberger |   | Energy | 34.10 | 40 | -2.82% | -9.83% |

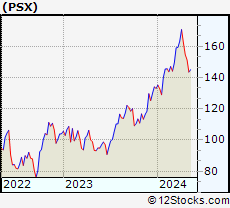

| PSX | Phillips 66 |   | Energy | 134.94 | 50 | 0.26% | 20.15% |

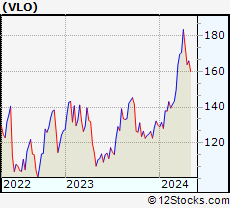

| VLO | Valero |   | Energy | 164.70 | 50 | -1.77% | 37.09% |

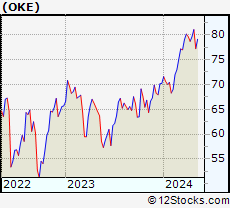

| OKE | Oneok Inc |   | Energy | 72.47 | 40 | -0.70% | -26.19% |

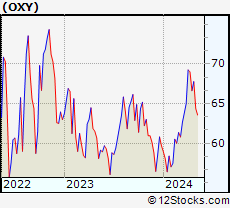

| OXY | Occidental |   | Energy | 44.23 | 20 | -7.31% | -10.25% |

| BKR | Baker Hughes |   | Energy | 48.40 | 50 | 0.08% | 18.39% |

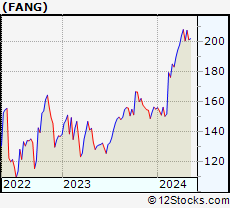

| FANG | Diamondback |   | Energy | 143.19 | 60 | -0.24% | -12.94% |

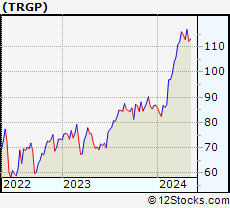

| TRGP | Targa Resources |   | Energy | 162.65 | 20 | -3.22% | -9.78% |

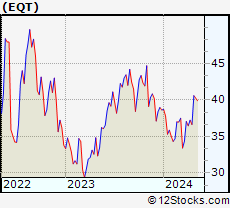

| EQT | EQT Corp |   | Energy | 55.76 | 80 | -0.71% | 18.82% |

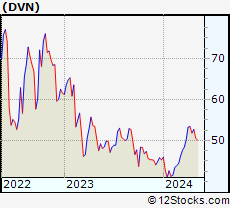

| DVN | Devon |   | Energy | 34.32 | 40 | -2.83% | 4.22% |

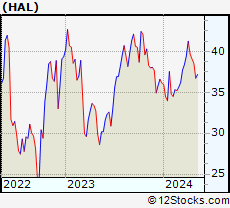

| HAL | Halliburton Co |   | Energy | 24.38 | 60 | -2.09% | -10.71% |

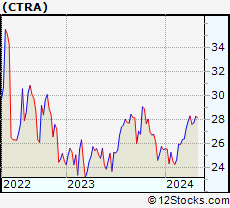

| CTRA | Coterra |   | Energy | 23.15 | 10 | -3.38% | -9.92% |

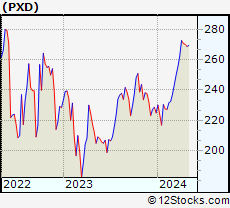

| PXD | Pioneer Natural |   | Energy | 561.08 | 70 | 0.89% | 0.00% |

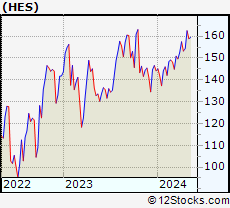

| HES | Hess |   | Energy | 148.97 | 60 | 0.00% | 10.77% |

| APA | APA |   | Energy | 23.86 | 50 | -4.79% | 6.26% |

| MRO | Marathon Oil |   | Energy | 28.55 | 40 | -1.28% | 0.00% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of S&P 500 Stocks |

| S&P 500 Technical Overview, Leaders & Laggards, Top S&P 500 ETF Funds & Detailed S&P 500 Stocks List, Charts, Trends & More |

| S&P 500: Technical Analysis, Trends & YTD Performance | |

| S&P 500 index as represented by

SPY, an exchange-traded fund [ETF], holds basket of five hundred (mostly largecap) stocks from across all major sectors of the US stock market. The S&P 500 index (contains stocks like Apple and Exxon) is up by 15.1527% and is currently outperforming the overall market by 0.3948% year-to-date. Below is a quick view of technical charts and trends: | |

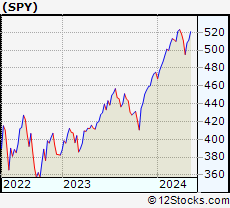

SPY Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Good | |

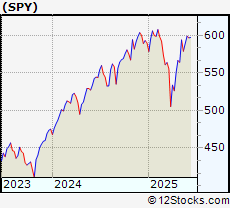

SPY Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 90 | |

| YTD Performance: 15.1527% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in S&P 500 Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track S&P 500 index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of S&P 500 indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track S&P 500 Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| SPY | SPDR S&P 500 ETF Trust |   | 669.22 | 90 | 0.115192 | 1.22826 | 15.1527% |

| IVV | iShares Core S&P 500 ETF |   | 672.50 | 90 | 0.0982377 | 1.24048 | 15.1922% |

| VOO | Vanguard S&P 500 ETF |   | 615.25 | 90 | 0.107389 | 0.943396 | 15.2251% |

| OEF | iShares S&P 100 ETF |   | 334.28 | 90 | 0.00598337 | 1.05505 | 16.5396% |

| SSO | ProShares Ultra S&P500 2x Shares |   | 113.12 | 90 | 0.177117 | 2.334 | 23.4297% |

| UPRO | ProShares UltraPro S&P 500 ETF 3x Shares |   | 113.01 | 90 | 0.275067 | 3.45112 | 29.2069% |

| SPXL | Direxion Daily S&P 500 Bull 3X Shares |   | 214.76 | 90 | 0.28953 | 3.47386 | 29.2396% |

| SH | ProShares Short S&P500 -1x Shares |   | 36.80 | 10 | -0.0543183 | -1.07527 | -11.8852% |

| SDS | ProShares UltraShort S&P500 -2x Shares |   | 14.33 | 10 | -0.139373 | -2.1843 | -25.9516% |

| SPXU | ProShares UltraPro Short S&P 500 |   | 13.34 | 10 | -0.224383 | -3.26323 | -40.0301% |

| SPXS | Direxion Daily S&P 500 Bear -3X Shares |   | 37.50 | 70 | -0.239425 | 868.992 | 503.962% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of S&P 500 Stocks | |

|

We now take in-depth look at all S&P 500 stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort S&P 500 stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

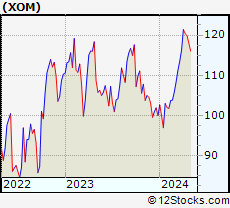

| XOM Exxon Mobil Corp |

| Sector: Energy | |

| SubSector: Oil & Gas Integrated | |

| MarketCap: 465674 Millions | |

| Recent Price: 111.29 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -0.625056% Day Change: -0.43 | |

| Week Change: -2.8544% Year-to-date Change: 5.6% | |

| XOM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XOM to Watchlist:  View: View:  Get XOM Trend Analysis ➞ Get XOM Trend Analysis ➞ | |

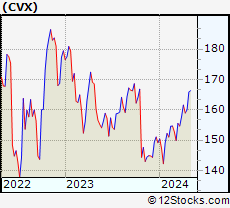

| CVX Chevron Corp |

| Sector: Energy | |

| SubSector: Oil & Gas Integrated | |

| MarketCap: 314603 Millions | |

| Recent Price: 153.37 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -0.782766% Day Change: -0.63 | |

| Week Change: -3.64996% Year-to-date Change: 7.0% | |

| CVX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVX to Watchlist:  View: View:  Get CVX Trend Analysis ➞ Get CVX Trend Analysis ➞ | |

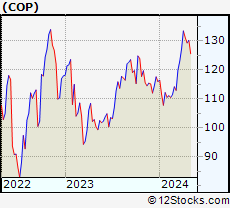

| COP Conoco Phillips |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 116089 Millions | |

| Recent Price: 93.38 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -2.17892% Day Change: -1.78 | |

| Week Change: -2.35282% Year-to-date Change: -5.1% | |

| COP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add COP to Watchlist:  View: View:  Get COP Trend Analysis ➞ Get COP Trend Analysis ➞ | |

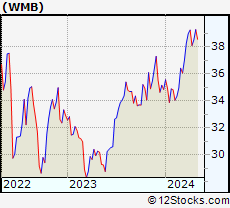

| WMB Williams Cos Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 69851.4 Millions | |

| Recent Price: 64.06 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0.580939% Day Change: 0.38 | |

| Week Change: 1.909% Year-to-date Change: 16.6% | |

| WMB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WMB to Watchlist:  View: View:  Get WMB Trend Analysis ➞ Get WMB Trend Analysis ➞ | |

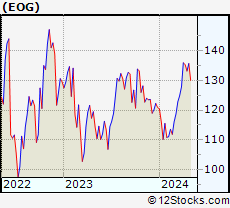

| EOG EOG Resources, Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 64389 Millions | |

| Recent Price: 110.40 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.781882% Day Change: -0.39 | |

| Week Change: -5.39846% Year-to-date Change: -9.3% | |

| EOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EOG to Watchlist:  View: View:  Get EOG Trend Analysis ➞ Get EOG Trend Analysis ➞ | |

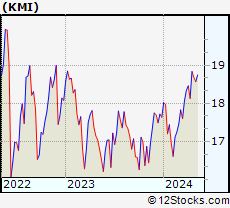

| KMI Kinder Morgan Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 59085 Millions | |

| Recent Price: 28.22 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -0.282686% Day Change: -0.06 | |

| Week Change: 1.43781% Year-to-date Change: 3.6% | |

| KMI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KMI to Watchlist:  View: View:  Get KMI Trend Analysis ➞ Get KMI Trend Analysis ➞ | |

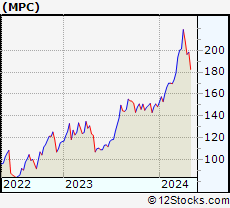

| MPC Marathon Petroleum Corp |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 54808.8 Millions | |

| Recent Price: 192.24 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -0.0363996% Day Change: 0.56 | |

| Week Change: -0.445365% Year-to-date Change: 37.4% | |

| MPC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MPC to Watchlist:  View: View:  Get MPC Trend Analysis ➞ Get MPC Trend Analysis ➞ | |

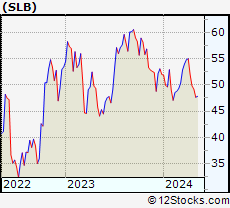

| SLB Schlumberger Ltd |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 53761.1 Millions | |

| Recent Price: 34.10 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -2.82132% Day Change: -0.85 | |

| Week Change: -1.47356% Year-to-date Change: -9.8% | |

| SLB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SLB to Watchlist:  View: View:  Get SLB Trend Analysis ➞ Get SLB Trend Analysis ➞ | |

| PSX Phillips 66 |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 53162.5 Millions | |

| Recent Price: 134.94 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.260049% Day Change: 0.64 | |

| Week Change: -1.20799% Year-to-date Change: 20.2% | |

| PSX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PSX to Watchlist:  View: View:  Get PSX Trend Analysis ➞ Get PSX Trend Analysis ➞ | |

| VLO Valero Energy Corp |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 48700.9 Millions | |

| Recent Price: 164.70 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -1.77134% Day Change: -2.72 | |

| Week Change: -3.58836% Year-to-date Change: 37.1% | |

| VLO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VLO to Watchlist:  View: View:  Get VLO Trend Analysis ➞ Get VLO Trend Analysis ➞ | |

| OKE Oneok Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 45739.2 Millions | |

| Recent Price: 72.47 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -0.698822% Day Change: -0.3 | |

| Week Change: -1.62889% Year-to-date Change: -26.2% | |

| OKE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OKE to Watchlist:  View: View:  Get OKE Trend Analysis ➞ Get OKE Trend Analysis ➞ | |

| OXY Occidental Petroleum Corp |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 45195.6 Millions | |

| Recent Price: 44.23 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -7.3135% Day Change: -3.44 | |

| Week Change: -5.67285% Year-to-date Change: -10.3% | |

| OXY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OXY to Watchlist:  View: View:  Get OXY Trend Analysis ➞ Get OXY Trend Analysis ➞ | |

| BKR Baker Hughes Co |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 44936.4 Millions | |

| Recent Price: 48.40 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.082713% Day Change: 0.08 | |

| Week Change: -2.94766% Year-to-date Change: 18.4% | |

| BKR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BKR to Watchlist:  View: View:  Get BKR Trend Analysis ➞ Get BKR Trend Analysis ➞ | |

| FANG Diamondback Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 40154.6 Millions | |

| Recent Price: 143.19 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -0.243834% Day Change: -0.23 | |

| Week Change: -0.981951% Year-to-date Change: -12.9% | |

| FANG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FANG to Watchlist:  View: View:  Get FANG Trend Analysis ➞ Get FANG Trend Analysis ➞ | |

| TRGP Targa Resources Corp |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 34936.4 Millions | |

| Recent Price: 162.65 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -3.22485% Day Change: -5.19 | |

| Week Change: -5.54039% Year-to-date Change: -9.8% | |

| TRGP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRGP to Watchlist:  View: View:  Get TRGP Trend Analysis ➞ Get TRGP Trend Analysis ➞ | |

| EQT EQT Corp |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 32201.7 Millions | |

| Recent Price: 55.76 Smart Investing & Trading Score: 80 | |

| Day Percent Change: -0.712251% Day Change: -0.38 | |

| Week Change: 5.04898% Year-to-date Change: 18.8% | |

| EQT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EQT to Watchlist:  View: View:  Get EQT Trend Analysis ➞ Get EQT Trend Analysis ➞ | |

| DVN Devon Energy Corp |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 22065.7 Millions | |

| Recent Price: 34.32 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -2.83126% Day Change: -0.89 | |

| Week Change: -2.52769% Year-to-date Change: 4.2% | |

| DVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DVN to Watchlist:  View: View:  Get DVN Trend Analysis ➞ Get DVN Trend Analysis ➞ | |

| HAL Halliburton Co |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 18842.5 Millions | |

| Recent Price: 24.38 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -2.08835% Day Change: -0.5 | |

| Week Change: -0.245499% Year-to-date Change: -10.7% | |

| HAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HAL to Watchlist:  View: View:  Get HAL Trend Analysis ➞ Get HAL Trend Analysis ➞ | |

| CTRA Coterra Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 18300.1 Millions | |

| Recent Price: 23.15 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -3.38063% Day Change: -0.8 | |

| Week Change: -2.52632% Year-to-date Change: -9.9% | |

| CTRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CTRA to Watchlist:  View: View:  Get CTRA Trend Analysis ➞ Get CTRA Trend Analysis ➞ | |

| PXD Pioneer Natural Resources Company |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 11846.2 Millions | |

| Recent Price: 561.08 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 0.886451% Day Change: -9999 | |

| Week Change: 108.1% Year-to-date Change: 0.0% | |

| PXD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PXD to Watchlist:  View: View:  Get PXD Trend Analysis ➞ Get PXD Trend Analysis ➞ | |

| HES Hess Corporation |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 10465.3 Millions | |

| Recent Price: 148.97 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: -2.01921% Year-to-date Change: 10.8% | |

| HES Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HES to Watchlist:  View: View:  Get HES Trend Analysis ➞ Get HES Trend Analysis ➞ | |

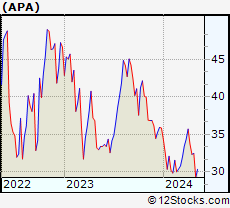

| APA APA Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 8139.64 Millions | |

| Recent Price: 23.86 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -4.78851% Day Change: -0.96 | |

| Week Change: -2.2932% Year-to-date Change: 6.3% | |

| APA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add APA to Watchlist:  View: View:  Get APA Trend Analysis ➞ Get APA Trend Analysis ➞ | |

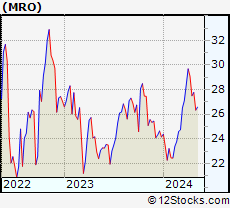

| MRO Marathon Oil Corporation |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 2911.53 Millions | |

| Recent Price: 28.55 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -1.27939% Day Change: -9999 | |

| Week Change: 0.137141% Year-to-date Change: 0.0% | |

| MRO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MRO to Watchlist:  View: View:  Get MRO Trend Analysis ➞ Get MRO Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

S&P 500 Stocks With Best Up Trends [0-bearish to 100-bullish]: Fair Isaac[100], Intel Corp[100], Bio-Techne Corp[100], DuPont de[100], First Solar[100], Centene Corp[100], Lam Research[100], Charles River[100], Applied Materials[100], Steel Dynamics[100], Teradyne Inc[100]

Best S&P 500 Stocks Year-to-Date:

Seagate [198.865%], Western Digital[181.204%], Newmont Corp[127.671%], Micron [110.87%], Lam Research[103.976%], Intel Corp[84.4708%], Warner Bros.[84.2%], NRG [82.3658%], CVS Health[81.156%], Amphenol Corp[79.8571%], KLA Corp[79.7904%] Best S&P 500 Stocks This Week:

Pioneer Natural[108.1%], Bio-Techne Corp[21.2222%], Electronic Arts[20.1076%], Western Digital[19.6645%], Intel Corp[19.4747%], Charles River[17.3369%], Fair Isaac[15.6495%], Lamb Weston[15.5663%], Lam Research[14.5184%], Seagate [13.8757%], Micron [13.6232%] Best S&P 500 Stocks Daily:

Fair Isaac[17.979%], Celanese Corp[6.98937%], Humana Inc[3.99157%], CF Industries[3.94539%], Eastman Chemical[3.88961%], Intel Corp[3.78408%], Albemarle Corp[3.7173%], Caesars Entertainment[3.66089%], Bio-Techne Corp[3.6215%], DuPont de[3.54129%], Advanced Micro[3.48759%]

Seagate [198.865%], Western Digital[181.204%], Newmont Corp[127.671%], Micron [110.87%], Lam Research[103.976%], Intel Corp[84.4708%], Warner Bros.[84.2%], NRG [82.3658%], CVS Health[81.156%], Amphenol Corp[79.8571%], KLA Corp[79.7904%] Best S&P 500 Stocks This Week:

Pioneer Natural[108.1%], Bio-Techne Corp[21.2222%], Electronic Arts[20.1076%], Western Digital[19.6645%], Intel Corp[19.4747%], Charles River[17.3369%], Fair Isaac[15.6495%], Lamb Weston[15.5663%], Lam Research[14.5184%], Seagate [13.8757%], Micron [13.6232%] Best S&P 500 Stocks Daily:

Fair Isaac[17.979%], Celanese Corp[6.98937%], Humana Inc[3.99157%], CF Industries[3.94539%], Eastman Chemical[3.88961%], Intel Corp[3.78408%], Albemarle Corp[3.7173%], Caesars Entertainment[3.66089%], Bio-Techne Corp[3.6215%], DuPont de[3.54129%], Advanced Micro[3.48759%]

Login Sign Up

Login Sign Up