Best Latin America Stocks

|

|

| Quick Read: Top Latin America Stocks By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Latin America Views: Quick Browse View, Summary & Slide Show | |||

| 12Stocks.com Latin America Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 40 (0-bearish to 100-bullish) which puts Latin America index in short term bearish to neutral trend. The market intelligence score from previous trading session is 50 and a deterioration of trend continues.

| ||||||||

Here are the market intelligence trend scores of the most requested Latin America stocks at 12Stocks.com (click stock name for detailed review):

| |||||||||||||||||||||||||

| Scroll down this page for most comprehensive review of Latin America stocks by performance, trends, technical analysis, charts, fund plays & more | |||||||||||||||||||||||||

| 12Stocks.com: Top Performing Latin America Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Latin America Index stocks year to date are

Now, more recently, over last week, the top performing Latin America Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Latin America Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Latin America Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Latin America Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| APHA | Aphria |   | Health Care | 17.23 | 10 | -3.39 | 0.00% |

| FSI | Flexible |   | Materials | 9.65 | 70 | -3.50 | 169.06% |

| WRN | Western Copper |   | Materials | 1.91 | 60 | -3.54 | 73.64% |

| SOLO | Electrameccanica Vehicles |   | Consumer Staples | 0.21 | 20 | -3.55 | 0.00% |

| XP | XP |   | Financials | 17.57 | 20 | -3.62 | 48.77% |

| OSB | Norbord |   | Services & Goods | 37.02 | 0 | -3.67 | 0.00% |

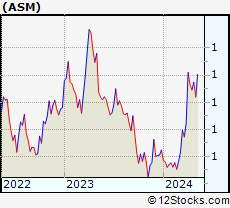

| ASM | Avino Silver |   | Materials | 5.20 | 60 | -3.70 | 437.52% |

| AUG | Auryn Resources |   | Materials | 3.70 | 20 | -3.90 | 0.00% |

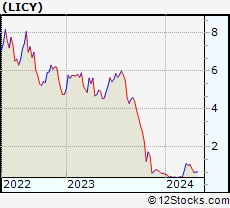

| LICY | Li-Cycle |   | Industrials | 0.84 | 20 | -4.06 | -64.42% |

| VOXR | Vox Royalty |   | Materials | 4.12 | 70 | -4.19 | 71.02% |

| MPVD | Mountain Prove |   | Materials | 10.23 | 80 | -4.39 | 0.00% |

| KIQ | Kelso |   | Transports | 0.41 | 60 | -4.65 | 0.00% |

| VRX | Valeant |   | Health Care | 118.09 | 50 | -5.11 | 0.00% |

| BIOX | Bioceres Crop |   | Materials | 1.30 | 20 | -5.11 | -80.65% |

| THM | Tower |   | Materials | 1.67 | 80 | -5.65 | 254.57% |

| CRHM | CRH Medical |   | Health Care | 18.50 | 80 | -6.04 | 0.00% |

| ERJ | Embraer S.A. |   | Industrials | 56.78 | 10 | -6.24 | 50.00% |

| ASTL | Algoma Steel |   | Materials | 3.19 | 0 | -6.32 | -66.64% |

| DTEA | DAVIDsTEA |   | Consumer Staples | 0.23 | 10 | -8.00 | 0.00% |

| TMQ | Trilogy Metals |   | Materials | 2.09 | 50 | -8.33 | 75.63% |

| GTE | Gran Tierra |   | Energy | 4.21 | 50 | -8.48 | -44.09% |

| SIM | Grupo Simec |   | Materials | 25.20 | 10 | -10.00 | -5.94% |

| BRFS | BRF S.A. |   | Consumer Staples | 3.38 | 10 | -11.52 | -16.95% |

| BOXC | Brookfield Canada |   | Financials | 0.57 | 0 | -38.71 | 0.00% |

| AYA | Amaya |   | Services & Goods | 17.70 | 0 | -50.31 | 0.00% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Latin America Stocks |

| Latin America Technical Overview, Leaders & Laggards, Top Latin America ETF Funds & Detailed Latin America Stocks List, Charts, Trends & More |

| Latin America: Technical Analysis, Trends & YTD Performance | |

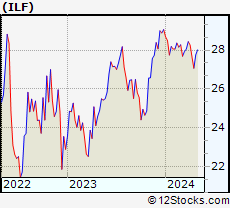

ILF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

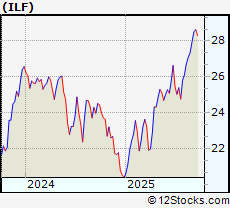

ILF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 40 | |

| YTD Performance: 37.1981% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Latin America Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors play Latin America stock market. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Latin America Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| LBJ | Latin America Bull |   | 60.40 | 50 | 0 | 0 | 0% |

| DBBR | Brazil Hedgd Eq |   | 54.06 | 70 | -0.478645 | 0.632911 | 0% |

| FBZ | Brazil AlphaDEX |   | 11.52 | 30 | 0 | 0 | 29.5955% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Latin America Stocks | |

|

We now take in-depth look at all Latin America stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Latin America stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

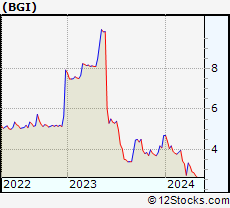

| BGI Birks Group Inc |

| Sector: Services & Goods | |

| SubSector: Luxury Goods | |

| MarketCap: 16.83 Millions | |

| Recent Price: 1.14 Market Intelligence Score: 80 | |

| Day Percent Change: -3.38983% Day Change: -0.03 | |

| Week Change: 0% Year-to-date Change: -28.5% | |

| BGI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BGI to Watchlist:  View: View:  Get Complete BGI Trend Analysis ➞ Get Complete BGI Trend Analysis ➞ | |

| APHA Aphria Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 670.533 Millions | |

| Recent Price: 17.23 Market Intelligence Score: 10 | |

| Day Percent Change: -3.39221% Day Change: -9999 | |

| Week Change: -5.64074% Year-to-date Change: 0.0% | |

| APHA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add APHA to Watchlist:  View: View:  Get Complete APHA Trend Analysis ➞ Get Complete APHA Trend Analysis ➞ | |

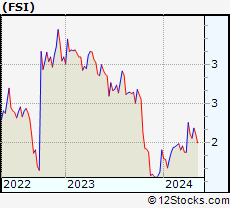

| FSI Flexible Solutions International Inc |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 120.24 Millions | |

| Recent Price: 9.65 Market Intelligence Score: 70 | |

| Day Percent Change: -3.5% Day Change: 0 | |

| Week Change: -2.62361% Year-to-date Change: 169.1% | |

| FSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FSI to Watchlist:  View: View:  Get Complete FSI Trend Analysis ➞ Get Complete FSI Trend Analysis ➞ | |

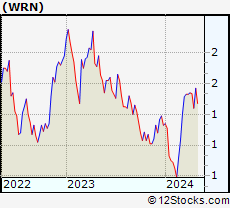

| WRN Western Copper & Gold Corp |

| Sector: Materials | |

| SubSector: Other Industrial Metals & Mining | |

| MarketCap: 306.71 Millions | |

| Recent Price: 1.91 Market Intelligence Score: 60 | |

| Day Percent Change: -3.53535% Day Change: 0.03 | |

| Week Change: 4.37158% Year-to-date Change: 73.6% | |

| WRN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WRN to Watchlist:  View: View:  Get Complete WRN Trend Analysis ➞ Get Complete WRN Trend Analysis ➞ | |

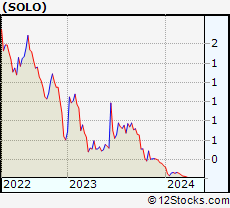

| SOLO Electrameccanica Vehicles Corp. |

| Sector: Consumer Staples | |

| SubSector: Auto Manufacturers - Major | |

| MarketCap: 61.6471 Millions | |

| Recent Price: 0.21 Market Intelligence Score: 20 | |

| Day Percent Change: -3.54545% Day Change: -9999 | |

| Week Change: -6.06463% Year-to-date Change: 0.0% | |

| SOLO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SOLO to Watchlist:  View: View:  Get Complete SOLO Trend Analysis ➞ Get Complete SOLO Trend Analysis ➞ | |

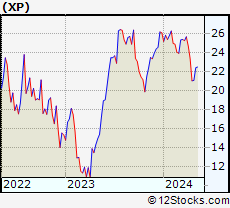

| XP XP Inc |

| Sector: Financials | |

| SubSector: Capital Markets | |

| MarketCap: 9964.48 Millions | |

| Recent Price: 17.57 Market Intelligence Score: 20 | |

| Day Percent Change: -3.62041% Day Change: -0.49 | |

| Week Change: -8.53722% Year-to-date Change: 48.8% | |

| XP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XP to Watchlist:  View: View:  Get Complete XP Trend Analysis ➞ Get Complete XP Trend Analysis ➞ | |

| OSB Norbord Inc. |

| Sector: Services & Goods | |

| SubSector: Building Materials Wholesale | |

| MarketCap: 847.243 Millions | |

| Recent Price: 37.02 Market Intelligence Score: 0 | |

| Day Percent Change: -3.66901% Day Change: -9999 | |

| Week Change: -92.3035% Year-to-date Change: 0.0% | |

| OSB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OSB to Watchlist:  View: View:  Get Complete OSB Trend Analysis ➞ Get Complete OSB Trend Analysis ➞ | |

| ASM Avino Silver & Gold Mines Ltd |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 615.27 Millions | |

| Recent Price: 5.20 Market Intelligence Score: 60 | |

| Day Percent Change: -3.7037% Day Change: 0.17 | |

| Week Change: 15.8129% Year-to-date Change: 437.5% | |

| ASM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ASM to Watchlist:  View: View:  Get Complete ASM Trend Analysis ➞ Get Complete ASM Trend Analysis ➞ | |

| AUG Auryn Resources Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 82.291 Millions | |

| Recent Price: 3.70 Market Intelligence Score: 20 | |

| Day Percent Change: -3.8961% Day Change: -9999 | |

| Week Change: -21.7759% Year-to-date Change: 0.0% | |

| AUG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AUG to Watchlist:  View: View:  Get Complete AUG Trend Analysis ➞ Get Complete AUG Trend Analysis ➞ | |

| LICY Li-Cycle Holdings Corp. |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 959 Millions | |

| Recent Price: 0.84 Market Intelligence Score: 20 | |

| Day Percent Change: -4.06143% Day Change: -9999 | |

| Week Change: -13.0619% Year-to-date Change: -64.4% | |

| LICY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LICY to Watchlist:  View: View:  Get Complete LICY Trend Analysis ➞ Get Complete LICY Trend Analysis ➞ | |

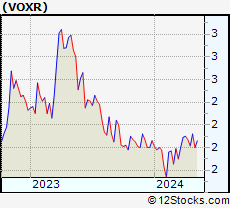

| VOXR Vox Royalty Corp |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 179.69 Millions | |

| Recent Price: 4.12 Market Intelligence Score: 70 | |

| Day Percent Change: -4.18605% Day Change: 0.15 | |

| Week Change: 11.3514% Year-to-date Change: 71.0% | |

| VOXR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VOXR to Watchlist:  View: View:  Get Complete VOXR Trend Analysis ➞ Get Complete VOXR Trend Analysis ➞ | |

| MPVD Mountain Province Diamonds Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 581.66 Millions | |

| Recent Price: 10.23 Market Intelligence Score: 80 | |

| Day Percent Change: -4.39252% Day Change: -9999 | |

| Week Change: 22.6619% Year-to-date Change: 0.0% | |

| MPVD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MPVD to Watchlist:  View: View:  Get Complete MPVD Trend Analysis ➞ Get Complete MPVD Trend Analysis ➞ | |

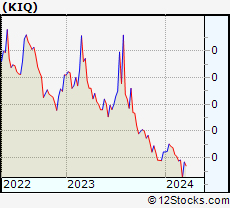

| KIQ Kelso Technologies Inc. |

| Sector: Transports | |

| SubSector: Railroads | |

| MarketCap: 24.5722 Millions | |

| Recent Price: 0.41 Market Intelligence Score: 60 | |

| Day Percent Change: -4.65116% Day Change: -9999 | |

| Week Change: 203.929% Year-to-date Change: 0.0% | |

| KIQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KIQ to Watchlist:  View: View:  Get Complete KIQ Trend Analysis ➞ Get Complete KIQ Trend Analysis ➞ | |

| VRX Valeant Pharmaceuticals International, Inc. |

| Sector: Health Care | |

| SubSector: Drug Delivery | |

| MarketCap: 3850.2 Millions | |

| Recent Price: 118.09 Market Intelligence Score: 50 | |

| Day Percent Change: -5.11049% Day Change: -9999 | |

| Week Change: -4.76613% Year-to-date Change: 0.0% | |

| VRX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VRX to Watchlist:  View: View:  Get Complete VRX Trend Analysis ➞ Get Complete VRX Trend Analysis ➞ | |

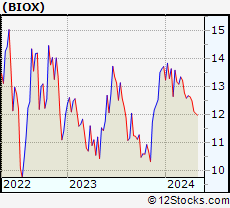

| BIOX Bioceres Crop Solutions Corp |

| Sector: Materials | |

| SubSector: Agricultural Inputs | |

| MarketCap: 169.95 Millions | |

| Recent Price: 1.30 Market Intelligence Score: 20 | |

| Day Percent Change: -5.10949% Day Change: 0.24 | |

| Week Change: -24.8555% Year-to-date Change: -80.7% | |

| BIOX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BIOX to Watchlist:  View: View:  Get Complete BIOX Trend Analysis ➞ Get Complete BIOX Trend Analysis ➞ | |

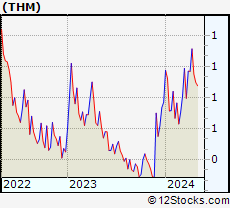

| THM International Tower Hill Mines Ltd |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 293.11 Millions | |

| Recent Price: 1.67 Market Intelligence Score: 80 | |

| Day Percent Change: -5.64972% Day Change: 0.08 | |

| Week Change: 10.596% Year-to-date Change: 254.6% | |

| THM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THM to Watchlist:  View: View:  Get Complete THM Trend Analysis ➞ Get Complete THM Trend Analysis ➞ | |

| CRHM CRH Medical Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 80.286 Millions | |

| Recent Price: 18.50 Market Intelligence Score: 80 | |

| Day Percent Change: -6.04368% Day Change: -9999 | |

| Week Change: 363.659% Year-to-date Change: 0.0% | |

| CRHM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRHM to Watchlist:  View: View:  Get Complete CRHM Trend Analysis ➞ Get Complete CRHM Trend Analysis ➞ | |

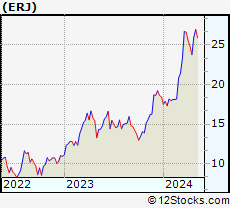

| ERJ Embraer S.A. ADR |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 11181.3 Millions | |

| Recent Price: 56.78 Market Intelligence Score: 10 | |

| Day Percent Change: -6.24174% Day Change: -3.33 | |

| Week Change: -5.8687% Year-to-date Change: 50.0% | |

| ERJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ERJ to Watchlist:  View: View:  Get Complete ERJ Trend Analysis ➞ Get Complete ERJ Trend Analysis ➞ | |

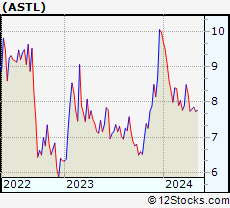

| ASTL Algoma Steel Group Inc |

| Sector: Materials | |

| SubSector: Steel | |

| MarketCap: 538.29 Millions | |

| Recent Price: 3.19 Market Intelligence Score: 0 | |

| Day Percent Change: -6.32353% Day Change: 0.22 | |

| Week Change: -23.4375% Year-to-date Change: -66.6% | |

| ASTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ASTL to Watchlist:  View: View:  Get Complete ASTL Trend Analysis ➞ Get Complete ASTL Trend Analysis ➞ | |

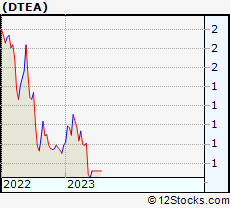

| DTEA DAVIDsTEA Inc. |

| Sector: Consumer Staples | |

| SubSector: Food - Major Diversified | |

| MarketCap: 13.7143 Millions | |

| Recent Price: 0.23 Market Intelligence Score: 10 | |

| Day Percent Change: -8% Day Change: -9999 | |

| Week Change: -46.1358% Year-to-date Change: 0.0% | |

| DTEA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DTEA to Watchlist:  View: View:  Get Complete DTEA Trend Analysis ➞ Get Complete DTEA Trend Analysis ➞ | |

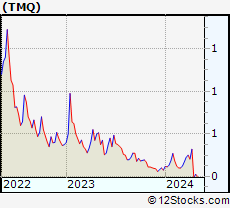

| TMQ Trilogy Metals Inc |

| Sector: Materials | |

| SubSector: Other Industrial Metals & Mining | |

| MarketCap: 302.2 Millions | |

| Recent Price: 2.09 Market Intelligence Score: 50 | |

| Day Percent Change: -8.33333% Day Change: 0 | |

| Week Change: -1.41509% Year-to-date Change: 75.6% | |

| TMQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TMQ to Watchlist:  View: View:  Get Complete TMQ Trend Analysis ➞ Get Complete TMQ Trend Analysis ➞ | |

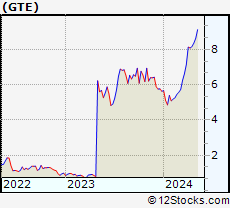

| GTE Gran Tierra Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 139.05 Millions | |

| Recent Price: 4.21 Market Intelligence Score: 50 | |

| Day Percent Change: -8.47826% Day Change: 0.02 | |

| Week Change: -8.97297% Year-to-date Change: -44.1% | |

| GTE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GTE to Watchlist:  View: View:  Get Complete GTE Trend Analysis ➞ Get Complete GTE Trend Analysis ➞ | |

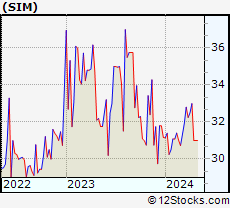

| SIM Grupo Simec S.A.B. de C.V. ADR |

| Sector: Materials | |

| SubSector: Steel | |

| MarketCap: 4635.25 Millions | |

| Recent Price: 25.20 Market Intelligence Score: 10 | |

| Day Percent Change: -10% Day Change: -2.8 | |

| Week Change: -10.6066% Year-to-date Change: -5.9% | |

| SIM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SIM to Watchlist:  View: View:  Get Complete SIM Trend Analysis ➞ Get Complete SIM Trend Analysis ➞ | |

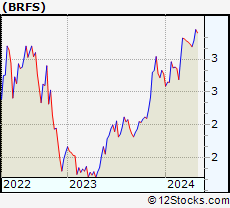

| BRFS BRF S.A. ADR |

| Sector: Consumer Staples | |

| SubSector: Packaged Foods | |

| MarketCap: 5862.22 Millions | |

| Recent Price: 3.38 Market Intelligence Score: 10 | |

| Day Percent Change: -11.5183% Day Change: 0.02 | |

| Week Change: -12.8866% Year-to-date Change: -17.0% | |

| BRFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BRFS to Watchlist:  View: View:  Get Complete BRFS Trend Analysis ➞ Get Complete BRFS Trend Analysis ➞ | |

| BOXC Brookfield Canada Office Properties |

| Sector: Financials | |

| SubSector: REIT - Office | |

| MarketCap: 2208.5 Millions | |

| Recent Price: 0.57 Market Intelligence Score: 0 | |

| Day Percent Change: -38.7097% Day Change: -9999 | |

| Week Change: -99.0812% Year-to-date Change: 0.0% | |

| BOXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BOXC to Watchlist:  View: View:  Get Complete BOXC Trend Analysis ➞ Get Complete BOXC Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Latin America Stocks With Best Up Trends [0-bearish to 100-bullish]: Milestone [100], BRP [100], Turquoise Hill[100], Canada Goose[100], Canadian Solar[100], Nevsun Resources[100], Iamgold Corp[100], Bellatrix Exploration[100], Silvercorp Metals[100], Gerdau S.A.[100], Crescent Point[100]

Best Latin America Stocks Year-to-Date:

Americas Gold[892.308%], Avino Silver[437.523%], Tower[254.565%], Gold Royalty[206.452%], EMX Royalty[189.655%], New Gold[180.534%], Celestica [169.593%], Kinross Gold[153.727%], Iamgold Corp[138.172%], Lithium Americas[124.183%], Vasta Platform[119.556%] Best Latin America Stocks This Week:

Companhia Brasileira[18587.4%], Cosan [16415.2%], Crescent Point[4066.17%], Golden Star[1837.95%], Grupo Financiero[1283.52%], Alexco Resource[690.301%], Yamana Gold[625.812%], Novelion [579.167%], Turquoise Hill[433.11%], Enerplus [415.601%], Nevsun Resources[402.516%] Best Latin America Stocks Daily:

Novelion [7.37813%], Ambipar Emergency[6.89655%], Grupo Supervielle[6.39659%], Milestone [6.34146%], Nutrien [5.50945%], Grupo Financiero[4.91926%], Mitel Networks[4.5045%], BRP [4.30981%], Empresa Distribuidora[4.06396%], Pampa Energia[4.0515%], Loma Negra[3.92707%]

Americas Gold[892.308%], Avino Silver[437.523%], Tower[254.565%], Gold Royalty[206.452%], EMX Royalty[189.655%], New Gold[180.534%], Celestica [169.593%], Kinross Gold[153.727%], Iamgold Corp[138.172%], Lithium Americas[124.183%], Vasta Platform[119.556%] Best Latin America Stocks This Week:

Companhia Brasileira[18587.4%], Cosan [16415.2%], Crescent Point[4066.17%], Golden Star[1837.95%], Grupo Financiero[1283.52%], Alexco Resource[690.301%], Yamana Gold[625.812%], Novelion [579.167%], Turquoise Hill[433.11%], Enerplus [415.601%], Nevsun Resources[402.516%] Best Latin America Stocks Daily:

Novelion [7.37813%], Ambipar Emergency[6.89655%], Grupo Supervielle[6.39659%], Milestone [6.34146%], Nutrien [5.50945%], Grupo Financiero[4.91926%], Mitel Networks[4.5045%], BRP [4.30981%], Empresa Distribuidora[4.06396%], Pampa Energia[4.0515%], Loma Negra[3.92707%]

Login Sign Up

Login Sign Up