Best Financial Stocks

| In a hurry? Financial Stocks Lists: Performance Trends Table, Stock Charts

Sort Financial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Financial stocks list by size:All Financial Large Mid-Range Small & MicroCap |

| 12Stocks.com Financial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 36 (0-bearish to 100-bullish) which puts Financial sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 21 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Financial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Financial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Financial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Financial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Trend Score | Change % | YTD Change% |

| LU | Lufax Holding |   | Credit Services | 4.58 | 83 | 4.09% | 49.19% |

| LBAI | Lakeland Bancorp |   | Regional Banks | 12.64 | 83 | 1.44% | -14.54% |

| L | Loews |   | Insurance | 76.71 | 83 | 0.56% | 10.23% |

| HGTY | Hagerty |   | Insurance - Property & Casualty | 8.90 | 83 | 0.11% | 13.81% |

| AFG | American |   | Insurance | 128.79 | 83 | 0.04% | 8.33% |

| VOYA | Voya |   | Asset Mgmt | 70.04 | 83 | -0.72% | -4.00% |

| GGAL | Grupo Financiero |   | Foreign Banks | 32.21 | 83 | -0.49% | 86.56% |

| SBRA | Sabra Health |   | REIT | 14.23 | 83 | 2.15% | -0.28% |

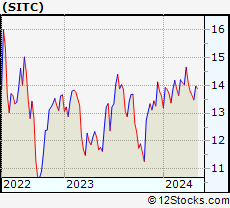

| SITC | SITE Centers |   | REIT - Retail | 13.94 | 83 | 1.49% | 2.24% |

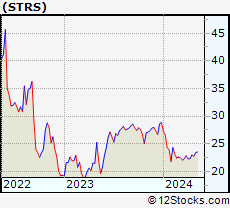

| STRS | Stratus Properties |   | Real Estatet | 23.15 | 83 | 1.05% | -19.79% |

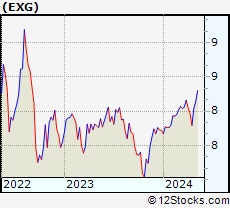

| EXG | Eaton Vance |   | Closed-End Fund - Foreign | 8.05 | 83 | 0.75% | 4.27% |

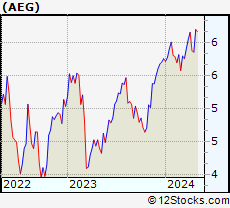

| AEG | Aegon N.V |   | Life Insurance | 6.29 | 83 | 0.72% | 9.11% |

| GOF | Guggenheim Strategic |   | Closed-End Fund - Debt | 14.64 | 83 | 0.67% | 14.36% |

| CFG | Citizens |   | Regional Banks | 34.88 | 83 | 0.53% | 5.27% |

| FHB | First Hawaiian |   | Regional Banks | 21.65 | 83 | 0.46% | -5.29% |

| FNB | F.N.B |   | Regional Banks | 13.64 | 83 | 0.37% | -0.94% |

| RF | Regions |   | Regional Banks | 19.61 | 83 | 0.18% | 1.16% |

| EFC | Ellington |   | Mortgage | 11.63 | 83 | 0.17% | -8.50% |

| BRKH | Burtech Acquisition |   | SPAC | 11.14 | 83 | 0.04% | 3.82% |

| MTB | M&T Bank |   | Regional Banks | 146.17 | 83 | 0.03% | 6.63% |

| MAIN | Main Street |   | Investments | 49.83 | 83 | -0.65% | 15.26% |

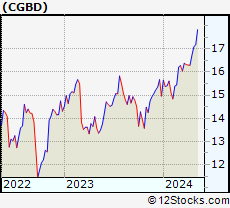

| CGBD | TCG BDC |   | Asset Mgmt | 17.23 | 83 | -0.58% | 15.17% |

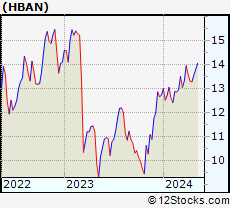

| HBAN | Huntington Bancshares |   | Regional Banks | 13.59 | 83 | -0.44% | 6.84% |

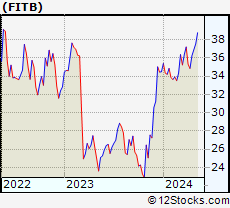

| FITB | Fifth Third |   | Regional Banks | 37.01 | 83 | -0.24% | 7.31% |

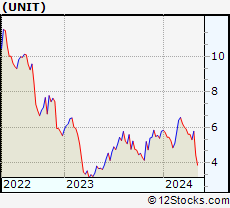

| UNIT | Uniti |   | REIT - Industrial | 6.04 | 82 | 3.96% | 4.50% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Financial Stocks |

| Financial Technical Overview, Leaders & Laggards, Top Financial ETF Funds & Detailed Financial Stocks List, Charts, Trends & More |

| Financial Sector: Technical Analysis, Trends & YTD Performance | |

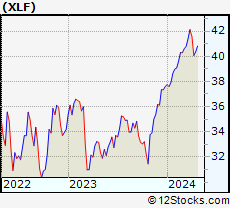

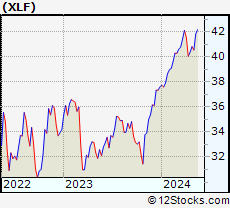

| Financial sector is composed of stocks

from banks, brokers, insurance, REITs

and services subsectors. Financial sector, as represented by XLF, an exchange-traded fund [ETF] that holds basket of Financial stocks (e.g, Bank of America, Goldman Sachs) is up by 7.7% and is currently outperforming the overall market by 2.11% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLF Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Good | |

XLF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 36 | |

| YTD Performance: 7.7% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Financial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Financial sector stocks year to date are

Now, more recently, over last week, the top performing Financial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Financial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Financial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Financial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLF | Financial |   | 40.49 | 36 | 0.33 | -0.8 | 7.7% |

| IAI | Broker-Dealers & Secs |   | 112.93 | 78 | 0.77 | -0.07 | 4.06% |

| IYF | Financials |   | 92.14 | 59 | 0.51 | -0.03 | 7.88% |

| IYG | Financial Services |   | 63.82 | 21 | 0.44 | -1.22 | 6.84% |

| KRE | Regional Banking |   | 48.98 | 86 | 1.56 | 1.64 | -6.58% |

| IXG | Global Financials |   | 84.19 | 66 | 0.70 | -0.01 | 7.13% |

| VFH | Financials |   | 98.33 | 21 | 0.58 | -0.61 | 6.57% |

| KBE | Bank |   | 45.83 | 100 | 1.24 | 1.1 | -0.41% |

| FAS | Financial Bull 3X |   | 98.11 | 25 | 0.83 | -2.5 | 18.71% |

| FAZ | Financial Bear 3X |   | 11.17 | 44 | -0.80 | 2.85 | -18.29% |

| UYG | Financials |   | 62.34 | 28 | 0.31 | -2.06 | 12.93% |

| IAT | Regional Banks |   | 41.74 | 79 | 0.58 | 0.05 | -0.24% |

| KIE | Insurance |   | 49.35 | 54 | 0.41 | 1.69 | 9.13% |

| PSCF | SmallCap Financials |   | 46.24 | 56 | 0.00 | -0.25 | -5.97% |

| EUFN | Europe Financials |   | 22.57 | 71 | 1.55 | 0.51 | 7.71% |

| PGF | Financial Preferred |   | 14.69 | 32 | 0.62 | 0.82 | 0.75% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Financial Stocks | |

|

We now take in-depth look at all Financial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Financial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

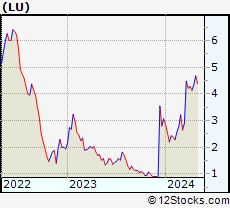

| LU Lufax Holding Ltd |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 33457 Millions | |

| Recent Price: 4.58 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 4.09% Day Change: 0.18 | |

| Week Change: -2.14% Year-to-date Change: 49.2% | |

| LU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LU to Watchlist:  View: View:  Get Complete LU Trend Analysis ➞ Get Complete LU Trend Analysis ➞ | |

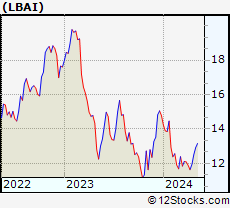

| LBAI Lakeland Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 534.599 Millions | |

| Recent Price: 12.64 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 1.44% Day Change: 0.18 | |

| Week Change: 0.96% Year-to-date Change: -14.5% | |

| LBAI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LBAI to Watchlist:  View: View:  Get Complete LBAI Trend Analysis ➞ Get Complete LBAI Trend Analysis ➞ | |

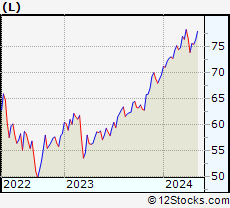

| L Loews Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 10768.2 Millions | |

| Recent Price: 76.71 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.56% Day Change: 0.43 | |

| Week Change: 1.66% Year-to-date Change: 10.2% | |

| L Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add L to Watchlist:  View: View:  Get Complete L Trend Analysis ➞ Get Complete L Trend Analysis ➞ | |

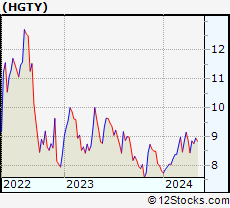

| HGTY Hagerty, Inc. |

| Sector: Financials | |

| SubSector: Insurance - Property & Casualty | |

| MarketCap: 3110 Millions | |

| Recent Price: 8.90 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.11% Day Change: 0.01 | |

| Week Change: 1.6% Year-to-date Change: 13.8% | |

| HGTY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HGTY to Watchlist:  View: View:  Get Complete HGTY Trend Analysis ➞ Get Complete HGTY Trend Analysis ➞ | |

| AFG American Financial Group, Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 5353.82 Millions | |

| Recent Price: 128.79 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.04% Day Change: 0.05 | |

| Week Change: 1.14% Year-to-date Change: 8.3% | |

| AFG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AFG to Watchlist:  View: View:  Get Complete AFG Trend Analysis ➞ Get Complete AFG Trend Analysis ➞ | |

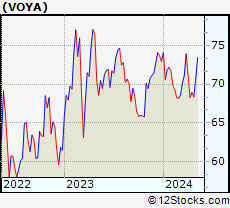

| VOYA Voya Financial, Inc. |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 4771.23 Millions | |

| Recent Price: 70.04 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.72% Day Change: -0.51 | |

| Week Change: 2.47% Year-to-date Change: -4.0% | |

| VOYA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VOYA to Watchlist:  View: View:  Get Complete VOYA Trend Analysis ➞ Get Complete VOYA Trend Analysis ➞ | |

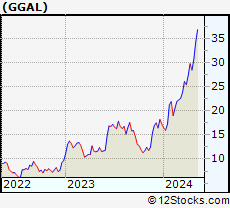

| GGAL Grupo Financiero Galicia S.A. |

| Sector: Financials | |

| SubSector: Foreign Regional Banks | |

| MarketCap: 1274.69 Millions | |

| Recent Price: 32.21 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.49% Day Change: -0.16 | |

| Week Change: 4.92% Year-to-date Change: 86.6% | |

| GGAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GGAL to Watchlist:  View: View:  Get Complete GGAL Trend Analysis ➞ Get Complete GGAL Trend Analysis ➞ | |

| SBRA Sabra Health Care REIT, Inc. |

| Sector: Financials | |

| SubSector: REIT - Healthcare Facilities | |

| MarketCap: 2576.54 Millions | |

| Recent Price: 14.23 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 2.15% Day Change: 0.30 | |

| Week Change: 2.08% Year-to-date Change: -0.3% | |

| SBRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SBRA to Watchlist:  View: View:  Get Complete SBRA Trend Analysis ➞ Get Complete SBRA Trend Analysis ➞ | |

| SITC SITE Centers Corp. |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 1449.54 Millions | |

| Recent Price: 13.94 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 1.49% Day Change: 0.21 | |

| Week Change: 3.38% Year-to-date Change: 2.2% | |

| SITC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SITC to Watchlist:  View: View:  Get Complete SITC Trend Analysis ➞ Get Complete SITC Trend Analysis ➞ | |

| STRS Stratus Properties Inc. |

| Sector: Financials | |

| SubSector: Real Estate Development | |

| MarketCap: 167.819 Millions | |

| Recent Price: 23.15 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 1.05% Day Change: 0.24 | |

| Week Change: 1.71% Year-to-date Change: -19.8% | |

| STRS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STRS to Watchlist:  View: View:  Get Complete STRS Trend Analysis ➞ Get Complete STRS Trend Analysis ➞ | |

| EXG Eaton Vance Tax-Managed Global Diversified Equity Income Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Foreign | |

| MarketCap: 1635.47 Millions | |

| Recent Price: 8.05 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.75% Day Change: 0.06 | |

| Week Change: 0.12% Year-to-date Change: 4.3% | |

| EXG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EXG to Watchlist:  View: View:  Get Complete EXG Trend Analysis ➞ Get Complete EXG Trend Analysis ➞ | |

| AEG Aegon N.V. |

| Sector: Financials | |

| SubSector: Life Insurance | |

| MarketCap: 6154.26 Millions | |

| Recent Price: 6.29 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.72% Day Change: 0.04 | |

| Week Change: 1.37% Year-to-date Change: 9.1% | |

| AEG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEG to Watchlist:  View: View:  Get Complete AEG Trend Analysis ➞ Get Complete AEG Trend Analysis ➞ | |

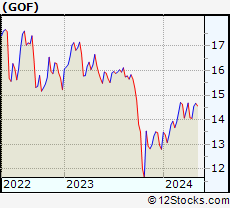

| GOF Guggenheim Strategic Opportunities Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 609.107 Millions | |

| Recent Price: 14.64 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.67% Day Change: 0.10 | |

| Week Change: 0.6% Year-to-date Change: 14.4% | |

| GOF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GOF to Watchlist:  View: View:  Get Complete GOF Trend Analysis ➞ Get Complete GOF Trend Analysis ➞ | |

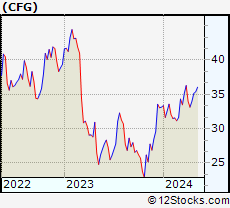

| CFG Citizens Financial Group, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 8225.19 Millions | |

| Recent Price: 34.88 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.53% Day Change: 0.18 | |

| Week Change: -0.75% Year-to-date Change: 5.3% | |

| CFG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CFG to Watchlist:  View: View:  Get Complete CFG Trend Analysis ➞ Get Complete CFG Trend Analysis ➞ | |

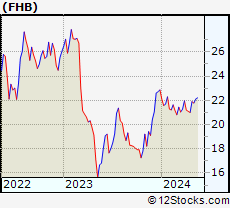

| FHB First Hawaiian, Inc. |

| Sector: Financials | |

| SubSector: Regional - Pacific Banks | |

| MarketCap: 2398.99 Millions | |

| Recent Price: 21.65 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.46% Day Change: 0.10 | |

| Week Change: -1.1% Year-to-date Change: -5.3% | |

| FHB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FHB to Watchlist:  View: View:  Get Complete FHB Trend Analysis ➞ Get Complete FHB Trend Analysis ➞ | |

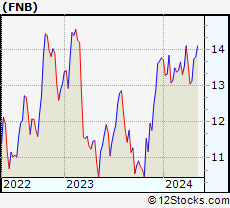

| FNB F.N.B. Corporation |

| Sector: Financials | |

| SubSector: Regional - Southeast Banks | |

| MarketCap: 2445.55 Millions | |

| Recent Price: 13.64 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.37% Day Change: 0.05 | |

| Week Change: -0.73% Year-to-date Change: -0.9% | |

| FNB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FNB to Watchlist:  View: View:  Get Complete FNB Trend Analysis ➞ Get Complete FNB Trend Analysis ➞ | |

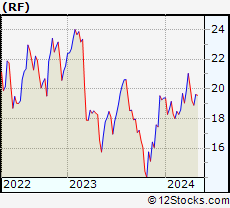

| RF Regions Financial Corporation |

| Sector: Financials | |

| SubSector: Regional - Southeast Banks | |

| MarketCap: 8936.25 Millions | |

| Recent Price: 19.61 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.18% Day Change: 0.04 | |

| Week Change: -0.08% Year-to-date Change: 1.2% | |

| RF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RF to Watchlist:  View: View:  Get Complete RF Trend Analysis ➞ Get Complete RF Trend Analysis ➞ | |

| EFC Ellington Financial Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 380.239 Millions | |

| Recent Price: 11.63 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.17% Day Change: 0.02 | |

| Week Change: -0.68% Year-to-date Change: -8.5% | |

| EFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EFC to Watchlist:  View: View:  Get Complete EFC Trend Analysis ➞ Get Complete EFC Trend Analysis ➞ | |

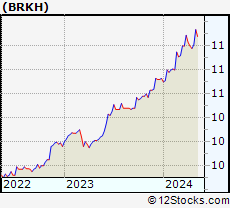

| BRKH Burtech Acquisition Corp. |

| Sector: Financials | |

| SubSector: SPAC | |

| MarketCap: 182 Millions | |

| Recent Price: 11.14 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.04% Day Change: 0.01 | |

| Week Change: 1.18% Year-to-date Change: 3.8% | |

| BRKH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BRKH to Watchlist:  View: View:  Get Complete BRKH Trend Analysis ➞ Get Complete BRKH Trend Analysis ➞ | |

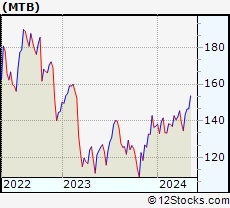

| MTB M&T Bank Corporation |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 13950.9 Millions | |

| Recent Price: 146.17 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.03% Day Change: 0.04 | |

| Week Change: -0.14% Year-to-date Change: 6.6% | |

| MTB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MTB to Watchlist:  View: View:  Get Complete MTB Trend Analysis ➞ Get Complete MTB Trend Analysis ➞ | |

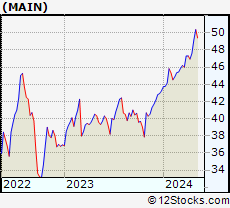

| MAIN Main Street Capital Corporation |

| Sector: Financials | |

| SubSector: Diversified Investments | |

| MarketCap: 1355.7 Millions | |

| Recent Price: 49.83 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.65% Day Change: -0.32 | |

| Week Change: 1.41% Year-to-date Change: 15.3% | |

| MAIN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MAIN to Watchlist:  View: View:  Get Complete MAIN Trend Analysis ➞ Get Complete MAIN Trend Analysis ➞ | |

| CGBD TCG BDC, Inc. |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 379.003 Millions | |

| Recent Price: 17.23 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.58% Day Change: -0.10 | |

| Week Change: 0.82% Year-to-date Change: 15.2% | |

| CGBD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CGBD to Watchlist:  View: View:  Get Complete CGBD Trend Analysis ➞ Get Complete CGBD Trend Analysis ➞ | |

| HBAN Huntington Bancshares Incorporated |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 8468.1 Millions | |

| Recent Price: 13.59 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.44% Day Change: -0.06 | |

| Week Change: 0.3% Year-to-date Change: 6.8% | |

| HBAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HBAN to Watchlist:  View: View:  Get Complete HBAN Trend Analysis ➞ Get Complete HBAN Trend Analysis ➞ | |

| FITB Fifth Third Bancorp |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 10197 Millions | |

| Recent Price: 37.01 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.24% Day Change: -0.09 | |

| Week Change: 0.3% Year-to-date Change: 7.3% | |

| FITB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FITB to Watchlist:  View: View:  Get Complete FITB Trend Analysis ➞ Get Complete FITB Trend Analysis ➞ | |

| UNIT Uniti Group Inc. |

| Sector: Financials | |

| SubSector: REIT - Industrial | |

| MarketCap: 1363.09 Millions | |

| Recent Price: 6.04 Smart Investing & Trading Score: 82 | |

| Day Percent Change: 3.96% Day Change: 0.23 | |

| Week Change: 4.5% Year-to-date Change: 4.5% | |

| UNIT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UNIT to Watchlist:  View: View:  Get Complete UNIT Trend Analysis ➞ Get Complete UNIT Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Financial Stocks With Best Up Trends [0-bearish to 100-bullish]: Noah [100], Regional Management[100], ING Groep[100], KE [100], Genworth [100], Ventas [100], Markel [100], AXIS Capital[100], EverQuote [100], KraneShares Trust[100], Star [100]

Best Financial Stocks Year-to-Date:

Root [449.19%], Hippo [99.34%], Banco Macro[95.68%], Gladstone Capital[95.23%], Grupo Financiero[86.56%], Banco BBVA[78.22%], Yiren Digital[77.4%], EverQuote [74.43%], B. Riley[65.89%], LendingTree [64.69%], Grupo Supervielle[60.1%] Best Financial Stocks This Week:

LendingTree [31.75%], Office Properties[27.86%], Heartland [21.72%], Huize Holding[19.35%], Industrial Logistics[17.36%], Douglas Elliman[13.87%], LendingClub [13.7%], AdvisorShares Pure[13.1%], Innovative Industrial[11.71%], Skyward Specialty[11.44%], eXp World[11.36%] Best Financial Stocks Daily:

Office Properties[28.50%], eXp World[11.03%], Huize Holding[10.59%], Coinbase Global[10.36%], SelectQuote [8.39%], Cipher Mining[7.74%], Noah [7.41%], Regional Management[7.32%], ING Groep[7.16%], 360 Finance[7.00%], KE [6.79%]

Root [449.19%], Hippo [99.34%], Banco Macro[95.68%], Gladstone Capital[95.23%], Grupo Financiero[86.56%], Banco BBVA[78.22%], Yiren Digital[77.4%], EverQuote [74.43%], B. Riley[65.89%], LendingTree [64.69%], Grupo Supervielle[60.1%] Best Financial Stocks This Week:

LendingTree [31.75%], Office Properties[27.86%], Heartland [21.72%], Huize Holding[19.35%], Industrial Logistics[17.36%], Douglas Elliman[13.87%], LendingClub [13.7%], AdvisorShares Pure[13.1%], Innovative Industrial[11.71%], Skyward Specialty[11.44%], eXp World[11.36%] Best Financial Stocks Daily:

Office Properties[28.50%], eXp World[11.03%], Huize Holding[10.59%], Coinbase Global[10.36%], SelectQuote [8.39%], Cipher Mining[7.74%], Noah [7.41%], Regional Management[7.32%], ING Groep[7.16%], 360 Finance[7.00%], KE [6.79%]

Login Sign Up

Login Sign Up