Best Healthcare Stocks

| "Discover best trending healthcare stocks with 12Stocks.com." |

| - Subu Vdaygiri, Founder, 12Stocks.com |

| In a hurry? Healthcare Stocks Lists: Performance Trends Table, Stock Charts

Sort Healthcare stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Healthcare stocks list by size:All Healthcare Large Mid-Range Small |

| 12Stocks.com Healthcare Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 70 (0-bearish to 100-bullish) which puts Healthcare sector in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 70 and an improvement of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Healthcare stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Healthcare sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Healthcare sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Healthcare Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| NTRA | Natera |   | Laboratories | 157.70 | 50 | 0.29% | -0.38% |

| NTRA | Natera |   | Laboratories | 158.44 | 50 | 0.29% | -0.38% |

| KOD | Kodiak Sciences |   | Biotechnology | 10.04 | 100 | 8.30% | -13.37% |

| NVST | Envista |   | Instruments | 20.82 | 80 | 4.29% | 11.77% |

| LIVN | LivaNova |   | Equipment | 54.13 | 100 | 1.61% | 14.58% |

| ENSG | Ensign |   | Long-Term | 166.27 | 100 | 52.70% | 25.26% |

| ENSG | Ensign |   | Long-Term | 166.00 | 100 | 52.70% | 25.26% |

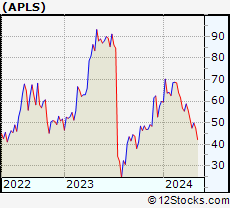

| APLS | Apellis |   | Biotechnology | 27.62 | 100 | 2.71% | -16.70% |

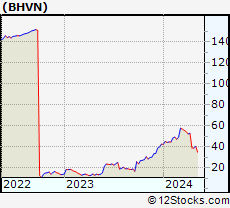

| BHVN | Biohaven |   | Biotechnology | 14.23 | 50 | 4.39% | -61.47% |

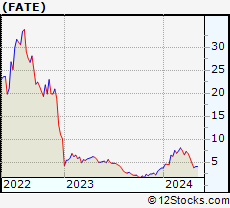

| FATE | Fate |   | Biotechnology | 1.13 | 60 | 2.13% | -31.52% |

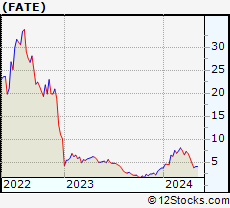

| FATE | Fate |   | Biotechnology | 1.07 | 60 | 2.13% | -31.52% |

| DNLI | Denali |   | Biotechnology | 14.46 | 80 | 3.86% | -27.33% |

| VTYX | Ventyx Biosciences |   | Biotechnology | 3.00 | 54 | 20.86% | 30.14% |

| CRON | Cronos |   | Biotechnology | 2.52 | 70 | 1.74% | 29.70% |

| ABCL | AbCellera Biologics |   | Biotechnology | 4.50 | 50 | 3.78% | 56.31% |

| ITGR | Integer |   | Equipment | 109.58 | 30 | 2.54% | -17.31% |

| ITGR | Integer |   | Equipment | 106.77 | 30 | 2.54% | -17.31% |

| OSCR | Oscar Health |   | Healthcare Plans | 14.68 | 30 | 4.85% | 11.09% |

| SEM | Select |   | Hospitals | 12.67 | 50 | 3.94% | -32.27% |

| SEM | Select |   | Hospitals | 12.60 | 50 | 3.94% | -32.27% |

| XNCR | Xencor |   | Biotechnology | 7.72 | 30 | -25.94% | -66.41% |

| XNCR | Xencor |   | Biotechnology | 7.65 | 30 | -25.94% | -66.41% |

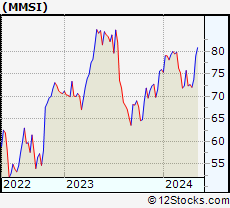

| MMSI | Merit |   | Instruments | 86.15 | 60 | 33.48% | -10.93% |

| MMSI | Merit |   | Instruments | 85.22 | 60 | 33.48% | -10.93% |

| DH | Definitive |   | Health Information | 3.80 | 46 | 3.42% | -4.14% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Healthcare Stocks |

| Healthcare Technical Overview, Leaders & Laggards, Top Healthcare ETF Funds & Detailed Healthcare Stocks List, Charts, Trends & More |

| Healthcare Sector: Technical Analysis, Trends & YTD Performance | |

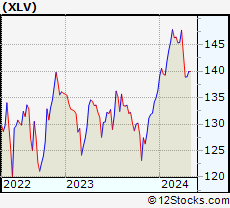

| Healthcare sector is composed of stocks

from pharmaceutical, biotech, diagnostics labs, insurance providers

and healthcare services. Healthcare sector, as represented by XLV, an exchange-traded fund [ETF] that holds basket of Healthcare stocks (e.g, Merck, Amgen) is down by -2.27% and is currently underperforming the overall market by -12.6% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLV Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Not Good | |

XLV Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 70 | |

| YTD Performance: -2.27% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Healthcare Sector Stocks | |||||||||||||||||||||||||

The top performing Healthcare sector stocks year to date are Now, more recently, over last week, the top performing Healthcare sector stocks on the move are

|

|||||||||||||||||||||||||

| 12Stocks.com: Investing in Healthcare Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Healthcare Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Healthcare Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLV | Health Care |   | 133.29 | 70 | 0.63 | 2.13 | -2.27% |

| XLV | Health Care |   | 133.96 | 70 | 0.63 | 2.13 | -2.27% |

| XBI | Biotech |   | 89.52 | 100 | 27.96 | 3.94 | -0.58% |

| XBI | Biotech |   | 89.57 | 100 | 27.96 | 3.94 | -0.58% |

| IBB | Biotechnology |   | 137.10 | 100 | 16.19 | 4.27 | 3.79% |

| IBB | Biotechnology |   | 137.27 | 100 | 16.19 | 4.27 | 3.79% |

| BBH | Biotech |   | 164.79 | 80 | 13.23 | 4.48 | 4.98% |

| BBH | Biotech |   | 165.04 | 80 | 13.23 | 4.48 | 4.98% |

| VHT | Health Care |   | 247.64 | 70 | 0.9 | 2.5 | -1.66% |

| VHT | Health Care |   | 248.61 | 70 | 0.9 | 2.5 | -1.66% |

| IYH | Healthcare |   | 56.22 | 70 | -76.82 | 2.44 | -2.98% |

| IYH | Healthcare |   | 56.48 | 70 | -76.82 | 2.44 | -2.98% |

| IHF | Healthcare Providers |   | 44.10 | 70 | 1.48 | 6.7 | -7.8% |

| IHF | Healthcare Providers |   | 44.11 | 70 | 1.48 | 6.7 | -7.8% |

| IHI | Medical Devices |   | 61.79 | 80 | 8.95 | 3.36 | 6.05% |

| IHI | Medical Devices |   | 61.59 | 80 | 8.95 | 3.36 | 6.05% |

| BIB | Biotechnology |   | 54.59 | 100 | 2.26 | 8.69 | 8.43% |

| BIB | Biotechnology |   | 54.80 | 100 | 2.26 | 8.69 | 8.43% |

| BIS | Short Biotech |   | 14.60 | 0 | -1.9 | -8.1 | -18.59% |

| BIS | Short Biotech |   | 14.55 | 0 | -1.9 | -8.1 | -18.59% |

| XHE | Health Care Equipment |   | 80.23 | 70 | -1.87 | 5.78 | -8.29% |

| CURE | Healthcare Bull 3X |   | 74.15 | 70 | 33.21 | 5.76 | -19.07% |

| CURE | Healthcare Bull 3X |   | 75.23 | 70 | 33.21 | 5.76 | -19.07% |

| LABU | Biotech Bull 3X |   | 69.12 | 100 | 2753.31 | 11.7 | -22.8% |

| LABU | Biotech Bull 3X |   | 69.34 | 100 | 2753.31 | 11.7 | -22.8% |

| LABD | Biotech Bear 3X |   | 5.83 | 10 | -4.32 | -11.26 | -18.59% |

| LABD | Biotech Bear 3X |   | 5.82 | 10 | -4.32 | -11.26 | -18.59% |

| PSCH | SmallCap Health Care |   | 39.84 | 70 | 9.4 | 7.11 | -8.86% |

| XHS | Health Care Services |   | 95.12 | 70 | 2.39 | 7.01 | 5.6% |

| PTH | DWA Healthcare Momentum |   | 39.22 | 100 | 1.76 | 5.17 | -2.11% |

| RXL | Health Care |   | 39.23 | 70 | 25.59 | 3.98 | -10.09% |

| RXL | Health Care |   | 39.68 | 70 | 25.59 | 3.98 | -10.09% |

| RXD | Short Health Care |   | 12.29 | 20 | -1.14 | -4.17 | 4.29% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Healthcare Stocks | |

|

We now take in-depth look at all Healthcare stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Healthcare stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

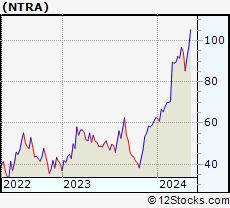

| NTRA Natera, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 2152.1 Millions | |

| Recent Price: 157.70 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.29% Day Change: 0.36 | |

| Week Change: 14.17% Year-to-date Change: -0.4% | |

| NTRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NTRA to Watchlist:  View: View:  Get Complete NTRA Trend Analysis ➞ Get Complete NTRA Trend Analysis ➞ | |

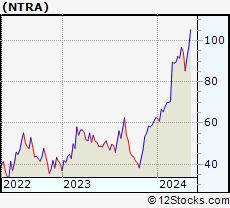

| NTRA Natera, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 2152.1 Millions | |

| Recent Price: 158.44 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.29% Day Change: 0.36 | |

| Week Change: 14.17% Year-to-date Change: -0.4% | |

| NTRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NTRA to Watchlist:  View: View:  Get Complete NTRA Trend Analysis ➞ Get Complete NTRA Trend Analysis ➞ | |

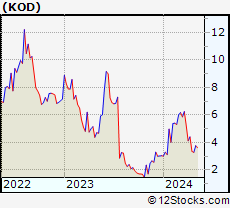

| KOD Kodiak Sciences Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2132.15 Millions | |

| Recent Price: 10.04 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 8.3% Day Change: 0.22 | |

| Week Change: 4.99% Year-to-date Change: -13.4% | |

| KOD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KOD to Watchlist:  View: View:  Get Complete KOD Trend Analysis ➞ Get Complete KOD Trend Analysis ➞ | |

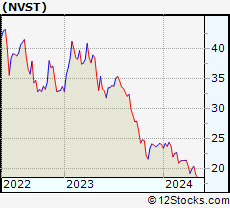

| NVST Envista Holdings Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 2075.8 Millions | |

| Recent Price: 20.82 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 4.29% Day Change: 0.77 | |

| Week Change: 9.39% Year-to-date Change: 11.8% | |

| NVST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVST to Watchlist:  View: View:  Get Complete NVST Trend Analysis ➞ Get Complete NVST Trend Analysis ➞ | |

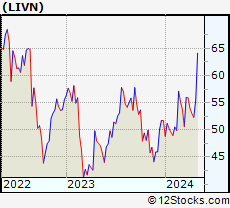

| LIVN LivaNova PLC |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 2060.5 Millions | |

| Recent Price: 54.13 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.61% Day Change: 0.74 | |

| Week Change: 12.04% Year-to-date Change: 14.6% | |

| LIVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LIVN to Watchlist:  View: View:  Get Complete LIVN Trend Analysis ➞ Get Complete LIVN Trend Analysis ➞ | |

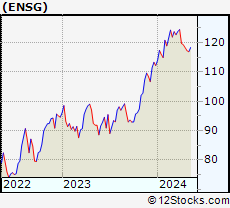

| ENSG The Ensign Group, Inc. |

| Sector: Health Care | |

| SubSector: Long-Term Care Facilities | |

| MarketCap: 2053.76 Millions | |

| Recent Price: 166.27 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 52.7% Day Change: 51.1 | |

| Week Change: 5.15% Year-to-date Change: 25.3% | |

| ENSG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ENSG to Watchlist:  View: View:  Get Complete ENSG Trend Analysis ➞ Get Complete ENSG Trend Analysis ➞ | |

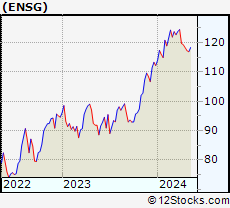

| ENSG The Ensign Group, Inc. |

| Sector: Health Care | |

| SubSector: Long-Term Care Facilities | |

| MarketCap: 2053.76 Millions | |

| Recent Price: 166.00 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 52.7% Day Change: 51.1 | |

| Week Change: 5.15% Year-to-date Change: 25.3% | |

| ENSG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ENSG to Watchlist:  View: View:  Get Complete ENSG Trend Analysis ➞ Get Complete ENSG Trend Analysis ➞ | |

| APLS Apellis Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2030.95 Millions | |

| Recent Price: 27.62 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.71% Day Change: 1.06 | |

| Week Change: 12.01% Year-to-date Change: -16.7% | |

| APLS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add APLS to Watchlist:  View: View:  Get Complete APLS Trend Analysis ➞ Get Complete APLS Trend Analysis ➞ | |

| BHVN Biohaven Pharmaceutical Holding Company Ltd. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2024.25 Millions | |

| Recent Price: 14.23 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 4.39% Day Change: 1.75 | |

| Week Change: -4.45% Year-to-date Change: -61.5% | |

| BHVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BHVN to Watchlist:  View: View:  Get Complete BHVN Trend Analysis ➞ Get Complete BHVN Trend Analysis ➞ | |

| FATE Fate Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2022.45 Millions | |

| Recent Price: 1.13 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 2.13% Day Change: 0.08 | |

| Week Change: 8.65% Year-to-date Change: -31.5% | |

| FATE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FATE to Watchlist:  View: View:  Get Complete FATE Trend Analysis ➞ Get Complete FATE Trend Analysis ➞ | |

| FATE Fate Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2022.45 Millions | |

| Recent Price: 1.07 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 2.13% Day Change: 0.08 | |

| Week Change: 8.65% Year-to-date Change: -31.5% | |

| FATE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FATE to Watchlist:  View: View:  Get Complete FATE Trend Analysis ➞ Get Complete FATE Trend Analysis ➞ | |

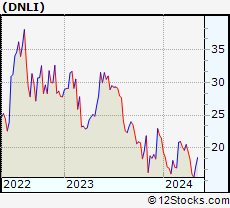

| DNLI Denali Therapeutics Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2020.05 Millions | |

| Recent Price: 14.46 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 3.86% Day Change: 0.92 | |

| Week Change: 3.21% Year-to-date Change: -27.3% | |

| DNLI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DNLI to Watchlist:  View: View:  Get Complete DNLI Trend Analysis ➞ Get Complete DNLI Trend Analysis ➞ | |

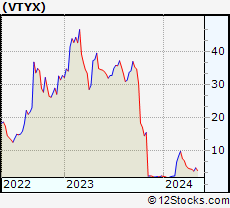

| VTYX Ventyx Biosciences, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1950 Millions | |

| Recent Price: 3.00 Smart Investing & Trading Score: 54 | |

| Day Percent Change: 20.86% Day Change: 0.39 | |

| Week Change: 12.65% Year-to-date Change: 30.1% | |

| VTYX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VTYX to Watchlist:  View: View:  Get Complete VTYX Trend Analysis ➞ Get Complete VTYX Trend Analysis ➞ | |

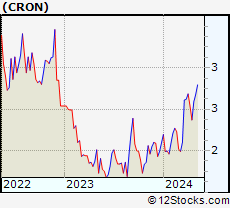

| CRON Cronos Group Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1935.95 Millions | |

| Recent Price: 2.52 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 1.74% Day Change: 0.04 | |

| Week Change: 24.76% Year-to-date Change: 29.7% | |

| CRON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRON to Watchlist:  View: View:  Get Complete CRON Trend Analysis ➞ Get Complete CRON Trend Analysis ➞ | |

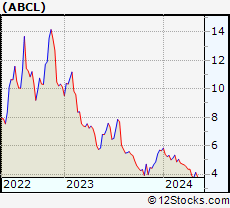

| ABCL AbCellera Biologics Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1870 Millions | |

| Recent Price: 4.50 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 3.78% Day Change: 0.09 | |

| Week Change: 11.17% Year-to-date Change: 56.3% | |

| ABCL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ABCL to Watchlist:  View: View:  Get Complete ABCL Trend Analysis ➞ Get Complete ABCL Trend Analysis ➞ | |

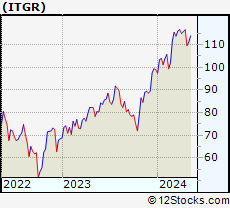

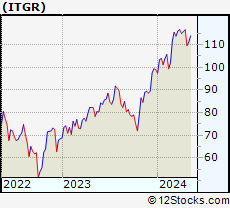

| ITGR Integer Holdings Corporation |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 1794.8 Millions | |

| Recent Price: 109.58 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 2.54% Day Change: 3.14 | |

| Week Change: 4.01% Year-to-date Change: -17.3% | |

| ITGR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ITGR to Watchlist:  View: View:  Get Complete ITGR Trend Analysis ➞ Get Complete ITGR Trend Analysis ➞ | |

| ITGR Integer Holdings Corporation |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 1794.8 Millions | |

| Recent Price: 106.77 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 2.54% Day Change: 3.14 | |

| Week Change: 4.01% Year-to-date Change: -17.3% | |

| ITGR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ITGR to Watchlist:  View: View:  Get Complete ITGR Trend Analysis ➞ Get Complete ITGR Trend Analysis ➞ | |

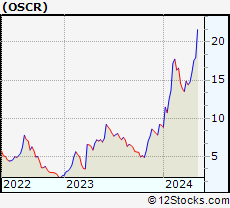

| OSCR Oscar Health, Inc. |

| Sector: Health Care | |

| SubSector: Healthcare Plans | |

| MarketCap: 1790 Millions | |

| Recent Price: 14.68 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 4.85% Day Change: 0.82 | |

| Week Change: 4.11% Year-to-date Change: 11.1% | |

| OSCR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OSCR to Watchlist:  View: View:  Get Complete OSCR Trend Analysis ➞ Get Complete OSCR Trend Analysis ➞ | |

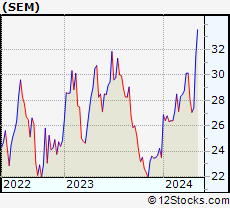

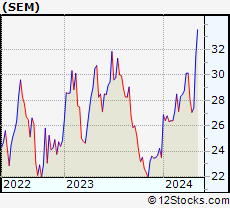

| SEM Select Medical Holdings Corporation |

| Sector: Health Care | |

| SubSector: Hospitals | |

| MarketCap: 1765.96 Millions | |

| Recent Price: 12.67 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 3.94% Day Change: 1.35 | |

| Week Change: 6.03% Year-to-date Change: -32.3% | |

| SEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SEM to Watchlist:  View: View:  Get Complete SEM Trend Analysis ➞ Get Complete SEM Trend Analysis ➞ | |

| SEM Select Medical Holdings Corporation |

| Sector: Health Care | |

| SubSector: Hospitals | |

| MarketCap: 1765.96 Millions | |

| Recent Price: 12.60 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 3.94% Day Change: 1.35 | |

| Week Change: 6.03% Year-to-date Change: -32.3% | |

| SEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SEM to Watchlist:  View: View:  Get Complete SEM Trend Analysis ➞ Get Complete SEM Trend Analysis ➞ | |

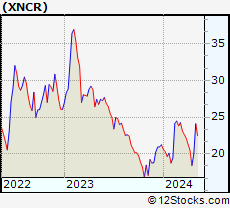

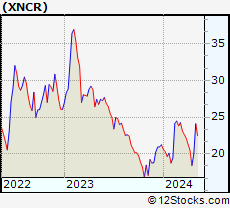

| XNCR Xencor, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1744.35 Millions | |

| Recent Price: 7.72 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -25.94% Day Change: -6.19 | |

| Week Change: 3.07% Year-to-date Change: -66.4% | |

| XNCR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XNCR to Watchlist:  View: View:  Get Complete XNCR Trend Analysis ➞ Get Complete XNCR Trend Analysis ➞ | |

| XNCR Xencor, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1744.35 Millions | |

| Recent Price: 7.65 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -25.94% Day Change: -6.19 | |

| Week Change: 3.07% Year-to-date Change: -66.4% | |

| XNCR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XNCR to Watchlist:  View: View:  Get Complete XNCR Trend Analysis ➞ Get Complete XNCR Trend Analysis ➞ | |

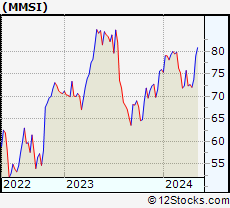

| MMSI Merit Medical Systems, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 1719.2 Millions | |

| Recent Price: 86.15 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 33.48% Day Change: 23.4 | |

| Week Change: 3.11% Year-to-date Change: -10.9% | |

| MMSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MMSI to Watchlist:  View: View:  Get Complete MMSI Trend Analysis ➞ Get Complete MMSI Trend Analysis ➞ | |

| MMSI Merit Medical Systems, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 1719.2 Millions | |

| Recent Price: 85.22 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 33.48% Day Change: 23.4 | |

| Week Change: 3.11% Year-to-date Change: -10.9% | |

| MMSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MMSI to Watchlist:  View: View:  Get Complete MMSI Trend Analysis ➞ Get Complete MMSI Trend Analysis ➞ | |

| DH Definitive Healthcare Corp. |

| Sector: Health Care | |

| SubSector: Health Information Services | |

| MarketCap: 1690 Millions | |

| Recent Price: 3.80 Smart Investing & Trading Score: 46 | |

| Day Percent Change: 3.42% Day Change: 0.15 | |

| Week Change: 0.25% Year-to-date Change: -4.1% | |

| DH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DH to Watchlist:  View: View:  Get Complete DH Trend Analysis ➞ Get Complete DH Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Healthcare Stocks With Best Up Trends [0-bearish to 100-bullish]: Amneal [100], XOMA [100], XOMA [100], Novavax [100], Novavax [100], Ensign [100], Ensign [100], Halozyme [100], Halozyme [100], Xenon [100], Xenon [100]

Best Healthcare Stocks Year-to-Date:

Evofem Biosciences[101000000%], Translate Bio[2499650%], Eagle [1999700%], Avenue [499850%], Brainstorm Cell[440385%], Sinovac Biotech[154444%], LogicBio [142133%], Petros [101438%], Regencell Bioscience[10223.1%], Regencell Bioscience[10223.1%], I Mab[398.82%] Best Healthcare Stocks This Week:

Evofem Biosciences[111100000%], Translate Bio[45449900%], Petros [34479200%], Avenue [3208820%], Brainstorm Cell[1639080%], Eagle [313348%], Sinovac Biotech[154444%], LogicBio [133220%], Tilray [102.53%], X4 [85.44%], Aveanna [83.8%] Best Healthcare Stocks Daily:

vTv [2351.05%], vTv [2351.05%], RedHill Biopharma[913.48%], RedHill Biopharma[913.48%], Corbus [827.02%], Corbus [827.02%], Summit [647.43%], Summit [647.43%], Concord [417.91%], Concord [417.91%], Mesoblast [378.83%]

Evofem Biosciences[101000000%], Translate Bio[2499650%], Eagle [1999700%], Avenue [499850%], Brainstorm Cell[440385%], Sinovac Biotech[154444%], LogicBio [142133%], Petros [101438%], Regencell Bioscience[10223.1%], Regencell Bioscience[10223.1%], I Mab[398.82%] Best Healthcare Stocks This Week:

Evofem Biosciences[111100000%], Translate Bio[45449900%], Petros [34479200%], Avenue [3208820%], Brainstorm Cell[1639080%], Eagle [313348%], Sinovac Biotech[154444%], LogicBio [133220%], Tilray [102.53%], X4 [85.44%], Aveanna [83.8%] Best Healthcare Stocks Daily:

vTv [2351.05%], vTv [2351.05%], RedHill Biopharma[913.48%], RedHill Biopharma[913.48%], Corbus [827.02%], Corbus [827.02%], Summit [647.43%], Summit [647.43%], Concord [417.91%], Concord [417.91%], Mesoblast [378.83%]

Login Sign Up

Login Sign Up