Best Latin America Stocks

|

|

| Quick Read: Top Latin America Stocks By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Latin America Views: Quick Browse View, Summary & Slide Show | |||

| 12Stocks.com Latin America Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 40 (0-bearish to 100-bullish) which puts Latin America index in short term bearish to neutral trend. The market intelligence score from previous trading session is 50 and a deterioration of trend continues.

| ||||||||

Here are the market intelligence trend scores of the most requested Latin America stocks at 12Stocks.com (click stock name for detailed review):

| |||||||||||||||||||||||||

| Scroll down this page for most comprehensive review of Latin America stocks by performance, trends, technical analysis, charts, fund plays & more | |||||||||||||||||||||||||

| 12Stocks.com: Top Performing Latin America Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Latin America Index stocks year to date are

Now, more recently, over last week, the top performing Latin America Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Latin America Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Latin America Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Latin America Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| NVLN | Novelion |   | Health Care | 16.30 | 60 | 7.38% | 0.00% |

| TCX | Tucows |   | Technology | 18.05 | 10 | -1.53% | 7.57% |

| BXE | Bellatrix Exploration |   | Energy | 79.46 | 100 | 1.81% | 0.00% |

| PLG | Platinum |   | Materials | 2.58 | 80 | -2.64% | 91.11% |

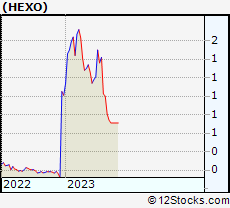

| HEXO | HEXO |   | Health Care | 0.71 | 20 | 0.00% | 0.00% |

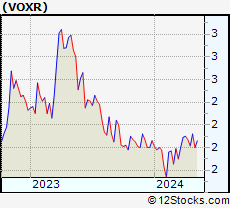

| VOXR | Vox Royalty |   | Materials | 4.12 | 70 | -4.19% | 71.02% |

| AKG | Asanko Gold |   | Materials | 16.87 | 0 | -3.38% | 0.00% |

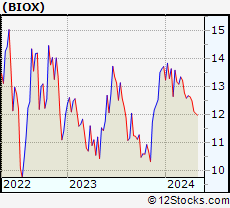

| BIOX | Bioceres Crop |   | Materials | 1.30 | 20 | -5.11% | -80.65% |

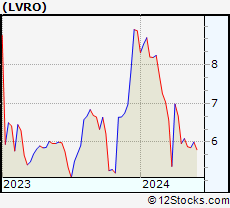

| LVRO | Lavoro |   | Materials | 1.81 | 71 | -1.76% | -65.14% |

| ARLZ | Aralez |   | Health Care | 30.62 | 60 | -0.26% | 0.00% |

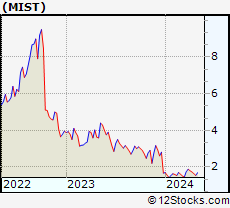

| MIST | Milestone |   | Health Care | 2.18 | 100 | 6.34% | 0.46% |

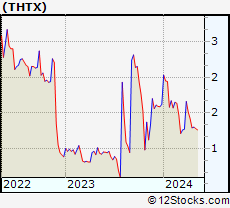

| THTX | Thera |   | Health Care | 3.39 | 90 | 0.00% | 84.24% |

| ACHV | Achieve Life |   | Health Care | 3.19 | 100 | 2.90% | -13.55% |

| NYMX | Nymox |   | Health Care | 44.30 | 70 | 0.16% | 0.00% |

| GTE | Gran Tierra |   | Energy | 4.21 | 50 | -8.48% | -44.09% |

| EXFO | EXFO |   | Technology | 32.25 | 100 | 2.19% | 0.00% |

| SRSC | Sears Canada |   | Services & Goods | 1.02 | 10 | 0.99% | 0.00% |

| RFP | Resolute Forest |   | Consumer Staples | 47.23 | 70 | 1.46% | 0.00% |

| SRRA | Sierra Oncology |   | Health Care | 14.95 | 30 | 3.68% | 0.00% |

| SMTS | Sierra Metals |   | Materials | 0.29 | 80 | -2.66% | 0.00% |

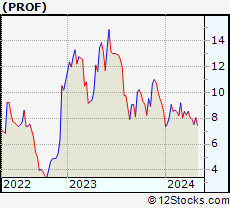

| PROF | Profound Medical |   | Health Care | 5.34 | 80 | 8.10% | -32.41% |

| MFCB | MFC Bancorp |   | Materials | 0.73 | 20 | 2.82% | 0.00% |

| TGD | Timmins Gold |   | Materials | 0.48 | 0 | 0.00% | 0.00% |

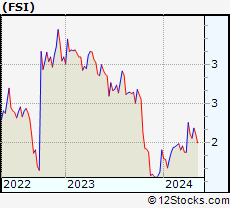

| FSI | Flexible |   | Materials | 9.65 | 70 | -3.50% | 169.06% |

| USGO | U.S. GoldMining |   | Materials | 13.20 | 43 | 2.05% | -7.43% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Latin America Stocks |

| Latin America Technical Overview, Leaders & Laggards, Top Latin America ETF Funds & Detailed Latin America Stocks List, Charts, Trends & More |

| Latin America: Technical Analysis, Trends & YTD Performance | |

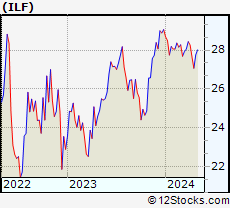

ILF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

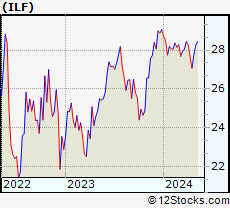

ILF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 40 | |

| YTD Performance: 37.1981% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Latin America Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors play Latin America stock market. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Latin America Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| LBJ | Latin America Bull |   | 60.40 | 50 | 0 | 0 | 0% |

| DBBR | Brazil Hedgd Eq |   | 54.06 | 70 | -0.478645 | 0.632911 | 0% |

| FBZ | Brazil AlphaDEX |   | 11.52 | 30 | 0 | 0 | 29.5955% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Latin America Stocks | |

|

We now take in-depth look at all Latin America stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Latin America stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

| NVLN Novelion Therapeutics Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 198.02 Millions | |

| Recent Price: 16.30 Market Intelligence Score: 60 | |

| Day Percent Change: 7.37813% Day Change: -9999 | |

| Week Change: 579.167% Year-to-date Change: 0.0% | |

| NVLN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVLN to Watchlist:  View: View:  Get Complete NVLN Trend Analysis ➞ Get Complete NVLN Trend Analysis ➞ | |

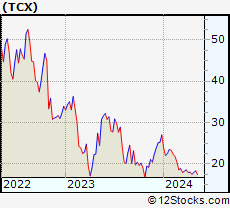

| TCX Tucows, Inc |

| Sector: Technology | |

| SubSector: Software - Infrastructure | |

| MarketCap: 197.53 Millions | |

| Recent Price: 18.05 Market Intelligence Score: 10 | |

| Day Percent Change: -1.52755% Day Change: -0.47 | |

| Week Change: -5.19958% Year-to-date Change: 7.6% | |

| TCX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TCX to Watchlist:  View: View:  Get Complete TCX Trend Analysis ➞ Get Complete TCX Trend Analysis ➞ | |

| BXE Bellatrix Exploration Ltd. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 189.33 Millions | |

| Recent Price: 79.46 Market Intelligence Score: 100 | |

| Day Percent Change: 1.80653% Day Change: -9999 | |

| Week Change: 291.621% Year-to-date Change: 0.0% | |

| BXE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BXE to Watchlist:  View: View:  Get Complete BXE Trend Analysis ➞ Get Complete BXE Trend Analysis ➞ | |

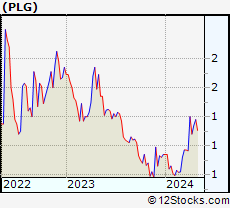

| PLG Platinum Group Metals Ltd |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 186.17 Millions | |

| Recent Price: 2.58 Market Intelligence Score: 80 | |

| Day Percent Change: -2.64151% Day Change: 0.05 | |

| Week Change: 22.8571% Year-to-date Change: 91.1% | |

| PLG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PLG to Watchlist:  View: View:  Get Complete PLG Trend Analysis ➞ Get Complete PLG Trend Analysis ➞ | |

| HEXO HEXO Corp. |

| Sector: Health Care | |

| SubSector: Drugs - Generic | |

| MarketCap: 185.385 Millions | |

| Recent Price: 0.71 Market Intelligence Score: 20 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| HEXO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HEXO to Watchlist:  View: View:  Get Complete HEXO Trend Analysis ➞ Get Complete HEXO Trend Analysis ➞ | |

| VOXR Vox Royalty Corp |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 179.69 Millions | |

| Recent Price: 4.12 Market Intelligence Score: 70 | |

| Day Percent Change: -4.18605% Day Change: 0.15 | |

| Week Change: 11.3514% Year-to-date Change: 71.0% | |

| VOXR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VOXR to Watchlist:  View: View:  Get Complete VOXR Trend Analysis ➞ Get Complete VOXR Trend Analysis ➞ | |

| AKG Asanko Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 175.619 Millions | |

| Recent Price: 16.87 Market Intelligence Score: 0 | |

| Day Percent Change: -3.37915% Day Change: -9999 | |

| Week Change: -19.4365% Year-to-date Change: 0.0% | |

| AKG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AKG to Watchlist:  View: View:  Get Complete AKG Trend Analysis ➞ Get Complete AKG Trend Analysis ➞ | |

| BIOX Bioceres Crop Solutions Corp |

| Sector: Materials | |

| SubSector: Agricultural Inputs | |

| MarketCap: 169.95 Millions | |

| Recent Price: 1.30 Market Intelligence Score: 20 | |

| Day Percent Change: -5.10949% Day Change: 0.24 | |

| Week Change: -24.8555% Year-to-date Change: -80.7% | |

| BIOX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BIOX to Watchlist:  View: View:  Get Complete BIOX Trend Analysis ➞ Get Complete BIOX Trend Analysis ➞ | |

| LVRO Lavoro Ltd |

| Sector: Materials | |

| SubSector: Agricultural Inputs | |

| MarketCap: 155.59 Millions | |

| Recent Price: 1.81 Market Intelligence Score: 71 | |

| Day Percent Change: -1.76% Day Change: -0.03 | |

| Week Change: -18.54% Year-to-date Change: -65.1% | |

| LVRO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LVRO to Watchlist:  View: View:  Get Complete LVRO Trend Analysis ➞ Get Complete LVRO Trend Analysis ➞ | |

| ARLZ Aralez Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 155.5 Millions | |

| Recent Price: 30.62 Market Intelligence Score: 60 | |

| Day Percent Change: -0.260586% Day Change: -9999 | |

| Week Change: 3.16712% Year-to-date Change: 0.0% | |

| ARLZ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARLZ to Watchlist:  View: View:  Get Complete ARLZ Trend Analysis ➞ Get Complete ARLZ Trend Analysis ➞ | |

| MIST Milestone Pharmaceuticals Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 152.99 Millions | |

| Recent Price: 2.18 Market Intelligence Score: 100 | |

| Day Percent Change: 6.34146% Day Change: 0.07 | |

| Week Change: 12.3711% Year-to-date Change: 0.5% | |

| MIST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MIST to Watchlist:  View: View:  Get Complete MIST Trend Analysis ➞ Get Complete MIST Trend Analysis ➞ | |

| THTX Theratechnologies Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 150.35 Millions | |

| Recent Price: 3.39 Market Intelligence Score: 90 | |

| Day Percent Change: 0% Day Change: 0 | |

| Week Change: 2.41692% Year-to-date Change: 84.2% | |

| THTX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THTX to Watchlist:  View: View:  Get Complete THTX Trend Analysis ➞ Get Complete THTX Trend Analysis ➞ | |

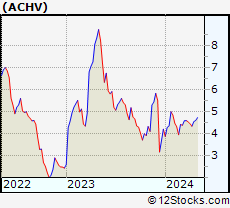

| ACHV Achieve Life Sciences Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 144.63 Millions | |

| Recent Price: 3.19 Market Intelligence Score: 100 | |

| Day Percent Change: 2.90323% Day Change: 0.31 | |

| Week Change: 3.57143% Year-to-date Change: -13.6% | |

| ACHV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACHV to Watchlist:  View: View:  Get Complete ACHV Trend Analysis ➞ Get Complete ACHV Trend Analysis ➞ | |

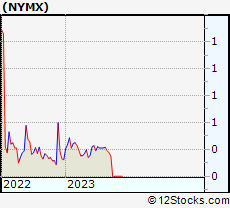

| NYMX Nymox Pharmaceutical Corporation |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 143.585 Millions | |

| Recent Price: 44.30 Market Intelligence Score: 70 | |

| Day Percent Change: 0.158264% Day Change: -9999 | |

| Week Change: 8258.49% Year-to-date Change: 0.0% | |

| NYMX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NYMX to Watchlist:  View: View:  Get Complete NYMX Trend Analysis ➞ Get Complete NYMX Trend Analysis ➞ | |

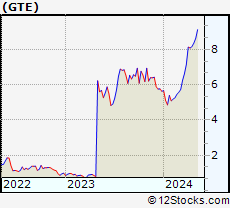

| GTE Gran Tierra Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 139.05 Millions | |

| Recent Price: 4.21 Market Intelligence Score: 50 | |

| Day Percent Change: -8.47826% Day Change: 0.02 | |

| Week Change: -8.97297% Year-to-date Change: -44.1% | |

| GTE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GTE to Watchlist:  View: View:  Get Complete GTE Trend Analysis ➞ Get Complete GTE Trend Analysis ➞ | |

| EXFO EXFO Inc. |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 134.239 Millions | |

| Recent Price: 32.25 Market Intelligence Score: 100 | |

| Day Percent Change: 2.18631% Day Change: -9999 | |

| Week Change: 416.413% Year-to-date Change: 0.0% | |

| EXFO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EXFO to Watchlist:  View: View:  Get Complete EXFO Trend Analysis ➞ Get Complete EXFO Trend Analysis ➞ | |

| SRSC Sears Canada Inc. |

| Sector: Services & Goods | |

| SubSector: Department Stores | |

| MarketCap: 132.44 Millions | |

| Recent Price: 1.02 Market Intelligence Score: 10 | |

| Day Percent Change: 0.990099% Day Change: -9999 | |

| Week Change: -87.218% Year-to-date Change: 0.0% | |

| SRSC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SRSC to Watchlist:  View: View:  Get Complete SRSC Trend Analysis ➞ Get Complete SRSC Trend Analysis ➞ | |

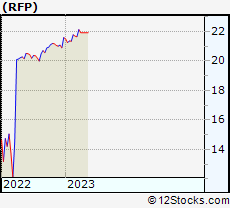

| RFP Resolute Forest Products Inc. |

| Sector: Consumer Staples | |

| SubSector: Paper & Paper Products | |

| MarketCap: 129.303 Millions | |

| Recent Price: 47.23 Market Intelligence Score: 70 | |

| Day Percent Change: 1.46079% Day Change: -9999 | |

| Week Change: 115.465% Year-to-date Change: 0.0% | |

| RFP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RFP to Watchlist:  View: View:  Get Complete RFP Trend Analysis ➞ Get Complete RFP Trend Analysis ➞ | |

| SRRA Sierra Oncology, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 125.185 Millions | |

| Recent Price: 14.95 Market Intelligence Score: 30 | |

| Day Percent Change: 3.67545% Day Change: -9999 | |

| Week Change: -72.8132% Year-to-date Change: 0.0% | |

| SRRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SRRA to Watchlist:  View: View:  Get Complete SRRA Trend Analysis ➞ Get Complete SRRA Trend Analysis ➞ | |

| SMTS Sierra Metals Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 124.91 Millions | |

| Recent Price: 0.29 Market Intelligence Score: 80 | |

| Day Percent Change: -2.65781% Day Change: -9999 | |

| Week Change: 67.4286% Year-to-date Change: 0.0% | |

| SMTS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SMTS to Watchlist:  View: View:  Get Complete SMTS Trend Analysis ➞ Get Complete SMTS Trend Analysis ➞ | |

| PROF Profound Medical Corp |

| Sector: Health Care | |

| SubSector: Medical Devices | |

| MarketCap: 123.81 Millions | |

| Recent Price: 5.34 Market Intelligence Score: 80 | |

| Day Percent Change: 8.09717% Day Change: -0.04 | |

| Week Change: -0.558659% Year-to-date Change: -32.4% | |

| PROF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PROF to Watchlist:  View: View:  Get Complete PROF Trend Analysis ➞ Get Complete PROF Trend Analysis ➞ | |

| MFCB MFC Bancorp Ltd. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 123.17 Millions | |

| Recent Price: 0.73 Market Intelligence Score: 20 | |

| Day Percent Change: 2.8169% Day Change: -9999 | |

| Week Change: -96.4092% Year-to-date Change: 0.0% | |

| MFCB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MFCB to Watchlist:  View: View:  Get Complete MFCB Trend Analysis ➞ Get Complete MFCB Trend Analysis ➞ | |

| TGD Timmins Gold Corp. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 122.46 Millions | |

| Recent Price: 0.48 Market Intelligence Score: 0 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| TGD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TGD to Watchlist:  View: View:  Get Complete TGD Trend Analysis ➞ Get Complete TGD Trend Analysis ➞ | |

| FSI Flexible Solutions International Inc |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 120.24 Millions | |

| Recent Price: 9.65 Market Intelligence Score: 70 | |

| Day Percent Change: -3.5% Day Change: 0 | |

| Week Change: -2.62361% Year-to-date Change: 169.1% | |

| FSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FSI to Watchlist:  View: View:  Get Complete FSI Trend Analysis ➞ Get Complete FSI Trend Analysis ➞ | |

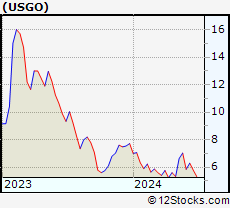

| USGO U.S. GoldMining Inc |

| Sector: Materials | |

| SubSector: Other Industrial Metals & Mining | |

| MarketCap: 114.71 Millions | |

| Recent Price: 13.20 Market Intelligence Score: 43 | |

| Day Percent Change: 2.05% Day Change: 0.16 | |

| Week Change: 0.89% Year-to-date Change: -7.4% | |

| USGO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add USGO to Watchlist:  View: View:  Get Complete USGO Trend Analysis ➞ Get Complete USGO Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Latin America Stocks With Best Up Trends [0-bearish to 100-bullish]: Milestone [100], BRP [100], Turquoise Hill[100], Canada Goose[100], Canadian Solar[100], Nevsun Resources[100], Iamgold Corp[100], Bellatrix Exploration[100], Silvercorp Metals[100], Gerdau S.A.[100], Crescent Point[100]

Best Latin America Stocks Year-to-Date:

Americas Gold[892.308%], Avino Silver[437.523%], Tower[254.565%], Gold Royalty[206.452%], EMX Royalty[189.655%], New Gold[180.534%], Celestica [169.593%], Kinross Gold[153.727%], Iamgold Corp[138.172%], Lithium Americas[124.183%], Vasta Platform[119.556%] Best Latin America Stocks This Week:

Companhia Brasileira[18587.4%], Cosan [16415.2%], Crescent Point[4066.17%], Golden Star[1837.95%], Grupo Financiero[1283.52%], Alexco Resource[690.301%], Yamana Gold[625.812%], Novelion [579.167%], Turquoise Hill[433.11%], Enerplus [415.601%], Nevsun Resources[402.516%] Best Latin America Stocks Daily:

Novelion [7.37813%], Ambipar Emergency[6.89655%], Grupo Supervielle[6.39659%], Milestone [6.34146%], Nutrien [5.50945%], Grupo Financiero[4.91926%], Mitel Networks[4.5045%], BRP [4.30981%], Empresa Distribuidora[4.06396%], Pampa Energia[4.0515%], Loma Negra[3.92707%]

Americas Gold[892.308%], Avino Silver[437.523%], Tower[254.565%], Gold Royalty[206.452%], EMX Royalty[189.655%], New Gold[180.534%], Celestica [169.593%], Kinross Gold[153.727%], Iamgold Corp[138.172%], Lithium Americas[124.183%], Vasta Platform[119.556%] Best Latin America Stocks This Week:

Companhia Brasileira[18587.4%], Cosan [16415.2%], Crescent Point[4066.17%], Golden Star[1837.95%], Grupo Financiero[1283.52%], Alexco Resource[690.301%], Yamana Gold[625.812%], Novelion [579.167%], Turquoise Hill[433.11%], Enerplus [415.601%], Nevsun Resources[402.516%] Best Latin America Stocks Daily:

Novelion [7.37813%], Ambipar Emergency[6.89655%], Grupo Supervielle[6.39659%], Milestone [6.34146%], Nutrien [5.50945%], Grupo Financiero[4.91926%], Mitel Networks[4.5045%], BRP [4.30981%], Empresa Distribuidora[4.06396%], Pampa Energia[4.0515%], Loma Negra[3.92707%]

Login Sign Up

Login Sign Up