Stock Charts, Performance & Trend Analysis for AGMH

AGM Group Holdings Inc.

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Stocks Similar To AGM

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The table below shows stocks similar to AGM Group Holdings Inc., i.e, from same subsector or sector along with year-to-date (-97.3% YTD), weekly (-10.4%) & daily performaces for comparison. Usually, stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Compare 12Stocks.com Smart Investing & Trading Scores to see which stocks in this sector are trending better currently. Click on ticker or stock name for detailed view (place cursor on ticker or stock name to view charts quickly). Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. | ||||||||||

| ||||||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score [0 to 100] | Change % | Weekly Change% | YTD Change% | ||

| MSFT | Microsoft |   | Software | 507.23 | 20 | 0.59 | -2.5 | 22.68% | ||

| INTU | Intuit |   | Software | 697.76 | 0 | -0.20 | -1.8 | 11.55% | ||

| ORCL | Oracle |   | Software | 236.37 | 50 | 1.38 | -4.8 | 39.79% | ||

| ADBE | Adobe |   | Software | 362.09 | 70 | 2.45 | 2.0 | -17.23% | ||

| CRM | salesforce.com |   | Software | 248.29 | 50 | 1.00 | 2.4 | -27.11% | ||

| SAP | SAP SE |   | Software | 269.21 | 0 | -1.22 | -3.5 | 10.30% | ||

| ADP | Automatic Data |   | Software | 304.94 | 50 | -1.32 | 1.1 | 5.25% | ||

| SHOP | Shopify |   | Software | 136.68 | 80 | -0.44 | -5.3 | 28.54% | ||

| UBER | Uber |   | Software | 94.23 | 90 | 0.53 | 3.1 | 56.22% | ||

| ADSK | Autodesk |   | Software | 290.23 | 40 | 1.46 | 1.2 | -6.78% | ||

| ZM | Zoom Video |   | Software | 82.47 | 100 | 12.71 | 12.8 | -5.14% | ||

| WDAY | Workday |   | Software | 227.58 | 0 | 0.04 | 2.6 | -11.80% | ||

| EA | Electronic Arts |   | Software | 171.4 | 60 | -0.09 | -1.9 | 39.83% | ||

| MSCI |   | Software | 567.27 | 80 | -1.22 | 0.3 | -4.86% | |||

| SE | Sea |   | Software | 179.60 | 100 | 0.48 | 3.2 | 69.27% | ||

| RNG | RingCentral |   | Software | 29.14 | 90 | -0.92 | -4.5 | -16.77% | ||

| FTNT | Fortinet |   | Software | 77.75 | 40 | -2.34 | 0.7 | -17.71% | ||

| CDNS | Cadence Design |   | Software | 347.57 | 60 | 0.61 | -0.4 | 15.68% | ||

| DOCU | DocuSign |   | Software | 70.74 | 70 | -0.49 | 2.5 | -21.35% | ||

| OKTA | Okta |   | Software | 89.78 | 40 | -1.37 | 1.3 | 13.93% | ||

| CHKP | Check Point |   | Software | 188.41 | 60 | -0.46 | 1.7 | 0.92% | ||

| CA | CA |   | Software | 24.20 | 90 | -0.14 | -0.1 | -1.46% | ||

| TWLO | Twilio |   | Software | 100.97 | 40 | -0.95 | 0.1 | -6.58% | ||

| PAYC | Paycom Software |   | Software | 225.32 | 80 | -0.72 | 4.3 | 10.28% | ||

| TTWO | Take-Two Interactive |   | Software | 227.87 | 70 | -0.35 | -2.3 | 23.79% | ||

| AAPL | Apple |   | Electronics | 227.76 | 70 | 1.27 | -1.7 | -3.15% | ||

| GOOGL | Alphabet |   | Tech Services | 206.09 | 90 | 3.17 | 1.1 | 1.25% | ||

| META | Meta Platforms |   | Internet Content & Information | 739.10 | 60 | -1.15 | -5.5 | 26.44% | ||

| GOOG | Alphabet |   | Tech Services | 206.72 | 90 | 3.04 | 0.9 | 0.78% | ||

| TSM | Taiwan Semiconductor |   | Semiconductor | 227.33 | 50 | -0.56 | -5.7 | 15.98% | ||

| VZ | Verizon |   | Telecom | 44.44 | 50 | -1.31 | 0.5 | 16.48% | ||

| T | AT&T |   | Telecom | 28.77 | 40 | -2.28 | -0.4 | 23.75% | ||

Technical Levels: For the trading inclined, the following are the key levels of resistance (ceiling) and support (floor) for AGMH. Ceiling and floor levels are stock prices at which the stock trend gets resistance or support respectively. Stocks & their trends tend to pause at these levels and hence traders have an eye on them. Long term levels are more important. Stocks that have broken thru their resistance or support levels convincingly tend to have stronger trends (confirm with charts above visually). |

| Key Technical Levels for AGMH | |||

| Short Term | Weekly | Long Term | |

| Resistance (Ceiling) | 2.07 | 2.43 | 3.21 |

| Support (Floor) | 1.94 | 2.13 | 2.11 |

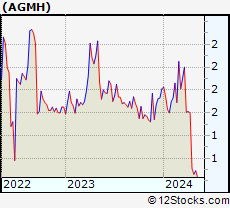

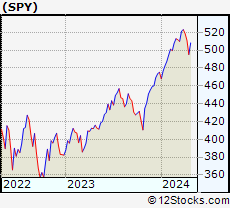

| RELATIVE PERFORMANCE OF AGM Group Holdings Inc. Vs THE MARKET | ||||

| Relative performance of AGM Group Holdings Inc. Compared to Overall Market | ||||

| How is AGMH faring versus the market [S&P 500] ? Is it lagging or leading ? How is its relative performance ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| SPY | 1.73% | 0.54% | 7.25% | |

| AGMH | 1.98% | -10.43% | -97.27% | |

AGMH Chart |  S&P 500 (Market) Chart | |||

| Year to date returns, AGMH is underperforming the market by -104.52% | |

| This week, AGMH is underperforming the market by -10.97% | |

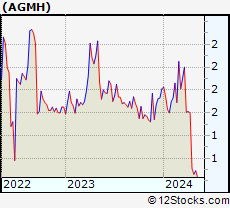

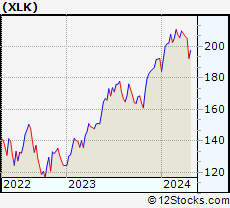

| Performance of AGM Group Holdings Inc. vs Technology ETF | RELATIVE PERFORMANCE OF AGM Group Holdings Inc. Vs Technology Sector | |||

| Let us compare apples to apples and compare performance of AGMH with its sector ETF (contains basket of stocks of same sector) XLK [Technology SPDR] ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| XLK | 1.36 % | -1.23 % | 14.08 % | |

| AGMH | 1.98% | -10.43% | -97.27% | |

AGMH Chart |  Technology Chart | |||

| Year to date, AGMH is underperforming Technology sector by -111.35% | ||||

| This week, AGMH is underperforming Technology sector by -9.2% | ||||

List Of ETF Funds Related To AGM Group Holdings Inc.

The table below shows ETFs (Exchange Traded Funds) similar to AGM Group Holdings Inc., i.e, from same sector along with year-to-date (YTD), weekly & daily performaces for comparison. Usually, ETFs and associated stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Move mouse or cursor over ETF symbol to view short-term technical chart and over ETF name to view long term chart. Click on  to add ETF symbol to your watchlist and to add ETF symbol to your watchlist and  to view watchlist. to view watchlist. | |||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| LTL | Ultra Telecom |   | Technology | 102.97 | 2.72 | -0.62 | 11.13% |

| ROM | ProShares Ultra Technology |   | Technology | 80.73 | 2.7 | -2.61 | 19.42% |

| USD | ProShares Ultra Semiconductors |   | Technology | 86.67 | 3.62 | -3.21 | 57.29% |

| QID | ProShares Double Short QQQ |   | Technology | 23.83 | -2.93 | 1.92 | -22.32% |

| QLD | ProShares Ultra QQQ |   | Technology | 125.1 | 3.01 | -2.01 | 11.84% |

| XLK | Technology SPDR |   | Technology | 262.42 | 1.36 | -1.23 | 14.08% |

| SMH | Semiconductor HOLDRs |   | Technology | 293.76 | 2.19 | -0.64 | 20.58% |

| SOXS | Triple Bear Semicondutors |   | Technology | 7.44 | 1.64 | 15.17 | -66.42% |

| SOXL | Triple Bull Semiconductors |   | Technology | 27.47 | 8.36 | 0.37 | 2.3% |

| REW | ProShares UltraShort Technology |   | Technology | 6.91 | -2.61 | 2.52 | -31.31% |

| SSG | ProShares UltraShort Semiconductors |   | Technology | 10.88 | -3.72 | 2.74 | -60.15% |

| PSQ | ProShares Short QQQ |   | Technology | 32.8 | -1.41 | 1.08 | -8.88% |

| QQEW | First Trust NASDAQ-100 Equal Weighted |   | Technology | 137.34 | 1.76 | 0.65 | 5.13% |

| HHH | Internet HOLDRs |   | Technology | 75.54 | 4.02 | 2.43 | -1.09% |

| ONEQ | Fidelity Nasdaq Composite Index |   | Technology | 83.08 | -0.35 | -2.72 | 9.54% |

| NXT | NYSE Arca Tech 100 |   | Technology | 64.04 | -3.16 | 18.61 | 75.31% |

| PTF | PowerShares Dyn Technology |   | Technology | 65.75 | -0.56 | -4.23 | -9.17% |

| FDN | FT Internet Index Fund |   | Technology | 267.86 | -0.24 | -1.22 | 10.15% |

| XSD | SPDR Semiconductor |   | Technology | 286.03 | 4.21 | 1.87 | 15.22% |

| VOX | Vanguard Telecom Services VIPERs |   | Technology | 175.47 | -0.2 | -1.87 | 13.78% |

| VGT | Vanguard Information Technology VIPERs |   | Technology | 682.08 | -0.26 | -3.18 | 9.95% |

| QTEC | First Trust NASDAQ-100 Equal Weighted Technology |   | Technology | 208.95 | -0.36 | -2.77 | 10.98% |

| PSI | PowerShares Semiconductors |   | Technology | 60.41 | 0.27 | -3.88 | 4.39% |

| IYZ | iShares US Telecom |   | Technology | 30.54 | 0.36 | -0.07 | 15.04% |

| IYW | iShares US Technology |   | Technology | 178.60 | -0.37 | -3.41 | 12.08% |

| IXP | iShares Global Telecom |   | Technology | 116.67 | -0.08 | -1.17 | 21.25% |

| IXN | iShares Global Technology |   | Technology | 94.42 | -0.44 | -3.5 | 11.62% |

| IGV | iShares Software |   | Technology | 105.96 | -0.35 | -2.2 | 5.83% |

| IGM | iShares Technology |   | Technology | 114.68 | -0.34 | -3.31 | 12.45% |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dow Stocks With Best Current Trends [0-bearish to 100-bullish]: [100], Home Depot[100], Merck [100], McDonald s[100], Caterpillar [90], Goldman Sachs[90], American Express[90], NIKE [90], Chevron [90], Chase[90] Best S&P 500 Stocks Year-to-Date Update:

Seagate [81.55%], Newmont [67.44%], Western Digital[65.96%], NRG Energy[63.49%], eBay [60.95%], Amphenol [57.36%], Uber [56.22%], IDEXX [53.12%], Tapestry [51.93%], Dollar General[51.26%] Best Nasdaq 100 Stocks Weekly Update:

Pinduoduo [7.16%], Texas [5.91%], Regeneron [5.69%], Palo Alto[5.63%], Booking [4.89%], Analog Devices[4.55%], Datadog [3.72%], MongoDB [3.71%], Cognizant [3.39%], T-Mobile [3.14%] Today's Stock Market In A Nutshell:US Small Cap [3.9%], US Mid Cap [2.8%], China [2.3%], Emerging Markets [2%], US Large Cap [1.5%], Gold [1.1%], Euro [1.1%], Oil [0.7%], Bonds [0.5%], Europe [-0.7%], US Dollar [-0.9%],

Seagate [81.55%], Newmont [67.44%], Western Digital[65.96%], NRG Energy[63.49%], eBay [60.95%], Amphenol [57.36%], Uber [56.22%], IDEXX [53.12%], Tapestry [51.93%], Dollar General[51.26%] Best Nasdaq 100 Stocks Weekly Update:

Pinduoduo [7.16%], Texas [5.91%], Regeneron [5.69%], Palo Alto[5.63%], Booking [4.89%], Analog Devices[4.55%], Datadog [3.72%], MongoDB [3.71%], Cognizant [3.39%], T-Mobile [3.14%] Today's Stock Market In A Nutshell:US Small Cap [3.9%], US Mid Cap [2.8%], China [2.3%], Emerging Markets [2%], US Large Cap [1.5%], Gold [1.1%], Euro [1.1%], Oil [0.7%], Bonds [0.5%], Europe [-0.7%], US Dollar [-0.9%],

Login Sign Up

Login Sign Up