One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dow Stocks With Best Current Trends [0-bearish to 100-bullish]: Intel Corp[100], [100], Goldman Sachs[100], Caterpillar Inc[100], American Express[100], Exxon Mobil[100], Walmart Inc[90], Chase[90], Chevron Corp[80], Travelers [70] Best S&P 500 Stocks Year-to-Date Update:

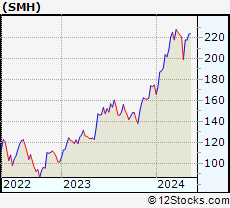

Seagate [153.661%], Western Digital[123.146%], Newmont Corp[105.07%], Micron [92.4269%], NRG Energy[78.9866%], Oracle Corp[78.9527%], Lam Research[75.7983%], GE Aerospace[74.5392%], Amphenol Corp[74.2975%], CVS Health[72.3146%] Best Nasdaq 100 Stocks Weekly Update:

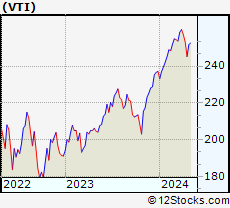

Splunk [38.7643%], Intel Corp[25.434%], Tesla Inc[22.9823%], Micron [19.7643%], Synopsys Inc[18.6704%], Lam Research[17.9676%], ASML Holding[17.4774%], Crowdstrike [15.6777%], Applied Materials[14.4291%], KLA Corp[13.2839%] Today's Stock Market In A Nutshell:US Small Cap [1%], US Mid Cap [0.6%], US Dollar [0.5%], US Large Cap [0.3%], Oil [0.2%], India [0.1%], Bonds [-0.2%], Europe [-0.4%], Euro [-0.5%], Gold [-0.7%], Emerging Markets [-0.8%], China [-1.7%],

Login Sign Up

Login Sign Up

to add stock symbol to your watchlist and

to add stock symbol to your watchlist and  to view watchlist.

to view watchlist.