| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks & ETFs | Settings |

Best Asia-Pacific Exchange Traded Funds (ETFs)

| ||||||||||||||||||

| Detailed View: Best Asia-Pacific ETFs by Daily, Weekly, Year-to-date and Trends | ||||||||||||||||||

| Quickly Browse, Sort and Filter to Find Best Asia-Pacific ETFs Using Our Slide Show Tool | ||||||||||||||||||

| Asia-Pacific ETF Segment in Brief | ||||||||||||||||||

| Year-to-date Asia-Pacific segment is outperforming market by 12.0126%. | ||||||||||||||||||

|

||||||||||||||||||

| Year To Date Performance: 23.2072 % | ||||||||||||||||||

| Weekly Performance: 0.637681 % | ||||||||||||||||||

| Daily Performance: 0.61 % | ||||||||||||||||||

|

Asia-Pacific Segment Short Term Technical Trend Score: 80 Trend Score : 0(bearish) to 100(bullish). Updated daily. Not to be used for investing. |

||||||||||||||||||

| 12Stocks.com: Asia-Pacific ETF Sector - Look at Big Picture | |

|

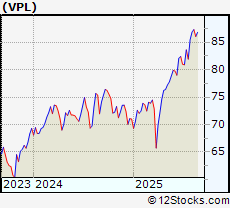

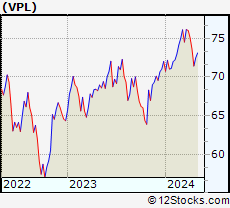

Let's take comprehensive view of Asia-Pacific segment. The Asia-Pacific segment of the Global Stock Market is best represented by VPL - exchange traded fund that tracks FTSE Developed Asia Pacific Index. It consists of top stocks

- from all major sectors - and is primarily Asia-Pacific region based. The Asia-Pacific sector contains stocks like China Mobile and Toyota. Year to date, Asia-Pacific sector as represented by VPL is up by 23.2072% and is currently outperforming the market (S&P 500) by 12.0126%. Next, let us look at relative performance of Asia-Pacific segment as represented by S&P Asia-Pacific 350 versus other major market segments like US stock indexes (Nasdaq 100, Dow 30, S&P 500, S&P 400 Midcap & Total Stock Market Index), emerging markets and other asset classes like bonds, gold and oil. The performances of major market segments year to date are - Gold [34.8912%], US Pacific [23.2072%], Emerging Markets [21.9798%], Euro [14.9435%], US Pacific [11.3706%], US Total Market [11.1946%], US Mid Cap [6.69524%], Bonds [5.5936%], India [0%], Oil [-5.5895%], US Dollar [-7.65083%], . Now, we dive deep to identify investing opportunities both with ETFs that track Asia-Pacific segment of the stock market and Asia-Pacific stock holdings contained within these ETF baskets. Check daily for updates. Scroll down this guide or just click the links below - |

|

|

| Asia-Pacific ETFs | |

| SEGMENT | |

| PERFORMANCE | |

|

23.2072% (YEAR-TO-DATE) |

|

|

0.637681% (WEEKLY) |

|

|

0.61% (DAILY) |

|

| 12Stocks.com: Quick View of Technicals of Overall Asia-Pacific Sector | |

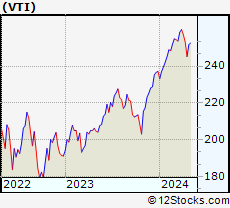

| VPL : Invests to track index of 400 equities from Australia, Japan, Hong Kong, New Zealand and Singapore | |

|

|

|

| Weekly Chart | Daily Chart (Short Term) |

| Weekly: 0.637681% | Daily: 0.61% |

| Year-to-date Performance : 23.2072% | Relative Performance: The Asia-Pacific Index is outperforming the market (S&P 500) by 12.0126% |

| 12Stocks.com: Top Performing Asia-Pacific ETFs | |

|

|

Most popular Asia-Pacific exchange traded funds track the broad Asia-Pacific sector. But there are ETF funds that track specific sub-sectors within the wide Asia-Pacific sector. For instance, most Asia-Pacific ETFs focus on broad market but there are ETFs that focus on smallcap segment. The top performing ETFs (year-to-date) that track the whole Asia-Pacific segment are shown in left side bar. The popular Asia-Pacific ETFs with Best YTD Performances: iShares South Korea [44.0336%], Japan Small Cap Fund [39.9121%], iShares Singapore [33.5537%], iShares Hong Kong [31.9454%], iShares China 25 [30.1439%], Vanguard Pacific Stock VIPERs [23.2072%], iShares Emerging Mkts [21.9798%], iShares Japan [19.1182%], Vanguard Emerging Markets VIPERs [18.7964%], iShares Taiwan [17.277%], iShares Australia [14.3554%]. Also, there are leveraged ETFs that given enhanced performance by moving twice or thrice the daily movement of Asia-Pacific sector Ultra China [56.8312%], TripleBull Emerging Markets [55.5249%], Ultra Emerging Mkts [38.4751%], Ultra Japan [31.3802%], Double Bull India [-9.48193%]. Finally, there are inverse or bearish Asia-Pacific ETFs that move in opposite direction to the daily movement of the Asia-Pacific segment Short MSCI Emerging Markets [-16.0528%], UltraShort MSCI Japan [-30.9766%], UltraShort MSCI Emerging Markets [-32.744%], TripleShort Emerging Markets [-46.8836%], UltraShort FTSE/Xinhua China 25 [-47.5262%]. Now, more recently, over last week, the top performing Asia-Pacific ETFs that track the whole segment on the move are - India ETN [7.6594%], BRIC ADRs/GDRs [7.6594%], Japan SmlCap CF [2.97505%], China CF [2.37443%], Singapore [2.29473%], China150 [2.1579%], China [1.77917%], Korea [1.60066%], Emerging Mkts [1.08195%] . |

|

LEADING Asia-Pacific ETFs (YEAR-TO-DATE) |

|

| iShares South Korea : 44.0336% | |

| Japan Small Cap Fund: 39.9121% | |

| Templeton Dragon Fund: 36.4959% | |

| iShares Singapore : 33.5537% | |

| SPDR S&P China: 32.2633% | |

| iShares Hong Kong : 31.9454% | |

| iShares China 25: 30.1439% | |

| Templeton Emerging Markets: 28.2373% | |

| Vanguard Pacific Stock VIPERs: 23.2072% | |

| iShares Emerging Mkts : 21.9798% | |

|

For Complete List of Winners and Laggards from Asia-Pacific ETF

Segment

| |

| 12Stocks.com: Investing With Asia-Pacific ETFs | |

|

The following table helps investors and traders sort through current performance of various

Asia-Pacific ETFs. One can glean long and short term trends by sorting Asia-Pacific ETF list by performance over daily, weekly or year-to-date periods. |

12Stocks.com Performance of Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| GAF | SPDR S&P Emerging Middle East & Africa |   | Emerging Markets | 9.77 | 0.31 | -11.7435 | 0% |

| EMF | Templeton Emerging Markets |   | Emerging Markets | 15.35 | 0.92 | -0.389358 | 28.2373% |

| IIF | MS India Investment Fund |   | Pacific | 26.66 | -0.30 | -0.224551 | 4.59004% |

| GMM | SPDR S&P Emerging Markets |   | Emerging Markets | 2.16 | -2.70 | -8.08511 | -43.6767% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 94.77 | 0.68 | 1.64651 | 27.8905% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 94.77 | 0.68 | 1.64651 | 27.8905% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 94.77 | 0.68 | 1.64651 | 27.8905% |

| JEQ | Japan Equity Fund |   | Pacific | 8.25 | 2.36 | 1.47601 | 43.7282% |

| TWN | Taiwan Fund |   | Pacific | 51.10 | 1.21 | 1.75229 | 32.1438% |

| PGJ | PowerShares China |   | Pacific | 30.94 | 1.11 | 2.03892 | 21.4649% |

| TFC | Taiwan Greater China Fund |   | Pacific | 46.52 | -1.17 | -0.555793 | 11.3753% |

| KF | Korea Fund |   | Pacific | 27.96 | 1.62 | 1.30435 | 51.2169% |

| EFV | iShares Foreign LargeCap Value |   | Emerging Markets | 67.12 | 0.33 | 0.209018 | 31.2106% |

| ADRA | BLDRS Asia 50 |   | Pacific | 3.29 | 9.67 | 2.49221 | 0% |

| CHN | China Fund |   | Pacific | 17.23 | 1.06 | 3.11191 | 48.0241% |

| DNL | Japan High-Yielding Equity Fund |   | Pacific | 39.34 | 0.77 | -0.177597 | 10.5799% |

| ADRE | BLDRS Emerging Markets 50 ADR Index |   | Emerging Markets | 38.20 | 0.00 | 0 | 0% |

| IAF | Australia Equity Fund |   | Pacific | 4.54 | -0.22 | -1.08932 | 13.7275% |

| DXJ | Japan Total Dividend Fund |   | Pacific | 127.21 | 0.25 | 1.72731 | 15.3205% |

| DXJ | Japan Total Dividend Fund |   | Pacific | 127.21 | 0.25 | 1.72731 | 15.3205% |

| DNL | Japan High-Yielding Equity Fund |   | Pacific | 39.34 | 0.77 | -0.177597 | 10.5799% |

| Showing 25 to 50 ETFs. Click on arrows to view more! Sort by performace by clicking on Daily, Weekly or YTD % Change |  | |||||

| 12Stocks.com: Euro Currency | |

| Investors using Asia-Pacific ETFs have to also deal with currency movements versus US dollar. Unless the ETF is hedged for Asia-Pacific currency exposure, traders will have to take into account the performance of Asia-Pacific currencies. |

12Stocks.com Performance of Asia-Pacific Currencies

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| YCL | Ultra Yen |   | Pacific | 21.98 | 1.46 | 0.0692168 | 9.05806% |

| FXA | Australian Dollar |   | Pacific | 64.83 | 0.53 | 0.586483 | 6.37739% |

| CYB | Chinese Yuan |   | Pacific | 11.27 | 3.68 | -53.5591 | 0% |

| ICN | Indian Rupee |   | Pacific | 11.27 | 3.68 | -59.8932 | 0% |

| YCS | UltraShort Yen |   | Pacific | 44.00 | -1.22 | 0.326037 | -8.11652% |

| INR | Indian Rupee |   | Pacific | 14.11 | -3.36 | -3.68601 | -33.0327% |

| 12Stocks.com: Trading With Bullish (Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can enhance their performances by trading leveraged ETFs that double or triple the daily returns of Asia-Pacific indexes. Also, listed below are leveraged ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bullish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| XPP | Ultra China |   | Pacific | 27.45 | 2.04 | 2.7255 | 56.8312% |

| EDC | TripleBull Emerging Markets |   | Emerging Markets | 43.60 | 3.78 | 3.09766 | 55.5249% |

| EET | Ultra Emerging Mkts |   | Emerging Markets | 69.03 | 2.29 | 1.85665 | 38.4751% |

| EZJ | Ultra Japan |   | Pacific | 47.81 | 1.03 | 1.18425 | 31.3802% |

| INDL | Double Bull India |   | Pacific | 55.23 | -0.53 | -1.04677 | -9.48193% |

| 12Stocks.com: Trading With Bearish (& Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can hedge or take advantage of market pullbacks by betting on bearish (inverse) ETFs that move in opposite direction to underlying index. Asia-Pacific traders can enhance their performances by trading leveraged bearish ETFs that double or triple inverse the daily returns of Asia-Pacific indexes. Also, listed below are ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bearish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EUM | Short MSCI Emerging Markets |   | Emerging Markets | 22.27 | -1.08 | -0.713375 | -16.0528% |

| EWV | UltraShort MSCI Japan |   | Pacific | 28.74 | -0.97 | -1.01825 | -30.9766% |

| EEV | UltraShort MSCI Emerging Markets |   | Emerging Markets | 11.55 | -2.42 | -1.87166 | -32.744% |

| EDZ | TripleShort Emerging Markets |   | Emerging Markets | 4.78 | -3.82 | -3.0426 | -46.8836% |

| FXP | UltraShort FTSE/Xinhua China 25 |   | Pacific | 9.36 | -2.59 | -3.05516 | -47.5262% |

| Charts, Fundamental Data and Performances of ETFs | ||

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows | ||

| GAF SPDR S&P Emerging Middle East & Africa |

| Description: Tracks index containing basket of companies from Egypt, Israel, Jordan, Morocco, Nigeria, and South Africa | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 9.77 | |

| Day Percent Change: 0.31% Day Change: 0.03 | |

| Week Change: -11.7435% Year-to-date Change: 0.0% | |

| GAF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GAF for Review:   | |

| EMF Templeton Emerging Markets |

| Description: Invests in equities and debt securities primarily from Korea, Russia, Taiwan, China, Brazil & Africa | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 15.35 | |

| Day Percent Change: 0.92% Day Change: 0.14 | |

| Week Change: -0.389358% Year-to-date Change: 28.2% | |

| EMF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EMF for Review:   | |

| IIF MS India Investment Fund |

| Description: Invests in leading companies from India | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 26.66 | |

| Day Percent Change: -0.30% Day Change: -0.08 | |

| Week Change: -0.224551% Year-to-date Change: 4.6% | |

| IIF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IIF for Review:   | |

| GMM SPDR S&P Emerging Markets |

| Description: Tracks index containing basket of 1,500 companies across 26 emerging countries | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 2.16 | |

| Day Percent Change: -2.70% Day Change: -0.06 | |

| Week Change: -8.08511% Year-to-date Change: -43.7% | |

| GMM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GMM for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 94.77 | |

| Day Percent Change: 0.68% Day Change: 0.64 | |

| Week Change: 1.64651% Year-to-date Change: 27.9% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 94.77 | |

| Day Percent Change: 0.68% Day Change: 0.64 | |

| Week Change: 1.64651% Year-to-date Change: 27.9% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 94.77 | |

| Day Percent Change: 0.68% Day Change: 0.64 | |

| Week Change: 1.64651% Year-to-date Change: 27.9% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| JEQ Japan Equity Fund |

| Description: Invests in non-financial services sector of Japan equity markets | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 8.25 | |

| Day Percent Change: 2.36% Day Change: 0.19 | |

| Week Change: 1.47601% Year-to-date Change: 43.7% | |

| JEQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save JEQ for Review:   | |

| TWN Taiwan Fund |

| Description: Invests in equities of companies that trade primarily in Taiwan stock market | |

| Sector: Pacific | |

| Sub-Sector: Taiwan | |

| Recent Price: 51.10 | |

| Day Percent Change: 1.21% Day Change: 0.61 | |

| Week Change: 1.75229% Year-to-date Change: 32.1% | |

| TWN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TWN for Review:   | |

| PGJ PowerShares China |

| Description: Invests in US listed companies that derive majority of revenues from China | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 30.94 | |

| Day Percent Change: 1.11% Day Change: 0.34 | |

| Week Change: 2.03892% Year-to-date Change: 21.5% | |

| PGJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PGJ for Review:   | |

| TFC Taiwan Greater China Fund |

| Description: Invests in equities of companies that trade primarily in Taiwan stock market and gets substantial revenues from mainland China | |

| Sector: Pacific | |

| Sub-Sector: Thailand | |

| Recent Price: 46.52 | |

| Day Percent Change: -1.17% Day Change: -0.55 | |

| Week Change: -0.555793% Year-to-date Change: 11.4% | |

| TFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TFC for Review:   | |

| KF Korea Fund |

| Description: Invests in equities and debt securities primarily from Korea | |

| Sector: Pacific | |

| Sub-Sector: Korea | |

| Recent Price: 27.96 | |

| Day Percent Change: 1.62% Day Change: 0.44 | |

| Week Change: 1.30435% Year-to-date Change: 51.2% | |

| KF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save KF for Review:   | |

| EFV iShares Foreign LargeCap Value |

| Description: Invests in large cap [big] value companies from markets like Europe and Asia | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 67.12 | |

| Day Percent Change: 0.33% Day Change: 0.22 | |

| Week Change: 0.209018% Year-to-date Change: 31.2% | |

| EFV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EFV for Review:   | |

| ADRA BLDRS Asia 50 |

| Description: Invests in leading companies from Asian countries primarily Japan & Australia | |

| Sector: Pacific | |

| Sub-Sector: Pacific | |

| Recent Price: 3.29 | |

| Day Percent Change: 9.67% Day Change: 0.29 | |

| Week Change: 2.49221% Year-to-date Change: 0.0% | |

| ADRA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save ADRA for Review:   | |

| CHN China Fund |

| Description: Invests in equities of China related securities traded primarily in Hong Kong, Taiwan and also in unlisted securities | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 17.23 | |

| Day Percent Change: 1.06% Day Change: 0.18 | |

| Week Change: 3.11191% Year-to-date Change: 48.0% | |

| CHN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CHN for Review:   | |

| DNL Japan High-Yielding Equity Fund |

| Description: Tracks to perform similar to WisdomTree Japan High-Yielding Equity Index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 39.34 | |

| Day Percent Change: 0.77% Day Change: 0.30 | |

| Week Change: -0.177597% Year-to-date Change: 10.6% | |

| DNL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DNL for Review:   | |

| ADRE BLDRS Emerging Markets 50 ADR Index |

| Description: Invests in leading companies from emerging markets like Latin America and Asia [China, India, etc] | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 38.20 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| ADRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save ADRE for Review:   | |

| IAF Australia Equity Fund |

| Description: Invests in large cap companies traded in Australian stock exchange | |

| Sector: Pacific | |

| Sub-Sector: Australia | |

| Recent Price: 4.54 | |

| Day Percent Change: -0.22% Day Change: -0.01 | |

| Week Change: -1.08932% Year-to-date Change: 13.7% | |

| IAF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IAF for Review:   | |

| DXJ Japan Total Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan Dividend Index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 127.21 | |

| Day Percent Change: 0.25% Day Change: 0.32 | |

| Week Change: 1.72731% Year-to-date Change: 15.3% | |

| DXJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DXJ for Review:   | |

| DXJ Japan Total Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan Dividend Index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 127.21 | |

| Day Percent Change: 0.25% Day Change: 0.32 | |

| Week Change: 1.72731% Year-to-date Change: 15.3% | |

| DXJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DXJ for Review:   | |

| DNL Japan High-Yielding Equity Fund |

| Description: Tracks to perform similar to WisdomTree Japan High-Yielding Equity Index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 39.34 | |

| Day Percent Change: 0.77% Day Change: 0.30 | |

| Week Change: -0.177597% Year-to-date Change: 10.6% | |

| DNL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DNL for Review:   | |

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows |

| 12Stocks.com: Typical Stock Holdings in Asia-Pacific ETFs | |

| ETFs are funds that hold basket of stocks. The following table shows list of stocks or holdings commonly found in most Asia-Pacific ETFs . The funds basically perform based on what stocks they hold. You can dive deep into Asia-Pacific stocks in the following pages - Asia-Pacific Stocks |

12Stocks.com Performance of Stock Holdings in Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| TSM | Taiwan Semiconductor Manufacturing ADR |   | Technology | 243.41 | 3.49 | 1.72176 | 21.6606% |

| HDB | HDFC Bank Ltd. ADR |   | Financials | 70.60 | -0.06 | -2.33781 | 11.4289% |

| BABA | Alibaba Group Holding Ltd ADR |   | Services & Goods | 135.58 | 3.56 | 10.922 | 60.8699% |

| TM | Toyota Motor Corporation ADR |   | Services & Goods | 199.62 | 1.00 | 1.46386 | 5.40044% |

| PDD | PDD Holdings Inc ADR |   | Services & Goods | 124.68 | 0.65 | 2.01276 | 28.682% |

| BHP | BHP Group Limited ADR |   | Materials | 54.39 | -2.09 | -2.64901 | 12.7506% |

| PTR | PetroChina Company Limited |   | Energy | 521.31 | 0.60 | 1137.09 | 0% |

| IBN | ICICI Bank Ltd. ADR |   | Financials | 31.67 | -0.66 | -0.907384 | 7.0797% |

| SMFG | Sumitomo Mitsui Financial Group Inc ADR |   | Financials | 16.44 | -1.08 | -0.423985 | 16.0108% |

| DADA | Dada Nexus Limited |   | Services & Goods | 1.96 | -1.26 | -2.48756 | 47.3684% |

| DCM | NTT DOCOMO, Inc. |   | Technology | 4.16 | -0.72 | -99.9887 | 0% |

| MTU | Mitsubishi UFJ Financial Group, Inc. |   | Financials | 6.64 | 0.00 | 0 | 0% |

| LFC | China Life Insurance Company Limited |   | Financials | 43.74 | -0.36 | 690.958 | 0% |

| NTT | Nippon Telegraph and Telephone Corporation |   | Technology | 9.25 | 0.00 | -82.8163 | 0% |

| NTES | NetEase Inc ADR |   | Technology | 134.27 | 0.85 | -0.592285 | 55.6734% |

| MFG | Mizuho Financial Group, Inc. ADR |   | Financials | 6.51 | -0.46 | -0.762195 | 35.5939% |

| SNE | Sony Corporation |   | Technology | 288.85 | 194.56 | 193.696 | 0% |

| SNP | China Petroleum & Chemical Corporation |   | Energy | 510.10 | 1.35 | 1104.2 | 0% |

| INFY | Infosys Ltd ADR |   | Technology | 16.38 | -1.27 | -5.64516 | -26.5603% |

| BRLI | Brilliant Acquisition Corporation |   | Financials | 4.70 | 0.00 | 0 | 0% |

| TAK | Takeda Pharmaceutical Co ADR |   | Health Care | 15.40 | 0.72 | 3.63392 | 18.9051% |

| HMC | Honda Motor ADR |   | Services & Goods | 34.35 | 0.50 | 1.38725 | 23.8146% |

| JD | JD.com Inc ADR |   | Services & Goods | 31.45 | 1.68 | 2.04413 | -5.46869% |

| WBK | Westpac Banking Corporation |   | Financials | 79.00 | -0.57 | 456.338 | 0% |

| CHT | Chunghwa Telecom ADR |   | Technology | 44.18 | 0.43 | 0.454752 | 22.3528% |

| CLEU | China Liberal Education Holdings Limited |   | Consumer Staples | 0.10 | 0.00 | 0 | -99.9645% |

| CAJ | Canon Inc. |   | Consumer Staples | 1.71 | 0.00 | -92.1811 | 0% |

| IX | Orix Corporation ADR |   | Financials | 26.22 | 0.46 | 1.70675 | 26.0813% |

| WIT | Wipro Ltd. ADR |   | Technology | 2.73 | 0.00 | -2.84698 | -21.4908% |

| BIDU | Baidu Inc ADR |   | Technology | 101.96 | 3.82 | 13.4654 | 23.289% |

| CTRP | Ctrip.com International, Ltd. |   | Services & Goods | 27.62 | 1.21 | 18.1352 | 0% |

| ASX | ASE Technology Holding Co.Ltd ADR |   | Technology | 10.47 | 1.55 | 4.49102 | 8.27973% |

| NMR | Nomura Holdings Inc. ADR |   | Financials | 7.20 | 0.56 | -0.277008 | 28.7093% |

| BEKE | KE Holdings Inc ADR |   | Financials | 18.99 | 2.32 | 6.74536 | 8.55647% |

| KYO | Kyocera Corporation |   | Technology | 1.29 | -5.15 | -89.9922 | 0% |

| LI | Li Auto Inc ADR |   | Services & Goods | 23.65 | -1.38 | 4.64602 | -1.54038% |

| UMC | United Micro Electronics ADR |   | Technology | 6.80 | -1.16 | 1.19048 | 10.6195% |

| LIZI | Lizhi Inc. |   | Technology | 3.40 | -3.41 | -6.84932 | 0% |

| YUMC | Yum China Holdings Inc |   | Services & Goods | 44.93 | 0.51 | 0.73991 | -2.561% |

| XPEV | XPeng Inc ADR |   | Services & Goods | 19.83 | -0.05 | -12.6432 | 71.6883% |

| TME | Tencent Music Entertainment Group ADR |   | Technology | 24.49 | -0.73 | -5.15105 | 116.343% |

| YMM | Full Truck Alliance Co Ltd ADR |   | Technology | 13.25 | 1.15 | 4.41292 | 22.4584% |

| RDY | Dr. Reddy's Laboratories Ltd. ADR |   | Health Care | 14.34 | 1.34 | 0.702247 | -8.03035% |

| NIO | NIO Inc ADR |   | Services & Goods | 5.95 | -2.62 | -5.70998 | 30.7626% |

| HTHT | H World Group Limited ADR |   | Services & Goods | 37.60 | 3.33 | 5.49944 | 19.1585% |

| LN | LINE Corporation |   | Technology | 20.80 | -0.29 | 23.7359 | 0% |

| ZTO | ZTO Express (Cayman) Inc ADR |   | Industrials | 18.34 | 0.82 | -2.44681 | -1.69751% |

| BGNE | BeiGene, Ltd. |   | Health Care | 184.71 | 0.49 | 4.65156 | 0% |

| GSX | GSX Techedu Inc. |   | Services & Goods | 12.97 | -4.35 | -13.2441 | 0% |

| MMYT | MakeMyTrip Ltd |   | Services & Goods | 100.45 | 0.36 | -2.63643 | -13.5765% |

| BZ | Kanzhun Ltd ADR |   | Technology | 23.98 | -0.12 | 4.9453 | 75.8064% |

| CEA | China Eastern Airlines Corporation Limited |   | Transports | 19.98 | -0.20 | 3.3092 | 0% |

| HNP | Huaneng Power International, Inc. |   | Utilities | 32.15 | 0.19 | 71.6956 | 0% |

| EDU | New Oriental Education & Technology Group Inc. ADR |   | Consumer Staples | 48.82 | 0.08 | 4.13823 | -20.6953% |

| ZNH | China Southern Airlines Company Limited |   | Transports | 9.84 | 1.23 | -73.7949 | 0% |

| MNSO | MINISO Group Holding Ltd ADR |   | Services & Goods | 24.52 | 0.62 | -1.40732 | -0.728343% |

| BILI | Bilibili Inc ADR |   | Technology | 22.41 | -0.40 | -0.178174 | 30.8231% |

| WUBA | 58.com Inc. |   | Technology | 78.83 | -1.08 | -24.0851 | 0% |

| IREN | IREN Ltd |   | Financials | 26.15 | 0.08 | 2.67 | 99.49% |

| VIPS | Vipshop Holdings Ltd ADR |   | Services & Goods | 17.14 | 1.00 | 1.66074 | 36.1117% |

| GDS | GDS Holdings Limited ADR |   | Technology | 33.17 | 1.25 | -1.485 | 43.0975% |

| SMI | Semiconductor Manufacturing International Corporation |   | Technology | 46.56 | 0.02 | -0.192926 | 0% |

| ACH | Aluminum Corporation of China Limited |   | Materials | 42.46 | -0.09 | 516.255 | 0% |

| SHI | Sinopec Shanghai Petrochemical Company Limited |   | Energy | 273.71 | 0.16 | 1992.58 | 0% |

| SPIL | Siliconware Precision Industries Co., Ltd. |   | Technology | 47.27 | 0.81 | -18.2746 | 0% |

| TAL | TAL Education Group ADR |   | Consumer Staples | 10.14 | -1.07 | -6.0241 | 3.36391% |

| ATAT | Atour Lifestyle Holdings Ltd ADR |   | Services & Goods | 39.04 | 0.36 | 0.03 | 30.01% |

| CBPO | China Biologic Products Holdings, Inc. |   | Health Care | 8.47 | -0.24 | -71.9536 | 0% |

| JOBS | 51job, Inc. |   | Services & Goods | 9.75 | -0.51 | -84.0007 | 0% |

| VEDL | Vedanta Limited |   | Materials | 27.08 | -0.44 | 61.9617 | 0% |

| AUO | AU Optronics Corp. |   | Technology | 20.25 | 0.40 | -27.4973 | 0% |

| KC | Kingsoft Cloud Holdings Ltd ADR |   | Technology | 13.82 | 2.98 | -2.12465 | 28.9179% |

| QFIN | Qfin Holdings Inc. ADR |   | Financials | 28.77 | -0.45 | -3.16392 | -24.2416% |

| YY | JOYY Inc. |   | Technology | 47.85 | -2.39 | 10.8922 | 20.2866% |

| ZLAB | Zai Lab Limited ADR |   | Health Care | 30.76 | 2.53 | -5.52826 | 23.9823% |

| TTM | Tata Motors Limited |   | Consumer Staples | 25.14 | 0.00 | 0 | 0% |

| ATHM | Autohome Inc ADR |   | Technology | 28.61 | 0.00 | 0.527056 | 11.0206% |

| WNS | WNS (Holdings) Limited |   | Technology | 75.40 | 0.00 | -0.0662691 | 59.408% |

| RNW | ReNew Energy Global plc |   | Utilities | 7.80 | 2.09 | 1.16732 | 14.7059% |

| HSAI | Hesai Group ADR |   | Services & Goods | 26.49 | 0.30 | -1.11 | 66.86% |

| LU | Lufax Holding Ltd ADR |   | Financials | 3.01 | 1.69 | -0.331126 | 25.9414% |

| RLX | RLX Technology Inc ADR |   | Consumer Staples | 2.61 | 1.95 | 8.75 | 18.0995% |

| GSH | Guangshen Railway Company Limited |   | Transports | 283.85 | 1.27 | -6.83057 | 0% |

| SINA | SINA Corporation |   | Technology | 79.70 | 1.07 | 64.9762 | 0% |

| VNET | VNET Group Inc ADR |   | Technology | 7.90 | 4.22 | 1.28205 | 56.1265% |

| CHA | Chagee Holdings Ltd. ADR |   | Services & Goods | 17.07 | -4.32 | -22.8649 | -39.0357% |

| BEST | BEST Inc. |   | Consumer Staples | 2.78 | -0.71 | 0 | 5.30303% |

| DQ | Daqo New Energy Corp ADR |   | Technology | 29.21 | 8.35 | 26.8346 | 44.3182% |

| MESO | Mesoblast Ltd ADR |   | Health Care | 14.39 | 6.43 | -10.732 | -30.1795% |

| WB | Weibo Corp ADR |   | Technology | 11.71 | 1.47 | 4.83438 | 40.9044% |

| HIMX | Himax Technologies ADR |   | Technology | 8.39 | 0.84 | -0.94451 | 16.7418% |

| FANH | Fanhua Inc. |   | Financials | 1.51 | -1.31 | -7.92683 | 0% |

| IQ | iQIYI Inc ADR |   | Technology | 2.71 | 0.00 | 14.8305 | 36.1809% |

| TUYA | Tuya Inc ADR |   | Technology | 2.52 | 1.61 | -5.97015 | 46.6139% |

| JKS | JinkoSolar Holding Co. Ltd ADR |   | Technology | 25.48 | 5.07 | 13.2444 | 4.23869% |

| FINV | FinVolution Group ADR |   | Financials | 7.91 | 1.67 | -7.59346 | 21.0739% |

| VDTH | Videocon d2h Limited |   | Services & Goods | 11.08 | 0.00 | 13.9918 | 0% |

| MOMO | Hello Group Inc ADR |   | Technology | 8.52 | 2.04 | 4.6683 | 21.9041% |

| HLG | Hailiang Education Group Inc. |   | Services & Goods | 10.79 | -0.46 | -24.5455 | 0% |

| KANG | iKang Healthcare Group, Inc. |   | Health Care | 52.79 | 0.00 | 6.19594 | 0% |

| ZPIN | Zhaopin Limited |   | Services & Goods | 58.69 | -0.46 | -29.2295 | 0% |

| QTT | Qutoutiao Inc. |   | Technology | 0.18 | 0.00 | 0 | 0% |

| CANG | Cango Inc ADR |   | Financials | 5.04 | 6.55 | 3.49076 | 0.398406% |

| EH | EHang Holdings Ltd ADR |   | Industrials | 16.16 | 0.37 | 1.57134 | 3.12699% |

| IIJI | Internet Initiative Japan Inc. |   | Technology | 31.11 | -2.63 | 913.355 | 0% |

| BITA | Bitauto Holdings Limited |   | Technology | 63.74 | -1.06 | 54.0358 | 0% |

| SIFY | Sify Technologies Limited ADR |   | Technology | 11.17 | 9.14 | 16.9634 | 265.033% |

| LX | LexinFintech Holdings Ltd ADR |   | Financials | 6.09 | 1.50 | -2.56 | 7.20887% |

| NOAH | Noah Holdings Ltd ADR |   | Financials | 12.04 | -2.75 | -0.413565 | 18.2897% |

| EHIC | eHi Car Services Limited |   | Transports | 386.03 | -0.56 | 175.244 | 0% |

| UXIN | Uxin Ltd ADR |   | Services & Goods | 3.50 | -1.13 | -5.66038 | -25.3731% |

| AZRE | Azure Power Global Limited |   | Utilities | 0.45 | -18.18 | 0 | 0% |

| HOLI | Hollysys Automation Technologies Ltd. |   | Industrials | 31.23 | 0.71 | 18.3403 | 0% |

| IMOS | Chipmos Technologies Inc ADR |   | Technology | 17.50 | 2.64 | 10.7245 | -2.92178% |

| CYOU | Changyou.com Limited |   | Technology | 43.91 | -0.05 | 123.233 | 0% |

| YSG | Yatsen Holding Ltd ADR |   | Consumer Staples | 9.39 | 6.83 | -2.49221 | 144.531% |

| RERE | ATRenew Inc ADR |   | Services & Goods | 4.36 | 2.59 | -7.82241 | 52.9825% |

| WDH | Waterdrop Inc ADR |   | Financials | 1.81 | -0.55 | 2.25989 | 56.6693% |

| NEW | Puxin Limited |   | Services & Goods | 1.20 | 0.00 | 4.34783 | 0% |

|

List of Asia-Pacific ETFs

|

|

US Stock Market Performance Year-to-Date: 6% |

performance (%Change)

performance (%Change)

| Stock | Price | YTD | Week | Day% |

| GAF | 9.77 | 0.0 | -11.7 | 0.3 |

| EMF | 15.35 | 28.2 | -0.4 | 0.9 |

| IIF | 26.66 | 4.6 | -0.2 | -0.3 |

| GMM | 2.16 | -43.7 | -8.1 | -2.7 |

| DFJ | 94.77 | 27.9 | 1.6 | 0.7 |

| DFJ | 94.77 | 27.9 | 1.6 | 0.7 |

| DFJ | 94.77 | 27.9 | 1.6 | 0.7 |

| JEQ | 8.25 | 43.7 | 1.5 | 2.4 |

| TWN | 51.10 | 32.1 | 1.8 | 1.2 |

| PGJ | 30.94 | 21.5 | 2.0 | 1.1 |

| TFC | 46.52 | 11.4 | -0.6 | -1.2 |

| KF | 27.96 | 51.2 | 1.3 | 1.6 |

| EFV | 67.12 | 31.2 | 0.2 | 0.3 |

| ADRA | 3.29 | 0.0 | 2.5 | 9.7 |

| CHN | 17.23 | 48.0 | 3.1 | 1.1 |

| DNL | 39.34 | 10.6 | -0.2 | 0.8 |

| ADRE | 38.20 | 0.0 | 0.0 | 0.0 |

| IAF | 4.54 | 13.7 | -1.1 | -0.2 |

| DXJ | 127.21 | 15.3 | 1.7 | 0.3 |

| DXJ | 127.21 | 15.3 | 1.7 | 0.3 |

| DNL | 39.34 | 10.6 | -0.2 | 0.8 |

performance (%Change)

performance (%Change)

End-of-Day Market data as of

© 2014 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

|

|

Best US Stocks |

|

Top Exchange Traded Funds (ETFs) |

|

Global Markets |

|

Best Sectors |

|

Books & More |