| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks & ETFs | Settings |

Best Asia-Pacific Exchange Traded Funds (ETFs)

| ||||||||||||||||||

| Detailed View: Best Asia-Pacific ETFs by Daily, Weekly, Year-to-date and Trends | ||||||||||||||||||

| Quickly Browse, Sort and Filter to Find Best Asia-Pacific ETFs Using Our Slide Show Tool | ||||||||||||||||||

| Asia-Pacific ETF Segment in Brief | ||||||||||||||||||

| Year-to-date Asia-Pacific segment is outperforming market by 8.33%. | ||||||||||||||||||

|

||||||||||||||||||

| Year To Date Performance: 14.64 % | ||||||||||||||||||

| Weekly Performance: -1.69 % | ||||||||||||||||||

| Daily Performance: 12.00 % | ||||||||||||||||||

|

Asia-Pacific Segment Short Term Technical Trend Score: 59 Trend Score : 0(bearish) to 100(bullish). Updated daily. Not to be used for investing. |

||||||||||||||||||

| 12Stocks.com: Asia-Pacific ETF Sector - Look at Big Picture | |

|

Let's take comprehensive view of Asia-Pacific segment. The Asia-Pacific segment of the Global Stock Market is best represented by VPL - exchange traded fund that tracks FTSE Developed Asia Pacific Index. It consists of top stocks

- from all major sectors - and is primarily Asia-Pacific region based. The Asia-Pacific sector contains stocks like China Mobile and Toyota. Year to date, Asia-Pacific sector as represented by VPL is up by 14.64% and is currently outperforming the market (S&P 500) by 8.33%. Next, let us look at relative performance of Asia-Pacific segment as represented by S&P Asia-Pacific 350 versus other major market segments like US stock indexes (Nasdaq 100, Dow 30, S&P 500, S&P 400 Midcap & Total Stock Market Index), emerging markets and other asset classes like bonds, gold and oil. The performances of major market segments year to date are - Gold [27.68%], Emerging Markets [15.4%], US Pacific [14.64%], Euro [13.28%], US Pacific [6.73%], US Total Market [6.31%], Oil [2.3%], Bonds [2.21%], US Mid Cap [1.94%], US Dollar [-7.48%], . Now, we dive deep to identify investing opportunities both with ETFs that track Asia-Pacific segment of the stock market and Asia-Pacific stock holdings contained within these ETF baskets. Check daily for updates. Scroll down this guide or just click the links below - |

|

|

| Asia-Pacific ETFs | |

| SEGMENT | |

| PERFORMANCE | |

|

14.64% (YEAR-TO-DATE) |

|

|

-1.69% (WEEKLY) |

|

|

12.00% (DAILY) |

|

| 12Stocks.com: Quick View of Technicals of Overall Asia-Pacific Sector | |

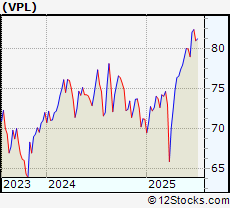

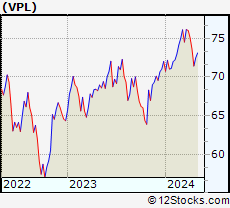

| VPL : Invests to track index of 400 equities from Australia, Japan, Hong Kong, New Zealand and Singapore | |

|

|

|

| Weekly Chart | Daily Chart (Short Term) |

| Weekly: -1.69% | Daily: 12.00% |

| Year-to-date Performance : 14.64% | Relative Performance: The Asia-Pacific Index is outperforming the market (S&P 500) by 8.33% |

| 12Stocks.com: Top Performing Asia-Pacific ETFs | |

|

|

Most popular Asia-Pacific exchange traded funds track the broad Asia-Pacific sector. But there are ETF funds that track specific sub-sectors within the wide Asia-Pacific sector. For instance, most Asia-Pacific ETFs focus on broad market but there are ETFs that focus on smallcap segment. The top performing ETFs (year-to-date) that track the whole Asia-Pacific segment are shown in left side bar. The popular Asia-Pacific ETFs with Best YTD Performances: iShares South Korea [42.58%], iShares Hong Kong [20.59%], iShares Singapore [20.09%], iShares China 25 [19.84%], iShares Emerging Mkts [15.4%], Vanguard Pacific Stock VIPERs [14.64%], Vanguard Emerging Markets VIPERs [12.72%], iShares Taiwan [12.64%], iShares Australia [10.48%], iShares Japan [7.84%], India Closed-End ETF Fund [4.89%]. Also, there are leveraged ETFs that given enhanced performance by moving twice or thrice the daily movement of Asia-Pacific sector TripleBull Emerging Markets [37.55%], Ultra China [34.52%], Ultra Emerging Mkts [27.27%], Ultra Japan [10.49%], Double Bull India [2.95%]. Finally, there are inverse or bearish Asia-Pacific ETFs that move in opposite direction to the daily movement of the Asia-Pacific segment Short MSCI Emerging Markets [-13.57%], UltraShort FTSE/Xinhua China 25 [-38.96%], TripleShort Emerging Markets [-39.92%]. Now, more recently, over last week, the top performing Asia-Pacific ETFs that track the whole segment on the move are - Singapore [1.39%], China [0.58%], Korea [-0.19%], Hong Kong [-0.4%], Australia [-0.45%], Emerging Mkts [-0.86%], Emerging Mkts [-1.03%], Malaysia [-1.35%], Pacific [-1.69%], India [-1.87%], Taiwan [-1.92%] . |

|

LEADING Asia-Pacific ETFs (YEAR-TO-DATE) |

|

| iShares South Korea : 42.58% | |

| iShares Hong Kong : 20.59% | |

| iShares Singapore : 20.09% | |

| iShares China 25: 19.84% | |

| iShares Emerging Mkts : 15.4% | |

| Vanguard Pacific Stock VIPERs: 14.64% | |

| Vanguard Emerging Markets VIPERs: 12.72% | |

| iShares Taiwan : 12.64% | |

| iShares Australia: 10.48% | |

| iShares Japan : 7.84% | |

|

For Complete List of Winners and Laggards from Asia-Pacific ETF

Segment

| |

| 12Stocks.com: Investing With Asia-Pacific ETFs | |

|

The following table helps investors and traders sort through current performance of various

Asia-Pacific ETFs. One can glean long and short term trends by sorting Asia-Pacific ETF list by performance over daily, weekly or year-to-date periods. |

12Stocks.com Performance of Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| FXI | iShares China 25 |   | Pacific | 36.48 | -7.02 | 0.58 | 19.84% |

| EEM | iShares Emerging Mkts |   | Emerging Markets | 48.26 | 9.63 | -1.03 | 15.4% |

| EPI | Wisdom Tree India Earnings Fund |   | Pacific | 46.74 | 0.66 | -1.87 | 3.25% |

| EWY | iShares South Korea |   | Pacific | 72.56 | 5.39 | -0.19 | 42.58% |

| EWH | iShares Hong Kong |   | Pacific | 20.09 | 1.40 | -0.4 | 20.59% |

| EWS | iShares Singapore |   | Pacific | 26.24 | 6.95 | 1.39 | 20.09% |

| VPL | Vanguard Pacific Stock VIPERs |   | Pacific | 80.99 | 12.00 | -1.69 | 14.64% |

| VWO | Vanguard Emerging Markets VIPERs |   | Emerging Markets | 49.59 | 1.50 | -0.86 | 12.72% |

| EWT | iShares Taiwan |   | Pacific | 58.30 | 2.94 | -1.92 | 12.64% |

| EWA | iShares Australia |   | Pacific | 26.36 | 2.49 | -0.45 | 10.48% |

| EWJ | iShares Japan |   | Pacific | 72.36 | 2.42 | -3 | 7.84% |

| IFN | India Closed-End ETF Fund |   | Pacific | 16.04 | -2.35 | -2.85 | 4.89% |

| EWM | iShares Malaysia |   | Pacific | 24.08 | 0.82 | -1.35 | -1.83% |

| HAO | China Smallcap |   | Pacific | 1.36 | 0.00 | -2.86 | -64.63% |

| TFC | Taiwan Greater China Fund |   | Pacific | 45.43 | 35.27 | -0.24 | 5.91% |

| Showing 0 to 25 ETFs. Click on arrows to view more! Sort by performace by clicking on Daily, Weekly or YTD % Change |  | |||||

| 12Stocks.com: Euro Currency | |

| Investors using Asia-Pacific ETFs have to also deal with currency movements versus US dollar. Unless the ETF is hedged for Asia-Pacific currency exposure, traders will have to take into account the performance of Asia-Pacific currencies. |

12Stocks.com Performance of Asia-Pacific Currencies

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| YCL | Ultra Yen |   | Pacific | 22.18 | -9.69 | -3.14 | 8.99% |

| YCS | UltraShort Yen |   | Pacific | 43.50 | -2.88 | 3.77 | -6.81% |

| 12Stocks.com: Trading With Bullish (Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can enhance their performances by trading leveraged ETFs that double or triple the daily returns of Asia-Pacific indexes. Also, listed below are leveraged ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bullish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EDC | TripleBull Emerging Markets |   | Emerging Markets | 39.06 | 5.08 | -3.22 | 37.55% |

| XPP | Ultra China |   | Pacific | 24.62 | -24.43 | 0.49 | 34.52% |

| EET | Ultra Emerging Mkts |   | Emerging Markets | 63.91 | 10.70 | -2.17 | 27.27% |

| EZJ | Ultra Japan |   | Pacific | 40.60 | 24.80 | -5.94 | 10.49% |

| INDL | Double Bull India |   | Pacific | 61.12 | 51.49 | -3.54 | 2.95% |

| 12Stocks.com: Trading With Bearish (& Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can hedge or take advantage of market pullbacks by betting on bearish (inverse) ETFs that move in opposite direction to underlying index. Asia-Pacific traders can enhance their performances by trading leveraged bearish ETFs that double or triple inverse the daily returns of Asia-Pacific indexes. Also, listed below are ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bearish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EUM | Short MSCI Emerging Markets |   | Emerging Markets | 23.10 | -9.70 | 1.32 | -13.57% |

| FXP | UltraShort FTSE/Xinhua China 25 |   | Pacific | 10.63 | -3.01 | -1.04 | -38.96% |

| EDZ | TripleShort Emerging Markets |   | Emerging Markets | 5.41 | -4.97 | 3.84 | -39.92% |

| Charts, Fundamental Data and Performances of ETFs | ||

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows | ||

| FXI iShares China 25 |

| Description: Invests in 25 largest and most liquid Chinese companies | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 36.48 | |

| Day Percent Change: -7.02% Day Change: -2.00 | |

| Week Change: 0.58% Year-to-date Change: 19.8% | |

| FXI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save FXI for Review:   | |

| EEM iShares Emerging Mkts |

| Description: Invests in leading companies from emerging markets like Latin America and Asia [Korea, Taiwan, etc] | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 48.26 | |

| Day Percent Change: 9.63% Day Change: 3.85 | |

| Week Change: -1.03% Year-to-date Change: 15.4% | |

| EEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EEM for Review:   | |

| EPI Wisdom Tree India Earnings Fund |

| Description: Tracks an earnings-weighted index of 150 Indian companies | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 46.74 | |

| Day Percent Change: 0.66% Day Change: 0.33 | |

| Week Change: -1.87% Year-to-date Change: 3.3% | |

| EPI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EPI for Review:   | |

| EWY iShares South Korea |

| Description: Invests in large cap value companies traded primarily on Seoul stock exchange & tracks MSCI South Korea index | |

| Sector: Pacific | |

| Sub-Sector: Korea | |

| Recent Price: 72.56 | |

| Day Percent Change: 5.39% Day Change: 3.44 | |

| Week Change: -0.19% Year-to-date Change: 42.6% | |

| EWY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWY for Review:   | |

| EWH iShares Hong Kong |

| Description: Invests in large cap companies traded primarily on HongKong stock exchange & tracks MSCI Hong Kong index | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 20.09 | |

| Day Percent Change: 1.40% Day Change: 0.22 | |

| Week Change: -0.4% Year-to-date Change: 20.6% | |

| EWH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWH for Review:   | |

| EWS iShares Singapore |

| Description: Invests in large cap value companies traded primarily on Singapore stock exchange & tracks MSCI Singapore index | |

| Sector: Pacific | |

| Sub-Sector: Singapore | |

| Recent Price: 26.24 | |

| Day Percent Change: 6.95% Day Change: 1.34 | |

| Week Change: 1.39% Year-to-date Change: 20.1% | |

| EWS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWS for Review:   | |

| VPL Vanguard Pacific Stock VIPERs |

| Description: Invests to track index of 400 equities from Australia, Japan, Hong Kong, New Zealand and Singapore | |

| Sector: Pacific | |

| Sub-Sector: Pacific | |

| Recent Price: 80.99 | |

| Day Percent Change: 12.00% Day Change: 8.37 | |

| Week Change: -1.69% Year-to-date Change: 14.6% | |

| VPL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VPL for Review:   | |

| VWO Vanguard Emerging Markets VIPERs |

| Description: Invests to track index of 500 equities from all across worlds emerging markets | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 49.59 | |

| Day Percent Change: 1.50% Day Change: 0.66 | |

| Week Change: -0.86% Year-to-date Change: 12.7% | |

| VWO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VWO for Review:   | |

| EWT iShares Taiwan |

| Description: Invests in large cap companies traded primarily on Taiwan stock exchange & tracks MSCI Taiwan index | |

| Sector: Pacific | |

| Sub-Sector: Taiwan | |

| Recent Price: 58.30 | |

| Day Percent Change: 2.94% Day Change: 1.55 | |

| Week Change: -1.92% Year-to-date Change: 12.6% | |

| EWT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWT for Review:   | |

| EWA iShares Australia |

| Description: Invests in large cap companies traded in Australian stock exchange & tracks MSCI Australia index | |

| Sector: Pacific | |

| Sub-Sector: Australia | |

| Recent Price: 26.36 | |

| Day Percent Change: 2.49% Day Change: 0.63 | |

| Week Change: -0.45% Year-to-date Change: 10.5% | |

| EWA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWA for Review:   | |

| EWJ iShares Japan |

| Description: Invests in large cap companies traded primarily on Tokyo stock exchange & tracks MSCI Japan index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 72.36 | |

| Day Percent Change: 2.42% Day Change: 1.70 | |

| Week Change: -3% Year-to-date Change: 7.8% | |

| EWJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWJ for Review:   | |

| IFN India Closed-End ETF Fund |

| Description: Invests in leading companies from India | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 16.04 | |

| Day Percent Change: -2.35% Day Change: -0.45 | |

| Week Change: -2.85% Year-to-date Change: 4.9% | |

| IFN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IFN for Review:   | |

| EWM iShares Malaysia |

| Description: Invests in large cap value companies traded primarily on Kuala Lampur stock exchange & tracks MSCI Malaysia index | |

| Sector: Pacific | |

| Sub-Sector: Malaysia | |

| Recent Price: 24.08 | |

| Day Percent Change: 0.82% Day Change: 0.20 | |

| Week Change: -1.35% Year-to-date Change: -1.8% | |

| EWM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWM for Review:   | |

| HAO China Smallcap |

| Description: Invests in small cap value companies traded primarily on China market index | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 1.36 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: -2.86% Year-to-date Change: -64.6% | |

| HAO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save HAO for Review:   | |

| TFC Taiwan Greater China Fund |

| Description: Invests in equities of companies that trade primarily in Taiwan stock market and gets substantial revenues from mainland China | |

| Sector: Pacific | |

| Sub-Sector: Thailand | |

| Recent Price: 45.43 | |

| Day Percent Change: 35.27% Day Change: 11.43 | |

| Week Change: -0.24% Year-to-date Change: 5.9% | |

| TFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TFC for Review:   | |

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows |

| 12Stocks.com: Typical Stock Holdings in Asia-Pacific ETFs | |

| ETFs are funds that hold basket of stocks. The following table shows list of stocks or holdings commonly found in most Asia-Pacific ETFs . The funds basically perform based on what stocks they hold. You can dive deep into Asia-Pacific stocks in the following pages - Asia-Pacific Stocks |

12Stocks.com Performance of Stock Holdings in Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| PDD | Pinduoduo Inc. |   | Services & Goods | 104.91 | -4.89 | 1.27 | 8.17% |

| TEAM | Atlassian Corporation Plc |   | Technology | 187.01 | 3.03 | -12.42 | -23.16% |

| WNS | WNS (Holdings) Limited |   | Services & Goods | 74.70 | 0.62 | 14.26 | 57.63% |

|

List of Asia-Pacific ETFs

|

|

US Stock Market Performance Year-to-Date: 6% |

performance (%Change)

performance (%Change)

| Stock | Price | YTD | Week | Day% |

| FXI | 36.48 | 19.8 | 0.6 | -7.0 |

| EEM | 48.26 | 15.4 | -1.0 | 9.6 |

| EPI | 46.74 | 3.3 | -1.9 | 0.7 |

| EWY | 72.56 | 42.6 | -0.2 | 5.4 |

| EWH | 20.09 | 20.6 | -0.4 | 1.4 |

| EWS | 26.24 | 20.1 | 1.4 | 7.0 |

| VPL | 80.99 | 14.6 | -1.7 | 12.0 |

| VWO | 49.59 | 12.7 | -0.9 | 1.5 |

| EWT | 58.30 | 12.6 | -1.9 | 2.9 |

| EWA | 26.36 | 10.5 | -0.5 | 2.5 |

| EWJ | 72.36 | 7.8 | -3.0 | 2.4 |

| IFN | 16.04 | 4.9 | -2.9 | -2.4 |

| EWM | 24.08 | -1.8 | -1.4 | 0.8 |

| HAO | 1.36 | -64.6 | -2.9 | 0.0 |

| TFC | 45.43 | 5.9 | -0.2 | 35.3 |

performance (%Change)

performance (%Change)

End-of-Day Market data as of

© 2014 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

|

|

Best US Stocks |

|

Top Exchange Traded Funds (ETFs) |

|

Global Markets |

|

Best Sectors |

|

Books & More |