Best Latin America Stocks

|

|

| Quick Read: Top Latin America Stocks By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Latin America Views: Quick Browse View, Summary & Slide Show | |||

| 12Stocks.com Latin America Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 80 (0-bearish to 100-bullish) which puts Latin America index in short term neutral to bullish trend. The market intelligence score from previous trading session is 70 and hence an improvement of trend.

| ||||||||

| Here are the market intelligence trend scores of the most requested Latin America stocks at 12Stocks.com (click stock name for detailed review): | |

| Scroll down this page for most comprehensive review of Latin America stocks by performance, trends, technical analysis, charts, fund plays & more | |

| 12Stocks.com: Top Performing Latin America Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Latin America Index stocks year to date are

Now, more recently, over last week, the top performing Latin America Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Latin America Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Latin America Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Latin America Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| ASTL | Algoma Steel |   | Materials | 4.87 | 50 | 5.05% | -52.42% |

| DDC | Dominion Diamond |   | Materials | 13.92 | 30 | 28.83% | 207.43% |

| EQX | Equinox Gold |   | Materials | 8.76 | 80 | 1.94% | 57.37% |

| LVRO | Lavoro |   | Materials | 1.65 | 71 | -1.76% | -65.14% |

| DOOO | BRP |   | Consumer Staples | 62.98 | 100 | -1.86% | 9.69% |

| SA | Seabridge Gold |   | Materials | 17.44 | 70 | 1.24% | 43.65% |

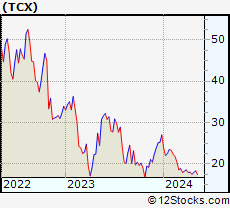

| TCX | Tucows |   | Technology | 18.28 | 10 | -2.47% | 8.11% |

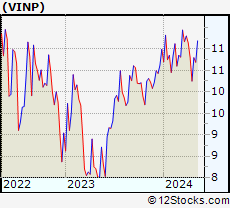

| VINP | Vi Partners |   | Financials | 10.06 | 30 | -0.20% | 0.19% |

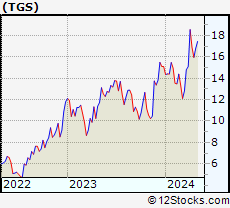

| TGS | Transportadora de |   | Utilities | 27.16 | 10 | 3.27% | -3.89% |

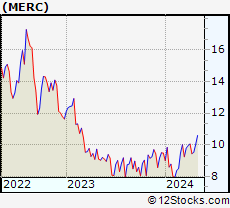

| MERC | Mercer |   | Consumer Staples | 3.33 | 50 | 1.89% | -48.64% |

| SVM | Silvercorp Metals |   | Materials | 4.84 | 80 | 1.59% | 49.43% |

| CIO | City Office |   | Financials | 6.93 | 80 | 0.00% | 33.15% |

| CLS | Celestica |   | Technology | 194.75 | 100 | -0.85% | 96.47% |

| AMBI | Ambipar Emergency |   | Industrials | 4.80 | 10 | -1.46% | -10.59% |

| TLRY | Tilray |   | Health Care | 1.38 | 50 | 4.72% | -16.54% |

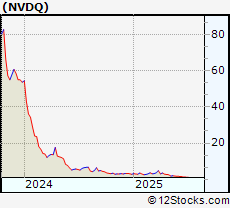

| NVDQ | Novadaq |   | Health Care | 1.09 | 80 | 0.47% | -67.47% |

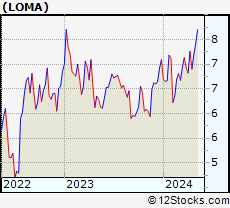

| LOMA | Loma Negra |   | Industrials | 9.31 | 0 | 1.18% | -13.74% |

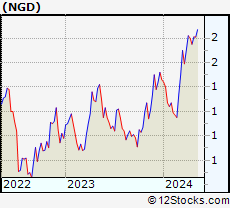

| NGD | New Gold |   | Materials | 5.90 | 100 | 3.42% | 119.35% |

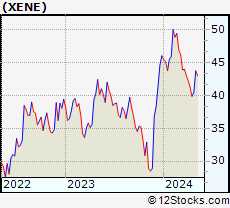

| XENE | Xenon |   | Health Care | 38.71 | 80 | 1.43% | -2.60% |

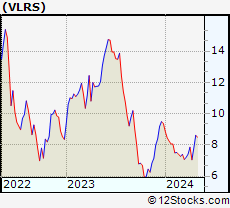

| VLRS | Controladora Vuela |   | Transports | 6.16 | 70 | -1.51% | -21.10% |

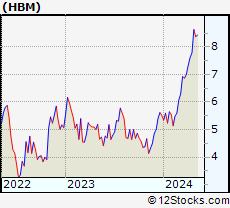

| HBM | Hudbay Minerals |   | Materials | 12.00 | 100 | 2.64% | 39.40% |

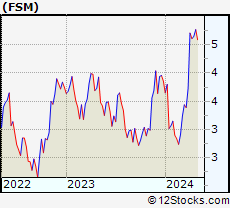

| FSM | Fortuna Silver |   | Materials | 7.70 | 60 | 3.67% | 71.33% |

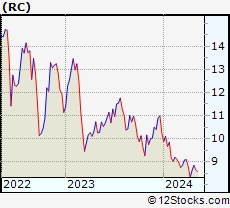

| RC | Ready Capital |   | Financials | 4.26 | 60 | -3.64% | -42.60% |

| MIST | Milestone |   | Health Care | 1.84 | 40 | 4.27% | -27.54% |

| CEPU | Central Puerto |   | Utilities | 10.68 | 0 | 1.09% | -23.40% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Latin America Stocks |

| Latin America Technical Overview, Leaders & Laggards, Top Latin America ETF Funds & Detailed Latin America Stocks List, Charts, Trends & More |

| Latin America: Technical Analysis, Trends & YTD Performance | |

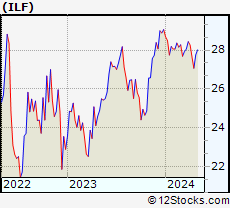

ILF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

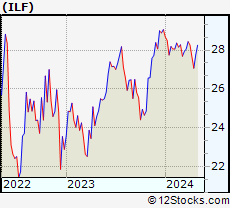

ILF Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 80 | |

| YTD Performance: 21.12% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Latin America Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors play Latin America stock market. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Latin America Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| ILF | Latin America 40 |   | 27.17 | 80 | 0.67 | 0.26 | 21.12% |

| EWC | Canada |   | 48.79 | 100 | 1.57 | 1.59 | 17.28% |

| FLN | Latin America AlphaDEX |   | 20.48 | 100 | 0.31 | -0.55 | 33.28% |

| EWZ | Brazil |   | 29.50 | 70 | 3.33 | 1.35 | 14.93% |

| EWW | Mexico |   | 61.94 | 100 | 2 | 2.35 | 30.49% |

| ARGT | Argentina |   | 80.15 | 30 | 0.48 | -2.82 | -1.29% |

| EWZS | Brazil Small-Cap |   | 13.40 | 90 | -0.6 | -2.06 | 35.19% |

| BRF | Brazil Small-Cap |   | 15.65 | 90 | -0.22 | -2.19 | 32.59% |

| BZQ | Short Brazil |   | 10.00 | 30 | -0.06 | 1.69 | -39.37% |

| BRZU | Brazil Bull 3X |   | 67.10 | 80 | -0.12 | -1.98 | 45.21% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Latin America Stocks | |

|

We now take in-depth look at all Latin America stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Latin America stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

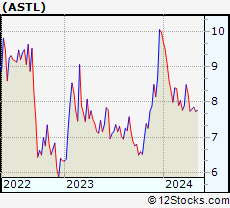

| ASTL Algoma Steel Group Inc. |

| Sector: Materials | |

| SubSector: Steel | |

| MarketCap: 731 Millions | |

| Recent Price: 4.87 Market Intelligence Score: 50 | |

| Day Percent Change: 5.05% Day Change: 0.22 | |

| Week Change: -1.93% Year-to-date Change: -52.4% | |

| ASTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ASTL to Watchlist:  View: View:  Get Complete ASTL Trend Analysis ➞ Get Complete ASTL Trend Analysis ➞ | |

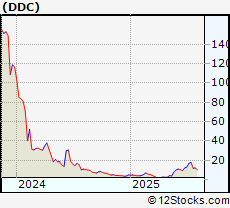

| DDC Dominion Diamond Corporation |

| Sector: Materials | |

| SubSector: Nonmetallic Mineral Mining | |

| MarketCap: 713.29 Millions | |

| Recent Price: 13.92 Market Intelligence Score: 30 | |

| Day Percent Change: 28.83% Day Change: 3.01 | |

| Week Change: 33.17% Year-to-date Change: 207.4% | |

| DDC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DDC to Watchlist:  View: View:  Get Complete DDC Trend Analysis ➞ Get Complete DDC Trend Analysis ➞ | |

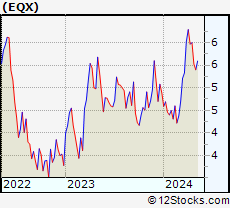

| EQX Equinox Gold Corp. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 706.119 Millions | |

| Recent Price: 8.76 Market Intelligence Score: 80 | |

| Day Percent Change: 1.94% Day Change: 0.15 | |

| Week Change: 1.02% Year-to-date Change: 57.4% | |

| EQX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EQX to Watchlist:  View: View:  Get Complete EQX Trend Analysis ➞ Get Complete EQX Trend Analysis ➞ | |

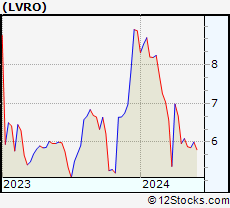

| LVRO Lavoro Limited |

| Sector: Materials | |

| SubSector: Agricultural Inputs | |

| MarketCap: 686 Millions | |

| Recent Price: 1.65 Market Intelligence Score: 71 | |

| Day Percent Change: -1.76% Day Change: -0.03 | |

| Week Change: -18.54% Year-to-date Change: -65.1% | |

| LVRO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LVRO to Watchlist:  View: View:  Get Complete LVRO Trend Analysis ➞ Get Complete LVRO Trend Analysis ➞ | |

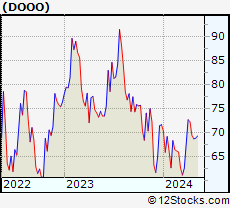

| DOOO BRP Inc. |

| Sector: Consumer Staples | |

| SubSector: Recreational Vehicles | |

| MarketCap: 638.559 Millions | |

| Recent Price: 62.98 Market Intelligence Score: 100 | |

| Day Percent Change: -1.86% Day Change: -1.05 | |

| Week Change: -3.77% Year-to-date Change: 9.7% | |

| DOOO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DOOO to Watchlist:  View: View:  Get Complete DOOO Trend Analysis ➞ Get Complete DOOO Trend Analysis ➞ | |

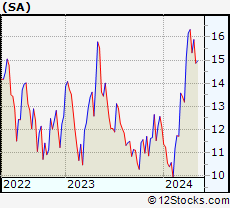

| SA Seabridge Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 565.419 Millions | |

| Recent Price: 17.44 Market Intelligence Score: 70 | |

| Day Percent Change: 1.24% Day Change: 0.2 | |

| Week Change: -1.09% Year-to-date Change: 43.7% | |

| SA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SA to Watchlist:  View: View:  Get Complete SA Trend Analysis ➞ Get Complete SA Trend Analysis ➞ | |

| TCX Tucows Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 557.78 Millions | |

| Recent Price: 18.28 Market Intelligence Score: 10 | |

| Day Percent Change: -2.47% Day Change: -0.47 | |

| Week Change: -2.68% Year-to-date Change: 8.1% | |

| TCX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TCX to Watchlist:  View: View:  Get Complete TCX Trend Analysis ➞ Get Complete TCX Trend Analysis ➞ | |

| VINP Vinci Partners Investments Ltd. |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 537 Millions | |

| Recent Price: 10.06 Market Intelligence Score: 30 | |

| Day Percent Change: -0.2% Day Change: -0.02 | |

| Week Change: -5.32% Year-to-date Change: 0.2% | |

| VINP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VINP to Watchlist:  View: View:  Get Complete VINP Trend Analysis ➞ Get Complete VINP Trend Analysis ➞ | |

| TGS Transportadora de Gas del Sur S.A. |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 514.177 Millions | |

| Recent Price: 27.16 Market Intelligence Score: 10 | |

| Day Percent Change: 3.27% Day Change: 0.89 | |

| Week Change: 0.11% Year-to-date Change: -3.9% | |

| TGS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TGS to Watchlist:  View: View:  Get Complete TGS Trend Analysis ➞ Get Complete TGS Trend Analysis ➞ | |

| MERC Mercer International Inc. |

| Sector: Consumer Staples | |

| SubSector: Paper & Paper Products | |

| MarketCap: 509.003 Millions | |

| Recent Price: 3.33 Market Intelligence Score: 50 | |

| Day Percent Change: 1.89% Day Change: 0.06 | |

| Week Change: 5.9% Year-to-date Change: -48.6% | |

| MERC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MERC to Watchlist:  View: View:  Get Complete MERC Trend Analysis ➞ Get Complete MERC Trend Analysis ➞ | |

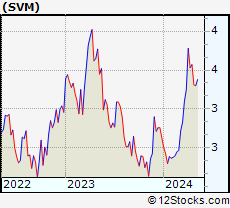

| SVM Silvercorp Metals Inc. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 504.056 Millions | |

| Recent Price: 4.84 Market Intelligence Score: 80 | |

| Day Percent Change: 1.59% Day Change: 0.07 | |

| Week Change: -1.97% Year-to-date Change: 49.4% | |

| SVM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SVM to Watchlist:  View: View:  Get Complete SVM Trend Analysis ➞ Get Complete SVM Trend Analysis ➞ | |

| CIO City Office REIT, Inc. |

| Sector: Financials | |

| SubSector: REIT - Office | |

| MarketCap: 478.566 Millions | |

| Recent Price: 6.93 Market Intelligence Score: 80 | |

| Day Percent Change: 0% Day Change: 0 | |

| Week Change: -0.14% Year-to-date Change: 33.2% | |

| CIO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CIO to Watchlist:  View: View:  Get Complete CIO Trend Analysis ➞ Get Complete CIO Trend Analysis ➞ | |

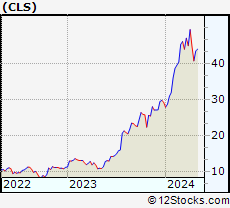

| CLS Celestica Inc. |

| Sector: Technology | |

| SubSector: Printed Circuit Boards | |

| MarketCap: 474.235 Millions | |

| Recent Price: 194.75 Market Intelligence Score: 100 | |

| Day Percent Change: -0.85% Day Change: -1.56 | |

| Week Change: -7.78% Year-to-date Change: 96.5% | |

| CLS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CLS to Watchlist:  View: View:  Get Complete CLS Trend Analysis ➞ Get Complete CLS Trend Analysis ➞ | |

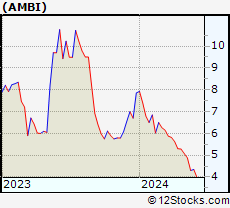

| AMBI Ambipar Emergency Response |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 462 Millions | |

| Recent Price: 4.80 Market Intelligence Score: 10 | |

| Day Percent Change: -1.46% Day Change: -0.07 | |

| Week Change: -3.86% Year-to-date Change: -10.6% | |

| AMBI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMBI to Watchlist:  View: View:  Get Complete AMBI Trend Analysis ➞ Get Complete AMBI Trend Analysis ➞ | |

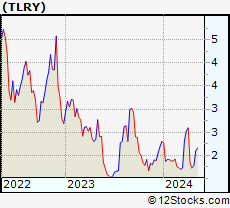

| TLRY Tilray, Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 452.533 Millions | |

| Recent Price: 1.38 Market Intelligence Score: 50 | |

| Day Percent Change: 4.72% Day Change: 0.05 | |

| Week Change: -5.93% Year-to-date Change: -16.5% | |

| TLRY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TLRY to Watchlist:  View: View:  Get Complete TLRY Trend Analysis ➞ Get Complete TLRY Trend Analysis ➞ | |

| NVDQ Novadaq Technologies Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 443.48 Millions | |

| Recent Price: 1.09 Market Intelligence Score: 80 | |

| Day Percent Change: 0.47% Day Change: 0 | |

| Week Change: 8% Year-to-date Change: -67.5% | |

| NVDQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVDQ to Watchlist:  View: View:  Get Complete NVDQ Trend Analysis ➞ Get Complete NVDQ Trend Analysis ➞ | |

| LOMA Loma Negra Compania Industrial Argentina Sociedad Anonima |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 408.853 Millions | |

| Recent Price: 9.31 Market Intelligence Score: 0 | |

| Day Percent Change: 1.18% Day Change: 0.12 | |

| Week Change: -4.36% Year-to-date Change: -13.7% | |

| LOMA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LOMA to Watchlist:  View: View:  Get Complete LOMA Trend Analysis ➞ Get Complete LOMA Trend Analysis ➞ | |

| NGD New Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 398.119 Millions | |

| Recent Price: 5.90 Market Intelligence Score: 100 | |

| Day Percent Change: 3.42% Day Change: 0.18 | |

| Week Change: 6.67% Year-to-date Change: 119.4% | |

| NGD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGD to Watchlist:  View: View:  Get Complete NGD Trend Analysis ➞ Get Complete NGD Trend Analysis ➞ | |

| XENE Xenon Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 388.585 Millions | |

| Recent Price: 38.71 Market Intelligence Score: 80 | |

| Day Percent Change: 1.43% Day Change: 0.54 | |

| Week Change: 0.58% Year-to-date Change: -2.6% | |

| XENE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XENE to Watchlist:  View: View:  Get Complete XENE Trend Analysis ➞ Get Complete XENE Trend Analysis ➞ | |

| VLRS Controladora Vuela Compania de Aviacion, S.A.B. de C.V. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 382 Millions | |

| Recent Price: 6.16 Market Intelligence Score: 70 | |

| Day Percent Change: -1.51% Day Change: -0.09 | |

| Week Change: 0.51% Year-to-date Change: -21.1% | |

| VLRS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VLRS to Watchlist:  View: View:  Get Complete VLRS Trend Analysis ➞ Get Complete VLRS Trend Analysis ➞ | |

| HBM Hudbay Minerals Inc. |

| Sector: Materials | |

| SubSector: Copper | |

| MarketCap: 363.157 Millions | |

| Recent Price: 12.00 Market Intelligence Score: 100 | |

| Day Percent Change: 2.64% Day Change: 0.29 | |

| Week Change: 2.64% Year-to-date Change: 39.4% | |

| HBM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HBM to Watchlist:  View: View:  Get Complete HBM Trend Analysis ➞ Get Complete HBM Trend Analysis ➞ | |

| FSM Fortuna Silver Mines Inc. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 362.256 Millions | |

| Recent Price: 7.70 Market Intelligence Score: 60 | |

| Day Percent Change: 3.67% Day Change: 0.26 | |

| Week Change: 1.24% Year-to-date Change: 71.3% | |

| FSM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FSM to Watchlist:  View: View:  Get Complete FSM Trend Analysis ➞ Get Complete FSM Trend Analysis ➞ | |

| RC Ready Capital Corporation |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 358.039 Millions | |

| Recent Price: 4.26 Market Intelligence Score: 60 | |

| Day Percent Change: -3.64% Day Change: -0.14 | |

| Week Change: -3.89% Year-to-date Change: -42.6% | |

| RC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RC to Watchlist:  View: View:  Get Complete RC Trend Analysis ➞ Get Complete RC Trend Analysis ➞ | |

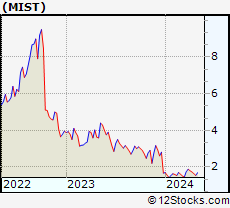

| MIST Milestone Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 342.685 Millions | |

| Recent Price: 1.84 Market Intelligence Score: 40 | |

| Day Percent Change: 4.27% Day Change: 0.07 | |

| Week Change: 1.79% Year-to-date Change: -27.5% | |

| MIST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MIST to Watchlist:  View: View:  Get Complete MIST Trend Analysis ➞ Get Complete MIST Trend Analysis ➞ | |

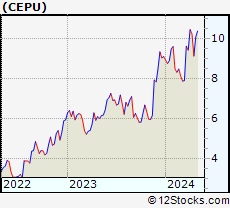

| CEPU Central Puerto S.A. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 340.114 Millions | |

| Recent Price: 10.68 Market Intelligence Score: 0 | |

| Day Percent Change: 1.09% Day Change: 0.12 | |

| Week Change: -6.8% Year-to-date Change: -23.4% | |

| CEPU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CEPU to Watchlist:  View: View:  Get Complete CEPU Trend Analysis ➞ Get Complete CEPU Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Latin America Stocks With Best Up Trends [0-bearish to 100-bullish]: IAMGOLD [100], New Gold[100], SSR Mining[100], Hudbay Minerals[100], Grupo Aeroportuario[100], TELUS [100], Baytex Energy[100], Franco-Nevada [100], CEMEX S.A.B.[100], Osisko Gold[100], Agnico Eagle[100]

Best Latin America Stocks Year-to-Date:

Dominion Diamond[207.43%], Gold Royalty[161.16%], SSR Mining[143.1%], New Gold[119.35%], Kinross Gold[111.46%], Vasta Platform[109.75%], Celestica [96.47%], Sandstorm Gold[95.03%], Inter & Co[86.91%], StoneCo [86.07%], NovaGold Resources[78.68%] Best Latin America Stocks This Week:

Dominion Diamond[33.17%], Nu [13.82%], Alamos Gold[9.37%], Novadaq [8%], New Gold[6.67%], Mercer [5.9%], BRF S.A[5.85%], Trilogy Metals[5.77%], IAMGOLD [5.75%], McEwen Mining[5.39%], SSR Mining[5.22%] Best Latin America Stocks Daily:

Dominion Diamond[28.83%], Bioceres Crop[8.89%], Gold Royalty[6.76%], Cronos [5.79%], Vision Marine[5.23%], Algoma Steel[5.05%], Alamos Gold[4.79%], Tilray [4.72%], Vox Royalty[4.72%], OrganiGram [4.67%], Braskem S.A[4.48%]

Dominion Diamond[207.43%], Gold Royalty[161.16%], SSR Mining[143.1%], New Gold[119.35%], Kinross Gold[111.46%], Vasta Platform[109.75%], Celestica [96.47%], Sandstorm Gold[95.03%], Inter & Co[86.91%], StoneCo [86.07%], NovaGold Resources[78.68%] Best Latin America Stocks This Week:

Dominion Diamond[33.17%], Nu [13.82%], Alamos Gold[9.37%], Novadaq [8%], New Gold[6.67%], Mercer [5.9%], BRF S.A[5.85%], Trilogy Metals[5.77%], IAMGOLD [5.75%], McEwen Mining[5.39%], SSR Mining[5.22%] Best Latin America Stocks Daily:

Dominion Diamond[28.83%], Bioceres Crop[8.89%], Gold Royalty[6.76%], Cronos [5.79%], Vision Marine[5.23%], Algoma Steel[5.05%], Alamos Gold[4.79%], Tilray [4.72%], Vox Royalty[4.72%], OrganiGram [4.67%], Braskem S.A[4.48%]

Login Sign Up

Login Sign Up