Best Industrial Stocks

| In a hurry? Industrial Stocks Lists: Performance Trends Table, Stock Charts

Sort Industrial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Industrial stocks list by size:All Industrial Large Mid-Range Small |

| 12Stocks.com Industrial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 70 (0-bearish to 100-bullish) which puts Industrial sector in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 50 and an improvement of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Industrial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Industrial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Industrial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Industrial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| BROG | Brooge |   | Conglomerates | 3.20 | 100 | 29.55 | 114.77% |

| NPWR | NET Power |   | Specialty Industrial Machinery | 2.63 | 90 | 17.41 | -75.63% |

| PESI | Perma-Fix Environmental |   | Waste Mgmt | 9.56 | 40 | 16.73 | -11.07% |

| BW | Babcock & Wilcox Enterprises |   | Specialty Industrial Machinery | 3.52 | 100 | 14.29 | 103.47% |

| CYRX | CryoPort |   | Integrated Freight & Logistics | 10.05 | 100 | 13.30 | 25.94% |

| ESGL | ESGL |   | Waste Mgmt | 3.97 | 100 | 11.57 | 201.90% |

| TGEN | Tecogen |   | Electrical Equipment & Parts | 9.09 | 60 | 10.99 | 486.45% |

| AAON | AAON |   | Building Products & Equipment | 88.64 | 100 | 10.08 | -24.67% |

| SERV | Serve Robotics |   | Specialty Industrial Machinery | 12.84 | 100 | 9.46 | -13.01% |

| EVTL | Vertical Aerospace |   | Aerospace & Defense | 5.19 | 60 | 9.26 | -52.47% |

| HTZ | Hertz Global |   | Rental & Leasing | 6.74 | 80 | 8.89 | 80.70% |

| BEAV | B/E Aerospace |   | Aerospace/Defense | 217.02 | 40 | 8.86 | 0.00% |

| STRL | Sterling Infrastructure |   | Engineering & Construction | 348.58 | 100 | 8.61 | 107.82% |

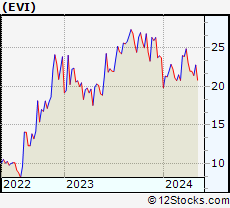

| EVI | EVI Industries |   | Industrial Distribution | 29.33 | 100 | 8.47 | 73.24% |

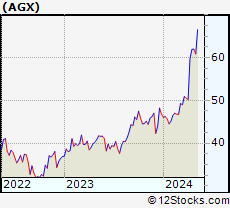

| AGX | Argan |   | Engineering & Construction | 259.58 | 100 | 8.42 | 82.35% |

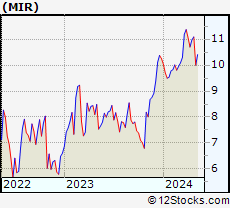

| MIR | Mirion Technologies |   | Specialty Industrial Machinery | 24.60 | 100 | 8.37 | 45.39% |

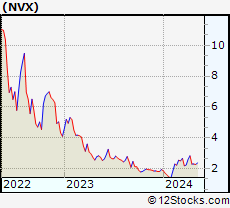

| NVX | Novonix |   | Electrical Equipment & Parts | 1.32 | 50 | 8.20 | -30.89% |

| AMRC | Ameresco |   | Engineering & Construction | 31.27 | 100 | 7.68 | 24.38% |

| AEIS | Advanced Energy |   | Electrical Equipment & Parts | 169.75 | 100 | 7.58 | 47.42% |

| ENVX | Enovix |   | Electrical Equipment & Parts | 9.96 | 70 | 6.98 | -17.75% |

| AMSC | American Superconductor |   | Specialty Industrial Machinery | 64.49 | 100 | 6.61 | 152.41% |

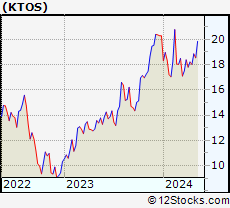

| KTOS | Kratos Defense |   | Aerospace & Defense | 80.65 | 100 | 6.48 | 205.72% |

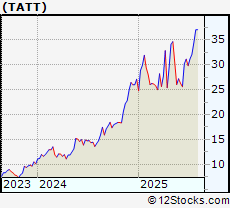

| TATT | TAT Technologies |   | Aerospace & Defense | 41.61 | 100 | 5.93 | 53.43% |

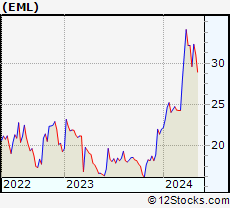

| EML | Eastern Co |   | Tools & Accessories | 26.77 | 100 | 5.89 | 1.42% |

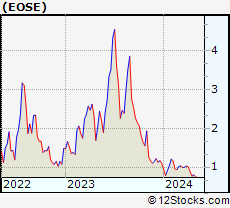

| EOSE | Eos Energy |   | Electrical Equipment & Parts | 9.00 | 100 | 5.88 | 62.75% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Industrial Stocks |

| Industrial Technical Overview, Leaders & Laggards, Top Industrial ETF Funds & Detailed Industrial Stocks List, Charts, Trends & More |

| Industrial Sector: Technical Analysis, Trends & YTD Performance | |

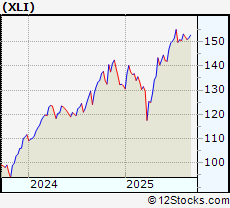

| Industrial sector is composed of stocks

from industrial machinery, aerospace, defense, farm/construction

and industrial services subsectors. Industrial sector, as represented by XLI, an exchange-traded fund [ETF] that holds basket of Industrial stocks (e.g, Caterpillar, Boeing) is up by 17.0489% and is currently outperforming the overall market by 3.1888% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLI Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Good | |

XLI Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 70 | |

| YTD Performance: 17.0489% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Industrial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Industrial sector stocks year to date are

Now, more recently, over last week, the top performing Industrial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Industrial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Industrial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Industrial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| CHII | China Industrials |   | 9.80 | 20 | 0 | -0.0509944 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Industrial Stocks | |

|

We now take in-depth look at all Industrial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Industrial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

| BROG Brooge Holdings Limited |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 242.748 Millions | |

| Recent Price: 3.20 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 29.5547% Day Change: -9999 | |

| Week Change: 10.3448% Year-to-date Change: 114.8% | |

| BROG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BROG to Watchlist:  View: View:  Get Complete BROG Trend Analysis ➞ Get Complete BROG Trend Analysis ➞ | |

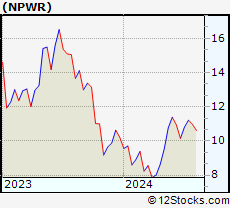

| NPWR NET Power Inc |

| Sector: Industrials | |

| SubSector: Specialty Industrial Machinery | |

| MarketCap: 482.29 Millions | |

| Recent Price: 2.63 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 17.4107% Day Change: -0.08 | |

| Week Change: 25.8373% Year-to-date Change: -75.6% | |

| NPWR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NPWR to Watchlist:  View: View:  Get Complete NPWR Trend Analysis ➞ Get Complete NPWR Trend Analysis ➞ | |

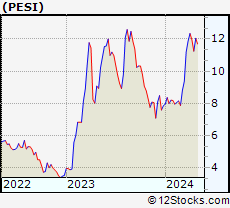

| PESI Perma-Fix Environmental Services, Inc |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 222.57 Millions | |

| Recent Price: 9.56 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 16.7277% Day Change: 0.21 | |

| Week Change: -4.97018% Year-to-date Change: -11.1% | |

| PESI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PESI to Watchlist:  View: View:  Get Complete PESI Trend Analysis ➞ Get Complete PESI Trend Analysis ➞ | |

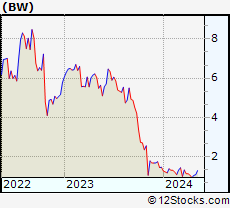

| BW Babcock & Wilcox Enterprises Inc |

| Sector: Industrials | |

| SubSector: Specialty Industrial Machinery | |

| MarketCap: 215.34 Millions | |

| Recent Price: 3.52 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 14.2857% Day Change: 0.12 | |

| Week Change: 33.8403% Year-to-date Change: 103.5% | |

| BW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BW to Watchlist:  View: View:  Get Complete BW Trend Analysis ➞ Get Complete BW Trend Analysis ➞ | |

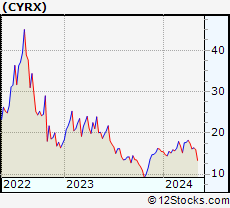

| CYRX CryoPort Inc |

| Sector: Industrials | |

| SubSector: Integrated Freight & Logistics | |

| MarketCap: 518.19 Millions | |

| Recent Price: 10.05 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 13.3033% Day Change: -0.16 | |

| Week Change: 4.79666% Year-to-date Change: 25.9% | |

| CYRX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CYRX to Watchlist:  View: View:  Get Complete CYRX Trend Analysis ➞ Get Complete CYRX Trend Analysis ➞ | |

| ESGL ESGL Holdings Ltd |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 157.21 Millions | |

| Recent Price: 3.97 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 11.5701% Day Change: -9996.36 | |

| Week Change: 58.8% Year-to-date Change: 201.9% | |

| ESGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ESGL to Watchlist:  View: View:  Get Complete ESGL Trend Analysis ➞ Get Complete ESGL Trend Analysis ➞ | |

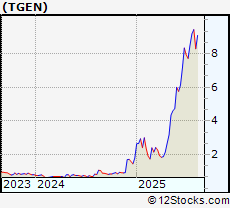

| TGEN Tecogen Inc |

| Sector: Industrials | |

| SubSector: Electrical Equipment & Parts | |

| MarketCap: 209.02 Millions | |

| Recent Price: 9.09 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 10.989% Day Change: -8.19 | |

| Week Change: 0.776053% Year-to-date Change: 486.5% | |

| TGEN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TGEN to Watchlist:  View: View:  Get Complete TGEN Trend Analysis ➞ Get Complete TGEN Trend Analysis ➞ | |

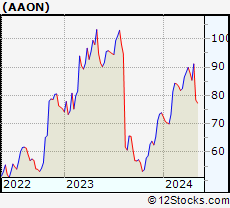

| AAON AAON Inc |

| Sector: Industrials | |

| SubSector: Building Products & Equipment | |

| MarketCap: 6616.21 Millions | |

| Recent Price: 88.64 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 10.0845% Day Change: 0.84 | |

| Week Change: 4.29462% Year-to-date Change: -24.7% | |

| AAON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAON to Watchlist:  View: View:  Get Complete AAON Trend Analysis ➞ Get Complete AAON Trend Analysis ➞ | |

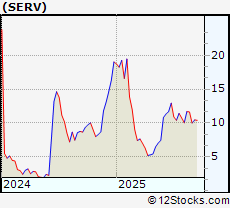

| SERV Serve Robotics Inc |

| Sector: Industrials | |

| SubSector: Specialty Industrial Machinery | |

| MarketCap: 598.82 Millions | |

| Recent Price: 12.84 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 9.46292% Day Change: -0.01 | |

| Week Change: 20.3374% Year-to-date Change: -13.0% | |

| SERV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SERV to Watchlist:  View: View:  Get Complete SERV Trend Analysis ➞ Get Complete SERV Trend Analysis ➞ | |

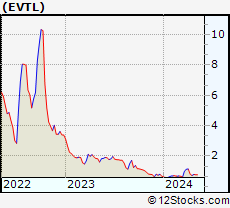

| EVTL Vertical Aerospace Ltd |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 445.68 Millions | |

| Recent Price: 5.19 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 9.26316% Day Change: 0.05 | |

| Week Change: 5.27383% Year-to-date Change: -52.5% | |

| EVTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EVTL to Watchlist:  View: View:  Get Complete EVTL Trend Analysis ➞ Get Complete EVTL Trend Analysis ➞ | |

| HTZ Hertz Global Holdings Inc |

| Sector: Industrials | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1700 Millions | |

| Recent Price: 6.74 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 8.8853% Day Change: 0.59 | |

| Week Change: 15.2137% Year-to-date Change: 80.7% | |

| HTZ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HTZ to Watchlist:  View: View:  Get Complete HTZ Trend Analysis ➞ Get Complete HTZ Trend Analysis ➞ | |

| BEAV B/E Aerospace, Inc. |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 6508.08 Millions | |

| Recent Price: 217.02 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 8.86381% Day Change: -9999 | |

| Week Change: -23.9887% Year-to-date Change: 0.0% | |

| BEAV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BEAV to Watchlist:  View: View:  Get Complete BEAV Trend Analysis ➞ Get Complete BEAV Trend Analysis ➞ | |

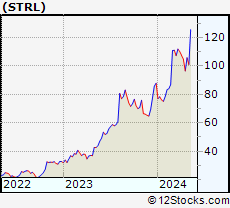

| STRL Sterling Infrastructure Inc |

| Sector: Industrials | |

| SubSector: Engineering & Construction | |

| MarketCap: 8699.46 Millions | |

| Recent Price: 348.58 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 8.6122% Day Change: 3.14 | |

| Week Change: 15.7573% Year-to-date Change: 107.8% | |

| STRL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STRL to Watchlist:  View: View:  Get Complete STRL Trend Analysis ➞ Get Complete STRL Trend Analysis ➞ | |

| EVI EVI Industries Inc |

| Sector: Industrials | |

| SubSector: Industrial Distribution | |

| MarketCap: 362.35 Millions | |

| Recent Price: 29.33 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 8.46894% Day Change: -1.1 | |

| Week Change: 6.11433% Year-to-date Change: 73.2% | |

| EVI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EVI to Watchlist:  View: View:  Get Complete EVI Trend Analysis ➞ Get Complete EVI Trend Analysis ➞ | |

| AGX Argan, Inc |

| Sector: Industrials | |

| SubSector: Engineering & Construction | |

| MarketCap: 2921.29 Millions | |

| Recent Price: 259.58 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 8.42035% Day Change: 2.4 | |

| Week Change: 14.95% Year-to-date Change: 82.3% | |

| AGX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AGX to Watchlist:  View: View:  Get Complete AGX Trend Analysis ➞ Get Complete AGX Trend Analysis ➞ | |

| MIR Mirion Technologies Inc |

| Sector: Industrials | |

| SubSector: Specialty Industrial Machinery | |

| MarketCap: 5357.83 Millions | |

| Recent Price: 24.60 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 8.37004% Day Change: -0.03 | |

| Week Change: 15.2765% Year-to-date Change: 45.4% | |

| MIR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MIR to Watchlist:  View: View:  Get Complete MIR Trend Analysis ➞ Get Complete MIR Trend Analysis ➞ | |

| NVX Novonix Limited ADR |

| Sector: Industrials | |

| SubSector: Electrical Equipment & Parts | |

| MarketCap: 215.13 Millions | |

| Recent Price: 1.32 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 8.19672% Day Change: 0.09 | |

| Week Change: 0.763359% Year-to-date Change: -30.9% | |

| NVX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVX to Watchlist:  View: View:  Get Complete NVX Trend Analysis ➞ Get Complete NVX Trend Analysis ➞ | |

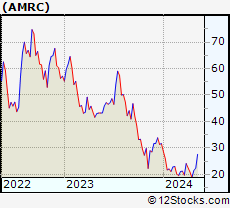

| AMRC Ameresco Inc |

| Sector: Industrials | |

| SubSector: Engineering & Construction | |

| MarketCap: 1366.61 Millions | |

| Recent Price: 31.27 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 7.67906% Day Change: 0.08 | |

| Week Change: 11.5989% Year-to-date Change: 24.4% | |

| AMRC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMRC to Watchlist:  View: View:  Get Complete AMRC Trend Analysis ➞ Get Complete AMRC Trend Analysis ➞ | |

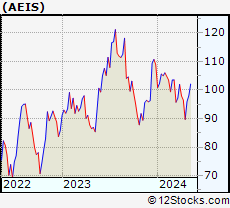

| AEIS Advanced Energy Industries Inc |

| Sector: Industrials | |

| SubSector: Electrical Equipment & Parts | |

| MarketCap: 5789.14 Millions | |

| Recent Price: 169.75 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 7.57969% Day Change: 0.33 | |

| Week Change: 7.94913% Year-to-date Change: 47.4% | |

| AEIS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEIS to Watchlist:  View: View:  Get Complete AEIS Trend Analysis ➞ Get Complete AEIS Trend Analysis ➞ | |

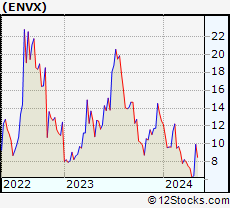

| ENVX Enovix Corporation |

| Sector: Industrials | |

| SubSector: Electrical Equipment & Parts | |

| MarketCap: 1806.75 Millions | |

| Recent Price: 9.96 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 6.98174% Day Change: 0.18 | |

| Week Change: 8.85246% Year-to-date Change: -17.8% | |

| ENVX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ENVX to Watchlist:  View: View:  Get Complete ENVX Trend Analysis ➞ Get Complete ENVX Trend Analysis ➞ | |

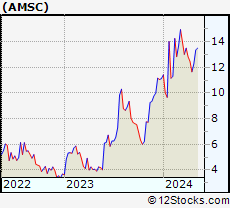

| AMSC American Superconductor Corp |

| Sector: Industrials | |

| SubSector: Specialty Industrial Machinery | |

| MarketCap: 2207.47 Millions | |

| Recent Price: 64.49 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 6.61266% Day Change: 0.48 | |

| Week Change: 25.345% Year-to-date Change: 152.4% | |

| AMSC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMSC to Watchlist:  View: View:  Get Complete AMSC Trend Analysis ➞ Get Complete AMSC Trend Analysis ➞ | |

| KTOS Kratos Defense & Security Solutions Inc |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 10939.6 Millions | |

| Recent Price: 80.65 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 6.4827% Day Change: 0.51 | |

| Week Change: 22.8297% Year-to-date Change: 205.7% | |

| KTOS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KTOS to Watchlist:  View: View:  Get Complete KTOS Trend Analysis ➞ Get Complete KTOS Trend Analysis ➞ | |

| TATT TAT Technologies Ltd |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 435.85 Millions | |

| Recent Price: 41.61 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 5.93177% Day Change: 1.3 | |

| Week Change: 13.844% Year-to-date Change: 53.4% | |

| TATT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TATT to Watchlist:  View: View:  Get Complete TATT Trend Analysis ➞ Get Complete TATT Trend Analysis ➞ | |

| EML Eastern Co |

| Sector: Industrials | |

| SubSector: Tools & Accessories | |

| MarketCap: 146.11 Millions | |

| Recent Price: 26.77 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 5.89399% Day Change: -1.08 | |

| Week Change: 10.8948% Year-to-date Change: 1.4% | |

| EML Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EML to Watchlist:  View: View:  Get Complete EML Trend Analysis ➞ Get Complete EML Trend Analysis ➞ | |

| EOSE Eos Energy Enterprises Inc |

| Sector: Industrials | |

| SubSector: Electrical Equipment & Parts | |

| MarketCap: 2013.15 Millions | |

| Recent Price: 9.00 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 5.88235% Day Change: 0.03 | |

| Week Change: 31.0044% Year-to-date Change: 62.7% | |

| EOSE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EOSE to Watchlist:  View: View:  Get Complete EOSE Trend Analysis ➞ Get Complete EOSE Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Industrial Stocks With Best Up Trends [0-bearish to 100-bullish]: Brooge [100], Babcock & Wilcox Enterprises[100], CryoPort [100], ESGL [100], AAON [100], Serve Robotics[100], Sterling Infrastructure[100], EVI Industries[100], Argan [100], Mirion Technologies[100], Ameresco [100]

Best Industrial Stocks Year-to-Date:

Triumph [1281.83%], GrafTech [638.372%], Tecogen [486.452%], Power [263.325%], Bloom Energy[246.47%], Kratos Defense[205.724%], ESGL [201.901%], Lightbridge Corp[196.863%], Willdan [180.653%], Tutor Perini[174.089%], Planet Labs[167.254%] Best Industrial Stocks This Week:

TRC [10149.1%], Advanced Emissions[3571.78%], L3 Technologies[1915.25%], Forterra [1845.47%], KLX [437.488%], Allegro Merger[402.182%], LMI Aerospace[291.621%], Chicago Bridge[205.472%], Covanta Holding[148.617%], MOOG [148.377%], Altra [103.372%] Best Industrial Stocks Daily:

Brooge [29.5547%], NET Power[17.4107%], Perma-Fix Environmental[16.7277%], Babcock & Wilcox Enterprises[14.2857%], CryoPort [13.3033%], ESGL [11.5701%], Tecogen [10.989%], AAON [10.0845%], Serve Robotics[9.46292%], Vertical Aerospace[9.26316%], Hertz Global[8.8853%]

Triumph [1281.83%], GrafTech [638.372%], Tecogen [486.452%], Power [263.325%], Bloom Energy[246.47%], Kratos Defense[205.724%], ESGL [201.901%], Lightbridge Corp[196.863%], Willdan [180.653%], Tutor Perini[174.089%], Planet Labs[167.254%] Best Industrial Stocks This Week:

TRC [10149.1%], Advanced Emissions[3571.78%], L3 Technologies[1915.25%], Forterra [1845.47%], KLX [437.488%], Allegro Merger[402.182%], LMI Aerospace[291.621%], Chicago Bridge[205.472%], Covanta Holding[148.617%], MOOG [148.377%], Altra [103.372%] Best Industrial Stocks Daily:

Brooge [29.5547%], NET Power[17.4107%], Perma-Fix Environmental[16.7277%], Babcock & Wilcox Enterprises[14.2857%], CryoPort [13.3033%], ESGL [11.5701%], Tecogen [10.989%], AAON [10.0845%], Serve Robotics[9.46292%], Vertical Aerospace[9.26316%], Hertz Global[8.8853%]

Login Sign Up

Login Sign Up