Best Healthcare Stocks

| "Discover best trending healthcare stocks with 12Stocks.com." |

| - Subu Vdaygiri, Founder, 12Stocks.com |

| In a hurry? Healthcare Stocks Lists: Performance Trends Table, Stock Charts

Sort Healthcare stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Healthcare stocks list by size:All Healthcare Large Mid-Range Small |

| 12Stocks.com Healthcare Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 83 (0-bearish to 100-bullish) which puts Healthcare sector in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 88 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Healthcare stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Healthcare sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Healthcare sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Healthcare Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| OLK | Olink Holding |   | Diagnostics & Research | 23.84 | 58 | -0.46% | -0.46% |

| GKOS | Glaukos |   | Instruments | 109.27 | 58 | -0.47% | -0.47% |

| IQV | IQVIA |   | Laboratories | 230.09 | 25 | -0.47% | -0.47% |

| HAE | Haemonetics |   | Instruments | 95.27 | 56 | -0.48% | -0.48% |

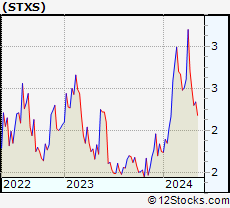

| STXS | Stereotaxis |   | Instruments | 2.09 | 10 | -0.48% | -0.48% |

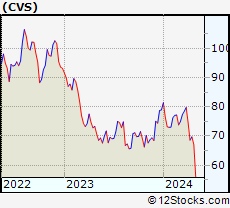

| CVS | CVS Health |   | Insurance | 57.40 | 64 | -0.49% | -0.49% |

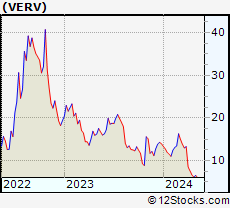

| VERV | Verve |   | Biotechnology | 5.95 | 17 | -0.50% | -0.50% |

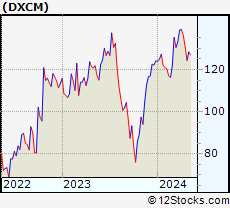

| DXCM | DexCom |   | Laboratories | 130.69 | 93 | -0.51% | -0.51% |

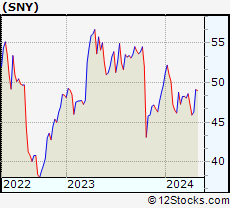

| SNY | Sanofi |   | Pharmaceutical | 48.42 | 43 | -0.51% | -0.51% |

| KNSA | Kiniksa |   | Biotechnology | 19.67 | 10 | -0.51% | -0.51% |

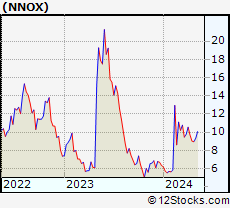

| NNOX | Nano X |   | Medical Devices | 9.75 | 39 | -0.51% | -0.51% |

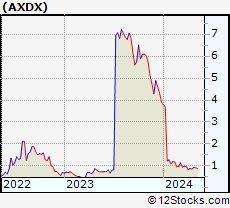

| AXDX | Accelerate Diagnostics |   | Laboratories | 0.88 | 10 | -0.52% | -0.52% |

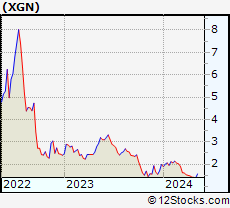

| XGN | Exagen |   | Laboratories | 1.87 | 35 | -0.53% | -0.53% |

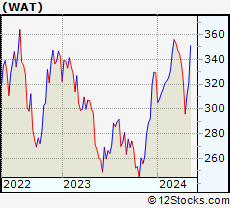

| WAT | Waters |   | Instruments | 354.02 | 68 | -0.54% | -0.54% |

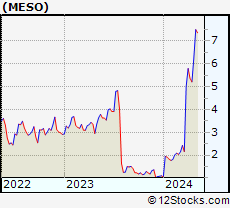

| MESO | Mesoblast |   | Biotechnology | 7.31 | 68 | -0.54% | -0.54% |

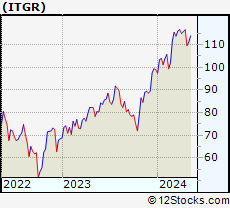

| ITGR | Integer |   | Equipment | 120.26 | 100 | -0.55% | -0.55% |

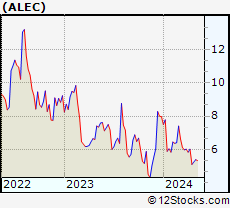

| ALEC | Alector |   | Biotechnology | 5.41 | 22 | -0.55% | -0.55% |

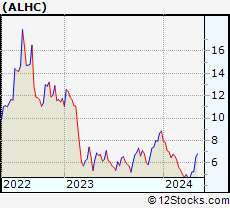

| ALHC | Alignment |   | Healthcare Plans | 7.22 | 90 | -0.55% | -0.55% |

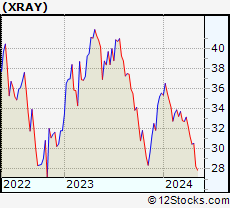

| XRAY | DENTSPLY SIRONA |   | Instruments | 28.12 | 42 | -0.57% | -0.57% |

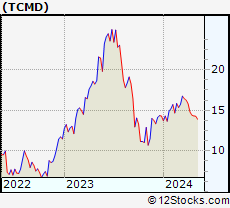

| TCMD | Tactile Systems |   | Instruments | 13.65 | 25 | -0.58% | -0.58% |

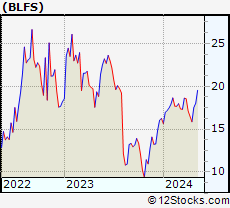

| BLFS | BioLife |   | Instruments | 21.83 | 68 | -0.59% | -0.59% |

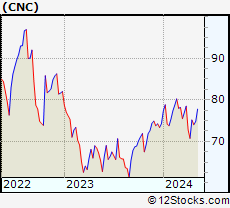

| CNC | Centene |   | Insurance | 77.57 | 57 | -0.63% | -0.63% |

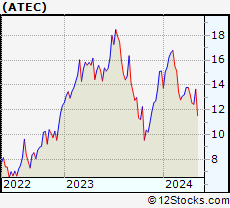

| ATEC | Alphatec |   | Instruments | 11.03 | 25 | -0.63% | -0.63% |

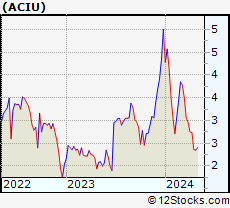

| ACIU | AC Immune |   | Biotechnology | 3.16 | 37 | -0.63% | -0.63% |

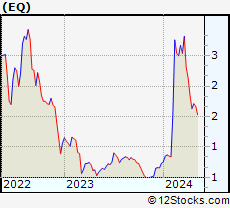

| EQ | Equillium |   | Biotechnology | 1.55 | 20 | -0.64% | -0.64% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Healthcare Stocks |

| Healthcare Technical Overview, Leaders & Laggards, Top Healthcare ETF Funds & Detailed Healthcare Stocks List, Charts, Trends & More |

| Healthcare Sector: Technical Analysis, Trends & YTD Performance | |

| Healthcare sector is composed of stocks

from pharmaceutical, biotech, diagnostics labs, insurance providers

and healthcare services. Healthcare sector, as represented by XLV, an exchange-traded fund [ETF] that holds basket of Healthcare stocks (e.g, Merck, Amgen) is up by 7.05% and is currently underperforming the overall market by -3.64% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLV Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

XLV Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 83 | |

| YTD Performance: 7.05% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Healthcare Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Healthcare sector stocks year to date are

Now, more recently, over last week, the top performing Healthcare sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Healthcare Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Healthcare Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Healthcare Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLV | Health Care |   | 146.00 | 83 | -0.21 | -0.21 | 7.05% |

| XBI | Biotech |   | 92.27 | 38 | 1.20 | 1.2 | 3.34% |

| IBB | Biotechnology |   | 137.51 | 70 | 0.60 | 0.6 | 1.22% |

| BBH | Biotech |   | 168.59 | 83 | 0.36 | 0.36 | 1.98% |

| VHT | Health Care |   | 266.85 | 63 | -0.10 | -0.1 | 6.44% |

| IYH | Healthcare |   | 61.24 | 63 | -0.16 | -0.16 | 6.97% |

| IHF | Healthcare Providers |   | 53.54 | 76 | -0.69 | -0.69 | 1.96% |

| IHI | Medical Devices |   | 56.45 | 38 | -0.42 | -0.42 | 4.6% |

| BIB | Biotechnology |   | 57.89 | 82 | 1.63 | 1.63 | 1.47% |

| BIS | Short Biotech |   | 17.33 | 18 | -1.48 | -1.48 | -4.1% |

| XHE | Health Care Equipment |   | 87.50 | 69 | 0.06 | 0.06 | 3.85% |

| CURE | Healthcare Bull 3X |   | 118.25 | 56 | -0.72 | -0.72 | 16.22% |

| LABU | Biotech Bull 3X |   | 115.80 | 30 | 3.59 | 3.59 | -5.06% |

| LABD | Biotech Bear 3X |   | 7.67 | 61 | -3.52 | -3.52 | -20.85% |

| PSCH | SmallCap Health Care |   | 43.45 | 71 | 0.13 | 0.13 | 1.52% |

| XHS | Health Care Services |   | 91.88 | 83 | 0.36 | 0.36 | 3.29% |

| PTH | DWA Healthcare Momentum |   | 43.11 | 37 | 1.13 | 1.13 | 10.14% |

| BTEC | Principal Healthcare Innovators |   | 36.94 | 22 | 1.26 | 1.26 | 1.68% |

| RXL | Health Care |   | 102.89 | 70 | 0.13 | 0.13 | 12.57% |

| RXD | Short Health Care |   | 10.57 | 25 | 0.07 | 0.07 | -11.36% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Healthcare Stocks | |

|

We now take in-depth look at all Healthcare stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Healthcare stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

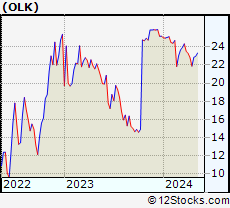

| OLK Olink Holding AB (publ) |

| Sector: Health Care | |

| SubSector: Diagnostics & Research | |

| MarketCap: 2370 Millions | |

| Recent Price: 23.84 Smart Investing & Trading Score: 58 | |

| Day Percent Change: -0.46% Day Change: -0.11 | |

| Week Change: -0.46% Year-to-date Change: -5.3% | |

| OLK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OLK to Watchlist:  View: View:  Get Complete OLK Trend Analysis ➞ Get Complete OLK Trend Analysis ➞ | |

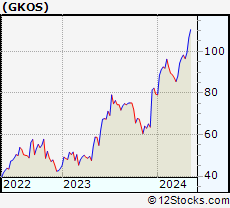

| GKOS Glaukos Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 1103.6 Millions | |

| Recent Price: 109.27 Smart Investing & Trading Score: 58 | |

| Day Percent Change: -0.47% Day Change: -0.52 | |

| Week Change: -0.47% Year-to-date Change: 37.5% | |

| GKOS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GKOS to Watchlist:  View: View:  Get Complete GKOS Trend Analysis ➞ Get Complete GKOS Trend Analysis ➞ | |

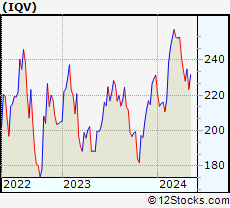

| IQV IQVIA Holdings Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 19616.5 Millions | |

| Recent Price: 230.09 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.47% Day Change: -1.09 | |

| Week Change: -0.47% Year-to-date Change: -0.6% | |

| IQV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IQV to Watchlist:  View: View:  Get Complete IQV Trend Analysis ➞ Get Complete IQV Trend Analysis ➞ | |

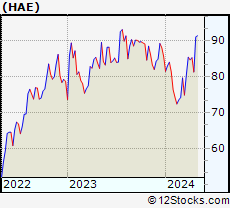

| HAE Haemonetics Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 4500.7 Millions | |

| Recent Price: 95.27 Smart Investing & Trading Score: 56 | |

| Day Percent Change: -0.48% Day Change: -0.46 | |

| Week Change: -0.48% Year-to-date Change: 11.4% | |

| HAE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HAE to Watchlist:  View: View:  Get Complete HAE Trend Analysis ➞ Get Complete HAE Trend Analysis ➞ | |

| STXS Stereotaxis, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 232.26 Millions | |

| Recent Price: 2.09 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.48% Day Change: -0.01 | |

| Week Change: -0.48% Year-to-date Change: 19.4% | |

| STXS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STXS to Watchlist:  View: View:  Get Complete STXS Trend Analysis ➞ Get Complete STXS Trend Analysis ➞ | |

| CVS CVS Health Corporation |

| Sector: Health Care | |

| SubSector: Health Care Plans | |

| MarketCap: 80104.3 Millions | |

| Recent Price: 57.40 Smart Investing & Trading Score: 64 | |

| Day Percent Change: -0.49% Day Change: -0.28 | |

| Week Change: -0.49% Year-to-date Change: -27.3% | |

| CVS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVS to Watchlist:  View: View:  Get Complete CVS Trend Analysis ➞ Get Complete CVS Trend Analysis ➞ | |

| VERV Verve Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1200 Millions | |

| Recent Price: 5.95 Smart Investing & Trading Score: 17 | |

| Day Percent Change: -0.50% Day Change: -0.03 | |

| Week Change: -0.5% Year-to-date Change: -57.4% | |

| VERV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VERV to Watchlist:  View: View:  Get Complete VERV Trend Analysis ➞ Get Complete VERV Trend Analysis ➞ | |

| DXCM DexCom, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 19559 Millions | |

| Recent Price: 130.69 Smart Investing & Trading Score: 93 | |

| Day Percent Change: -0.51% Day Change: -0.67 | |

| Week Change: -0.51% Year-to-date Change: 5.3% | |

| DXCM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DXCM to Watchlist:  View: View:  Get Complete DXCM Trend Analysis ➞ Get Complete DXCM Trend Analysis ➞ | |

| SNY Sanofi |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Major | |

| MarketCap: 104761 Millions | |

| Recent Price: 48.42 Smart Investing & Trading Score: 43 | |

| Day Percent Change: -0.51% Day Change: -0.25 | |

| Week Change: -0.51% Year-to-date Change: -2.6% | |

| SNY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SNY to Watchlist:  View: View:  Get Complete SNY Trend Analysis ➞ Get Complete SNY Trend Analysis ➞ | |

| KNSA Kiniksa Pharmaceuticals, Ltd. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 780.285 Millions | |

| Recent Price: 19.67 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.51% Day Change: -0.10 | |

| Week Change: -0.51% Year-to-date Change: 12.1% | |

| KNSA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KNSA to Watchlist:  View: View:  Get Complete KNSA Trend Analysis ➞ Get Complete KNSA Trend Analysis ➞ | |

| NNOX Nano X Imaging Ltd. |

| Sector: Health Care | |

| SubSector: Medical Devices | |

| MarketCap: 22587 Millions | |

| Recent Price: 9.75 Smart Investing & Trading Score: 39 | |

| Day Percent Change: -0.51% Day Change: -0.05 | |

| Week Change: -0.51% Year-to-date Change: 53.1% | |

| NNOX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NNOX to Watchlist:  View: View:  Get Complete NNOX Trend Analysis ➞ Get Complete NNOX Trend Analysis ➞ | |

| AXDX Accelerate Diagnostics, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 286.4 Millions | |

| Recent Price: 0.88 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.52% Day Change: 0.00 | |

| Week Change: -0.52% Year-to-date Change: -77.6% | |

| AXDX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AXDX to Watchlist:  View: View:  Get Complete AXDX Trend Analysis ➞ Get Complete AXDX Trend Analysis ➞ | |

| XGN Exagen Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 231.7 Millions | |

| Recent Price: 1.87 Smart Investing & Trading Score: 35 | |

| Day Percent Change: -0.53% Day Change: -0.01 | |

| Week Change: -0.53% Year-to-date Change: -6.0% | |

| XGN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XGN to Watchlist:  View: View:  Get Complete XGN Trend Analysis ➞ Get Complete XGN Trend Analysis ➞ | |

| WAT Waters Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 11882 Millions | |

| Recent Price: 354.02 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.54% Day Change: -1.93 | |

| Week Change: -0.54% Year-to-date Change: 7.5% | |

| WAT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WAT to Watchlist:  View: View:  Get Complete WAT Trend Analysis ➞ Get Complete WAT Trend Analysis ➞ | |

| MESO Mesoblast Limited |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 471.385 Millions | |

| Recent Price: 7.31 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.54% Day Change: -0.04 | |

| Week Change: -0.54% Year-to-date Change: 564.6% | |

| MESO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MESO to Watchlist:  View: View:  Get Complete MESO Trend Analysis ➞ Get Complete MESO Trend Analysis ➞ | |

| ITGR Integer Holdings Corporation |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 1794.8 Millions | |

| Recent Price: 120.26 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.55% Day Change: -0.66 | |

| Week Change: -0.55% Year-to-date Change: 21.4% | |

| ITGR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ITGR to Watchlist:  View: View:  Get Complete ITGR Trend Analysis ➞ Get Complete ITGR Trend Analysis ➞ | |

| ALEC Alector, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2719.35 Millions | |

| Recent Price: 5.41 Smart Investing & Trading Score: 22 | |

| Day Percent Change: -0.55% Day Change: -0.03 | |

| Week Change: -0.55% Year-to-date Change: -32.2% | |

| ALEC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALEC to Watchlist:  View: View:  Get Complete ALEC Trend Analysis ➞ Get Complete ALEC Trend Analysis ➞ | |

| ALHC Alignment Healthcare, Inc. |

| Sector: Health Care | |

| SubSector: Healthcare Plans | |

| MarketCap: 1100 Millions | |

| Recent Price: 7.22 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -0.55% Day Change: -0.04 | |

| Week Change: -0.55% Year-to-date Change: -18.4% | |

| ALHC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALHC to Watchlist:  View: View:  Get Complete ALHC Trend Analysis ➞ Get Complete ALHC Trend Analysis ➞ | |

| XRAY DENTSPLY SIRONA Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 7746.1 Millions | |

| Recent Price: 28.12 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -0.57% Day Change: -0.16 | |

| Week Change: -0.57% Year-to-date Change: -21.0% | |

| XRAY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XRAY to Watchlist:  View: View:  Get Complete XRAY Trend Analysis ➞ Get Complete XRAY Trend Analysis ➞ | |

| TCMD Tactile Systems Technology, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 655.96 Millions | |

| Recent Price: 13.65 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.58% Day Change: -0.08 | |

| Week Change: -0.58% Year-to-date Change: -4.6% | |

| TCMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TCMD to Watchlist:  View: View:  Get Complete TCMD Trend Analysis ➞ Get Complete TCMD Trend Analysis ➞ | |

| BLFS BioLife Solutions, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 264.36 Millions | |

| Recent Price: 21.83 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.59% Day Change: -0.13 | |

| Week Change: -0.59% Year-to-date Change: 34.3% | |

| BLFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BLFS to Watchlist:  View: View:  Get Complete BLFS Trend Analysis ➞ Get Complete BLFS Trend Analysis ➞ | |

| CNC Centene Corporation |

| Sector: Health Care | |

| SubSector: Health Care Plans | |

| MarketCap: 29075 Millions | |

| Recent Price: 77.57 Smart Investing & Trading Score: 57 | |

| Day Percent Change: -0.63% Day Change: -0.49 | |

| Week Change: -0.63% Year-to-date Change: 4.5% | |

| CNC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CNC to Watchlist:  View: View:  Get Complete CNC Trend Analysis ➞ Get Complete CNC Trend Analysis ➞ | |

| ATEC Alphatec Holdings, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 181.16 Millions | |

| Recent Price: 11.03 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.63% Day Change: -0.07 | |

| Week Change: -0.63% Year-to-date Change: -27.0% | |

| ATEC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATEC to Watchlist:  View: View:  Get Complete ATEC Trend Analysis ➞ Get Complete ATEC Trend Analysis ➞ | |

| ACIU AC Immune SA |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 356.585 Millions | |

| Recent Price: 3.16 Smart Investing & Trading Score: 37 | |

| Day Percent Change: -0.63% Day Change: -0.02 | |

| Week Change: -0.63% Year-to-date Change: -36.8% | |

| ACIU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACIU to Watchlist:  View: View:  Get Complete ACIU Trend Analysis ➞ Get Complete ACIU Trend Analysis ➞ | |

| EQ Equillium, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 56.4785 Millions | |

| Recent Price: 1.55 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -0.64% Day Change: -0.01 | |

| Week Change: -0.64% Year-to-date Change: 112.3% | |

| EQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EQ to Watchlist:  View: View:  Get Complete EQ Trend Analysis ➞ Get Complete EQ Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Healthcare Stocks With Best Up Trends [0-bearish to 100-bullish]: PTC [100], Stoke [100], Humacyte [100], NovoCure [100], Reneo [100], Vericel [100], Corbus [100], Genfit SA[100], Heron [100], Moderna [100], Innate Pharma[100]

Best Healthcare Stocks Year-to-Date:

Pieris [6081.32%], Precision BioSciences[3417.81%], Avenue [2266.46%], Inovio [2078.43%], Assembly Biosciences[1724.17%], Aurora Cannabis[1453.97%], Agenus [1192.43%], NuCana [1117.04%], Adverum Biotechnologies[995.91%], Affimed N.V[725.6%], Burning Rock[706.3%] Best Healthcare Stocks This Week:

Scilex Holding[34.44%], Nobilis Health[29.64%], Dyne [27.82%], BioTelemetry [21.98%], PTC [21.23%], Concord [19.24%], Genelux [17.81%], Sutro Biopharma[16.71%], iBio [16.53%], InnovAge Holding[16.49%], Atara Bio[16.39%] Best Healthcare Stocks Daily:

Scilex Holding[34.44%], Nobilis Health[29.64%], Dyne [27.82%], BioTelemetry [21.98%], PTC [21.23%], Concord [19.24%], Genelux [17.81%], Sutro Biopharma[16.71%], iBio [16.53%], InnovAge Holding[16.49%], Atara Bio[16.39%]

Pieris [6081.32%], Precision BioSciences[3417.81%], Avenue [2266.46%], Inovio [2078.43%], Assembly Biosciences[1724.17%], Aurora Cannabis[1453.97%], Agenus [1192.43%], NuCana [1117.04%], Adverum Biotechnologies[995.91%], Affimed N.V[725.6%], Burning Rock[706.3%] Best Healthcare Stocks This Week:

Scilex Holding[34.44%], Nobilis Health[29.64%], Dyne [27.82%], BioTelemetry [21.98%], PTC [21.23%], Concord [19.24%], Genelux [17.81%], Sutro Biopharma[16.71%], iBio [16.53%], InnovAge Holding[16.49%], Atara Bio[16.39%] Best Healthcare Stocks Daily:

Scilex Holding[34.44%], Nobilis Health[29.64%], Dyne [27.82%], BioTelemetry [21.98%], PTC [21.23%], Concord [19.24%], Genelux [17.81%], Sutro Biopharma[16.71%], iBio [16.53%], InnovAge Holding[16.49%], Atara Bio[16.39%]

Login Sign Up

Login Sign Up