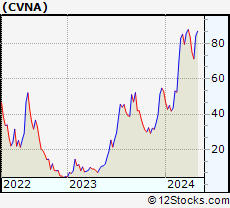

Stock Charts, Performance & Trend Analysis for CVNA

Carvana Co

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Stocks Similar To Carvana Co

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The table below shows stocks similar to Carvana Co, i.e, from same subsector or sector along with year-to-date (97.8% YTD), weekly (5.3%) & daily performaces for comparison. Usually, stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Compare 12Stocks.com Smart Investing & Trading Scores to see which stocks in this sector are trending better currently. Click on ticker or stock name for detailed view (place cursor on ticker or stock name to view charts quickly). Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. | ||||||||||

| ||||||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score [0 to 100] | Change % | Weekly Change% | YTD Change% | ||

| TSLA | Tesla Inc |   | Auto | 435.91 | 60 | -5.13 | -1.6 | 14.93% | ||

| TM | Toyota Motor |   | Auto | 190.52 | 20 | -0.68 | -3.6 | 0.60% | ||

| ORLY | OReilly Automotive |   | Auto | 104.97 | 30 | -0.67 | 1.4 | 32.57% | ||

| RACE | Ferrari N.V |   | Auto | 504.09 | 100 | 2.83 | 4.9 | 22.88% | ||

| CVNA | Carvana Co |   | Auto | 394.71 | 90 | -0.18 | 5.3 | 97.79% | ||

| AZO | Autozone Inc |   | Auto | 4253.71 | 40 | 0.14 | 1.8 | 30.88% | ||

| GM | General Motors |   | Auto | 59.36 | 50 | -3.23 | -0.9 | 16.22% | ||

| HMC | Honda Motor |   | Auto | 30.55 | 0 | -0.91 | -8.8 | 10.12% | ||

| F | Ford Motor |   | Auto | 12.22 | 100 | -0.41 | 5.1 | 34.46% | ||

| LI | Li Auto |   | Auto | 25.82 | 80 | 1.25 | 1.5 | 7.49% | ||

| GPC | Genuine Parts |   | Auto | 140.39 | 70 | 1.61 | 1.3 | 22.96% | ||

| APTV | Aptiv |   | Auto | 87.36 | 90 | 0.30 | 2.7 | 44.88% | ||

| RIVN | Rivian Automotive |   | Auto | 13.53 | 10 | -7.53 | -13.3 | 7.56% | ||

| XPEV | XPeng ADR |   | Auto | 23.81 | 80 | 0.46 | 11.9 | 106.15% | ||

| MGA | Magna |   | Auto | 48.50 | 90 | 2.80 | 5.4 | 20.74% | ||

| PAG | Penske Automotive |   | Auto | 174.83 | 60 | -1.05 | 0.5 | 18.20% | ||

| MBLY | Mobileye Global |   | Auto | 14.60 | 100 | 2.93 | 4.5 | -27.10% | ||

| NIO | NIO ADR |   | Auto | 7.89 | 100 | 3.27 | 10.7 | 73.41% | ||

| FCAU | Fiat Chrysler |   | Auto | 191.51 | 70 | -0.70 | 10.4 | 0.00% | ||

| ALV | Autoliv Inc |   | Auto | 125.52 | 70 | 1.05 | 0.5 | 37.91% | ||

| BWA | BorgWarner Inc |   | Auto | 44.42 | 90 | 0.36 | 2.5 | 42.83% | ||

| KMX | Carmax Inc |   | Auto | 46.07 | 40 | 0.07 | -19.2 | -43.28% | ||

| LAD | Lithia Motors |   | Auto | 320.85 | 60 | -0.83 | -4.3 | -7.50% | ||

| AN | Autonation Inc |   | Auto | 223.92 | 90 | 0.17 | 1.5 | 34.13% | ||

| LKQ | LKQ Corp |   | Auto | 31.32 | 90 | 0.59 | 3.0 | -12.35% | ||

| AMZN | Amazon.com Inc |   | Retail | 222.42 | 50 | 0.81 | 1.0 | 1.00% | ||

| HD | Home Depot |   | Retail | 395.01 | 10 | -0.51 | -3.6 | 2.97% | ||

| BABA | Alibaba |   | Retail | 189.34 | 100 | 3.59 | 7.3 | 124.66% | ||

| MCD | McDonalds Corp |   | Restaurants | 299.88 | 10 | -0.21 | -1.5 | 3.70% | ||

| BKNG | Booking |   | Services | 5430.36 | 30 | 1.49 | -1.7 | 10.67% | ||

| PDD | PDD |   | Retail | 135.24 | 100 | 0.63 | 3.3 | 39.58% | ||

| TJX | TJX |   | Retail | 142.49 | 50 | -1.27 | 1.5 | 18.35% | ||

Technical Levels: For the trading inclined, the following are the key levels of resistance (ceiling) and support (floor) for CVNA. Ceiling and floor levels are stock prices at which the stock trend gets resistance or support respectively. Stocks & their trends tend to pause at these levels and hence traders have an eye on them. Long term levels are more important. Stocks that have broken thru their resistance or support levels convincingly tend to have stronger trends (confirm with charts above visually). |

| Key Technical Levels for CVNA | |||

| Short Term | Weekly | Long Term | |

| Resistance (Ceiling) | 341.54 | 354.5 | 413.33 |

| Support (Floor) | 318.17 | 335.16 | 325.86 |

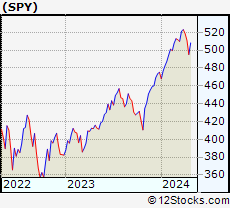

| RELATIVE PERFORMANCE OF Carvana Co Vs THE MARKET | ||||

| Relative performance of Carvana Co Compared to Overall Market | ||||

| How is CVNA faring versus the market [S&P 500] ? Is it lagging or leading ? How is its relative performance ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| SPY | 0.145759% | 0.887149% | 14.7579% | |

| CVNA | -0.177031% | 5.30936% | 97.7901% | |

CVNA Chart |  S&P 500 (Market) Chart | |||

| Year to date returns, CVNA is outperforming the market by 83.0322% | |

| This week, CVNA is outperforming the market by 4.422211% | |

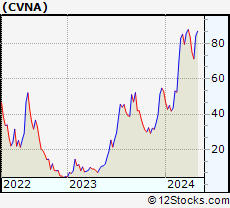

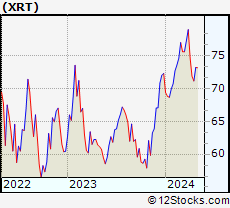

| Performance of Carvana Co vs Services & Goods ETF | RELATIVE PERFORMANCE OF Carvana Co Vs Services & Goods Sector | |||

| Let us compare apples to apples and compare performance of CVNA with its sector ETF (contains basket of stocks of same sector) XRT [Retail SPDR] ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| XRT | 0.509613 % | -0.424555 % | 9.92992 % | |

| CVNA | -0.177031% | 5.30936% | 97.7901% | |

CVNA Chart |  Services & Goods Chart | |||

| Year to date, CVNA is outperforming Services & Goods sector by 87.86018% | ||||

| This week, CVNA is outperforming Services & Goods sector by 5.733915% | ||||

List Of ETF Funds Related To Carvana Co

The table below shows ETFs (Exchange Traded Funds) similar to Carvana Co, i.e, from same sector along with year-to-date (YTD), weekly & daily performaces for comparison. Usually, ETFs and associated stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Move mouse or cursor over ETF symbol to view short-term technical chart and over ETF name to view long term chart. Click on  to add ETF symbol to your watchlist and to add ETF symbol to your watchlist and  to view watchlist. to view watchlist. | |||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| UCC | ProShares Ultra Consumer Svcs |   | Services & Goods | 53.59 | -1.47575 | -0.297674 | 7.04341% |

| UGE | ProShares Ultra Consumer Goods |   | Services & Goods | 17.00 | -0.990099 | -1.73183 | -4.2782% |

| XLY | Consumer Discretionary SPDR |   | Services & Goods | 239.40 | -0.721573 | -0.0834725 | 8.65816% |

| XHB | SPDR Homebuilders |   | Services & Goods | 111.64 | 0.0717103 | 0.903832 | 8.40624% |

| RTH | Retail HOLDRs |   | Services & Goods | 250.29 | 0.0479672 | 0.220629 | 11.9419% |

| SCC | ProShares UltraShort Consumer Svcs |   | Services & Goods | 14.48 | 1.40695 | 0.112696 | -22.0567% |

| SZK | ProShares UltraShort Consumer Goods |   | Services & Goods | 12.79 | 0.780037 | 1.67488 | 0.753046% |

| XRT | Retail SPDR |   | Services & Goods | 86.78 | 0.509613 | -0.424555 | 9.92992% |

| ITB | iShares U.S. Home Construction |   | Services & Goods | 108.26 | 0.120226 | 1.05479 | 7.5833% |

| RCD | Rydex EW Consumer Discretionary |   | Services & Goods | 24.27 | 0.559238 | 3.56317 | 1.29186% |

| VCR | Vanguard Consumer Discretionary VIPERs |   | Services & Goods | 396.25 | -0.589563 | -0.773777 | 7.07752% |

| PKB | PowerShares Construction |   | Services & Goods | 95.46 | 0.319252 | 0.129851 | 26.5871% |

| PEJ | PowerShares Leisure |   | Services & Goods | 60.35 | 0.382568 | -1.7101 | 15.2032% |

| PBS | PowerShares Media |   | Services & Goods | 40.46 | 1.68384 | 5.86219 | 0% |

| IYC | iShares US Consumer Services |   | Services & Goods | 104.33 | -0.353391 | -0.476963 | 9.59529% |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dow Stocks With Best Current Trends [0-bearish to 100-bullish]: Intel Corp[100], Caterpillar Inc[100], Unitedhealth [100], Johnson & Johnson[100], AMGEN Inc[100], Merck & Co Inc[100], 3M Co[90], Travelers [90], Nike Inc[90], [90] Best S&P 500 Stocks Year-to-Date Update:

Seagate [198.865%], Western Digital[181.204%], Newmont Corp[127.671%], Micron [110.87%], Lam Research[103.976%], Intel Corp[84.4708%], Warner Bros.[84.2%], NRG Energy[82.3658%], CVS Health[81.156%], Amphenol Corp[79.8571%] Best Nasdaq 100 Stocks Weekly Update:

Electronic Arts[20.1076%], Intel Corp[19.4747%], Lam Research[14.5184%], Micron [13.6232%], Biogen Inc[12.7697%], Astrazeneca [11.0138%], Applied Materials[11.0008%], Datadog Inc[10.9834%], Moderna Inc[9.62133%], ASML Holding[8.78936%] Today's Stock Market In A Nutshell:China [0.9%], US Small Cap [0.6%], Emerging Markets [0.5%], Europe [0.3%], US Dollar [0.1%], US Mid Cap [0.1%], India [0.1%], US Large Cap [0.1%], Bonds [0.1%], Euro [-0.1%], Gold [-0.3%], Oil [-2.2%],

Seagate [198.865%], Western Digital[181.204%], Newmont Corp[127.671%], Micron [110.87%], Lam Research[103.976%], Intel Corp[84.4708%], Warner Bros.[84.2%], NRG Energy[82.3658%], CVS Health[81.156%], Amphenol Corp[79.8571%] Best Nasdaq 100 Stocks Weekly Update:

Electronic Arts[20.1076%], Intel Corp[19.4747%], Lam Research[14.5184%], Micron [13.6232%], Biogen Inc[12.7697%], Astrazeneca [11.0138%], Applied Materials[11.0008%], Datadog Inc[10.9834%], Moderna Inc[9.62133%], ASML Holding[8.78936%] Today's Stock Market In A Nutshell:China [0.9%], US Small Cap [0.6%], Emerging Markets [0.5%], Europe [0.3%], US Dollar [0.1%], US Mid Cap [0.1%], India [0.1%], US Large Cap [0.1%], Bonds [0.1%], Euro [-0.1%], Gold [-0.3%], Oil [-2.2%],

Login Sign Up

Login Sign Up