Best Tech Stocks

| In a hurry? Tech Stocks Lists: Performance & Trends, Stock Charts, FANG Stocks

Sort Tech stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Tech stocks list by size:All Tech Large Mid-Range Small and MicroCap |

| 12Stocks.com Tech Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 100 (0-bearish to 100-bullish) which puts Technology sector in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 90 and an improvement of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Technology stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Technology sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Tech sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Tech Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| QADB | QAD |   | Software | 9.26 | 0 | 0.11% | 0.00% |

| ACFN | Acorn Energy |   | Instruments | 27.25 | 70 | 2.29% | 46.90% |

| PNTR | Pointer Telocation |   | Communication | 1.65 | 40 | -0.60% | 0.00% |

| LOV | Spark Networks |   | Internet Service Providers | 0.01 | 20 | -50.76% | 0.00% |

| ELTK | Eltek |   | Electronic Components | 10.89 | 60 | 0.88% | 0.39% |

| MAXN | Maxeon Solar |   | Solar | 3.77 | 50 | 5.31% | -55.59% |

| RWC | RELM Wireless |   | Communication | 3.65 | 10 | 0.00% | 0.00% |

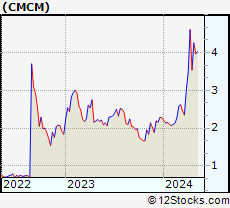

| CMCM | Cheetah Mobile |   | Internet Content & Information | 8.30 | 60 | 2.98% | 80.43% |

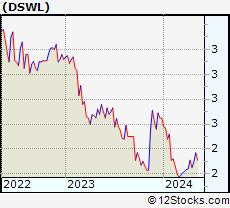

| DSWL | Deswell Industries |   | Electronic Components | 3.95 | 30 | -2.07% | 71.00% |

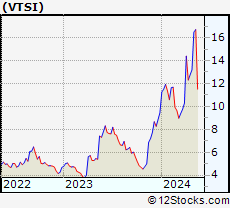

| VTSI | VirTra |   | Software - | 5.60 | 80 | -2.10% | -18.01% |

| CMTL | Comtech Tele |   | Communication | 2.67 | 90 | 0.64% | -34.79% |

| RESN | Resonant |   | Semiconductor | 23.15 | 100 | 416.74% | 0.00% |

| MTBC | MTBC |   | Healthcare Information | 3.04 | 20 | -10.06% | 0.00% |

| UEIC | Universal Electronics |   | Consumer Electronics | 4.75 | 30 | 1.39% | -56.34% |

| GMM | Global Mofy |   | IT | 1.95 | 20 | -8.88% | -49.15% |

| IEC | IEC Electronics |   | Circuit Boards | 35.38 | 100 | 1.90% | 0.00% |

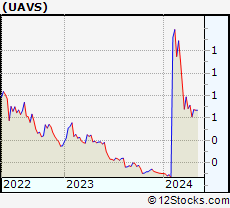

| UAVS | AgEagle Aerial |   | Computer Hardware | 2.49 | 90 | 14.75% | -26.76% |

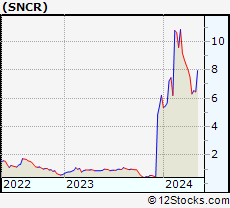

| SNCR | Synchronoss |   | Software - Infrastructure | 5.86 | 10 | 0.86% | -38.38% |

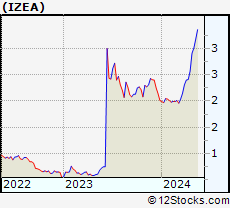

| IZEA | IZEA Worldwide |   | Internet Content & Information | 3.88 | 80 | 7.18% | 48.66% |

| NOTE | FiscalNote |   | IT | 4.97 | 100 | 6.20% | 377.89% |

| NLST | Netlist |   | Semiconductor- | 0.84 | 90 | -2.33% | -2.33% |

| KOSS | Koss Corp |   | Consumer Electronics | 5.18 | 10 | -0.77% | -30.19% |

| SMTX | SMTC |   | Circuit Boards | 2.06 | 0 | -2.37% | 0.00% |

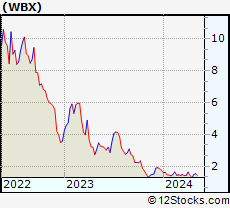

| WBX | Wallbox N.V |   | Electronic Components | 4.58 | 40 | 0.66% | -65.56% |

| WSTG | Wayside |   | Computers Wholesale | 35.95 | 50 | -0.42% | 0.00% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Tech Stocks |

| Tech Technical Overview, Leaders & Laggards, Top Tech ETF Funds & Detailed Tech Stocks List, Charts, Trends & More |

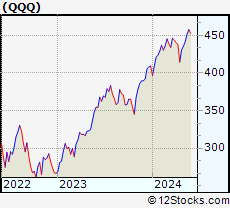

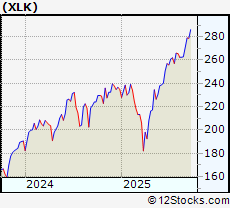

| Tech Sector: Technical Analysis, Trends & YTD Performance | |

| Technology sector is composed of stocks

from semiconductors, software, web, social media

and services subsectors. Technology sector, as represented by XLK, an exchange-traded fund [ETF] that holds basket of tech stocks (e.g, Intel, Google) is up by 23.7823% and is currently outperforming the overall market by 9.0244% year-to-date. Below is a quick view of technical charts and trends: |

|

XLK Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Good | |

XLK Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 100 | |

| YTD Performance: 23.7823% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Technology Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Technology sector stocks year to date are

Now, more recently, over last week, the top performing Technology sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Tech Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Tech Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Tech Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IGN | Tech-Multimd Ntwk |   | 53.86 | 40 | 0.918119 | -20.6435 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Tech Stocks | |

|

We now take in-depth look at all Tech stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Tech stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

| QADB QAD Inc. |

| Sector: Technology | |

| SubSector: Application Software | |

| MarketCap: 69.7662 Millions | |

| Recent Price: 9.26 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.108108% Day Change: -9999 | |

| Week Change: -89.422% Year-to-date Change: 0.0% | |

| QADB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QADB to Watchlist:  View: View:  Get Complete QADB Trend Analysis ➞ Get Complete QADB Trend Analysis ➞ | |

| ACFN Acorn Energy Inc |

| Sector: Technology | |

| SubSector: Scientific & Technical Instruments | |

| MarketCap: 69.09 Millions | |

| Recent Price: 27.25 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 2.28979% Day Change: 1.64 | |

| Week Change: -2.99039% Year-to-date Change: 46.9% | |

| ACFN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACFN to Watchlist:  View: View:  Get Complete ACFN Trend Analysis ➞ Get Complete ACFN Trend Analysis ➞ | |

| PNTR Pointer Telocation Ltd. |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 68.71 Millions | |

| Recent Price: 1.65 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -0.60241% Day Change: -9999 | |

| Week Change: 65% Year-to-date Change: 0.0% | |

| PNTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PNTR to Watchlist:  View: View:  Get Complete PNTR Trend Analysis ➞ Get Complete PNTR Trend Analysis ➞ | |

| LOV Spark Networks SE |

| Sector: Technology | |

| SubSector: Internet Service Providers | |

| MarketCap: 68.438 Millions | |

| Recent Price: 0.01 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -50.7576% Day Change: -9999 | |

| Week Change: -62.8571% Year-to-date Change: 0.0% | |

| LOV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LOV to Watchlist:  View: View:  Get Complete LOV Trend Analysis ➞ Get Complete LOV Trend Analysis ➞ | |

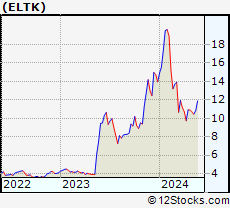

| ELTK Eltek Ltd |

| Sector: Technology | |

| SubSector: Electronic Components | |

| MarketCap: 67.74 Millions | |

| Recent Price: 10.89 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.880037% Day Change: -0.1 | |

| Week Change: 3.5821% Year-to-date Change: 0.4% | |

| ELTK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ELTK to Watchlist:  View: View:  Get Complete ELTK Trend Analysis ➞ Get Complete ELTK Trend Analysis ➞ | |

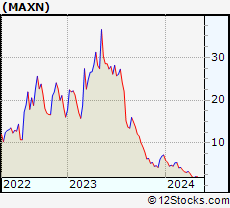

| MAXN Maxeon Solar Technologies Ltd |

| Sector: Technology | |

| SubSector: Solar | |

| MarketCap: 66.91 Millions | |

| Recent Price: 3.77 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 5.30726% Day Change: 0.03 | |

| Week Change: -1.04987% Year-to-date Change: -55.6% | |

| MAXN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MAXN to Watchlist:  View: View:  Get Complete MAXN Trend Analysis ➞ Get Complete MAXN Trend Analysis ➞ | |

| RWC RELM Wireless Corporation |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 66.65 Millions | |

| Recent Price: 3.65 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| RWC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RWC to Watchlist:  View: View:  Get Complete RWC Trend Analysis ➞ Get Complete RWC Trend Analysis ➞ | |

| CMCM Cheetah Mobile Inc ADR |

| Sector: Technology | |

| SubSector: Internet Content & Information | |

| MarketCap: 66.3 Millions | |

| Recent Price: 8.30 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 2.97767% Day Change: 0.15 | |

| Week Change: -4.26759% Year-to-date Change: 80.4% | |

| CMCM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CMCM to Watchlist:  View: View:  Get Complete CMCM Trend Analysis ➞ Get Complete CMCM Trend Analysis ➞ | |

| DSWL Deswell Industries, Inc |

| Sector: Technology | |

| SubSector: Electronic Components | |

| MarketCap: 66.05 Millions | |

| Recent Price: 3.95 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -2.07444% Day Change: -0.03 | |

| Week Change: -0.844221% Year-to-date Change: 71.0% | |

| DSWL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DSWL to Watchlist:  View: View:  Get Complete DSWL Trend Analysis ➞ Get Complete DSWL Trend Analysis ➞ | |

| VTSI VirTra Inc |

| Sector: Technology | |

| SubSector: Software - Application | |

| MarketCap: 65.66 Millions | |

| Recent Price: 5.60 Smart Investing & Trading Score: 80 | |

| Day Percent Change: -2.0979% Day Change: 0.07 | |

| Week Change: 2.00364% Year-to-date Change: -18.0% | |

| VTSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VTSI to Watchlist:  View: View:  Get Complete VTSI Trend Analysis ➞ Get Complete VTSI Trend Analysis ➞ | |

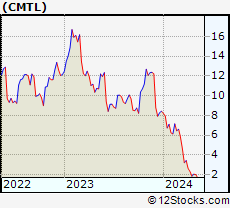

| CMTL Comtech Telecommunications Corp |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 65.26 Millions | |

| Recent Price: 2.67 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 0.641509% Day Change: -0.02 | |

| Week Change: 13.0085% Year-to-date Change: -34.8% | |

| CMTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CMTL to Watchlist:  View: View:  Get Complete CMTL Trend Analysis ➞ Get Complete CMTL Trend Analysis ➞ | |

| RESN Resonant Inc. |

| Sector: Technology | |

| SubSector: Semiconductor - Integrated Circuits | |

| MarketCap: 64.951 Millions | |

| Recent Price: 23.15 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 416.741% Day Change: -9999 | |

| Week Change: 416.741% Year-to-date Change: 0.0% | |

| RESN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RESN to Watchlist:  View: View:  Get Complete RESN Trend Analysis ➞ Get Complete RESN Trend Analysis ➞ | |

| MTBC MTBC, Inc. |

| Sector: Technology | |

| SubSector: Healthcare Information Services | |

| MarketCap: 64.1155 Millions | |

| Recent Price: 3.04 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -10.0592% Day Change: -9999 | |

| Week Change: -13.1429% Year-to-date Change: 0.0% | |

| MTBC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MTBC to Watchlist:  View: View:  Get Complete MTBC Trend Analysis ➞ Get Complete MTBC Trend Analysis ➞ | |

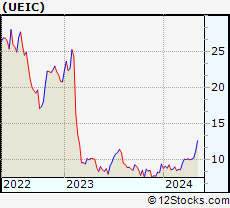

| UEIC Universal Electronics Inc |

| Sector: Technology | |

| SubSector: Consumer Electronics | |

| MarketCap: 64.02 Millions | |

| Recent Price: 4.75 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.38593% Day Change: 0.07 | |

| Week Change: 5.66667% Year-to-date Change: -56.3% | |

| UEIC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UEIC to Watchlist:  View: View:  Get Complete UEIC Trend Analysis ➞ Get Complete UEIC Trend Analysis ➞ | |

| GMM Global Mofy AI Ltd |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 63.99 Millions | |

| Recent Price: 1.95 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -8.8785% Day Change: -0.01 | |

| Week Change: 1.5625% Year-to-date Change: -49.2% | |

| GMM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GMM to Watchlist:  View: View:  Get Complete GMM Trend Analysis ➞ Get Complete GMM Trend Analysis ➞ | |

| IEC IEC Electronics Corp. |

| Sector: Technology | |

| SubSector: Printed Circuit Boards | |

| MarketCap: 63.2235 Millions | |

| Recent Price: 35.38 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.90092% Day Change: -9999 | |

| Week Change: 130.639% Year-to-date Change: 0.0% | |

| IEC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IEC to Watchlist:  View: View:  Get Complete IEC Trend Analysis ➞ Get Complete IEC Trend Analysis ➞ | |

| UAVS AgEagle Aerial Systems Inc |

| Sector: Technology | |

| SubSector: Computer Hardware | |

| MarketCap: 62.96 Millions | |

| Recent Price: 2.49 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 14.7465% Day Change: 0.1 | |

| Week Change: 16.3551% Year-to-date Change: -26.8% | |

| UAVS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UAVS to Watchlist:  View: View:  Get Complete UAVS Trend Analysis ➞ Get Complete UAVS Trend Analysis ➞ | |

| SNCR Synchronoss Technologies Inc |

| Sector: Technology | |

| SubSector: Software - Infrastructure | |

| MarketCap: 61.76 Millions | |

| Recent Price: 5.86 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.860585% Day Change: 0.09 | |

| Week Change: -11.6139% Year-to-date Change: -38.4% | |

| SNCR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SNCR to Watchlist:  View: View:  Get Complete SNCR Trend Analysis ➞ Get Complete SNCR Trend Analysis ➞ | |

| IZEA IZEA Worldwide Inc |

| Sector: Technology | |

| SubSector: Internet Content & Information | |

| MarketCap: 60.72 Millions | |

| Recent Price: 3.88 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 7.18232% Day Change: 0.09 | |

| Week Change: 2.37467% Year-to-date Change: 48.7% | |

| IZEA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IZEA to Watchlist:  View: View:  Get Complete IZEA Trend Analysis ➞ Get Complete IZEA Trend Analysis ➞ | |

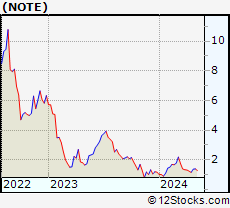

| NOTE FiscalNote Holdings Inc |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 58.75 Millions | |

| Recent Price: 4.97 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 6.19658% Day Change: 0.01 | |

| Week Change: 1.63599% Year-to-date Change: 377.9% | |

| NOTE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NOTE to Watchlist:  View: View:  Get Complete NOTE Trend Analysis ➞ Get Complete NOTE Trend Analysis ➞ | |

| NLST Netlist, Inc. |

| Sector: Technology | |

| SubSector: Semiconductor- Memory Chips | |

| MarketCap: 58.59 Millions | |

| Recent Price: 0.84 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -2.32558% Day Change: -9999 | |

| Week Change: 20% Year-to-date Change: -2.3% | |

| NLST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NLST to Watchlist:  View: View:  Get Complete NLST Trend Analysis ➞ Get Complete NLST Trend Analysis ➞ | |

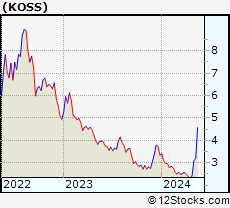

| KOSS Koss Corp |

| Sector: Technology | |

| SubSector: Consumer Electronics | |

| MarketCap: 58.16 Millions | |

| Recent Price: 5.18 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.766284% Day Change: 0.05 | |

| Week Change: -4.86685% Year-to-date Change: -30.2% | |

| KOSS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KOSS to Watchlist:  View: View:  Get Complete KOSS Trend Analysis ➞ Get Complete KOSS Trend Analysis ➞ | |

| SMTX SMTC Corporation |

| Sector: Technology | |

| SubSector: Printed Circuit Boards | |

| MarketCap: 57.1235 Millions | |

| Recent Price: 2.06 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -2.36967% Day Change: -9999 | |

| Week Change: -65.894% Year-to-date Change: 0.0% | |

| SMTX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SMTX to Watchlist:  View: View:  Get Complete SMTX Trend Analysis ➞ Get Complete SMTX Trend Analysis ➞ | |

| WBX Wallbox N.V |

| Sector: Technology | |

| SubSector: Electronic Components | |

| MarketCap: 57.02 Millions | |

| Recent Price: 4.58 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0.659341% Day Change: -0.13 | |

| Week Change: -5.56701% Year-to-date Change: -65.6% | |

| WBX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WBX to Watchlist:  View: View:  Get Complete WBX Trend Analysis ➞ Get Complete WBX Trend Analysis ➞ | |

| WSTG Wayside Technology Group, Inc. |

| Sector: Technology | |

| SubSector: Computers Wholesale | |

| MarketCap: 56.8 Millions | |

| Recent Price: 35.95 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -0.415512% Day Change: -9999 | |

| Week Change: 7.34548% Year-to-date Change: 0.0% | |

| WSTG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WSTG to Watchlist:  View: View:  Get Complete WSTG Trend Analysis ➞ Get Complete WSTG Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Technology Stocks With Best Up Trends [0-bearish to 100-bullish]: Sony [100], Bakkt [100], Rigetti Computing[100], Fair Isaac[100], Arqit Quantum[100], D-Wave Quantum[100], Navitas Semiconductor[100], Shoals [100], Vuzix [100], Arteris [100], Lantronix [100]

Best Technology Stocks Year-to-Date:

Xunlei [370.476%], Sify [315.033%], Wolfspeed [307.01%], Digital Turbine[265.057%], EchoStar Corp[247.253%], CuriosityStream [241.605%], Viasat [224.029%], Pagaya [222.638%], Oneconnect Financial[209.053%], D-Wave Quantum[203.954%], CommScope Holding[203.101%] Best Technology Stocks This Week:

GTT [443626%], Barracuda Networks[71050%], Mobile TeleSystems[10483.5%], Nam Tai[5033.33%], Ebix [4200.85%], Fang [4150%], NantHealth [3114.02%], Hemisphere Media[2981.82%], Yandex N.V[2935.27%], Wolfspeed [1961.98%], Castlight Health[1751.96%] Best Technology Stocks Daily:

Sony [194.565%], Bakkt [28.6091%], Rigetti Computing[18.4925%], Fair Isaac[17.979%], Arqit Quantum[17.9369%], Marti [17%], Latch [16.6667%], Oclaro [14.734%], D-Wave Quantum[13.968%], Arbe Robotics[13.0178%], Navitas Semiconductor[12.3288%]

Xunlei [370.476%], Sify [315.033%], Wolfspeed [307.01%], Digital Turbine[265.057%], EchoStar Corp[247.253%], CuriosityStream [241.605%], Viasat [224.029%], Pagaya [222.638%], Oneconnect Financial[209.053%], D-Wave Quantum[203.954%], CommScope Holding[203.101%] Best Technology Stocks This Week:

GTT [443626%], Barracuda Networks[71050%], Mobile TeleSystems[10483.5%], Nam Tai[5033.33%], Ebix [4200.85%], Fang [4150%], NantHealth [3114.02%], Hemisphere Media[2981.82%], Yandex N.V[2935.27%], Wolfspeed [1961.98%], Castlight Health[1751.96%] Best Technology Stocks Daily:

Sony [194.565%], Bakkt [28.6091%], Rigetti Computing[18.4925%], Fair Isaac[17.979%], Arqit Quantum[17.9369%], Marti [17%], Latch [16.6667%], Oclaro [14.734%], D-Wave Quantum[13.968%], Arbe Robotics[13.0178%], Navitas Semiconductor[12.3288%]

Login Sign Up

Login Sign Up