Best Industrial Stocks

| In a hurry? Industrial Stocks Lists: Performance Trends Table, Stock Charts

Sort Industrial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Industrial stocks list by size:All Industrial Large Mid-Range Small |

| 12Stocks.com Industrial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 50 (0-bearish to 100-bullish) which puts Industrial sector in short term neutral trend. The Smart Investing & Trading Score from previous trading session is 50 and an improvement of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Industrial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Industrial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Industrial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Industrial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| WNC | Wabash National |   | Farm & Heavy Construction Machinery | 11.69 | 90 | 3.18% | -29.91% |

| EBF | Ennis |   | Equipment & Supplies | 18.48 | 100 | -0.70% | -8.29% |

| AEGN | Aegion |   | Heavy Construction | 56.07 | 70 | -0.95% | 0.00% |

| TSP | TuSimple |   | Trucking | 0.25 | 20 | -5.66% | 0.00% |

| DEAC | Diamond Eagle |   | Conglomerates | 28.86 | 70 | -0.82% | 0.00% |

| SB | Safe Bulkers |   | Marine Shipping | 4.45 | 100 | 0.91% | 24.85% |

| TPIC | TPI Composites |   | Machinery | 0.13 | 10 | -45.91% | -92.90% |

| TRC | Tejon Ranch |   | Conglomerates | 16.60 | 0 | -2.01% | 5.00% |

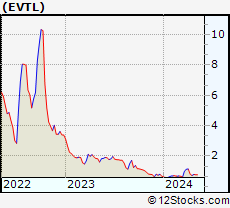

| EVTL | Vertical Aerospace |   | Aerospace & Defense | 4.61 | 10 | 2.22% | -57.78% |

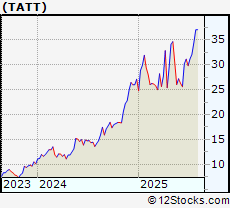

| TATT | TAT Technologies |   | Aerospace & Defense | 33.82 | 20 | -2.34% | 24.71% |

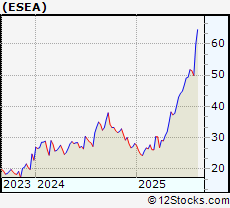

| ESEA | Euroseas |   | Marine Shipping | 61.89 | 80 | 0.19% | 111.60% |

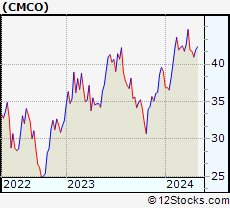

| CMCO | Columbus Mckinnon |   | Farm & Heavy Construction Machinery | 14.89 | 50 | 0.00% | -59.22% |

| BOMN | Boston Omaha |   | Conglomerates | 22.96 | 0 | -4.29% | 0.00% |

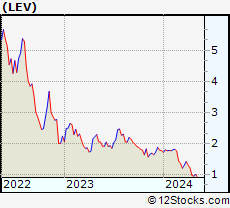

| LEV | Lion Electric |   | Farm & Heavy Construction Machinery | 0.07 | 0 | -71.96% | 0.00% |

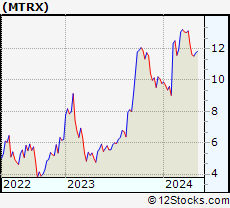

| MTRX | Matrix Service |   | Engineering & Construction | 14.58 | 10 | -0.41% | 21.10% |

| MNCLU | Monocle Acquisition |   | Conglomerates | 25.49 | 60 | 0.16% | 0.00% |

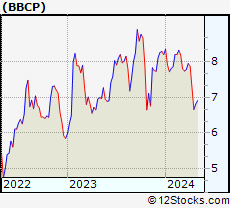

| BBCP | Concrete Pumping |   | Engineering & Construction | 7.64 | 100 | 12.19% | 30.06% |

| PACQ | Pure Acquisition |   | Conglomerates | 8.31 | 70 | -0.48% | 0.00% |

| CFI | Culp |   | Textile Industrial | 0.97 | 30 | 0.00% | 0.00% |

| POPE | Pope Resources |   | Lumber, Wood | 18.73 | 0 | 0.48% | 0.00% |

| HCCI | Heritage-Crystal Clean |   | Pollution & Treatment Controls | 47.96 | 100 | 1.61% | 0.00% |

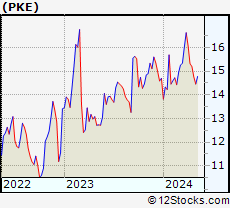

| PKE | Park Aerospace |   | Aerospace & Defense | 19.16 | 50 | -1.49% | 36.82% |

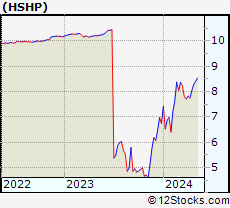

| HSHP | Himalaya Shipping |   | Marine Shipping | 8.04 | 66 | 1.90% | 58.85% |

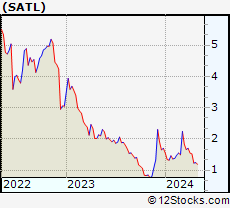

| SATL | Satellogic |   | Aerospace & Defense | 3.52 | 20 | 1.73% | 15.41% |

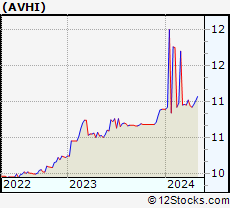

| AVHI | AV Homes |   | Residential | 11.20 | 10 | 0.00% | 0.00% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Industrial Stocks |

| Industrial Technical Overview, Leaders & Laggards, Top Industrial ETF Funds & Detailed Industrial Stocks List, Charts, Trends & More |

| Industrial Sector: Technical Analysis, Trends & YTD Performance | |

| Industrial sector is composed of stocks

from industrial machinery, aerospace, defense, farm/construction

and industrial services subsectors. Industrial sector, as represented by XLI, an exchange-traded fund [ETF] that holds basket of Industrial stocks (e.g, Caterpillar, Boeing) is up by 15.6543% and is currently outperforming the overall market by 4.4597% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLI Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Good | |

XLI Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 50 | |

| YTD Performance: 15.6543% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Industrial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Industrial sector stocks year to date are

Now, more recently, over last week, the top performing Industrial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Industrial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Industrial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Industrial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| CHII | China Industrials |   | 9.80 | 20 | 0 | -0.0509944 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Industrial Stocks | |

|

We now take in-depth look at all Industrial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Industrial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

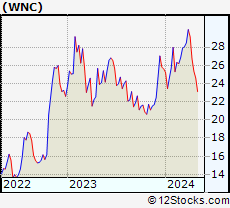

| WNC Wabash National Corp |

| Sector: Industrials | |

| SubSector: Farm & Heavy Construction Machinery | |

| MarketCap: 478.57 Millions | |

| Recent Price: 11.69 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 3.17741% Day Change: -0.02 | |

| Week Change: 1.91805% Year-to-date Change: -29.9% | |

| WNC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WNC to Watchlist:  View: View:  Get Complete WNC Trend Analysis ➞ Get Complete WNC Trend Analysis ➞ | |

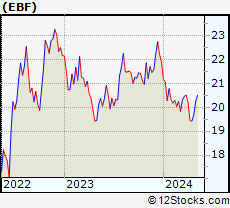

| EBF Ennis Inc |

| Sector: Industrials | |

| SubSector: Business Equipment & Supplies | |

| MarketCap: 476.69 Millions | |

| Recent Price: 18.48 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.698549% Day Change: 0.04 | |

| Week Change: -0.162075% Year-to-date Change: -8.3% | |

| EBF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EBF to Watchlist:  View: View:  Get Complete EBF Trend Analysis ➞ Get Complete EBF Trend Analysis ➞ | |

| AEGN Aegion Corporation |

| Sector: Industrials | |

| SubSector: Heavy Construction | |

| MarketCap: 473.995 Millions | |

| Recent Price: 56.07 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -0.953895% Day Change: -9999 | |

| Week Change: 86.9623% Year-to-date Change: 0.0% | |

| AEGN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEGN to Watchlist:  View: View:  Get Complete AEGN Trend Analysis ➞ Get Complete AEGN Trend Analysis ➞ | |

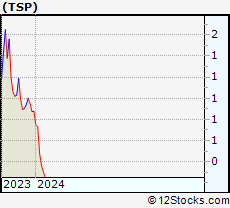

| TSP TuSimple Holdings Inc. |

| Sector: Industrials | |

| SubSector: Trucking | |

| MarketCap: 470 Millions | |

| Recent Price: 0.25 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -5.66038% Day Change: -9999 | |

| Week Change: -23.0769% Year-to-date Change: 0.0% | |

| TSP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TSP to Watchlist:  View: View:  Get Complete TSP Trend Analysis ➞ Get Complete TSP Trend Analysis ➞ | |

| DEAC Diamond Eagle Acquisition Corp. |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 459.648 Millions | |

| Recent Price: 28.86 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -0.824742% Day Change: -9999 | |

| Week Change: 2.92439% Year-to-date Change: 0.0% | |

| DEAC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DEAC to Watchlist:  View: View:  Get Complete DEAC Trend Analysis ➞ Get Complete DEAC Trend Analysis ➞ | |

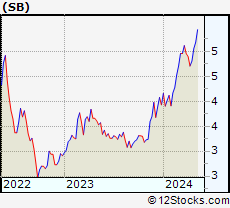

| SB Safe Bulkers, Inc |

| Sector: Industrials | |

| SubSector: Marine Shipping | |

| MarketCap: 455.32 Millions | |

| Recent Price: 4.45 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.907029% Day Change: 0.04 | |

| Week Change: 3.24826% Year-to-date Change: 24.8% | |

| SB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SB to Watchlist:  View: View:  Get Complete SB Trend Analysis ➞ Get Complete SB Trend Analysis ➞ | |

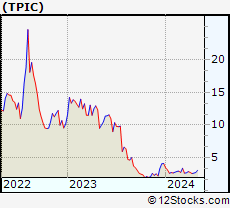

| TPIC TPI Composites, Inc. |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 451.016 Millions | |

| Recent Price: 0.13 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -45.9149% Day Change: -9999 | |

| Week Change: -60.3061% Year-to-date Change: -92.9% | |

| TPIC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TPIC to Watchlist:  View: View:  Get Complete TPIC Trend Analysis ➞ Get Complete TPIC Trend Analysis ➞ | |

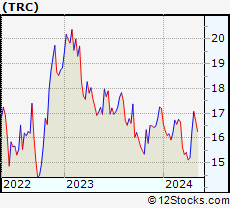

| TRC Tejon Ranch Co |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 446.44 Millions | |

| Recent Price: 16.60 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -2.00708% Day Change: 0.26 | |

| Week Change: -4.48792% Year-to-date Change: 5.0% | |

| TRC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRC to Watchlist:  View: View:  Get Complete TRC Trend Analysis ➞ Get Complete TRC Trend Analysis ➞ | |

| EVTL Vertical Aerospace Ltd |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 445.68 Millions | |

| Recent Price: 4.61 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 2.21729% Day Change: 0.05 | |

| Week Change: -7.05645% Year-to-date Change: -57.8% | |

| EVTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EVTL to Watchlist:  View: View:  Get Complete EVTL Trend Analysis ➞ Get Complete EVTL Trend Analysis ➞ | |

| TATT TAT Technologies Ltd |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 435.85 Millions | |

| Recent Price: 33.82 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -2.33901% Day Change: 1.3 | |

| Week Change: -8.71795% Year-to-date Change: 24.7% | |

| TATT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TATT to Watchlist:  View: View:  Get Complete TATT Trend Analysis ➞ Get Complete TATT Trend Analysis ➞ | |

| ESEA Euroseas Ltd |

| Sector: Industrials | |

| SubSector: Marine Shipping | |

| MarketCap: 433.64 Millions | |

| Recent Price: 61.89 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0.194269% Day Change: 0.47 | |

| Week Change: -0.450378% Year-to-date Change: 111.6% | |

| ESEA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ESEA to Watchlist:  View: View:  Get Complete ESEA Trend Analysis ➞ Get Complete ESEA Trend Analysis ➞ | |

| CMCO Columbus Mckinnon Corp |

| Sector: Industrials | |

| SubSector: Farm & Heavy Construction Machinery | |

| MarketCap: 427.72 Millions | |

| Recent Price: 14.89 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0% Day Change: -0.2 | |

| Week Change: -1.71617% Year-to-date Change: -59.2% | |

| CMCO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CMCO to Watchlist:  View: View:  Get Complete CMCO Trend Analysis ➞ Get Complete CMCO Trend Analysis ➞ | |

| BOMN Boston Omaha Corporation |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 416.548 Millions | |

| Recent Price: 22.96 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -4.29346% Day Change: -9999 | |

| Week Change: -8.85272% Year-to-date Change: 0.0% | |

| BOMN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BOMN to Watchlist:  View: View:  Get Complete BOMN Trend Analysis ➞ Get Complete BOMN Trend Analysis ➞ | |

| LEV The Lion Electric Company |

| Sector: Industrials | |

| SubSector: Farm & Heavy Construction Machinery | |

| MarketCap: 414 Millions | |

| Recent Price: 0.07 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -71.96% Day Change: -9999 | |

| Week Change: -80.5278% Year-to-date Change: 0.0% | |

| LEV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LEV to Watchlist:  View: View:  Get Complete LEV Trend Analysis ➞ Get Complete LEV Trend Analysis ➞ | |

| MTRX Matrix Service Co |

| Sector: Industrials | |

| SubSector: Engineering & Construction | |

| MarketCap: 402.56 Millions | |

| Recent Price: 14.58 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.409836% Day Change: 0.33 | |

| Week Change: -5.13988% Year-to-date Change: 21.1% | |

| MTRX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MTRX to Watchlist:  View: View:  Get Complete MTRX Trend Analysis ➞ Get Complete MTRX Trend Analysis ➞ | |

| MNCLU Monocle Acquisition Corporation |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 394.348 Millions | |

| Recent Price: 25.49 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.157171% Day Change: -9999 | |

| Week Change: -1.20155% Year-to-date Change: 0.0% | |

| MNCLU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MNCLU to Watchlist:  View: View:  Get Complete MNCLU Trend Analysis ➞ Get Complete MNCLU Trend Analysis ➞ | |

| BBCP Concrete Pumping Holdings Inc |

| Sector: Industrials | |

| SubSector: Engineering & Construction | |

| MarketCap: 393.26 Millions | |

| Recent Price: 7.64 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 12.188% Day Change: 0.09 | |

| Week Change: 7.15287% Year-to-date Change: 30.1% | |

| BBCP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BBCP to Watchlist:  View: View:  Get Complete BBCP Trend Analysis ➞ Get Complete BBCP Trend Analysis ➞ | |

| PACQ Pure Acquisition Corp. |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 389.348 Millions | |

| Recent Price: 8.31 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -0.479042% Day Change: -9999 | |

| Week Change: 2.71941% Year-to-date Change: 0.0% | |

| PACQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PACQ to Watchlist:  View: View:  Get Complete PACQ Trend Analysis ➞ Get Complete PACQ Trend Analysis ➞ | |

| CFI Culp, Inc. |

| Sector: Industrials | |

| SubSector: Textile Industrial | |

| MarketCap: 387.2 Millions | |

| Recent Price: 0.97 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 12.069% Year-to-date Change: 0.0% | |

| CFI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CFI to Watchlist:  View: View:  Get Complete CFI Trend Analysis ➞ Get Complete CFI Trend Analysis ➞ | |

| POPE Pope Resources, A Delaware Limited Partnership |

| Sector: Industrials | |

| SubSector: Lumber, Wood Production | |

| MarketCap: 382.938 Millions | |

| Recent Price: 18.73 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.482833% Day Change: -9999 | |

| Week Change: -60.7913% Year-to-date Change: 0.0% | |

| POPE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add POPE to Watchlist:  View: View:  Get Complete POPE Trend Analysis ➞ Get Complete POPE Trend Analysis ➞ | |

| HCCI Heritage-Crystal Clean, Inc |

| Sector: Industrials | |

| SubSector: Pollution & Treatment Controls | |

| MarketCap: 381.975 Millions | |

| Recent Price: 47.96 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.61017% Day Change: -9999 | |

| Week Change: 5.38343% Year-to-date Change: 0.0% | |

| HCCI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HCCI to Watchlist:  View: View:  Get Complete HCCI Trend Analysis ➞ Get Complete HCCI Trend Analysis ➞ | |

| PKE Park Aerospace Corp |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 380.44 Millions | |

| Recent Price: 19.16 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -1.491% Day Change: 0.25 | |

| Week Change: 1.42933% Year-to-date Change: 36.8% | |

| PKE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PKE to Watchlist:  View: View:  Get Complete PKE Trend Analysis ➞ Get Complete PKE Trend Analysis ➞ | |

| HSHP Himalaya Shipping Ltd |

| Sector: Industrials | |

| SubSector: Marine Shipping | |

| MarketCap: 374.26 Millions | |

| Recent Price: 8.04 Smart Investing & Trading Score: 66 | |

| Day Percent Change: 1.9% Day Change: 0.14 | |

| Week Change: 1.35% Year-to-date Change: 58.9% | |

| HSHP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HSHP to Watchlist:  View: View:  Get Complete HSHP Trend Analysis ➞ Get Complete HSHP Trend Analysis ➞ | |

| SATL Satellogic Inc |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 369.49 Millions | |

| Recent Price: 3.52 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 1.7341% Day Change: 0.19 | |

| Week Change: -3.82514% Year-to-date Change: 15.4% | |

| SATL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SATL to Watchlist:  View: View:  Get Complete SATL Trend Analysis ➞ Get Complete SATL Trend Analysis ➞ | |

| AVHI AV Homes, Inc. |

| Sector: Industrials | |

| SubSector: Residential Construction | |

| MarketCap: 369.18 Millions | |

| Recent Price: 11.20 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| AVHI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AVHI to Watchlist:  View: View:  Get Complete AVHI Trend Analysis ➞ Get Complete AVHI Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Industrial Stocks With Best Up Trends [0-bearish to 100-bullish]: Brooge [100], CryoPort [100], Concrete Pumping[100], Mirion Technologies[100], Herc [100], Stanley Black[100], JELD-WEN Holding[100], Builders Firstsource[100], Bloom Energy[100], SiteOne Landscape[100], Embraer S.A.[100]

Best Industrial Stocks Year-to-Date:

Triumph [1432.18%], Tecogen [486.452%], GrafTech [476.744%], Power [197.092%], Lightbridge Corp[179.02%], Willdan [162.367%], Tutor Perini[159.23%], Kratos Defense[145.679%], Astronics Corp[144.965%], Bloom Energy[144.202%], Amprius Technologies[142.5%] Best Industrial Stocks This Week:

TRC [10149.1%], Advanced Emissions[3571.78%], L3 Technologies[1915.25%], Forterra [1845.47%], GrafTech [896.885%], KLX [437.488%], Allegro Merger[402.182%], LMI Aerospace[291.621%], Chicago Bridge[205.472%], Covanta Holding[148.617%], MOOG [148.377%] Best Industrial Stocks Daily:

Brooge [29.5547%], CryoPort [16.9492%], Concrete Pumping[12.188%], Tecogen [10.989%], Mirion Technologies[9.09957%], B/E Aerospace[8.86381%], Ballard Power[7.56757%], Hurco [7.494%], GrafTech [7.35931%], Herc [7.34109%], Symbotic [6.70057%]

Triumph [1432.18%], Tecogen [486.452%], GrafTech [476.744%], Power [197.092%], Lightbridge Corp[179.02%], Willdan [162.367%], Tutor Perini[159.23%], Kratos Defense[145.679%], Astronics Corp[144.965%], Bloom Energy[144.202%], Amprius Technologies[142.5%] Best Industrial Stocks This Week:

TRC [10149.1%], Advanced Emissions[3571.78%], L3 Technologies[1915.25%], Forterra [1845.47%], GrafTech [896.885%], KLX [437.488%], Allegro Merger[402.182%], LMI Aerospace[291.621%], Chicago Bridge[205.472%], Covanta Holding[148.617%], MOOG [148.377%] Best Industrial Stocks Daily:

Brooge [29.5547%], CryoPort [16.9492%], Concrete Pumping[12.188%], Tecogen [10.989%], Mirion Technologies[9.09957%], B/E Aerospace[8.86381%], Ballard Power[7.56757%], Hurco [7.494%], GrafTech [7.35931%], Herc [7.34109%], Symbotic [6.70057%]

Login Sign Up

Login Sign Up