Best Energy Stocks

| In a hurry? Energy Stocks Lists: Performance Trends Table, Stock Charts

Sort Energy stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Energy stocks list by size: All Energy Large Mid-Range Small & MicroCap |

| 12Stocks.com Energy Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 30 (0-bearish to 100-bullish) which puts Energy sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 70 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Energy stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Energy sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Energy sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Energy Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| USDP | USD Partners |   | Equipment | 0.01 | 60 | 33.33 | -75.76% |

| CVRR | CVR Refining |   | Refining | 8.41 | 30 | 14.73 | 0.00% |

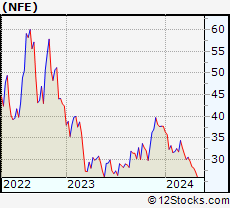

| NFE | New Fortress |   | Midstream | 1.40 | 50 | 6.87 | -91.41% |

| GST | Gastar Exploration |   | Independent | 2.03 | 30 | 6.84 | 0.00% |

| HK | Halcon Resources |   | Drilling & Exploration | 3.60 | 0 | 6.19 | 0.00% |

| REGI | Renewable |   | Refining | 52.54 | 40 | 5.74 | 0.00% |

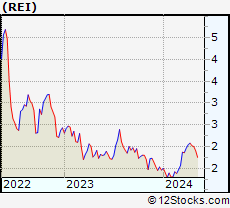

| REI | Ring |   | E&P | 1.06 | 100 | 3.92 | -24.29% |

| HNRG | Hallador |   | Thermal Coal | 17.75 | 60 | 3.74 | 51.84% |

| PKD | Parker Drilling |   | Equipment | 16.69 | 90 | 3.73 | 0.00% |

| CKH | Seacor |   | Equipment | 150.75 | 70 | 3.66 | 0.00% |

| ALDW | Alon USA |   | Refining | 140.40 | 80 | 3.27 | 0.00% |

| LB | Landbridge |   | Equipment | 53.40 | 50 | 3.17 | -17.35% |

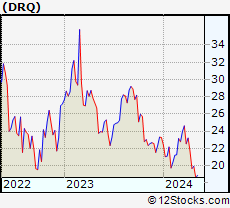

| DRQ | Dril-Quip |   | Equipment | 15.88 | 20 | 3.05 | 0.00% |

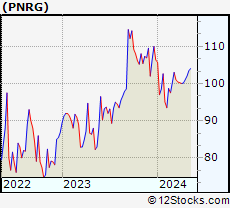

| PNRG | Prime Resources |   | E&P | 170.48 | 80 | 2.98 | -17.20% |

| DNR | Denbury Resources |   | Independent | 51.62 | 100 | 2.83 | 0.00% |

| CDEV | Centennial Resource |   | Pipelines | 10.59 | 100 | 2.62 | 0.00% |

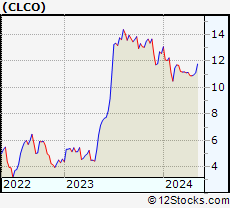

| CLCO | Cool |   | Midstream | 7.92 | 53 | 2.46 | -0.38% |

| CWEI | Clayton Williams |   | Independent | 9.20 | 20 | 2.45 | 0.00% |

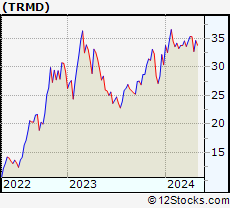

| TRMD | Torm |   | Midstream | 22.56 | 70 | 2.36 | 15.43% |

| SGY | Stone |   | Independent | 83.81 | 100 | 2.33 | 0.00% |

| EEQ | Enbridge |   | Independent | 43.17 | 10 | 2.23 | 0.00% |

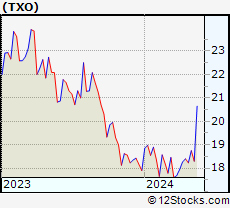

| TXO | TXO Partners |   | E&P | 13.86 | 53 | 1.99 | -11.50% |

| RICE | Rice |   | Independent | 30.53 | 90 | 1.94 | 0.00% |

| PES | Pioneer |   | Drilling & Exploration | 1.65 | 30 | 1.85 | 0.00% |

| CEO | CNOOC |   | Drilling & Exploration | 903.87 | 70 | 1.82 | 0.00% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Energy Stocks |

| Energy Technical Overview, Leaders & Laggards, Top Energy ETF Funds & Detailed Energy Stocks List, Charts, Trends & More |

| Energy Sector: Technical Analysis, Trends & YTD Performance | |

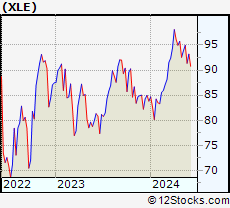

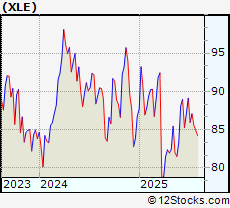

| Energy sector is composed of stocks

from oil production, refining, exploration, drilling

and services subsectors. Energy sector, as represented by XLE, an exchange-traded fund [ETF] that holds basket of Energy stocks (e.g, Exxon, Halliburton) is up by 3.6756% and is currently underperforming the overall market by -9.6834% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLE Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

XLE Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 30 | |

| YTD Performance: 3.6756% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Energy Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Energy sector stocks year to date are

Now, more recently, over last week, the top performing Energy sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Energy Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Energy Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Energy Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| UHN | Diesel-Heating Oil |   | 62.75 | 90 | 2.06571 | 216.44 | 0% |

| CHIE | China Energy |   | 16.39 | 30 | 0 | 0 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Energy Stocks | |

|

We now take in-depth look at all Energy stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Energy stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

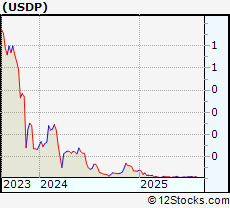

| USDP USD Partners LP |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 143.361 Millions | |

| Recent Price: 0.01 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 33.3333% Day Change: -9999 | |

| Week Change: -11.1111% Year-to-date Change: -75.8% | |

| USDP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add USDP to Watchlist:  View: View:  Get Complete USDP Trend Analysis ➞ Get Complete USDP Trend Analysis ➞ | |

| CVRR CVR Refining, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1571.75 Millions | |

| Recent Price: 8.41 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 14.734% Day Change: -9999 | |

| Week Change: -84.8904% Year-to-date Change: 0.0% | |

| CVRR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVRR to Watchlist:  View: View:  Get Complete CVRR Trend Analysis ➞ Get Complete CVRR Trend Analysis ➞ | |

| NFE New Fortress Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 671.79 Millions | |

| Recent Price: 1.40 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 6.87023% Day Change: 0.09 | |

| Week Change: -42.8571% Year-to-date Change: -91.4% | |

| NFE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NFE to Watchlist:  View: View:  Get Complete NFE Trend Analysis ➞ Get Complete NFE Trend Analysis ➞ | |

| GST Gastar Exploration Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 222.45 Millions | |

| Recent Price: 2.03 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 6.84211% Day Change: -9999 | |

| Week Change: -73.6021% Year-to-date Change: 0.0% | |

| GST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GST to Watchlist:  View: View:  Get Complete GST Trend Analysis ➞ Get Complete GST Trend Analysis ➞ | |

| HK Halcon Resources Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 678.62 Millions | |

| Recent Price: 3.60 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 6.19469% Day Change: -9999 | |

| Week Change: -89.0277% Year-to-date Change: 0.0% | |

| HK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HK to Watchlist:  View: View:  Get Complete HK Trend Analysis ➞ Get Complete HK Trend Analysis ➞ | |

| REGI Renewable Energy Group, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 828.354 Millions | |

| Recent Price: 52.54 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 5.73556% Day Change: -9999 | |

| Week Change: -14.5691% Year-to-date Change: 0.0% | |

| REGI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add REGI to Watchlist:  View: View:  Get Complete REGI Trend Analysis ➞ Get Complete REGI Trend Analysis ➞ | |

| REI Ring Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 206.54 Millions | |

| Recent Price: 1.06 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 3.92157% Day Change: -0.01 | |

| Week Change: 6.55408% Year-to-date Change: -24.3% | |

| REI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add REI to Watchlist:  View: View:  Get Complete REI Trend Analysis ➞ Get Complete REI Trend Analysis ➞ | |

| HNRG Hallador Energy Co |

| Sector: Energy | |

| SubSector: Thermal Coal | |

| MarketCap: 732.89 Millions | |

| Recent Price: 17.75 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 3.7405% Day Change: -0.12 | |

| Week Change: 7.90274% Year-to-date Change: 51.8% | |

| HNRG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HNRG to Watchlist:  View: View:  Get Complete HNRG Trend Analysis ➞ Get Complete HNRG Trend Analysis ➞ | |

| PKD Parker Drilling Company |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 194.45 Millions | |

| Recent Price: 16.69 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 3.72902% Day Change: -9999 | |

| Week Change: 36988.9% Year-to-date Change: 0.0% | |

| PKD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PKD to Watchlist:  View: View:  Get Complete PKD Trend Analysis ➞ Get Complete PKD Trend Analysis ➞ | |

| CKH Seacor Holdings Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 497.361 Millions | |

| Recent Price: 150.75 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 3.65812% Day Change: -9999 | |

| Week Change: -12.7352% Year-to-date Change: 0.0% | |

| CKH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CKH to Watchlist:  View: View:  Get Complete CKH Trend Analysis ➞ Get Complete CKH Trend Analysis ➞ | |

| ALDW Alon USA Partners, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 609.55 Millions | |

| Recent Price: 140.40 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 3.27326% Day Change: -9999 | |

| Week Change: 15.3467% Year-to-date Change: 0.0% | |

| ALDW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALDW to Watchlist:  View: View:  Get Complete ALDW Trend Analysis ➞ Get Complete ALDW Trend Analysis ➞ | |

| LB Landbridge Company LLC |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 3985.99 Millions | |

| Recent Price: 53.40 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 3.16847% Day Change: -0.62 | |

| Week Change: -1.40325% Year-to-date Change: -17.4% | |

| LB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LB to Watchlist:  View: View:  Get Complete LB Trend Analysis ➞ Get Complete LB Trend Analysis ➞ | |

| DRQ Dril-Quip, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 1211.61 Millions | |

| Recent Price: 15.88 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 3.04997% Day Change: -9999 | |

| Week Change: -3.52369% Year-to-date Change: 0.0% | |

| DRQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DRQ to Watchlist:  View: View:  Get Complete DRQ Trend Analysis ➞ Get Complete DRQ Trend Analysis ➞ | |

| PNRG PrimeEnergy Resources Corp |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 251.64 Millions | |

| Recent Price: 170.48 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 2.97795% Day Change: -5.4 | |

| Week Change: 10.8092% Year-to-date Change: -17.2% | |

| PNRG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PNRG to Watchlist:  View: View:  Get Complete PNRG Trend Analysis ➞ Get Complete PNRG Trend Analysis ➞ | |

| DNR Denbury Resources Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 173.593 Millions | |

| Recent Price: 51.62 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.82869% Day Change: -9999 | |

| Week Change: 688.092% Year-to-date Change: 0.0% | |

| DNR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DNR to Watchlist:  View: View:  Get Complete DNR Trend Analysis ➞ Get Complete DNR Trend Analysis ➞ | |

| CDEV Centennial Resource Development, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 115.255 Millions | |

| Recent Price: 10.59 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.61628% Day Change: -9999 | |

| Week Change: 9.85477% Year-to-date Change: 0.0% | |

| CDEV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CDEV to Watchlist:  View: View:  Get Complete CDEV Trend Analysis ➞ Get Complete CDEV Trend Analysis ➞ | |

| CLCO Cool Company Ltd |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 406.2 Millions | |

| Recent Price: 7.92 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 2.46% Day Change: 0.19 | |

| Week Change: 6.45% Year-to-date Change: -0.4% | |

| CLCO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CLCO to Watchlist:  View: View:  Get Complete CLCO Trend Analysis ➞ Get Complete CLCO Trend Analysis ➞ | |

| CWEI Clayton Williams Energy, Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 2358.19 Millions | |

| Recent Price: 9.20 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 2.44989% Day Change: -9999 | |

| Week Change: -86.9928% Year-to-date Change: 0.0% | |

| CWEI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CWEI to Watchlist:  View: View:  Get Complete CWEI Trend Analysis ➞ Get Complete CWEI Trend Analysis ➞ | |

| TRMD Torm Plc |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 2254.81 Millions | |

| Recent Price: 22.56 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 2.35935% Day Change: 0.67 | |

| Week Change: -0.922266% Year-to-date Change: 15.4% | |

| TRMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRMD to Watchlist:  View: View:  Get Complete TRMD Trend Analysis ➞ Get Complete TRMD Trend Analysis ➞ | |

| SGY Stone Energy Corporation |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 404.94 Millions | |

| Recent Price: 83.81 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.33211% Day Change: -9999 | |

| Week Change: 19.4726% Year-to-date Change: 0.0% | |

| SGY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SGY to Watchlist:  View: View:  Get Complete SGY Trend Analysis ➞ Get Complete SGY Trend Analysis ➞ | |

| EEQ Enbridge Energy Management, L.L.C. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 1441.79 Millions | |

| Recent Price: 43.17 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 2.22591% Day Change: -9999 | |

| Week Change: -18.9144% Year-to-date Change: 0.0% | |

| EEQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EEQ to Watchlist:  View: View:  Get Complete EEQ Trend Analysis ➞ Get Complete EEQ Trend Analysis ➞ | |

| TXO TXO Partners L.P |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 743.42 Millions | |

| Recent Price: 13.86 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 1.99% Day Change: 0.27 | |

| Week Change: -5.45% Year-to-date Change: -11.5% | |

| TXO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TXO to Watchlist:  View: View:  Get Complete TXO Trend Analysis ➞ Get Complete TXO Trend Analysis ➞ | |

| RICE Rice Energy Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 4365.38 Millions | |

| Recent Price: 30.53 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 1.93656% Day Change: -9999 | |

| Week Change: 53.0326% Year-to-date Change: 0.0% | |

| RICE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RICE to Watchlist:  View: View:  Get Complete RICE Trend Analysis ➞ Get Complete RICE Trend Analysis ➞ | |

| PES Pioneer Energy Services Corp. |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 347.72 Millions | |

| Recent Price: 1.65 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.85185% Day Change: -9999 | |

| Week Change: 25% Year-to-date Change: 0.0% | |

| PES Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PES to Watchlist:  View: View:  Get Complete PES Trend Analysis ➞ Get Complete PES Trend Analysis ➞ | |

| CEO CNOOC Limited |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 44343.2 Millions | |

| Recent Price: 903.87 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 1.82041% Day Change: -9999 | |

| Week Change: 137266% Year-to-date Change: 0.0% | |

| CEO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CEO to Watchlist:  View: View:  Get Complete CEO Trend Analysis ➞ Get Complete CEO Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Energy Stocks With Best Up Trends [0-bearish to 100-bullish]: Ring [100], Denbury Resources[100], Centennial Resource[100], Stone [100], Bellatrix Exploration[100], Alon USA[100], Seadrill Partners[100], Weatherford [100], Crescent Point[100], China [100], NuStar GP[100]

Best Energy Stocks Year-to-Date:

Centrus [199.973%], Fuels[110.035%], Par Pacific[96.6447%], CVR [85.5745%], Dominion Midstream[84.3866%], NCS Multistage[66.5976%], Forum [66.2747%], Genesis [62.6704%], Geospace Technologies[61.9284%], Frontline [61.806%], Delek US[58.1642%] Best Energy Stocks This Week:

CNOOC [137266%], Parker Drilling[36988.9%], Crescent Point[4066.17%], Spectra [2373.97%], Sinopec Shanghai[1992.58%], Shell Midstream[1402.59%], PetroChina [1137.09%], China [1104.2%], Enable Midstream[966.906%], Alon USA[959.753%], NuStar GP[933.475%] Best Energy Stocks Daily:

USD Partners[33.3333%], CVR Refining[14.734%], New Fortress[6.87023%], Gastar Exploration[6.84211%], Halcon Resources[6.19469%], Renewable [5.73556%], Ring [3.92157%], Hallador [3.7405%], Parker Drilling[3.72902%], Seacor [3.65812%], Alon USA[3.27326%]

Centrus [199.973%], Fuels[110.035%], Par Pacific[96.6447%], CVR [85.5745%], Dominion Midstream[84.3866%], NCS Multistage[66.5976%], Forum [66.2747%], Genesis [62.6704%], Geospace Technologies[61.9284%], Frontline [61.806%], Delek US[58.1642%] Best Energy Stocks This Week:

CNOOC [137266%], Parker Drilling[36988.9%], Crescent Point[4066.17%], Spectra [2373.97%], Sinopec Shanghai[1992.58%], Shell Midstream[1402.59%], PetroChina [1137.09%], China [1104.2%], Enable Midstream[966.906%], Alon USA[959.753%], NuStar GP[933.475%] Best Energy Stocks Daily:

USD Partners[33.3333%], CVR Refining[14.734%], New Fortress[6.87023%], Gastar Exploration[6.84211%], Halcon Resources[6.19469%], Renewable [5.73556%], Ring [3.92157%], Hallador [3.7405%], Parker Drilling[3.72902%], Seacor [3.65812%], Alon USA[3.27326%]

Login Sign Up

Login Sign Up