Best Energy Stocks

| In a hurry? Energy Stocks Lists: Performance Trends Table, Stock Charts

Sort Energy stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Energy stocks list by size: All Energy Large Mid-Range Small & MicroCap |

| 12Stocks.com Energy Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 44 (0-bearish to 100-bullish) which puts Energy sector in short term neutral trend. The Smart Investing & Trading Score from previous trading session is 51 and a deterioration of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Energy stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Energy sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Energy sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Energy Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| SUN | Sunoco LP |   | Refining | 54.00 | 32 | 5.61 | -9.89% |

| NS | NuStar |   | Pipelines | 21.48 | 32 | 5.50 | 14.99% |

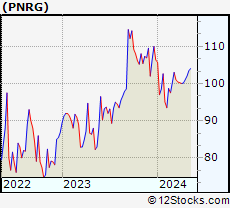

| PNRG | Prime Resources |   | Independent | 102.23 | 100 | 2.35 | -3.87% |

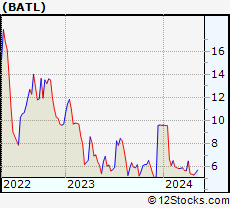

| BATL | Battalion Oil |   | E&P | 5.42 | 27 | 2.26 | -43.57% |

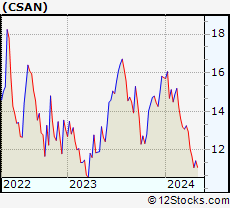

| CSAN | Cosan S.A |   | Refining | 10.92 | 17 | 1.87 | -30.69% |

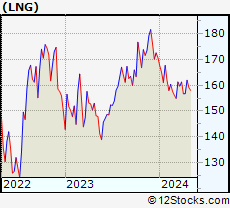

| LNG | Cheniere |   | Pipelines | 156.81 | 35 | 1.65 | -8.14% |

| GNE | Genie |   | Independent | 15.60 | 57 | 1.53 | -44.56% |

| BGH | Barings Global |   | Pipelines | 13.96 | 30 | 1.44 | 3.87% |

| BSM | Black Stone |   | Independent | 15.72 | 17 | 1.22 | -1.50% |

| HESM | Hess Midstream |   | Equipment | 34.74 | 53 | 1.22 | 9.83% |

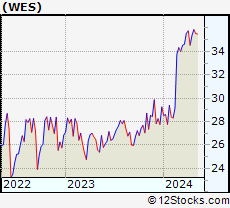

| WES | Western Midstream |   | Pipelines | 34.43 | 61 | 1.12 | 17.67% |

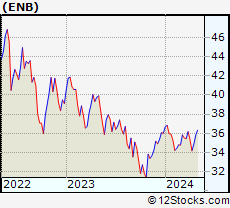

| ENB | Enbridge |   | Pipelines | 33.33 | 20 | 1.09 | -7.47% |

| DM | Dominion Midstream |   | Pipelines | 0.86 | 32 | 0.96 | 14.41% |

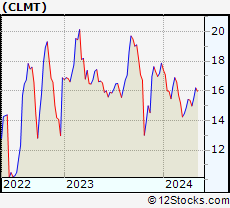

| CLMT | Calumet Specialty |   | Refining | 15.12 | 35 | 0.93 | -15.39% |

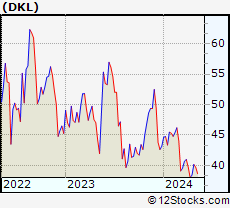

| DKL | Delek Logistics |   | Independent | 37.68 | 17 | 0.88 | -12.72% |

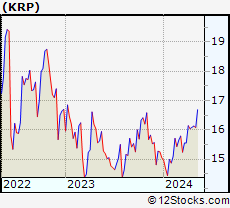

| KRP | Kimbell Royalty |   | Drilling & Exploration | 16.00 | 71 | 0.88 | 6.31% |

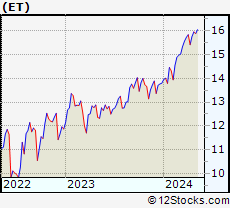

| ET | Transfer |   | Equipment | 15.23 | 48 | 0.86 | 10.36% |

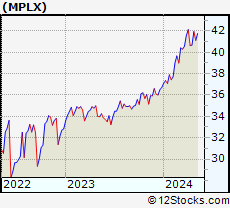

| MPLX | MPLX LP |   | Pipelines | 39.99 | 53 | 0.83 | 8.91% |

| SU | Suncor |   | Independent | 37.89 | 76 | 0.82 | 18.26% |

| FLNG | Flex LNG |   | Equipment | 25.51 | 52 | 0.79 | -12.22% |

| DTM | DT Midstream |   | Midstream | 62.51 | 71 | 0.77 | 13.76% |

| NFG | National Fuel |   | Independent | 52.04 | 36 | 0.60 | 3.73% |

| PAA | Plains All |   | Pipelines | 17.36 | 36 | 0.58 | 14.59% |

| CRK | Comstock Resources |   | Independent | 9.16 | 48 | 0.49 | 3.56% |

| AM | Antero Midstream |   | Pipelines | 13.65 | 43 | 0.44 | 8.94% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Energy Stocks |

| Energy Technical Overview, Leaders & Laggards, Top Energy ETF Funds & Detailed Energy Stocks List, Charts, Trends & More |

| Energy Sector: Technical Analysis, Trends & YTD Performance | |

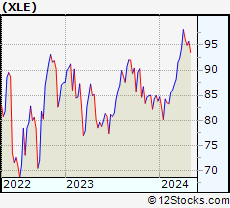

| Energy sector is composed of stocks

from oil production, refining, exploration, drilling

and services subsectors. Energy sector, as represented by XLE, an exchange-traded fund [ETF] that holds basket of Energy stocks (e.g, Exxon, Halliburton) is up by 12.27% and is currently outperforming the overall market by 7.86% year-to-date. Below is a quick view of Technical charts and trends: |

|

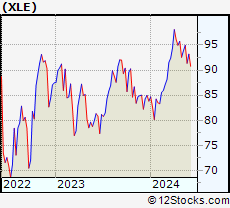

XLE Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

XLE Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 44 | |

| YTD Performance: 12.27% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Energy Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Energy sector stocks year to date are

Now, more recently, over last week, the top performing Energy sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Energy Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Energy Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Energy Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLE | Energy |   | 94.13 | 44 | -0.29 | -2.08 | 12.27% |

| OIH | Oil Services |   | 321.34 | 36 | -1.21 | -3.84 | 3.82% |

| USO | Oil |   | 78.91 | 44 | -2.98 | -3.21 | 18.39% |

| UNG | Natural Gas |   | 14.38 | 17 | -0.69 | -3.43 | 183.63% |

| BNO | Brent Oil |   | 32.16 | 51 | -3.13 | -3.19 | 17.76% |

| IYE | Energy |   | 49.16 | 44 | -0.24 | -2.13 | 11.42% |

| PBW | Clean Energy |   | 19.97 | 17 | -0.75 | -5.13 | -32.81% |

| ERX | Energy Bull 3X |   | 70.00 | 36 | -0.71 | -4.25 | 23.74% |

| ERY | Energy Bear 3X |   | 21.91 | 64 | 0.78 | 4.38 | -21.55% |

| DIG | Oil & Gas |   | 45.43 | 36 | -0.74 | -4.18 | 23.65% |

| DUG | Short Oil & |   | 9.19 | 64 | 0.71 | 4.31 | -20.98% |

| XOP | Oil & Gas |   | 152.96 | 43 | -0.77 | -3.18 | 11.72% |

| XES | Oil & Gas |   | 89.49 | 36 | -1.69 | -4.7 | 5.89% |

| ICLN | Global Clean Energy |   | 13.17 | 17 | 0.84 | -2.66 | -15.41% |

| PSCE | SmallCap Energy |   | 54.65 | 33 | -1.01 | -3.17 | 5% |

| IEO | Oil&Gas Explor&Prodtn |   | 106.65 | 44 | -0.74 | -2.7 | 14.44% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Energy Stocks | |

|

We now take in-depth look at all Energy stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Energy stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

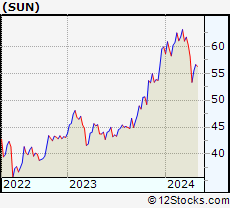

| SUN Sunoco LP |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1656.34 Millions | |

| Recent Price: 54.00 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 5.61% Day Change: 2.87 | |

| Week Change: 1.22% Year-to-date Change: -9.9% | |

| SUN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SUN to Watchlist:  View: View:  Get Complete SUN Trend Analysis ➞ Get Complete SUN Trend Analysis ➞ | |

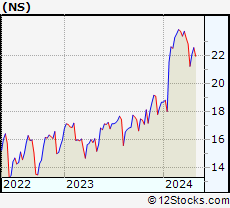

| NS NuStar Energy L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 1332.15 Millions | |

| Recent Price: 21.48 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 5.50% Day Change: 1.12 | |

| Week Change: 1.08% Year-to-date Change: 15.0% | |

| NS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NS to Watchlist:  View: View:  Get Complete NS Trend Analysis ➞ Get Complete NS Trend Analysis ➞ | |

| PNRG PrimeEnergy Resources Corporation |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 112.593 Millions | |

| Recent Price: 102.23 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.35% Day Change: 2.35 | |

| Week Change: 2.14% Year-to-date Change: -3.9% | |

| PNRG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PNRG to Watchlist:  View: View:  Get Complete PNRG Trend Analysis ➞ Get Complete PNRG Trend Analysis ➞ | |

| BATL Battalion Oil Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 12847 Millions | |

| Recent Price: 5.42 Smart Investing & Trading Score: 27 | |

| Day Percent Change: 2.26% Day Change: 0.12 | |

| Week Change: 0.18% Year-to-date Change: -43.6% | |

| BATL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BATL to Watchlist:  View: View:  Get Complete BATL Trend Analysis ➞ Get Complete BATL Trend Analysis ➞ | |

| CSAN Cosan S.A. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 6890 Millions | |

| Recent Price: 10.92 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 1.87% Day Change: 0.20 | |

| Week Change: -6.27% Year-to-date Change: -30.7% | |

| CSAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CSAN to Watchlist:  View: View:  Get Complete CSAN Trend Analysis ➞ Get Complete CSAN Trend Analysis ➞ | |

| LNG Cheniere Energy, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 9905.15 Millions | |

| Recent Price: 156.81 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 1.65% Day Change: 2.54 | |

| Week Change: 0.01% Year-to-date Change: -8.1% | |

| LNG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LNG to Watchlist:  View: View:  Get Complete LNG Trend Analysis ➞ Get Complete LNG Trend Analysis ➞ | |

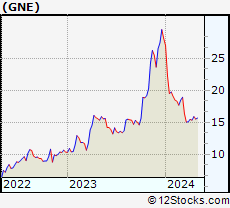

| GNE Genie Energy Ltd. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 177.293 Millions | |

| Recent Price: 15.60 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 1.53% Day Change: 0.24 | |

| Week Change: 1.66% Year-to-date Change: -44.6% | |

| GNE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GNE to Watchlist:  View: View:  Get Complete GNE Trend Analysis ➞ Get Complete GNE Trend Analysis ➞ | |

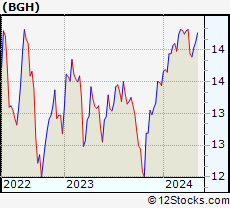

| BGH Barings Global Short Duration High Yield Fund |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 202.655 Millions | |

| Recent Price: 13.96 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.44% Day Change: 0.20 | |

| Week Change: 0.14% Year-to-date Change: 3.9% | |

| BGH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BGH to Watchlist:  View: View:  Get Complete BGH Trend Analysis ➞ Get Complete BGH Trend Analysis ➞ | |

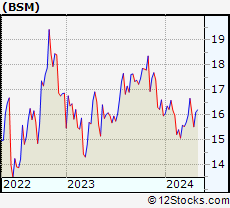

| BSM Black Stone Minerals, L.P. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 1127.43 Millions | |

| Recent Price: 15.72 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 1.22% Day Change: 0.19 | |

| Week Change: -2.12% Year-to-date Change: -1.5% | |

| BSM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BSM to Watchlist:  View: View:  Get Complete BSM Trend Analysis ➞ Get Complete BSM Trend Analysis ➞ | |

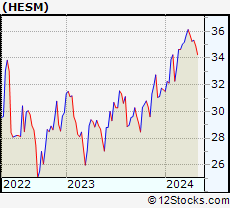

| HESM Hess Midstream LP |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 3123.71 Millions | |

| Recent Price: 34.74 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 1.22% Day Change: 0.42 | |

| Week Change: -1.47% Year-to-date Change: 9.8% | |

| HESM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HESM to Watchlist:  View: View:  Get Complete HESM Trend Analysis ➞ Get Complete HESM Trend Analysis ➞ | |

| WES Western Midstream Partners, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 3110.05 Millions | |

| Recent Price: 34.43 Smart Investing & Trading Score: 61 | |

| Day Percent Change: 1.12% Day Change: 0.38 | |

| Week Change: -0.32% Year-to-date Change: 17.7% | |

| WES Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WES to Watchlist:  View: View:  Get Complete WES Trend Analysis ➞ Get Complete WES Trend Analysis ➞ | |

| ENB Enbridge Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 62578.4 Millions | |

| Recent Price: 33.33 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 1.09% Day Change: 0.36 | |

| Week Change: -2.49% Year-to-date Change: -7.5% | |

| ENB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ENB to Watchlist:  View: View:  Get Complete ENB Trend Analysis ➞ Get Complete ENB Trend Analysis ➞ | |

| DM Dominion Midstream Partners, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 3017.01 Millions | |

| Recent Price: 0.86 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 0.96% Day Change: 0.01 | |

| Week Change: -10.15% Year-to-date Change: 14.4% | |

| DM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DM to Watchlist:  View: View:  Get Complete DM Trend Analysis ➞ Get Complete DM Trend Analysis ➞ | |

| CLMT Calumet Specialty Products Partners, L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 108.354 Millions | |

| Recent Price: 15.12 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 0.93% Day Change: 0.14 | |

| Week Change: -1.63% Year-to-date Change: -15.4% | |

| CLMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CLMT to Watchlist:  View: View:  Get Complete CLMT Trend Analysis ➞ Get Complete CLMT Trend Analysis ➞ | |

| DKL Delek Logistics Partners, LP |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 277.193 Millions | |

| Recent Price: 37.68 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 0.88% Day Change: 0.33 | |

| Week Change: -0.84% Year-to-date Change: -12.7% | |

| DKL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DKL to Watchlist:  View: View:  Get Complete DKL Trend Analysis ➞ Get Complete DKL Trend Analysis ➞ | |

| KRP Kimbell Royalty Partners, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 156.439 Millions | |

| Recent Price: 16.00 Smart Investing & Trading Score: 71 | |

| Day Percent Change: 0.88% Day Change: 0.14 | |

| Week Change: -0.25% Year-to-date Change: 6.3% | |

| KRP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KRP to Watchlist:  View: View:  Get Complete KRP Trend Analysis ➞ Get Complete KRP Trend Analysis ➞ | |

| ET Energy Transfer LP |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 15803.1 Millions | |

| Recent Price: 15.23 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 0.86% Day Change: 0.13 | |

| Week Change: -1.23% Year-to-date Change: 10.4% | |

| ET Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ET to Watchlist:  View: View:  Get Complete ET Trend Analysis ➞ Get Complete ET Trend Analysis ➞ | |

| MPLX MPLX LP |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 14439.1 Millions | |

| Recent Price: 39.99 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 0.83% Day Change: 0.33 | |

| Week Change: -1.6% Year-to-date Change: 8.9% | |

| MPLX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MPLX to Watchlist:  View: View:  Get Complete MPLX Trend Analysis ➞ Get Complete MPLX Trend Analysis ➞ | |

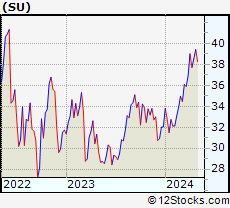

| SU Suncor Energy Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 21550.6 Millions | |

| Recent Price: 37.89 Smart Investing & Trading Score: 76 | |

| Day Percent Change: 0.82% Day Change: 0.31 | |

| Week Change: 0.53% Year-to-date Change: 18.3% | |

| SU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SU to Watchlist:  View: View:  Get Complete SU Trend Analysis ➞ Get Complete SU Trend Analysis ➞ | |

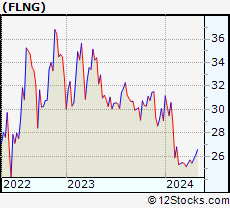

| FLNG Flex LNG Ltd. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 220.261 Millions | |

| Recent Price: 25.51 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 0.79% Day Change: 0.20 | |

| Week Change: 0.28% Year-to-date Change: -12.2% | |

| FLNG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FLNG to Watchlist:  View: View:  Get Complete FLNG Trend Analysis ➞ Get Complete FLNG Trend Analysis ➞ | |

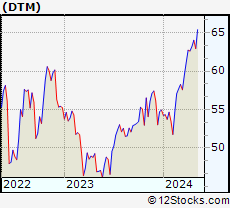

| DTM DT Midstream, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 4690 Millions | |

| Recent Price: 62.51 Smart Investing & Trading Score: 71 | |

| Day Percent Change: 0.77% Day Change: 0.48 | |

| Week Change: -0.21% Year-to-date Change: 13.8% | |

| DTM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DTM to Watchlist:  View: View:  Get Complete DTM Trend Analysis ➞ Get Complete DTM Trend Analysis ➞ | |

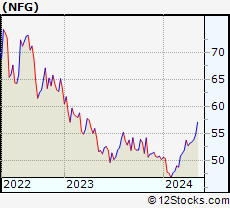

| NFG National Fuel Gas Company |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 3197.73 Millions | |

| Recent Price: 52.04 Smart Investing & Trading Score: 36 | |

| Day Percent Change: 0.60% Day Change: 0.31 | |

| Week Change: -2.18% Year-to-date Change: 3.7% | |

| NFG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NFG to Watchlist:  View: View:  Get Complete NFG Trend Analysis ➞ Get Complete NFG Trend Analysis ➞ | |

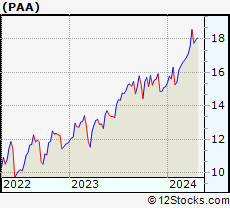

| PAA Plains All American Pipeline, L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 5491.05 Millions | |

| Recent Price: 17.36 Smart Investing & Trading Score: 36 | |

| Day Percent Change: 0.58% Day Change: 0.10 | |

| Week Change: -2.2% Year-to-date Change: 14.6% | |

| PAA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAA to Watchlist:  View: View:  Get Complete PAA Trend Analysis ➞ Get Complete PAA Trend Analysis ➞ | |

| CRK Comstock Resources, Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 959.793 Millions | |

| Recent Price: 9.16 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 0.49% Day Change: 0.04 | |

| Week Change: -4.13% Year-to-date Change: 3.6% | |

| CRK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRK to Watchlist:  View: View:  Get Complete CRK Trend Analysis ➞ Get Complete CRK Trend Analysis ➞ | |

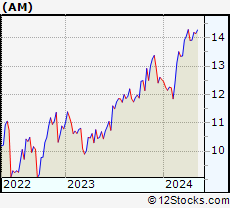

| AM Antero Midstream Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 1195.35 Millions | |

| Recent Price: 13.65 Smart Investing & Trading Score: 43 | |

| Day Percent Change: 0.44% Day Change: 0.06 | |

| Week Change: -1.87% Year-to-date Change: 8.9% | |

| AM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AM to Watchlist:  View: View:  Get Complete AM Trend Analysis ➞ Get Complete AM Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Energy Stocks With Best Up Trends [0-bearish to 100-bullish]: Prime Resources[100], Suncor [76], Northern Oil[76], Genesis [76], Kimbell Royalty[71], DT Midstream[71], Berry [63], EOG Resources[63], NextDecade [63], Natural Gas[63], Western Midstream[61]

Best Energy Stocks Year-to-Date:

Natural Gas[44.15%], Marathon [36.47%], Indonesia [36.33%], Kodiak Gas[30.83%], Enerplus [30.7%], PBF [30.28%], Diamondback [29.71%], Targa Resources[29.19%], NOW [29.15%], Valero [28.68%], Antero Resources[28.57%] Best Energy Stocks This Week:

Indonesia [30.69%], Prime Resources[2.14%], Genie [1.66%], Sunoco LP[1.22%], NuStar [1.08%], Suncor [0.53%], Flex LNG[0.28%], Battalion Oil[0.18%], Barings Global[0.14%], Northern Oil[0.14%], Cheniere [0.01%] Best Energy Stocks Daily:

Sunoco LP[5.61%], NuStar [5.50%], Prime Resources[2.35%], Battalion Oil[2.26%], Cosan S.A[1.87%], Cheniere [1.65%], Genie [1.53%], Barings Global[1.44%], Black Stone[1.22%], Hess Midstream[1.22%], Western Midstream[1.12%]

Natural Gas[44.15%], Marathon [36.47%], Indonesia [36.33%], Kodiak Gas[30.83%], Enerplus [30.7%], PBF [30.28%], Diamondback [29.71%], Targa Resources[29.19%], NOW [29.15%], Valero [28.68%], Antero Resources[28.57%] Best Energy Stocks This Week:

Indonesia [30.69%], Prime Resources[2.14%], Genie [1.66%], Sunoco LP[1.22%], NuStar [1.08%], Suncor [0.53%], Flex LNG[0.28%], Battalion Oil[0.18%], Barings Global[0.14%], Northern Oil[0.14%], Cheniere [0.01%] Best Energy Stocks Daily:

Sunoco LP[5.61%], NuStar [5.50%], Prime Resources[2.35%], Battalion Oil[2.26%], Cosan S.A[1.87%], Cheniere [1.65%], Genie [1.53%], Barings Global[1.44%], Black Stone[1.22%], Hess Midstream[1.22%], Western Midstream[1.12%]

Login Sign Up

Login Sign Up