| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks & ETFs | Settings |

Best Asia-Pacific Exchange Traded Funds (ETFs)

| ||||||||||||||||||

| Detailed View: Best Asia-Pacific ETFs by Daily, Weekly, Year-to-date and Trends | ||||||||||||||||||

| Quickly Browse, Sort and Filter to Find Best Asia-Pacific ETFs Using Our Slide Show Tool | ||||||||||||||||||

| Asia-Pacific ETF Segment in Brief | ||||||||||||||||||

| Year-to-date Asia-Pacific segment is outperforming market by 12.65%. | ||||||||||||||||||

|

||||||||||||||||||

| Year To Date Performance: 22.98 % | ||||||||||||||||||

| Weekly Performance: 2.91 % | ||||||||||||||||||

| Daily Performance: 12.00 % | ||||||||||||||||||

|

Asia-Pacific Segment Short Term Technical Trend Score: 80 Trend Score : 0(bearish) to 100(bullish). Updated daily. Not to be used for investing. |

||||||||||||||||||

| 12Stocks.com: Asia-Pacific ETF Sector - Look at Big Picture | |

|

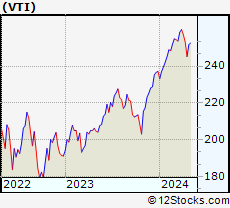

Let's take comprehensive view of Asia-Pacific segment. The Asia-Pacific segment of the Global Stock Market is best represented by VPL - exchange traded fund that tracks FTSE Developed Asia Pacific Index. It consists of top stocks

- from all major sectors - and is primarily Asia-Pacific region based. The Asia-Pacific sector contains stocks like China Mobile and Toyota. Year to date, Asia-Pacific sector as represented by VPL is up by 22.98% and is currently outperforming the market (S&P 500) by 12.65%. Next, let us look at relative performance of Asia-Pacific segment as represented by S&P Asia-Pacific 350 versus other major market segments like US stock indexes (Nasdaq 100, Dow 30, S&P 500, S&P 400 Midcap & Total Stock Market Index), emerging markets and other asset classes like bonds, gold and oil. The performances of major market segments year to date are - Gold [27.7%], Gold [27.7%], US Pacific [22.98%], US Pacific [22.98%], Emerging Markets [21.93%], Emerging Markets [21.93%], Euro [13.71%], Euro [13.71%], US Pacific [10.69%], US Pacific [10.69%], US Total Market [10.33%], US Total Market [10.33%], Bonds [4.9%]. Now, we dive deep to identify investing opportunities both with ETFs that track Asia-Pacific segment of the stock market and Asia-Pacific stock holdings contained within these ETF baskets. Check daily for updates. Scroll down this guide or just click the links below - |

|

|

| Asia-Pacific ETFs | |

| SEGMENT | |

| PERFORMANCE | |

|

22.98% (YEAR-TO-DATE) |

|

|

2.91% (WEEKLY) |

|

|

12.00% (DAILY) |

|

| 12Stocks.com: Quick View of Technicals of Overall Asia-Pacific Sector | |

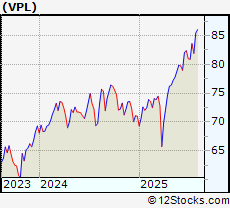

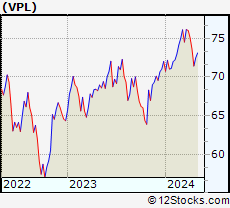

| VPL : Invests to track index of 400 equities from Australia, Japan, Hong Kong, New Zealand and Singapore | |

|

|

|

| Weekly Chart | Daily Chart (Short Term) |

| Weekly: 2.91% | Daily: 12.00% |

| Year-to-date Performance : 22.98% | Relative Performance: The Asia-Pacific Index is outperforming the market (S&P 500) by 12.65% |

| 12Stocks.com: Top Performing Asia-Pacific ETFs | |

|

|

Most popular Asia-Pacific exchange traded funds track the broad Asia-Pacific sector. But there are ETF funds that track specific sub-sectors within the wide Asia-Pacific sector. For instance, most Asia-Pacific ETFs focus on broad market but there are ETFs that focus on smallcap segment. The top performing ETFs (year-to-date) that track the whole Asia-Pacific segment are shown in left side bar. The popular Asia-Pacific ETFs with Best YTD Performances: iShares South Korea [46.83%], iShares South Korea [46.83%], Japan Small Cap Fund [37.9%], iShares Hong Kong [32.22%], iShares Hong Kong [32.22%], iShares Singapore [30.89%], iShares Singapore [30.89%], iShares China 25 [28.42%], iShares China 25 [28.42%], Vanguard Pacific Stock VIPERs [22.98%], Vanguard Pacific Stock VIPERs [22.98%]. Also, there are leveraged ETFs that given enhanced performance by moving twice or thrice the daily movement of Asia-Pacific sector TripleBull Emerging Markets [56.84%], TripleBull Emerging Markets [56.84%], Ultra China [54.04%], Ultra China [54.04%], Ultra Emerging Mkts [39.31%], Ultra Emerging Mkts [39.31%], Ultra Japan [31.82%], Double Bull India [-5.16%], Double Bull India [-5.16%]. Finally, there are inverse or bearish Asia-Pacific ETFs that move in opposite direction to the daily movement of the Asia-Pacific segment Short MSCI Emerging Markets [-16.43%], Short MSCI Emerging Markets [-16.43%], UltraShort MSCI Japan [-31.08%], UltraShort MSCI Emerging Markets [-32.51%], UltraShort MSCI Emerging Markets [-32.51%], UltraShort FTSE/Xinhua China 25 [-46%], UltraShort FTSE/Xinhua China 25 [-46%], TripleShort Emerging Markets [-46.81%], TripleShort Emerging Markets [-46.81%]. Now, more recently, over last week, the top performing Asia-Pacific ETFs that track the whole segment on the move are - Singapore [4.38%], Singapore [4.38%], Japan [4.26%], Japan [4.26%], Emrg Markets CF [4.16%], China CF [3.78%], Malaysia [3.57%], Malaysia [3.57%], Hong Kong [3.55%], Hong Kong [3.55%], China [3.44%] . |

|

LEADING Asia-Pacific ETFs (YEAR-TO-DATE) |

|

| iShares South Korea : 46.83% | |

| iShares South Korea : 46.83% | |

| Japan Small Cap Fund: 37.9% | |

| iShares Hong Kong : 32.22% | |

| iShares Hong Kong : 32.22% | |

| iShares Singapore : 30.89% | |

| iShares Singapore : 30.89% | |

| Templeton Emerging Markets: 30.04% | |

| Templeton Dragon Fund: 28.84% | |

| iShares China 25: 28.42% | |

|

For Complete List of Winners and Laggards from Asia-Pacific ETF

Segment

| |

| 12Stocks.com: Investing With Asia-Pacific ETFs | |

|

The following table helps investors and traders sort through current performance of various

Asia-Pacific ETFs. One can glean long and short term trends by sorting Asia-Pacific ETF list by performance over daily, weekly or year-to-date periods. |

12Stocks.com Performance of Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EWM | iShares Malaysia |   | Pacific | 25.27 | 0.82 | 3.57 | 3.02% |

| EWM | iShares Malaysia |   | Pacific | 25.03 | 0.82 | 3.57 | 3.02% |

| HAO | China Smallcap |   | Pacific | 1.19 | 0.00 | -1.67 | -69.05% |

| HAO | China Smallcap |   | Pacific | 1.16 | 0.00 | -1.67 | -69.05% |

| IFN | India Closed-End ETF Fund |   | Pacific | 15.52 | -2.35 | 1.44 | 4.02% |

| IFN | India Closed-End ETF Fund |   | Pacific | 15.42 | -2.35 | 1.44 | 4.02% |

| GMF | SPDR S&P Emerging Asia Pacific |   | Pacific | 130.73 | 12.15 | 2.74 | 14.48% |

| EPP | iShares Pacific ex-Japan |   | Pacific | 51.49 | 2.41 | 2.37 | 19.62% |

| EPP | iShares Pacific ex-Japan |   | Pacific | 51.08 | 2.41 | 2.37 | 19.62% |

| IIF | MS India Investment Fund |   | Pacific | 26.79 | 0.51 | 0.67 | 6.45% |

| EMF | Templeton Emerging Markets |   | Emerging Markets | 15.34 | 0.43 | 4.16 | 30.04% |

| GMM | SPDR S&P Emerging Markets |   | Emerging Markets | 2.26 | -1.00 | -12.17 | -40.46% |

| GXC | SPDR S&P China |   | Pacific | 96.26 | -11.14 | 3.33 | 26.86% |

| GXC | SPDR S&P China |   | Pacific | 94.40 | -11.14 | 3.33 | 26.86% |

| TDF | Templeton Dragon Fund |   | Pacific | 10.52 | -16.61 | 3.78 | 28.84% |

| TFC | Taiwan Greater China Fund |   | Pacific | 44.95 | 35.27 | 5.46 | 7.16% |

| EFV | iShares Foreign LargeCap Value |   | Emerging Markets | 66.87 | 14.14 | 3.39 | 30.22% |

| EFV | iShares Foreign LargeCap Value |   | Emerging Markets | 66.98 | 14.14 | 3.39 | 30.22% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 91.74 | 1.79 | 1.09 | 24.13% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 91.74 | 1.79 | 1.09 | 24.13% |

| DFJ | Japan SmallCap Dividend Fund |   | Pacific | 91.74 | 1.79 | 1.09 | 24.13% |

| DNL | Japan High-Yielding Equity Fund |   | Pacific | 39.46 | 1.79 | 2.61 | 11.44% |

| TWN | Taiwan Fund |   | Pacific | 47.95 | 1.79 | 4.09 | 24.48% |

| KF | Korea Fund |   | Pacific | 27.97 | 0.51 | 3.19 | 54.48% |

| CHN | China Fund |   | Pacific | 16.25 | 0.46 | 3.47 | 37.64% |

| Showing 25 to 50 ETFs. Click on arrows to view more! Sort by performace by clicking on Daily, Weekly or YTD % Change |  | |||||

| 12Stocks.com: Euro Currency | |

| Investors using Asia-Pacific ETFs have to also deal with currency movements versus US dollar. Unless the ETF is hedged for Asia-Pacific currency exposure, traders will have to take into account the performance of Asia-Pacific currencies. |

12Stocks.com Performance of Asia-Pacific Currencies

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| YCL | Ultra Yen |   | Pacific | 22.08 | -9.69 | -0.18 | 8.5% |

| YCL | Ultra Yen |   | Pacific | 21.95 | -9.69 | -0.18 | 8.5% |

| FXA | Australian Dollar |   | Pacific | 64.32 | 1.54 | 0.65 | 6.57% |

| YCS | UltraShort Yen |   | Pacific | 43.80 | -2.88 | 0.5 | -6.17% |

| YCS | UltraShort Yen |   | Pacific | 43.98 | -2.88 | 0.5 | -6.17% |

| 12Stocks.com: Trading With Bullish (Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can enhance their performances by trading leveraged ETFs that double or triple the daily returns of Asia-Pacific indexes. Also, listed below are leveraged ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bullish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EDC | TripleBull Emerging Markets |   | Emerging Markets | 44.23 | 5.08 | 8.89 | 56.84% |

| EDC | TripleBull Emerging Markets |   | Emerging Markets | 42.44 | 5.08 | 8.89 | 56.84% |

| XPP | Ultra China |   | Pacific | 28.02 | -24.43 | 6.7 | 54.04% |

| XPP | Ultra China |   | Pacific | 26.95 | -24.43 | 6.7 | 54.04% |

| EET | Ultra Emerging Mkts |   | Emerging Markets | 69.60 | 10.70 | 5.77 | 39.31% |

| EET | Ultra Emerging Mkts |   | Emerging Markets | 67.79 | 10.70 | 5.77 | 39.31% |

| EZJ | Ultra Japan |   | Pacific | 47.63 | 24.80 | 8.25 | 31.82% |

| INDL | Double Bull India |   | Pacific | 56.12 | 51.49 | 1.8 | -5.16% |

| INDL | Double Bull India |   | Pacific | 55.47 | 51.49 | 1.8 | -5.16% |

| 12Stocks.com: Trading With Bearish (& Leveraged) Asia-Pacific ETFs | |

| Traders and speculators can hedge or take advantage of market pullbacks by betting on bearish (inverse) ETFs that move in opposite direction to underlying index. Asia-Pacific traders can enhance their performances by trading leveraged bearish ETFs that double or triple inverse the daily returns of Asia-Pacific indexes. Also, listed below are ETFs that have exposure to Asia-Pacific economy. |

12Stocks.com Performance of Bearish (Leveraged) Asia-Pacific ETFs

| Ticker | ETF Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| EUM | Short MSCI Emerging Markets |   | Emerging Markets | 22.13 | -9.70 | -2.72 | -16.43% |

| EUM | Short MSCI Emerging Markets |   | Emerging Markets | 22.44 | -9.70 | -2.72 | -16.43% |

| EWV | UltraShort MSCI Japan |   | Pacific | 28.92 | -3.91 | -7.67 | -31.08% |

| EEV | UltraShort MSCI Emerging Markets |   | Emerging Markets | 11.49 | -20.46 | -5.42 | -32.51% |

| EEV | UltraShort MSCI Emerging Markets |   | Emerging Markets | 11.77 | -20.46 | -5.42 | -32.51% |

| FXP | UltraShort FTSE/Xinhua China 25 |   | Pacific | 9.26 | -3.01 | -6.6 | -46% |

| FXP | UltraShort FTSE/Xinhua China 25 |   | Pacific | 9.61 | -3.01 | -6.6 | -46% |

| EDZ | TripleShort Emerging Markets |   | Emerging Markets | 4.74 | -4.97 | -8.14 | -46.81% |

| EDZ | TripleShort Emerging Markets |   | Emerging Markets | 4.94 | -4.97 | -8.14 | -46.81% |

| Charts, Fundamental Data and Performances of ETFs | ||

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows | ||

| EWM iShares Malaysia |

| Description: Invests in large cap value companies traded primarily on Kuala Lampur stock exchange & tracks MSCI Malaysia index | |

| Sector: Pacific | |

| Sub-Sector: Malaysia | |

| Recent Price: 25.27 | |

| Day Percent Change: 0.82% Day Change: 0.20 | |

| Week Change: 3.57% Year-to-date Change: 3.0% | |

| EWM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWM for Review:   | |

| EWM iShares Malaysia |

| Description: Invests in large cap value companies traded primarily on Kuala Lampur stock exchange & tracks MSCI Malaysia index | |

| Sector: Pacific | |

| Sub-Sector: Malaysia | |

| Recent Price: 25.03 | |

| Day Percent Change: 0.82% Day Change: 0.20 | |

| Week Change: 3.57% Year-to-date Change: 3.0% | |

| EWM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EWM for Review:   | |

| HAO China Smallcap |

| Description: Invests in small cap value companies traded primarily on China market index | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 1.19 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: -1.67% Year-to-date Change: -69.1% | |

| HAO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save HAO for Review:   | |

| HAO China Smallcap |

| Description: Invests in small cap value companies traded primarily on China market index | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 1.16 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: -1.67% Year-to-date Change: -69.1% | |

| HAO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save HAO for Review:   | |

| IFN India Closed-End ETF Fund |

| Description: Invests in leading companies from India | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 15.52 | |

| Day Percent Change: -2.35% Day Change: -0.45 | |

| Week Change: 1.44% Year-to-date Change: 4.0% | |

| IFN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IFN for Review:   | |

| IFN India Closed-End ETF Fund |

| Description: Invests in leading companies from India | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 15.42 | |

| Day Percent Change: -2.35% Day Change: -0.45 | |

| Week Change: 1.44% Year-to-date Change: 4.0% | |

| IFN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IFN for Review:   | |

| GMF SPDR S&P Emerging Asia Pacific |

| Description: Tracks index containing basket of companies from China, India, Indonesia, Malaysia, Pakistan, the Philippines, Taiwan, and Thailand | |

| Sector: Pacific | |

| Sub-Sector: Pacific | |

| Recent Price: 130.73 | |

| Day Percent Change: 12.15% Day Change: 12.27 | |

| Week Change: 2.74% Year-to-date Change: 14.5% | |

| GMF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GMF for Review:   | |

| EPP iShares Pacific ex-Japan |

| Description: Invests in large companies from Australia, Hong Kong, New Zealand and Singapore | |

| Sector: Pacific | |

| Sub-Sector: Pacific | |

| Recent Price: 51.49 | |

| Day Percent Change: 2.41% Day Change: 1.07 | |

| Week Change: 2.37% Year-to-date Change: 19.6% | |

| EPP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EPP for Review:   | |

| EPP iShares Pacific ex-Japan |

| Description: Invests in large companies from Australia, Hong Kong, New Zealand and Singapore | |

| Sector: Pacific | |

| Sub-Sector: Pacific | |

| Recent Price: 51.08 | |

| Day Percent Change: 2.41% Day Change: 1.07 | |

| Week Change: 2.37% Year-to-date Change: 19.6% | |

| EPP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EPP for Review:   | |

| IIF MS India Investment Fund |

| Description: Invests in leading companies from India | |

| Sector: Pacific | |

| Sub-Sector: India | |

| Recent Price: 26.79 | |

| Day Percent Change: 0.51% Day Change: 0.14 | |

| Week Change: 0.67% Year-to-date Change: 6.5% | |

| IIF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IIF for Review:   | |

| EMF Templeton Emerging Markets |

| Description: Invests in equities and debt securities primarily from Korea, Russia, Taiwan, China, Brazil & Africa | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 15.34 | |

| Day Percent Change: 0.43% Day Change: 0.05 | |

| Week Change: 4.16% Year-to-date Change: 30.0% | |

| EMF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EMF for Review:   | |

| GMM SPDR S&P Emerging Markets |

| Description: Tracks index containing basket of 1,500 companies across 26 emerging countries | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 2.26 | |

| Day Percent Change: -1.00% Day Change: 0.00 | |

| Week Change: -12.17% Year-to-date Change: -40.5% | |

| GMM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GMM for Review:   | |

| GXC SPDR S&P China |

| Description: Tracks index containing basket of 150 companies from China | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 96.26 | |

| Day Percent Change: -11.14% Day Change: -8.55 | |

| Week Change: 3.33% Year-to-date Change: 26.9% | |

| GXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GXC for Review:   | |

| GXC SPDR S&P China |

| Description: Tracks index containing basket of 150 companies from China | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 94.40 | |

| Day Percent Change: -11.14% Day Change: -8.55 | |

| Week Change: 3.33% Year-to-date Change: 26.9% | |

| GXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GXC for Review:   | |

| TDF Templeton Dragon Fund |

| Description: Invests in equities primarily from China, HongKong, Taiwan and Korea | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 10.52 | |

| Day Percent Change: -16.61% Day Change: -1.56 | |

| Week Change: 3.78% Year-to-date Change: 28.8% | |

| TDF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TDF for Review:   | |

| TFC Taiwan Greater China Fund |

| Description: Invests in equities of companies that trade primarily in Taiwan stock market and gets substantial revenues from mainland China | |

| Sector: Pacific | |

| Sub-Sector: Thailand | |

| Recent Price: 44.95 | |

| Day Percent Change: 35.27% Day Change: 11.43 | |

| Week Change: 5.46% Year-to-date Change: 7.2% | |

| TFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TFC for Review:   | |

| EFV iShares Foreign LargeCap Value |

| Description: Invests in large cap [big] value companies from markets like Europe and Asia | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 66.87 | |

| Day Percent Change: 14.14% Day Change: 7.02 | |

| Week Change: 3.39% Year-to-date Change: 30.2% | |

| EFV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EFV for Review:   | |

| EFV iShares Foreign LargeCap Value |

| Description: Invests in large cap [big] value companies from markets like Europe and Asia | |

| Sector: Emerging Markets | |

| Sub-Sector: Emerging Markets | |

| Recent Price: 66.98 | |

| Day Percent Change: 14.14% Day Change: 7.02 | |

| Week Change: 3.39% Year-to-date Change: 30.2% | |

| EFV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EFV for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 91.74 | |

| Day Percent Change: 1.79% Day Change: 1.40 | |

| Week Change: 1.09% Year-to-date Change: 24.1% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 91.74 | |

| Day Percent Change: 1.79% Day Change: 1.40 | |

| Week Change: 1.09% Year-to-date Change: 24.1% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| DFJ Japan SmallCap Dividend Fund |

| Description: Tracks to perform similar to WisdomTree Japan SmallCap Dividend Fund | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 91.74 | |

| Day Percent Change: 1.79% Day Change: 1.40 | |

| Week Change: 1.09% Year-to-date Change: 24.1% | |

| DFJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DFJ for Review:   | |

| DNL Japan High-Yielding Equity Fund |

| Description: Tracks to perform similar to WisdomTree Japan High-Yielding Equity Index | |

| Sector: Pacific | |

| Sub-Sector: Japan | |

| Recent Price: 39.46 | |

| Day Percent Change: 1.79% Day Change: 0.71 | |

| Week Change: 2.61% Year-to-date Change: 11.4% | |

| DNL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DNL for Review:   | |

| TWN Taiwan Fund |

| Description: Invests in equities of companies that trade primarily in Taiwan stock market | |

| Sector: Pacific | |

| Sub-Sector: Taiwan | |

| Recent Price: 47.95 | |

| Day Percent Change: 1.79% Day Change: 0.78 | |

| Week Change: 4.09% Year-to-date Change: 24.5% | |

| TWN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TWN for Review:   | |

| KF Korea Fund |

| Description: Invests in equities and debt securities primarily from Korea | |

| Sector: Pacific | |

| Sub-Sector: Korea | |

| Recent Price: 27.97 | |

| Day Percent Change: 0.51% Day Change: 0.13 | |

| Week Change: 3.19% Year-to-date Change: 54.5% | |

| KF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save KF for Review:   | |

| CHN China Fund |

| Description: Invests in equities of China related securities traded primarily in Hong Kong, Taiwan and also in unlisted securities | |

| Sector: Pacific | |

| Sub-Sector: China | |

| Recent Price: 16.25 | |

| Day Percent Change: 0.46% Day Change: 0.04 | |

| Week Change: 3.47% Year-to-date Change: 37.6% | |

| CHN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CHN for Review:   | |

| Click on following links to sort by: Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| To view more ETFs click on next and previous arrows |

| 12Stocks.com: Typical Stock Holdings in Asia-Pacific ETFs | |

| ETFs are funds that hold basket of stocks. The following table shows list of stocks or holdings commonly found in most Asia-Pacific ETFs . The funds basically perform based on what stocks they hold. You can dive deep into Asia-Pacific stocks in the following pages - Asia-Pacific Stocks |

12Stocks.com Performance of Stock Holdings in Asia-Pacific ETFs

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| BABA | Alibaba Group Holding Limited |   | Services & Goods | 126.86 | 3.13 | 4.96 | 50.81% |

| BABA | Alibaba Group Holding Limited |   | Services & Goods | 122.28 | 3.13 | 4.96 | 50.81% |

| TSM | Taiwan Semiconductor Manufacturing Company Limited |   | Technology | 241.44 | 81.27 | 4.35 | 23.17% |

| TSM | Taiwan Semiconductor Manufacturing Company Limited |   | Technology | 241.00 | 81.27 | 4.35 | 23.17% |

| TM | Toyota Motor Corporation |   | Consumer Staples | 194.40 | 8.69 | 5.66 | 1.86% |

| TM | Toyota Motor Corporation |   | Consumer Staples | 192.48 | 8.69 | 5.66 | 1.86% |

| KC | Kingsoft Cloud Holdings Limited |   | Technology | 13.26 | 4.13 | -2.74 | 31.84% |

| BHP | BHP Group |   | Materials | 54.73 | 1.64 | 6.19 | 14.34% |

| BHP | BHP Group |   | Materials | 53.82 | 1.64 | 6.19 | 14.34% |

| OCFT | OneConnect Financial Technology Co., Ltd. |   | Technology | 7.43 | -8.53 | 1.08 | 207% |

| BEKE | KE Holdings Inc. |   | Financials | 18.39 | 1.58 | 4.91 | 1.88% |

| MNSO | MINISO Group Holding Limited |   | Services & Goods | 19.52 | -1.73 | 3.2 | -13.1% |

| JD | JD.com, Inc. |   | Technology | 32.51 | 0.77 | 3.73 | -3.52% |

| JD | JD.com, Inc. |   | Technology | 31.58 | 0.77 | 3.73 | -3.52% |

| API | Agora, Inc. |   | Technology | 3.65 | -2.76 | 2.15 | -8.65% |

| WIMI | WiMi Hologram Cloud Inc. |   | Technology | 4.08 | 8.02 | 18.77 | -77.08% |

| PDD | Pinduoduo Inc. |   | Services & Goods | 114.74 | -4.89 | 2.36 | 20.25% |

| YGMZ | MingZhu Logistics Holdings Limited |   | Industrials | 0.78 | 5.66 | -7.95 | -23.99% |

| HMC | Honda Motor Co., Ltd. |   | Consumer Staples | 33.40 | 4.94 | 3.15 | 19.88% |

| HMC | Honda Motor Co., Ltd. |   | Consumer Staples | 33.25 | 4.94 | 3.15 | 19.88% |

| ZCMD | Zhongchao Inc. |   | Health Care | 0.97 | 2.31 | 2.96 | -37.65% |

| TAK | Takeda Pharmaceutical Company Limited |   | Health Care | 14.80 | -1.82 | 3.5 | 14.13% |

| NTES | NetEase, Inc. |   | Technology | 134.90 | -0.21 | 2.48 | 53.86% |

| NTES | NetEase, Inc. |   | Technology | 129.67 | -0.21 | 2.48 | 53.86% |

| QH | Quhuo Limited |   | Technology | 0.11 | 3.09 | 5.5 | -92.64% |

| HUIZ | Huize Holding Limited |   | Financials | 2.58 | -5.39 | 5.91 | -22.29% |

| SMFG | Sumitomo Mitsui Financial Group, Inc. |   | Financials | 16.25 | 2.53 | 5.11 | 13.96% |

| SMFG | Sumitomo Mitsui Financial Group, Inc. |   | Financials | 16.75 | 2.53 | 5.11 | 13.96% |

| INFY | Infosys Limited |   | Technology | 16.38 | 0.04 | 1.93 | -24.22% |

| INFY | Infosys Limited |   | Technology | 16.36 | 0.04 | 1.93 | -24.22% |

| EBON | Ebang International Holdings Inc. |   | Technology | 3.90 | 12.62 | -2.59 | -29.46% |

| BIDU | Baidu, Inc. |   | Technology | 91.07 | -0.13 | 4.91 | 8.02% |

| BIDU | Baidu, Inc. |   | Technology | 88.73 | -0.13 | 4.91 | 8.02% |

| LU | Lufax Holding Ltd |   | Financials | 2.85 | -5.79 | 2.12 | 20.92% |

| BQ | Boqii Holding Limited |   | Services & Goods | 2.45 | 4.44 | 4.88 | -28.33% |

| XPEV | XPeng Inc. |   | Services & Goods | 19.38 | 0.57 | 4.67 | 70.64% |

| EDTK | Skillful Craftsman Education Technology Limited |   | Consumer Staples | 1.03 | 2.68 | 13.64 | -0.99% |

| YQ | 17 Education & Technology Group Inc. |   | Consumer Staples | 1.95 | 1.42 | 7.53 | 25.79% |

| TEAM | Atlassian Corporation Plc |   | Technology | 163.99 | 3.03 | -11.6 | -32.62% |

| TEAM | Atlassian Corporation Plc |   | Technology | 164.39 | 3.03 | -11.6 | -32.62% |

| IBN | ICICI Bank Limited |   | Financials | 32.66 | 1.08 | -0.16 | 10.24% |

| IBN | ICICI Bank Limited |   | Financials | 32.62 | 1.08 | -0.16 | 10.24% |

| TAL | TAL Education Group |   | Services & Goods | 11.68 | 0.35 | 4.47 | 16.57% |

| TAL | TAL Education Group |   | Services & Goods | 11.28 | 0.35 | 4.47 | 16.57% |

| HDB | HDFC Bank Limited |   | Financials | 74.00 | -8.40 | -2.48 | 17.16% |

| HDB | HDFC Bank Limited |   | Financials | 73.85 | -8.40 | -2.48 | 17.16% |

| LI | Li Auto Inc. |   | Services & Goods | 23.75 | -0.45 | 2.89 | 3.79% |

| CHT | Chunghwa Telecom Co., Ltd. |   | Technology | 44.97 | 1.59 | 0.25 | 23.85% |

| CHT | Chunghwa Telecom Co., Ltd. |   | Technology | 45.09 | 1.59 | 0.25 | 23.85% |

| MFG | Mizuho Financial Group, Inc. |   | Financials | 6.40 | 29.22 | 5.26 | 33.3% |

| MFG | Mizuho Financial Group, Inc. |   | Financials | 6.50 | 29.22 | 5.26 | 33.3% |

| BNR | Burning Rock Biotech Limited |   | Health Care | 6.95 | -3.87 | 14.59 | 3.56% |

| IMAB | I Mab |   | Health Care | 5.16 | -51.40 | 13.37 | 398.82% |

| ZTO | ZTO Express (Cayman) Inc. |   | Transports | 20.17 | -2.42 | 1.1 | 5.24% |

| ZTO | ZTO Express (Cayman) Inc. |   | Transports | 19.83 | -2.42 | 1.1 | 5.24% |

| EDU | New Oriental Education & Technology Group Inc. |   | Services & Goods | 46.79 | 28.05 | 1.28 | -27.1% |

| EDU | New Oriental Education & Technology Group Inc. |   | Services & Goods | 48.06 | 28.05 | 1.28 | -27.1% |

| YUMC | Yum China Holdings, Inc. |   | Services & Goods | 45.61 | -41.09 | 1.81 | -4.33% |

| YUMC | Yum China Holdings, Inc. |   | Services & Goods | 44.82 | -41.09 | 1.81 | -4.33% |

| TME | Tencent Music Entertainment Group |   | Technology | 25.52 | 0.05 | 16.95 | 125.55% |

| IX | ORIX Corporation |   | Financials | 25.40 | 5.22 | 6.77 | 21.87% |

| IX | ORIX Corporation |   | Financials | 25.64 | 5.22 | 6.77 | 21.87% |

| NMR | Nomura Holdings, Inc. |   | Financials | 7.25 | 53.00 | 5.38 | 30.05% |

| NMR | Nomura Holdings, Inc. |   | Financials | 7.26 | 53.00 | 5.38 | 30.05% |

| WIT | Wipro Limited |   | Technology | 2.73 | 23.09 | 3.41 | -20.82% |

| WIT | Wipro Limited |   | Technology | 2.71 | 23.09 | 3.41 | -20.82% |

| IQ | iQIYI, Inc. |   | Technology | 1.91 | -10.17 | 4.84 | -2.99% |

| TCOM | Trip.com Group Limited |   | Services & Goods | 60.31 | 5.61 | -0.06 | -9.47% |

| LXEH | Lixiang Education Holding Co., Ltd. |   | Consumer Staples | 1.26 | 0.12 | -44.64 | -74.58% |

| IH | iHuman Inc. |   | Consumer Staples | 2.75 | -0.61 | -3.57 | 68.44% |

| YSG | Yatsen Holding Limited |   | Services & Goods | 9.50 | -7.46 | 2.09 | 133.67% |

| VIPS | Vipshop Holdings Limited |   | Services & Goods | 16.36 | 1.32 | 7.21 | 26.06% |

| VIPS | Vipshop Holdings Limited |   | Services & Goods | 17.33 | 1.32 | 7.21 | 26.06% |

| HTHT | Huazhu Group Limited |   | Services & Goods | 32.86 | -37.77 | 4.28 | 2.72% |

| HTHT | Huazhu Group Limited |   | Services & Goods | 33.22 | -37.77 | 4.28 | 2.72% |

| GDS | GDS Holdings Limited |   | Technology | 33.92 | 2.46 | -4.91 | 42.76% |

| GDS | GDS Holdings Limited |   | Technology | 31.84 | 2.46 | -4.91 | 42.76% |

| ASX | ASE Technology Holding Co., Ltd. |   | Technology | 10.03 | 30.39 | 3.19 | 3.21% |

| ASX | ASE Technology Holding Co., Ltd. |   | Technology | 9.94 | 30.39 | 3.19 | 3.21% |

| WB | Weibo Corporation |   | Technology | 10.28 | 0.45 | 5.44 | 20.2% |

| WB | Weibo Corporation |   | Technology | 11.44 | 0.45 | 5.44 | 20.2% |

| ATHM | Autohome Inc. |   | Technology | 29.59 | -0.12 | 6.63 | 14.03% |

| ATHM | Autohome Inc. |   | Technology | 28.85 | -0.12 | 6.63 | 14.03% |

| BILI | Bilibili Inc. |   | Technology | 23.82 | -13.54 | 4.41 | 34.57% |

| YMM | Full Truck Alliance Co. Ltd. |   | Technology | 10.77 | -1.18 | -0.53 | 4.44% |

| BZ | Kanzhun Limited |   | Industrials | 21.32 | -0.53 | 11.59 | 62.61% |

| RDY | Dr. Reddy s Laboratories Limited |   | Health Care | 14.26 | 17.39 | 6.98 | -9.24% |

| RDY | Dr. Reddy s Laboratories Limited |   | Health Care | 14.11 | 17.39 | 6.98 | -9.24% |

| UMC | United Microelectronics Corporation |   | Technology | 6.84 | 23.77 | 1.48 | 11.96% |

| UMC | United Microelectronics Corporation |   | Technology | 6.89 | 23.77 | 1.48 | 11.96% |

| MOMO | Momo Inc. |   | Technology | 8.06 | 2.29 | -0.49 | 10.54% |

| MOMO | Momo Inc. |   | Technology | 8.05 | 2.29 | -0.49 | 10.54% |

| ZLAB | Zai Lab Limited |   | Health Care | 34.93 | 3.00 | -7.98 | 36.04% |

| HUYA | HUYA Inc. |   | Services & Goods | 3.30 | 0.97 | 1.17 | 93.52% |

| RLX | RLX Technology Inc. |   | Consumer Staples | 2.14 | 0.84 | -4.02 | -0.46% |

| SDA | SunCar Technology Group Inc. |   | Services & Goods | 2.36 | 1.58 | 2.7 | -76.37% |

| NIO | NIO Limited |   | Consumer Staples | 4.45 | 1.87 | 0.22 | 5.96% |

| DOYU | DouYu International Holdings Limited |   | Technology | 7.28 | 2.28 | -2.6 | -33.1% |

| WNS | WNS (Holdings) Limited |   | Services & Goods | 75.18 | 0.62 | 0.44 | 58.64% |

| WNS | WNS (Holdings) Limited |   | Services & Goods | 74.95 | 0.62 | 0.44 | 58.64% |

| ATAT | Atour Lifestyle Holdings Limited |   | Services & Goods | 34.48 | -0.28 | 4.63 | 32.99% |

| DAO | Youdao, Inc. |   | Technology | 9.76 | -0.58 | 0.91 | 20% |

| VNET | 21Vianet Group, Inc. |   | Technology | 8.01 | 8.53 | 0 | 68.99% |

| VNET | 21Vianet Group, Inc. |   | Technology | 7.95 | 8.53 | 0 | 68.99% |

| LX | LexinFintech Holdings Ltd. |   | Financials | 6.65 | -32.95 | 3.73 | 21.89% |

| BZUN | Baozun Inc. |   | Services & Goods | 2.79 | -49.22 | 3.33 | 2.57% |

| BZUN | Baozun Inc. |   | Services & Goods | 2.75 | -49.22 | 3.33 | 2.57% |

| NOAH | Noah Holdings Limited |   | Financials | 11.76 | -44.23 | -2.73 | 10.61% |

| NOAH | Noah Holdings Limited |   | Financials | 11.95 | -44.23 | -2.73 | 10.61% |

| MMYT | MakeMyTrip Limited |   | Services & Goods | 95.60 | 2.41 | 2.82 | -14.86% |

| MMYT | MakeMyTrip Limited |   | Services & Goods | 94.33 | 2.41 | 2.82 | -14.86% |

| HSAI | Hesai Group |   | Services & Goods | 23.32 | 0.59 | 10.53 | 68.6% |

| GHG | GreenTree Hospitality Group Ltd. |   | Services & Goods | 2.22 | -58.58 | -0.68 | -14.65% |

| SIMO | Silicon Motion Technology Corporation |   | Technology | 76.64 | -1.19 | 0.72 | 45.41% |

| SIMO | Silicon Motion Technology Corporation |   | Technology | 75.48 | -1.19 | 0.72 | 45.41% |

| TSL | Trina Solar Limited |   | Technology | 13.49 | 0.00 | 7.49 | -25.35% |

| TSL | Trina Solar Limited |   | Technology | 13.32 | 0.00 | 7.49 | -25.35% |

| TUYA | Tuya Inc. |   | Technology | 2.42 | 1.55 | 7.14 | 44.21% |

| SY | So-Young International Inc. |   | Technology | 4.84 | -4.09 | 3.45 | 535.51% |

| QFIN | 360 Finance, Inc. |   | Financials | 33.30 | -0.69 | 4.5 | -7.46% |

| CANG | Cango Inc. |   | Technology | 4.83 | 31.62 | 2.3 | 11.36% |

| WDH | Waterdrop Inc. |   | Financials | 1.80 | 0.00 | 5.78 | 57.07% |

| GGR | Gogoro Inc. |   | Services & Goods | 0.35 | -0.77 | -0.51 | -29.98% |

| BEDU | Bright Scholar Education Holdings Limited |   | Services & Goods | 1.74 | 8.70 | 588076 | 581237% |

| DUO | Fangdd Network Group Ltd. |   | Financials | 1.65 | -0.86 | 2.96 | -81.81% |

| YJ | Yunji Inc. |   | Services & Goods | 1.75 | -7.08 | 0 | 9.32% |

| SFWL | Shengfeng Development Limited |   | Industrials | 1.03 | -2.33 | -10.26 | -7.41% |

| ZH | Zhihu Inc. |   | Services & Goods | 4.20 | 1.30 | -2.28 | 20.9% |

| LANV | Lanvin Group Holdings Limited |   | Services & Goods | 2.33 | 7.24 | -3.04 | 10.95% |

| DDL | Dingdong (Cayman) Limited |   | Consumer Staples | 2.28 | -3.33 | 7.77 | -32.32% |

|

List of Asia-Pacific ETFs

|

|

US Stock Market Performance Year-to-Date: 6% |

performance (%Change)

performance (%Change)

| Stock | Price | YTD | Week | Day% |

| EWM | 25.27 | 3.0 | 3.6 | 0.8 |

| EWM | 25.03 | 3.0 | 3.6 | 0.8 |

| HAO | 1.19 | -69.1 | -1.7 | 0.0 |

| HAO | 1.16 | -69.1 | -1.7 | 0.0 |

| IFN | 15.52 | 4.0 | 1.4 | -2.4 |

| IFN | 15.42 | 4.0 | 1.4 | -2.4 |

| GMF | 130.73 | 14.5 | 2.7 | 12.2 |

| EPP | 51.49 | 19.6 | 2.4 | 2.4 |

| EPP | 51.08 | 19.6 | 2.4 | 2.4 |

| IIF | 26.79 | 6.5 | 0.7 | 0.5 |

| EMF | 15.34 | 30.0 | 4.2 | 0.4 |

| GMM | 2.26 | -40.5 | -12.2 | -1.0 |

| GXC | 96.26 | 26.9 | 3.3 | -11.1 |

| GXC | 94.40 | 26.9 | 3.3 | -11.1 |

| TDF | 10.52 | 28.8 | 3.8 | -16.6 |

| TFC | 44.95 | 7.2 | 5.5 | 35.3 |

| EFV | 66.87 | 30.2 | 3.4 | 14.1 |

| EFV | 66.98 | 30.2 | 3.4 | 14.1 |

| DFJ | 91.74 | 24.1 | 1.1 | 1.8 |

| DFJ | 91.74 | 24.1 | 1.1 | 1.8 |

| DFJ | 91.74 | 24.1 | 1.1 | 1.8 |

| DNL | 39.46 | 11.4 | 2.6 | 1.8 |

| TWN | 47.95 | 24.5 | 4.1 | 1.8 |

| KF | 27.97 | 54.5 | 3.2 | 0.5 |

| CHN | 16.25 | 37.6 | 3.5 | 0.5 |

performance (%Change)

performance (%Change)

End-of-Day Market data as of

© 2014 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

|

|

Best US Stocks |

|

Top Exchange Traded Funds (ETFs) |

|

Global Markets |

|

Best Sectors |

|

Books & More |