Best Industrial Stocks

| In a hurry? Industrial Stocks Lists: Performance Trends Table, Stock Charts

Sort Industrial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Industrial stocks list by size:All Industrial Large Mid-Range Small |

| 12Stocks.com Industrial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 30 (0-bearish to 100-bullish) which puts Industrial sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 60 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Industrial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Industrial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Industrial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Industrial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| UFPI | Universal Forest |   | Lumber, Wood | 101.41 | 30 | 4.97% | -5.00% |

| FLS | Flowserve |   | Machinery | 52.62 | 20 | 2.04% | -5.40% |

| BV | BrightView |   | Contractors | 14.57 | 0 | 2.54% | -5.94% |

| CWST | Casella Waste |   | Waste Mgmt | 99.34 | 10 | 1.79% | -5.95% |

| BAER | Bridger Aerospace |   | Security & Protection | 1.94 | 40 | 2.63% | -6.10% |

| CDRE | Cadre |   | Aerospace & Defense | 29.25 | 73 | 2.00% | -6.48% |

| BZH | Beazer Homes |   | Residential | 25.66 | 90 | 4.40% | -6.59% |

| USLM | United States |   | Building Materials | 117.29 | 70 | -62.21% | -7.39% |

| OC | Owens Corning |   | Building Materials | 150.27 | 90 | 20.25% | -7.49% |

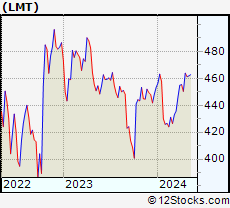

| LMT | Lockheed Martin |   | Aerospace/Defense | 437.56 | 60 | -0.19% | -7.62% |

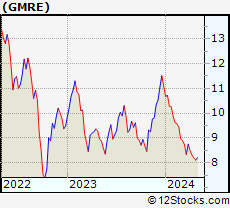

| GMRE | Global Medical |   | Conglomerates | 6.67 | 20 | -6.03% | -7.63% |

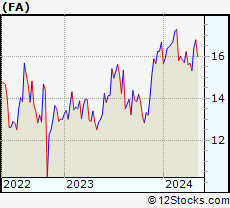

| FA | First Advantage |   | Specialty | 16.48 | 10 | 2.12% | -7.96% |

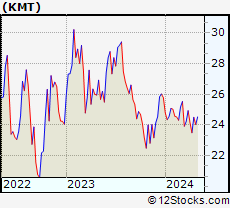

| KMT | Kennametal |   | Machine Tools | 21.02 | 30 | 2.74% | -7.98% |

| NX | Quanex Building |   | Building Materials | 20.99 | 80 | 5.02% | -8.08% |

| EML | Eastern |   | Small Tools & Accessories | 21.52 | 0 | 68.24% | -8.46% |

| DHR | Danaher |   | Machinery | 210.93 | 100 | 0.76% | -8.61% |

| LOMA | Loma Negra |   | Building Materials | 10.50 | 0 | 1.25% | -8.71% |

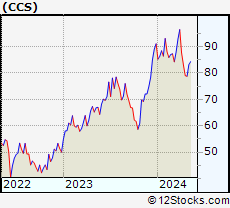

| CCS | Century Communities |   | Residential | 65.45 | 100 | 36.23% | -8.87% |

| THR | Thermon |   | Machinery | 25.21 | 0 | 16.54% | -9.70% |

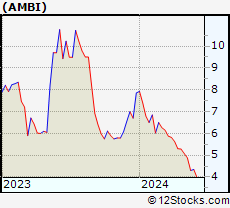

| AMBI | Ambipar Emergency |   | Waste Mgmt | 4.90 | 50 | -8.59% | -9.83% |

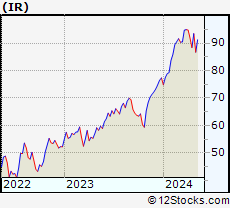

| IR | Ingersoll Rand |   | Machinery | 78.32 | 20 | 1.68% | -10.67% |

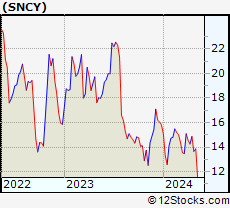

| SNCY | Sun Country |   | Airlines | 12.20 | 70 | 8.46% | -10.97% |

| PSN | Parsons |   | Machinery | 79.55 | 60 | 0.10% | -11.27% |

| SKYH | Sky Harbour |   | Aerospace & Defense | 10.27 | 20 | 4.16% | -11.57% |

| APT | Alpha Pro |   | Building Materials | 4.61 | 0 | 60.20% | -12.10% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Industrial Stocks |

| Industrial Technical Overview, Leaders & Laggards, Top Industrial ETF Funds & Detailed Industrial Stocks List, Charts, Trends & More |

| Industrial Sector: Technical Analysis, Trends & YTD Performance | |

| Industrial sector is composed of stocks

from industrial machinery, aerospace, defense, farm/construction

and industrial services subsectors. Industrial sector, as represented by XLI, an exchange-traded fund [ETF] that holds basket of Industrial stocks (e.g, Caterpillar, Boeing) is up by 16.43% and is currently outperforming the overall market by 6.1% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLI Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Deteriorating | |

XLI Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 30 | |

| YTD Performance: 16.43% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Industrial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Industrial sector stocks year to date are

Now, more recently, over last week, the top performing Industrial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Industrial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Industrial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Industrial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLI | Industrial |   | 150.44 | 30 | 1.17 | 1.03 | 16.43% |

| UXI | Industrials |   | 44.33 | 30 | 31.9 | 2 | 26.16% |

| PPA | Aerospace & Defense |   | 146.23 | 20 | 0.64 | 0.39 | 29.15% |

| ITA | Aerospace & Defense |   | 195.08 | 20 | 0.67 | -0.3 | 35.76% |

| ITB | Home Construction |   | 109.62 | 100 | 4.39 | 7.99 | 9.08% |

| XHB | Homebuilders |   | 113.34 | 100 | 4.45 | 8.64 | 11.28% |

| SIJ | Short Industrials |   | 12.29 | 70 | -1.1 | -1.91 | -27.73% |

| IYJ | Industrials |   | 143.75 | 30 | 1.02 | 1.74 | 9.55% |

| EXI | Global Industrials |   | 169.04 | 50 | 1.32 | 1.47 | 21.49% |

| VIS | Industrials |   | 288.11 | 30 | 19.27 | 1.49 | 15.62% |

| PSCI | SmallCap Industrials |   | 145.06 | 60 | 2.89 | 5.67 | 11.45% |

| XAR | Aerospace & Defense |   | 215.51 | 30 | 0.99 | 0.99 | 32.3% |

| ARKQ | ARK Industrial Innovation |   | 99.95 | 80 | 2.92 | 3.86 | 32.12% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Industrial Stocks | |

|

We now take in-depth look at all Industrial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Industrial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

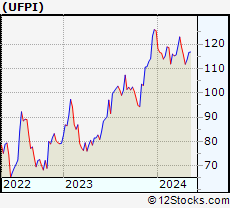

| UFPI Universal Forest Products, Inc. |

| Sector: Industrials | |

| SubSector: Lumber, Wood Production | |

| MarketCap: 2263.38 Millions | |

| Recent Price: 101.41 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 4.97% Day Change: 5.92 | |

| Week Change: 7.1% Year-to-date Change: -5.0% | |

| UFPI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UFPI to Watchlist:  View: View:  Get Complete UFPI Trend Analysis ➞ Get Complete UFPI Trend Analysis ➞ | |

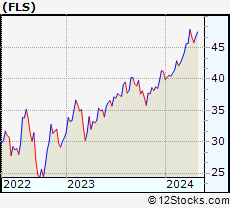

| FLS Flowserve Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 2974.66 Millions | |

| Recent Price: 52.62 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 2.04% Day Change: 0.98 | |

| Week Change: 0.35% Year-to-date Change: -5.4% | |

| FLS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FLS to Watchlist:  View: View:  Get Complete FLS Trend Analysis ➞ Get Complete FLS Trend Analysis ➞ | |

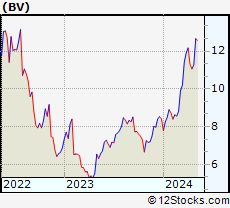

| BV BrightView Holdings, Inc. |

| Sector: Industrials | |

| SubSector: General Contractors | |

| MarketCap: 973.763 Millions | |

| Recent Price: 14.57 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 2.54% Day Change: 0.39 | |

| Week Change: -7.62% Year-to-date Change: -5.9% | |

| BV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BV to Watchlist:  View: View:  Get Complete BV Trend Analysis ➞ Get Complete BV Trend Analysis ➞ | |

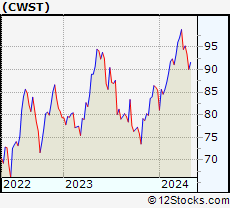

| CWST Casella Waste Systems, Inc. |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 2093.38 Millions | |

| Recent Price: 99.34 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 1.79% Day Change: 1.88 | |

| Week Change: -0.11% Year-to-date Change: -6.0% | |

| CWST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CWST to Watchlist:  View: View:  Get Complete CWST Trend Analysis ➞ Get Complete CWST Trend Analysis ➞ | |

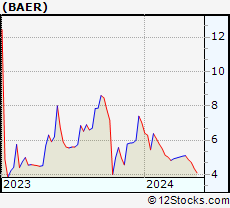

| BAER Bridger Aerospace Group Holdings, Inc. |

| Sector: Industrials | |

| SubSector: Security & Protection Services | |

| MarketCap: 239 Millions | |

| Recent Price: 1.94 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 2.63% Day Change: 0.08 | |

| Week Change: -0.99% Year-to-date Change: -6.1% | |

| BAER Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BAER to Watchlist:  View: View:  Get Complete BAER Trend Analysis ➞ Get Complete BAER Trend Analysis ➞ | |

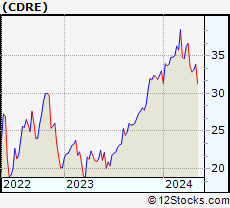

| CDRE Cadre Holdings, Inc. |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 817 Millions | |

| Recent Price: 29.25 Smart Investing & Trading Score: 73 | |

| Day Percent Change: 2% Day Change: 0.71 | |

| Week Change: 3.81% Year-to-date Change: -6.5% | |

| CDRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CDRE to Watchlist:  View: View:  Get Complete CDRE Trend Analysis ➞ Get Complete CDRE Trend Analysis ➞ | |

| BZH Beazer Homes USA, Inc. |

| Sector: Industrials | |

| SubSector: Residential Construction | |

| MarketCap: 180.106 Millions | |

| Recent Price: 25.66 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 4.4% Day Change: 1.37 | |

| Week Change: 10.09% Year-to-date Change: -6.6% | |

| BZH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BZH to Watchlist:  View: View:  Get Complete BZH Trend Analysis ➞ Get Complete BZH Trend Analysis ➞ | |

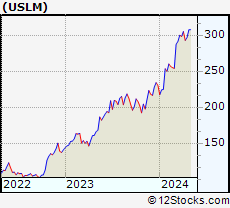

| USLM United States Lime & Minerals, Inc. |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 427.653 Millions | |

| Recent Price: 117.29 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -62.21% Day Change: -133.94 | |

| Week Change: 15.11% Year-to-date Change: -7.4% | |

| USLM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add USLM to Watchlist:  View: View:  Get Complete USLM Trend Analysis ➞ Get Complete USLM Trend Analysis ➞ | |

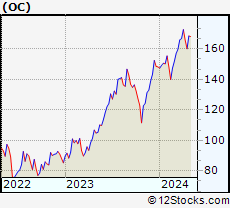

| OC Owens Corning |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 3686.73 Millions | |

| Recent Price: 150.27 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 20.25% Day Change: 28.92 | |

| Week Change: 5.2% Year-to-date Change: -7.5% | |

| OC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OC to Watchlist:  View: View:  Get Complete OC Trend Analysis ➞ Get Complete OC Trend Analysis ➞ | |

| LMT Lockheed Martin Corporation |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 94116.4 Millions | |

| Recent Price: 437.56 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -0.19% Day Change: -1.06 | |

| Week Change: 1.78% Year-to-date Change: -7.6% | |

| LMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LMT to Watchlist:  View: View:  Get Complete LMT Trend Analysis ➞ Get Complete LMT Trend Analysis ➞ | |

| GMRE Global Medical REIT Inc. |

| Sector: Industrials | |

| SubSector: Conglomerates | |

| MarketCap: 529.748 Millions | |

| Recent Price: 6.67 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -6.03% Day Change: -0.6 | |

| Week Change: 4.46% Year-to-date Change: -7.6% | |

| GMRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GMRE to Watchlist:  View: View:  Get Complete GMRE Trend Analysis ➞ Get Complete GMRE Trend Analysis ➞ | |

| FA First Advantage Corporation |

| Sector: Industrials | |

| SubSector: Specialty Business Services | |

| MarketCap: 2170 Millions | |

| Recent Price: 16.48 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 2.12% Day Change: 0.39 | |

| Week Change: 6.35% Year-to-date Change: -8.0% | |

| FA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FA to Watchlist:  View: View:  Get Complete FA Trend Analysis ➞ Get Complete FA Trend Analysis ➞ | |

| KMT Kennametal Inc. |

| Sector: Industrials | |

| SubSector: Machine Tools & Accessories | |

| MarketCap: 1486.48 Millions | |

| Recent Price: 21.02 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 2.74% Day Change: 0.69 | |

| Week Change: 5.61% Year-to-date Change: -8.0% | |

| KMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KMT to Watchlist:  View: View:  Get Complete KMT Trend Analysis ➞ Get Complete KMT Trend Analysis ➞ | |

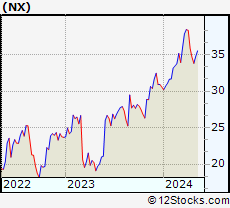

| NX Quanex Building Products Corporation |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 315.453 Millions | |

| Recent Price: 20.99 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 5.02% Day Change: 1.38 | |

| Week Change: 15.4% Year-to-date Change: -8.1% | |

| NX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NX to Watchlist:  View: View:  Get Complete NX Trend Analysis ➞ Get Complete NX Trend Analysis ➞ | |

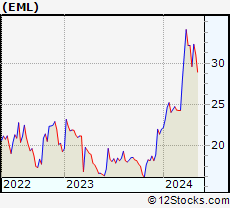

| EML The Eastern Company |

| Sector: Industrials | |

| SubSector: Small Tools & Accessories | |

| MarketCap: 140.356 Millions | |

| Recent Price: 21.52 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 68.24% Day Change: 12.61 | |

| Week Change: 8.08% Year-to-date Change: -8.5% | |

| EML Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EML to Watchlist:  View: View:  Get Complete EML Trend Analysis ➞ Get Complete EML Trend Analysis ➞ | |

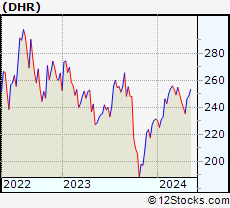

| DHR Danaher Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 93210.3 Millions | |

| Recent Price: 210.93 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.76% Day Change: 2.04 | |

| Week Change: 7.16% Year-to-date Change: -8.6% | |

| DHR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DHR to Watchlist:  View: View:  Get Complete DHR Trend Analysis ➞ Get Complete DHR Trend Analysis ➞ | |

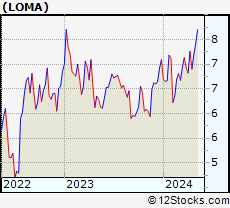

| LOMA Loma Negra Compania Industrial Argentina Sociedad Anonima |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 408.853 Millions | |

| Recent Price: 10.50 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 1.25% Day Change: 0.08 | |

| Week Change: -12.66% Year-to-date Change: -8.7% | |

| LOMA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LOMA to Watchlist:  View: View:  Get Complete LOMA Trend Analysis ➞ Get Complete LOMA Trend Analysis ➞ | |

| CCS Century Communities, Inc. |

| Sector: Industrials | |

| SubSector: Residential Construction | |

| MarketCap: 459.206 Millions | |

| Recent Price: 65.45 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 36.23% Day Change: 27.63 | |

| Week Change: 9.14% Year-to-date Change: -8.9% | |

| CCS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CCS to Watchlist:  View: View:  Get Complete CCS Trend Analysis ➞ Get Complete CCS Trend Analysis ➞ | |

| THR Thermon Group Holdings, Inc. |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 492.816 Millions | |

| Recent Price: 25.21 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 16.54% Day Change: 4.37 | |

| Week Change: -7.97% Year-to-date Change: -9.7% | |

| THR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THR to Watchlist:  View: View:  Get Complete THR Trend Analysis ➞ Get Complete THR Trend Analysis ➞ | |

| AMBI Ambipar Emergency Response |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 462 Millions | |

| Recent Price: 4.90 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -8.59% Day Change: -0.47 | |

| Week Change: -5.54% Year-to-date Change: -9.8% | |

| AMBI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMBI to Watchlist:  View: View:  Get Complete AMBI Trend Analysis ➞ Get Complete AMBI Trend Analysis ➞ | |

| IR Ingersoll Rand Inc. |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 8970.56 Millions | |

| Recent Price: 78.32 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 1.68% Day Change: 1.51 | |

| Week Change: 5.61% Year-to-date Change: -10.7% | |

| IR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IR to Watchlist:  View: View:  Get Complete IR Trend Analysis ➞ Get Complete IR Trend Analysis ➞ | |

| SNCY Sun Country Airlines Holdings, Inc. |

| Sector: Industrials | |

| SubSector: Airlines | |

| MarketCap: 1230 Millions | |

| Recent Price: 12.20 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 8.46% Day Change: 0.79 | |

| Week Change: 22.92% Year-to-date Change: -11.0% | |

| SNCY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SNCY to Watchlist:  View: View:  Get Complete SNCY Trend Analysis ➞ Get Complete SNCY Trend Analysis ➞ | |

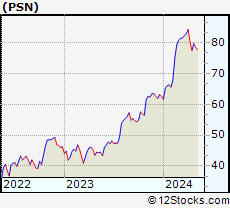

| PSN Parsons Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 3021.16 Millions | |

| Recent Price: 79.55 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.1% Day Change: 0.09 | |

| Week Change: 7.81% Year-to-date Change: -11.3% | |

| PSN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PSN to Watchlist:  View: View:  Get Complete PSN Trend Analysis ➞ Get Complete PSN Trend Analysis ➞ | |

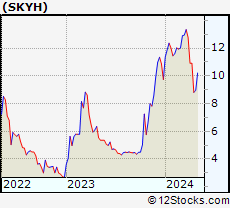

| SKYH Sky Harbour Group Corporation |

| Sector: Industrials | |

| SubSector: Aerospace & Defense | |

| MarketCap: 271 Millions | |

| Recent Price: 10.27 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 4.16% Day Change: 0.46 | |

| Week Change: 6.46% Year-to-date Change: -11.6% | |

| SKYH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SKYH to Watchlist:  View: View:  Get Complete SKYH Trend Analysis ➞ Get Complete SKYH Trend Analysis ➞ | |

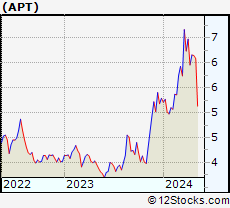

| APT Alpha Pro Tech, Ltd. |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 125.953 Millions | |

| Recent Price: 4.61 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 60.2% Day Change: 2.39 | |

| Week Change: -4.32% Year-to-date Change: -12.1% | |

| APT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add APT to Watchlist:  View: View:  Get Complete APT Trend Analysis ➞ Get Complete APT Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Industrial Stocks With Best Up Trends [0-bearish to 100-bullish]: Toll Brothers[100], Pulte [100], Taylor Morrison[100], Century Communities[100], Masco [100], Legacy Housing[100], Evolv Technologies[100], Solid Power[100], Meritage Homes[100], Proto Labs[100], Installed Building[100]

Best Industrial Stocks Year-to-Date:

China Yuchai[215.15%], Amprius Technologies[173.93%], Solid Power[155.03%], Tutor Perini[138.64%], Symbotic [126.4%], American Superconductor[119.61%], Joby Aviation[118.82%], Astronics [114.6%], NuScale Power[108.03%], Evolv Technologies[89.62%], Elbit Systems[79.41%] Best Industrial Stocks This Week:

Solid Power[40.52%], Frontier [37.7%], Hillenbrand [34.71%], CompoSecure [34.1%], Installed Building[28.67%], LegalZoom.com [25.35%], Construction Partners[24.32%], China Yuchai[24.26%], Montrose Environmental[23.35%], Sun Country[22.92%], Tutor Perini[22.14%] Best Industrial Stocks Daily:

Embraer S.A[128.34%], Virgin Galactic[105.78%], Graham [92.69%], Argan [92.17%], AeroVironment [91.63%], Construction Partners[90.54%], Comfort Systems[86.98%], Toll Brothers[84.15%], Granite Construction[74.15%], Eastern [68.24%], Armstrong World[62.49%]

China Yuchai[215.15%], Amprius Technologies[173.93%], Solid Power[155.03%], Tutor Perini[138.64%], Symbotic [126.4%], American Superconductor[119.61%], Joby Aviation[118.82%], Astronics [114.6%], NuScale Power[108.03%], Evolv Technologies[89.62%], Elbit Systems[79.41%] Best Industrial Stocks This Week:

Solid Power[40.52%], Frontier [37.7%], Hillenbrand [34.71%], CompoSecure [34.1%], Installed Building[28.67%], LegalZoom.com [25.35%], Construction Partners[24.32%], China Yuchai[24.26%], Montrose Environmental[23.35%], Sun Country[22.92%], Tutor Perini[22.14%] Best Industrial Stocks Daily:

Embraer S.A[128.34%], Virgin Galactic[105.78%], Graham [92.69%], Argan [92.17%], AeroVironment [91.63%], Construction Partners[90.54%], Comfort Systems[86.98%], Toll Brothers[84.15%], Granite Construction[74.15%], Eastern [68.24%], Armstrong World[62.49%]

Login Sign Up

Login Sign Up