Best Healthcare Stocks

| "Discover best trending healthcare stocks with 12Stocks.com." |

| - Subu Vdaygiri, Founder, 12Stocks.com |

| In a hurry? Healthcare Stocks Lists: Performance Trends Table, Stock Charts

Sort Healthcare stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Healthcare stocks list by size:All Healthcare Large Mid-Range Small |

| 12Stocks.com Healthcare Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 100 (0-bearish to 100-bullish) which puts Healthcare sector in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 70 and an improvement of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Healthcare stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Healthcare sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Healthcare sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Healthcare Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| DPLO | Diplomat Pharmacy |   | Pharmaceutical | 19.70 | 0 | 0.46% | 0.00% |

| ZEAL | Zealand Pharma |   | Biotechnology | 17.59 | 10 | 0.00% | 0.00% |

| KANG | iKang |   | Laboratories | 52.79 | 80 | 0.00% | 0.00% |

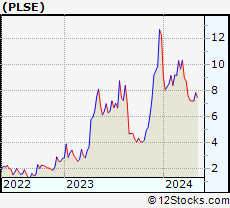

| PLSE | Pulse Biosciences |   | Instruments | 18.99 | 100 | 4.80% | 6.75% |

| DEPO | Depomed |   | Pharmaceutical | 7.30 | 0 | 0.00% | 0.00% |

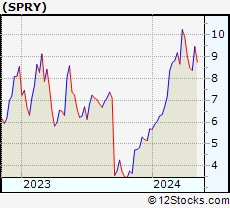

| SPRY | ARS |   | Biotechnology | 10.29 | 70 | 1.98% | -3.92% |

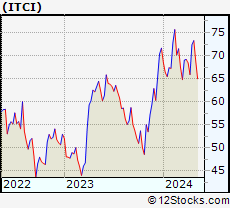

| ITCI | Intra-Cellular Therapies |   | Biotechnology | 131.87 | 50 | -0.04% | 56.54% |

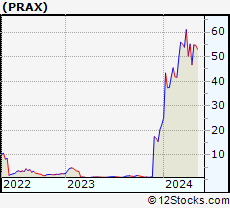

| PRAX | Praxis Precision |   | Biotechnology | 55.15 | 90 | 4.02% | -30.65% |

| QURE | uniQure N.V |   | Biotechnology | 54.50 | 60 | -0.89% | 201.94% |

| ATAI | ATAI Life |   | Biotechnology | 5.14 | 70 | -1.15% | 221.25% |

| EYPT | EyePoint |   | Biotechnology | 13.49 | 40 | 4.49% | 68.06% |

| CRON | Cronos |   | Drug Manufacturers - Specialty & Generic | 2.59 | 50 | -2.63% | 25.73% |

| NGM | NGM Bio |   | Biotechnology | 1.54 | 20 | 0.00% | 0.00% |

| QSII | Quality Systems |   | HealthcareIT | 22.35 | 20 | 0.00% | 0.00% |

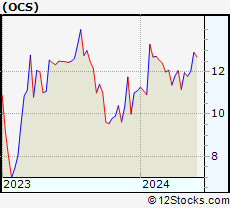

| OCS | Oculis Holding |   | Biotechnology | 17.52 | 40 | 0.69% | 3.48% |

| ALOG | Analogic |   | Laboratories | 137.94 | 40 | -0.70% | 0.00% |

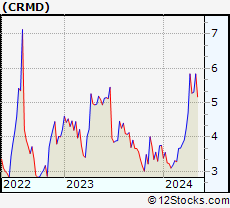

| CRMD | CorMedix |   | Biotechnology | 11.04 | 20 | -0.08% | 34.32% |

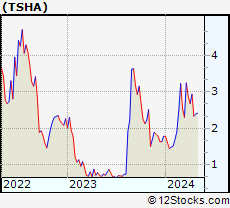

| TSHA | Taysha Gene |   | Biotechnology | 4.88 | 100 | 53.46% | 163.78% |

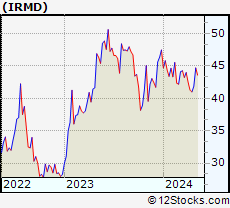

| IRMD | Iradimed Corp |   | Medical Devices | 71.05 | 70 | 0.89% | 30.12% |

| IMNM | Immunome |   | Biotechnology | 11.48 | 90 | 1.23% | 9.02% |

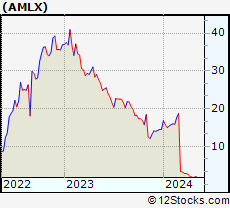

| AMLX | Amylyx |   | Biotechnology | 13.29 | 53 | 4.98% | 123.02% |

| AIMT | Aimmune |   | Biotechnology | 150.75 | 70 | 3.66% | 0.00% |

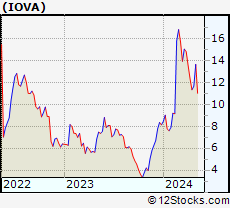

| IOVA | Iovance Bio |   | Biotechnology | 2.25 | 60 | 1.81% | -71.12% |

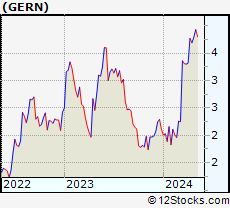

| GERN | Geron Corp |   | Biotechnology | 1.38 | 90 | -2.48% | -61.81% |

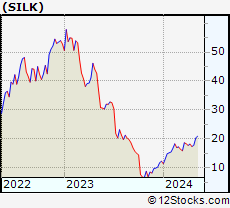

| SILK | Silk Road |   | Equipment | 27.49 | 40 | 0.00% | 0.00% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Healthcare Stocks |

| Healthcare Technical Overview, Leaders & Laggards, Top Healthcare ETF Funds & Detailed Healthcare Stocks List, Charts, Trends & More |

| Healthcare Sector: Technical Analysis, Trends & YTD Performance | |

| Healthcare sector is composed of stocks

from pharmaceutical, biotech, diagnostics labs, insurance providers

and healthcare services. Healthcare sector, as represented by XLV, an exchange-traded fund [ETF] that holds basket of Healthcare stocks (e.g, Merck, Amgen) is up by 4.95646% and is currently underperforming the overall market by -9.80144% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLV Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

XLV Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 100 | |

| YTD Performance: 4.95646% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Healthcare Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||

The top performing Healthcare sector stocks year to date are

Now, more recently, over last week, the top performing Healthcare sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Healthcare Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Healthcare Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Healthcare Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| BTEC | Principal Healthcare Innovators |   | 39.49 | 30 | 0 | 1.02328 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Healthcare Stocks | |

|

We now take in-depth look at all Healthcare stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Healthcare stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

| DPLO Diplomat Pharmacy, Inc. |

| Sector: Health Care | |

| SubSector: Drugs - Generic | |

| MarketCap: 1028.62 Millions | |

| Recent Price: 19.70 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.45895% Day Change: -9999 | |

| Week Change: -47.1708% Year-to-date Change: 0.0% | |

| DPLO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DPLO to Watchlist:  View: View:  Get Complete DPLO Trend Analysis ➞ Get Complete DPLO Trend Analysis ➞ | |

| ZEAL Zealand Pharma A/S |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1025.75 Millions | |

| Recent Price: 17.59 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| ZEAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ZEAL to Watchlist:  View: View:  Get Complete ZEAL Trend Analysis ➞ Get Complete ZEAL Trend Analysis ➞ | |

| KANG iKang Healthcare Group, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 1023.9 Millions | |

| Recent Price: 52.79 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 6.19594% Year-to-date Change: 0.0% | |

| KANG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KANG to Watchlist:  View: View:  Get Complete KANG Trend Analysis ➞ Get Complete KANG Trend Analysis ➞ | |

| PLSE Pulse Biosciences Inc |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 1016.58 Millions | |

| Recent Price: 18.99 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 4.80132% Day Change: 0.05 | |

| Week Change: 7.47029% Year-to-date Change: 6.7% | |

| PLSE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PLSE to Watchlist:  View: View:  Get Complete PLSE Trend Analysis ➞ Get Complete PLSE Trend Analysis ➞ | |

| DEPO Depomed, Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 997.04 Millions | |

| Recent Price: 7.30 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| DEPO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DEPO to Watchlist:  View: View:  Get Complete DEPO Trend Analysis ➞ Get Complete DEPO Trend Analysis ➞ | |

| SPRY ARS Pharmaceuticals Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 995.18 Millions | |

| Recent Price: 10.29 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 1.98216% Day Change: 0.27 | |

| Week Change: 6.85358% Year-to-date Change: -3.9% | |

| SPRY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SPRY to Watchlist:  View: View:  Get Complete SPRY Trend Analysis ➞ Get Complete SPRY Trend Analysis ➞ | |

| ITCI Intra-Cellular Therapies, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 991.885 Millions | |

| Recent Price: 131.87 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -0.0379018% Day Change: -9999 | |

| Week Change: 0.129081% Year-to-date Change: 56.5% | |

| ITCI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ITCI to Watchlist:  View: View:  Get Complete ITCI Trend Analysis ➞ Get Complete ITCI Trend Analysis ➞ | |

| PRAX Praxis Precision Medicines Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 985.99 Millions | |

| Recent Price: 55.15 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 4.01735% Day Change: 1.13 | |

| Week Change: 12.62% Year-to-date Change: -30.6% | |

| PRAX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PRAX to Watchlist:  View: View:  Get Complete PRAX Trend Analysis ➞ Get Complete PRAX Trend Analysis ➞ | |

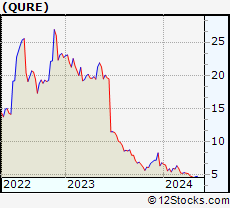

| QURE uniQure N.V |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 984.86 Millions | |

| Recent Price: 54.50 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -0.891071% Day Change: 0.07 | |

| Week Change: 16.453% Year-to-date Change: 201.9% | |

| QURE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QURE to Watchlist:  View: View:  Get Complete QURE Trend Analysis ➞ Get Complete QURE Trend Analysis ➞ | |

| ATAI ATAI Life Sciences N.V |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 979.53 Millions | |

| Recent Price: 5.14 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -1.15385% Day Change: 0.42 | |

| Week Change: -6.37523% Year-to-date Change: 221.3% | |

| ATAI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATAI to Watchlist:  View: View:  Get Complete ATAI Trend Analysis ➞ Get Complete ATAI Trend Analysis ➞ | |

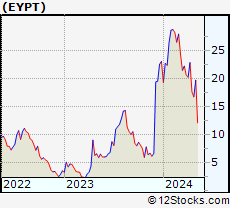

| EYPT EyePoint Pharmaceuticals Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 965.67 Millions | |

| Recent Price: 13.49 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 4.4909% Day Change: 0.09 | |

| Week Change: -4.15483% Year-to-date Change: 68.1% | |

| EYPT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EYPT to Watchlist:  View: View:  Get Complete EYPT Trend Analysis ➞ Get Complete EYPT Trend Analysis ➞ | |

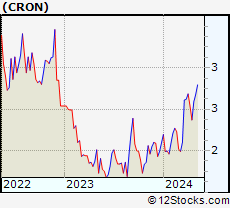

| CRON Cronos Group Inc |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Specialty & Generic | |

| MarketCap: 957.35 Millions | |

| Recent Price: 2.59 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -2.63158% Day Change: 0.14 | |

| Week Change: -4.42804% Year-to-date Change: 25.7% | |

| CRON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRON to Watchlist:  View: View:  Get Complete CRON Trend Analysis ➞ Get Complete CRON Trend Analysis ➞ | |

| NGM NGM Biopharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 951.385 Millions | |

| Recent Price: 1.54 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: -3.14465% Year-to-date Change: 0.0% | |

| NGM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGM to Watchlist:  View: View:  Get Complete NGM Trend Analysis ➞ Get Complete NGM Trend Analysis ➞ | |

| QSII Quality Systems, Inc. |

| Sector: Health Care | |

| SubSector: Healthcare Information Services | |

| MarketCap: 943.44 Millions | |

| Recent Price: 22.35 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| QSII Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QSII to Watchlist:  View: View:  Get Complete QSII Trend Analysis ➞ Get Complete QSII Trend Analysis ➞ | |

| OCS Oculis Holding AG |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 939.07 Millions | |

| Recent Price: 17.52 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0.689655% Day Change: 0.25 | |

| Week Change: -1.12867% Year-to-date Change: 3.5% | |

| OCS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OCS to Watchlist:  View: View:  Get Complete OCS Trend Analysis ➞ Get Complete OCS Trend Analysis ➞ | |

| ALOG Analogic Corporation |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 926.64 Millions | |

| Recent Price: 137.94 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -0.698294% Day Change: -9999 | |

| Week Change: 3.30263% Year-to-date Change: 0.0% | |

| ALOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALOG to Watchlist:  View: View:  Get Complete ALOG Trend Analysis ➞ Get Complete ALOG Trend Analysis ➞ | |

| CRMD CorMedix Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 925.65 Millions | |

| Recent Price: 11.04 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -0.081448% Day Change: 0.04 | |

| Week Change: -1.77046% Year-to-date Change: 34.3% | |

| CRMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRMD to Watchlist:  View: View:  Get Complete CRMD Trend Analysis ➞ Get Complete CRMD Trend Analysis ➞ | |

| TSHA Taysha Gene Therapies Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 916.59 Millions | |

| Recent Price: 4.88 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 53.4591% Day Change: 0 | |

| Week Change: 54.9206% Year-to-date Change: 163.8% | |

| TSHA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TSHA to Watchlist:  View: View:  Get Complete TSHA Trend Analysis ➞ Get Complete TSHA Trend Analysis ➞ | |

| IRMD Iradimed Corp |

| Sector: Health Care | |

| SubSector: Medical Devices | |

| MarketCap: 915.71 Millions | |

| Recent Price: 71.05 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 0.894632% Day Change: 0.71 | |

| Week Change: 1.16759% Year-to-date Change: 30.1% | |

| IRMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IRMD to Watchlist:  View: View:  Get Complete IRMD Trend Analysis ➞ Get Complete IRMD Trend Analysis ➞ | |

| IMNM Immunome Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 915.71 Millions | |

| Recent Price: 11.48 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 1.23457% Day Change: 0.38 | |

| Week Change: 2.5% Year-to-date Change: 9.0% | |

| IMNM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IMNM to Watchlist:  View: View:  Get Complete IMNM Trend Analysis ➞ Get Complete IMNM Trend Analysis ➞ | |

| AMLX Amylyx Pharmaceuticals Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 909.51 Millions | |

| Recent Price: 13.29 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 4.98% Day Change: 0.4 | |

| Week Change: 0.24% Year-to-date Change: 123.0% | |

| AMLX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMLX to Watchlist:  View: View:  Get Complete AMLX Trend Analysis ➞ Get Complete AMLX Trend Analysis ➞ | |

| AIMT Aimmune Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 903.485 Millions | |

| Recent Price: 150.75 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 3.65812% Day Change: -9999 | |

| Week Change: -12.7352% Year-to-date Change: 0.0% | |

| AIMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AIMT to Watchlist:  View: View:  Get Complete AIMT Trend Analysis ➞ Get Complete AIMT Trend Analysis ➞ | |

| IOVA Iovance Biotherapeutics Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 901.02 Millions | |

| Recent Price: 2.25 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 1.80995% Day Change: 0.01 | |

| Week Change: 6.13208% Year-to-date Change: -71.1% | |

| IOVA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IOVA to Watchlist:  View: View:  Get Complete IOVA Trend Analysis ➞ Get Complete IOVA Trend Analysis ➞ | |

| GERN Geron Corp |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 893.22 Millions | |

| Recent Price: 1.38 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -2.48227% Day Change: 0.04 | |

| Week Change: 3.38346% Year-to-date Change: -61.8% | |

| GERN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GERN to Watchlist:  View: View:  Get Complete GERN Trend Analysis ➞ Get Complete GERN Trend Analysis ➞ | |

| SILK Silk Road Medical, Inc |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 881.78 Millions | |

| Recent Price: 27.49 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0% Year-to-date Change: 0.0% | |

| SILK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SILK to Watchlist:  View: View:  Get Complete SILK Trend Analysis ➞ Get Complete SILK Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Healthcare Stocks With Best Up Trends [0-bearish to 100-bullish]: Taysha Gene[100], DBV Technologies[100], Valneva SE[100], ClearPoint Neuro[100], Prime Medicine[100], AlloVir [100], Sarepta [100], Monopar [100], Cara [100], Absci Corp[100], Spruce Biosciences[100]

Best Healthcare Stocks Year-to-Date:

Regencell Bioscience[12636.6%], Kaleido BioSciences[9900%], Vor Biopharma[3175%], Nanobiotix ADR[581.379%], Eagle [542.857%], So-Young [395.711%], I-Mab ADR[357.506%], Monopar [337.489%], Nektar [319.84%], 908 Devices[299.543%], DBV Technologies[276.923%] Best Healthcare Stocks This Week:

Athersys [193287%], Nobilis Health[101349%], VBI Vaccines[86898.5%], ContraFect [47677.8%], Clovis Oncology[39610.5%], Endo [28369.6%], NanoString Technologies[17224.7%], Neptune Wellness[14100%], ViewRay [11470.2%], Mallkrodt [11382.1%], Achillion [10033.3%] Best Healthcare Stocks Daily:

Kaleido BioSciences[9900%], Neoleukin [332.665%], Syros [226.23%], Athenex [103.333%], Taysha Gene[53.4591%], DBV Technologies[21.6485%], Valneva SE[20.197%], ClearPoint Neuro[19.7991%], Prime Medicine[19.4097%], Accelerate Diagnostics[17.6471%], Aptose Biosciences[17.5439%]

Regencell Bioscience[12636.6%], Kaleido BioSciences[9900%], Vor Biopharma[3175%], Nanobiotix ADR[581.379%], Eagle [542.857%], So-Young [395.711%], I-Mab ADR[357.506%], Monopar [337.489%], Nektar [319.84%], 908 Devices[299.543%], DBV Technologies[276.923%] Best Healthcare Stocks This Week:

Athersys [193287%], Nobilis Health[101349%], VBI Vaccines[86898.5%], ContraFect [47677.8%], Clovis Oncology[39610.5%], Endo [28369.6%], NanoString Technologies[17224.7%], Neptune Wellness[14100%], ViewRay [11470.2%], Mallkrodt [11382.1%], Achillion [10033.3%] Best Healthcare Stocks Daily:

Kaleido BioSciences[9900%], Neoleukin [332.665%], Syros [226.23%], Athenex [103.333%], Taysha Gene[53.4591%], DBV Technologies[21.6485%], Valneva SE[20.197%], ClearPoint Neuro[19.7991%], Prime Medicine[19.4097%], Accelerate Diagnostics[17.6471%], Aptose Biosciences[17.5439%]

Login Sign Up

Login Sign Up