Best Gold Stocks

|

|

| Quick Read: Best Gold Stocks List By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Gold Stocks Views: Quick Browse View, Summary & Slide Show View | |||

| 12Stocks.com Gold Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 70 (0-bearish to 100-bullish) which puts Gold sector in short term neutral to bullish trend. The market intelligence score from previous trading session is 50 and an improvement of trend continues.

| ||||||||

Here are the market intelligence trend scores of the most requested Gold stocks at 12Stocks.com (click stock name for detailed review):

| ||||||||||||||||||||||||||||||||

| Scroll down this page for most comprehensive review of Gold stocks by performance, trends, technical analysis, charts, fund plays & more | ||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Gold sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Gold sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Gold Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | Weekly Change% |

| GSS | Golden Star |   | Gold | 75.58 | 80 | 1.27% | 1,837.95% |

| AXU | Alexco Resource |   | Minerals | 3.52 | 70 | -0.56% | 690.30% |

| HCLP | Hi-Crush Partners |   | Minerals | 85.00 | 60 | -6.75% | 626.50% |

| AUY | Yamana Gold |   | Gold | 42.46 | 70 | 1.77% | 625.81% |

| PLM | PolyMet Mining |   | Minerals | 4.84 | 90 | 1.47% | 129.38% |

| SLW | Silver Wheaton |   | Silver | 118.80 | 60 | 0.65% | 84.19% |

| SMTS | Sierra Metals |   | Minerals | 0.29 | 80 | -2.66% | 67.43% |

| VEDL | Vedanta |   | Minerals | 27.08 | 70 | -0.44% | 61.96% |

| CVIA | Covia |   | Minerals | 23.89 | 70 | -1.81% | 30.76% |

| CLD | Cloud Peak |   | Minerals | 38.59 | 90 | 1.61% | 28.76% |

| NG | Novagold Resources |   | Gold | 9.65 | 100 | -4.64% | 25.65% |

| MPVD | Mountain Prove |   | Minerals | 10.23 | 80 | -4.39% | 22.66% |

| PVG | Pretium Resources |   | Gold | 17.94 | 80 | 1.36% | 17.64% |

| SA | Seabridge Gold |   | Gold | 24.85 | 90 | -0.52% | 17.22% |

| KLDX | Klondex Mines |   | Minerals | 56.07 | 50 | -0.95% | 16.91% |

| IAG | Iamgold Corp |   | Gold | 13.29 | 100 | 1.84% | 13.59% |

| ARCH | Arch Coal |   | Minerals | 10.35 | 80 | 8.72% | 13.11% |

| SVM | Silvercorp Metals |   | Silver | 6.63 | 100 | 1.69% | 12.76% |

| NFGC | New Found |   | Gold | 2.34 | 50 | -3.31% | 11.43% |

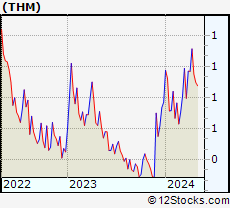

| THM | Tower Hill |   | Gold | 1.67 | 80 | -5.65% | 10.60% |

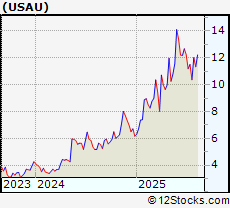

| USAU | U.S. Gold |   | Gold | 16.54 | 70 | -2.76% | 9.39% |

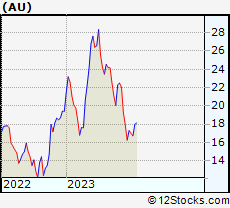

| AU | AngloGold Ashanti |   | Gold | 72.46 | 80 | 1.10% | 8.80% |

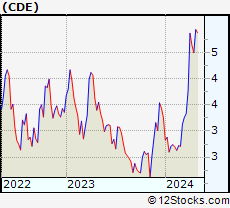

| CDE | Coeur Mining |   | Gold | 18.80 | 90 | -0.42% | 7.92% |

| PAAS | Pan American |   | Gold | 39.19 | 70 | -0.23% | 7.69% |

| NGD | New Gold |   | Gold | 7.35 | 80 | 0.96% | 7.61% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Gold Stocks |

| Gold Technical Overview, Leaders & Laggards, Top Gold ETF Funds & Detailed Gold Stocks List, Charts, Trends & More |

| Gold Sector: Technical Analysis, Trends & YTD Performance | |

| Gold sector, as represented by GDX, an exchange-traded fund [ETF] that holds basket of Gold stocks (e.g, Newmont Mining, Pan American Silver) is up by 118.166% and is currently outperforming the overall market by 103.4081% year-to-date. Below is a quick view of Technical charts and trends: | |

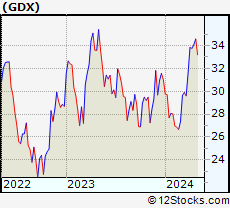

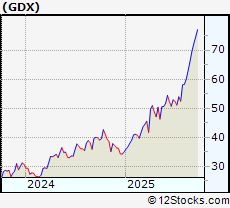

GDX Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

GDX Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 70 | |

| YTD Performance: 118.166% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Gold Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Gold sector stocks year to date are

Now, more recently, over last week, the top performing Gold sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Gold Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Gold Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Gold Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| PGM | Platinum Sub |   | 49.41 | 10 | 0 | 0 | 0% |

| USLV | Long Silver |   | 100.56 | 80 | -0.524285 | 394.638 | 0% |

| DSLV | Inverse Silver |   | 0.55 | 10 | -0.669199 | -19.5075 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Gold Stocks | |

|

We now take in-depth look at all Gold stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Gold stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

| GSS Golden Star Resources Ltd. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 261.919 Millions | |

| Recent Price: 75.58 Market Intelligence Score: 80 | |

| Day Percent Change: 1.27295% Day Change: -9999 | |

| Week Change: 1837.95% Year-to-date Change: 0.0% | |

| GSS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GSS to Watchlist:  View: View:  Get Complete GSS Trend Analysis ➞ Get Complete GSS Trend Analysis ➞ | |

| AXU Alexco Resource Corp. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 230.41 Millions | |

| Recent Price: 3.52 Market Intelligence Score: 70 | |

| Day Percent Change: -0.564972% Day Change: -9999 | |

| Week Change: 690.301% Year-to-date Change: 0.0% | |

| AXU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AXU to Watchlist:  View: View:  Get Complete AXU Trend Analysis ➞ Get Complete AXU Trend Analysis ➞ | |

| HCLP Hi-Crush Partners LP |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 1333.67 Millions | |

| Recent Price: 85.00 Market Intelligence Score: 60 | |

| Day Percent Change: -6.74712% Day Change: -9999 | |

| Week Change: 626.496% Year-to-date Change: 0.0% | |

| HCLP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HCLP to Watchlist:  View: View:  Get Complete HCLP Trend Analysis ➞ Get Complete HCLP Trend Analysis ➞ | |

| AUY Yamana Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 2786.49 Millions | |

| Recent Price: 42.46 Market Intelligence Score: 70 | |

| Day Percent Change: 1.77373% Day Change: -9999 | |

| Week Change: 625.812% Year-to-date Change: 0.0% | |

| AUY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AUY to Watchlist:  View: View:  Get Complete AUY Trend Analysis ➞ Get Complete AUY Trend Analysis ➞ | |

| PLM PolyMet Mining Corp. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 233.11 Millions | |

| Recent Price: 4.84 Market Intelligence Score: 90 | |

| Day Percent Change: 1.46751% Day Change: -9999 | |

| Week Change: 129.384% Year-to-date Change: 0.0% | |

| PLM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PLM to Watchlist:  View: View:  Get Complete PLM Trend Analysis ➞ Get Complete PLM Trend Analysis ➞ | |

| SLW Silver Wheaton Corp. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 8631.34 Millions | |

| Recent Price: 118.80 Market Intelligence Score: 60 | |

| Day Percent Change: 0.652377% Day Change: -9999 | |

| Week Change: 84.186% Year-to-date Change: 0.0% | |

| SLW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SLW to Watchlist:  View: View:  Get Complete SLW Trend Analysis ➞ Get Complete SLW Trend Analysis ➞ | |

| SMTS Sierra Metals Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 124.91 Millions | |

| Recent Price: 0.29 Market Intelligence Score: 80 | |

| Day Percent Change: -2.65781% Day Change: -9999 | |

| Week Change: 67.4286% Year-to-date Change: 0.0% | |

| SMTS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SMTS to Watchlist:  View: View:  Get Complete SMTS Trend Analysis ➞ Get Complete SMTS Trend Analysis ➞ | |

| VEDL Vedanta Limited |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 4079.5 Millions | |

| Recent Price: 27.08 Market Intelligence Score: 70 | |

| Day Percent Change: -0.441176% Day Change: -9999 | |

| Week Change: 61.9617% Year-to-date Change: 0.0% | |

| VEDL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VEDL to Watchlist:  View: View:  Get Complete VEDL Trend Analysis ➞ Get Complete VEDL Trend Analysis ➞ | |

| CVIA Covia Holdings Corporation |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 105.31 Millions | |

| Recent Price: 23.89 Market Intelligence Score: 70 | |

| Day Percent Change: -1.80847% Day Change: -9999 | |

| Week Change: 30.7608% Year-to-date Change: 0.0% | |

| CVIA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVIA to Watchlist:  View: View:  Get Complete CVIA Trend Analysis ➞ Get Complete CVIA Trend Analysis ➞ | |

| CLD Cloud Peak Energy Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 302.13 Millions | |

| Recent Price: 38.59 Market Intelligence Score: 90 | |

| Day Percent Change: 1.60611% Day Change: -9999 | |

| Week Change: 28.7621% Year-to-date Change: 0.0% | |

| CLD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CLD to Watchlist:  View: View:  Get Complete CLD Trend Analysis ➞ Get Complete CLD Trend Analysis ➞ | |

| NG Novagold Resources Inc |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 2750.64 Millions | |

| Recent Price: 9.65 Market Intelligence Score: 100 | |

| Day Percent Change: -4.64427% Day Change: 0.03 | |

| Week Change: 25.651% Year-to-date Change: 181.3% | |

| NG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NG to Watchlist:  View: View:  Get Complete NG Trend Analysis ➞ Get Complete NG Trend Analysis ➞ | |

| MPVD Mountain Province Diamonds Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 581.66 Millions | |

| Recent Price: 10.23 Market Intelligence Score: 80 | |

| Day Percent Change: -4.39252% Day Change: -9999 | |

| Week Change: 22.6619% Year-to-date Change: 0.0% | |

| MPVD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MPVD to Watchlist:  View: View:  Get Complete MPVD Trend Analysis ➞ Get Complete MPVD Trend Analysis ➞ | |

| PVG Pretium Resources Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1025.19 Millions | |

| Recent Price: 17.94 Market Intelligence Score: 80 | |

| Day Percent Change: 1.35593% Day Change: -9999 | |

| Week Change: 17.6393% Year-to-date Change: 0.0% | |

| PVG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PVG to Watchlist:  View: View:  Get Complete PVG Trend Analysis ➞ Get Complete PVG Trend Analysis ➞ | |

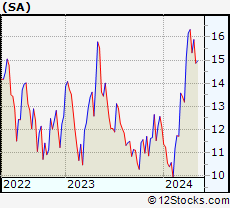

| SA Seabridge Gold, Inc |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1782.57 Millions | |

| Recent Price: 24.85 Market Intelligence Score: 90 | |

| Day Percent Change: -0.520416% Day Change: 0.2 | |

| Week Change: 17.217% Year-to-date Change: 106.4% | |

| SA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SA to Watchlist:  View: View:  Get Complete SA Trend Analysis ➞ Get Complete SA Trend Analysis ➞ | |

| KLDX Klondex Mines Ltd. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 755.11 Millions | |

| Recent Price: 56.07 Market Intelligence Score: 50 | |

| Day Percent Change: -0.953895% Day Change: -9999 | |

| Week Change: 16.9099% Year-to-date Change: 0.0% | |

| KLDX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KLDX to Watchlist:  View: View:  Get Complete KLDX Trend Analysis ➞ Get Complete KLDX Trend Analysis ➞ | |

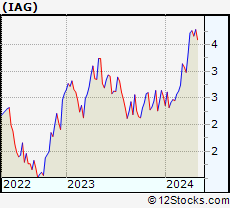

| IAG Iamgold Corp |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 5699.24 Millions | |

| Recent Price: 13.29 Market Intelligence Score: 100 | |

| Day Percent Change: 1.83908% Day Change: -0.32 | |

| Week Change: 13.5897% Year-to-date Change: 138.2% | |

| IAG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IAG to Watchlist:  View: View:  Get Complete IAG Trend Analysis ➞ Get Complete IAG Trend Analysis ➞ | |

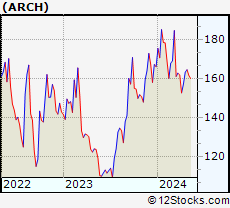

| ARCH Arch Coal, Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 547.21 Millions | |

| Recent Price: 10.35 Market Intelligence Score: 80 | |

| Day Percent Change: 8.71849% Day Change: -9999 | |

| Week Change: 13.1148% Year-to-date Change: 8.2% | |

| ARCH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARCH to Watchlist:  View: View:  Get Complete ARCH Trend Analysis ➞ Get Complete ARCH Trend Analysis ➞ | |

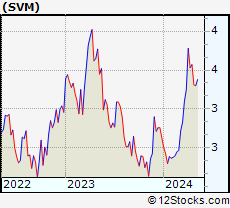

| SVM Silvercorp Metals Inc |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 1075.66 Millions | |

| Recent Price: 6.63 Market Intelligence Score: 100 | |

| Day Percent Change: 1.68712% Day Change: 0.07 | |

| Week Change: 12.7551% Year-to-date Change: 111.1% | |

| SVM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SVM to Watchlist:  View: View:  Get Complete SVM Trend Analysis ➞ Get Complete SVM Trend Analysis ➞ | |

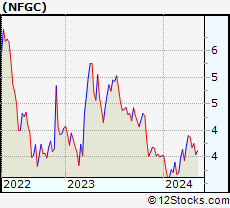

| NFGC New Found Gold Corp |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 413.53 Millions | |

| Recent Price: 2.34 Market Intelligence Score: 50 | |

| Day Percent Change: -3.30579% Day Change: 0.05 | |

| Week Change: 11.4286% Year-to-date Change: 21.2% | |

| NFGC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NFGC to Watchlist:  View: View:  Get Complete NFGC Trend Analysis ➞ Get Complete NFGC Trend Analysis ➞ | |

| THM International Tower Hill Mines Ltd |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 293.11 Millions | |

| Recent Price: 1.67 Market Intelligence Score: 80 | |

| Day Percent Change: -5.64972% Day Change: 0.08 | |

| Week Change: 10.596% Year-to-date Change: 254.6% | |

| THM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THM to Watchlist:  View: View:  Get Complete THM Trend Analysis ➞ Get Complete THM Trend Analysis ➞ | |

| USAU U.S. Gold Corp |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 174.9 Millions | |

| Recent Price: 16.54 Market Intelligence Score: 70 | |

| Day Percent Change: -2.76308% Day Change: 0.71 | |

| Week Change: 9.39153% Year-to-date Change: 168.1% | |

| USAU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add USAU to Watchlist:  View: View:  Get Complete USAU Trend Analysis ➞ Get Complete USAU Trend Analysis ➞ | |

| AU AngloGold Ashanti Plc |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 30095.8 Millions | |

| Recent Price: 72.46 Market Intelligence Score: 80 | |

| Day Percent Change: 1.10227% Day Change: -1.55 | |

| Week Change: 8.7988% Year-to-date Change: 205.0% | |

| AU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AU to Watchlist:  View: View:  Get Complete AU Trend Analysis ➞ Get Complete AU Trend Analysis ➞ | |

| CDE Coeur Mining Inc |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 9428.64 Millions | |

| Recent Price: 18.80 Market Intelligence Score: 90 | |

| Day Percent Change: -0.423729% Day Change: 0.22 | |

| Week Change: 7.92193% Year-to-date Change: 203.2% | |

| CDE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CDE to Watchlist:  View: View:  Get Complete CDE Trend Analysis ➞ Get Complete CDE Trend Analysis ➞ | |

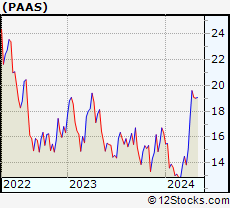

| PAAS Pan American Silver Corp |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 12518.3 Millions | |

| Recent Price: 39.19 Market Intelligence Score: 70 | |

| Day Percent Change: -0.229124% Day Change: -1.55 | |

| Week Change: 7.69442% Year-to-date Change: 85.0% | |

| PAAS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAAS to Watchlist:  View: View:  Get Complete PAAS Trend Analysis ➞ Get Complete PAAS Trend Analysis ➞ | |

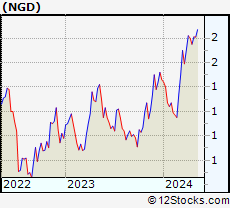

| NGD New Gold Inc |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 4987.71 Millions | |

| Recent Price: 7.35 Market Intelligence Score: 80 | |

| Day Percent Change: 0.961538% Day Change: -0.21 | |

| Week Change: 7.61347% Year-to-date Change: 180.5% | |

| NGD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGD to Watchlist:  View: View:  Get Complete NGD Trend Analysis ➞ Get Complete NGD Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Gold Stocks With Best Up Trends [0-bearish to 100-bullish]: Iamgold Corp[100], Silvercorp Metals[100], Novagold Resources[100], Cloud Peak[90], PolyMet Mining[90], Newmont Corp[90], Fortuna Mining[90], Coeur Mining[90], Seabridge Gold[90], Arch Coal[80], Pretium Resources[80]

Best Gold Stocks Year-to-Date:

Vista Gold[273.653%], Gold Resource[272.523%], Tower Hill[254.565%], SSR Mining[227.298%], DRDGold .[211.911%], Gold Royalty[206.452%], Gold Fields[206.101%], AngloGold Ashanti[205.031%], Coeur Mining[203.226%], Novagold Resources[181.341%], New Gold[180.534%] Best Gold Stocks This Week:

Golden Star[1837.95%], Alexco Resource[690.301%], Hi-Crush Partners[626.496%], Yamana Gold[625.812%], PolyMet Mining[129.384%], Silver Wheaton[84.186%], Sierra Metals[67.4286%], Vedanta [61.9617%], Covia [30.7608%], Cloud Peak[28.7621%], Novagold Resources[25.651%] Best Gold Stocks Daily:

Arch Coal[8.71849%], Sibanye Gold[5.06135%], MFC Bancorp[2.8169%], CONSOL Energy[2.30901%], Iamgold Corp[1.83908%], Dakota Gold[1.82%], Yamana Gold[1.77373%], Silvercorp Metals[1.68712%], Cloud Peak[1.60611%], PolyMet Mining[1.46751%], Tahoe Resources[1.39543%]

Vista Gold[273.653%], Gold Resource[272.523%], Tower Hill[254.565%], SSR Mining[227.298%], DRDGold .[211.911%], Gold Royalty[206.452%], Gold Fields[206.101%], AngloGold Ashanti[205.031%], Coeur Mining[203.226%], Novagold Resources[181.341%], New Gold[180.534%] Best Gold Stocks This Week:

Golden Star[1837.95%], Alexco Resource[690.301%], Hi-Crush Partners[626.496%], Yamana Gold[625.812%], PolyMet Mining[129.384%], Silver Wheaton[84.186%], Sierra Metals[67.4286%], Vedanta [61.9617%], Covia [30.7608%], Cloud Peak[28.7621%], Novagold Resources[25.651%] Best Gold Stocks Daily:

Arch Coal[8.71849%], Sibanye Gold[5.06135%], MFC Bancorp[2.8169%], CONSOL Energy[2.30901%], Iamgold Corp[1.83908%], Dakota Gold[1.82%], Yamana Gold[1.77373%], Silvercorp Metals[1.68712%], Cloud Peak[1.60611%], PolyMet Mining[1.46751%], Tahoe Resources[1.39543%]

Login Sign Up

Login Sign Up