Best Gold Stocks

|

|

| Quick Read: Best Gold Stocks List By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Gold Stocks Views: Quick Browse View, Summary & Slide Show View | |||

| 12Stocks.com Gold Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 43 (0-bearish to 100-bullish) which puts Gold sector in short term neutral trend. The market intelligence score from previous trading session is 36 and hence an improvement of trend.

| ||||||||

Here are the market intelligence trend scores of the most requested Gold stocks at 12Stocks.com (click stock name for detailed review):

| |||||||||||||||||||||||||||

| Scroll down this page for most comprehensive review of Gold stocks by performance, trends, technical analysis, charts, fund plays & more | |||||||||||||||||||||||||||

| 12Stocks.com: Investing in Gold sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Gold sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Gold Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| METC | Ramaco Resources |   | Minerals | 15.39 | 7 | 4.77 | -10.42% |

| SILV | SilverCrest Metals |   | Silver | 8.15 | 100 | 3.95 | 24.43% |

| PROF | Profound Medical |   | Minerals | 7.99 | 18 | 3.77 | -5.89% |

| SA | Seabridge Gold |   | Gold | 15.16 | 61 | 3.62 | 24.98% |

| TC | TuanChe |   | Minerals | 1.71 | 10 | 2.40 | 741.12% |

| NEM | Newmont |   | Gold | 38.60 | 58 | 2.36 | -6.74% |

| RIO | Rio Tinto |   | Minerals | 68.14 | 74 | 2.25 | -8.49% |

| SSRM | SSR Mining |   | Gold | 5.47 | 55 | 1.96 | -49.16% |

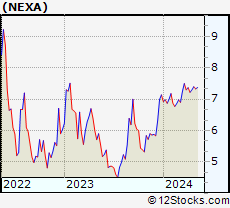

| NEXA | Nexa Resources |   | Minerals | 7.39 | 50 | 1.65 | 3.50% |

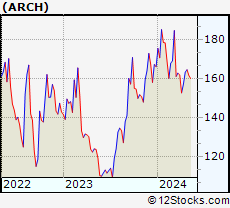

| ARCH | Arch Coal |   | Minerals | 159.24 | 32 | 1.59 | -4.04% |

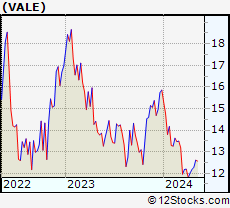

| VALE | Vale S.A |   | Minerals | 12.37 | 64 | 1.31 | -22.01% |

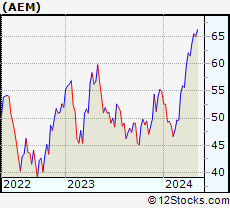

| AEM | Agnico Eagle |   | Gold | 63.69 | 81 | 1.22 | 16.12% |

| UUUU | Energy Fuels |   | Minerals | 5.36 | 7 | 1.13 | -25.45% |

| BHP | BHP |   | Minerals | 59.24 | 67 | 0.92 | -13.28% |

| HCC | Warrior Met |   | Minerals | 66.12 | 68 | 0.85 | 8.45% |

| BVN | Compania de |   | Minerals | 15.85 | 43 | 0.63 | 4.00% |

| SBSW | Sibanye Stillwater |   | Gold | 4.88 | 20 | 0.62 | -10.13% |

| KGC | Kinross Gold |   | Gold | 6.60 | 63 | 0.61 | 9.09% |

| EMX | EMX Royalty |   | Minerals | 1.90 | 41 | 0.53 | 17.28% |

| AGI | Alamos Gold |   | Gold | 15.20 | 88 | 0.46 | 12.84% |

| RGLD | Royal Gold |   | Gold | 120.93 | 46 | 0.43 | -0.02% |

| GFI | Gold Fields |   | Gold | 16.96 | 43 | 0.41 | 17.29% |

| SAND | Sandstorm Gold |   | Gold | 5.37 | 53 | 0.19 | 6.76% |

| CCJ | Cameco |   | Minerals | 48.76 | 86 | 0.16 | 13.13% |

| WPM | Wheaton Precious |   | Silver | 52.56 | 78 | 0.15 | 6.53% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Gold Stocks |

| Gold Technical Overview, Leaders & Laggards, Top Gold ETF Funds & Detailed Gold Stocks List, Charts, Trends & More |

| Gold Sector: Technical Analysis, Trends & YTD Performance | |

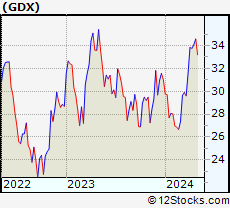

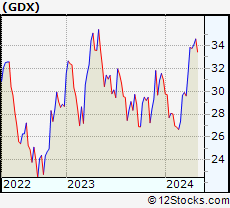

| Gold sector, as represented by GDX, an exchange-traded fund [ETF] that holds basket of Gold stocks (e.g, Newmont Mining, Pan American Silver) is up by 6.8% and is currently outperforming the overall market by 1.14% year-to-date. Below is a quick view of Technical charts and trends: | |

GDX Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

GDX Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 43 | |

| YTD Performance: 6.8% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Gold Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Gold sector stocks year to date are

Now, more recently, over last week, the top performing Gold sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Gold Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Gold Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Gold Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| GDX | Gold Miners |   | 33.12 | 43 | 0.21 | -2.79 | 6.8% |

| GLD | Gold |   | 214.64 | 51 | -0.19 | -2.89 | 12.28% |

| SLV | Silver |   | 24.90 | 51 | -0.36 | -4.96 | 14.33% |

| SIL | Silver Miners |   | 30.98 | 59 | -0.10 | -1.37 | 9.2% |

| GDXJ | Junior Gold Miners |   | 41.00 | 43 | -0.41 | -2.82 | 8.15% |

| XME | Metals and Mining |   | 59.30 | 43 | -0.34 | -2.63 | -0.89% |

| UGL | Gold |   | 78.13 | 43 | -0.38 | -5.82 | 22.33% |

| GLL | Short Gold |   | 21.52 | 50 | 0.33 | 5.96 | -18.39% |

| SILJ | Junior Silver |   | 11.05 | 51 | -0.09 | -1.43 | 10.5% |

| NUGT | Gold Miners Bull |   | 37.21 | 43 | 0.27 | -5.82 | 6.99% |

| DUST | Gold Miners Bear |   | 8.44 | 57 | -0.12 | 5.63 | -17.17% |

| RING | Global Gold Miners |   | 26.46 | 46 | 0.42 | -2.51 | 7.65% |

| AGQ | Silver |   | 33.96 | 43 | -0.79 | -10.35 | 24.99% |

| ZSL | Short Silver |   | 13.76 | 57 | 0.58 | 10.08 | -24.56% |

| PPLT | Physical Platinum |   | 83.29 | 20 | -0.47 | -3.03 | -8.63% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Gold Stocks | |

|

We now take in-depth look at all Gold stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Gold stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

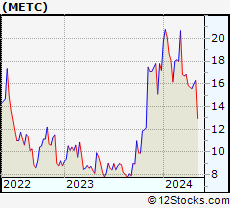

| METC Ramaco Resources, Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 114.41 Millions | |

| Recent Price: 15.39 Market Intelligence Score: 7 | |

| Day Percent Change: 4.77% Day Change: 0.70 | |

| Week Change: -1.22% Year-to-date Change: -10.4% | |

| METC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add METC to Watchlist:  View: View:  Get Complete METC Trend Analysis ➞ Get Complete METC Trend Analysis ➞ | |

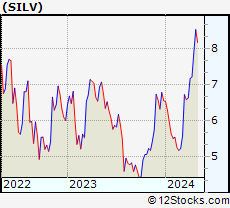

| SILV SilverCrest Metals Inc. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 555.356 Millions | |

| Recent Price: 8.15 Market Intelligence Score: 100 | |

| Day Percent Change: 3.95% Day Change: 0.31 | |

| Week Change: 3.16% Year-to-date Change: 24.4% | |

| SILV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SILV to Watchlist:  View: View:  Get Complete SILV Trend Analysis ➞ Get Complete SILV Trend Analysis ➞ | |

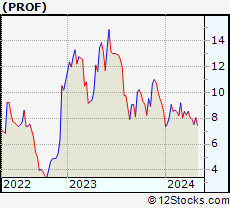

| PROF Profound Medical Corp. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 121.41 Millions | |

| Recent Price: 7.99 Market Intelligence Score: 18 | |

| Day Percent Change: 3.77% Day Change: 0.29 | |

| Week Change: 6.39% Year-to-date Change: -5.9% | |

| PROF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PROF to Watchlist:  View: View:  Get Complete PROF Trend Analysis ➞ Get Complete PROF Trend Analysis ➞ | |

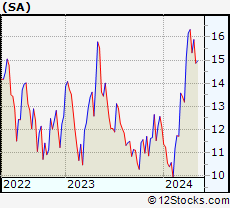

| SA Seabridge Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 565.419 Millions | |

| Recent Price: 15.16 Market Intelligence Score: 61 | |

| Day Percent Change: 3.62% Day Change: 0.53 | |

| Week Change: -1.04% Year-to-date Change: 25.0% | |

| SA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SA to Watchlist:  View: View:  Get Complete SA Trend Analysis ➞ Get Complete SA Trend Analysis ➞ | |

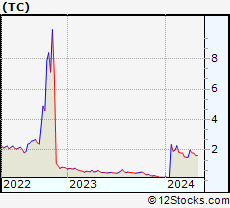

| TC TuanChe Limited |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 107.31 Millions | |

| Recent Price: 1.71 Market Intelligence Score: 10 | |

| Day Percent Change: 2.40% Day Change: 0.04 | |

| Week Change: -5% Year-to-date Change: 741.1% | |

| TC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TC to Watchlist:  View: View:  Get Complete TC Trend Analysis ➞ Get Complete TC Trend Analysis ➞ | |

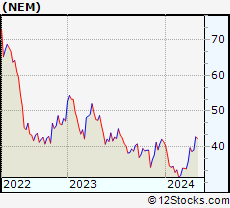

| NEM Newmont Corporation |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 33928.8 Millions | |

| Recent Price: 38.60 Market Intelligence Score: 58 | |

| Day Percent Change: 2.36% Day Change: 0.89 | |

| Week Change: -1.08% Year-to-date Change: -6.7% | |

| NEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NEM to Watchlist:  View: View:  Get Complete NEM Trend Analysis ➞ Get Complete NEM Trend Analysis ➞ | |

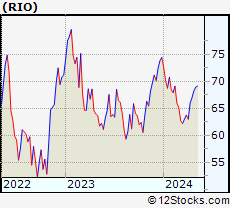

| RIO Rio Tinto Group |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 69399.7 Millions | |

| Recent Price: 68.14 Market Intelligence Score: 74 | |

| Day Percent Change: 2.25% Day Change: 1.50 | |

| Week Change: 1.75% Year-to-date Change: -8.5% | |

| RIO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RIO to Watchlist:  View: View:  Get Complete RIO Trend Analysis ➞ Get Complete RIO Trend Analysis ➞ | |

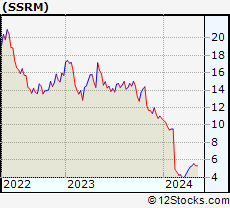

| SSRM SSR Mining Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1546.09 Millions | |

| Recent Price: 5.47 Market Intelligence Score: 55 | |

| Day Percent Change: 1.96% Day Change: 0.10 | |

| Week Change: 2.34% Year-to-date Change: -49.2% | |

| SSRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SSRM to Watchlist:  View: View:  Get Complete SSRM Trend Analysis ➞ Get Complete SSRM Trend Analysis ➞ | |

| NEXA Nexa Resources S.A. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 437.31 Millions | |

| Recent Price: 7.39 Market Intelligence Score: 50 | |

| Day Percent Change: 1.65% Day Change: 0.12 | |

| Week Change: 1.23% Year-to-date Change: 3.5% | |

| NEXA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NEXA to Watchlist:  View: View:  Get Complete NEXA Trend Analysis ➞ Get Complete NEXA Trend Analysis ➞ | |

| ARCH Arch Coal, Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 547.21 Millions | |

| Recent Price: 159.24 Market Intelligence Score: 32 | |

| Day Percent Change: 1.59% Day Change: 2.50 | |

| Week Change: -2.41% Year-to-date Change: -4.0% | |

| ARCH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARCH to Watchlist:  View: View:  Get Complete ARCH Trend Analysis ➞ Get Complete ARCH Trend Analysis ➞ | |

| VALE Vale S.A. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 43601 Millions | |

| Recent Price: 12.37 Market Intelligence Score: 64 | |

| Day Percent Change: 1.31% Day Change: 0.16 | |

| Week Change: 1.56% Year-to-date Change: -22.0% | |

| VALE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VALE to Watchlist:  View: View:  Get Complete VALE Trend Analysis ➞ Get Complete VALE Trend Analysis ➞ | |

| AEM Agnico Eagle Mines Limited |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 9491.49 Millions | |

| Recent Price: 63.69 Market Intelligence Score: 81 | |

| Day Percent Change: 1.22% Day Change: 0.77 | |

| Week Change: -0.23% Year-to-date Change: 16.1% | |

| AEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEM to Watchlist:  View: View:  Get Complete AEM Trend Analysis ➞ Get Complete AEM Trend Analysis ➞ | |

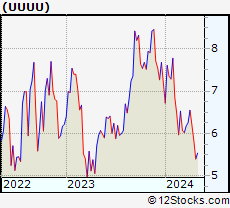

| UUUU Energy Fuels Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 107.61 Millions | |

| Recent Price: 5.36 Market Intelligence Score: 7 | |

| Day Percent Change: 1.13% Day Change: 0.06 | |

| Week Change: -8.22% Year-to-date Change: -25.5% | |

| UUUU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UUUU to Watchlist:  View: View:  Get Complete UUUU Trend Analysis ➞ Get Complete UUUU Trend Analysis ➞ | |

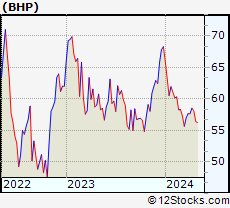

| BHP BHP Group |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 86605.2 Millions | |

| Recent Price: 59.24 Market Intelligence Score: 67 | |

| Day Percent Change: 0.92% Day Change: 0.54 | |

| Week Change: 1.93% Year-to-date Change: -13.3% | |

| BHP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BHP to Watchlist:  View: View:  Get Complete BHP Trend Analysis ➞ Get Complete BHP Trend Analysis ➞ | |

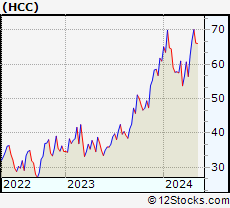

| HCC Warrior Met Coal, Inc. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 748.81 Millions | |

| Recent Price: 66.12 Market Intelligence Score: 68 | |

| Day Percent Change: 0.85% Day Change: 0.56 | |

| Week Change: -1.37% Year-to-date Change: 8.5% | |

| HCC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HCC to Watchlist:  View: View:  Get Complete HCC Trend Analysis ➞ Get Complete HCC Trend Analysis ➞ | |

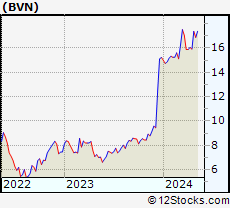

| BVN Compania de Minas Buenaventura S.A.A. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 2827.8 Millions | |

| Recent Price: 15.85 Market Intelligence Score: 43 | |

| Day Percent Change: 0.63% Day Change: 0.10 | |

| Week Change: -0.44% Year-to-date Change: 4.0% | |

| BVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BVN to Watchlist:  View: View:  Get Complete BVN Trend Analysis ➞ Get Complete BVN Trend Analysis ➞ | |

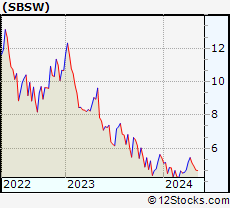

| SBSW Sibanye Stillwater Limited |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 3853.99 Millions | |

| Recent Price: 4.88 Market Intelligence Score: 20 | |

| Day Percent Change: 0.62% Day Change: 0.03 | |

| Week Change: -4.69% Year-to-date Change: -10.1% | |

| SBSW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SBSW to Watchlist:  View: View:  Get Complete SBSW Trend Analysis ➞ Get Complete SBSW Trend Analysis ➞ | |

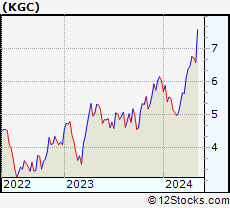

| KGC Kinross Gold Corporation |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 5389.29 Millions | |

| Recent Price: 6.60 Market Intelligence Score: 63 | |

| Day Percent Change: 0.61% Day Change: 0.04 | |

| Week Change: -2.51% Year-to-date Change: 9.1% | |

| KGC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KGC to Watchlist:  View: View:  Get Complete KGC Trend Analysis ➞ Get Complete KGC Trend Analysis ➞ | |

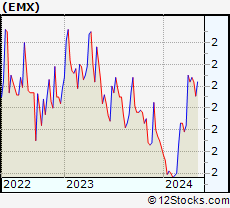

| EMX EMX Royalty Corporation |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 103.91 Millions | |

| Recent Price: 1.90 Market Intelligence Score: 41 | |

| Day Percent Change: 0.53% Day Change: 0.01 | |

| Week Change: -2.06% Year-to-date Change: 17.3% | |

| EMX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EMX to Watchlist:  View: View:  Get Complete EMX Trend Analysis ➞ Get Complete EMX Trend Analysis ➞ | |

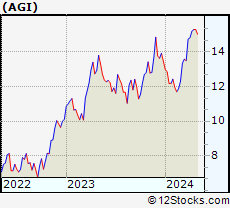

| AGI Alamos Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1740.39 Millions | |

| Recent Price: 15.20 Market Intelligence Score: 88 | |

| Day Percent Change: 0.46% Day Change: 0.07 | |

| Week Change: -0.65% Year-to-date Change: 12.8% | |

| AGI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AGI to Watchlist:  View: View:  Get Complete AGI Trend Analysis ➞ Get Complete AGI Trend Analysis ➞ | |

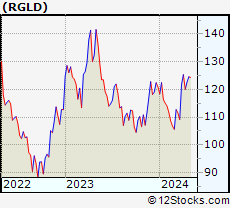

| RGLD Royal Gold, Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 5110.09 Millions | |

| Recent Price: 120.93 Market Intelligence Score: 46 | |

| Day Percent Change: 0.43% Day Change: 0.52 | |

| Week Change: -1.47% Year-to-date Change: 0.0% | |

| RGLD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RGLD to Watchlist:  View: View:  Get Complete RGLD Trend Analysis ➞ Get Complete RGLD Trend Analysis ➞ | |

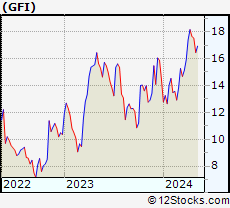

| GFI Gold Fields Limited |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 4908.39 Millions | |

| Recent Price: 16.96 Market Intelligence Score: 43 | |

| Day Percent Change: 0.41% Day Change: 0.07 | |

| Week Change: -3.91% Year-to-date Change: 17.3% | |

| GFI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GFI to Watchlist:  View: View:  Get Complete GFI Trend Analysis ➞ Get Complete GFI Trend Analysis ➞ | |

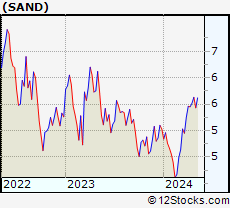

| SAND Sandstorm Gold Ltd. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 808.119 Millions | |

| Recent Price: 5.37 Market Intelligence Score: 53 | |

| Day Percent Change: 0.19% Day Change: 0.01 | |

| Week Change: -2.72% Year-to-date Change: 6.8% | |

| SAND Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SAND to Watchlist:  View: View:  Get Complete SAND Trend Analysis ➞ Get Complete SAND Trend Analysis ➞ | |

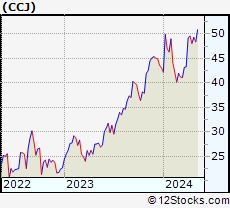

| CCJ Cameco Corporation |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 2722.9 Millions | |

| Recent Price: 48.76 Market Intelligence Score: 86 | |

| Day Percent Change: 0.16% Day Change: 0.08 | |

| Week Change: 1.37% Year-to-date Change: 13.1% | |

| CCJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CCJ to Watchlist:  View: View:  Get Complete CCJ Trend Analysis ➞ Get Complete CCJ Trend Analysis ➞ | |

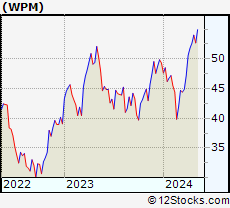

| WPM Wheaton Precious Metals Corp. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 11349.6 Millions | |

| Recent Price: 52.56 Market Intelligence Score: 78 | |

| Day Percent Change: 0.15% Day Change: 0.08 | |

| Week Change: -0.17% Year-to-date Change: 6.5% | |

| WPM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WPM to Watchlist:  View: View:  Get Complete WPM Trend Analysis ➞ Get Complete WPM Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Gold Stocks With Best Up Trends [0-bearish to 100-bullish]: SilverCrest Metals[100], Alamos Gold[88], Cameco [86], Agnico Eagle[81], Wheaton Precious[78], Alliance Resource[76], Rio Tinto[74], Endeavour Silver[73], Coeur Mining[73], Warrior Met[68], New Found[68]

Best Gold Stocks Year-to-Date:

TuanChe [741.12%], McEwen Mining[51.46%], IAMGOLD [42.29%], Harmony Gold[42.11%], Coeur Mining[39.57%], Endeavour Silver[37.06%], Silvercorp Metals[31.94%], Gold Resource[25%], Seabridge Gold[24.98%], SilverCrest Metals[24.43%], Fortuna Silver[20.21%] Best Gold Stocks This Week:

Profound Medical[6.39%], Endeavour Silver[3.45%], SilverCrest Metals[3.16%], New Found[2.99%], Trilogy Metals[2.89%], SSR Mining[2.34%], BHP [1.93%], Rio Tinto[1.75%], Vale S.A[1.56%], Cameco [1.37%], Nexa Resources[1.23%] Best Gold Stocks Daily:

Ramaco Resources[4.77%], SilverCrest Metals[3.95%], Profound Medical[3.77%], Seabridge Gold[3.62%], TuanChe [2.40%], Newmont [2.36%], Rio Tinto[2.25%], SSR Mining[1.96%], Nexa Resources[1.65%], Arch Coal[1.59%], Vale S.A[1.31%]

TuanChe [741.12%], McEwen Mining[51.46%], IAMGOLD [42.29%], Harmony Gold[42.11%], Coeur Mining[39.57%], Endeavour Silver[37.06%], Silvercorp Metals[31.94%], Gold Resource[25%], Seabridge Gold[24.98%], SilverCrest Metals[24.43%], Fortuna Silver[20.21%] Best Gold Stocks This Week:

Profound Medical[6.39%], Endeavour Silver[3.45%], SilverCrest Metals[3.16%], New Found[2.99%], Trilogy Metals[2.89%], SSR Mining[2.34%], BHP [1.93%], Rio Tinto[1.75%], Vale S.A[1.56%], Cameco [1.37%], Nexa Resources[1.23%] Best Gold Stocks Daily:

Ramaco Resources[4.77%], SilverCrest Metals[3.95%], Profound Medical[3.77%], Seabridge Gold[3.62%], TuanChe [2.40%], Newmont [2.36%], Rio Tinto[2.25%], SSR Mining[1.96%], Nexa Resources[1.65%], Arch Coal[1.59%], Vale S.A[1.31%]

Login Sign Up

Login Sign Up