Best Financial Stocks

| In a hurry? Financial Stocks Lists: Performance Trends Table, Stock Charts

Sort Financial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Financial stocks list by size:All Financial Large Mid-Range Small & MicroCap |

| 12Stocks.com Financial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 20 (0-bearish to 100-bullish) which puts Financial sector in short term bearish trend. The Smart Investing & Trading Score from previous trading session is 30 and a deterioration of trend continues.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Financial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Financial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Financial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Financial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Trend Score | Change % | YTD Change% |

| HOPE | Hope Bancorp |   | Banks - Regional | 10.67 | 20 | 0.00% | -7.30% |

| GOV | Government Properties |   | REIT - Office | 43.91 | 0 | -0.05% | 0.00% |

| ALEX | Alexander & Baldwin |   | REIT - Retail | 17.75 | 0 | -2.15% | 3.26% |

| NGHCO | National General |   | Insurance | 14.09 | 10 | -1.47% | 0.00% |

| NGHCN | National General |   | Insurance | 45.29 | 100 | 5.47% | 0.00% |

| PEB | Pebblebrook Hotel |   | REIT - Hotel & Motel | 11.21 | 40 | -0.09% | -15.36% |

| EFC | Ellington |   | REIT - Mortgage | 13.15 | 60 | 0.46% | 16.01% |

| XHR | Xenia Hotels |   | REIT - Hotel & Motel | 13.59 | 20 | 0.15% | -5.73% |

| BST | BlackRock Science |   | Closed-End Fund - Equity | 41.66 | 100 | 0.19% | 19.42% |

| NAVI | Navient Corp |   | Credit Services | 13.16 | 80 | -0.53% | 3.16% |

| ESRT | Empire State |   | REIT - | 7.75 | 80 | 0.65% | -23.15% |

| DCOM | Dime Community |   | Banks - Regional | 29.75 | 30 | -0.37% | 0.72% |

| WSR | Whitestone REIT |   | REIT - Retail | 12.08 | 0 | -0.82% | -11.79% |

| PSEC | Prospect Capital |   | Asset Mgmt | 2.76 | 60 | 0.00% | -30.79% |

| RBCAA | Republic Bancorp |   | Banks - Regional | 70.83 | 10 | -0.73% | 4.07% |

| QQQX | Nuveen NASDAQ |   | Closed-End Fund - Equity | 27.58 | 80 | 0.44% | 7.37% |

| QCRH | QCR Holding |   | Banks - Regional | 75.27 | 30 | -1.23% | -4.88% |

| BY | Byline Bancorp |   | Banks - Regional | 27.36 | 10 | -0.40% | -2.64% |

| PX | P10 |   | Asset Mgmt | 10.69 | 10 | 0.00% | -16.22% |

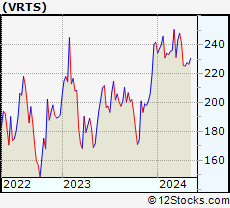

| VRTS | Virtus |   | Asset Mgmt | 187.87 | 20 | 0.99% | -11.09% |

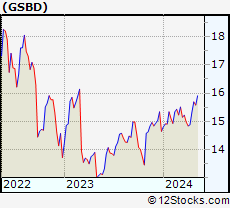

| GSBD | Goldman Sachs |   | Asset Mgmt | 10.13 | 0 | 1.40% | -9.35% |

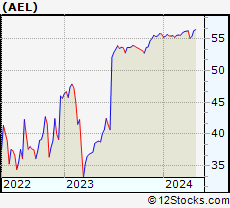

| AEL | American Equity |   | Life Insurance | 62.26 | 80 | 1.82% | 0.00% |

| ARGO | Argo |   | Insurance | 29.99 | 50 | 0.00% | 0.00% |

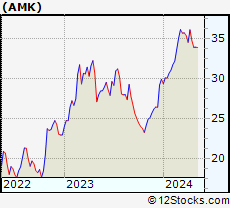

| AMK | AssetMark |   | Asset Mgmt | 35.24 | 60 | -0.06% | 0.00% |

| UMH | UMH Properties |   | REIT | 14.56 | 0 | -1.02% | -20.98% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 , 1250 - 1275 , 1275 - 1300 , 1300 - 1325 , 1325 - 1350 , 1350 - 1375 , 1375 - 1400 , 1400 - 1425 , 1425 - 1450 , 1450 - 1475 , 1475 - 1500 , 1500 - 1525 , 1525 - 1550 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Financial Stocks |

| Financial Technical Overview, Leaders & Laggards, Top Financial ETF Funds & Detailed Financial Stocks List, Charts, Trends & More |

| Financial Sector: Technical Analysis, Trends & YTD Performance | |

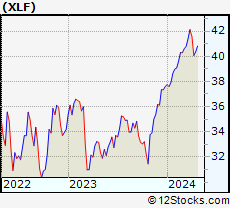

| Financial sector is composed of stocks

from banks, brokers, insurance, REITs

and services subsectors. Financial sector, as represented by XLF, an exchange-traded fund [ETF] that holds basket of Financial stocks (e.g, Bank of America, Goldman Sachs) is up by 11.4442% and is currently underperforming the overall market by -3.3137% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLF Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Not Good | |

XLF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 20 | |

| YTD Performance: 11.4442% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Financial Sector Stocks | |||||||||||||||||||||||||||||||||||||||||||||||

The top performing Financial sector stocks year to date are

Now, more recently, over last week, the top performing Financial sector stocks on the move are

|

|||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Financial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Financial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Financial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| CHIX | China Financials |   | 10.57 | 20 | 0 | 0 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Financial Stocks | |

|

We now take in-depth look at all Financial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Financial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

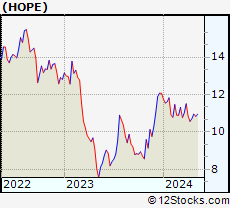

| HOPE Hope Bancorp Inc |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1425.36 Millions | |

| Recent Price: 10.67 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0% Day Change: -0.04 | |

| Week Change: -2.28938% Year-to-date Change: -7.3% | |

| HOPE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HOPE to Watchlist:  View: View:  Get Complete HOPE Trend Analysis ➞ Get Complete HOPE Trend Analysis ➞ | |

| GOV Government Properties Income Trust |

| Sector: Financials | |

| SubSector: REIT - Office | |

| MarketCap: 1423.05 Millions | |

| Recent Price: 43.91 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.045527% Day Change: -9999 | |

| Week Change: -37.3341% Year-to-date Change: 0.0% | |

| GOV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GOV to Watchlist:  View: View:  Get Complete GOV Trend Analysis ➞ Get Complete GOV Trend Analysis ➞ | |

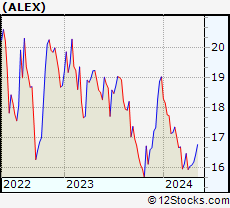

| ALEX Alexander & Baldwin Inc |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 1414.32 Millions | |

| Recent Price: 17.75 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -2.14994% Day Change: 0.02 | |

| Week Change: -1.9337% Year-to-date Change: 3.3% | |

| ALEX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALEX to Watchlist:  View: View:  Get Complete ALEX Trend Analysis ➞ Get Complete ALEX Trend Analysis ➞ | |

| NGHCO National General Holdings Corp. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 1414.12 Millions | |

| Recent Price: 14.09 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -1.46853% Day Change: -9999 | |

| Week Change: -13.9805% Year-to-date Change: 0.0% | |

| NGHCO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGHCO to Watchlist:  View: View:  Get Complete NGHCO Trend Analysis ➞ Get Complete NGHCO Trend Analysis ➞ | |

| NGHCN National General Holdings Corp. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 1403.92 Millions | |

| Recent Price: 45.29 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 5.47275% Day Change: -9999 | |

| Week Change: 76.2257% Year-to-date Change: 0.0% | |

| NGHCN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGHCN to Watchlist:  View: View:  Get Complete NGHCN Trend Analysis ➞ Get Complete NGHCN Trend Analysis ➞ | |

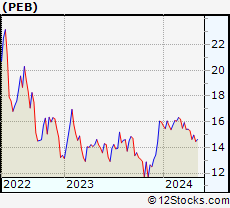

| PEB Pebblebrook Hotel Trust |

| Sector: Financials | |

| SubSector: REIT - Hotel & Motel | |

| MarketCap: 1397.99 Millions | |

| Recent Price: 11.21 Smart Investing & Trading Score: 40 | |

| Day Percent Change: -0.0891266% Day Change: -0.07 | |

| Week Change: -1.75285% Year-to-date Change: -15.4% | |

| PEB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PEB to Watchlist:  View: View:  Get Complete PEB Trend Analysis ➞ Get Complete PEB Trend Analysis ➞ | |

| EFC Ellington Financial Inc |

| Sector: Financials | |

| SubSector: REIT - Mortgage | |

| MarketCap: 1381.53 Millions | |

| Recent Price: 13.15 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.458365% Day Change: -0.15 | |

| Week Change: 1.38782% Year-to-date Change: 16.0% | |

| EFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EFC to Watchlist:  View: View:  Get Complete EFC Trend Analysis ➞ Get Complete EFC Trend Analysis ➞ | |

| XHR Xenia Hotels & Resorts Inc |

| Sector: Financials | |

| SubSector: REIT - Hotel & Motel | |

| MarketCap: 1380.2 Millions | |

| Recent Price: 13.59 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0.147384% Day Change: 0.02 | |

| Week Change: -5.55942% Year-to-date Change: -5.7% | |

| XHR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XHR to Watchlist:  View: View:  Get Complete XHR Trend Analysis ➞ Get Complete XHR Trend Analysis ➞ | |

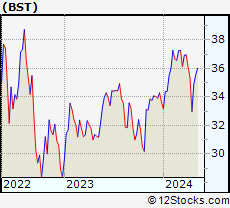

| BST BlackRock Science and Technology Trust |

| Sector: Financials | |

| SubSector: Closed-End Fund - Equity | |

| MarketCap: 1374.91 Millions | |

| Recent Price: 41.66 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.1924% Day Change: -0.11 | |

| Week Change: 1.33787% Year-to-date Change: 19.4% | |

| BST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BST to Watchlist:  View: View:  Get Complete BST Trend Analysis ➞ Get Complete BST Trend Analysis ➞ | |

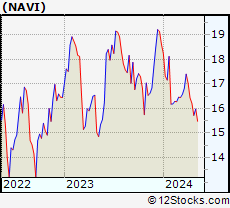

| NAVI Navient Corp |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 1365.19 Millions | |

| Recent Price: 13.16 Smart Investing & Trading Score: 80 | |

| Day Percent Change: -0.529101% Day Change: 0.01 | |

| Week Change: 1.3087% Year-to-date Change: 3.2% | |

| NAVI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NAVI to Watchlist:  View: View:  Get Complete NAVI Trend Analysis ➞ Get Complete NAVI Trend Analysis ➞ | |

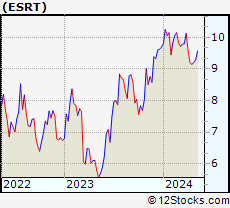

| ESRT Empire State Realty Trust Inc |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 1351.82 Millions | |

| Recent Price: 7.75 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0.649351% Day Change: -0.03 | |

| Week Change: 1.17493% Year-to-date Change: -23.2% | |

| ESRT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ESRT to Watchlist:  View: View:  Get Complete ESRT Trend Analysis ➞ Get Complete ESRT Trend Analysis ➞ | |

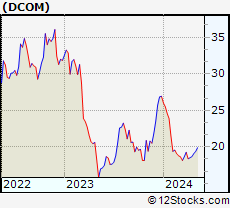

| DCOM Dime Community Bancshares Inc |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1344.38 Millions | |

| Recent Price: 29.75 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -0.368386% Day Change: -0.24 | |

| Week Change: -2.00922% Year-to-date Change: 0.7% | |

| DCOM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DCOM to Watchlist:  View: View:  Get Complete DCOM Trend Analysis ➞ Get Complete DCOM Trend Analysis ➞ | |

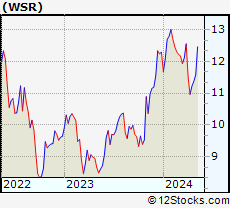

| WSR Whitestone REIT |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 1343.21 Millions | |

| Recent Price: 12.08 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.821018% Day Change: 0.29 | |

| Week Change: -5.40329% Year-to-date Change: -11.8% | |

| WSR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WSR to Watchlist:  View: View:  Get Complete WSR Trend Analysis ➞ Get Complete WSR Trend Analysis ➞ | |

| PSEC Prospect Capital Corp |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1336.17 Millions | |

| Recent Price: 2.76 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0% Day Change: -0.01 | |

| Week Change: 5.74713% Year-to-date Change: -30.8% | |

| PSEC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PSEC to Watchlist:  View: View:  Get Complete PSEC Trend Analysis ➞ Get Complete PSEC Trend Analysis ➞ | |

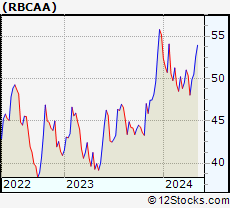

| RBCAA Republic Bancorp, Inc. (KY) |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1335.43 Millions | |

| Recent Price: 70.83 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.728802% Day Change: 0.04 | |

| Week Change: -3.8028% Year-to-date Change: 4.1% | |

| RBCAA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RBCAA to Watchlist:  View: View:  Get Complete RBCAA Trend Analysis ➞ Get Complete RBCAA Trend Analysis ➞ | |

| QQQX Nuveen NASDAQ 100 Dynamic Overwrite Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Equity | |

| MarketCap: 1330.04 Millions | |

| Recent Price: 27.58 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0.436999% Day Change: -0.11 | |

| Week Change: 0.327392% Year-to-date Change: 7.4% | |

| QQQX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QQQX to Watchlist:  View: View:  Get Complete QQQX Trend Analysis ➞ Get Complete QQQX Trend Analysis ➞ | |

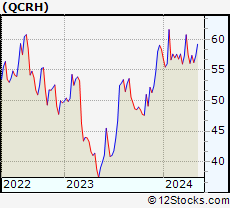

| QCRH QCR Holding, Inc |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1327.4 Millions | |

| Recent Price: 75.27 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -1.23343% Day Change: 0.11 | |

| Week Change: -3.4381% Year-to-date Change: -4.9% | |

| QCRH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QCRH to Watchlist:  View: View:  Get Complete QCRH Trend Analysis ➞ Get Complete QCRH Trend Analysis ➞ | |

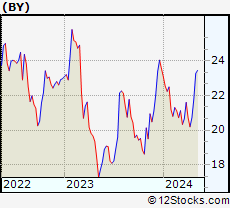

| BY Byline Bancorp Inc |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1326.87 Millions | |

| Recent Price: 27.36 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.400437% Day Change: -0.16 | |

| Week Change: -3.21896% Year-to-date Change: -2.6% | |

| BY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BY to Watchlist:  View: View:  Get Complete BY Trend Analysis ➞ Get Complete BY Trend Analysis ➞ | |

| PX P10 Inc |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1321.84 Millions | |

| Recent Price: 10.69 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0% Day Change: 0.09 | |

| Week Change: -5.31444% Year-to-date Change: -16.2% | |

| PX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PX to Watchlist:  View: View:  Get Complete PX Trend Analysis ➞ Get Complete PX Trend Analysis ➞ | |

| VRTS Virtus Investment Partners Inc |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1308.99 Millions | |

| Recent Price: 187.87 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0.989088% Day Change: -2.15 | |

| Week Change: -1.09503% Year-to-date Change: -11.1% | |

| VRTS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VRTS to Watchlist:  View: View:  Get Complete VRTS Trend Analysis ➞ Get Complete VRTS Trend Analysis ➞ | |

| GSBD Goldman Sachs BDC Inc |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1305.45 Millions | |

| Recent Price: 10.13 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 1.4014% Day Change: -0.06 | |

| Week Change: -7.48858% Year-to-date Change: -9.3% | |

| GSBD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GSBD to Watchlist:  View: View:  Get Complete GSBD Trend Analysis ➞ Get Complete GSBD Trend Analysis ➞ | |

| AEL American Equity Investment Life Holding Company |

| Sector: Financials | |

| SubSector: Life Insurance | |

| MarketCap: 1304.46 Millions | |

| Recent Price: 62.26 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 1.81521% Day Change: -9999 | |

| Week Change: 10.8618% Year-to-date Change: 0.0% | |

| AEL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEL to Watchlist:  View: View:  Get Complete AEL Trend Analysis ➞ Get Complete AEL Trend Analysis ➞ | |

| ARGO Argo Group International Holdings, Ltd. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 1299.72 Millions | |

| Recent Price: 29.99 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0% Day Change: -9999 | |

| Week Change: 0.33456% Year-to-date Change: 0.0% | |

| ARGO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARGO to Watchlist:  View: View:  Get Complete ARGO Trend Analysis ➞ Get Complete ARGO Trend Analysis ➞ | |

| AMK AssetMark Financial Holdings, Inc. |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1296.33 Millions | |

| Recent Price: 35.24 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -0.0567215% Day Change: -9999 | |

| Week Change: 0.39886% Year-to-date Change: 0.0% | |

| AMK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMK to Watchlist:  View: View:  Get Complete AMK Trend Analysis ➞ Get Complete AMK Trend Analysis ➞ | |

| UMH UMH Properties Inc |

| Sector: Financials | |

| SubSector: REIT - Residential | |

| MarketCap: 1294.32 Millions | |

| Recent Price: 14.56 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -1.01971% Day Change: 0.05 | |

| Week Change: -2.47823% Year-to-date Change: -21.0% | |

| UMH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UMH to Watchlist:  View: View:  Get Complete UMH Trend Analysis ➞ Get Complete UMH Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 , 1250 - 1275 , 1275 - 1300 , 1300 - 1325 , 1325 - 1350 , 1350 - 1375 , 1375 - 1400 , 1400 - 1425 , 1425 - 1450 , 1450 - 1475 , 1475 - 1500 , 1500 - 1525 , 1525 - 1550 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Financial Stocks With Best Up Trends [0-bearish to 100-bullish]: PIMCO California[100], Torchmark [100], PIMCO California[100], Triumph Bancorp[100], Cipher Mining[100], Lufax Holding[100], PIMCO Municipal[100], PIMCO Municipal[100], Front Yard[100], National General[100], Fifth Street[100]

Best Financial Stocks Year-to-Date:

Insight Select[12384.6%], Better Home[523.632%], IREN [363.5%], Global Medical[353.709%], Oxford Lane[287.756%], Robinhood Markets[269.422%], Metalpha Technology[225.664%], Cipher Mining[185.3%], Banco Santander[131.403%], Mr. Cooper[124.245%], Altisource Portfolio[121.195%] Best Financial Stocks This Week:

Colony Starwood[15929900%], Blackhawk Network[91300%], Macquarie Global[81662.9%], Credit Suisse[63241.6%], Pennsylvania Real[23823%], First Republic[22570.9%], Select ome[14000%], CorEnergy Infrastructure[6797.78%], FedNat Holding[5525%], BlackRock Municipal[5340%], BlackRock MuniYield[3379.04%] Best Financial Stocks Daily:

PIMCO California[11.9545%], Torchmark [11.8363%], PIMCO California[11.4754%], BlackRock Muni[10.8108%], Blackrock MuniYield[10.72%], Triumph Bancorp[10.2661%], Cipher Mining[9.36508%], AMBAC [8.24108%], BlackRock MuniYield[8.15348%], Summit [7.79817%], Concord Acquisition[7.63431%]

Insight Select[12384.6%], Better Home[523.632%], IREN [363.5%], Global Medical[353.709%], Oxford Lane[287.756%], Robinhood Markets[269.422%], Metalpha Technology[225.664%], Cipher Mining[185.3%], Banco Santander[131.403%], Mr. Cooper[124.245%], Altisource Portfolio[121.195%] Best Financial Stocks This Week:

Colony Starwood[15929900%], Blackhawk Network[91300%], Macquarie Global[81662.9%], Credit Suisse[63241.6%], Pennsylvania Real[23823%], First Republic[22570.9%], Select ome[14000%], CorEnergy Infrastructure[6797.78%], FedNat Holding[5525%], BlackRock Municipal[5340%], BlackRock MuniYield[3379.04%] Best Financial Stocks Daily:

PIMCO California[11.9545%], Torchmark [11.8363%], PIMCO California[11.4754%], BlackRock Muni[10.8108%], Blackrock MuniYield[10.72%], Triumph Bancorp[10.2661%], Cipher Mining[9.36508%], AMBAC [8.24108%], BlackRock MuniYield[8.15348%], Summit [7.79817%], Concord Acquisition[7.63431%]

Login Sign Up

Login Sign Up