Best Energy Stocks

| In a hurry? Energy Stocks Lists: Performance Trends Table, Stock Charts

Sort Energy stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Energy stocks list by size: All Energy Large Mid-Range Small & MicroCap |

| 12Stocks.com Energy Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 40 (0-bearish to 100-bullish) which puts Energy sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 50 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Energy stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Energy sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Energy sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Energy Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| SGU | Star |   | Refining | 11.85 | 80 | 1.20 | 8.93% |

| MMP | Magellan Midstream |   | Pipelines | 157.26 | 80 | 1.17 | 0.00% |

| HEP | Holly |   | Pipelines | 20.95 | 20 | 1.16 | 0.00% |

| WG | Willbros |   | Equipment | 8.85 | 40 | 1.14 | 0.00% |

| XEC | Cimarex |   | Independent | 9.10 | 30 | 1.11 | 0.00% |

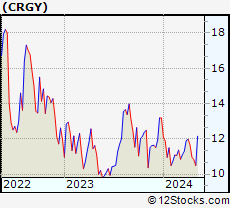

| CRGY | Crescent |   | Integrated | 8.68 | 61 | 1.08 | -34.19% |

| NBL | Noble |   | Independent | 14.79 | 30 | 1.02 | 0.00% |

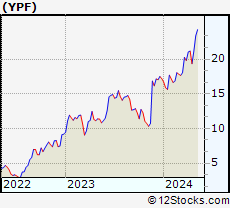

| YPF | YPF ADR |   | Integrated | 23.81 | 0 | 1.02 | -46.61% |

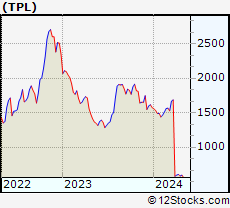

| TPL | Texas Pacific |   | E&P | 967.74 | 70 | 1.02 | -17.78% |

| AAV | Advantage Oil |   | Drilling & Exploration | 117.57 | 40 | 1.02 | 0.00% |

| DM | Dominion Midstream |   | Pipelines | 4.96 | 70 | 1.02 | 84.39% |

| INT | World Fuel |   | Refining | 21.95 | 20 | 1.01 | 0.00% |

| MEP | Midcoast |   | Independent | 3.13 | 10 | 0.97 | 0.00% |

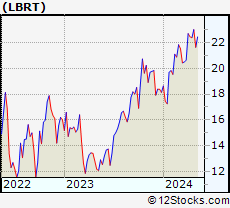

| LBRT | Liberty |   | Equipment | 12.69 | 80 | 0.95 | -38.00% |

| WNRL | Western Refining |   | Pipelines | 259.31 | 40 | 0.91 | 0.00% |

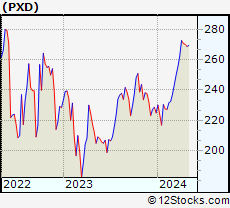

| PXD | Pioneer Natural |   | Independent | 561.08 | 70 | 0.89 | 0.00% |

| TLP | Transmontaigne Partners |   | Pipelines | 12.51 | 0 | 0.89 | 0.00% |

| NRP | Natural Resource |   | Thermal Coal | 107.03 | 100 | 0.88 | 2.41% |

| EPD | Enterprise Products |   | Midstream | 31.42 | 60 | 0.87 | 4.12% |

| CCJ | Cameco Corp |   | Uranium | 84.20 | 50 | 0.85 | 61.43% |

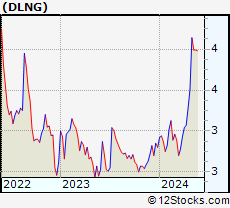

| DLNG | Dynagas LNG |   | Midstream | 3.55 | 40 | 0.85 | -34.04% |

| ATW | Atwood Oceanics |   | Drilling & Exploration | 81.99 | 100 | 0.84 | 0.00% |

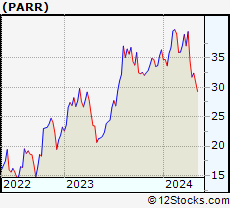

| PARR | Par Pacific |   | Refining | 35.20 | 50 | 0.83 | 110.91% |

| FLMN | Falcon Minerals |   | Independent | 27.55 | 20 | 0.77 | 0.00% |

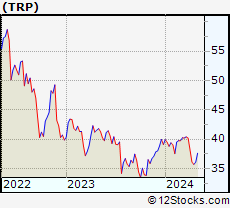

| TRP | TC |   | Midstream | 54.28 | 100 | 0.72 | 17.50% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Energy Stocks |

| Energy Technical Overview, Leaders & Laggards, Top Energy ETF Funds & Detailed Energy Stocks List, Charts, Trends & More |

| Energy Sector: Technical Analysis, Trends & YTD Performance | |

| Energy sector is composed of stocks

from oil production, refining, exploration, drilling

and services subsectors. Energy sector, as represented by XLE, an exchange-traded fund [ETF] that holds basket of Energy stocks (e.g, Exxon, Halliburton) is up by 3.68732% and is currently underperforming the overall market by -11.07058% year-to-date. Below is a quick view of Technical charts and trends: |

|

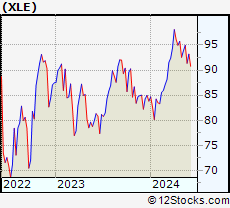

XLE Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

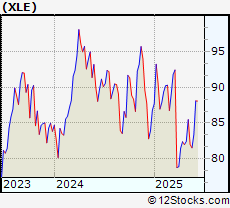

XLE Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 40 | |

| YTD Performance: 3.68732% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Energy Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Energy sector stocks year to date are

Now, more recently, over last week, the top performing Energy sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Energy Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Energy Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Energy Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| UHN | Diesel-Heating Oil |   | 62.75 | 90 | 2.06571 | 216.44 | 0% |

| CHIE | China Energy |   | 16.39 | 30 | 0 | 0 | 0% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Energy Stocks | |

|

We now take in-depth look at all Energy stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Energy stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

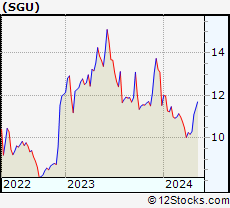

| SGU Star Group L.P |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 394.88 Millions | |

| Recent Price: 11.85 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 1.19556% Day Change: -0.01 | |

| Week Change: 2.33161% Year-to-date Change: 8.9% | |

| SGU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SGU to Watchlist:  View: View:  Get Complete SGU Trend Analysis ➞ Get Complete SGU Trend Analysis ➞ | |

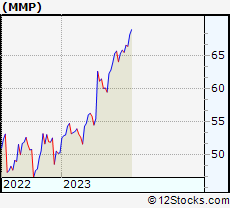

| MMP Magellan Midstream Partners, L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 7883.35 Millions | |

| Recent Price: 157.26 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 1.17087% Day Change: -9999 | |

| Week Change: 127.715% Year-to-date Change: 0.0% | |

| MMP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MMP to Watchlist:  View: View:  Get Complete MMP Trend Analysis ➞ Get Complete MMP Trend Analysis ➞ | |

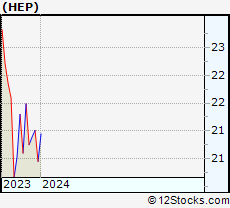

| HEP Holly Energy Partners, L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 1582.25 Millions | |

| Recent Price: 20.95 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 1.15886% Day Change: -9999 | |

| Week Change: -0.190567% Year-to-date Change: 0.0% | |

| HEP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HEP to Watchlist:  View: View:  Get Complete HEP Trend Analysis ➞ Get Complete HEP Trend Analysis ➞ | |

| WG Willbros Group, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 149.1 Millions | |

| Recent Price: 8.85 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 1.14286% Day Change: -9999 | |

| Week Change: -71.4792% Year-to-date Change: 0.0% | |

| WG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WG to Watchlist:  View: View:  Get Complete WG Trend Analysis ➞ Get Complete WG Trend Analysis ➞ | |

| XEC Cimarex Energy Co. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 1654.33 Millions | |

| Recent Price: 9.10 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.11111% Day Change: -9999 | |

| Week Change: -89.5642% Year-to-date Change: 0.0% | |

| XEC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XEC to Watchlist:  View: View:  Get Complete XEC Trend Analysis ➞ Get Complete XEC Trend Analysis ➞ | |

| CRGY Crescent Energy Co |

| Sector: Energy | |

| SubSector: Oil & Gas Integrated | |

| MarketCap: 2230.43 Millions | |

| Recent Price: 8.68 Smart Investing & Trading Score: 61 | |

| Day Percent Change: 1.08% Day Change: 0.1 | |

| Week Change: -2.8% Year-to-date Change: -34.2% | |

| CRGY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRGY to Watchlist:  View: View:  Get Complete CRGY Trend Analysis ➞ Get Complete CRGY Trend Analysis ➞ | |

| NBL Noble Energy, Inc. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 2307.03 Millions | |

| Recent Price: 14.79 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.02459% Day Change: -9999 | |

| Week Change: -88.439% Year-to-date Change: 0.0% | |

| NBL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NBL to Watchlist:  View: View:  Get Complete NBL Trend Analysis ➞ Get Complete NBL Trend Analysis ➞ | |

| YPF YPF ADR |

| Sector: Energy | |

| SubSector: Oil & Gas Integrated | |

| MarketCap: 12124.2 Millions | |

| Recent Price: 23.81 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 1.01824% Day Change: -0.27 | |

| Week Change: -14.1363% Year-to-date Change: -46.6% | |

| YPF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add YPF to Watchlist:  View: View:  Get Complete YPF Trend Analysis ➞ Get Complete YPF Trend Analysis ➞ | |

| TPL Texas Pacific Land Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas E&P | |

| MarketCap: 20440.1 Millions | |

| Recent Price: 967.74 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 1.01881% Day Change: 10.69 | |

| Week Change: 3.5016% Year-to-date Change: -17.8% | |

| TPL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TPL to Watchlist:  View: View:  Get Complete TPL Trend Analysis ➞ Get Complete TPL Trend Analysis ➞ | |

| AAV Advantage Oil & Gas Ltd. |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 1119.29 Millions | |

| Recent Price: 117.57 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 1.02251% Day Change: -9999 | |

| Week Change: 1.11809% Year-to-date Change: 0.0% | |

| AAV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAV to Watchlist:  View: View:  Get Complete AAV Trend Analysis ➞ Get Complete AAV Trend Analysis ➞ | |

| DM Dominion Midstream Partners, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 3017.01 Millions | |

| Recent Price: 4.96 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 1.01833% Day Change: -9999 | |

| Week Change: 118.502% Year-to-date Change: 84.4% | |

| DM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DM to Watchlist:  View: View:  Get Complete DM Trend Analysis ➞ Get Complete DM Trend Analysis ➞ | |

| INT World Fuel Services Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1793.44 Millions | |

| Recent Price: 21.95 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 1.01243% Day Change: -9999 | |

| Week Change: -2.40107% Year-to-date Change: 0.0% | |

| INT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add INT to Watchlist:  View: View:  Get Complete INT Trend Analysis ➞ Get Complete INT Trend Analysis ➞ | |

| MEP Midcoast Energy Partners, L.P. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 364.51 Millions | |

| Recent Price: 3.13 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.967742% Day Change: -9999 | |

| Week Change: -61.358% Year-to-date Change: 0.0% | |

| MEP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MEP to Watchlist:  View: View:  Get Complete MEP Trend Analysis ➞ Get Complete MEP Trend Analysis ➞ | |

| LBRT Liberty Energy Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 1697.3 Millions | |

| Recent Price: 12.69 Smart Investing & Trading Score: 80 | |

| Day Percent Change: 0.954654% Day Change: -0.03 | |

| Week Change: 1.35783% Year-to-date Change: -38.0% | |

| LBRT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LBRT to Watchlist:  View: View:  Get Complete LBRT Trend Analysis ➞ Get Complete LBRT Trend Analysis ➞ | |

| WNRL Western Refining Logistics, LP |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 1546.59 Millions | |

| Recent Price: 259.31 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0.910612% Day Change: -9999 | |

| Week Change: 4.3753% Year-to-date Change: 0.0% | |

| WNRL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WNRL to Watchlist:  View: View:  Get Complete WNRL Trend Analysis ➞ Get Complete WNRL Trend Analysis ➞ | |

| PXD Pioneer Natural Resources Company |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 11846.2 Millions | |

| Recent Price: 561.08 Smart Investing & Trading Score: 70 | |

| Day Percent Change: 0.886451% Day Change: -9999 | |

| Week Change: 108.1% Year-to-date Change: 0.0% | |

| PXD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PXD to Watchlist:  View: View:  Get Complete PXD Trend Analysis ➞ Get Complete PXD Trend Analysis ➞ | |

| TLP Transmontaigne Partners L.P. |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 782.72 Millions | |

| Recent Price: 12.51 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.887097% Day Change: -9999 | |

| Week Change: -68.8185% Year-to-date Change: 0.0% | |

| TLP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TLP to Watchlist:  View: View:  Get Complete TLP Trend Analysis ➞ Get Complete TLP Trend Analysis ➞ | |

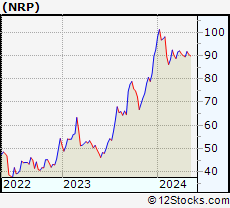

| NRP Natural Resource Partners LP |

| Sector: Energy | |

| SubSector: Thermal Coal | |

| MarketCap: 1346 Millions | |

| Recent Price: 107.03 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.876532% Day Change: -2.07 | |

| Week Change: 3.77157% Year-to-date Change: 2.4% | |

| NRP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NRP to Watchlist:  View: View:  Get Complete NRP Trend Analysis ➞ Get Complete NRP Trend Analysis ➞ | |

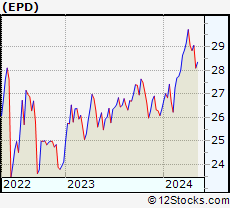

| EPD Enterprise Products Partners L P |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 68573.4 Millions | |

| Recent Price: 31.42 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.866774% Day Change: 0.1 | |

| Week Change: -0.883281% Year-to-date Change: 4.1% | |

| EPD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EPD to Watchlist:  View: View:  Get Complete EPD Trend Analysis ➞ Get Complete EPD Trend Analysis ➞ | |

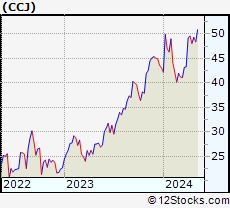

| CCJ Cameco Corp |

| Sector: Energy | |

| SubSector: Uranium | |

| MarketCap: 33024.3 Millions | |

| Recent Price: 84.20 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.850401% Day Change: 0.1 | |

| Week Change: 1.3359% Year-to-date Change: 61.4% | |

| CCJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CCJ to Watchlist:  View: View:  Get Complete CCJ Trend Analysis ➞ Get Complete CCJ Trend Analysis ➞ | |

| DLNG Dynagas LNG Partners LP |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 137.72 Millions | |

| Recent Price: 3.55 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0.852273% Day Change: 0.04 | |

| Week Change: -5.58511% Year-to-date Change: -34.0% | |

| DLNG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DLNG to Watchlist:  View: View:  Get Complete DLNG Trend Analysis ➞ Get Complete DLNG Trend Analysis ➞ | |

| ATW Atwood Oceanics, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 773.68 Millions | |

| Recent Price: 81.99 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.836305% Day Change: -9999 | |

| Week Change: 18.9985% Year-to-date Change: 0.0% | |

| ATW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATW to Watchlist:  View: View:  Get Complete ATW Trend Analysis ➞ Get Complete ATW Trend Analysis ➞ | |

| PARR Par Pacific Holdings Inc |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1721.6 Millions | |

| Recent Price: 35.20 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 0.830708% Day Change: -1.62 | |

| Week Change: -5.6806% Year-to-date Change: 110.9% | |

| PARR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PARR to Watchlist:  View: View:  Get Complete PARR Trend Analysis ➞ Get Complete PARR Trend Analysis ➞ | |

| FLMN Falcon Minerals Corporation |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 210.193 Millions | |

| Recent Price: 27.55 Smart Investing & Trading Score: 20 | |

| Day Percent Change: 0.768105% Day Change: -9999 | |

| Week Change: -3.2994% Year-to-date Change: 0.0% | |

| FLMN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FLMN to Watchlist:  View: View:  Get Complete FLMN Trend Analysis ➞ Get Complete FLMN Trend Analysis ➞ | |

| TRP TC Energy Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas Midstream | |

| MarketCap: 53934.4 Millions | |

| Recent Price: 54.28 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.723696% Day Change: 0.21 | |

| Week Change: 1.36321% Year-to-date Change: 17.5% | |

| TRP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRP to Watchlist:  View: View:  Get Complete TRP Trend Analysis ➞ Get Complete TRP Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Energy Stocks With Best Up Trends [0-bearish to 100-bullish]: Fuels[100], Centrus [100], Peabody [100], Denbury Resources[100], Centennial Resource[100], Stone [100], Bellatrix Exploration[100], Alon USA[100], Seadrill Partners[100], Weatherford [100], Crescent Point[100]

Best Energy Stocks Year-to-Date:

Centrus [370.828%], Fuels[196.567%], CVR [121.546%], Par Pacific[110.905%], Geospace Technologies[97.4155%], Dominion Midstream[84.3866%], Delek US[83.0509%], Uranium [79.5276%], NCS Multistage[65.4577%], Flotek Industries[65%], Cameco Corp[61.4264%] Best Energy Stocks This Week:

CNOOC [137266%], Parker Drilling[36988.9%], Crescent Point[4066.17%], Spectra [2373.97%], Sinopec Shanghai[1992.58%], Shell Midstream[1402.59%], PetroChina [1137.09%], China [1104.2%], Enable Midstream[966.906%], Alon USA[959.753%], NuStar GP[933.475%] Best Energy Stocks Daily:

USD Partners[33.3333%], CVR Refining[14.734%], Fuels[7.2247%], Gastar Exploration[6.84211%], Halcon Resources[6.19469%], Renewable [5.73556%], Uranium [5.31178%], Centrus [5.29673%], Parker Drilling[3.72902%], Seacor [3.65812%], Peabody [3.64215%]

Centrus [370.828%], Fuels[196.567%], CVR [121.546%], Par Pacific[110.905%], Geospace Technologies[97.4155%], Dominion Midstream[84.3866%], Delek US[83.0509%], Uranium [79.5276%], NCS Multistage[65.4577%], Flotek Industries[65%], Cameco Corp[61.4264%] Best Energy Stocks This Week:

CNOOC [137266%], Parker Drilling[36988.9%], Crescent Point[4066.17%], Spectra [2373.97%], Sinopec Shanghai[1992.58%], Shell Midstream[1402.59%], PetroChina [1137.09%], China [1104.2%], Enable Midstream[966.906%], Alon USA[959.753%], NuStar GP[933.475%] Best Energy Stocks Daily:

USD Partners[33.3333%], CVR Refining[14.734%], Fuels[7.2247%], Gastar Exploration[6.84211%], Halcon Resources[6.19469%], Renewable [5.73556%], Uranium [5.31178%], Centrus [5.29673%], Parker Drilling[3.72902%], Seacor [3.65812%], Peabody [3.64215%]

Login Sign Up

Login Sign Up