Best MidCap Stocks

|

| In a hurry? Mid Cap Stocks Lists: Performance Trends Table, Stock Charts

Sort midcap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter midcap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter midcap stocks list by size:All MidCap Large Mid-Range Small |

| 12Stocks.com Mid Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 70 (0-bearish to 100-bullish) which puts Mid Cap index in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 56 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested mid cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Top Performing Mid Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Mid Cap Index stocks year to date are

Now, more recently, over last week, the top performing Mid Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Midcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Midcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Midcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

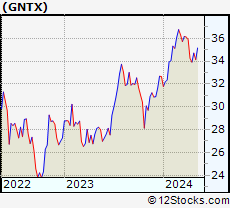

| GNTX | Gentex |   | Consumer Staples | 34.86 | 65 | 0.43% | 6.74% |

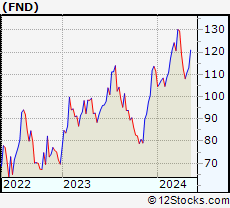

| FND | Floor & Decor |   | Services & Goods | 111.26 | 65 | 0.30% | -0.27% |

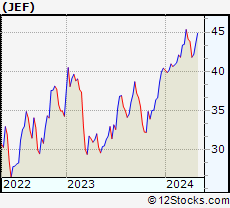

| JEF | Jefferies Financial |   | Financials | 43.68 | 65 | 0.28% | 8.09% |

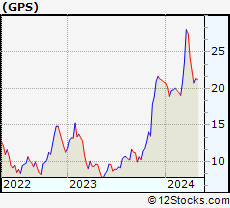

| GPS | Gap |   | Services & Goods | 21.25 | 65 | -0.47% | 1.63% |

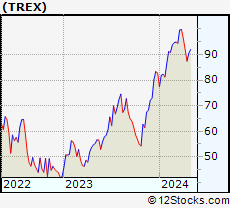

| TREX | Trex |   | Industrials | 90.24 | 65 | -0.32% | 9.00% |

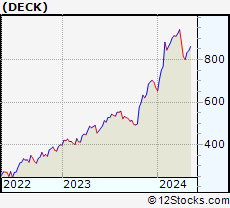

| DECK | Deckers |   | Consumer Staples | 832.43 | 65 | -0.12% | 24.54% |

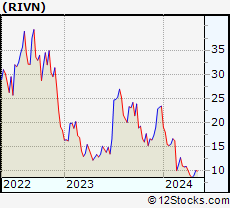

| RIVN | Rivian Automotive |   | Services & Goods | 9.38 | 64 | 3.82% | -59.97% |

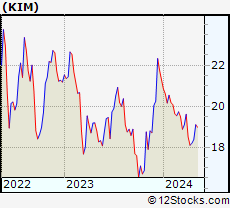

| KIM | Kimco Realty |   | Financials | 18.81 | 64 | 2.34% | -11.73% |

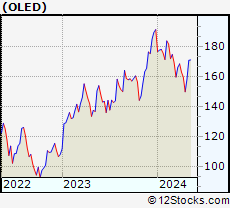

| OLED | Universal Display |   | Technology | 162.02 | 64 | 2.34% | -15.29% |

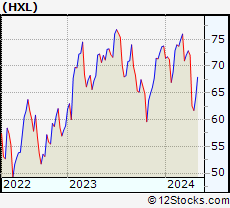

| HXL | Hexcel |   | Industrials | 65.43 | 64 | 1.98% | -11.28% |

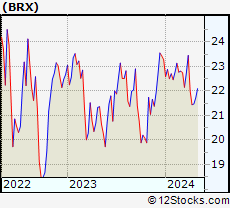

| BRX | Brixmor Property |   | Financials | 22.15 | 64 | 1.98% | -4.81% |

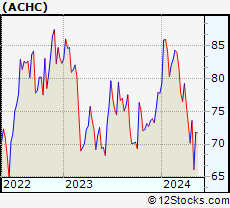

| ACHC | Acadia |   | Health Care | 74.61 | 64 | 1.39% | -4.05% |

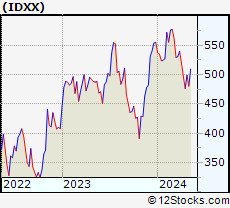

| IDXX | IDEXX |   | Health Care | 505.34 | 64 | 1.21% | -8.96% |

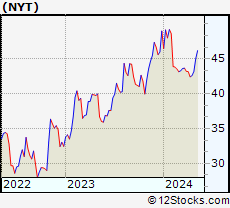

| NYT | New York |   | Services & Goods | 43.66 | 64 | 1.14% | -10.88% |

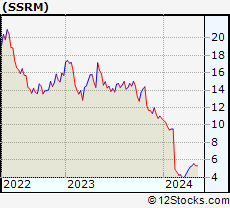

| SSRM | SSR Mining |   | Materials | 5.63 | 64 | 1.08% | -47.68% |

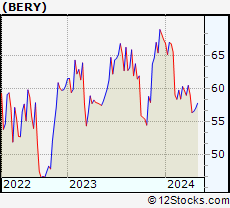

| BERY | Berry Global |   | Consumer Staples | 57.45 | 64 | 0.70% | -14.75% |

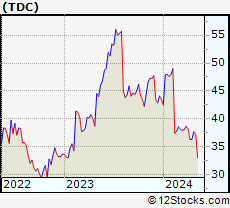

| TDC | Teradata |   | Technology | 37.86 | 64 | 0.50% | -12.99% |

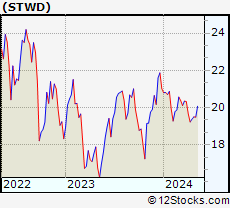

| STWD | Starwood Property |   | Financials | 19.57 | 64 | 0.36% | -6.90% |

| CIEN | Ciena |   | Technology | 46.76 | 64 | 0.32% | 3.89% |

| AFRM | Affirm |   | Technology | 33.42 | 64 | 0.24% | -31.74% |

| THC | Tenet |   | Health Care | 99.15 | 63 | 3.14% | 31.20% |

| K | Kellogg |   | Consumer Staples | 58.21 | 63 | 0.83% | 4.11% |

| NDSN | Nordson |   | Industrials | 262.49 | 63 | 0.80% | -0.63% |

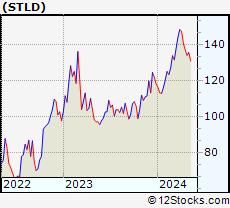

| STLD | Steel Dynamics |   | Materials | 135.07 | 63 | 0.77% | 14.37% |

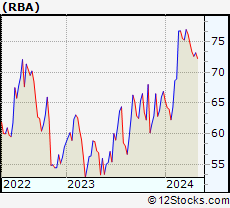

| RBA | Ritchie Bros. |   | Services & Goods | 73.71 | 63 | 0.72% | 10.20% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Midcap Stocks |

| Midcap Technical Overview, Leaders & Laggards, Top Midcap ETF Funds & Detailed Midcap Stocks List, Charts, Trends & More |

| Midcap: Technical Analysis, Trends & YTD Performance | |

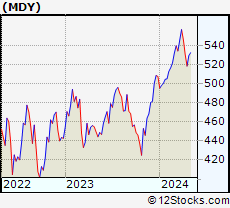

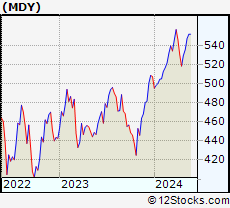

| MidCap segment as represented by

MDY, an exchange-traded fund [ETF], holds basket of about four hundred midcap stocks from across all major sectors of the US stock market. The midcap index (contains stocks like Green Mountain Coffee Roasters and Tractor Supply Company) is up by 4.91% and is currently underperforming the overall market by -1.65% year-to-date. Below is a quick view of technical charts and trends: | |

MDY Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Good | |

MDY Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 70 | |

| YTD Performance: 4.91% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Midcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Midcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Midcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Midcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IJH | iShares Core S&P Mid-Cap |   | 58.17 | 75 | 0.61 | 0.61 | 4.94% |

| IWR | iShares Russell Mid-Cap |   | 80.98 | 75 | 0.57 | 0.57 | 4.18% |

| IWP | iShares Russell Mid-Cap Growth |   | 109.47 | 78 | 0.45 | 0.45 | 4.8% |

| MDY | SPDR S&P MidCap 400 ETF |   | 532.28 | 70 | 0.55 | 0.55 | 4.91% |

| IWS | iShares Russell Mid-Cap Value |   | 120.76 | 75 | 0.64 | 0.64 | 3.84% |

| IJK | iShares S&P Mid-Cap 400 Growth |   | 87.51 | 70 | 0.59 | 0.59 | 10.46% |

| IJJ | iShares S&P Mid-Cap 400 Value |   | 112.85 | 88 | 0.55 | 0.55 | -1.04% |

| XMLV | PowerShares S&P MidCap Low Volatil ETF |   | 54.94 | 83 | 0.53 | 0.53 | 3.31% |

| UMDD | ProShares UltraPro MidCap400 |   | 24.32 | 71 | 1.50 | 1.5 | 8.96% |

| SMDD | ProShares UltraPro Short MidCap400 |   | 11.62 | 10 | -1.78 | -1.78 | -13.69% |

| MYY | ProShares Short MidCap400 |   | 20.69 | 18 | -0.48 | -0.48 | -3.56% |

| MZZ | ProShares UltraShort MidCap400 |   | 11.59 | 20 | -0.77 | -0.77 | -7.8% |

| MVV | ProShares Ultra MidCap400 |   | 61.81 | 75 | 0.61 | 0.61 | 6.76% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of MidCap Stocks | |

|

We now take in-depth look at all MidCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort MidCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

| GNTX Gentex Corporation |

| Sector: Consumer Staples | |

| SubSector: Auto Parts | |

| MarketCap: 5638.99 Millions | |

| Recent Price: 34.86 Smart Investing & Trading Score: 65 | |

| Day Percent Change: 0.43% Day Change: 0.15 | |

| Week Change: 0.43% Year-to-date Change: 6.7% | |

| GNTX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GNTX to Watchlist:  View: View:  Get Complete GNTX Trend Analysis ➞ Get Complete GNTX Trend Analysis ➞ | |

| FND Floor & Decor Holdings, Inc. |

| Sector: Services & Goods | |

| SubSector: Home Improvement Stores | |

| MarketCap: 3327.52 Millions | |

| Recent Price: 111.26 Smart Investing & Trading Score: 65 | |

| Day Percent Change: 0.30% Day Change: 0.33 | |

| Week Change: 0.3% Year-to-date Change: -0.3% | |

| FND Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FND to Watchlist:  View: View:  Get Complete FND Trend Analysis ➞ Get Complete FND Trend Analysis ➞ | |

| JEF Jefferies Financial Group Inc. |

| Sector: Financials | |

| SubSector: Investment Brokerage - Regional | |

| MarketCap: 3987.15 Millions | |

| Recent Price: 43.68 Smart Investing & Trading Score: 65 | |

| Day Percent Change: 0.28% Day Change: 0.12 | |

| Week Change: 0.28% Year-to-date Change: 8.1% | |

| JEF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JEF to Watchlist:  View: View:  Get Complete JEF Trend Analysis ➞ Get Complete JEF Trend Analysis ➞ | |

| GPS The Gap, Inc. |

| Sector: Services & Goods | |

| SubSector: Apparel Stores | |

| MarketCap: 2936.08 Millions | |

| Recent Price: 21.25 Smart Investing & Trading Score: 65 | |

| Day Percent Change: -0.47% Day Change: -0.10 | |

| Week Change: -0.47% Year-to-date Change: 1.6% | |

| GPS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GPS to Watchlist:  View: View:  Get Complete GPS Trend Analysis ➞ Get Complete GPS Trend Analysis ➞ | |

| TREX Trex Company, Inc. |

| Sector: Industrials | |

| SubSector: General Building Materials | |

| MarketCap: 4369.23 Millions | |

| Recent Price: 90.24 Smart Investing & Trading Score: 65 | |

| Day Percent Change: -0.32% Day Change: -0.29 | |

| Week Change: -0.32% Year-to-date Change: 9.0% | |

| TREX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TREX to Watchlist:  View: View:  Get Complete TREX Trend Analysis ➞ Get Complete TREX Trend Analysis ➞ | |

| DECK Deckers Outdoor Corporation |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Footwear & Accessories | |

| MarketCap: 3401.6 Millions | |

| Recent Price: 832.43 Smart Investing & Trading Score: 65 | |

| Day Percent Change: -0.12% Day Change: -1.03 | |

| Week Change: -0.12% Year-to-date Change: 24.5% | |

| DECK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DECK to Watchlist:  View: View:  Get Complete DECK Trend Analysis ➞ Get Complete DECK Trend Analysis ➞ | |

| RIVN Rivian Automotive, Inc. |

| Sector: Services & Goods | |

| SubSector: Auto Manufacturers | |

| MarketCap: 14310 Millions | |

| Recent Price: 9.38 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 3.82% Day Change: 0.35 | |

| Week Change: 3.82% Year-to-date Change: -60.0% | |

| RIVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RIVN to Watchlist:  View: View:  Get Complete RIVN Trend Analysis ➞ Get Complete RIVN Trend Analysis ➞ | |

| KIM Kimco Realty Corporation |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 5358.64 Millions | |

| Recent Price: 18.81 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 2.34% Day Change: 0.43 | |

| Week Change: 2.34% Year-to-date Change: -11.7% | |

| KIM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KIM to Watchlist:  View: View:  Get Complete KIM Trend Analysis ➞ Get Complete KIM Trend Analysis ➞ | |

| OLED Universal Display Corporation |

| Sector: Technology | |

| SubSector: Semiconductor Equipment & Materials | |

| MarketCap: 5660.08 Millions | |

| Recent Price: 162.02 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 2.34% Day Change: 3.71 | |

| Week Change: 2.34% Year-to-date Change: -15.3% | |

| OLED Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OLED to Watchlist:  View: View:  Get Complete OLED Trend Analysis ➞ Get Complete OLED Trend Analysis ➞ | |

| HXL Hexcel Corporation |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 2905.51 Millions | |

| Recent Price: 65.43 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.98% Day Change: 1.27 | |

| Week Change: 1.98% Year-to-date Change: -11.3% | |

| HXL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HXL to Watchlist:  View: View:  Get Complete HXL Trend Analysis ➞ Get Complete HXL Trend Analysis ➞ | |

| BRX Brixmor Property Group Inc. |

| Sector: Financials | |

| SubSector: REIT - Retail | |

| MarketCap: 3561.54 Millions | |

| Recent Price: 22.15 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.98% Day Change: 0.43 | |

| Week Change: 1.98% Year-to-date Change: -4.8% | |

| BRX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BRX to Watchlist:  View: View:  Get Complete BRX Trend Analysis ➞ Get Complete BRX Trend Analysis ➞ | |

| ACHC Acadia Healthcare Company, Inc. |

| Sector: Health Care | |

| SubSector: Specialized Health Services | |

| MarketCap: 1331.56 Millions | |

| Recent Price: 74.61 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.39% Day Change: 1.02 | |

| Week Change: 1.39% Year-to-date Change: -4.1% | |

| ACHC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACHC to Watchlist:  View: View:  Get Complete ACHC Trend Analysis ➞ Get Complete ACHC Trend Analysis ➞ | |

| IDXX IDEXX Laboratories, Inc. |

| Sector: Health Care | |

| SubSector: Diagnostic Substances | |

| MarketCap: 15937.1 Millions | |

| Recent Price: 505.34 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.21% Day Change: 6.04 | |

| Week Change: 1.21% Year-to-date Change: -9.0% | |

| IDXX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IDXX to Watchlist:  View: View:  Get Complete IDXX Trend Analysis ➞ Get Complete IDXX Trend Analysis ➞ | |

| NYT The New York Times Company |

| Sector: Services & Goods | |

| SubSector: Publishing - Newspapers | |

| MarketCap: 5188.22 Millions | |

| Recent Price: 43.66 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.14% Day Change: 0.49 | |

| Week Change: 1.14% Year-to-date Change: -10.9% | |

| NYT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NYT to Watchlist:  View: View:  Get Complete NYT Trend Analysis ➞ Get Complete NYT Trend Analysis ➞ | |

| SSRM SSR Mining Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1546.09 Millions | |

| Recent Price: 5.63 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.08% Day Change: 0.06 | |

| Week Change: 1.08% Year-to-date Change: -47.7% | |

| SSRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SSRM to Watchlist:  View: View:  Get Complete SSRM Trend Analysis ➞ Get Complete SSRM Trend Analysis ➞ | |

| BERY Berry Global Group, Inc. |

| Sector: Consumer Staples | |

| SubSector: Packaging & Containers | |

| MarketCap: 4349.33 Millions | |

| Recent Price: 57.45 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 0.70% Day Change: 0.40 | |

| Week Change: 0.7% Year-to-date Change: -14.8% | |

| BERY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BERY to Watchlist:  View: View:  Get Complete BERY Trend Analysis ➞ Get Complete BERY Trend Analysis ➞ | |

| TDC Teradata Corporation |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 2229.48 Millions | |

| Recent Price: 37.86 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 0.50% Day Change: 0.19 | |

| Week Change: 0.5% Year-to-date Change: -13.0% | |

| TDC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TDC to Watchlist:  View: View:  Get Complete TDC Trend Analysis ➞ Get Complete TDC Trend Analysis ➞ | |

| STWD Starwood Property Trust, Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 3447.09 Millions | |

| Recent Price: 19.57 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 0.36% Day Change: 0.07 | |

| Week Change: 0.36% Year-to-date Change: -6.9% | |

| STWD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STWD to Watchlist:  View: View:  Get Complete STWD Trend Analysis ➞ Get Complete STWD Trend Analysis ➞ | |

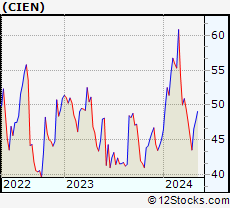

| CIEN Ciena Corporation |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 6206.99 Millions | |

| Recent Price: 46.76 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 0.32% Day Change: 0.15 | |

| Week Change: 0.32% Year-to-date Change: 3.9% | |

| CIEN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CIEN to Watchlist:  View: View:  Get Complete CIEN Trend Analysis ➞ Get Complete CIEN Trend Analysis ➞ | |

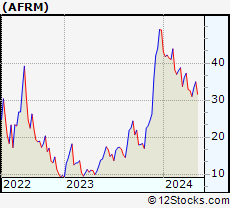

| AFRM Affirm Holdings, Inc. |

| Sector: Technology | |

| SubSector: Software - Infrastructure | |

| MarketCap: 4560 Millions | |

| Recent Price: 33.42 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 0.24% Day Change: 0.08 | |

| Week Change: 0.24% Year-to-date Change: -31.7% | |

| AFRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AFRM to Watchlist:  View: View:  Get Complete AFRM Trend Analysis ➞ Get Complete AFRM Trend Analysis ➞ | |

| THC Tenet Healthcare Corporation |

| Sector: Health Care | |

| SubSector: Hospitals | |

| MarketCap: 1544.46 Millions | |

| Recent Price: 99.15 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 3.14% Day Change: 3.02 | |

| Week Change: 3.14% Year-to-date Change: 31.2% | |

| THC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THC to Watchlist:  View: View:  Get Complete THC Trend Analysis ➞ Get Complete THC Trend Analysis ➞ | |

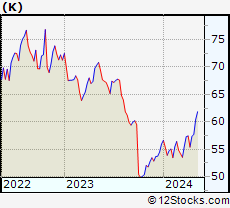

| K Kellogg Company |

| Sector: Consumer Staples | |

| SubSector: Processed & Packaged Goods | |

| MarketCap: 20264.6 Millions | |

| Recent Price: 58.21 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 0.83% Day Change: 0.48 | |

| Week Change: 0.83% Year-to-date Change: 4.1% | |

| K Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add K to Watchlist:  View: View:  Get Complete K Trend Analysis ➞ Get Complete K Trend Analysis ➞ | |

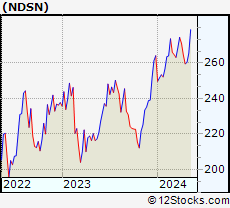

| NDSN Nordson Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 7117.56 Millions | |

| Recent Price: 262.49 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 0.80% Day Change: 2.09 | |

| Week Change: 0.8% Year-to-date Change: -0.6% | |

| NDSN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NDSN to Watchlist:  View: View:  Get Complete NDSN Trend Analysis ➞ Get Complete NDSN Trend Analysis ➞ | |

| STLD Steel Dynamics, Inc. |

| Sector: Materials | |

| SubSector: Steel & Iron | |

| MarketCap: 4533.58 Millions | |

| Recent Price: 135.07 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 0.77% Day Change: 1.03 | |

| Week Change: 0.77% Year-to-date Change: 14.4% | |

| STLD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STLD to Watchlist:  View: View:  Get Complete STLD Trend Analysis ➞ Get Complete STLD Trend Analysis ➞ | |

| RBA Ritchie Bros. Auctioneers Incorporated |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 3491.02 Millions | |

| Recent Price: 73.71 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 0.72% Day Change: 0.53 | |

| Week Change: 0.72% Year-to-date Change: 10.2% | |

| RBA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RBA to Watchlist:  View: View:  Get Complete RBA Trend Analysis ➞ Get Complete RBA Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Midcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Albemarle [100], Medical Properties[100], Domino s[100], Tandem Diabetes[100], Lattice Semiconductor[100], Quest Diagnostics[100], AES [100], Carrier Global[100], Teradyne [100], DaVita [100], Skyworks Solutions[100]

Best Midcap Stocks Year-to-Date:

Vistra Energy[102.39%], AppLovin [83.42%], ShockWave Medical[72.92%], EMCOR [68.8%], CAVA [62.35%], Constellation Energy[61.05%], Spotify [53.34%], Antero Resources[51.23%], Natera [50.13%], Wingstop [49.98%], Pure Storage[47.03%] Best Midcap Stocks This Week:

Ginkgo Bioworks[15.08%], Hertz Global[7.92%], Albemarle [7.57%], Vistra Energy[7.24%], Medical Properties[5.99%], Domino s[5.62%], Liberty SiriusXM[5.49%], Liberty SiriusXM[5.27%], Tandem Diabetes[5.19%], Sirius XM[4.97%], Peloton Interactive[4.43%] Best Midcap Stocks Daily:

Ginkgo Bioworks[15.08%], Hertz Global[7.92%], Albemarle [7.57%], Vistra Energy[7.24%], Medical Properties[5.99%], Domino s[5.62%], Liberty SiriusXM[5.49%], Liberty SiriusXM[5.27%], Tandem Diabetes[5.19%], Sirius XM[4.97%], Peloton Interactive[4.43%]

Vistra Energy[102.39%], AppLovin [83.42%], ShockWave Medical[72.92%], EMCOR [68.8%], CAVA [62.35%], Constellation Energy[61.05%], Spotify [53.34%], Antero Resources[51.23%], Natera [50.13%], Wingstop [49.98%], Pure Storage[47.03%] Best Midcap Stocks This Week:

Ginkgo Bioworks[15.08%], Hertz Global[7.92%], Albemarle [7.57%], Vistra Energy[7.24%], Medical Properties[5.99%], Domino s[5.62%], Liberty SiriusXM[5.49%], Liberty SiriusXM[5.27%], Tandem Diabetes[5.19%], Sirius XM[4.97%], Peloton Interactive[4.43%] Best Midcap Stocks Daily:

Ginkgo Bioworks[15.08%], Hertz Global[7.92%], Albemarle [7.57%], Vistra Energy[7.24%], Medical Properties[5.99%], Domino s[5.62%], Liberty SiriusXM[5.49%], Liberty SiriusXM[5.27%], Tandem Diabetes[5.19%], Sirius XM[4.97%], Peloton Interactive[4.43%]

Login Sign Up

Login Sign Up