Best S&P 100 Stocks

| In a hurry? S&P 100 Stocks Lists: Performance Trends Table, Stock Charts

Sort S&P 100 stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. |

| 12Stocks.com S&P 100 Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 41 (0-bearish to 100-bullish) which puts S&P 100 index in short term neutral trend. The Smart Investing & Trading Score from previous trading session is 78 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested S&P 100 stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Top Performing S&P 100 Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing S&P 100 Index stocks year to date are

Now, more recently, over last week, the top performing S&P 100 Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in S&P 100 Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the S&P 100 Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in S&P 100 Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| MMM | 3M |   | Industrials | 98.56 | 100 | 2.13% | -9.84% |

| PYPL | PayPal |   | Financials | 65.97 | 100 | -2.87% | 7.43% |

| CL | Colgate-Palmolive |   | Consumer Staples | 91.05 | 100 | -0.95% | 14.23% |

| LLY | Eli Lilly |   | Health Care | 770.36 | 95 | -1.37% | 32.16% |

| MO | Altria |   | Consumer Staples | 43.94 | 88 | 0.30% | 8.92% |

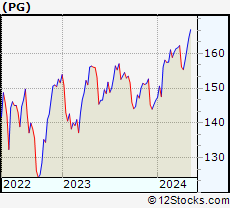

| PG | Procter & Gamble |   | Consumer Staples | 162.76 | 88 | -0.27% | 11.07% |

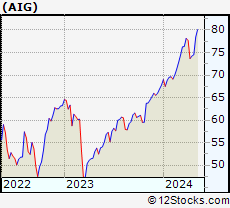

| AIG | American |   | Financials | 75.94 | 85 | 0.83% | 12.08% |

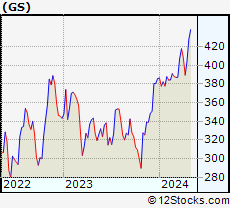

| GS | Goldman Sachs |   | Financials | 426.85 | 83 | 0.03% | 10.65% |

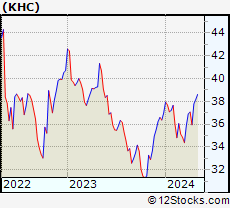

| KHC | Kraft Heinz |   | Consumer Staples | 36.25 | 83 | -6.11% | -1.97% |

| LMT | Lockheed Martin |   | Industrials | 461.19 | 83 | -0.80% | 1.75% |

| KO | Coca-Cola |   | Consumer Staples | 61.45 | 83 | -0.52% | 4.28% |

| DHR | Danaher |   | Industrials | 247.36 | 81 | 0.30% | 6.92% |

| UPS | United Parcel |   | Transports | 146.01 | 81 | -1.00% | -7.14% |

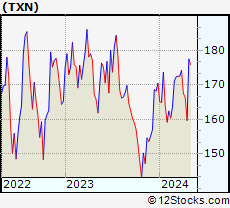

| TXN | Texas Instruments |   | Technology | 175.58 | 81 | -0.48% | 3.00% |

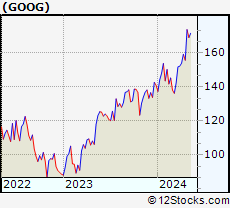

| GOOGL |   | Technology | 164.64 | 78 | 1.14% | 17.86% | |

| GOOG |   | Technology | 166.48 | 78 | 1.12% | 18.13% | |

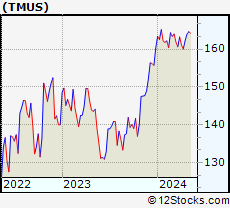

| TMUS | T-Mobile US |   | Technology | 164.54 | 76 | 0.23% | 2.63% |

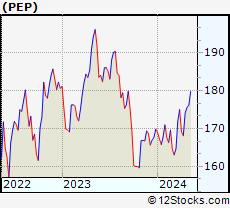

| PEP | PepsiCo |   | Consumer Staples | 174.24 | 76 | -0.95% | 2.59% |

| GD | General Dynamics |   | Industrials | 285.07 | 76 | -0.70% | 9.78% |

| QCOM | QUALCOMM |   | Technology | 165.13 | 75 | -0.43% | 14.17% |

| NEE | NextEra Energy |   | Utilities | 67.20 | 71 | 0.34% | 10.64% |

| EXC | Exelon |   | Utilities | 37.50 | 71 | -0.21% | 4.46% |

| NVDA | NVIDIA |   | Technology | 842.36 | 70 | -2.51% | 70.10% |

| PM | Philip Morris |   | Consumer Staples | 95.61 | 68 | 0.71% | 1.63% |

| SO | Southern |   | Utilities | 73.66 | 68 | 0.21% | 5.04% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of S&P 100 Stocks |

| S&P 100 Technical Overview, Leaders & Laggards, Top S&P 100 ETF Funds & Detailed S&P 100 Stocks List, Charts, Trends & More |

| S&P 100: Technical Analysis, Trends & YTD Performance | |

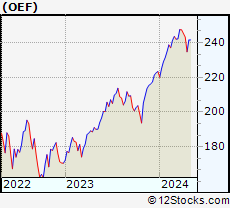

| S&P 100 index as represented by

OEF, an exchange-traded fund [ETF], holds basket of one hundred US (mostly largecap) stocks from across all major sectors of the US stock market. The S&P 100 index (contains stocks like Apple and Exxon) is up by 6.59% and is currently outperforming the overall market by 2.08% year-to-date. Below is a quick view of technical charts and trends: | |

OEF Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Not Good | |

OEF Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 41 | |

| YTD Performance: 6.59% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in S&P 100 Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track S&P 100 index. We have also included ETF funds that track S&P 500 index since it is market-cap weighted. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of S&P 100 indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track S&P 100 Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| SPY | SPDR S&P 500 ETF |   | 500.91 | 41 | -0.21 | -1.45 | 5.39% |

| SH | ProShares Short S&P500 |   | 12.48 | 60 | 0.36 | 1.59 | -3.96% |

| SDS | ProShares UltraShort S&P500 |   | 27.34 | 60 | 0.51 | 3.05 | -8.62% |

| SPXU | ProShares UltraPro Short S&P500 |   | 37.17 | 67 | 0.88 | 4.72 | -13.55% |

| UPRO | ProShares UltraPro S&P500 |   | 60.90 | 33 | -0.81 | -4.58 | 11.25% |

| SSO | ProShares Ultra S&P500 |   | 70.62 | 41 | -0.35 | -2.87 | 8.53% |

| OEF | iShares S&P 100 |   | 238.11 | 41 | -0.14 | -1.43 | 6.59% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of S&P 100 Stocks | |

|

We now take in-depth look at all S&P 100 stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort S&P 100 stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

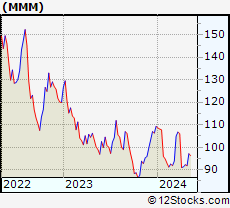

| MMM 3M Company |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 79237.7 Millions | |

| Recent Price: 98.56 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.13% Day Change: 2.05 | |

| Week Change: 7.33% Year-to-date Change: -9.8% | |

| MMM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MMM to Watchlist:  View: View:  Get Complete MMM Trend Analysis ➞ Get Complete MMM Trend Analysis ➞ | |

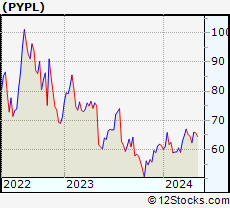

| PYPL PayPal Holdings, Inc. |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 108949 Millions | |

| Recent Price: 65.97 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -2.87% Day Change: -1.95 | |

| Week Change: 0.02% Year-to-date Change: 7.4% | |

| PYPL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PYPL to Watchlist:  View: View:  Get Complete PYPL Trend Analysis ➞ Get Complete PYPL Trend Analysis ➞ | |

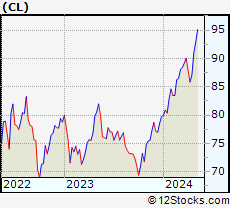

| CL Colgate-Palmolive Company |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 57242.7 Millions | |

| Recent Price: 91.05 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.95% Day Change: -0.87 | |

| Week Change: 0.04% Year-to-date Change: 14.2% | |

| CL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CL to Watchlist:  View: View:  Get Complete CL Trend Analysis ➞ Get Complete CL Trend Analysis ➞ | |

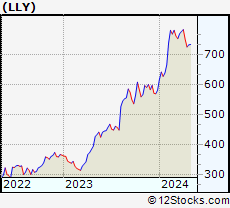

| LLY Eli Lilly and Company |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Major | |

| MarketCap: 130066 Millions | |

| Recent Price: 770.36 Smart Investing & Trading Score: 95 | |

| Day Percent Change: -1.37% Day Change: -10.74 | |

| Week Change: 5.02% Year-to-date Change: 32.2% | |

| LLY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LLY to Watchlist:  View: View:  Get Complete LLY Trend Analysis ➞ Get Complete LLY Trend Analysis ➞ | |

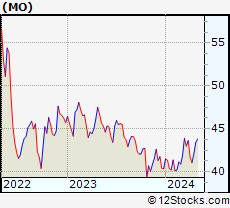

| MO Altria Group, Inc. |

| Sector: Consumer Staples | |

| SubSector: Cigarettes | |

| MarketCap: 70806.3 Millions | |

| Recent Price: 43.94 Smart Investing & Trading Score: 88 | |

| Day Percent Change: 0.30% Day Change: 0.13 | |

| Week Change: 1.29% Year-to-date Change: 8.9% | |

| MO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MO to Watchlist:  View: View:  Get Complete MO Trend Analysis ➞ Get Complete MO Trend Analysis ➞ | |

| PG The Procter & Gamble Company |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 277162 Millions | |

| Recent Price: 162.76 Smart Investing & Trading Score: 88 | |

| Day Percent Change: -0.27% Day Change: -0.44 | |

| Week Change: 0.91% Year-to-date Change: 11.1% | |

| PG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PG to Watchlist:  View: View:  Get Complete PG Trend Analysis ➞ Get Complete PG Trend Analysis ➞ | |

| AIG American International Group, Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 21219 Millions | |

| Recent Price: 75.94 Smart Investing & Trading Score: 85 | |

| Day Percent Change: 0.83% Day Change: 0.63 | |

| Week Change: 1.89% Year-to-date Change: 12.1% | |

| AIG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AIG to Watchlist:  View: View:  Get Complete AIG Trend Analysis ➞ Get Complete AIG Trend Analysis ➞ | |

| GS The Goldman Sachs Group, Inc. |

| Sector: Financials | |

| SubSector: Investment Brokerage - National | |

| MarketCap: 54579.3 Millions | |

| Recent Price: 426.85 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 0.03% Day Change: 0.14 | |

| Week Change: -0.17% Year-to-date Change: 10.7% | |

| GS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GS to Watchlist:  View: View:  Get Complete GS Trend Analysis ➞ Get Complete GS Trend Analysis ➞ | |

| KHC The Kraft Heinz Company |

| Sector: Consumer Staples | |

| SubSector: Food - Major Diversified | |

| MarketCap: 32096.3 Millions | |

| Recent Price: 36.25 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -6.11% Day Change: -2.36 | |

| Week Change: -5.01% Year-to-date Change: -2.0% | |

| KHC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KHC to Watchlist:  View: View:  Get Complete KHC Trend Analysis ➞ Get Complete KHC Trend Analysis ➞ | |

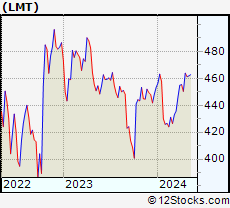

| LMT Lockheed Martin Corporation |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 94116.4 Millions | |

| Recent Price: 461.19 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.80% Day Change: -3.74 | |

| Week Change: -0.02% Year-to-date Change: 1.8% | |

| LMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LMT to Watchlist:  View: View:  Get Complete LMT Trend Analysis ➞ Get Complete LMT Trend Analysis ➞ | |

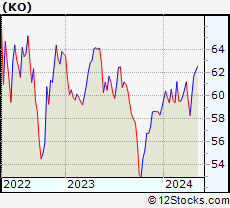

| KO The Coca-Cola Company |

| Sector: Consumer Staples | |

| SubSector: Beverages - Soft Drinks | |

| MarketCap: 182046 Millions | |

| Recent Price: 61.45 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -0.52% Day Change: -0.32 | |

| Week Change: -0.47% Year-to-date Change: 4.3% | |

| KO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KO to Watchlist:  View: View:  Get Complete KO Trend Analysis ➞ Get Complete KO Trend Analysis ➞ | |

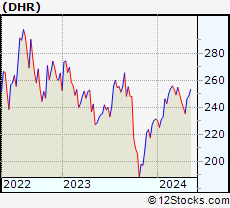

| DHR Danaher Corporation |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 93210.3 Millions | |

| Recent Price: 247.36 Smart Investing & Trading Score: 81 | |

| Day Percent Change: 0.30% Day Change: 0.74 | |

| Week Change: 0.32% Year-to-date Change: 6.9% | |

| DHR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DHR to Watchlist:  View: View:  Get Complete DHR Trend Analysis ➞ Get Complete DHR Trend Analysis ➞ | |

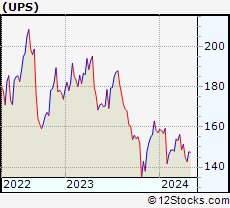

| UPS United Parcel Service, Inc. |

| Sector: Transports | |

| SubSector: Air Delivery & Freight Services | |

| MarketCap: 81928.9 Millions | |

| Recent Price: 146.01 Smart Investing & Trading Score: 81 | |

| Day Percent Change: -1.00% Day Change: -1.47 | |

| Week Change: -1.07% Year-to-date Change: -7.1% | |

| UPS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UPS to Watchlist:  View: View:  Get Complete UPS Trend Analysis ➞ Get Complete UPS Trend Analysis ➞ | |

| TXN Texas Instruments Incorporated |

| Sector: Technology | |

| SubSector: Semiconductor - Broad Line | |

| MarketCap: 99509.1 Millions | |

| Recent Price: 175.58 Smart Investing & Trading Score: 81 | |

| Day Percent Change: -0.48% Day Change: -0.84 | |

| Week Change: -1.07% Year-to-date Change: 3.0% | |

| TXN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TXN to Watchlist:  View: View:  Get Complete TXN Trend Analysis ➞ Get Complete TXN Trend Analysis ➞ | |

| GOOGL Alphabet Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 801264 Millions | |

| Recent Price: 164.64 Smart Investing & Trading Score: 78 | |

| Day Percent Change: 1.14% Day Change: 1.86 | |

| Week Change: -4.25% Year-to-date Change: 17.9% | |

| GOOGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GOOGL to Watchlist:  View: View:  Get Complete GOOGL Trend Analysis ➞ Get Complete GOOGL Trend Analysis ➞ | |

| GOOG Alphabet Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 730159 Millions | |

| Recent Price: 166.48 Smart Investing & Trading Score: 78 | |

| Day Percent Change: 1.12% Day Change: 1.84 | |

| Week Change: -4.15% Year-to-date Change: 18.1% | |

| GOOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GOOG to Watchlist:  View: View:  Get Complete GOOG Trend Analysis ➞ Get Complete GOOG Trend Analysis ➞ | |

| TMUS T-Mobile US, Inc. |

| Sector: Technology | |

| SubSector: Wireless Communications | |

| MarketCap: 71949 Millions | |

| Recent Price: 164.54 Smart Investing & Trading Score: 76 | |

| Day Percent Change: 0.23% Day Change: 0.37 | |

| Week Change: 0.35% Year-to-date Change: 2.6% | |

| TMUS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TMUS to Watchlist:  View: View:  Get Complete TMUS Trend Analysis ➞ Get Complete TMUS Trend Analysis ➞ | |

| PEP PepsiCo, Inc. |

| Sector: Consumer Staples | |

| SubSector: Beverages - Soft Drinks | |

| MarketCap: 162458 Millions | |

| Recent Price: 174.24 Smart Investing & Trading Score: 76 | |

| Day Percent Change: -0.95% Day Change: -1.67 | |

| Week Change: -0.76% Year-to-date Change: 2.6% | |

| PEP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PEP to Watchlist:  View: View:  Get Complete PEP Trend Analysis ➞ Get Complete PEP Trend Analysis ➞ | |

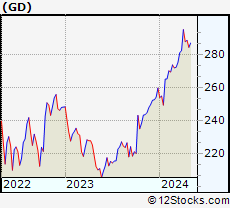

| GD General Dynamics Corporation |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 37063.8 Millions | |

| Recent Price: 285.07 Smart Investing & Trading Score: 76 | |

| Day Percent Change: -0.70% Day Change: -2.02 | |

| Week Change: 0.23% Year-to-date Change: 9.8% | |

| GD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GD to Watchlist:  View: View:  Get Complete GD Trend Analysis ➞ Get Complete GD Trend Analysis ➞ | |

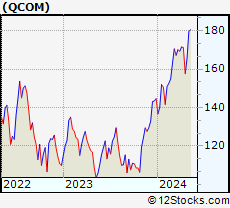

| QCOM QUALCOMM Incorporated |

| Sector: Technology | |

| SubSector: Communication Equipment | |

| MarketCap: 77517.7 Millions | |

| Recent Price: 165.13 Smart Investing & Trading Score: 75 | |

| Day Percent Change: -0.43% Day Change: -0.72 | |

| Week Change: -0.32% Year-to-date Change: 14.2% | |

| QCOM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add QCOM to Watchlist:  View: View:  Get Complete QCOM Trend Analysis ➞ Get Complete QCOM Trend Analysis ➞ | |

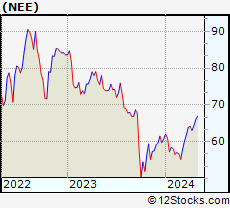

| NEE NextEra Energy, Inc. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 108288 Millions | |

| Recent Price: 67.20 Smart Investing & Trading Score: 71 | |

| Day Percent Change: 0.34% Day Change: 0.23 | |

| Week Change: 1.83% Year-to-date Change: 10.6% | |

| NEE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NEE to Watchlist:  View: View:  Get Complete NEE Trend Analysis ➞ Get Complete NEE Trend Analysis ➞ | |

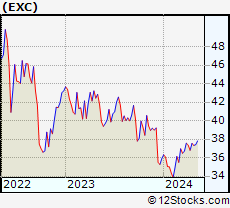

| EXC Exelon Corporation |

| Sector: Utilities | |

| SubSector: Diversified Utilities | |

| MarketCap: 34091.9 Millions | |

| Recent Price: 37.50 Smart Investing & Trading Score: 71 | |

| Day Percent Change: -0.21% Day Change: -0.08 | |

| Week Change: 0.48% Year-to-date Change: 4.5% | |

| EXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EXC to Watchlist:  View: View:  Get Complete EXC Trend Analysis ➞ Get Complete EXC Trend Analysis ➞ | |

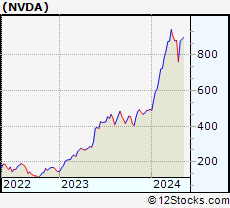

| NVDA NVIDIA Corporation |

| Sector: Technology | |

| SubSector: Semiconductor - Specialized | |

| MarketCap: 143476 Millions | |

| Recent Price: 842.36 Smart Investing & Trading Score: 70 | |

| Day Percent Change: -2.51% Day Change: -21.66 | |

| Week Change: -3.99% Year-to-date Change: 70.1% | |

| NVDA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVDA to Watchlist:  View: View:  Get Complete NVDA Trend Analysis ➞ Get Complete NVDA Trend Analysis ➞ | |

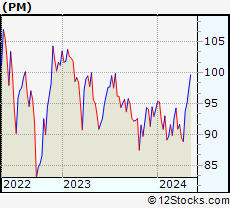

| PM Philip Morris International Inc. |

| Sector: Consumer Staples | |

| SubSector: Cigarettes | |

| MarketCap: 105035 Millions | |

| Recent Price: 95.61 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.71% Day Change: 0.67 | |

| Week Change: 0.62% Year-to-date Change: 1.6% | |

| PM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PM to Watchlist:  View: View:  Get Complete PM Trend Analysis ➞ Get Complete PM Trend Analysis ➞ | |

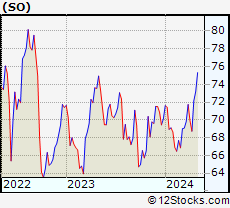

| SO The Southern Company |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 54483.6 Millions | |

| Recent Price: 73.66 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.21% Day Change: 0.16 | |

| Week Change: 0.61% Year-to-date Change: 5.0% | |

| SO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SO to Watchlist:  View: View:  Get Complete SO Trend Analysis ➞ Get Complete SO Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

S&P 100 Stocks With Best Up Trends [0-bearish to 100-bullish]: 3M [100], Colgate-Palmolive [100], PayPal [100], Eli Lilly[95], Altria [88], Procter & Gamble[88], American [85], Goldman Sachs[83], Coca-Cola [83], Lockheed Martin[83], Kraft Heinz[83]

Best S&P 100 Stocks Year-to-Date:

NVIDIA [70.1%], Eli Lilly[32.16%], General Electric[25.47%], General Motors[25.4%], American Express[24.54%], Walt Disney[22.97%], Meta Platforms[22.77%], Wells Fargo[21.27%], Citi [19.65%], Amazon.com [19.24%], Google [18.13%] Best S&P 100 Stocks This Week:

Tesla [8.18%], 3M [7.33%], Eli Lilly[5.02%], Pfizer [4.31%], Johnson & Johnson[2.11%], American [1.89%], NextEra Energy[1.83%], Amgen [1.61%], AbbVie [1.47%], MetLife [1.36%], Altria [1.29%] Best S&P 100 Stocks Daily:

Amazon.com [3.53%], Pfizer [3.42%], Johnson & Johnson[3.20%], 3M [2.13%], General Motors[1.16%], Google [1.14%], Google [1.12%], Meta Platforms[1.03%], Ford Motor[0.95%], Comcast [0.93%], American [0.83%]

NVIDIA [70.1%], Eli Lilly[32.16%], General Electric[25.47%], General Motors[25.4%], American Express[24.54%], Walt Disney[22.97%], Meta Platforms[22.77%], Wells Fargo[21.27%], Citi [19.65%], Amazon.com [19.24%], Google [18.13%] Best S&P 100 Stocks This Week:

Tesla [8.18%], 3M [7.33%], Eli Lilly[5.02%], Pfizer [4.31%], Johnson & Johnson[2.11%], American [1.89%], NextEra Energy[1.83%], Amgen [1.61%], AbbVie [1.47%], MetLife [1.36%], Altria [1.29%] Best S&P 100 Stocks Daily:

Amazon.com [3.53%], Pfizer [3.42%], Johnson & Johnson[3.20%], 3M [2.13%], General Motors[1.16%], Google [1.14%], Google [1.12%], Meta Platforms[1.03%], Ford Motor[0.95%], Comcast [0.93%], American [0.83%]

Login Sign Up

Login Sign Up