October 3, 2025 - The year-to-date (YTD) performance of Global Consumer Discretionary (RXI) ETF is up 14.8651% and is outperforming the overall stock market by 0.1072%.

Recently, the weekly returns of Global Consumer Discretionary (RXI) is up 0.678125% but is underperforming the overall market by -0.209024%. |

|

All trends (long term, mid-term and short term) for iShares Global Consumer Discretionary looks good.

The overall 12Stocks.com Smart Investing & Trading Score is 80 (measures stock trend from 0-bearish to 100-bullish) which puts RXI in short term neutral to bullish trend.

The Smart Investing & Trading Score from previous trading session is 90 and hence a deterioration of trend. Scroll down for key technical charts, support & resistance levels and analysis for Global.

|

| Stock Analysis for RXI | | Name: iShares Global Consumer Discretionary | | Sector: | | SubSector: | In A Glance

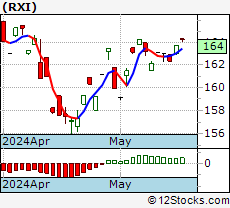

RXI Technical Trend Chart View | |

| |

Daily RXI Technical Chart

Add RXI To Watch List View List | 12Stocks.com

Short Term Trend Analysis for | | 80 / 100 | | The current technical trend score is 80 in a scale where 0 is bearish and 100 is bullish. | | The technical trend score from previous session is 90. | | Trend score updated daily. Not to be used for investing. | | Recent Price: 208.00 | | MarketCap: Millions | | Day Percent Change: -0.194333% | | Day Change: -1.61 | | Week Change: 0.678125% | | Year-to-date Change: 14.8651% |

Technical Levels: For the trading inclined, the following are the key levels of resistance (ceiling) and support (floor) for RXI. Ceiling and floor levels are stock prices at which the stock trend gets resistance or support respectively and traders have an eye on them. Long term levels are more important. Stocks that have broken thru their resistance or supports convincingly tend to have stronger trends (confirm with charts above visually).| Key Levels for RXI | |

| | Short Term | Weekly | Long Term | | Resistance (Ceiling) | 196.38 | 196.95 | 196.63 | | Support (Floor) | 196.01 | 191.47 | 186.8 |

|

The table below shows stocks similar to iShares Global Consumer Discretionary , i.e, from same subsector or sector along with year-to-date (YTD), weekly & daily performaces for comparison. Usually, stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. | | Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% | You have an error in your SQL syntax; check the manual that corresponds to your MySQL server version for the right syntax to use near 'AND etfequities.ETFID=etf.ETFID AND equities.EQUITYID=etfequities.EQUITYID and ' at line 1

|