May 5, 2024 - The year-to-date (YTD) performance of South Africa (EZA) ETF is down -0.53% and is underperforming the overall stock market by -7.41%.

Recently, the weekly returns of South Africa (EZA) is up 3.82% and is outperforming the overall market by 3.12%. |

|

All trends (long term, mid-term and short term) for iShares South Africa looks good.

The overall 12Stocks.com Smart Investing & Trading Score is 100 (measures stock trend from 0-bearish to 100-bullish) which puts EZA in short term bullish trend.

The Smart Investing & Trading Score from previous trading session is 93 and hence an improvement of trend. Scroll down for key technical charts, support & resistance levels and analysis for South.

|

| Stock Analysis for EZA | | Name: iShares South Africa | | Sector: | | SubSector: | In A Glance

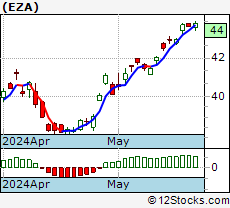

EZA Technical Trend Chart View | |

| |

Daily EZA Technical Chart

Add EZA To Watch List View List | 12Stocks.com

Short Term Trend Analysis for | | 100 / 100 | | The current technical trend score is 100 in a scale where 0 is bearish and 100 is bullish. | | The technical trend score from previous session is 93. | | Trend score updated daily. Not to be used for investing. | | Recent Price: 41.57 | | MarketCap: Millions | | Day Percent Change: 0.97% | | Day Change: 0.40 | | Week Change: 3.82% | | Year-to-date Change: -0.53% |

Technical Levels: For the trading inclined, the following are the key levels of resistance (ceiling) and support (floor) for EZA. Ceiling and floor levels are stock prices at which the stock trend gets resistance or support respectively and traders have an eye on them. Long term levels are more important. Stocks that have broken thru their resistance or supports convincingly tend to have stronger trends (confirm with charts above visually).| Key Levels for EZA | |

| | Short Term | Weekly | Long Term | | Resistance (Ceiling) | 41.49 | 40.18 | 41.41 | | Support (Floor) | 40.62 | 38.2 | 38.14 |

|

The table below shows stocks similar to iShares South Africa, i.e, from same subsector or sector along with year-to-date (YTD), weekly & daily performaces for comparison. Usually, stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. | | Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% | | GFI | Gold Fields Limited |   | Precious Metals | 16.45 | 0.43 | -6.16 | 13.76% | | SBSW | Sibanye Stillwater Limited |   | Precious Metals | 4.70 | 3.07 | -4.67 | -13.44% | | HMY | Harmony Gold Mining Company Limited |   | Precious Metals | 8.57 | 1.18 | -4.46 | 39.35% | | SSL | Sasol Limited |   | Big Oil | 7.05 | 4.60 | 1.73 | -29.07% | | DRD | DRDGOLD Limited |   | Precious Metals | 7.83 | -0.63 | -6 | -1.51% | You have an error in your SQL syntax; check the manual that corresponds to your MySQL server version for the right syntax to use near 'AND etfequities.ETFID=etf.ETFID AND equities.EQUITYID=etfequities.EQUITYID and ' at line 1

|