Best Transport Stocks

| In a hurry? Transport Stocks Lists: Performance Trends Table, Stock Charts

Sort Transport stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Transport stocks list by size: All Transport Large Mid-Range Small |

| 12Stocks.com Transport Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 90 (0-bearish to 100-bullish) which puts Transport sector in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 100 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Transport stocks at 12Stocks.com (click stock name for detailed review):

|

| Consider signing up for our daily 12Stocks.com "Best Stocks Newsletter". You will never ever miss a big stock move again! |

| 12Stocks.com: Investing in Transport sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Transport sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Transport Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| LPG | Dorian LPG |   | Shipping | 28.92 | 100 | 4.29% | 11.40% |

| DAL | Delta Air |   | Airlines | 56.65 | 93 | -0.23% | 11.38% |

| LUV | Southwest Airlines |   | Airlines | 37.13 | 100 | -0.59% | 8.95% |

| SB | Safe Bulkers |   | Shipping | 4.11 | 100 | 1.48% | 8.73% |

| GNK | Genco Shipping |   | Shipping | 15.10 | 100 | 2.65% | 8.24% |

| STNG | Scorpio Tankers |   | Shipping | 45.41 | 100 | -0.31% | 6.97% |

| UAL | United Airlines |   | Airlines | 87.69 | 100 | -4.34% | 6.47% |

| GOGL | Golden Ocean |   | Shipping | 8.41 | 100 | 2.94% | 5.92% |

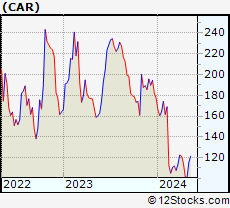

| CAR | Avis Budget |   | Rental | 191.38 | 95 | 1.16% | 5.56% |

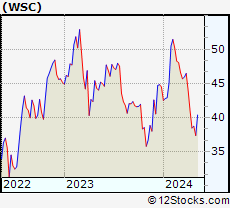

| WSC | WillScot |   | Rental | 30.40 | 100 | -0.91% | 5.19% |

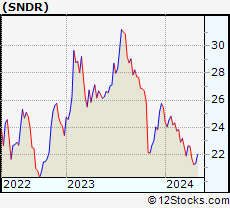

| SNDR | Schneider National |   | Trucking | 26.83 | 95 | -0.33% | 4.56% |

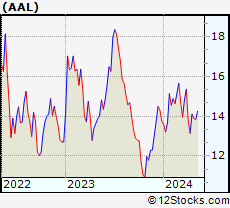

| AAL | American Airlines |   | Airlines | 12.22 | 95 | -5.56% | 4.53% |

| SKYW | SkyWest |   | Airlines | 111.76 | 95 | -1.63% | 3.69% |

| FWRD | Forward Air |   | Air Delivery | 27.37 | 68 | -4.17% | 3.28% |

| SFL | SFL |   | Shipping | 9.19 | 100 | 1.55% | 3.26% |

| ALK | Alaska Air |   | Airlines | 52.54 | 90 | -3.03% | 2.92% |

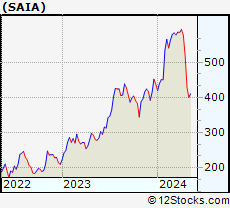

| SAIA | Saia |   | Trucking | 303.28 | 90 | -1.14% | 2.88% |

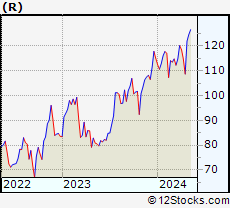

| R | Ryder System |   | Rental | 176.39 | 95 | 0.22% | 2.81% |

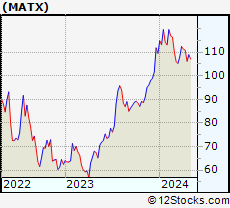

| MATX | Matson |   | Shipping | 116.30 | 100 | 2.46% | 2.78% |

| URI | United Rentals |   | Rental | 814.28 | 90 | -0.67% | 2.75% |

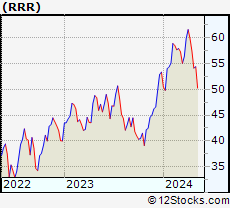

| RRR | Red Rock |   | Rental | 56.13 | 90 | -2.08% | 2.58% |

| ASC | Ardmore Shipping |   | Shipping | 10.48 | 100 | 1.16% | 2.24% |

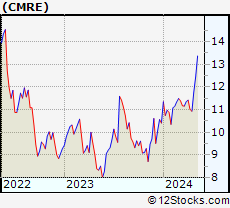

| CMRE | Costamare |   | Shipping | 9.48 | 100 | 0.85% | 2.05% |

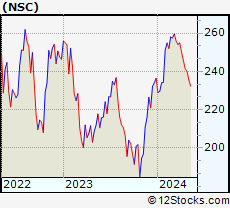

| NSC | Norfolk Southern |   | Railroads | 266.57 | 100 | 1.30% | 1.55% |

| CSX | CSX |   | Railroads | 34.10 | 100 | 1.67% | 1.49% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Transport Stocks |

| Transport Technical Overview, Leaders & Laggards, Top Transport ETF Funds & Detailed Transport Stocks List, Charts, Trends & More |

| Transport Sector: Technical Analysis, Trends & YTD Performance | |

| Transport sector is composed of stocks

from air delivery, shipping, trucking, railroads

and airline subsectors. Transport sector, as represented by IYT, an exchange-traded fund [ETF] that holds basket of Transport stocks (e.g, FedEx, United Airlines) is up by 6.46% and is currently outperforming the overall market by 0.15% year-to-date. Below is a quick view of Technical charts and trends: |

|

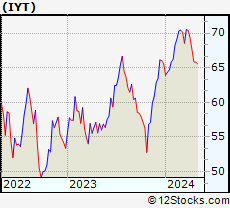

IYT Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

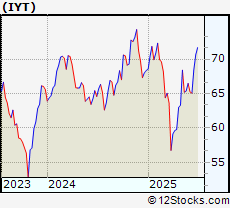

IYT Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 90 | |

| YTD Performance: 6.46% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Transport Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Transport sector stocks year to date are

Now, more recently, over last week, the top performing Transport sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Transport Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Transport Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Transport Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IYT | Transportation |   | 71.70 | 90 | -1.16 | 1.49 | 6.46% |

| SEA | Shipping |   | 14.35 | 83 | -0.07 | 0 | 10.43% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Transport Stocks | |

|

We now take in-depth look at all Transport stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Transport stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

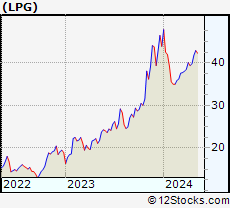

| LPG Dorian LPG Ltd. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 426.414 Millions | |

| Recent Price: 28.92 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 4.29% Day Change: 1.19 | |

| Week Change: 11.4% Year-to-date Change: 22.1% | |

| LPG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LPG to Watchlist:  View: View:  Get Complete LPG Trend Analysis ➞ Get Complete LPG Trend Analysis ➞ | |

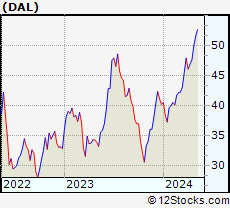

| DAL Delta Air Lines, Inc. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 17298.5 Millions | |

| Recent Price: 56.65 Smart Investing & Trading Score: 93 | |

| Day Percent Change: -0.23% Day Change: -0.13 | |

| Week Change: 11.38% Year-to-date Change: -6.1% | |

| DAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DAL to Watchlist:  View: View:  Get Complete DAL Trend Analysis ➞ Get Complete DAL Trend Analysis ➞ | |

| LUV Southwest Airlines Co. |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 19463.3 Millions | |

| Recent Price: 37.13 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.59% Day Change: -0.22 | |

| Week Change: 8.95% Year-to-date Change: 11.1% | |

| LUV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LUV to Watchlist:  View: View:  Get Complete LUV Trend Analysis ➞ Get Complete LUV Trend Analysis ➞ | |

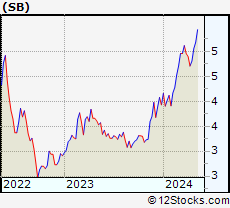

| SB Safe Bulkers, Inc. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 108.114 Millions | |

| Recent Price: 4.11 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.48% Day Change: 0.06 | |

| Week Change: 8.73% Year-to-date Change: 16.7% | |

| SB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SB to Watchlist:  View: View:  Get Complete SB Trend Analysis ➞ Get Complete SB Trend Analysis ➞ | |

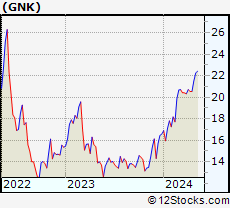

| GNK Genco Shipping & Trading Limited |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 251.614 Millions | |

| Recent Price: 15.10 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.65% Day Change: 0.39 | |

| Week Change: 8.24% Year-to-date Change: 10.7% | |

| GNK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GNK to Watchlist:  View: View:  Get Complete GNK Trend Analysis ➞ Get Complete GNK Trend Analysis ➞ | |

| STNG Scorpio Tankers Inc. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 813.214 Millions | |

| Recent Price: 45.41 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.31% Day Change: -0.14 | |

| Week Change: 6.97% Year-to-date Change: -7.7% | |

| STNG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STNG to Watchlist:  View: View:  Get Complete STNG Trend Analysis ➞ Get Complete STNG Trend Analysis ➞ | |

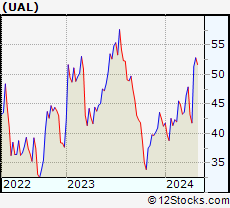

| UAL United Airlines Holdings, Inc. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 8083.25 Millions | |

| Recent Price: 87.69 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -4.34% Day Change: -3.98 | |

| Week Change: 6.47% Year-to-date Change: -9.7% | |

| UAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UAL to Watchlist:  View: View:  Get Complete UAL Trend Analysis ➞ Get Complete UAL Trend Analysis ➞ | |

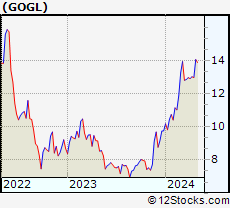

| GOGL Golden Ocean Group Limited |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 446.614 Millions | |

| Recent Price: 8.41 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.94% Day Change: 0.24 | |

| Week Change: 5.92% Year-to-date Change: -4.4% | |

| GOGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GOGL to Watchlist:  View: View:  Get Complete GOGL Trend Analysis ➞ Get Complete GOGL Trend Analysis ➞ | |

| CAR Avis Budget Group, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1020.44 Millions | |

| Recent Price: 191.38 Smart Investing & Trading Score: 95 | |

| Day Percent Change: 1.16% Day Change: 2.19 | |

| Week Change: 5.56% Year-to-date Change: 137.4% | |

| CAR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CAR to Watchlist:  View: View:  Get Complete CAR Trend Analysis ➞ Get Complete CAR Trend Analysis ➞ | |

| WSC WillScot Corporation |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1050.44 Millions | |

| Recent Price: 30.40 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.91% Day Change: -0.28 | |

| Week Change: 5.19% Year-to-date Change: -8.9% | |

| WSC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WSC to Watchlist:  View: View:  Get Complete WSC Trend Analysis ➞ Get Complete WSC Trend Analysis ➞ | |

| SNDR Schneider National, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 3299.95 Millions | |

| Recent Price: 26.83 Smart Investing & Trading Score: 95 | |

| Day Percent Change: -0.33% Day Change: -0.09 | |

| Week Change: 4.56% Year-to-date Change: -8.0% | |

| SNDR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SNDR to Watchlist:  View: View:  Get Complete SNDR Trend Analysis ➞ Get Complete SNDR Trend Analysis ➞ | |

| AAL American Airlines Group Inc. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 5346.45 Millions | |

| Recent Price: 12.22 Smart Investing & Trading Score: 95 | |

| Day Percent Change: -5.56% Day Change: -0.72 | |

| Week Change: 4.53% Year-to-date Change: -29.9% | |

| AAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAL to Watchlist:  View: View:  Get Complete AAL Trend Analysis ➞ Get Complete AAL Trend Analysis ➞ | |

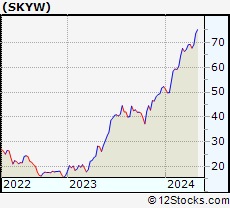

| SKYW SkyWest, Inc. |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 1394.7 Millions | |

| Recent Price: 111.76 Smart Investing & Trading Score: 95 | |

| Day Percent Change: -1.63% Day Change: -1.85 | |

| Week Change: 3.69% Year-to-date Change: 11.6% | |

| SKYW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SKYW to Watchlist:  View: View:  Get Complete SKYW Trend Analysis ➞ Get Complete SKYW Trend Analysis ➞ | |

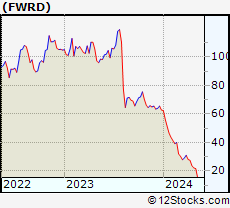

| FWRD Forward Air Corporation |

| Sector: Transports | |

| SubSector: Air Delivery & Freight Services | |

| MarketCap: 1278.88 Millions | |

| Recent Price: 27.37 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -4.17% Day Change: -1.19 | |

| Week Change: 3.28% Year-to-date Change: -15.1% | |

| FWRD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FWRD to Watchlist:  View: View:  Get Complete FWRD Trend Analysis ➞ Get Complete FWRD Trend Analysis ➞ | |

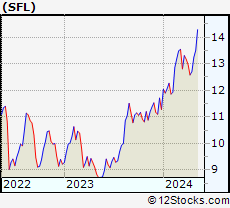

| SFL SFL Corporation Ltd. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 890.414 Millions | |

| Recent Price: 9.19 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.55% Day Change: 0.14 | |

| Week Change: 3.26% Year-to-date Change: -7.1% | |

| SFL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SFL to Watchlist:  View: View:  Get Complete SFL Trend Analysis ➞ Get Complete SFL Trend Analysis ➞ | |

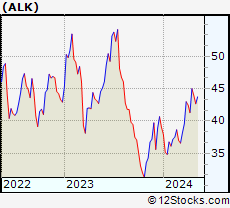

| ALK Alaska Air Group, Inc. |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 3772.5 Millions | |

| Recent Price: 52.54 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -3.03% Day Change: -1.64 | |

| Week Change: 2.92% Year-to-date Change: -18.9% | |

| ALK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALK to Watchlist:  View: View:  Get Complete ALK Trend Analysis ➞ Get Complete ALK Trend Analysis ➞ | |

| SAIA Saia, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 1978.15 Millions | |

| Recent Price: 303.28 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -1.14% Day Change: -3.5 | |

| Week Change: 2.88% Year-to-date Change: -33.5% | |

| SAIA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SAIA to Watchlist:  View: View:  Get Complete SAIA Trend Analysis ➞ Get Complete SAIA Trend Analysis ➞ | |

| R Ryder System, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1550.94 Millions | |

| Recent Price: 176.39 Smart Investing & Trading Score: 95 | |

| Day Percent Change: 0.22% Day Change: 0.38 | |

| Week Change: 2.81% Year-to-date Change: 13.0% | |

| R Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add R to Watchlist:  View: View:  Get Complete R Trend Analysis ➞ Get Complete R Trend Analysis ➞ | |

| MATX Matson, Inc. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 1509.94 Millions | |

| Recent Price: 116.30 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.46% Day Change: 2.79 | |

| Week Change: 2.78% Year-to-date Change: -13.5% | |

| MATX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MATX to Watchlist:  View: View:  Get Complete MATX Trend Analysis ➞ Get Complete MATX Trend Analysis ➞ | |

| URI United Rentals, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 6246.64 Millions | |

| Recent Price: 814.28 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -0.67% Day Change: -5.46 | |

| Week Change: 2.75% Year-to-date Change: 15.9% | |

| URI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add URI to Watchlist:  View: View:  Get Complete URI Trend Analysis ➞ Get Complete URI Trend Analysis ➞ | |

| RRR Red Rock Resorts, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1144.04 Millions | |

| Recent Price: 56.13 Smart Investing & Trading Score: 90 | |

| Day Percent Change: -2.08% Day Change: -1.19 | |

| Week Change: 2.58% Year-to-date Change: 22.1% | |

| RRR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RRR to Watchlist:  View: View:  Get Complete RRR Trend Analysis ➞ Get Complete RRR Trend Analysis ➞ | |

| ASC Ardmore Shipping Corporation |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 147.014 Millions | |

| Recent Price: 10.48 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.16% Day Change: 0.12 | |

| Week Change: 2.24% Year-to-date Change: -13.0% | |

| ASC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ASC to Watchlist:  View: View:  Get Complete ASC Trend Analysis ➞ Get Complete ASC Trend Analysis ➞ | |

| CMRE Costamare Inc. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 492.214 Millions | |

| Recent Price: 9.48 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 0.85% Day Change: 0.08 | |

| Week Change: 2.05% Year-to-date Change: -24.6% | |

| CMRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CMRE to Watchlist:  View: View:  Get Complete CMRE Trend Analysis ➞ Get Complete CMRE Trend Analysis ➞ | |

| NSC Norfolk Southern Corporation |

| Sector: Transports | |

| SubSector: Railroads | |

| MarketCap: 36165.4 Millions | |

| Recent Price: 266.57 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.3% Day Change: 3.43 | |

| Week Change: 1.55% Year-to-date Change: 14.2% | |

| NSC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NSC to Watchlist:  View: View:  Get Complete NSC Trend Analysis ➞ Get Complete NSC Trend Analysis ➞ | |

| CSX CSX Corporation |

| Sector: Transports | |

| SubSector: Railroads | |

| MarketCap: 42131.2 Millions | |

| Recent Price: 34.10 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.67% Day Change: 0.56 | |

| Week Change: 1.49% Year-to-date Change: 6.1% | |

| CSX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CSX to Watchlist:  View: View:  Get Complete CSX Trend Analysis ➞ Get Complete CSX Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2025 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Transport Stocks With Best Up Trends [0-bearish to 100-bullish]: Dorian LPG[100], Golden Ocean[100], Genco Shipping[100], Matson [100], CSX [100], SFL [100], Safe Bulkers[100], Norfolk Southern[100], Ardmore Shipping[100], Costamare [100], Scorpio Tankers[100]

Best Transport Stocks Year-to-Date:

Avis Budget[137.42%], DHT [22.53%], Air Lease[22.44%], Dorian LPG[22.09%], Red Rock[22.07%], Safe Bulkers[16.69%], United Rentals[15.87%], Norfolk Southern[14.19%], Ryder System[13%], Wabtec [12.84%], Nordic American[12.27%] Best Transport Stocks This Week:

Dorian LPG[11.4%], Delta Air[11.38%], Southwest Airlines[8.95%], Safe Bulkers[8.73%], Genco Shipping[8.24%], Scorpio Tankers[6.97%], United Airlines[6.47%], Golden Ocean[5.92%], Avis Budget[5.56%], WillScot [5.19%], Schneider National[4.56%] Best Transport Stocks Daily:

Dorian LPG[4.29%], Golden Ocean[2.94%], Genco Shipping[2.65%], Matson [2.46%], CSX [1.67%], DHT [1.63%], SFL [1.55%], Safe Bulkers[1.48%], Norfolk Southern[1.3%], Avis Budget[1.16%], Ardmore Shipping[1.16%]

Avis Budget[137.42%], DHT [22.53%], Air Lease[22.44%], Dorian LPG[22.09%], Red Rock[22.07%], Safe Bulkers[16.69%], United Rentals[15.87%], Norfolk Southern[14.19%], Ryder System[13%], Wabtec [12.84%], Nordic American[12.27%] Best Transport Stocks This Week:

Dorian LPG[11.4%], Delta Air[11.38%], Southwest Airlines[8.95%], Safe Bulkers[8.73%], Genco Shipping[8.24%], Scorpio Tankers[6.97%], United Airlines[6.47%], Golden Ocean[5.92%], Avis Budget[5.56%], WillScot [5.19%], Schneider National[4.56%] Best Transport Stocks Daily:

Dorian LPG[4.29%], Golden Ocean[2.94%], Genco Shipping[2.65%], Matson [2.46%], CSX [1.67%], DHT [1.63%], SFL [1.55%], Safe Bulkers[1.48%], Norfolk Southern[1.3%], Avis Budget[1.16%], Ardmore Shipping[1.16%]

Login Sign Up

Login Sign Up