Best SmallCap Stocks

|

| In a hurry? Small Cap Stock Lists: Performance Trends Table, Stock Charts

Sort Small Cap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Small Cap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter Small Cap stocks list by size: All Large Medium Small and MicroCap |

| 12Stocks.com Small Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 87 (0-bearish to 100-bullish) which puts Small Cap index in short term bullish trend. The Smart Investing & Trading Score from previous trading session is 82 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested small cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Smallcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Smallcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Smallcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| HBCP | Home Bancorp |   | Financials | 36.91 | 60 | -2.30% | -12.14% |

| BCRX | BioCryst |   | Health Care | 5.26 | 74 | -0.19% | -12.19% |

| ZYME | Zymeworks |   | Health Care | 9.12 | 52 | 0.66% | -12.22% |

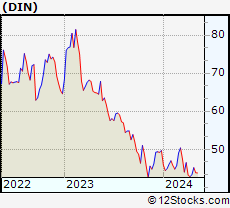

| DIN | Dine Brands |   | Services & Goods | 43.58 | 25 | -2.05% | -12.23% |

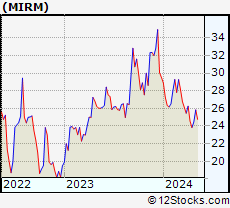

| MIRM | Mirum |   | Health Care | 25.91 | 47 | -1.89% | -12.23% |

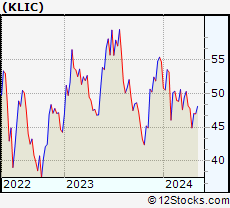

| KLIC | Kulicke and |   | Technology | 48.02 | 100 | 1.12% | -12.24% |

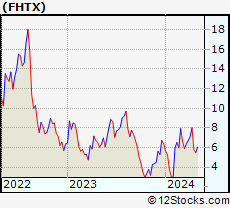

| FHTX | Foghorn |   | Health Care | 5.63 | 12 | -6.17% | -12.24% |

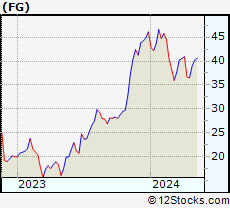

| FG | F&G Annuities |   | Financials | 40.44 | 85 | -2.27% | -12.29% |

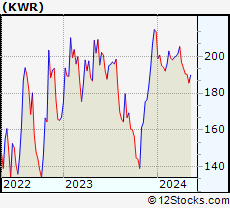

| KWR | Quaker Chemical |   | Materials | 187.18 | 17 | 1.06% | -12.30% |

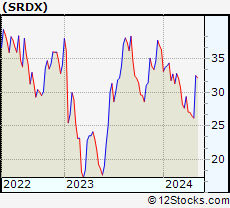

| SRDX | Surmodics |   | Health Care | 31.87 | 55 | -1.88% | -12.32% |

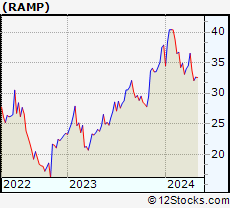

| RAMP | LiveRamp |   | Technology | 33.21 | 64 | 1.28% | -12.33% |

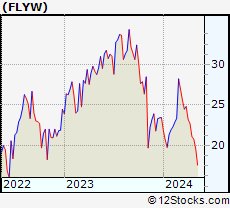

| FLYW | Flywire |   | Technology | 20.54 | 32 | 2.57% | -12.33% |

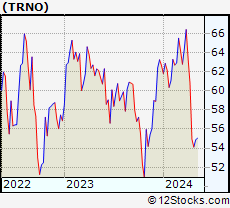

| TRNO | Terreno Realty |   | Financials | 54.90 | 50 | 1.48% | -12.40% |

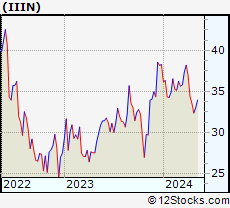

| IIIN | Insteel Industries |   | Materials | 33.53 | 57 | 0.21% | -12.43% |

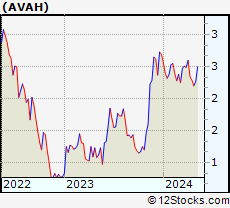

| AVAH | Aveanna Healthcare |   | Health Care | 2.36 | 57 | -1.87% | -12.43% |

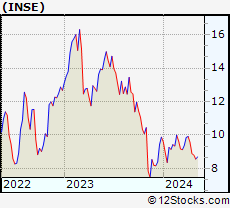

| INSE | Inspired Entertainment |   | Services & Goods | 8.65 | 28 | -0.46% | -12.45% |

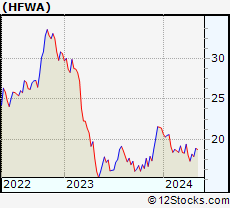

| HFWA | Heritage Financial |   | Financials | 18.72 | 76 | -1.63% | -12.48% |

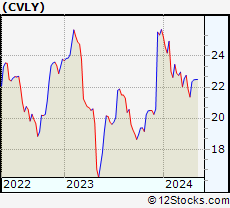

| CVLY | Codorus Valley |   | Financials | 22.49 | 39 | 0.13% | -12.49% |

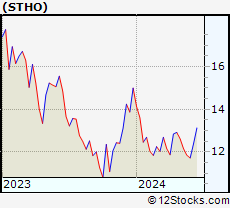

| STHO | Star |   | Financials | 13.12 | 100 | 3.55% | -12.50% |

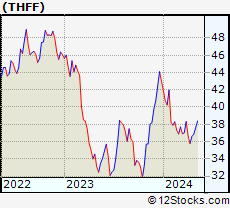

| THFF | First Financial |   | Financials | 37.64 | 76 | -1.23% | -12.53% |

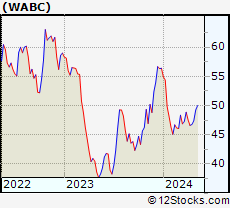

| WABC | Westamerica Ban |   | Financials | 49.33 | 95 | 0.02% | -12.55% |

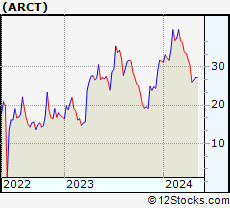

| ARCT | Arcturus |   | Health Care | 27.57 | 57 | 0.95% | -12.56% |

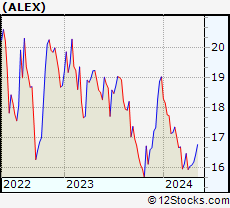

| ALEX | Alexander & Baldwin |   | Financials | 16.62 | 88 | 0.18% | -12.62% |

| BKU | BankUnited |   | Financials | 28.33 | 68 | -2.07% | -12.64% |

| CDNA | CareDx |   | Services & Goods | 10.48 | 74 | 2.95% | -12.67% |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small |

| Smallcap Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, & Medical |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of SmallCap Stocks |

| SmallCap Technical Overview, Leaders & Laggards, Top SmallCap ETF Funds & Detailed SmallCap Stocks List, Charts, Trends & More |

| Smallcap: Technical Analysis, Trends & YTD Performance | |

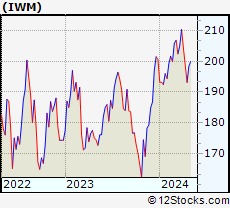

| SmallCap segment as represented by

IWM, an exchange-traded fund [ETF], holds basket of thousands of smallcap stocks from across all major sectors of the US stock market. The smallcap index (contains stocks like Riverbed & Sotheby's) is up by 2.12% and is currently underperforming the overall market by -6% year-to-date. Below is a quick view of technical charts and trends: | |

IWM Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

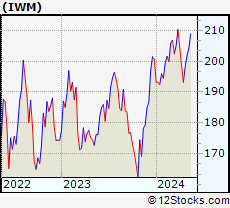

IWM Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 87 | |

| YTD Performance: 2.12% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Small Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Small Cap Index stocks year to date are

Now, more recently, over last week, the top performing Small Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Smallcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Smallcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Smallcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Smallcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IWM | iShares Russell 2000 |   | 204.97 | 87 | 0.22 | 1.52 | 2.12% |

| IJR | iShares Core S&P Small-Cap |   | 108.62 | 100 | 0.33 | 1.39 | 0.34% |

| VTWO | Vanguard Russell 2000 ETF |   | 82.84 | 82 | 0.22 | 1.51 | 2.15% |

| IWN | iShares Russell 2000 Value |   | 155.63 | 100 | -0.01 | 0.92 | 0.19% |

| IWO | iShares Russell 2000 Growth |   | 262.30 | 82 | 0.49 | 2.11 | 4% |

| IJS | iShares S&P Small-Cap 600 Value |   | 99.68 | 69 | -0.07 | 0.97 | -3.29% |

| IJT | iShares S&P Small-Cap 600 Growth |   | 129.84 | 95 | 0.56 | 1.63 | 3.76% |

| XSLV | PowerShares S&P SmallCap Low Volatil ETF |   | 44.00 | 100 | 0.96 | 1.8 | -0.34% |

| SAA | ProShares Ultra SmallCap600 |   | 24.39 | 95 | 1.16 | 3.39 | -2.24% |

| SMLV | SPDR SSGA US Small Cap Low Volatil ETF |   | 110.48 | 100 | -0.10 | 0.72 | -1.81% |

| SBB | ProShares Short SmallCap600 |   | 15.97 | 0 | -0.50 | -1.18 | 0.25% |

| SDD | ProShares UltraShort SmallCap600 |   | 18.22 | 10 | -1.10 | -3.33 | -1.13% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of SmallCap Stocks | |

|

We now take in-depth look at all SmallCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort SmallCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

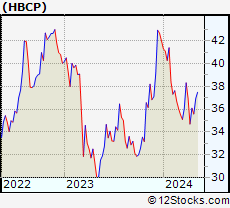

| HBCP Home Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 206.83 Millions | |

| Recent Price: 36.91 Smart Investing & Trading Score: 60 | |

| Day Percent Change: -2.30% Day Change: -0.87 | |

| Week Change: -0.11% Year-to-date Change: -12.1% | |

| HBCP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HBCP to Watchlist:  View: View:  Get Complete HBCP Trend Analysis ➞ Get Complete HBCP Trend Analysis ➞ | |

| BCRX BioCryst Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 369.385 Millions | |

| Recent Price: 5.26 Smart Investing & Trading Score: 74 | |

| Day Percent Change: -0.19% Day Change: -0.01 | |

| Week Change: 18.2% Year-to-date Change: -12.2% | |

| BCRX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BCRX to Watchlist:  View: View:  Get Complete BCRX Trend Analysis ➞ Get Complete BCRX Trend Analysis ➞ | |

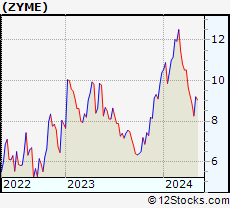

| ZYME Zymeworks Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1373.55 Millions | |

| Recent Price: 9.12 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 0.66% Day Change: 0.06 | |

| Week Change: -0.87% Year-to-date Change: -12.2% | |

| ZYME Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ZYME to Watchlist:  View: View:  Get Complete ZYME Trend Analysis ➞ Get Complete ZYME Trend Analysis ➞ | |

| DIN Dine Brands Global, Inc. |

| Sector: Services & Goods | |

| SubSector: Restaurants | |

| MarketCap: 421.17 Millions | |

| Recent Price: 43.58 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -2.05% Day Change: -0.91 | |

| Week Change: -0.57% Year-to-date Change: -12.2% | |

| DIN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DIN to Watchlist:  View: View:  Get Complete DIN Trend Analysis ➞ Get Complete DIN Trend Analysis ➞ | |

| MIRM Mirum Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 309.585 Millions | |

| Recent Price: 25.91 Smart Investing & Trading Score: 47 | |

| Day Percent Change: -1.89% Day Change: -0.50 | |

| Week Change: 0.27% Year-to-date Change: -12.2% | |

| MIRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MIRM to Watchlist:  View: View:  Get Complete MIRM Trend Analysis ➞ Get Complete MIRM Trend Analysis ➞ | |

| KLIC Kulicke and Soffa Industries, Inc. |

| Sector: Technology | |

| SubSector: Semiconductor Equipment & Materials | |

| MarketCap: 1336.68 Millions | |

| Recent Price: 48.02 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 1.12% Day Change: 0.53 | |

| Week Change: 2.17% Year-to-date Change: -12.2% | |

| KLIC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KLIC to Watchlist:  View: View:  Get Complete KLIC Trend Analysis ➞ Get Complete KLIC Trend Analysis ➞ | |

| FHTX Foghorn Therapeutics Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 74487 Millions | |

| Recent Price: 5.63 Smart Investing & Trading Score: 12 | |

| Day Percent Change: -6.17% Day Change: -0.37 | |

| Week Change: -6.48% Year-to-date Change: -12.2% | |

| FHTX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FHTX to Watchlist:  View: View:  Get Complete FHTX Trend Analysis ➞ Get Complete FHTX Trend Analysis ➞ | |

| FG F&G Annuities & Life, Inc. |

| Sector: Financials | |

| SubSector: Insurance - Life | |

| MarketCap: 2960 Millions | |

| Recent Price: 40.44 Smart Investing & Trading Score: 85 | |

| Day Percent Change: -2.27% Day Change: -0.94 | |

| Week Change: 0.6% Year-to-date Change: -12.3% | |

| FG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FG to Watchlist:  View: View:  Get Complete FG Trend Analysis ➞ Get Complete FG Trend Analysis ➞ | |

| KWR Quaker Chemical Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 2411.67 Millions | |

| Recent Price: 187.18 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 1.06% Day Change: 1.97 | |

| Week Change: 0.87% Year-to-date Change: -12.3% | |

| KWR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KWR to Watchlist:  View: View:  Get Complete KWR Trend Analysis ➞ Get Complete KWR Trend Analysis ➞ | |

| SRDX Surmodics, Inc. |

| Sector: Health Care | |

| SubSector: Diagnostic Substances | |

| MarketCap: 388.171 Millions | |

| Recent Price: 31.87 Smart Investing & Trading Score: 55 | |

| Day Percent Change: -1.88% Day Change: -0.61 | |

| Week Change: -1.91% Year-to-date Change: -12.3% | |

| SRDX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SRDX to Watchlist:  View: View:  Get Complete SRDX Trend Analysis ➞ Get Complete SRDX Trend Analysis ➞ | |

| RAMP LiveRamp Holdings, Inc. |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 2124.38 Millions | |

| Recent Price: 33.21 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 1.28% Day Change: 0.42 | |

| Week Change: 2% Year-to-date Change: -12.3% | |

| RAMP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RAMP to Watchlist:  View: View:  Get Complete RAMP Trend Analysis ➞ Get Complete RAMP Trend Analysis ➞ | |

| FLYW Flywire Corporation |

| Sector: Technology | |

| SubSector: Software - Infrastructure | |

| MarketCap: 3390 Millions | |

| Recent Price: 20.54 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 2.57% Day Change: 0.52 | |

| Week Change: 4.96% Year-to-date Change: -12.3% | |

| FLYW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FLYW to Watchlist:  View: View:  Get Complete FLYW Trend Analysis ➞ Get Complete FLYW Trend Analysis ➞ | |

| TRNO Terreno Realty Corporation |

| Sector: Financials | |

| SubSector: REIT - Industrial | |

| MarketCap: 3359.69 Millions | |

| Recent Price: 54.90 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 1.48% Day Change: 0.80 | |

| Week Change: 0.02% Year-to-date Change: -12.4% | |

| TRNO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRNO to Watchlist:  View: View:  Get Complete TRNO Trend Analysis ➞ Get Complete TRNO Trend Analysis ➞ | |

| IIIN Insteel Industries, Inc. |

| Sector: Materials | |

| SubSector: Steel & Iron | |

| MarketCap: 269.488 Millions | |

| Recent Price: 33.53 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 0.21% Day Change: 0.07 | |

| Week Change: 1.42% Year-to-date Change: -12.4% | |

| IIIN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IIIN to Watchlist:  View: View:  Get Complete IIIN Trend Analysis ➞ Get Complete IIIN Trend Analysis ➞ | |

| AVAH Aveanna Healthcare Holdings Inc. |

| Sector: Health Care | |

| SubSector: Medical Care Facilities | |

| MarketCap: 305 Millions | |

| Recent Price: 2.36 Smart Investing & Trading Score: 57 | |

| Day Percent Change: -1.87% Day Change: -0.04 | |

| Week Change: 3.96% Year-to-date Change: -12.4% | |

| AVAH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AVAH to Watchlist:  View: View:  Get Complete AVAH Trend Analysis ➞ Get Complete AVAH Trend Analysis ➞ | |

| INSE Inspired Entertainment, Inc. |

| Sector: Services & Goods | |

| SubSector: Gaming Activities | |

| MarketCap: 80.9289 Millions | |

| Recent Price: 8.65 Smart Investing & Trading Score: 28 | |

| Day Percent Change: -0.46% Day Change: -0.04 | |

| Week Change: 0.93% Year-to-date Change: -12.5% | |

| INSE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add INSE to Watchlist:  View: View:  Get Complete INSE Trend Analysis ➞ Get Complete INSE Trend Analysis ➞ | |

| HFWA Heritage Financial Corporation |

| Sector: Financials | |

| SubSector: Regional - Pacific Banks | |

| MarketCap: 752.829 Millions | |

| Recent Price: 18.72 Smart Investing & Trading Score: 76 | |

| Day Percent Change: -1.63% Day Change: -0.31 | |

| Week Change: -0.9% Year-to-date Change: -12.5% | |

| HFWA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HFWA to Watchlist:  View: View:  Get Complete HFWA Trend Analysis ➞ Get Complete HFWA Trend Analysis ➞ | |

| CVLY Codorus Valley Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 173.799 Millions | |

| Recent Price: 22.49 Smart Investing & Trading Score: 39 | |

| Day Percent Change: 0.13% Day Change: 0.03 | |

| Week Change: 0% Year-to-date Change: -12.5% | |

| CVLY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVLY to Watchlist:  View: View:  Get Complete CVLY Trend Analysis ➞ Get Complete CVLY Trend Analysis ➞ | |

| STHO Star Holdings |

| Sector: Financials | |

| SubSector: Financials Services | |

| MarketCap: 195 Millions | |

| Recent Price: 13.12 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 3.55% Day Change: 0.45 | |

| Week Change: 5.89% Year-to-date Change: -12.5% | |

| STHO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STHO to Watchlist:  View: View:  Get Complete STHO Trend Analysis ➞ Get Complete STHO Trend Analysis ➞ | |

| THFF First Financial Corporation |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 433.07 Millions | |

| Recent Price: 37.64 Smart Investing & Trading Score: 76 | |

| Day Percent Change: -1.23% Day Change: -0.47 | |

| Week Change: -0.03% Year-to-date Change: -12.5% | |

| THFF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THFF to Watchlist:  View: View:  Get Complete THFF Trend Analysis ➞ Get Complete THFF Trend Analysis ➞ | |

| WABC Westamerica Bancorporation |

| Sector: Financials | |

| SubSector: Regional - Pacific Banks | |

| MarketCap: 1557.69 Millions | |

| Recent Price: 49.33 Smart Investing & Trading Score: 95 | |

| Day Percent Change: 0.02% Day Change: 0.01 | |

| Week Change: 0.1% Year-to-date Change: -12.6% | |

| WABC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WABC to Watchlist:  View: View:  Get Complete WABC Trend Analysis ➞ Get Complete WABC Trend Analysis ➞ | |

| ARCT Arcturus Therapeutics Holdings Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 241.385 Millions | |

| Recent Price: 27.57 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 0.95% Day Change: 0.26 | |

| Week Change: 1.1% Year-to-date Change: -12.6% | |

| ARCT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARCT to Watchlist:  View: View:  Get Complete ARCT Trend Analysis ➞ Get Complete ARCT Trend Analysis ➞ | |

| ALEX Alexander & Baldwin, Inc. |

| Sector: Financials | |

| SubSector: Real Estate Development | |

| MarketCap: 751.419 Millions | |

| Recent Price: 16.62 Smart Investing & Trading Score: 88 | |

| Day Percent Change: 0.18% Day Change: 0.03 | |

| Week Change: 1.03% Year-to-date Change: -12.6% | |

| ALEX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALEX to Watchlist:  View: View:  Get Complete ALEX Trend Analysis ➞ Get Complete ALEX Trend Analysis ➞ | |

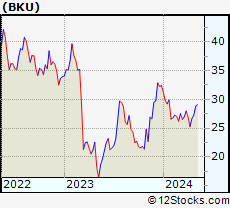

| BKU BankUnited, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 1905.99 Millions | |

| Recent Price: 28.33 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -2.07% Day Change: -0.60 | |

| Week Change: -1.8% Year-to-date Change: -12.6% | |

| BKU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BKU to Watchlist:  View: View:  Get Complete BKU Trend Analysis ➞ Get Complete BKU Trend Analysis ➞ | |

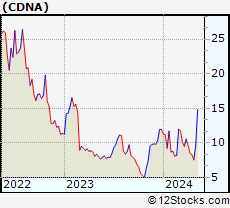

| CDNA CareDx, Inc |

| Sector: Services & Goods | |

| SubSector: Research Services | |

| MarketCap: 828.194 Millions | |

| Recent Price: 10.48 Smart Investing & Trading Score: 74 | |

| Day Percent Change: 2.95% Day Change: 0.30 | |

| Week Change: 7.82% Year-to-date Change: -12.7% | |

| CDNA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CDNA to Watchlist:  View: View:  Get Complete CDNA Trend Analysis ➞ Get Complete CDNA Trend Analysis ➞ | |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small & MicroCap |

| Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities & Medical |

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Smallcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Design [100], Ambac Financial[100], Summit [100], EverQuote [100], Zeta Global[100], Coca-Cola Consolidated[100], J & J Snack Foods[100], Sterling Construction[100], Vanda [100], CPI Card[100], Semrush [100]

Best Smallcap Stocks Year-to-Date:

CareMax [570.1%], Janux [472.36%], Viking [327.78%], Longboard [260.8%], Alpine Immune[239.34%], Bakkt [226.91%], Vera [190.7%], Super Micro[188.22%], Cullinan Oncology[187.89%], Avidity Biosciences[180.86%], Y-mAbs [152.49%] Best Smallcap Stocks This Week:

Perficient [52.32%], Thoughtworks Holding[34.22%], Trupanion [28.72%], DASAN Zhone[26.29%], Great Lakes[25.72%], Workhorse Group[24.5%], Design [23.42%], Ambac Financial[22.97%], P3 Health[22.36%], Outset Medical[21.09%], Summit [20.96%] Best Smallcap Stocks Daily:

Design [28.85%], Great Lakes[24.29%], Thoughtworks Holding[19.84%], Ambac Financial[19.31%], Summit [18.79%], EverQuote [18.40%], Origin Materials[18.38%], Zeta Global[18.35%], FibroGen [18.10%], Coca-Cola Consolidated[17.65%], Children s[16.44%]

CareMax [570.1%], Janux [472.36%], Viking [327.78%], Longboard [260.8%], Alpine Immune[239.34%], Bakkt [226.91%], Vera [190.7%], Super Micro[188.22%], Cullinan Oncology[187.89%], Avidity Biosciences[180.86%], Y-mAbs [152.49%] Best Smallcap Stocks This Week:

Perficient [52.32%], Thoughtworks Holding[34.22%], Trupanion [28.72%], DASAN Zhone[26.29%], Great Lakes[25.72%], Workhorse Group[24.5%], Design [23.42%], Ambac Financial[22.97%], P3 Health[22.36%], Outset Medical[21.09%], Summit [20.96%] Best Smallcap Stocks Daily:

Design [28.85%], Great Lakes[24.29%], Thoughtworks Holding[19.84%], Ambac Financial[19.31%], Summit [18.79%], EverQuote [18.40%], Origin Materials[18.38%], Zeta Global[18.35%], FibroGen [18.10%], Coca-Cola Consolidated[17.65%], Children s[16.44%]

Login Sign Up

Login Sign Up