Best SmallCap Stocks

|

| In a hurry? Small Cap Stock Lists: Performance Trends Table, Stock Charts

Sort Small Cap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Small Cap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter Small Cap stocks list by size: All Large Medium Small and MicroCap |

| 12Stocks.com Small Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 49 (0-bearish to 100-bullish) which puts Small Cap index in short term neutral trend. The Smart Investing & Trading Score from previous trading session is 14 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested small cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Smallcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Smallcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Smallcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| FATE | Fate |   | Health Care | 4.10 | 37 | 0.24 | 9.63% |

| ALDX | Aldeyra |   | Health Care | 4.21 | 81 | 0.24 | 19.94% |

| HOFT | Hooker Furniture |   | Consumer Staples | 17.43 | 35 | 0.23 | -33.17% |

| CNSL | Consolidated |   | Technology | 4.33 | 47 | 0.23 | -0.46% |

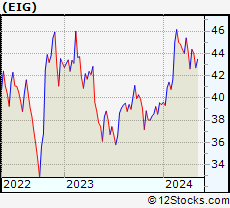

| EIG | Employers |   | Financials | 43.20 | 40 | 0.23 | 9.64% |

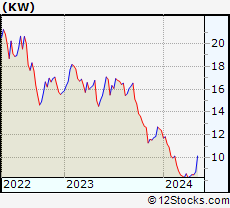

| KW | Kennedy-Wilson |   | Financials | 8.76 | 82 | 0.23 | -29.24% |

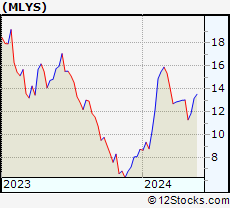

| MLYS | Mineralys |   | Health Care | 12.93 | 67 | 0.23 | 48.22% |

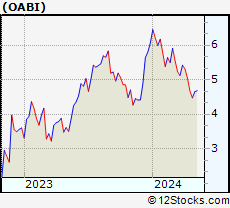

| OABI | OmniAb |   | Health Care | 4.55 | 27 | 0.22 | -24.92% |

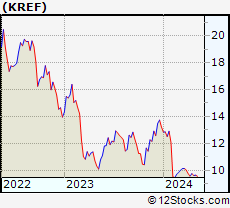

| KREF | KKR Real |   | Financials | 9.67 | 60 | 0.21 | -26.91% |

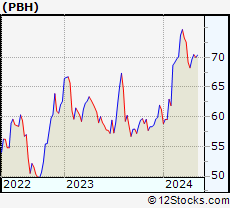

| PBH | Prestige Consumer |   | Health Care | 71.26 | 61 | 0.20 | 16.40% |

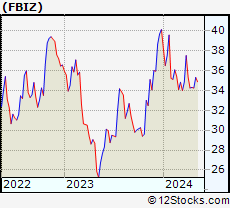

| FBIZ | First Business |   | Financials | 34.83 | 57 | 0.20 | -13.14% |

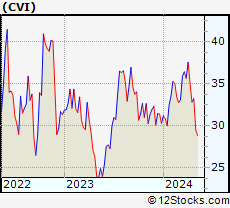

| CVI | CVR Energy |   | Energy | 29.43 | 0 | 0.20 | -2.87% |

| BLMN | Bloomin |   | Services & Goods | 25.09 | 0 | 0.20 | -10.87% |

| ATLC | Atlanticus |   | Financials | 26.81 | 22 | 0.19 | -30.67% |

| GNE | Genie Energy |   | Energy | 15.74 | 25 | 0.19 | -44.05% |

| ACAD | ACADIA |   | Health Care | 17.08 | 42 | 0.18 | -45.45% |

| TRC | Tejon Ranch |   | Financials | 16.86 | 68 | 0.18 | -1.98% |

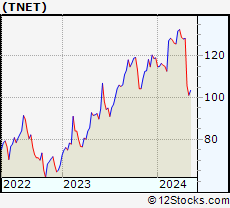

| TNET | TriNet Group |   | Services & Goods | 101.93 | 10 | 0.18 | -14.29% |

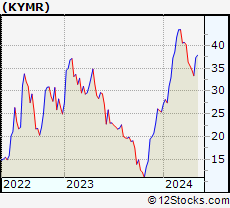

| KYMR | Kymera |   | Health Care | 36.30 | 69 | 0.17 | 42.86% |

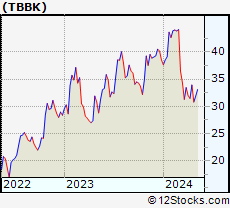

| TBBK | Bancorp |   | Financials | 31.32 | 42 | 0.16 | -18.78% |

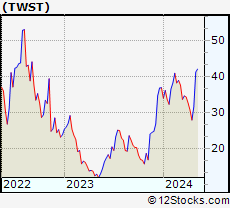

| TWST | Twist Bioscience |   | Health Care | 32.01 | 52 | 0.16 | -13.16% |

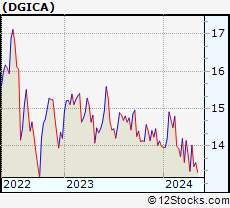

| DGICA | Donegal Group |   | Financials | 13.52 | 57 | 0.15 | -3.36% |

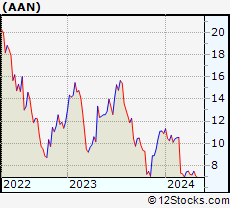

| AAN | Aaron s |   | Transports | 6.79 | 10 | 0.15 | -37.59% |

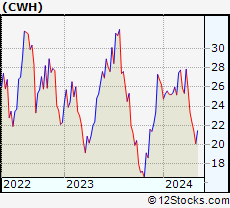

| CWH | Camping World |   | Financials | 20.13 | 10 | 0.15 | -23.34% |

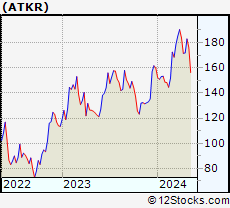

| ATKR | Atkore |   | Industrials | 175.26 | 48 | 0.15 | 9.54% |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small |

| Smallcap Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, & Medical |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of SmallCap Stocks |

| SmallCap Technical Overview, Leaders & Laggards, Top SmallCap ETF Funds & Detailed SmallCap Stocks List, Charts, Trends & More |

| Smallcap: Technical Analysis, Trends & YTD Performance | |

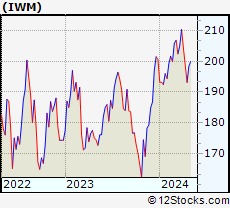

| SmallCap segment as represented by

IWM, an exchange-traded fund [ETF], holds basket of thousands of smallcap stocks from across all major sectors of the US stock market. The smallcap index (contains stocks like Riverbed & Sotheby's) is down by -0.39% and is currently underperforming the overall market by -6.01% year-to-date. Below is a quick view of technical charts and trends: | |

IWM Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Good | |

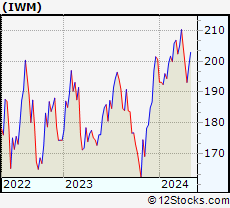

IWM Daily Chart |

|

| Short Term Trend: Deteriorating | |

| Overall Trend Score: 49 | |

| YTD Performance: -0.39% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Small Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Small Cap Index stocks year to date are

Now, more recently, over last week, the top performing Small Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Smallcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Smallcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Smallcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Smallcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IWM | iShares Russell 2000 |   | 199.92 | 49 | 1.84 | 0.77 | -0.39% |

| IJR | iShares Core S&P Small-Cap |   | 106.33 | 50 | 1.52 | 0.64 | -1.77% |

| VTWO | Vanguard Russell 2000 ETF |   | 80.85 | 42 | 1.88 | 0.79 | -0.31% |

| IWN | iShares Russell 2000 Value |   | 152.88 | 75 | 2.04 | 1.15 | -1.58% |

| IWO | iShares Russell 2000 Growth |   | 254.34 | 32 | 1.91 | 0.49 | 0.84% |

| IJS | iShares S&P Small-Cap 600 Value |   | 98.02 | 43 | 1.68 | 0.85 | -4.9% |

| IJT | iShares S&P Small-Cap 600 Growth |   | 126.72 | 63 | 1.42 | 0.5 | 1.26% |

| XSLV | PowerShares S&P SmallCap Low Volatil ETF |   | 43.14 | 73 | 0.72 | 0.98 | -2.29% |

| SDD | ProShares UltraShort SmallCap600 |   | 19.31 | 56 | -2.02 | -0.21 | 4.79% |

| SMLV | SPDR SSGA US Small Cap Low Volatil ETF |   | 108.83 | 87 | 1.30 | 1.22 | -3.27% |

| SAA | ProShares Ultra SmallCap600 |   | 22.93 | 42 | 1.56 | -0.46 | -8.08% |

| SBB | ProShares Short SmallCap600 |   | 16.37 | 49 | -1.14 | -0.09 | 2.76% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of SmallCap Stocks | |

|

We now take in-depth look at all SmallCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort SmallCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

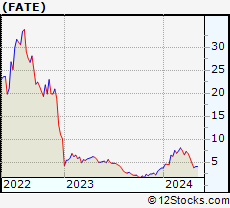

| FATE Fate Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2022.45 Millions | |

| Recent Price: 4.10 Smart Investing & Trading Score: 37 | |

| Day Percent Change: 0.24% Day Change: 0.01 | |

| Week Change: 7.89% Year-to-date Change: 9.6% | |

| FATE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FATE to Watchlist:  View: View:  Get Complete FATE Trend Analysis ➞ Get Complete FATE Trend Analysis ➞ | |

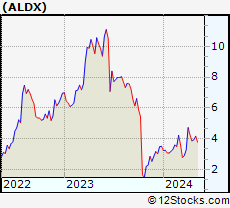

| ALDX Aldeyra Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 61.2785 Millions | |

| Recent Price: 4.21 Smart Investing & Trading Score: 81 | |

| Day Percent Change: 0.24% Day Change: 0.01 | |

| Week Change: 7.12% Year-to-date Change: 19.9% | |

| ALDX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ALDX to Watchlist:  View: View:  Get Complete ALDX Trend Analysis ➞ Get Complete ALDX Trend Analysis ➞ | |

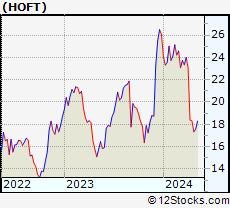

| HOFT Hooker Furniture Corporation |

| Sector: Consumer Staples | |

| SubSector: Home Furnishings & Fixtures | |

| MarketCap: 173.235 Millions | |

| Recent Price: 17.43 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 0.23% Day Change: 0.04 | |

| Week Change: 0.52% Year-to-date Change: -33.2% | |

| HOFT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HOFT to Watchlist:  View: View:  Get Complete HOFT Trend Analysis ➞ Get Complete HOFT Trend Analysis ➞ | |

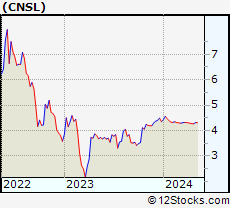

| CNSL Consolidated Communications Holdings, Inc. |

| Sector: Technology | |

| SubSector: Telecom Services - Domestic | |

| MarketCap: 319.677 Millions | |

| Recent Price: 4.33 Smart Investing & Trading Score: 47 | |

| Day Percent Change: 0.23% Day Change: 0.01 | |

| Week Change: 1.41% Year-to-date Change: -0.5% | |

| CNSL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CNSL to Watchlist:  View: View:  Get Complete CNSL Trend Analysis ➞ Get Complete CNSL Trend Analysis ➞ | |

| EIG Employers Holdings, Inc. |

| Sector: Financials | |

| SubSector: Accident & Health Insurance | |

| MarketCap: 1202.6 Millions | |

| Recent Price: 43.20 Smart Investing & Trading Score: 40 | |

| Day Percent Change: 0.23% Day Change: 0.10 | |

| Week Change: -1.84% Year-to-date Change: 9.6% | |

| EIG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EIG to Watchlist:  View: View:  Get Complete EIG Trend Analysis ➞ Get Complete EIG Trend Analysis ➞ | |

| KW Kennedy-Wilson Holdings, Inc. |

| Sector: Financials | |

| SubSector: Property Management | |

| MarketCap: 2025.42 Millions | |

| Recent Price: 8.76 Smart Investing & Trading Score: 82 | |

| Day Percent Change: 0.23% Day Change: 0.02 | |

| Week Change: 3.06% Year-to-date Change: -29.2% | |

| KW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KW to Watchlist:  View: View:  Get Complete KW Trend Analysis ➞ Get Complete KW Trend Analysis ➞ | |

| MLYS Mineralys Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 719 Millions | |

| Recent Price: 12.93 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 0.23% Day Change: 0.03 | |

| Week Change: 8.98% Year-to-date Change: 48.2% | |

| MLYS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MLYS to Watchlist:  View: View:  Get Complete MLYS Trend Analysis ➞ Get Complete MLYS Trend Analysis ➞ | |

| OABI OmniAb, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 570 Millions | |

| Recent Price: 4.55 Smart Investing & Trading Score: 27 | |

| Day Percent Change: 0.22% Day Change: 0.01 | |

| Week Change: 1.79% Year-to-date Change: -24.9% | |

| OABI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OABI to Watchlist:  View: View:  Get Complete OABI Trend Analysis ➞ Get Complete OABI Trend Analysis ➞ | |

| KREF KKR Real Estate Finance Trust Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 645.939 Millions | |

| Recent Price: 9.67 Smart Investing & Trading Score: 60 | |

| Day Percent Change: 0.21% Day Change: 0.02 | |

| Week Change: 0.52% Year-to-date Change: -26.9% | |

| KREF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KREF to Watchlist:  View: View:  Get Complete KREF Trend Analysis ➞ Get Complete KREF Trend Analysis ➞ | |

| PBH Prestige Consumer Healthcare Inc. |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 1639.6 Millions | |

| Recent Price: 71.26 Smart Investing & Trading Score: 61 | |

| Day Percent Change: 0.20% Day Change: 0.14 | |

| Week Change: 1.12% Year-to-date Change: 16.4% | |

| PBH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PBH to Watchlist:  View: View:  Get Complete PBH Trend Analysis ➞ Get Complete PBH Trend Analysis ➞ | |

| FBIZ First Business Financial Services, Inc. |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 144.97 Millions | |

| Recent Price: 34.83 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 0.20% Day Change: 0.07 | |

| Week Change: 1.72% Year-to-date Change: -13.1% | |

| FBIZ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FBIZ to Watchlist:  View: View:  Get Complete FBIZ Trend Analysis ➞ Get Complete FBIZ Trend Analysis ➞ | |

| CVI CVR Energy, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 2482.14 Millions | |

| Recent Price: 29.43 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.20% Day Change: 0.06 | |

| Week Change: -11.41% Year-to-date Change: -2.9% | |

| CVI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVI to Watchlist:  View: View:  Get Complete CVI Trend Analysis ➞ Get Complete CVI Trend Analysis ➞ | |

| BLMN Bloomin Brands, Inc. |

| Sector: Services & Goods | |

| SubSector: Restaurants | |

| MarketCap: 503.47 Millions | |

| Recent Price: 25.09 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 0.20% Day Change: 0.05 | |

| Week Change: -6.83% Year-to-date Change: -10.9% | |

| BLMN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BLMN to Watchlist:  View: View:  Get Complete BLMN Trend Analysis ➞ Get Complete BLMN Trend Analysis ➞ | |

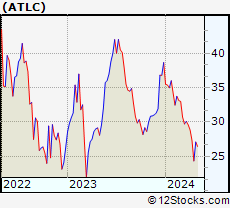

| ATLC Atlanticus Holdings Corporation |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 122.008 Millions | |

| Recent Price: 26.81 Smart Investing & Trading Score: 22 | |

| Day Percent Change: 0.19% Day Change: 0.05 | |

| Week Change: -1.11% Year-to-date Change: -30.7% | |

| ATLC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATLC to Watchlist:  View: View:  Get Complete ATLC Trend Analysis ➞ Get Complete ATLC Trend Analysis ➞ | |

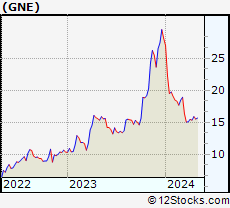

| GNE Genie Energy Ltd. |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 177.293 Millions | |

| Recent Price: 15.74 Smart Investing & Trading Score: 25 | |

| Day Percent Change: 0.19% Day Change: 0.03 | |

| Week Change: 1.48% Year-to-date Change: -44.1% | |

| GNE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GNE to Watchlist:  View: View:  Get Complete GNE Trend Analysis ➞ Get Complete GNE Trend Analysis ➞ | |

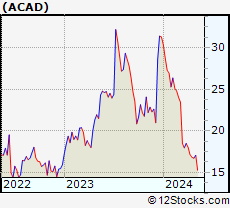

| ACAD ACADIA Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 5400.35 Millions | |

| Recent Price: 17.08 Smart Investing & Trading Score: 42 | |

| Day Percent Change: 0.18% Day Change: 0.03 | |

| Week Change: 2.21% Year-to-date Change: -45.5% | |

| ACAD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACAD to Watchlist:  View: View:  Get Complete ACAD Trend Analysis ➞ Get Complete ACAD Trend Analysis ➞ | |

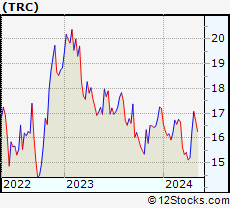

| TRC Tejon Ranch Co. |

| Sector: Financials | |

| SubSector: Property Management | |

| MarketCap: 346.442 Millions | |

| Recent Price: 16.86 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.18% Day Change: 0.03 | |

| Week Change: -1.23% Year-to-date Change: -2.0% | |

| TRC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRC to Watchlist:  View: View:  Get Complete TRC Trend Analysis ➞ Get Complete TRC Trend Analysis ➞ | |

| TNET TriNet Group, Inc. |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 2648.72 Millions | |

| Recent Price: 101.93 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.18% Day Change: 0.18 | |

| Week Change: -3.58% Year-to-date Change: -14.3% | |

| TNET Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TNET to Watchlist:  View: View:  Get Complete TNET Trend Analysis ➞ Get Complete TNET Trend Analysis ➞ | |

| KYMR Kymera Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 27087 Millions | |

| Recent Price: 36.30 Smart Investing & Trading Score: 69 | |

| Day Percent Change: 0.17% Day Change: 0.06 | |

| Week Change: 8.78% Year-to-date Change: 42.9% | |

| KYMR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KYMR to Watchlist:  View: View:  Get Complete KYMR Trend Analysis ➞ Get Complete KYMR Trend Analysis ➞ | |

| TBBK The Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 267.859 Millions | |

| Recent Price: 31.32 Smart Investing & Trading Score: 42 | |

| Day Percent Change: 0.16% Day Change: 0.05 | |

| Week Change: 1.69% Year-to-date Change: -18.8% | |

| TBBK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TBBK to Watchlist:  View: View:  Get Complete TBBK Trend Analysis ➞ Get Complete TBBK Trend Analysis ➞ | |

| TWST Twist Bioscience Corporation |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 1065 Millions | |

| Recent Price: 32.01 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 0.16% Day Change: 0.05 | |

| Week Change: 1.49% Year-to-date Change: -13.2% | |

| TWST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TWST to Watchlist:  View: View:  Get Complete TWST Trend Analysis ➞ Get Complete TWST Trend Analysis ➞ | |

| DGICA Donegal Group Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 350.512 Millions | |

| Recent Price: 13.52 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 0.15% Day Change: 0.02 | |

| Week Change: 0.52% Year-to-date Change: -3.4% | |

| DGICA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DGICA to Watchlist:  View: View:  Get Complete DGICA Trend Analysis ➞ Get Complete DGICA Trend Analysis ➞ | |

| AAN Aaron s, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1087.04 Millions | |

| Recent Price: 6.79 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.15% Day Change: 0.01 | |

| Week Change: -3.96% Year-to-date Change: -37.6% | |

| AAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAN to Watchlist:  View: View:  Get Complete AAN Trend Analysis ➞ Get Complete AAN Trend Analysis ➞ | |

| CWH Camping World Holdings, Inc. |

| Sector: Financials | |

| SubSector: REIT - Office | |

| MarketCap: 473.566 Millions | |

| Recent Price: 20.13 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.15% Day Change: 0.03 | |

| Week Change: -6.15% Year-to-date Change: -23.3% | |

| CWH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CWH to Watchlist:  View: View:  Get Complete CWH Trend Analysis ➞ Get Complete CWH Trend Analysis ➞ | |

| ATKR Atkore International Group Inc. |

| Sector: Industrials | |

| SubSector: Industrial Electrical Equipment | |

| MarketCap: 1086.79 Millions | |

| Recent Price: 175.26 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 0.15% Day Change: 0.26 | |

| Week Change: -4.22% Year-to-date Change: 9.5% | |

| ATKR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATKR to Watchlist:  View: View:  Get Complete ATKR Trend Analysis ➞ Get Complete ATKR Trend Analysis ➞ | |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small & MicroCap |

| Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities & Medical |

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Smallcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Emergent BioSolutions[100], Aspen Aerogels[100], Carvana Co[100], Perdoceo Education[100], Gannett Co[100], Pitney Bowes[100], Benchmark Electronics[100], Origin Materials[100], FormFactor [100], Lantheus [100], Q2 [100]

Best Smallcap Stocks Year-to-Date:

Janux [440.16%], Viking [307.09%], Longboard [273.98%], Alpine Immune[239.29%], Bakkt [187.89%], Avidity Biosciences[182.96%], Vera [170.74%], Cullinan Oncology[169.74%], Super Micro[168.25%], Arcutis Bio[166.25%], Y-mAbs [152.93%] Best Smallcap Stocks This Week:

Deciphera [73.24%], Emergent BioSolutions[71.88%], Eyenovia [49.22%], Aspen Aerogels[48.14%], P3 Health[38.51%], Carvana Co[38.18%], Cue Biopharma[37.73%], Origin Materials[36.24%], TransMedics Group[35.14%], Seres [34.55%], Enovix [32.07%] Best Smallcap Stocks Daily:

Emergent BioSolutions[70.98%], Aspen Aerogels[56.70%], Carvana Co[33.77%], Perdoceo Education[31.46%], Enovix [31.06%], Office Properties[28.00%], Gannett Co[26.97%], Sunnova Energy[25.21%], Pitney Bowes[24.70%], Pulmonx [21.50%], CommScope Holding[20.95%]

Janux [440.16%], Viking [307.09%], Longboard [273.98%], Alpine Immune[239.29%], Bakkt [187.89%], Avidity Biosciences[182.96%], Vera [170.74%], Cullinan Oncology[169.74%], Super Micro[168.25%], Arcutis Bio[166.25%], Y-mAbs [152.93%] Best Smallcap Stocks This Week:

Deciphera [73.24%], Emergent BioSolutions[71.88%], Eyenovia [49.22%], Aspen Aerogels[48.14%], P3 Health[38.51%], Carvana Co[38.18%], Cue Biopharma[37.73%], Origin Materials[36.24%], TransMedics Group[35.14%], Seres [34.55%], Enovix [32.07%] Best Smallcap Stocks Daily:

Emergent BioSolutions[70.98%], Aspen Aerogels[56.70%], Carvana Co[33.77%], Perdoceo Education[31.46%], Enovix [31.06%], Office Properties[28.00%], Gannett Co[26.97%], Sunnova Energy[25.21%], Pitney Bowes[24.70%], Pulmonx [21.50%], CommScope Holding[20.95%]

Login Sign Up

Login Sign Up