Best Financial Stocks

| In a hurry? Financial Stocks Lists: Performance Trends Table, Stock Charts

Sort Financial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Financial stocks list by size:All Financial Large Mid-Range Small & MicroCap |

| 12Stocks.com Financial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 63 (0-bearish to 100-bullish) which puts Financial sector in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 56 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Financial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Financial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Financial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Financial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| GHLD | Guild |   | Mortgage Finance | 13.63 | 32 | 0.96% | -5.18% |

| NKSH | National Bankshares |   | Regional Banks | 27.15 | 0 | -2.69% | -5.33% |

| IBTX | Independent Bank |   | Regional Banks | 39.34 | 7 | 0.20% | -5.43% |

| SLQT | SelectQuote |   | Insurance | 1.61 | 48 | 4.21% | -5.57% |

| MSBI | Midland States |   | Regional Banks | 22.36 | 0 | -7.03% | -5.69% |

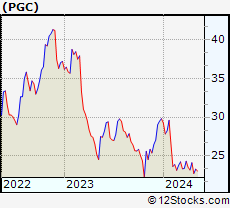

| PGC | Peapack-Gladstone |   | Regional Banks | 22.74 | 10 | -0.79% | -5.76% |

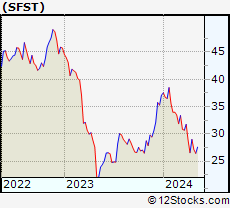

| SFST | Southern First |   | Banks | 27.18 | 17 | -0.38% | -6.28% |

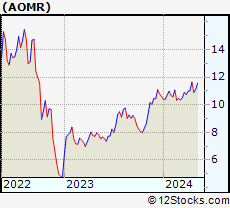

| AOMR | Angel Oak |   | REIT - Mortgage | 10.89 | 38 | 2.58% | -6.44% |

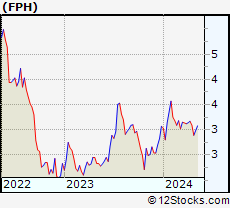

| FPH | Five Point |   | REIT - | 2.89 | 7 | -0.69% | -6.47% |

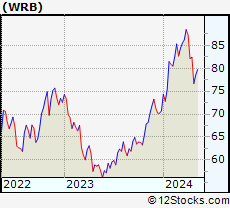

| WRB | W. R. |   | Insurance | 76.65 | 0 | -1.62% | -6.98% |

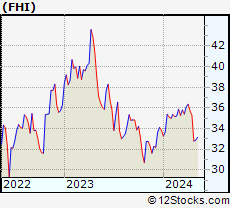

| FHI | Federated Hermes |   | Asset Mgmt | 32.80 | 0 | -3.95% | -7.06% |

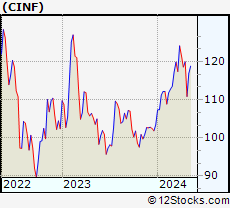

| CINF | Cinnati |   | Insurance | 110.88 | 13 | -6.38% | -7.56% |

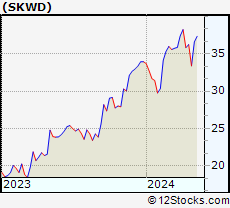

| SKWD | Skyward Specialty |   | Insurance - Property & Casualty | 33.39 | 26 | -7.15% | -7.86% |

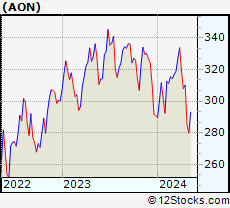

| AON | Aon |   | Insurance | 285.03 | 0 | -6.85% | -8.11% |

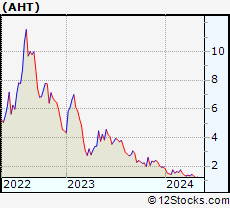

| AHT | Ashford Hospitality |   | REIT | 1.20 | 10 | 1.69% | -8.40% |

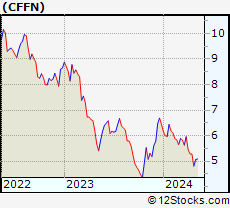

| CFFN | Capitol Federal |   | S&L | 4.81 | 0 | -3.02% | -8.90% |

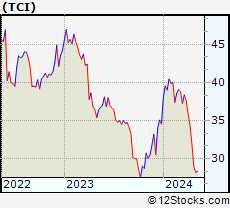

| TCI | Transcontinental Realty |   | REIT - | 28.96 | 0 | -0.82% | -9.10% |

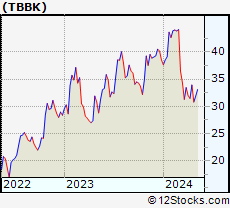

| TBBK | Bancorp |   | Regional Banks | 30.80 | 10 | -7.81% | -9.25% |

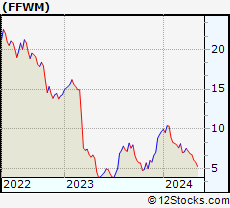

| FFWM | First Foundation |   | Regional Banks | 6.08 | 5 | -9.25% | -10.06% |

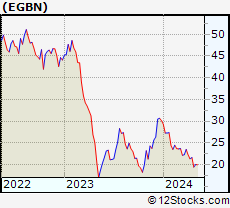

| EGBN | Eagle Bancorp |   | Regional Banks | 19.41 | 10 | -2.76% | -10.22% |

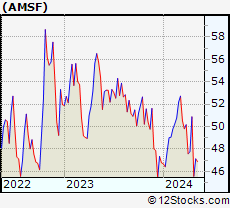

| AMSF | Amerisafe |   | Insurance | 45.56 | 0 | -0.57% | -10.46% |

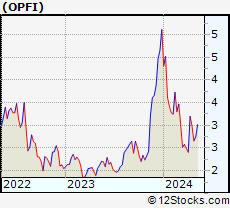

| OPFI | OppFi |   | Credit Services | 2.66 | 25 | -1.48% | -11.04% |

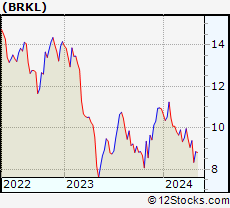

| BRKL | Brookline Bancorp |   | S&L | 8.34 | 0 | -1.01% | -11.14% |

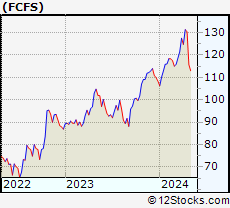

| FCFS | FirstCash |   | Credit Services | 115.71 | 26 | 0.96% | -11.27% |

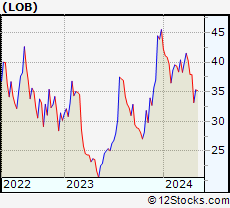

| LOB | Live Oak |   | S&L | 33.18 | 0 | -3.21% | -12.45% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Financial Stocks |

| Financial Technical Overview, Leaders & Laggards, Top Financial ETF Funds & Detailed Financial Stocks List, Charts, Trends & More |

| Financial Sector: Technical Analysis, Trends & YTD Performance | |

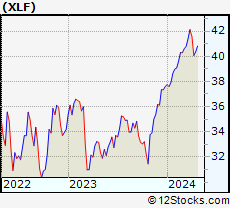

| Financial sector is composed of stocks

from banks, brokers, insurance, REITs

and services subsectors. Financial sector, as represented by XLF, an exchange-traded fund [ETF] that holds basket of Financial stocks (e.g, Bank of America, Goldman Sachs) is up by 8.56% and is currently outperforming the overall market by 2.42% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

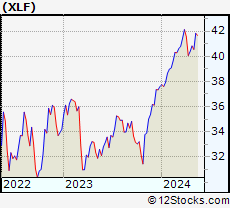

XLF Daily Chart |

|

| Short Term Trend: Deteriorating | |

| Overall Trend Score: 63 | |

| YTD Performance: 8.56% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Financial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Financial sector stocks year to date are

Now, more recently, over last week, the top performing Financial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Financial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Financial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Financial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLF | Financial |   | 40.82 | 63 | -0.15 | 1.09 | 8.56% |

| IAI | Broker-Dealers & Secs |   | 113.01 | 68 | 0.77 | 1.78 | 4.13% |

| IYF | Financials |   | 92.17 | 48 | -0.35 | 0.95 | 7.91% |

| IYG | Financial Services |   | 64.61 | 68 | 0.08 | 1.88 | 8.16% |

| KRE | Regional Banking |   | 48.19 | 59 | -0.58 | 1.84 | -8.09% |

| IXG | Global Financials |   | 84.19 | 70 | -0.30 | 1.61 | 7.14% |

| VFH | Financials |   | 98.93 | 68 | -0.19 | 1.21 | 7.23% |

| KBE | Bank |   | 45.33 | 85 | -0.31 | 2.07 | -1.5% |

| FAS | Financial Bull 3X |   | 100.63 | 55 | -0.79 | 2.76 | 21.75% |

| FAZ | Financial Bear 3X |   | 10.86 | 47 | 0.65 | -3.04 | -20.56% |

| UYG | Financials |   | 63.65 | 55 | -0.42 | 1.94 | 15.31% |

| IAT | Regional Banks |   | 41.72 | 78 | -0.31 | 2.41 | -0.29% |

| KIE | Insurance |   | 48.53 | 33 | -1.56 | -1.12 | 7.32% |

| PSCF | SmallCap Financials |   | 46.36 | 67 | 0.15 | 1.96 | -5.73% |

| EUFN | Europe Financials |   | 22.46 | 68 | 0.54 | 2.32 | 7.16% |

| PGF | Financial Preferred |   | 14.57 | 24 | 0.00 | 0.28 | -0.07% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Financial Stocks | |

|

We now take in-depth look at all Financial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Financial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

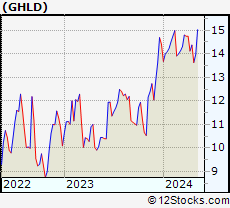

| GHLD Guild Holdings Company |

| Sector: Financials | |

| SubSector: Mortgage Finance | |

| MarketCap: 91157 Millions | |

| Recent Price: 13.63 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 0.96% Day Change: 0.13 | |

| Week Change: -5.18% Year-to-date Change: -5.5% | |

| GHLD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GHLD to Watchlist:  View: View:  Get Complete GHLD Trend Analysis ➞ Get Complete GHLD Trend Analysis ➞ | |

| NKSH National Bankshares, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 209.759 Millions | |

| Recent Price: 27.15 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -2.69% Day Change: -0.75 | |

| Week Change: -5.33% Year-to-date Change: -16.1% | |

| NKSH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NKSH to Watchlist:  View: View:  Get Complete NKSH Trend Analysis ➞ Get Complete NKSH Trend Analysis ➞ | |

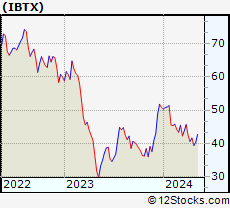

| IBTX Independent Bank Group, Inc. |

| Sector: Financials | |

| SubSector: Regional - Southeast Banks | |

| MarketCap: 1133.35 Millions | |

| Recent Price: 39.34 Smart Investing & Trading Score: 7 | |

| Day Percent Change: 0.20% Day Change: 0.08 | |

| Week Change: -5.43% Year-to-date Change: -22.7% | |

| IBTX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IBTX to Watchlist:  View: View:  Get Complete IBTX Trend Analysis ➞ Get Complete IBTX Trend Analysis ➞ | |

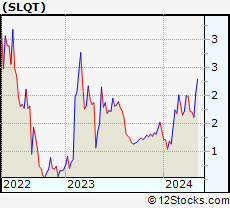

| SLQT SelectQuote, Inc. |

| Sector: Financials | |

| SubSector: Insurance Brokers | |

| MarketCap: 38257 Millions | |

| Recent Price: 1.61 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 4.21% Day Change: 0.07 | |

| Week Change: -5.57% Year-to-date Change: 17.5% | |

| SLQT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SLQT to Watchlist:  View: View:  Get Complete SLQT Trend Analysis ➞ Get Complete SLQT Trend Analysis ➞ | |

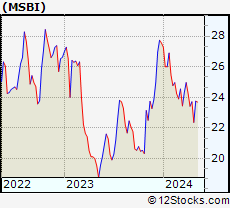

| MSBI Midland States Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 400.27 Millions | |

| Recent Price: 22.36 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -7.03% Day Change: -1.69 | |

| Week Change: -5.69% Year-to-date Change: -18.9% | |

| MSBI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MSBI to Watchlist:  View: View:  Get Complete MSBI Trend Analysis ➞ Get Complete MSBI Trend Analysis ➞ | |

| PGC Peapack-Gladstone Financial Corporation |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 284.399 Millions | |

| Recent Price: 22.74 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.79% Day Change: -0.18 | |

| Week Change: -5.76% Year-to-date Change: -23.7% | |

| PGC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PGC to Watchlist:  View: View:  Get Complete PGC Trend Analysis ➞ Get Complete PGC Trend Analysis ➞ | |

| SFST Southern First Bancshares, Inc. |

| Sector: Financials | |

| SubSector: Money Center Banks | |

| MarketCap: 189.099 Millions | |

| Recent Price: 27.18 Smart Investing & Trading Score: 17 | |

| Day Percent Change: -0.38% Day Change: -0.11 | |

| Week Change: -6.28% Year-to-date Change: -26.7% | |

| SFST Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SFST to Watchlist:  View: View:  Get Complete SFST Trend Analysis ➞ Get Complete SFST Trend Analysis ➞ | |

| AOMR Angel Oak Mortgage REIT, Inc. |

| Sector: Financials | |

| SubSector: REIT - Mortgage | |

| MarketCap: 202 Millions | |

| Recent Price: 10.89 Smart Investing & Trading Score: 38 | |

| Day Percent Change: 2.58% Day Change: 0.27 | |

| Week Change: -6.44% Year-to-date Change: 2.6% | |

| AOMR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AOMR to Watchlist:  View: View:  Get Complete AOMR Trend Analysis ➞ Get Complete AOMR Trend Analysis ➞ | |

| FPH Five Point Holdings, LLC |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 339.953 Millions | |

| Recent Price: 2.89 Smart Investing & Trading Score: 7 | |

| Day Percent Change: -0.69% Day Change: -0.02 | |

| Week Change: -6.47% Year-to-date Change: -5.9% | |

| FPH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FPH to Watchlist:  View: View:  Get Complete FPH Trend Analysis ➞ Get Complete FPH Trend Analysis ➞ | |

| WRB W. R. Berkley Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 9863.82 Millions | |

| Recent Price: 76.65 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -1.62% Day Change: -1.26 | |

| Week Change: -6.98% Year-to-date Change: 8.4% | |

| WRB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WRB to Watchlist:  View: View:  Get Complete WRB Trend Analysis ➞ Get Complete WRB Trend Analysis ➞ | |

| FHI Federated Hermes, Inc. |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 1883.03 Millions | |

| Recent Price: 32.80 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -3.95% Day Change: -1.35 | |

| Week Change: -7.06% Year-to-date Change: -3.1% | |

| FHI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FHI to Watchlist:  View: View:  Get Complete FHI Trend Analysis ➞ Get Complete FHI Trend Analysis ➞ | |

| CINF Cincinnati Financial Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 13637 Millions | |

| Recent Price: 110.88 Smart Investing & Trading Score: 13 | |

| Day Percent Change: -6.38% Day Change: -7.56 | |

| Week Change: -7.56% Year-to-date Change: 7.2% | |

| CINF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CINF to Watchlist:  View: View:  Get Complete CINF Trend Analysis ➞ Get Complete CINF Trend Analysis ➞ | |

| SKWD Skyward Specialty Insurance Group, Inc. |

| Sector: Financials | |

| SubSector: Insurance - Property & Casualty | |

| MarketCap: 936 Millions | |

| Recent Price: 33.39 Smart Investing & Trading Score: 26 | |

| Day Percent Change: -7.15% Day Change: -2.57 | |

| Week Change: -7.86% Year-to-date Change: -1.7% | |

| SKWD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SKWD to Watchlist:  View: View:  Get Complete SKWD Trend Analysis ➞ Get Complete SKWD Trend Analysis ➞ | |

| AON Aon plc |

| Sector: Financials | |

| SubSector: Insurance Brokers | |

| MarketCap: 36870.1 Millions | |

| Recent Price: 285.03 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -6.85% Day Change: -20.97 | |

| Week Change: -8.11% Year-to-date Change: -2.1% | |

| AON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AON to Watchlist:  View: View:  Get Complete AON Trend Analysis ➞ Get Complete AON Trend Analysis ➞ | |

| AHT Ashford Hospitality Trust, Inc. |

| Sector: Financials | |

| SubSector: REIT - Hotel/Motel | |

| MarketCap: 171.034 Millions | |

| Recent Price: 1.20 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 1.69% Day Change: 0.02 | |

| Week Change: -8.4% Year-to-date Change: -38.1% | |

| AHT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AHT to Watchlist:  View: View:  Get Complete AHT Trend Analysis ➞ Get Complete AHT Trend Analysis ➞ | |

| CFFN Capitol Federal Financial, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 1639.1 Millions | |

| Recent Price: 4.81 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -3.02% Day Change: -0.15 | |

| Week Change: -8.9% Year-to-date Change: -25.4% | |

| CFFN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CFFN to Watchlist:  View: View:  Get Complete CFFN Trend Analysis ➞ Get Complete CFFN Trend Analysis ➞ | |

| TCI Transcontinental Realty Investors, Inc. |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 158.653 Millions | |

| Recent Price: 28.96 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.82% Day Change: -0.24 | |

| Week Change: -9.1% Year-to-date Change: -16.2% | |

| TCI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TCI to Watchlist:  View: View:  Get Complete TCI Trend Analysis ➞ Get Complete TCI Trend Analysis ➞ | |

| TBBK The Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 267.859 Millions | |

| Recent Price: 30.80 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -7.81% Day Change: -2.61 | |

| Week Change: -9.25% Year-to-date Change: -20.1% | |

| TBBK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TBBK to Watchlist:  View: View:  Get Complete TBBK Trend Analysis ➞ Get Complete TBBK Trend Analysis ➞ | |

| FFWM First Foundation Inc. |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 457.17 Millions | |

| Recent Price: 6.08 Smart Investing & Trading Score: 5 | |

| Day Percent Change: -9.25% Day Change: -0.62 | |

| Week Change: -10.06% Year-to-date Change: -37.2% | |

| FFWM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FFWM to Watchlist:  View: View:  Get Complete FFWM Trend Analysis ➞ Get Complete FFWM Trend Analysis ➞ | |

| EGBN Eagle Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 906.559 Millions | |

| Recent Price: 19.41 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -2.76% Day Change: -0.55 | |

| Week Change: -10.22% Year-to-date Change: -35.6% | |

| EGBN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EGBN to Watchlist:  View: View:  Get Complete EGBN Trend Analysis ➞ Get Complete EGBN Trend Analysis ➞ | |

| AMSF Amerisafe, Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 1159.32 Millions | |

| Recent Price: 45.56 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.57% Day Change: -0.26 | |

| Week Change: -10.46% Year-to-date Change: -2.6% | |

| AMSF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMSF to Watchlist:  View: View:  Get Complete AMSF Trend Analysis ➞ Get Complete AMSF Trend Analysis ➞ | |

| OPFI OppFi Inc. |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 226 Millions | |

| Recent Price: 2.66 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -1.48% Day Change: -0.04 | |

| Week Change: -11.04% Year-to-date Change: -48.0% | |

| OPFI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OPFI to Watchlist:  View: View:  Get Complete OPFI Trend Analysis ➞ Get Complete OPFI Trend Analysis ➞ | |

| BRKL Brookline Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 894.43 Millions | |

| Recent Price: 8.34 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -1.01% Day Change: -0.08 | |

| Week Change: -11.14% Year-to-date Change: -23.6% | |

| BRKL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BRKL to Watchlist:  View: View:  Get Complete BRKL Trend Analysis ➞ Get Complete BRKL Trend Analysis ➞ | |

| FCFS FirstCash, Inc. |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 2795.48 Millions | |

| Recent Price: 115.71 Smart Investing & Trading Score: 26 | |

| Day Percent Change: 0.96% Day Change: 1.10 | |

| Week Change: -11.27% Year-to-date Change: 6.8% | |

| FCFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FCFS to Watchlist:  View: View:  Get Complete FCFS Trend Analysis ➞ Get Complete FCFS Trend Analysis ➞ | |

| LOB Live Oak Bancshares, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 394.23 Millions | |

| Recent Price: 33.18 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -3.21% Day Change: -1.10 | |

| Week Change: -12.45% Year-to-date Change: -27.1% | |

| LOB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LOB to Watchlist:  View: View:  Get Complete LOB Trend Analysis ➞ Get Complete LOB Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Financial Stocks With Best Up Trends [0-bearish to 100-bullish]: KB [100], MBIA [100], Shinhan [100], B. Riley[100], Lemonade [100], Oppenheimer [100], Greene County[100], Uniti [100], Metals Acquisition[100], PayPal [100], Victory Capital[100]

Best Financial Stocks Year-to-Date:

Root [515.09%], Hippo [139.52%], Gladstone Capital[100.47%], Banco Macro[79.02%], Grupo Financiero[77.82%], B. Riley[75.42%], Banco BBVA[70.04%], Yiren Digital[62.82%], EverQuote [59.72%], Heritage Insurance[57.82%], Fidelis Insurance[54.33%] Best Financial Stocks This Week:

B. Riley[84.19%], Oportun [35.78%], Root [24.47%], KB [18.21%], KE [17.23%], Cipher Mining[16.93%], Provident Bancorp[13.99%], TOP [13.62%], Globe Life[13.5%], Trustmark [12.42%], Coinbase Global[12.06%] Best Financial Stocks Daily:

Huize Holding[18.27%], KB [8.99%], Root [8.87%], KE [8.17%], MBIA [7.74%], PagSeguro Digital[7.28%], Shinhan [7.25%], Noah [6.71%], MicroSectors Gold[6.39%], B. Riley[6.14%], Coinbase Global[5.74%]

Root [515.09%], Hippo [139.52%], Gladstone Capital[100.47%], Banco Macro[79.02%], Grupo Financiero[77.82%], B. Riley[75.42%], Banco BBVA[70.04%], Yiren Digital[62.82%], EverQuote [59.72%], Heritage Insurance[57.82%], Fidelis Insurance[54.33%] Best Financial Stocks This Week:

B. Riley[84.19%], Oportun [35.78%], Root [24.47%], KB [18.21%], KE [17.23%], Cipher Mining[16.93%], Provident Bancorp[13.99%], TOP [13.62%], Globe Life[13.5%], Trustmark [12.42%], Coinbase Global[12.06%] Best Financial Stocks Daily:

Huize Holding[18.27%], KB [8.99%], Root [8.87%], KE [8.17%], MBIA [7.74%], PagSeguro Digital[7.28%], Shinhan [7.25%], Noah [6.71%], MicroSectors Gold[6.39%], B. Riley[6.14%], Coinbase Global[5.74%]

Login Sign Up

Login Sign Up