Best Transport Stocks

| In a hurry? Transport Stocks Lists: Performance Trends Table, Stock Charts

Sort Transport stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Transport stocks list by size: All Transport Large Mid-Range Small |

| 12Stocks.com Transport Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 25 (0-bearish to 100-bullish) which puts Transport sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 0 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Transport stocks at 12Stocks.com (click stock name for detailed review):

|

| Consider signing up for our daily 12Stocks.com "Best Stocks Newsletter". You will never ever miss a big stock move again! |

| 12Stocks.com: Investing in Transport sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Transport sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Transport Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| CAR | Avis Budget |   | Rental | 115.89 | 85 | 1.86% | 15.03% |

| AZUL | Azul S.A |   | Airlines | 6.34 | 35 | 7.28% | 11.62% |

| TRN | Trinity Industries |   | Railroads | 29.85 | 100 | -0.67% | 9.99% |

| XPO | XPO Logistics |   | Air Delivery | 118.29 | 10 | 8.60% | 6.66% |

| HUBG | Hub |   | Air Delivery | 42.51 | 87 | 0.54% | 6.46% |

| WERN | Werner Enterprises |   | Trucking | 36.57 | 52 | 2.32% | 5.27% |

| HTLD | Heartland Express |   | Trucking | 10.79 | 49 | 1.89% | 4.15% |

| R | Ryder System |   | Rental | 126.44 | 90 | 1.38% | 3.68% |

| FRO | Frontline |   | Shipping | 24.62 | 95 | 0.20% | 3.45% |

| CPA | Copa |   | Airlines | 102.17 | 93 | 1.49% | 3.25% |

| MRTN | Marten |   | Trucking | 17.48 | 57 | 1.51% | 3.19% |

| UHAL | AMERCO |   | Rental | 66.86 | 83 | 2.29% | 2.99% |

| SNDR | Schneider National |   | Trucking | 21.97 | 67 | 2.09% | 2.90% |

| SKYW | SkyWest |   | Airlines | 75.71 | 75 | 0.97% | 2.78% |

| AER | AerCap |   | Air , Other | 87.81 | 78 | 1.13% | 2.71% |

| KNX | Knight-Swift ation |   | Trucking | 47.95 | 35 | 1.87% | 2.26% |

| ATSG | Air |   | Air Delivery | 13.16 | 100 | -0.23% | 1.94% |

| MATX | Matson |   | Shipping | 110.48 | 27 | 1.26% | 1.41% |

| LSTR | Landstar System |   | Trucking | 179.61 | 35 | 1.47% | 1.33% |

| RRR | Red Rock |   | Rental | 54.74 | 17 | 2.29% | 1.15% |

| JBLU | JetBlue Airways |   | Airlines | 5.84 | 17 | 1.21% | 1.04% |

| AAL | American Airlines |   | Airlines | 14.00 | 32 | 1.01% | 0.86% |

| GATX | GATX |   | Rental | 128.38 | 38 | 1.61% | 0.68% |

| EURN | Euronav NV |   | Shipping | 16.91 | 64 | -0.24% | 0.36% |

| PAC | Grupo Aeroportuario |   | Air , Other | 183.90 | 75 | 0.52% | 0.23% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Transport Stocks |

| Transport Technical Overview, Leaders & Laggards, Top Transport ETF Funds & Detailed Transport Stocks List, Charts, Trends & More |

| Transport Sector: Technical Analysis, Trends & YTD Performance | |

| Transport sector is composed of stocks

from air delivery, shipping, trucking, railroads

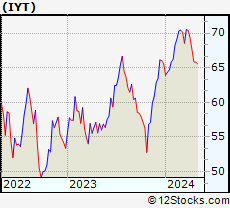

and airline subsectors. Transport sector, as represented by IYT, an exchange-traded fund [ETF] that holds basket of Transport stocks (e.g, FedEx, United Airlines) is up by 1.09% and is currently underperforming the overall market by -5.7% year-to-date. Below is a quick view of Technical charts and trends: |

|

IYT Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Not Good | |

IYT Daily Chart |

|

| Short Term Trend: Deteriorating | |

| Overall Trend Score: 25 | |

| YTD Performance: 1.09% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Transport Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Transport sector stocks year to date are

Now, more recently, over last week, the top performing Transport sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Transport Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Transport Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Transport Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IYT | Transportation |   | 66.32 | 25 | 1.36 | 0.76 | 1.09% |

| FTXR | Transportation |   | 30.84 | 25 | 0.19 | -0.56 | 2.77% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Transport Stocks | |

|

We now take in-depth look at all Transport stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Transport stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

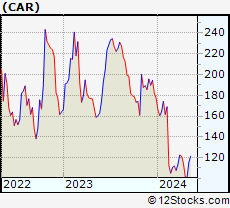

| CAR Avis Budget Group, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1020.44 Millions | |

| Recent Price: 115.89 Smart Investing & Trading Score: 85 | |

| Day Percent Change: 1.86% Day Change: 2.12 | |

| Week Change: 15.03% Year-to-date Change: -34.6% | |

| CAR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CAR to Watchlist:  View: View:  Get Complete CAR Trend Analysis ➞ Get Complete CAR Trend Analysis ➞ | |

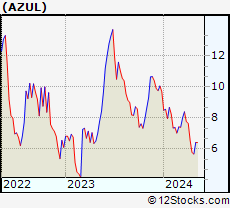

| AZUL Azul S.A. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 1289.85 Millions | |

| Recent Price: 6.34 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 7.28% Day Change: 0.43 | |

| Week Change: 11.62% Year-to-date Change: -34.6% | |

| AZUL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AZUL to Watchlist:  View: View:  Get Complete AZUL Trend Analysis ➞ Get Complete AZUL Trend Analysis ➞ | |

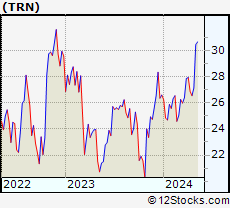

| TRN Trinity Industries, Inc. |

| Sector: Transports | |

| SubSector: Railroads | |

| MarketCap: 2058.22 Millions | |

| Recent Price: 29.85 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.67% Day Change: -0.20 | |

| Week Change: 9.99% Year-to-date Change: 12.3% | |

| TRN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TRN to Watchlist:  View: View:  Get Complete TRN Trend Analysis ➞ Get Complete TRN Trend Analysis ➞ | |

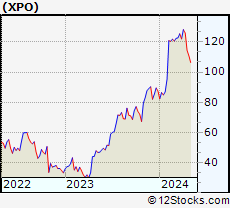

| XPO XPO Logistics, Inc. |

| Sector: Transports | |

| SubSector: Air Delivery & Freight Services | |

| MarketCap: 4049.08 Millions | |

| Recent Price: 118.29 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 8.60% Day Change: 9.37 | |

| Week Change: 6.66% Year-to-date Change: 35.1% | |

| XPO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XPO to Watchlist:  View: View:  Get Complete XPO Trend Analysis ➞ Get Complete XPO Trend Analysis ➞ | |

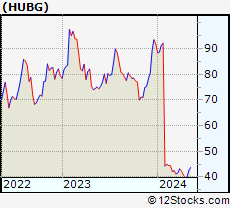

| HUBG Hub Group, Inc. |

| Sector: Transports | |

| SubSector: Air Delivery & Freight Services | |

| MarketCap: 1503.88 Millions | |

| Recent Price: 42.51 Smart Investing & Trading Score: 87 | |

| Day Percent Change: 0.54% Day Change: 0.23 | |

| Week Change: 6.46% Year-to-date Change: -53.8% | |

| HUBG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HUBG to Watchlist:  View: View:  Get Complete HUBG Trend Analysis ➞ Get Complete HUBG Trend Analysis ➞ | |

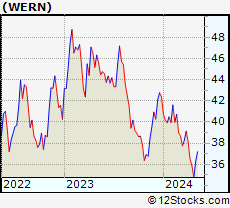

| WERN Werner Enterprises, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 2409.65 Millions | |

| Recent Price: 36.57 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 2.32% Day Change: 0.83 | |

| Week Change: 5.27% Year-to-date Change: -13.7% | |

| WERN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WERN to Watchlist:  View: View:  Get Complete WERN Trend Analysis ➞ Get Complete WERN Trend Analysis ➞ | |

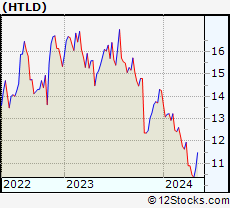

| HTLD Heartland Express, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 1461.25 Millions | |

| Recent Price: 10.79 Smart Investing & Trading Score: 49 | |

| Day Percent Change: 1.89% Day Change: 0.20 | |

| Week Change: 4.15% Year-to-date Change: -24.3% | |

| HTLD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HTLD to Watchlist:  View: View:  Get Complete HTLD Trend Analysis ➞ Get Complete HTLD Trend Analysis ➞ | |

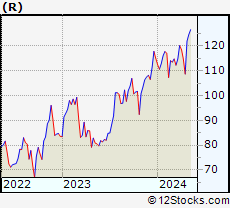

| R Ryder System, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1550.94 Millions | |

| Recent Price: 126.44 Smart Investing & Trading Score: 90 | |

| Day Percent Change: 1.38% Day Change: 1.73 | |

| Week Change: 3.68% Year-to-date Change: 9.9% | |

| R Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add R to Watchlist:  View: View:  Get Complete R Trend Analysis ➞ Get Complete R Trend Analysis ➞ | |

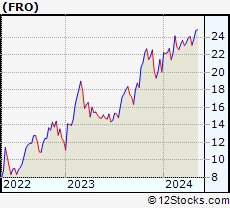

| FRO Frontline Ltd. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 1269.14 Millions | |

| Recent Price: 24.62 Smart Investing & Trading Score: 95 | |

| Day Percent Change: 0.20% Day Change: 0.05 | |

| Week Change: 3.45% Year-to-date Change: 22.8% | |

| FRO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FRO to Watchlist:  View: View:  Get Complete FRO Trend Analysis ➞ Get Complete FRO Trend Analysis ➞ | |

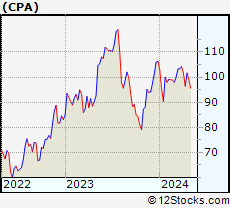

| CPA Copa Holdings, S.A. |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 1682.3 Millions | |

| Recent Price: 102.17 Smart Investing & Trading Score: 93 | |

| Day Percent Change: 1.49% Day Change: 1.50 | |

| Week Change: 3.25% Year-to-date Change: -3.9% | |

| CPA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CPA to Watchlist:  View: View:  Get Complete CPA Trend Analysis ➞ Get Complete CPA Trend Analysis ➞ | |

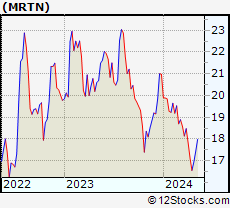

| MRTN Marten Transport, Ltd. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 1012.15 Millions | |

| Recent Price: 17.48 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 1.51% Day Change: 0.26 | |

| Week Change: 3.19% Year-to-date Change: -16.7% | |

| MRTN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MRTN to Watchlist:  View: View:  Get Complete MRTN Trend Analysis ➞ Get Complete MRTN Trend Analysis ➞ | |

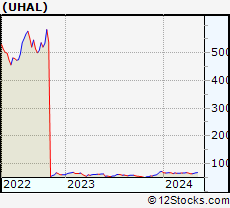

| UHAL AMERCO |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 5271.94 Millions | |

| Recent Price: 66.86 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 2.29% Day Change: 1.50 | |

| Week Change: 2.99% Year-to-date Change: -6.9% | |

| UHAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UHAL to Watchlist:  View: View:  Get Complete UHAL Trend Analysis ➞ Get Complete UHAL Trend Analysis ➞ | |

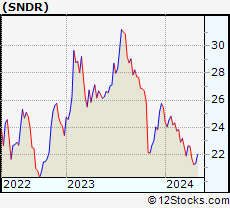

| SNDR Schneider National, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 3299.95 Millions | |

| Recent Price: 21.97 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 2.09% Day Change: 0.45 | |

| Week Change: 2.9% Year-to-date Change: -13.7% | |

| SNDR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SNDR to Watchlist:  View: View:  Get Complete SNDR Trend Analysis ➞ Get Complete SNDR Trend Analysis ➞ | |

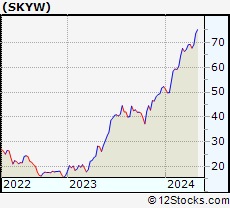

| SKYW SkyWest, Inc. |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 1394.7 Millions | |

| Recent Price: 75.71 Smart Investing & Trading Score: 75 | |

| Day Percent Change: 0.97% Day Change: 0.73 | |

| Week Change: 2.78% Year-to-date Change: 45.0% | |

| SKYW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SKYW to Watchlist:  View: View:  Get Complete SKYW Trend Analysis ➞ Get Complete SKYW Trend Analysis ➞ | |

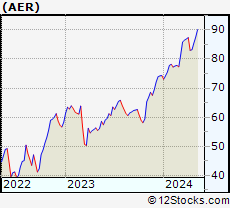

| AER AerCap Holdings N.V. |

| Sector: Transports | |

| SubSector: Air Services, Other | |

| MarketCap: 3633.68 Millions | |

| Recent Price: 87.81 Smart Investing & Trading Score: 78 | |

| Day Percent Change: 1.13% Day Change: 0.99 | |

| Week Change: 2.71% Year-to-date Change: 18.1% | |

| AER Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AER to Watchlist:  View: View:  Get Complete AER Trend Analysis ➞ Get Complete AER Trend Analysis ➞ | |

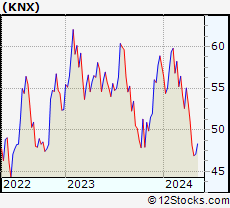

| KNX Knight-Swift Transportation Holdings Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 5602.95 Millions | |

| Recent Price: 47.95 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 1.87% Day Change: 0.88 | |

| Week Change: 2.26% Year-to-date Change: -16.8% | |

| KNX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KNX to Watchlist:  View: View:  Get Complete KNX Trend Analysis ➞ Get Complete KNX Trend Analysis ➞ | |

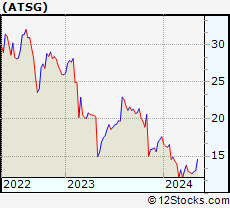

| ATSG Air Transport Services Group, Inc. |

| Sector: Transports | |

| SubSector: Air Delivery & Freight Services | |

| MarketCap: 1111.68 Millions | |

| Recent Price: 13.16 Smart Investing & Trading Score: 100 | |

| Day Percent Change: -0.23% Day Change: -0.03 | |

| Week Change: 1.94% Year-to-date Change: -25.3% | |

| ATSG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ATSG to Watchlist:  View: View:  Get Complete ATSG Trend Analysis ➞ Get Complete ATSG Trend Analysis ➞ | |

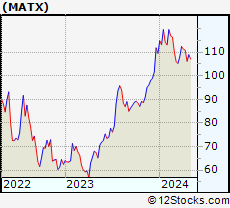

| MATX Matson, Inc. |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 1509.94 Millions | |

| Recent Price: 110.48 Smart Investing & Trading Score: 27 | |

| Day Percent Change: 1.26% Day Change: 1.37 | |

| Week Change: 1.41% Year-to-date Change: 0.8% | |

| MATX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MATX to Watchlist:  View: View:  Get Complete MATX Trend Analysis ➞ Get Complete MATX Trend Analysis ➞ | |

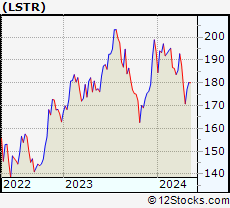

| LSTR Landstar System, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 3877.95 Millions | |

| Recent Price: 179.61 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 1.47% Day Change: 2.61 | |

| Week Change: 1.33% Year-to-date Change: -7.3% | |

| LSTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LSTR to Watchlist:  View: View:  Get Complete LSTR Trend Analysis ➞ Get Complete LSTR Trend Analysis ➞ | |

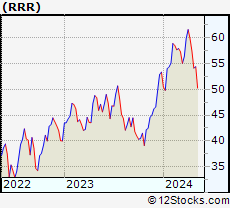

| RRR Red Rock Resorts, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1144.04 Millions | |

| Recent Price: 54.74 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 2.29% Day Change: 1.22 | |

| Week Change: 1.15% Year-to-date Change: 2.7% | |

| RRR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RRR to Watchlist:  View: View:  Get Complete RRR Trend Analysis ➞ Get Complete RRR Trend Analysis ➞ | |

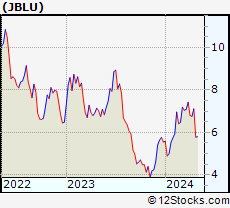

| JBLU JetBlue Airways Corporation |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 2383.1 Millions | |

| Recent Price: 5.84 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 1.21% Day Change: 0.07 | |

| Week Change: 1.04% Year-to-date Change: 5.2% | |

| JBLU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JBLU to Watchlist:  View: View:  Get Complete JBLU Trend Analysis ➞ Get Complete JBLU Trend Analysis ➞ | |

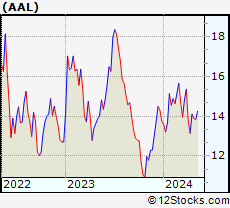

| AAL American Airlines Group Inc. |

| Sector: Transports | |

| SubSector: Major Airlines | |

| MarketCap: 5346.45 Millions | |

| Recent Price: 14.00 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 1.01% Day Change: 0.14 | |

| Week Change: 0.86% Year-to-date Change: 1.9% | |

| AAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAL to Watchlist:  View: View:  Get Complete AAL Trend Analysis ➞ Get Complete AAL Trend Analysis ➞ | |

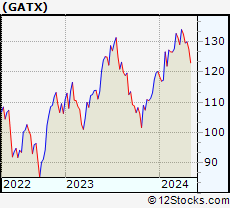

| GATX GATX Corporation |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 2080.34 Millions | |

| Recent Price: 128.38 Smart Investing & Trading Score: 38 | |

| Day Percent Change: 1.61% Day Change: 2.04 | |

| Week Change: 0.68% Year-to-date Change: 6.8% | |

| GATX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GATX to Watchlist:  View: View:  Get Complete GATX Trend Analysis ➞ Get Complete GATX Trend Analysis ➞ | |

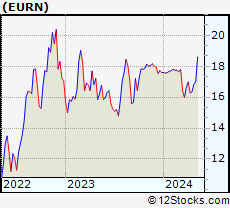

| EURN Euronav NV |

| Sector: Transports | |

| SubSector: Shipping | |

| MarketCap: 1785.14 Millions | |

| Recent Price: 16.91 Smart Investing & Trading Score: 64 | |

| Day Percent Change: -0.24% Day Change: -0.04 | |

| Week Change: 0.36% Year-to-date Change: -3.9% | |

| EURN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EURN to Watchlist:  View: View:  Get Complete EURN Trend Analysis ➞ Get Complete EURN Trend Analysis ➞ | |

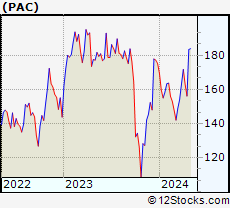

| PAC Grupo Aeroportuario del Pacifico, S.A.B. de C.V. |

| Sector: Transports | |

| SubSector: Air Services, Other | |

| MarketCap: 3204.18 Millions | |

| Recent Price: 183.90 Smart Investing & Trading Score: 75 | |

| Day Percent Change: 0.52% Day Change: 0.95 | |

| Week Change: 0.23% Year-to-date Change: 5.0% | |

| PAC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAC to Watchlist:  View: View:  Get Complete PAC Trend Analysis ➞ Get Complete PAC Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Transport Stocks With Best Up Trends [0-bearish to 100-bullish]: Fortress ation[100], Delta Air[100], Costamare [100], Golden Ocean[100], Genco Shipping[100], Star Bulk[100], Air [100], C.H. Robinson[100], Ardmore Shipping[100], ZTO Express[100], Trinity Industries[100]

Best Transport Stocks Year-to-Date:

Fortress ation[66.52%], Universal Logistics[56.25%], Golden Ocean[50.1%], SkyWest [45.04%], Kirby [40.04%], XPO Logistics[35.05%], Genco Shipping[33.42%], Delta Air[27.48%], Wabtec [27.09%], United Airlines[26.71%], Frontline [22.79%] Best Transport Stocks This Week:

Avis Budget[15.03%], C.H. Robinson[14.77%], Azul S.A[11.62%], Trinity Industries[9.99%], Fortress ation[9.21%], KNOT Offshore[8.3%], Spirit Airlines[6.78%], XPO Logistics[6.66%], Hub [6.46%], Werner Enterprises[5.27%], Costamare [5.01%] Best Transport Stocks Daily:

XPO Logistics[8.60%], Azul S.A[7.28%], Aaron s[3.09%], Allegiant Travel[2.85%], Forward Air[2.72%], Spirit Airlines[2.72%], United Rentals[2.63%], Herc [2.51%], WillScot [2.47%], ArcBest [2.41%], Werner Enterprises[2.32%]

Fortress ation[66.52%], Universal Logistics[56.25%], Golden Ocean[50.1%], SkyWest [45.04%], Kirby [40.04%], XPO Logistics[35.05%], Genco Shipping[33.42%], Delta Air[27.48%], Wabtec [27.09%], United Airlines[26.71%], Frontline [22.79%] Best Transport Stocks This Week:

Avis Budget[15.03%], C.H. Robinson[14.77%], Azul S.A[11.62%], Trinity Industries[9.99%], Fortress ation[9.21%], KNOT Offshore[8.3%], Spirit Airlines[6.78%], XPO Logistics[6.66%], Hub [6.46%], Werner Enterprises[5.27%], Costamare [5.01%] Best Transport Stocks Daily:

XPO Logistics[8.60%], Azul S.A[7.28%], Aaron s[3.09%], Allegiant Travel[2.85%], Forward Air[2.72%], Spirit Airlines[2.72%], United Rentals[2.63%], Herc [2.51%], WillScot [2.47%], ArcBest [2.41%], Werner Enterprises[2.32%]

Login Sign Up

Login Sign Up