Best Latin America Stocks

|

|

| Quick Read: Top Latin America Stocks By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Latin America Views: Quick Browse View, Summary & Slide Show | |||

| 12Stocks.com Latin America Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 62 (0-bearish to 100-bullish) which puts Latin America index in short term neutral to bullish trend. The market intelligence score from previous trading session is 18 and hence an improvement of trend.

| ||||||||

| Here are the market intelligence trend scores of the most requested Latin America stocks at 12Stocks.com (click stock name for detailed review): | |

| Scroll down this page for most comprehensive review of Latin America stocks by performance, trends, technical analysis, charts, fund plays & more | |

| 12Stocks.com: Top Performing Latin America Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Latin America Index stocks year to date are

Now, more recently, over last week, the top performing Latin America Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Latin America Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Latin America Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Latin America Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| LICY | Li-Cycle |   | Industrials | 0.68 | 61 | 2.78% | 8.62% |

| BHC | Bausch Health |   | Health Care | 8.71 | 48 | 1.04% | 8.60% |

| GIL | Gildan Activewear |   | Consumer Staples | 35.30 | 56 | 0.66% | 6.78% |

| PBR | Petroleo Brasileiro |   | Energy | 17.05 | 82 | 0.00% | 6.76% |

| CX | CEMEX S.A.B. |   | Industrials | 8.27 | 17 | 1.10% | 6.71% |

| NFGC | New Found |   | Materials | 3.75 | 61 | 1.08% | 6.53% |

| MFC | Manulife Financial |   | Financials | 23.47 | 55 | 0.43% | 6.20% |

| MERC | Mercer |   | Consumer Staples | 10.05 | 78 | -1.95% | 6.01% |

| NOA | North American |   | Energy | 22.07 | 49 | 1.28% | 5.85% |

| IE | Ivanhoe Electric |   | Materials | 10.68 | 43 | 11.83% | 5.38% |

| KOF | Coca-Cola FEMSA |   | Consumer Staples | 99.61 | 100 | 0.95% | 5.25% |

| AEZS | Aeterna Zentaris |   | Health Care | 1.96 | 60 | -0.20% | 5.16% |

| SBS | Companhia de |   | Utilities | 16.00 | 47 | 0.88% | 5.06% |

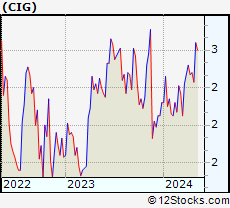

| CIG | Companhia Energetica |   | Utilities | 2.43 | 43 | 0.83% | 4.74% |

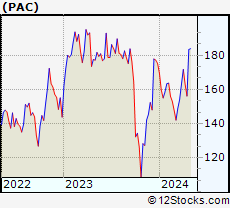

| PAC | Grupo Aeroportuario |   | Transports | 183.47 | 100 | 1.94% | 4.71% |

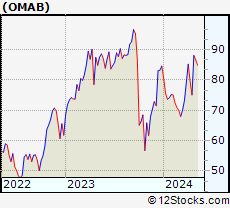

| OMAB | Grupo Aeroportuario |   | Transports | 88.12 | 100 | 3.35% | 4.12% |

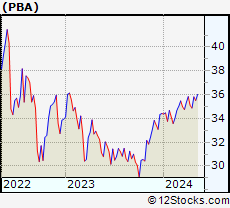

| PBA | Pembina Pipeline |   | Energy | 35.82 | 85 | 0.31% | 4.07% |

| CP | Canadian Pacific |   | Transports | 81.68 | 26 | -0.50% | 3.31% |

| VOXR | Vox Royalty |   | Materials | 2.12 | 75 | 2.91% | 2.91% |

| SUZ | Suzano S.A |   | Consumer Staples | 11.67 | 43 | 0.52% | 2.73% |

| KFS | Kingsway Financial |   | Financials | 8.58 | 42 | 0.59% | 2.14% |

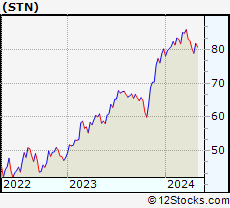

| STN | Stantec |   | Services & Goods | 81.84 | 75 | 0.42% | 2.06% |

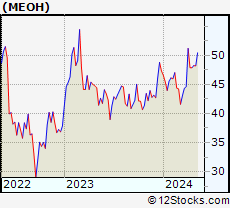

| MEOH | Methanex |   | Materials | 48.27 | 78 | 1.05% | 1.92% |

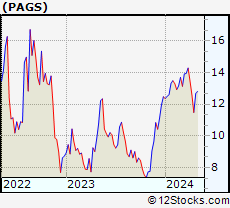

| PAGS | PagSeguro Digital |   | Financials | 12.68 | 17 | 7.28% | 1.68% |

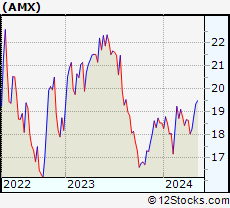

| AMX | America Movil |   | Technology | 18.83 | 100 | 2.90% | 1.67% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Latin America Stocks |

| Latin America Technical Overview, Leaders & Laggards, Top Latin America ETF Funds & Detailed Latin America Stocks List, Charts, Trends & More |

| Latin America: Technical Analysis, Trends & YTD Performance | |

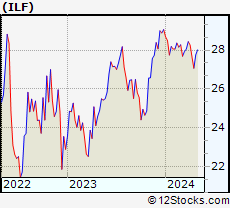

ILF Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Deteriorating | |

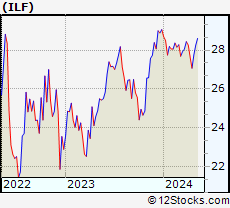

ILF Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 62 | |

| YTD Performance: -4.47% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Latin America Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors play Latin America stock market. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Latin America Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| ILF | Latin America 40 |   | 27.76 | 62 | 1.87 | 2.55 | -4.47% |

| EWC | Canada |   | 37.63 | 68 | 0.35 | 1.4 | 2.59% |

| FLN | Latin America AlphaDEX |   | 19.69 | 38 | 1.65 | 2.45 | -5.29% |

| EWZ | Brazil |   | 31.54 | 49 | 2.37 | 2.6 | -9.78% |

| EWW | Mexico |   | 66.85 | 38 | 1.60 | 3.02 | -1.47% |

| ARGT | Argentina |   | 56.33 | 78 | 3.13 | 5.35 | 9.72% |

| EWZS | Brazil Small-Cap |   | 13.47 | 39 | 3.18 | 3.62 | -10.56% |

| BRF | Brazil Small-Cap |   | 15.45 | 39 | 3.83 | 3.97 | -12.16% |

| BZQ | Short Brazil |   | 12.07 | 56 | -4.43 | -5.2 | 20.34% |

| BRZU | Brazil Bull 3X |   | 80.60 | 49 | 4.58 | 4.95 | -21.66% |

| FBZ | Brazil AlphaDEX |   | 11.47 | 17 | 2.69 | 2.05 | -6.15% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Latin America Stocks | |

|

We now take in-depth look at all Latin America stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Latin America stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

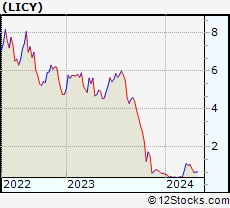

| LICY Li-Cycle Holdings Corp. |

| Sector: Industrials | |

| SubSector: Waste Management | |

| MarketCap: 959 Millions | |

| Recent Price: 0.68 Market Intelligence Score: 61 | |

| Day Percent Change: 2.78% Day Change: 0.02 | |

| Week Change: 1.26% Year-to-date Change: 8.6% | |

| LICY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LICY to Watchlist:  View: View:  Get Complete LICY Trend Analysis ➞ Get Complete LICY Trend Analysis ➞ | |

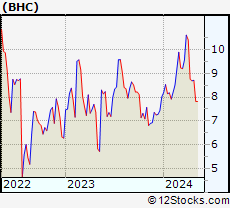

| BHC Bausch Health Companies Inc. |

| Sector: Health Care | |

| SubSector: Drug Delivery | |

| MarketCap: 5485.3 Millions | |

| Recent Price: 8.71 Market Intelligence Score: 48 | |

| Day Percent Change: 1.04% Day Change: 0.09 | |

| Week Change: 0.23% Year-to-date Change: 8.6% | |

| BHC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BHC to Watchlist:  View: View:  Get Complete BHC Trend Analysis ➞ Get Complete BHC Trend Analysis ➞ | |

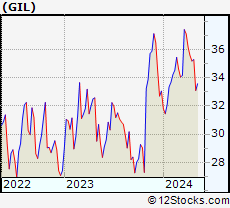

| GIL Gildan Activewear Inc. |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Clothing | |

| MarketCap: 2411.65 Millions | |

| Recent Price: 35.30 Market Intelligence Score: 56 | |

| Day Percent Change: 0.66% Day Change: 0.23 | |

| Week Change: 0.28% Year-to-date Change: 6.8% | |

| GIL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GIL to Watchlist:  View: View:  Get Complete GIL Trend Analysis ➞ Get Complete GIL Trend Analysis ➞ | |

| PBR Petroleo Brasileiro S.A. - Petrobras |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 38939.2 Millions | |

| Recent Price: 17.05 Market Intelligence Score: 82 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: 3.52% Year-to-date Change: 6.8% | |

| PBR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PBR to Watchlist:  View: View:  Get Complete PBR Trend Analysis ➞ Get Complete PBR Trend Analysis ➞ | |

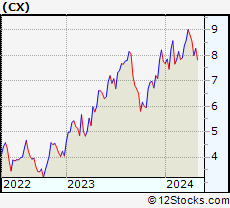

| CX CEMEX, S.A.B. de C.V. |

| Sector: Industrials | |

| SubSector: Cement | |

| MarketCap: 2948.23 Millions | |

| Recent Price: 8.27 Market Intelligence Score: 17 | |

| Day Percent Change: 1.10% Day Change: 0.09 | |

| Week Change: 3.5% Year-to-date Change: 6.7% | |

| CX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CX to Watchlist:  View: View:  Get Complete CX Trend Analysis ➞ Get Complete CX Trend Analysis ➞ | |

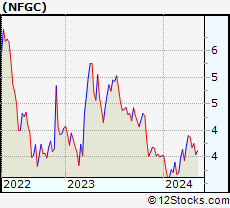

| NFGC New Found Gold Corp. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 868 Millions | |

| Recent Price: 3.75 Market Intelligence Score: 61 | |

| Day Percent Change: 1.08% Day Change: 0.04 | |

| Week Change: 1.9% Year-to-date Change: 6.5% | |

| NFGC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NFGC to Watchlist:  View: View:  Get Complete NFGC Trend Analysis ➞ Get Complete NFGC Trend Analysis ➞ | |

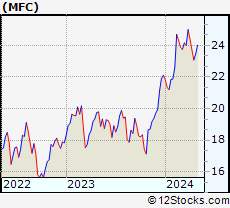

| MFC Manulife Financial Corporation |

| Sector: Financials | |

| SubSector: Life Insurance | |

| MarketCap: 22188.7 Millions | |

| Recent Price: 23.47 Market Intelligence Score: 55 | |

| Day Percent Change: 0.43% Day Change: 0.10 | |

| Week Change: 1.73% Year-to-date Change: 6.2% | |

| MFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MFC to Watchlist:  View: View:  Get Complete MFC Trend Analysis ➞ Get Complete MFC Trend Analysis ➞ | |

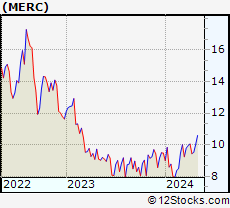

| MERC Mercer International Inc. |

| Sector: Consumer Staples | |

| SubSector: Paper & Paper Products | |

| MarketCap: 509.003 Millions | |

| Recent Price: 10.05 Market Intelligence Score: 78 | |

| Day Percent Change: -1.95% Day Change: -0.20 | |

| Week Change: 5.35% Year-to-date Change: 6.0% | |

| MERC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MERC to Watchlist:  View: View:  Get Complete MERC Trend Analysis ➞ Get Complete MERC Trend Analysis ➞ | |

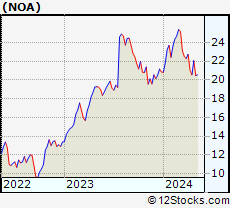

| NOA North American Construction Group Ltd. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 160.461 Millions | |

| Recent Price: 22.07 Market Intelligence Score: 49 | |

| Day Percent Change: 1.28% Day Change: 0.28 | |

| Week Change: 7.45% Year-to-date Change: 5.9% | |

| NOA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NOA to Watchlist:  View: View:  Get Complete NOA Trend Analysis ➞ Get Complete NOA Trend Analysis ➞ | |

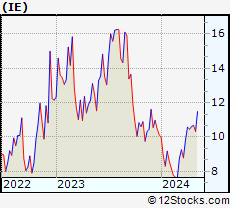

| IE Ivanhoe Electric Inc. |

| Sector: Materials | |

| SubSector: Copper | |

| MarketCap: 1200 Millions | |

| Recent Price: 10.68 Market Intelligence Score: 43 | |

| Day Percent Change: 11.83% Day Change: 1.13 | |

| Week Change: 0.75% Year-to-date Change: 5.4% | |

| IE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IE to Watchlist:  View: View:  Get Complete IE Trend Analysis ➞ Get Complete IE Trend Analysis ➞ | |

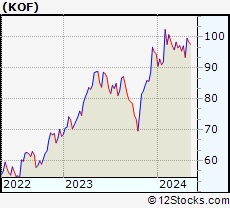

| KOF Coca-Cola FEMSA, S.A.B. de C.V. |

| Sector: Consumer Staples | |

| SubSector: Beverages - Soft Drinks | |

| MarketCap: 2258.9 Millions | |

| Recent Price: 99.61 Market Intelligence Score: 100 | |

| Day Percent Change: 0.95% Day Change: 0.94 | |

| Week Change: 6.66% Year-to-date Change: 5.3% | |

| KOF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KOF to Watchlist:  View: View:  Get Complete KOF Trend Analysis ➞ Get Complete KOF Trend Analysis ➞ | |

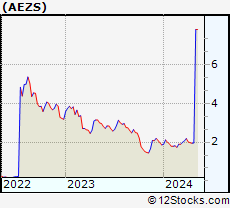

| AEZS Aeterna Zentaris Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 13.6785 Millions | |

| Recent Price: 1.96 Market Intelligence Score: 60 | |

| Day Percent Change: -0.20% Day Change: 0.00 | |

| Week Change: 0.31% Year-to-date Change: 5.2% | |

| AEZS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEZS to Watchlist:  View: View:  Get Complete AEZS Trend Analysis ➞ Get Complete AEZS Trend Analysis ➞ | |

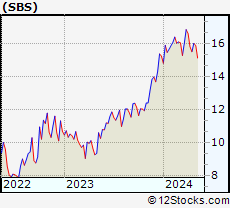

| SBS Companhia de Saneamento Basico do Estado de Sao Paulo - SABESP |

| Sector: Utilities | |

| SubSector: Water Utilities | |

| MarketCap: 5498.72 Millions | |

| Recent Price: 16.00 Market Intelligence Score: 47 | |

| Day Percent Change: 0.88% Day Change: 0.14 | |

| Week Change: 3.29% Year-to-date Change: 5.1% | |

| SBS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SBS to Watchlist:  View: View:  Get Complete SBS Trend Analysis ➞ Get Complete SBS Trend Analysis ➞ | |

| CIG Companhia Energetica de Minas Gerais |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 3203.54 Millions | |

| Recent Price: 2.43 Market Intelligence Score: 43 | |

| Day Percent Change: 0.83% Day Change: 0.02 | |

| Week Change: -2.02% Year-to-date Change: 4.7% | |

| CIG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CIG to Watchlist:  View: View:  Get Complete CIG Trend Analysis ➞ Get Complete CIG Trend Analysis ➞ | |

| PAC Grupo Aeroportuario del Pacifico, S.A.B. de C.V. |

| Sector: Transports | |

| SubSector: Air Services, Other | |

| MarketCap: 3204.18 Millions | |

| Recent Price: 183.47 Market Intelligence Score: 100 | |

| Day Percent Change: 1.94% Day Change: 3.50 | |

| Week Change: 17.5% Year-to-date Change: 4.7% | |

| PAC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAC to Watchlist:  View: View:  Get Complete PAC Trend Analysis ➞ Get Complete PAC Trend Analysis ➞ | |

| OMAB Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. |

| Sector: Transports | |

| SubSector: Air Services, Other | |

| MarketCap: 1196.38 Millions | |

| Recent Price: 88.12 Market Intelligence Score: 100 | |

| Day Percent Change: 3.35% Day Change: 2.86 | |

| Week Change: 17.34% Year-to-date Change: 4.1% | |

| OMAB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OMAB to Watchlist:  View: View:  Get Complete OMAB Trend Analysis ➞ Get Complete OMAB Trend Analysis ➞ | |

| PBA Pembina Pipeline Corporation |

| Sector: Energy | |

| SubSector: Oil & Gas Pipelines | |

| MarketCap: 8813.35 Millions | |

| Recent Price: 35.82 Market Intelligence Score: 85 | |

| Day Percent Change: 0.31% Day Change: 0.11 | |

| Week Change: 2.69% Year-to-date Change: 4.1% | |

| PBA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PBA to Watchlist:  View: View:  Get Complete PBA Trend Analysis ➞ Get Complete PBA Trend Analysis ➞ | |

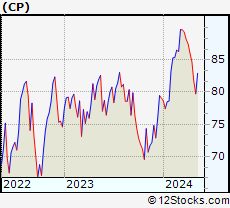

| CP Canadian Pacific Railway Limited |

| Sector: Transports | |

| SubSector: Railroads | |

| MarketCap: 25428.5 Millions | |

| Recent Price: 81.68 Market Intelligence Score: 26 | |

| Day Percent Change: -0.50% Day Change: -0.41 | |

| Week Change: -3.54% Year-to-date Change: 3.3% | |

| CP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CP to Watchlist:  View: View:  Get Complete CP Trend Analysis ➞ Get Complete CP Trend Analysis ➞ | |

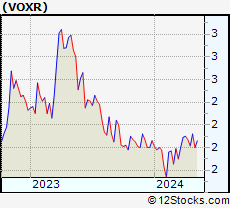

| VOXR Vox Royalty Corp. |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 154 Millions | |

| Recent Price: 2.12 Market Intelligence Score: 75 | |

| Day Percent Change: 2.91% Day Change: 0.06 | |

| Week Change: 5.21% Year-to-date Change: 2.9% | |

| VOXR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VOXR to Watchlist:  View: View:  Get Complete VOXR Trend Analysis ➞ Get Complete VOXR Trend Analysis ➞ | |

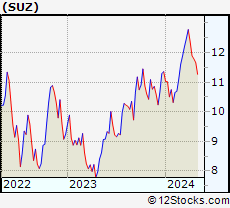

| SUZ Suzano S.A. |

| Sector: Consumer Staples | |

| SubSector: Paper & Paper Products | |

| MarketCap: 7042.93 Millions | |

| Recent Price: 11.67 Market Intelligence Score: 43 | |

| Day Percent Change: 0.52% Day Change: 0.06 | |

| Week Change: -1.02% Year-to-date Change: 2.7% | |

| SUZ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SUZ to Watchlist:  View: View:  Get Complete SUZ Trend Analysis ➞ Get Complete SUZ Trend Analysis ➞ | |

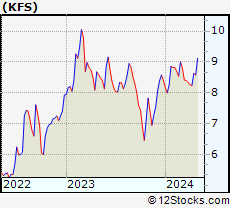

| KFS Kingsway Financial Services Inc. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 47.5812 Millions | |

| Recent Price: 8.58 Market Intelligence Score: 42 | |

| Day Percent Change: 0.59% Day Change: 0.05 | |

| Week Change: -0.58% Year-to-date Change: 2.1% | |

| KFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KFS to Watchlist:  View: View:  Get Complete KFS Trend Analysis ➞ Get Complete KFS Trend Analysis ➞ | |

| STN Stantec Inc. |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 2855.92 Millions | |

| Recent Price: 81.84 Market Intelligence Score: 75 | |

| Day Percent Change: 0.42% Day Change: 0.34 | |

| Week Change: 3.7% Year-to-date Change: 2.1% | |

| STN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add STN to Watchlist:  View: View:  Get Complete STN Trend Analysis ➞ Get Complete STN Trend Analysis ➞ | |

| MEOH Methanex Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 894.357 Millions | |

| Recent Price: 48.27 Market Intelligence Score: 78 | |

| Day Percent Change: 1.05% Day Change: 0.50 | |

| Week Change: 0.75% Year-to-date Change: 1.9% | |

| MEOH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MEOH to Watchlist:  View: View:  Get Complete MEOH Trend Analysis ➞ Get Complete MEOH Trend Analysis ➞ | |

| PAGS PagSeguro Digital Ltd. |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 6500.78 Millions | |

| Recent Price: 12.68 Market Intelligence Score: 17 | |

| Day Percent Change: 7.28% Day Change: 0.86 | |

| Week Change: 10.45% Year-to-date Change: 1.7% | |

| PAGS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAGS to Watchlist:  View: View:  Get Complete PAGS Trend Analysis ➞ Get Complete PAGS Trend Analysis ➞ | |

| AMX America Movil, S.A.B. de C.V. |

| Sector: Technology | |

| SubSector: Wireless Communications | |

| MarketCap: 44726.6 Millions | |

| Recent Price: 18.83 Market Intelligence Score: 100 | |

| Day Percent Change: 2.90% Day Change: 0.53 | |

| Week Change: 3.12% Year-to-date Change: 1.7% | |

| AMX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMX to Watchlist:  View: View:  Get Complete AMX Trend Analysis ➞ Get Complete AMX Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Latin America Stocks With Best Up Trends [0-bearish to 100-bullish]: Hudbay Minerals[100], Grupo Aeroportuario[100], America Movil[100], McEwen Mining[100], BRF S.A[100], SunOpta [100], Grupo Aeroportuario[100], Grupo Aeroportuario[100], Triple Flag[100], Coca-Cola FEMSA[100], Agnico Eagle[100]

Best Latin America Stocks Year-to-Date:

Aurora Cannabis[1306.97%], Fusion [123.33%], Banco Macro[79.02%], Grupo Financiero[77.82%], Canopy Growth[74.36%], Banco BBVA[70.04%], McEwen Mining[70.04%], D-Wave Quantum[61.84%], Hudbay Minerals[56.34%], IAMGOLD [49.41%], Grupo Supervielle[48.52%] Best Latin America Stocks This Week:

Grupo Aeroportuario[17.5%], Grupo Aeroportuario[17.34%], Grupo Aeroportuario[14.97%], Grupo Televisa[12.46%], SunOpta [12.25%], Canopy Growth[12.22%], Afya [12.13%], Telecom Argentina[11.28%], Hudbay Minerals[10.78%], Controladora Vuela[10.51%], PagSeguro Digital[10.45%] Best Latin America Stocks Daily:

Ivanhoe Electric[11.83%], PagSeguro Digital[7.28%], Hudbay Minerals[6.28%], Grupo Televisa[6.04%], Azul S.A[5.58%], Equinox Gold[5.33%], Ballard Power[5.26%], StoneCo [5.14%], Grupo Supervielle[4.87%], Telecom Argentina[4.86%], Banco Macro[4.69%]

Aurora Cannabis[1306.97%], Fusion [123.33%], Banco Macro[79.02%], Grupo Financiero[77.82%], Canopy Growth[74.36%], Banco BBVA[70.04%], McEwen Mining[70.04%], D-Wave Quantum[61.84%], Hudbay Minerals[56.34%], IAMGOLD [49.41%], Grupo Supervielle[48.52%] Best Latin America Stocks This Week:

Grupo Aeroportuario[17.5%], Grupo Aeroportuario[17.34%], Grupo Aeroportuario[14.97%], Grupo Televisa[12.46%], SunOpta [12.25%], Canopy Growth[12.22%], Afya [12.13%], Telecom Argentina[11.28%], Hudbay Minerals[10.78%], Controladora Vuela[10.51%], PagSeguro Digital[10.45%] Best Latin America Stocks Daily:

Ivanhoe Electric[11.83%], PagSeguro Digital[7.28%], Hudbay Minerals[6.28%], Grupo Televisa[6.04%], Azul S.A[5.58%], Equinox Gold[5.33%], Ballard Power[5.26%], StoneCo [5.14%], Grupo Supervielle[4.87%], Telecom Argentina[4.86%], Banco Macro[4.69%]

Login Sign Up

Login Sign Up