Best Financial Stocks

| In a hurry? Financial Stocks Lists: Performance Trends Table, Stock Charts

Sort Financial stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Financial stocks list by size:All Financial Large Mid-Range Small & MicroCap |

| 12Stocks.com Financial Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 78 (0-bearish to 100-bullish) which puts Financial sector in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 46 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Financial stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Financial sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Financial sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Financial Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| AGM | Federal Agricultural |   | Credit Services | 174.67 | 25 | -0.54% | -0.62% |

| EOD | Wells Fargo |   | Closed-End Fund - Equity | 4.81 | 69 | 0.63% | -0.62% |

| FBNC | First Bancorp |   | Regional Banks | 31.55 | 35 | 0.16% | -0.63% |

| BHLB | Berkshire Hills |   | S&L | 22.23 | 68 | 1.60% | -0.63% |

| FCFS | FirstCash |   | Credit Services | 117.92 | 66 | 0.61% | -0.64% |

| FPI | Farmland Partners |   | REIT - | 10.86 | 35 | 1.69% | -0.64% |

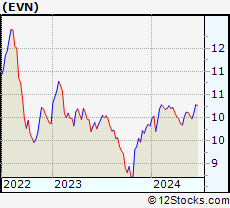

| EVN | Eaton Vance |   | Closed-End Fund - Debt | 9.97 | 30 | 0.55% | -0.65% |

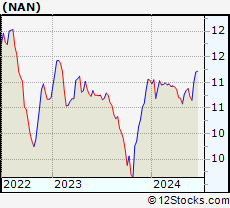

| NAN | Nuveen New |   | Closed-End Fund - Debt | 10.65 | 30 | 0.76% | -0.65% |

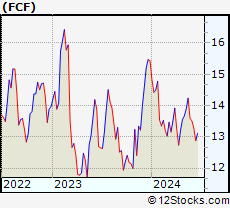

| FCF | First Commonwealth |   | Regional Banks | 13.51 | 61 | 0.97% | -0.66% |

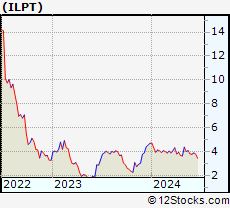

| ILPT | Industrial Logistics |   | REIT - Industrial | 3.77 | 32 | -2.33% | -0.66% |

| MHI | Pioneer Municipal |   | Closed-End Fund - Debt | 8.89 | 71 | 0.45% | -0.67% |

| WPC | W. P. |   | REIT - | 56.40 | 48 | 0.57% | -0.67% |

| HONE | HarborOne Bancorp |   | S&L | 10.41 | 68 | 0.77% | -0.67% |

| HEQ | John Hancock |   | Closed-End Fund - Equity | 10.42 | 78 | 0.39% | -0.67% |

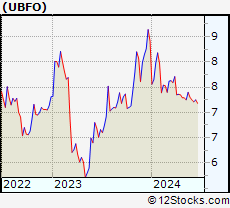

| UBFO | United Security |   | Regional Banks | 7.25 | 42 | 0.00% | -0.68% |

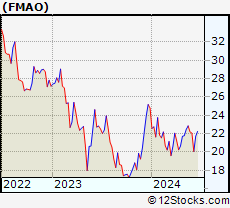

| FMAO | Farmers & Merchants Bancorp |   | Regional Banks | 22.06 | 61 | 2.41% | -0.68% |

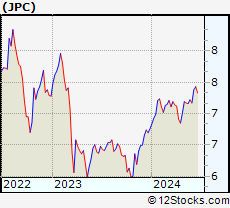

| JPC | Nuveen Preferred |   | Closed-End Fund - Debt | 7.17 | 58 | 0.28% | -0.69% |

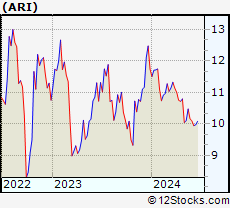

| ARI | Apollo Commercial |   | Mortgage | 10.10 | 57 | 1.71% | -0.69% |

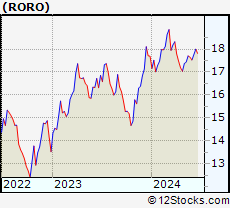

| RORO | ATAC US |   | Exchange Traded Fund | 17.53 | 50 | 1.08% | -0.69% |

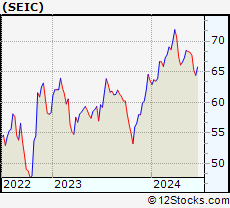

| SEIC | SEI s |   | Asset Mgmt | 67.71 | 53 | 1.10% | -0.70% |

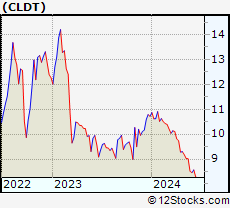

| CLDT | Chatham Lodging |   | REIT | 8.46 | 25 | 0.83% | -0.70% |

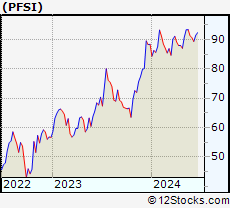

| PFSI | PennyMac |   | Mortgage | 90.65 | 44 | 0.13% | -0.70% |

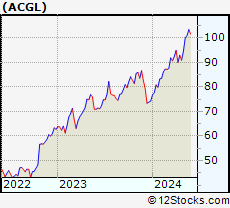

| ACGL | Arch Capital |   | Insurance | 102.63 | 83 | 1.20% | -0.71% |

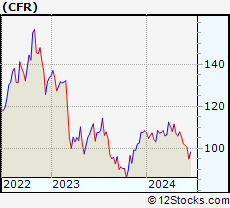

| CFR | Cullen/Frost Bankers |   | Regional - Southwest Banks | 101.58 | 25 | 0.03% | -0.71% |

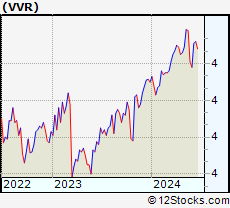

| VVR | Invesco Senior |   | Closed-End Fund - Debt | 4.18 | 30 | 1.21% | -0.71% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Financial Stocks |

| Financial Technical Overview, Leaders & Laggards, Top Financial ETF Funds & Detailed Financial Stocks List, Charts, Trends & More |

| Financial Sector: Technical Analysis, Trends & YTD Performance | |

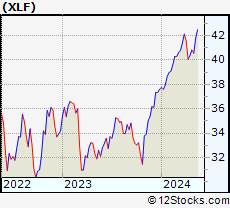

| Financial sector is composed of stocks

from banks, brokers, insurance, REITs

and services subsectors. Financial sector, as represented by XLF, an exchange-traded fund [ETF] that holds basket of Financial stocks (e.g, Bank of America, Goldman Sachs) is up by 10.74% and is currently outperforming the overall market by 0.95% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Good | |

XLF Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 78 | |

| YTD Performance: 10.74% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Financial Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Financial sector stocks year to date are

Now, more recently, over last week, the top performing Financial sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Financial Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Financial Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Financial Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLF | Financial |   | 41.64 | 78 | 1.46 | 0.07 | 10.74% |

| IAI | Broker-Dealers & Secs |   | 116.64 | 58 | 0.53 | -1.91 | 7.47% |

| IYF | Financials |   | 95.25 | 78 | 1.32 | 0.03 | 11.52% |

| IYG | Financial Services |   | 65.74 | 71 | 1.14 | -0.33 | 10.05% |

| KRE | Regional Banking |   | 48.85 | 61 | 1.41 | -0.14 | -6.83% |

| IXG | Global Financials |   | 87.05 | 76 | 0.80 | -0.54 | 10.77% |

| VFH | Financials |   | 101.01 | 78 | 1.28 | -0.12 | 9.48% |

| KBE | Bank |   | 46.23 | 68 | 1.34 | 0 | 0.46% |

| FAS | Financial Bull 3X |   | 105.34 | 78 | 4.16 | -0.02 | 27.45% |

| FAZ | Financial Bear 3X |   | 10.35 | 17 | -4.08 | -0.1 | -24.29% |

| UYG | Financials |   | 65.65 | 78 | 3.19 | -0.03 | 18.93% |

| IAT | Regional Banks |   | 41.90 | 68 | 1.87 | 0 | 0.14% |

| KIE | Insurance |   | 51.16 | 78 | 1.11 | 0.69 | 13.14% |

| PSCF | SmallCap Financials |   | 47.14 | 53 | 1.59 | -0.79 | -4.14% |

| EUFN | Europe Financials |   | 24.18 | 100 | 1.02 | 0.71 | 15.36% |

| PGF | Financial Preferred |   | 14.79 | 55 | 1.09 | 0.68 | 1.44% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Financial Stocks | |

|

We now take in-depth look at all Financial stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Financial stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

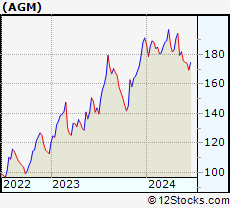

| AGM Federal Agricultural Mortgage Corporation |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 542.008 Millions | |

| Recent Price: 174.67 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.54% Day Change: -0.94 | |

| Week Change: -0.62% Year-to-date Change: -8.7% | |

| AGM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AGM to Watchlist:  View: View:  Get Complete AGM Trend Analysis ➞ Get Complete AGM Trend Analysis ➞ | |

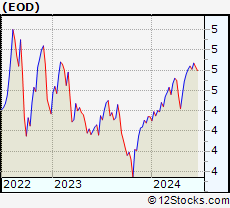

| EOD Wells Fargo Advantage Funds - Wells Fargo Global Dividend Opportunity Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Equity | |

| MarketCap: 144.747 Millions | |

| Recent Price: 4.81 Smart Investing & Trading Score: 69 | |

| Day Percent Change: 0.63% Day Change: 0.03 | |

| Week Change: -0.62% Year-to-date Change: 10.8% | |

| EOD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EOD to Watchlist:  View: View:  Get Complete EOD Trend Analysis ➞ Get Complete EOD Trend Analysis ➞ | |

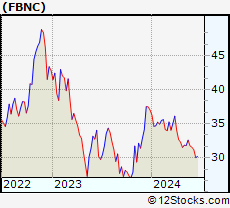

| FBNC First Bancorp |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 664.959 Millions | |

| Recent Price: 31.55 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 0.16% Day Change: 0.05 | |

| Week Change: -0.63% Year-to-date Change: -14.8% | |

| FBNC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FBNC to Watchlist:  View: View:  Get Complete FBNC Trend Analysis ➞ Get Complete FBNC Trend Analysis ➞ | |

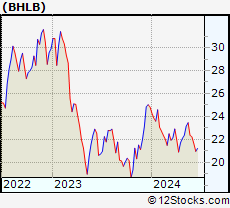

| BHLB Berkshire Hills Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 686.33 Millions | |

| Recent Price: 22.23 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 1.60% Day Change: 0.35 | |

| Week Change: -0.63% Year-to-date Change: -10.5% | |

| BHLB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BHLB to Watchlist:  View: View:  Get Complete BHLB Trend Analysis ➞ Get Complete BHLB Trend Analysis ➞ | |

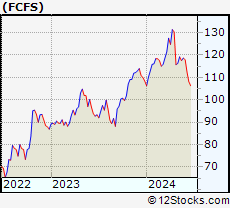

| FCFS FirstCash, Inc. |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 2795.48 Millions | |

| Recent Price: 117.92 Smart Investing & Trading Score: 66 | |

| Day Percent Change: 0.61% Day Change: 0.71 | |

| Week Change: -0.64% Year-to-date Change: 8.8% | |

| FCFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FCFS to Watchlist:  View: View:  Get Complete FCFS Trend Analysis ➞ Get Complete FCFS Trend Analysis ➞ | |

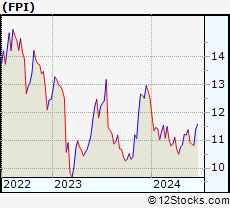

| FPI Farmland Partners Inc. |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 182.653 Millions | |

| Recent Price: 10.86 Smart Investing & Trading Score: 35 | |

| Day Percent Change: 1.69% Day Change: 0.18 | |

| Week Change: -0.64% Year-to-date Change: -13.0% | |

| FPI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FPI to Watchlist:  View: View:  Get Complete FPI Trend Analysis ➞ Get Complete FPI Trend Analysis ➞ | |

| EVN Eaton Vance Municipal Income Trust |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 430.707 Millions | |

| Recent Price: 9.97 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 0.55% Day Change: 0.05 | |

| Week Change: -0.65% Year-to-date Change: 1.6% | |

| EVN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EVN to Watchlist:  View: View:  Get Complete EVN Trend Analysis ➞ Get Complete EVN Trend Analysis ➞ | |

| NAN Nuveen New York Quality Municipal Income Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 352.307 Millions | |

| Recent Price: 10.65 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 0.76% Day Change: 0.08 | |

| Week Change: -0.65% Year-to-date Change: -3.5% | |

| NAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NAN to Watchlist:  View: View:  Get Complete NAN Trend Analysis ➞ Get Complete NAN Trend Analysis ➞ | |

| FCF First Commonwealth Financial Corporation |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 900.299 Millions | |

| Recent Price: 13.51 Smart Investing & Trading Score: 61 | |

| Day Percent Change: 0.97% Day Change: 0.13 | |

| Week Change: -0.66% Year-to-date Change: -12.5% | |

| FCF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FCF to Watchlist:  View: View:  Get Complete FCF Trend Analysis ➞ Get Complete FCF Trend Analysis ➞ | |

| ILPT Industrial Logistics Properties Trust |

| Sector: Financials | |

| SubSector: REIT - Industrial | |

| MarketCap: 988.549 Millions | |

| Recent Price: 3.77 Smart Investing & Trading Score: 32 | |

| Day Percent Change: -2.33% Day Change: -0.09 | |

| Week Change: -0.66% Year-to-date Change: -19.8% | |

| ILPT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ILPT to Watchlist:  View: View:  Get Complete ILPT Trend Analysis ➞ Get Complete ILPT Trend Analysis ➞ | |

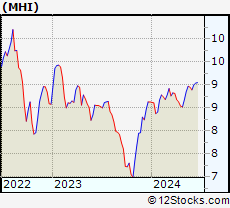

| MHI Pioneer Municipal High Income Trust |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 224.507 Millions | |

| Recent Price: 8.89 Smart Investing & Trading Score: 71 | |

| Day Percent Change: 0.45% Day Change: 0.04 | |

| Week Change: -0.67% Year-to-date Change: 3.0% | |

| MHI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MHI to Watchlist:  View: View:  Get Complete MHI Trend Analysis ➞ Get Complete MHI Trend Analysis ➞ | |

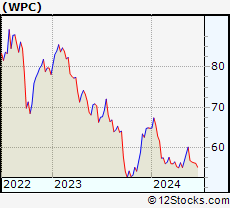

| WPC W. P. Carey Inc. |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 9560.03 Millions | |

| Recent Price: 56.40 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 0.57% Day Change: 0.32 | |

| Week Change: -0.67% Year-to-date Change: -13.0% | |

| WPC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WPC to Watchlist:  View: View:  Get Complete WPC Trend Analysis ➞ Get Complete WPC Trend Analysis ➞ | |

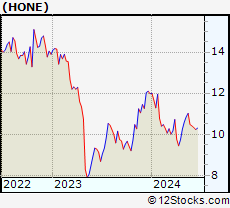

| HONE HarborOne Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Savings & Loans | |

| MarketCap: 456.03 Millions | |

| Recent Price: 10.41 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 0.77% Day Change: 0.08 | |

| Week Change: -0.67% Year-to-date Change: -13.1% | |

| HONE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HONE to Watchlist:  View: View:  Get Complete HONE Trend Analysis ➞ Get Complete HONE Trend Analysis ➞ | |

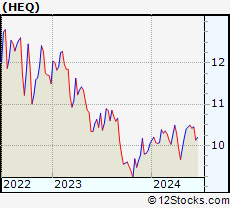

| HEQ John Hancock Hedged Equity & Income Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Equity | |

| MarketCap: 106.847 Millions | |

| Recent Price: 10.42 Smart Investing & Trading Score: 78 | |

| Day Percent Change: 0.39% Day Change: 0.04 | |

| Week Change: -0.67% Year-to-date Change: 3.7% | |

| HEQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HEQ to Watchlist:  View: View:  Get Complete HEQ Trend Analysis ➞ Get Complete HEQ Trend Analysis ➞ | |

| UBFO United Security Bancshares |

| Sector: Financials | |

| SubSector: Regional - Pacific Banks | |

| MarketCap: 135.029 Millions | |

| Recent Price: 7.25 Smart Investing & Trading Score: 42 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: -0.68% Year-to-date Change: -13.8% | |

| UBFO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UBFO to Watchlist:  View: View:  Get Complete UBFO Trend Analysis ➞ Get Complete UBFO Trend Analysis ➞ | |

| FMAO Farmers & Merchants Bancorp, Inc. |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 280.27 Millions | |

| Recent Price: 22.06 Smart Investing & Trading Score: 61 | |

| Day Percent Change: 2.41% Day Change: 0.52 | |

| Week Change: -0.68% Year-to-date Change: -11.1% | |

| FMAO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FMAO to Watchlist:  View: View:  Get Complete FMAO Trend Analysis ➞ Get Complete FMAO Trend Analysis ➞ | |

| JPC Nuveen Preferred & Income Opportunities Fund |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 621.007 Millions | |

| Recent Price: 7.17 Smart Investing & Trading Score: 58 | |

| Day Percent Change: 0.28% Day Change: 0.02 | |

| Week Change: -0.69% Year-to-date Change: 6.1% | |

| JPC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JPC to Watchlist:  View: View:  Get Complete JPC Trend Analysis ➞ Get Complete JPC Trend Analysis ➞ | |

| ARI Apollo Commercial Real Estate Finance, Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 1302.19 Millions | |

| Recent Price: 10.10 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 1.71% Day Change: 0.17 | |

| Week Change: -0.69% Year-to-date Change: -14.0% | |

| ARI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARI to Watchlist:  View: View:  Get Complete ARI Trend Analysis ➞ Get Complete ARI Trend Analysis ➞ | |

| RORO ATAC US Rotation ETF |

| Sector: Financials | |

| SubSector: Exchange Traded Fund | |

| MarketCap: 60157 Millions | |

| Recent Price: 17.53 Smart Investing & Trading Score: 50 | |

| Day Percent Change: 1.08% Day Change: 0.19 | |

| Week Change: -0.69% Year-to-date Change: -0.9% | |

| RORO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RORO to Watchlist:  View: View:  Get Complete RORO Trend Analysis ➞ Get Complete RORO Trend Analysis ➞ | |

| SEIC SEI Investments Company |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 6367.03 Millions | |

| Recent Price: 67.71 Smart Investing & Trading Score: 53 | |

| Day Percent Change: 1.10% Day Change: 0.74 | |

| Week Change: -0.7% Year-to-date Change: 6.6% | |

| SEIC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SEIC to Watchlist:  View: View:  Get Complete SEIC Trend Analysis ➞ Get Complete SEIC Trend Analysis ➞ | |

| CLDT Chatham Lodging Trust |

| Sector: Financials | |

| SubSector: REIT - Hotel/Motel | |

| MarketCap: 274.734 Millions | |

| Recent Price: 8.46 Smart Investing & Trading Score: 25 | |

| Day Percent Change: 0.83% Day Change: 0.07 | |

| Week Change: -0.7% Year-to-date Change: -21.1% | |

| CLDT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CLDT to Watchlist:  View: View:  Get Complete CLDT Trend Analysis ➞ Get Complete CLDT Trend Analysis ➞ | |

| PFSI PennyMac Financial Services, Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 1588.09 Millions | |

| Recent Price: 90.65 Smart Investing & Trading Score: 44 | |

| Day Percent Change: 0.13% Day Change: 0.12 | |

| Week Change: -0.7% Year-to-date Change: 2.6% | |

| PFSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PFSI to Watchlist:  View: View:  Get Complete PFSI Trend Analysis ➞ Get Complete PFSI Trend Analysis ➞ | |

| ACGL Arch Capital Group Ltd. |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 12350.9 Millions | |

| Recent Price: 102.63 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 1.20% Day Change: 1.22 | |

| Week Change: -0.71% Year-to-date Change: 38.2% | |

| ACGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ACGL to Watchlist:  View: View:  Get Complete ACGL Trend Analysis ➞ Get Complete ACGL Trend Analysis ➞ | |

| CFR Cullen/Frost Bankers, Inc. |

| Sector: Financials | |

| SubSector: Regional - Southwest Banks | |

| MarketCap: 3536.75 Millions | |

| Recent Price: 101.58 Smart Investing & Trading Score: 25 | |

| Day Percent Change: 0.03% Day Change: 0.03 | |

| Week Change: -0.71% Year-to-date Change: -6.4% | |

| CFR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CFR to Watchlist:  View: View:  Get Complete CFR Trend Analysis ➞ Get Complete CFR Trend Analysis ➞ | |

| VVR Invesco Senior Income Trust |

| Sector: Financials | |

| SubSector: Closed-End Fund - Debt | |

| MarketCap: 507.307 Millions | |

| Recent Price: 4.18 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 1.21% Day Change: 0.05 | |

| Week Change: -0.71% Year-to-date Change: 2.0% | |

| VVR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VVR to Watchlist:  View: View:  Get Complete VVR Trend Analysis ➞ Get Complete VVR Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Financial Stocks With Best Up Trends [0-bearish to 100-bullish]: X [100], Brighthouse [100], Central and[100], Northrim BanCorp[100], Bank of America[100], Hagerty [100], Urban Edge[100], Global Blockchain[100], Ventas [100], Omega Healthcare[100], LPL [100]

Best Financial Stocks Year-to-Date:

Root [385.58%], Chimera [138.48%], Banco Macro[130.98%], SelectQuote [127.74%], Gladstone Capital[109.35%], Grupo Financiero[107.65%], Banco BBVA[107.54%], EverQuote [95.18%], Hippo [93.63%], Grupo Supervielle[78.33%], Vista Oil[64.18%] Best Financial Stocks This Week:

C3.ai [23%], Investors Title[19.4%], Banco BBVA[14.74%], Riverview Bancorp[14.25%], Banco Macro[13.7%], IRSA Inversiones[12.15%], Grupo Supervielle[11.73%], Metals Acquisition[10.74%], Grupo Financiero[10.41%], Fathom [10.24%], Vista Oil[9.32%] Best Financial Stocks Daily:

Riverview Bancorp[15.75%], Allied World[14.88%], Medical Properties[7.20%], X [6.14%], Franklin Street[5.32%], Washington Federal[5.16%], Iris Energy[5.13%], Ameris Bancorp[4.80%], Brighthouse [4.79%], Auburn National[4.70%], Central and[4.63%]

Root [385.58%], Chimera [138.48%], Banco Macro[130.98%], SelectQuote [127.74%], Gladstone Capital[109.35%], Grupo Financiero[107.65%], Banco BBVA[107.54%], EverQuote [95.18%], Hippo [93.63%], Grupo Supervielle[78.33%], Vista Oil[64.18%] Best Financial Stocks This Week:

C3.ai [23%], Investors Title[19.4%], Banco BBVA[14.74%], Riverview Bancorp[14.25%], Banco Macro[13.7%], IRSA Inversiones[12.15%], Grupo Supervielle[11.73%], Metals Acquisition[10.74%], Grupo Financiero[10.41%], Fathom [10.24%], Vista Oil[9.32%] Best Financial Stocks Daily:

Riverview Bancorp[15.75%], Allied World[14.88%], Medical Properties[7.20%], X [6.14%], Franklin Street[5.32%], Washington Federal[5.16%], Iris Energy[5.13%], Ameris Bancorp[4.80%], Brighthouse [4.79%], Auburn National[4.70%], Central and[4.63%]

Login Sign Up

Login Sign Up