Best S&P 100 Stocks

| In a hurry? S&P 100 Stocks Lists: Performance Trends Table, Stock Charts

Sort S&P 100 stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. |

| 12Stocks.com S&P 100 Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 68 (0-bearish to 100-bullish) which puts S&P 100 index in short term neutral to bullish trend. The Smart Investing & Trading Score from previous trading session is 56 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested S&P 100 stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Top Performing S&P 100 Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing S&P 100 Index stocks year to date are

Now, more recently, over last week, the top performing S&P 100 Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in S&P 100 Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the S&P 100 Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in S&P 100 Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| CRM | salesforce.com |   | Technology | 234.44 | 7 | 7.54 | -10.91% |

| CVS | CVS Health |   | Health Care | 59.60 | 57 | 6.35 | -24.52% |

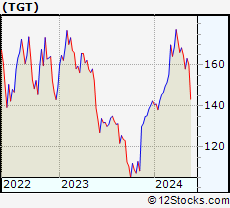

| TGT | Target |   | Services & Goods | 156.16 | 63 | 4.20 | 9.65% |

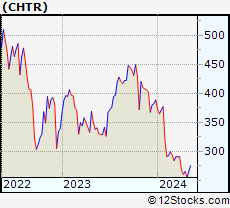

| CHTR | Charter |   | Technology | 287.12 | 74 | 3.99 | -26.13% |

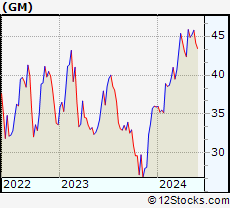

| GM | General Motors |   | Consumer Staples | 44.99 | 68 | 3.64 | 25.25% |

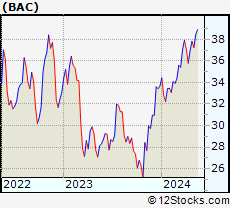

| BAC | Bank of America |   | Financials | 39.99 | 100 | 3.52 | 18.77% |

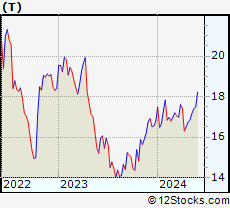

| T | AT&T |   | Technology | 18.22 | 100 | 3.41 | 8.58% |

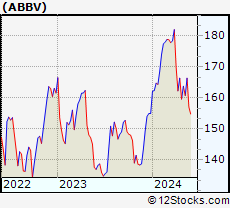

| ABBV | AbbVie |   | Health Care | 161.24 | 32 | 3.15 | 4.05% |

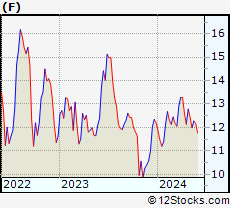

| F | Ford Motor |   | Consumer Staples | 12.13 | 32 | 3.06 | -0.49% |

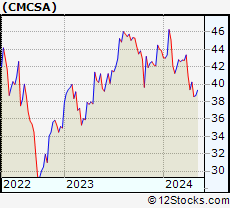

| CMCSA | Comcast |   | Services & Goods | 40.03 | 64 | 2.98 | -8.71% |

| USB | U.S. Bancorp |   | Financials | 40.55 | 32 | 2.97 | -6.31% |

| XOM | Exxon Mobil |   | Energy | 117.26 | 68 | 2.87 | 17.28% |

| UNH | UnitedHealth |   | Health Care | 495.37 | 48 | 2.85 | -5.91% |

| BA | Boeing |   | Industrials | 177.61 | 42 | 2.81 | -31.86% |

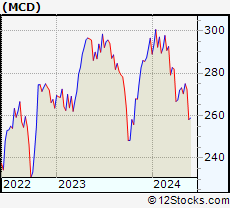

| MCD | McDonald s |   | Services & Goods | 258.89 | 32 | 2.71 | -12.69% |

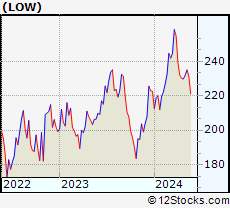

| LOW | Lowe s |   | Services & Goods | 221.29 | 32 | 2.71 | -0.57% |

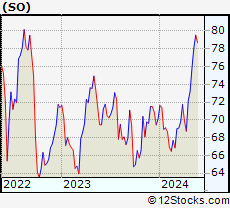

| SO | Southern |   | Utilities | 80.14 | 95 | 2.64 | 14.29% |

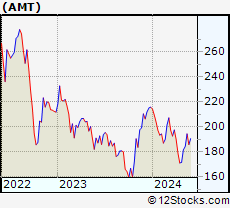

| AMT | American Tower |   | Financials | 195.74 | 74 | 2.60 | -9.33% |

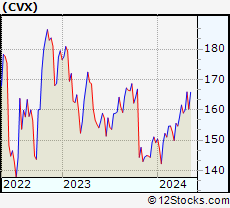

| CVX | Chevron |   | Energy | 162.30 | 68 | 2.55 | 8.81% |

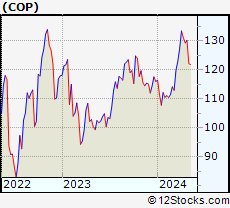

| COP | ConocoPhillips |   | Energy | 116.48 | 43 | 2.55 | 0.35% |

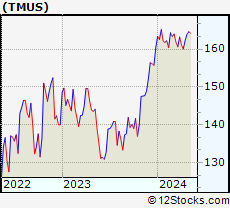

| TMUS | T-Mobile US |   | Technology | 174.96 | 100 | 2.50 | 9.12% |

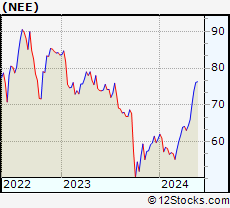

| NEE | NextEra Energy |   | Utilities | 80.02 | 100 | 2.34 | 31.74% |

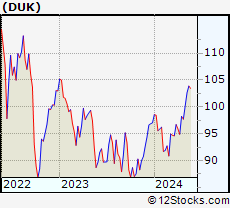

| DUK | Duke Energy |   | Utilities | 103.57 | 83 | 2.24 | 6.73% |

| EXC | Exelon |   | Utilities | 37.55 | 68 | 2.23 | 4.60% |

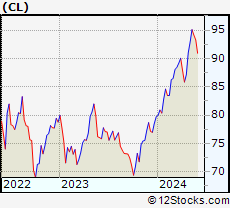

| CL | Colgate-Palmolive |   | Consumer Staples | 92.96 | 68 | 2.23 | 16.62% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of S&P 100 Stocks |

| S&P 100 Technical Overview, Leaders & Laggards, Top S&P 100 ETF Funds & Detailed S&P 100 Stocks List, Charts, Trends & More |

| S&P 100: Technical Analysis, Trends & YTD Performance | |

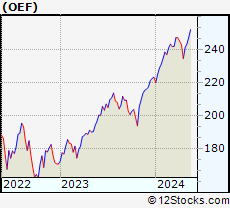

| S&P 100 index as represented by

OEF, an exchange-traded fund [ETF], holds basket of one hundred US (mostly largecap) stocks from across all major sectors of the US stock market. The S&P 100 index (contains stocks like Apple and Exxon) is up by 12.92% and is currently outperforming the overall market by 3.13% year-to-date. Below is a quick view of technical charts and trends: | |

OEF Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

OEF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 68 | |

| YTD Performance: 12.92% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in S&P 100 Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track S&P 100 index. We have also included ETF funds that track S&P 500 index since it is market-cap weighted. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of S&P 100 indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track S&P 100 Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| SPY | SPDR S&P 500 ETF |   | 527.37 | 76 | 0.91 | -0.39 | 10.95% |

| SPXS | Direxion Daily S&P 500 Bear 3X ETF |   | 8.72 | 32 | -2.46 | 1.4 | -24.5% |

| SH | ProShares Short S&P500 |   | 11.94 | 25 | -0.75 | 0.59 | -8.08% |

| SDS | ProShares UltraShort S&P500 |   | 24.91 | 32 | -1.70 | 1.01 | -16.74% |

| SPXU | ProShares UltraPro Short S&P500 |   | 32.21 | 32 | -2.54 | 1.51 | -25.09% |

| UPRO | ProShares UltraPro S&P500 |   | 70.17 | 68 | 2.63 | -1.46 | 28.19% |

| SPXL | Direxion Daily S&P500 Bull 3X ETF |   | 133.30 | 68 | 2.55 | -1.43 | 28.19% |

| VOO | Vanguard 500 ETF |   | 484.00 | 76 | 0.74 | -0.56 | 10.81% |

| SSO | ProShares Ultra S&P500 |   | 77.67 | 63 | 1.76 | -0.97 | 19.36% |

| OEF | iShares S&P 100 |   | 252.25 | 68 | 0.66 | -0.47 | 12.92% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of S&P 100 Stocks | |

|

We now take in-depth look at all S&P 100 stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort S&P 100 stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

| CRM salesforce.com, inc. |

| Sector: Technology | |

| SubSector: Application Software | |

| MarketCap: 137120 Millions | |

| Recent Price: 234.44 Smart Investing & Trading Score: 7 | |

| Day Percent Change: 7.54% Day Change: 16.43 | |

| Week Change: -13.9% Year-to-date Change: -10.9% | |

| CRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CRM to Watchlist:  View: View:  Get Complete CRM Trend Analysis ➞ Get Complete CRM Trend Analysis ➞ | |

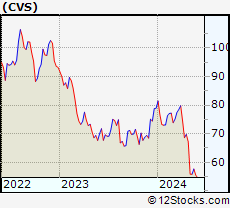

| CVS CVS Health Corporation |

| Sector: Health Care | |

| SubSector: Health Care Plans | |

| MarketCap: 80104.3 Millions | |

| Recent Price: 59.60 Smart Investing & Trading Score: 57 | |

| Day Percent Change: 6.35% Day Change: 3.56 | |

| Week Change: 7.31% Year-to-date Change: -24.5% | |

| CVS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVS to Watchlist:  View: View:  Get Complete CVS Trend Analysis ➞ Get Complete CVS Trend Analysis ➞ | |

| TGT Target Corporation |

| Sector: Services & Goods | |

| SubSector: Discount, Variety Stores | |

| MarketCap: 55980.6 Millions | |

| Recent Price: 156.16 Smart Investing & Trading Score: 63 | |

| Day Percent Change: 4.20% Day Change: 6.29 | |

| Week Change: 7.53% Year-to-date Change: 9.7% | |

| TGT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TGT to Watchlist:  View: View:  Get Complete TGT Trend Analysis ➞ Get Complete TGT Trend Analysis ➞ | |

| CHTR Charter Communications, Inc. |

| Sector: Technology | |

| SubSector: CATV Systems | |

| MarketCap: 82268.3 Millions | |

| Recent Price: 287.12 Smart Investing & Trading Score: 74 | |

| Day Percent Change: 3.99% Day Change: 11.01 | |

| Week Change: 5.77% Year-to-date Change: -26.1% | |

| CHTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CHTR to Watchlist:  View: View:  Get Complete CHTR Trend Analysis ➞ Get Complete CHTR Trend Analysis ➞ | |

| GM General Motors Company |

| Sector: Consumer Staples | |

| SubSector: Auto Manufacturers - Major | |

| MarketCap: 29252.4 Millions | |

| Recent Price: 44.99 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 3.64% Day Change: 1.58 | |

| Week Change: 2% Year-to-date Change: 25.3% | |

| GM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GM to Watchlist:  View: View:  Get Complete GM Trend Analysis ➞ Get Complete GM Trend Analysis ➞ | |

| BAC Bank of America Corporation |

| Sector: Financials | |

| SubSector: Money Center Banks | |

| MarketCap: 189690 Millions | |

| Recent Price: 39.99 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 3.52% Day Change: 1.36 | |

| Week Change: 0.73% Year-to-date Change: 18.8% | |

| BAC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BAC to Watchlist:  View: View:  Get Complete BAC Trend Analysis ➞ Get Complete BAC Trend Analysis ➞ | |

| T AT&T Inc. |

| Sector: Technology | |

| SubSector: Telecom Services - Domestic | |

| MarketCap: 224847 Millions | |

| Recent Price: 18.22 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 3.41% Day Change: 0.60 | |

| Week Change: 4.11% Year-to-date Change: 8.6% | |

| T Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add T to Watchlist:  View: View:  Get Complete T Trend Analysis ➞ Get Complete T Trend Analysis ➞ | |

| ABBV AbbVie Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Major | |

| MarketCap: 110080 Millions | |

| Recent Price: 161.24 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 3.15% Day Change: 4.93 | |

| Week Change: 2.66% Year-to-date Change: 4.1% | |

| ABBV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ABBV to Watchlist:  View: View:  Get Complete ABBV Trend Analysis ➞ Get Complete ABBV Trend Analysis ➞ | |

| F Ford Motor Company |

| Sector: Consumer Staples | |

| SubSector: Auto Manufacturers - Major | |

| MarketCap: 19052.1 Millions | |

| Recent Price: 12.13 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 3.06% Day Change: 0.36 | |

| Week Change: -0.25% Year-to-date Change: -0.5% | |

| F Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add F to Watchlist:  View: View:  Get Complete F Trend Analysis ➞ Get Complete F Trend Analysis ➞ | |

| CMCSA Comcast Corporation |

| Sector: Services & Goods | |

| SubSector: Entertainment - Diversified | |

| MarketCap: 164849 Millions | |

| Recent Price: 40.03 Smart Investing & Trading Score: 64 | |

| Day Percent Change: 2.98% Day Change: 1.16 | |

| Week Change: 3.87% Year-to-date Change: -8.7% | |

| CMCSA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CMCSA to Watchlist:  View: View:  Get Complete CMCSA Trend Analysis ➞ Get Complete CMCSA Trend Analysis ➞ | |

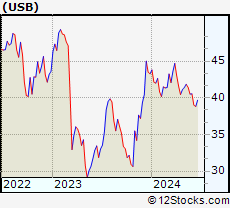

| USB U.S. Bancorp |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 56757.8 Millions | |

| Recent Price: 40.55 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 2.97% Day Change: 1.17 | |

| Week Change: 0.05% Year-to-date Change: -6.3% | |

| USB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add USB to Watchlist:  View: View:  Get Complete USB Trend Analysis ➞ Get Complete USB Trend Analysis ➞ | |

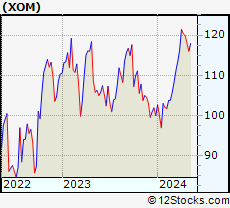

| XOM Exxon Mobil Corporation |

| Sector: Energy | |

| SubSector: Major Integrated Oil & Gas | |

| MarketCap: 156450 Millions | |

| Recent Price: 117.26 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 2.87% Day Change: 3.27 | |

| Week Change: 3.39% Year-to-date Change: 17.3% | |

| XOM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XOM to Watchlist:  View: View:  Get Complete XOM Trend Analysis ➞ Get Complete XOM Trend Analysis ➞ | |

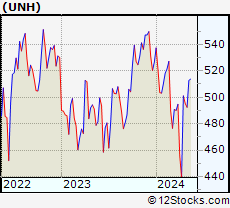

| UNH UnitedHealth Group Incorporated |

| Sector: Health Care | |

| SubSector: Health Care Plans | |

| MarketCap: 217384 Millions | |

| Recent Price: 495.37 Smart Investing & Trading Score: 48 | |

| Day Percent Change: 2.85% Day Change: 13.72 | |

| Week Change: -2.52% Year-to-date Change: -5.9% | |

| UNH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UNH to Watchlist:  View: View:  Get Complete UNH Trend Analysis ➞ Get Complete UNH Trend Analysis ➞ | |

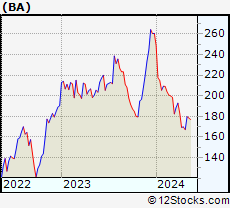

| BA The Boeing Company |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 65336.4 Millions | |

| Recent Price: 177.61 Smart Investing & Trading Score: 42 | |

| Day Percent Change: 2.81% Day Change: 4.86 | |

| Week Change: 1.77% Year-to-date Change: -31.9% | |

| BA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BA to Watchlist:  View: View:  Get Complete BA Trend Analysis ➞ Get Complete BA Trend Analysis ➞ | |

| MCD McDonald s Corporation |

| Sector: Services & Goods | |

| SubSector: Restaurants | |

| MarketCap: 122481 Millions | |

| Recent Price: 258.89 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 2.71% Day Change: 6.82 | |

| Week Change: 0.3% Year-to-date Change: -12.7% | |

| MCD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MCD to Watchlist:  View: View:  Get Complete MCD Trend Analysis ➞ Get Complete MCD Trend Analysis ➞ | |

| LOW Lowe s Companies, Inc. |

| Sector: Services & Goods | |

| SubSector: Home Improvement Stores | |

| MarketCap: 56084.2 Millions | |

| Recent Price: 221.29 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 2.71% Day Change: 5.83 | |

| Week Change: 2.83% Year-to-date Change: -0.6% | |

| LOW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LOW to Watchlist:  View: View:  Get Complete LOW Trend Analysis ➞ Get Complete LOW Trend Analysis ➞ | |

| SO The Southern Company |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 54483.6 Millions | |

| Recent Price: 80.14 Smart Investing & Trading Score: 95 | |

| Day Percent Change: 2.64% Day Change: 2.06 | |

| Week Change: 3.07% Year-to-date Change: 14.3% | |

| SO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SO to Watchlist:  View: View:  Get Complete SO Trend Analysis ➞ Get Complete SO Trend Analysis ➞ | |

| AMT American Tower Corporation (REIT) |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 92527 Millions | |

| Recent Price: 195.74 Smart Investing & Trading Score: 74 | |

| Day Percent Change: 2.60% Day Change: 4.96 | |

| Week Change: 5.28% Year-to-date Change: -9.3% | |

| AMT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMT to Watchlist:  View: View:  Get Complete AMT Trend Analysis ➞ Get Complete AMT Trend Analysis ➞ | |

| CVX Chevron Corporation |

| Sector: Energy | |

| SubSector: Major Integrated Oil & Gas | |

| MarketCap: 121521 Millions | |

| Recent Price: 162.30 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 2.55% Day Change: 4.04 | |

| Week Change: 2.88% Year-to-date Change: 8.8% | |

| CVX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVX to Watchlist:  View: View:  Get Complete CVX Trend Analysis ➞ Get Complete CVX Trend Analysis ➞ | |

| COP ConocoPhillips |

| Sector: Energy | |

| SubSector: Independent Oil & Gas | |

| MarketCap: 33504.3 Millions | |

| Recent Price: 116.48 Smart Investing & Trading Score: 43 | |

| Day Percent Change: 2.55% Day Change: 2.90 | |

| Week Change: -0.66% Year-to-date Change: 0.4% | |

| COP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add COP to Watchlist:  View: View:  Get Complete COP Trend Analysis ➞ Get Complete COP Trend Analysis ➞ | |

| TMUS T-Mobile US, Inc. |

| Sector: Technology | |

| SubSector: Wireless Communications | |

| MarketCap: 71949 Millions | |

| Recent Price: 174.96 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.50% Day Change: 4.26 | |

| Week Change: 5.4% Year-to-date Change: 9.1% | |

| TMUS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TMUS to Watchlist:  View: View:  Get Complete TMUS Trend Analysis ➞ Get Complete TMUS Trend Analysis ➞ | |

| NEE NextEra Energy, Inc. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 108288 Millions | |

| Recent Price: 80.02 Smart Investing & Trading Score: 100 | |

| Day Percent Change: 2.34% Day Change: 1.83 | |

| Week Change: 4.45% Year-to-date Change: 31.7% | |

| NEE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NEE to Watchlist:  View: View:  Get Complete NEE Trend Analysis ➞ Get Complete NEE Trend Analysis ➞ | |

| DUK Duke Energy Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 56678.2 Millions | |

| Recent Price: 103.57 Smart Investing & Trading Score: 83 | |

| Day Percent Change: 2.24% Day Change: 2.27 | |

| Week Change: 1.37% Year-to-date Change: 6.7% | |

| DUK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DUK to Watchlist:  View: View:  Get Complete DUK Trend Analysis ➞ Get Complete DUK Trend Analysis ➞ | |

| EXC Exelon Corporation |

| Sector: Utilities | |

| SubSector: Diversified Utilities | |

| MarketCap: 34091.9 Millions | |

| Recent Price: 37.55 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 2.23% Day Change: 0.82 | |

| Week Change: 2.34% Year-to-date Change: 4.6% | |

| EXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EXC to Watchlist:  View: View:  Get Complete EXC Trend Analysis ➞ Get Complete EXC Trend Analysis ➞ | |

| CL Colgate-Palmolive Company |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 57242.7 Millions | |

| Recent Price: 92.96 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 2.23% Day Change: 2.03 | |

| Week Change: -0.36% Year-to-date Change: 16.6% | |

| CL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CL to Watchlist:  View: View:  Get Complete CL Trend Analysis ➞ Get Complete CL Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

S&P 100 Stocks With Best Up Trends [0-bearish to 100-bullish]: Bank of America[100], AT&T [100], T-Mobile US[100], NextEra Energy[100], Philip Morris[100], Southern [95], Verizon [95], Bank of New York[93], Altria [93], Pfizer [93], Lockheed Martin[90]

Best S&P 100 Stocks Year-to-Date:

NVIDIA [121.38%], QUALCOMM [41.08%], Eli Lilly[40.73%], Meta Platforms[31.87%], Netflix [31.78%], NextEra Energy[31.74%], General Electric[29.39%], American Express[28.11%], General Motors[25.25%], Walmart [25.14%], Google [23.49%] Best S&P 100 Stocks This Week:

Target [7.53%], CVS Health[7.31%], Charter [5.77%], T-Mobile US[5.4%], American Tower[5.28%], NextEra Energy[4.45%], AT&T [4.11%], Comcast [3.87%], NIKE [3.6%], Verizon [3.55%], Exxon Mobil[3.39%] Best S&P 100 Stocks Daily:

salesforce.com [7.54%], CVS Health[6.35%], Target [4.20%], Charter [3.99%], General Motors[3.64%], Bank of America[3.52%], AT&T [3.41%], AbbVie [3.15%], Ford Motor[3.06%], Comcast [2.98%], U.S. Bancorp[2.97%]

NVIDIA [121.38%], QUALCOMM [41.08%], Eli Lilly[40.73%], Meta Platforms[31.87%], Netflix [31.78%], NextEra Energy[31.74%], General Electric[29.39%], American Express[28.11%], General Motors[25.25%], Walmart [25.14%], Google [23.49%] Best S&P 100 Stocks This Week:

Target [7.53%], CVS Health[7.31%], Charter [5.77%], T-Mobile US[5.4%], American Tower[5.28%], NextEra Energy[4.45%], AT&T [4.11%], Comcast [3.87%], NIKE [3.6%], Verizon [3.55%], Exxon Mobil[3.39%] Best S&P 100 Stocks Daily:

salesforce.com [7.54%], CVS Health[6.35%], Target [4.20%], Charter [3.99%], General Motors[3.64%], Bank of America[3.52%], AT&T [3.41%], AbbVie [3.15%], Ford Motor[3.06%], Comcast [2.98%], U.S. Bancorp[2.97%]

Login Sign Up

Login Sign Up