Stocks with best trends & most momentum Starts at just $9.99/Mo Subscribe ➞

| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks |

|

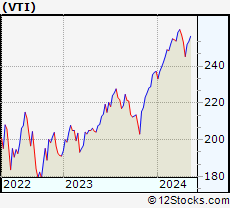

Best Dividend Stocks & ETFs

|

|

| Related Dividend Sector Pages: Technology, Nasdaq 100 & Web/Internet Stocks |

| ||||||||||||||||||

| Quick Read: Best Dividend Stocks List By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | ||||||||||||||||||

| Best Dividend Stocks Views: Quick Browse View, Summary View and Slide Show View | ||||||||||||||||||

| ||||||||||||||||||

| Dividend Index in Brief | ||||||||||||||||||

| Year-to-date Dividend is underperforming market by -3.29%. | ||||||||||||||||||

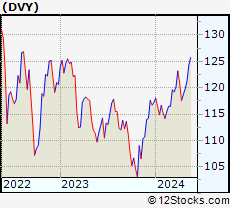

| Market Trend Chart View | ||||||||||||||||||

|

||||||||||||||||||

| Year To Date Performance: 7.28 % | ||||||||||||||||||

| Weekly Performance: 1.22 % | ||||||||||||||||||

| Daily Performance: 0.12 % | ||||||||||||||||||

| 12Stocks.com Short Term Trend Analysis for DVY | ||||||||||||||||||

| 83 | ||||||||||||||||||

| The current technical trend score is 83 in a scale where 0 is bearish and 100 is bullish. The trend score in the session before was 83. Trend score updated daily. Not to be used for investing. | ||||||||||||||||||

| 12Stocks.com: Investing in Dividend Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Dividend Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Dividend Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| IFF | International Flavors & Fragrances Inc. |   | Specialty Chemicals | 99.69 | 95 | 1.90 | 23.12% |

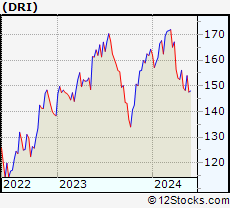

| DRI | Darden Restaurants, Inc. |   | Restaurants | 154.00 | 49 | 1.70 | -6.27% |

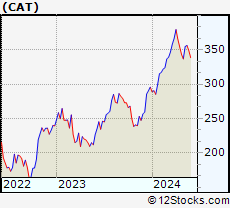

| CAT | Caterpillar Inc. |   | Farm & Construction Machinery | 356.27 | 66 | 1.58 | 20.50% |

| WSO | Watsco, Inc. |   | Electronics Wholesale | 477.62 | 68 | 1.51 | 11.47% |

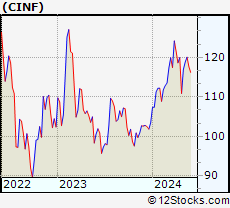

| CINF | Cincinnati Financial Corporation |   | Property & Casualty Insurance | 120.06 | 100 | 1.30 | 16.04% |

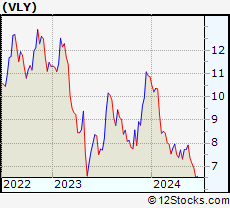

| VLY | Valley National Bancorp |   | Regional - Northeast Banks | 7.92 | 42 | 1.28 | -27.07% |

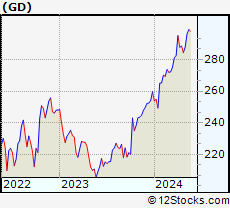

| GD | General Dynamics Corporation |   | Aerospace/Defense Products & Services | 299.02 | 100 | 1.11 | 15.15% |

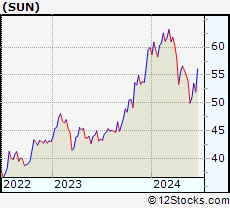

| SUN | Sunoco LP |   | Oil & Gas Refining & Marketing | 53.82 | 28 | 1.07 | -10.20% |

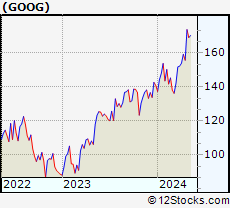

| GOOG | Alphabet Inc. |   | Internet Information Providers | 177.29 | 100 | 1.06 | 25.80% |

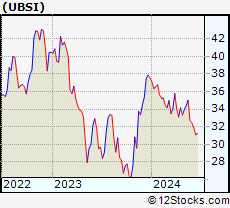

| UBSI | United Bankshares, Inc. |   | Regional - Mid-Atlantic Banks | 35.02 | 100 | 1.01 | -6.74% |

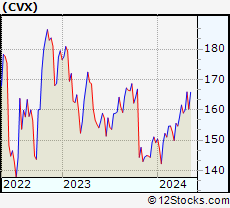

| CVX | Chevron Corporation |   | Major Integrated Oil & Gas | 162.67 | 51 | 0.98 | 9.06% |

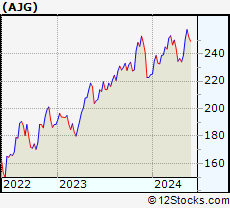

| AJG | Arthur J. Gallagher & Co. |   | Insurance Brokers | 257.67 | 95 | 0.84 | 14.58% |

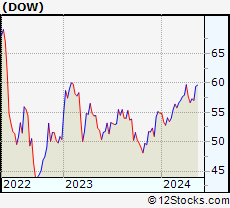

| DOW | Dow Inc. |   | Chemicals - Major Diversified | 59.19 | 68 | 0.83 | 7.93% |

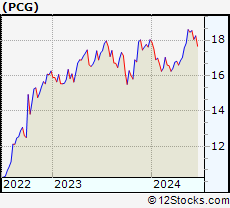

| PCG | PG&E Corporation |   | Electric Utilities | 18.60 | 100 | 0.81 | 3.16% |

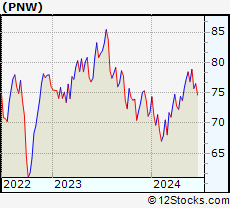

| PNW | Pinnacle West Capital Corporation |   | Electric Utilities | 78.44 | 100 | 0.80 | 9.19% |

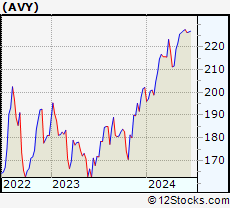

| AVY | Avery Dennison Corporation |   | Business Equipment | 226.30 | 76 | 0.77 | 11.94% |

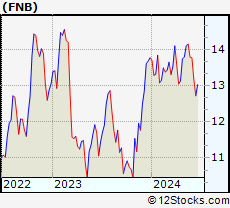

| FNB | F.N.B. Corporation |   | Regional - Southeast Banks | 14.15 | 76 | 0.71 | 2.76% |

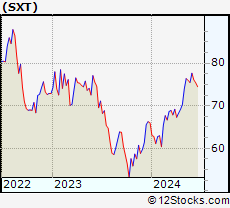

| SXT | Sensient Technologies Corporation |   | Specialty Chemicals | 75.98 | 85 | 0.64 | 15.12% |

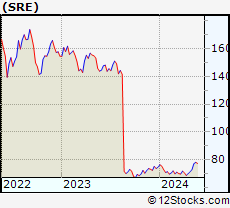

| SRE | Sempra Energy |   | Diversified Utilities | 78.17 | 83 | 0.64 | 4.60% |

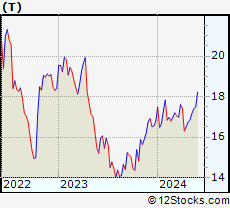

| T | AT&T Inc. |   | Telecom Services - Domestic | 17.40 | 83 | 0.58 | 3.69% |

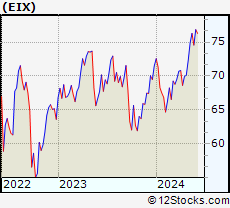

| EIX | Edison International |   | Electric Utilities | 76.30 | 95 | 0.58 | 6.73% |

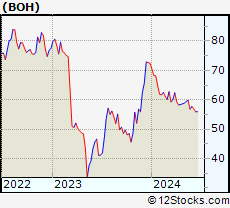

| BOH | Bank of Hawaii Corporation |   | Regional - Pacific Banks | 59.82 | 52 | 0.50 | -17.44% |

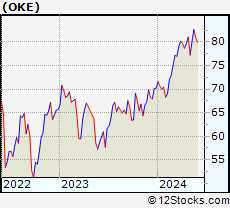

| OKE | ONEOK, Inc. |   | Gas Utilities | 82.63 | 100 | 0.47 | 17.67% |

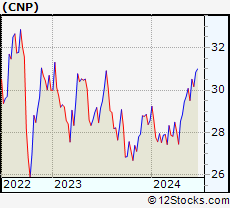

| CNP | CenterPoint Energy, Inc. |   | Gas Utilities | 30.08 | 100 | 0.47 | 5.29% |

| SON | Sonoco Products Company |   | Packaging & Containers | 60.28 | 83 | 0.43 | 7.89% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Dividend Stocks |

| Dividend Technical Overview, Leaders & Laggards, Top Dividend ETF Funds & Detailed Dividend Stocks List, Charts, Trends & More |

| Dividend: Technical Analysis, Trends & YTD Performance | |

DVY Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

DVY Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 83 | |

| YTD Performance: 7.28% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Dividend Index Stocks | |

|

|

We try to spot trends by analyzing the performances of various stocks or

components within Dividend Index and try to find best performing

stocks. The movers and shakers. The winners and losers. The top performing Dividend stocks year to date are Mercury General [55.99%], Nu Holdings [39.81%], Eaton [37.13%], Eli Lilly [32.09%], Alphabet [25.8%], General Electric [25.28%], Flavors [23.12%], Public Service [21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%]. More Now, more recently, over last week, the top performing Dividend stocks on the move are - Valaris [5.08%], PG&E [4.32%], agilon health [4.24%], Pitney Bowes [4.15%], Alphabet [4.11%], Darden Restaurants [3.88%], ONEOK [3.2%], Arthur J. [2.73%], V.F [2.65%], Altria [2.63%], Flavors [2.58%]. More The laggards stocks in this index year to date (YTD) are agilon health [-57.23%], Leggett & Platt [-53.88%], V.F [-32.13%], Valley National [-27.07%], Universal [-19.68%], Bank of Hawaii [-17.44%], Bristol-Myers [-14.19%], Sunoco LP [-10.2%], PPG Industries [-10.1%], McDonald s [-8.14%], United Bankshares [-6.74%]. The best trending Dividend stocks currently are Cinnati Financial [1.30%], General Dynamics [1.11%], Alphabet [1.06%], United Bankshares [1.01%], PG&E [0.81%], Pinnacle West [0.80%], ONEOK [0.47%], CenterPoint Energy [0.47%], Flavors [1.90%], Arthur J. [0.84%], Edison [0.58%]. More |

| LEADING DIVIDEND STOCKS | |

| MERCURY GENERAL: 55.99% | |

| NU HOLDINGS: 39.81% | |

| EATON : 37.13% | |

| ELI LILLY: 32.09% | |

| ALPHABET : 25.8% | |

| GENERAL ELECTRIC: 25.28% | |

| FLAVORS: 23.12% | |

| PUBLIC SERVICE: 21.9% | |

| ALLSTATE : 21.1% | |

| CATERPILLAR : 20.5% | |

| 12Stocks.com: Investing in Dividend Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Dividend Index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Dividend indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Dividend Index

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Dividend Stocks | |

|

We now take in-depth look at all Dividend stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Dividend stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

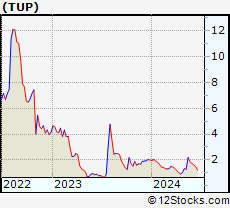

| TUP Tupperware Brands Corporation |

| Sector: Consumer Staples | |

| SubSector: Packaging & Containers | |

| MarketCap: 65.9253 Millions | |

| Recent Price: 2.20 Market Intelligence Score: 100 | |

| Day Percent Change: 32.53% Day Change: 0.54 | |

| Week Change: 70.54% Year-to-date Change: 10.0% | |

| TUP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TUP for Review:   | |

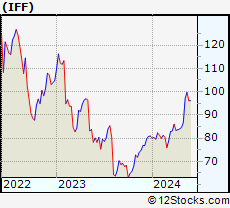

| IFF International Flavors & Fragrances Inc. |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 12178.7 Millions | |

| Recent Price: 99.69 Market Intelligence Score: 95 | |

| Day Percent Change: 1.90% Day Change: 1.86 | |

| Week Change: 2.58% Year-to-date Change: 23.1% | |

| IFF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IFF for Review:   | |

| DRI Darden Restaurants, Inc. |

| Sector: Services & Goods | |

| SubSector: Restaurants | |

| MarketCap: 5623.1 Millions | |

| Recent Price: 154.00 Market Intelligence Score: 49 | |

| Day Percent Change: 1.70% Day Change: 2.58 | |

| Week Change: 3.88% Year-to-date Change: -6.3% | |

| DRI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DRI for Review:   | |

| CAT Caterpillar Inc. |

| Sector: Industrials | |

| SubSector: Farm & Construction Machinery | |

| MarketCap: 58636 Millions | |

| Recent Price: 356.27 Market Intelligence Score: 66 | |

| Day Percent Change: 1.58% Day Change: 5.55 | |

| Week Change: 0.42% Year-to-date Change: 20.5% | |

| CAT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CAT for Review:   | |

| WSO Watsco, Inc. |

| Sector: Services & Goods | |

| SubSector: Electronics Wholesale | |

| MarketCap: 6000.33 Millions | |

| Recent Price: 477.62 Market Intelligence Score: 68 | |

| Day Percent Change: 1.51% Day Change: 7.10 | |

| Week Change: -0.34% Year-to-date Change: 11.5% | |

| WSO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save WSO for Review:   | |

| CINF Cincinnati Financial Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 13637 Millions | |

| Recent Price: 120.06 Market Intelligence Score: 100 | |

| Day Percent Change: 1.30% Day Change: 1.54 | |

| Week Change: 1% Year-to-date Change: 16.0% | |

| CINF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CINF for Review:   | |

| VLY Valley National Bancorp |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 2843.09 Millions | |

| Recent Price: 7.92 Market Intelligence Score: 42 | |

| Day Percent Change: 1.28% Day Change: 0.10 | |

| Week Change: 2.46% Year-to-date Change: -27.1% | |

| VLY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VLY for Review:   | |

| GD General Dynamics Corporation |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 37063.8 Millions | |

| Recent Price: 299.02 Market Intelligence Score: 100 | |

| Day Percent Change: 1.11% Day Change: 3.27 | |

| Week Change: 0.87% Year-to-date Change: 15.2% | |

| GD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GD for Review:   | |

| SUN Sunoco LP |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1656.34 Millions | |

| Recent Price: 53.82 Market Intelligence Score: 28 | |

| Day Percent Change: 1.07% Day Change: 0.57 | |

| Week Change: -2.22% Year-to-date Change: -10.2% | |

| SUN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SUN for Review:   | |

| GOOG Alphabet Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 730159 Millions | |

| Recent Price: 177.29 Market Intelligence Score: 100 | |

| Day Percent Change: 1.06% Day Change: 1.86 | |

| Week Change: 4.11% Year-to-date Change: 25.8% | |

| GOOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GOOG for Review:   | |

| UBSI United Bankshares, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 2286.79 Millions | |

| Recent Price: 35.02 Market Intelligence Score: 100 | |

| Day Percent Change: 1.01% Day Change: 0.35 | |

| Week Change: 1.77% Year-to-date Change: -6.7% | |

| UBSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save UBSI for Review:   | |

| CVX Chevron Corporation |

| Sector: Energy | |

| SubSector: Major Integrated Oil & Gas | |

| MarketCap: 121521 Millions | |

| Recent Price: 162.67 Market Intelligence Score: 51 | |

| Day Percent Change: 0.98% Day Change: 1.58 | |

| Week Change: -1.9% Year-to-date Change: 9.1% | |

| CVX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CVX for Review:   | |

| AJG Arthur J. Gallagher & Co. |

| Sector: Financials | |

| SubSector: Insurance Brokers | |

| MarketCap: 14852.2 Millions | |

| Recent Price: 257.67 Market Intelligence Score: 95 | |

| Day Percent Change: 0.84% Day Change: 2.15 | |

| Week Change: 2.73% Year-to-date Change: 14.6% | |

| AJG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AJG for Review:   | |

| DOW Dow Inc. |

| Sector: Materials | |

| SubSector: Chemicals - Major Diversified | |

| MarketCap: 24098.6 Millions | |

| Recent Price: 59.19 Market Intelligence Score: 68 | |

| Day Percent Change: 0.83% Day Change: 0.49 | |

| Week Change: -0.37% Year-to-date Change: 7.9% | |

| DOW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DOW for Review:   | |

| PCG PG&E Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 5078.04 Millions | |

| Recent Price: 18.60 Market Intelligence Score: 100 | |

| Day Percent Change: 0.81% Day Change: 0.15 | |

| Week Change: 4.32% Year-to-date Change: 3.2% | |

| PCG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PCG for Review:   | |

| PNW Pinnacle West Capital Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 8240.24 Millions | |

| Recent Price: 78.44 Market Intelligence Score: 100 | |

| Day Percent Change: 0.80% Day Change: 0.62 | |

| Week Change: 1.55% Year-to-date Change: 9.2% | |

| PNW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PNW for Review:   | |

| AVY Avery Dennison Corporation |

| Sector: Consumer Staples | |

| SubSector: Business Equipment | |

| MarketCap: 8051.27 Millions | |

| Recent Price: 226.30 Market Intelligence Score: 76 | |

| Day Percent Change: 0.77% Day Change: 1.72 | |

| Week Change: 0.31% Year-to-date Change: 11.9% | |

| AVY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AVY for Review:   | |

| FNB F.N.B. Corporation |

| Sector: Financials | |

| SubSector: Regional - Southeast Banks | |

| MarketCap: 2445.55 Millions | |

| Recent Price: 14.15 Market Intelligence Score: 76 | |

| Day Percent Change: 0.71% Day Change: 0.10 | |

| Week Change: 0.35% Year-to-date Change: 2.8% | |

| FNB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save FNB for Review:   | |

| SXT Sensient Technologies Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 1961.37 Millions | |

| Recent Price: 75.98 Market Intelligence Score: 85 | |

| Day Percent Change: 0.64% Day Change: 0.48 | |

| Week Change: -0.54% Year-to-date Change: 15.1% | |

| SXT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SXT for Review:   | |

| SRE Sempra Energy |

| Sector: Utilities | |

| SubSector: Diversified Utilities | |

| MarketCap: 34339.9 Millions | |

| Recent Price: 78.17 Market Intelligence Score: 83 | |

| Day Percent Change: 0.64% Day Change: 0.50 | |

| Week Change: 1.28% Year-to-date Change: 4.6% | |

| SRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SRE for Review:   | |

| T AT&T Inc. |

| Sector: Technology | |

| SubSector: Telecom Services - Domestic | |

| MarketCap: 224847 Millions | |

| Recent Price: 17.40 Market Intelligence Score: 83 | |

| Day Percent Change: 0.58% Day Change: 0.10 | |

| Week Change: 1.34% Year-to-date Change: 3.7% | |

| T Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save T for Review:   | |

| EIX Edison International |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 19358.1 Millions | |

| Recent Price: 76.30 Market Intelligence Score: 95 | |

| Day Percent Change: 0.58% Day Change: 0.44 | |

| Week Change: 1.88% Year-to-date Change: 6.7% | |

| EIX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EIX for Review:   | |

| BOH Bank of Hawaii Corporation |

| Sector: Financials | |

| SubSector: Regional - Pacific Banks | |

| MarketCap: 2305.19 Millions | |

| Recent Price: 59.82 Market Intelligence Score: 52 | |

| Day Percent Change: 0.50% Day Change: 0.30 | |

| Week Change: 0.61% Year-to-date Change: -17.4% | |

| BOH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save BOH for Review:   | |

| OKE ONEOK, Inc. |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 10788.7 Millions | |

| Recent Price: 82.63 Market Intelligence Score: 100 | |

| Day Percent Change: 0.47% Day Change: 0.39 | |

| Week Change: 3.2% Year-to-date Change: 17.7% | |

| OKE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save OKE for Review:   | |

| CNP CenterPoint Energy, Inc. |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 7444.07 Millions | |

| Recent Price: 30.08 Market Intelligence Score: 100 | |

| Day Percent Change: 0.47% Day Change: 0.14 | |

| Week Change: 1.28% Year-to-date Change: 5.3% | |

| CNP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CNP for Review:   | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

|

List of Dividend Stocks

|

|

US Stock Market Performance Year-to-Date: 6% |

View More Stocks In The List

View More Stocks In The List

| Stock | Price | YTD | Week | Day% |

| TUP | 2.20 | 10.0 | 70.5 | 32.5 |

| IFF | 99.69 | 23.1 | 2.6 | 1.9 |

| DRI | 154.00 | -6.3 | 3.9 | 1.7 |

| CAT | 356.27 | 20.5 | 0.4 | 1.6 |

| WSO | 477.62 | 11.5 | -0.3 | 1.5 |

| CINF | 120.06 | 16.0 | 1.0 | 1.3 |

| VLY | 7.92 | -27.1 | 2.5 | 1.3 |

| GD | 299.02 | 15.2 | 0.9 | 1.1 |

| SUN | 53.82 | -10.2 | -2.2 | 1.1 |

| GOOG | 177.29 | 25.8 | 4.1 | 1.1 |

| UBSI | 35.02 | -6.7 | 1.8 | 1.0 |

| CVX | 162.67 | 9.1 | -1.9 | 1.0 |

| AJG | 257.67 | 14.6 | 2.7 | 0.8 |

| DOW | 59.19 | 7.9 | -0.4 | 0.8 |

| PCG | 18.60 | 3.2 | 4.3 | 0.8 |

| PNW | 78.44 | 9.2 | 1.6 | 0.8 |

| AVY | 226.30 | 11.9 | 0.3 | 0.8 |

| FNB | 14.15 | 2.8 | 0.4 | 0.7 |

| SXT | 75.98 | 15.1 | -0.5 | 0.6 |

| SRE | 78.17 | 4.6 | 1.3 | 0.6 |

| T | 17.40 | 3.7 | 1.3 | 0.6 |

| EIX | 76.30 | 6.7 | 1.9 | 0.6 |

| BOH | 59.82 | -17.4 | 0.6 | 0.5 |

| OKE | 82.63 | 17.7 | 3.2 | 0.5 |

| CNP | 30.08 | 5.3 | 1.3 | 0.5 |

View More Stocks In The List

View More Stocks In The List

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dividend Stocks With Best Up Trends [0-bearish to 100-bullish]: Tupperware Brands[100], Cinnati Financial[100], General Dynamics[100], Alphabet [100], United Bankshares[100], PG&E [100], Pinnacle West[100], ONEOK [100], CenterPoint Energy[100], Flavors[95], Arthur J.[95]

Best Dividend Stocks Year-to-Date:

Mercury General[55.99%], Nu Holdings[39.81%], Eaton [37.13%], Eli Lilly[32.09%], Alphabet [25.8%], General Electric[25.28%], Flavors[23.12%], Public Service[21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%] Best Dividend Stocks This Week:

Tupperware Brands[70.54%], Valaris [5.08%], PG&E [4.32%], agilon health[4.24%], Pitney Bowes[4.15%], Alphabet [4.11%], Darden Restaurants[3.88%], ONEOK [3.2%], Arthur J.[2.73%], V.F [2.65%], Altria [2.63%] Best Dividend Stocks Daily:

Tupperware Brands[32.53%], Flavors[1.90%], Darden Restaurants[1.70%], Caterpillar [1.58%], Watsco [1.51%], Cinnati Financial[1.30%], Valley National[1.28%], General Dynamics[1.11%], Sunoco LP[1.07%], Alphabet [1.06%], United Bankshares[1.01%]

Mercury General[55.99%], Nu Holdings[39.81%], Eaton [37.13%], Eli Lilly[32.09%], Alphabet [25.8%], General Electric[25.28%], Flavors[23.12%], Public Service[21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%] Best Dividend Stocks This Week:

Tupperware Brands[70.54%], Valaris [5.08%], PG&E [4.32%], agilon health[4.24%], Pitney Bowes[4.15%], Alphabet [4.11%], Darden Restaurants[3.88%], ONEOK [3.2%], Arthur J.[2.73%], V.F [2.65%], Altria [2.63%] Best Dividend Stocks Daily:

Tupperware Brands[32.53%], Flavors[1.90%], Darden Restaurants[1.70%], Caterpillar [1.58%], Watsco [1.51%], Cinnati Financial[1.30%], Valley National[1.28%], General Dynamics[1.11%], Sunoco LP[1.07%], Alphabet [1.06%], United Bankshares[1.01%]

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

Login Sign Up

Login Sign Up