Stocks with best trends & most momentum Starts at just $9.99/Mo Subscribe ➞

| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks |

|

Best Dividend Stocks & ETFs

|

|

| Related Dividend Sector Pages: Technology, Nasdaq 100 & Web/Internet Stocks |

| ||||||||||||||||||

| Quick Read: Best Dividend Stocks List By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | ||||||||||||||||||

| Best Dividend Stocks Views: Quick Browse View, Summary View and Slide Show View | ||||||||||||||||||

| ||||||||||||||||||

| Dividend Index in Brief | ||||||||||||||||||

| Year-to-date Dividend is underperforming market by -3.29%. | ||||||||||||||||||

| Market Trend Chart View | ||||||||||||||||||

|

||||||||||||||||||

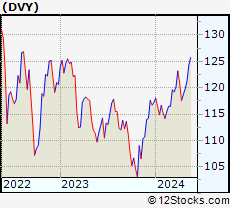

| Year To Date Performance: 7.28 % | ||||||||||||||||||

| Weekly Performance: 1.22 % | ||||||||||||||||||

| Daily Performance: 0.12 % | ||||||||||||||||||

| 12Stocks.com Short Term Trend Analysis for DVY | ||||||||||||||||||

| 83 | ||||||||||||||||||

| The current technical trend score is 83 in a scale where 0 is bearish and 100 is bullish. The trend score in the session before was 83. Trend score updated daily. Not to be used for investing. | ||||||||||||||||||

| 12Stocks.com: Investing in Dividend Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Dividend Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Dividend Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | Weekly Change% |

| VAL | Valaris Limited |   | Oil & Gas Equipment & Services | 76.60 | 90 | 0.05% | 5.08% |

| PCG | PG&E Corporation |   | Electric Utilities | 18.60 | 100 | 0.81% | 4.32% |

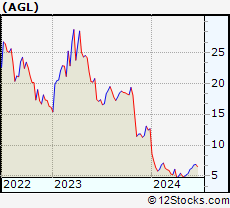

| AGL | agilon health, inc. |   | Medical Care Facilities | 5.41 | 49 | -3.05% | 4.24% |

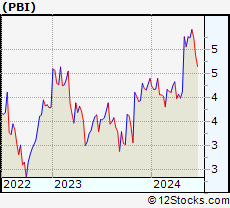

| PBI | Pitney Bowes Inc. |   | Business Equipment | 5.27 | 68 | -0.94% | 4.15% |

| GOOG | Alphabet Inc. |   | Internet Information Providers | 177.29 | 100 | 1.06% | 4.11% |

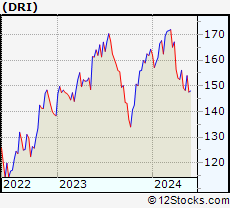

| DRI | Darden Restaurants, Inc. |   | Restaurants | 154.00 | 49 | 1.70% | 3.88% |

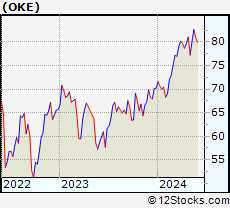

| OKE | ONEOK, Inc. |   | Gas Utilities | 82.63 | 100 | 0.47% | 3.20% |

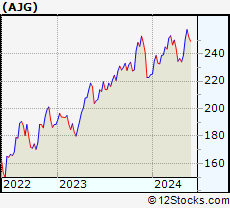

| AJG | Arthur J. Gallagher & Co. |   | Insurance Brokers | 257.67 | 95 | 0.84% | 2.73% |

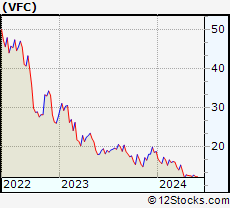

| VFC | V.F. Corporation |   | Textile - Apparel Clothing | 12.76 | 37 | -2.15% | 2.65% |

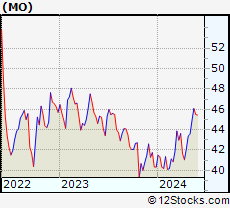

| MO | Altria Group, Inc. |   | Cigarettes | 46.08 | 95 | 0.28% | 2.63% |

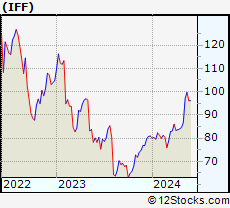

| IFF | International Flavors & Fragrances Inc. |   | Specialty Chemicals | 99.69 | 95 | 1.90% | 2.58% |

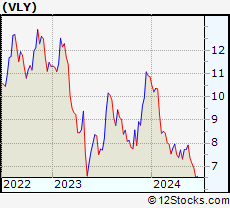

| VLY | Valley National Bancorp |   | Regional - Northeast Banks | 7.92 | 42 | 1.28% | 2.46% |

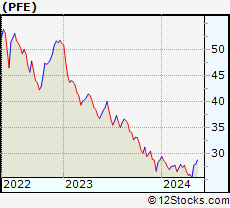

| PFE | Pfizer Inc. |   | Drug Manufacturers - Major | 28.64 | 83 | -0.97% | 2.25% |

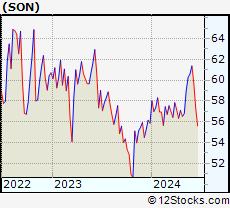

| SON | Sonoco Products Company |   | Packaging & Containers | 60.28 | 83 | 0.43% | 2.22% |

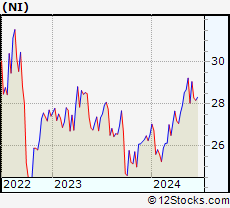

| NI | NiSource Inc. |   | Diversified Utilities | 29.23 | 88 | 0.27% | 1.92% |

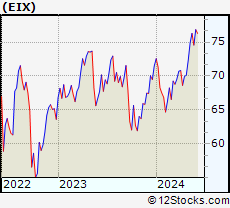

| EIX | Edison International |   | Electric Utilities | 76.30 | 95 | 0.58% | 1.88% |

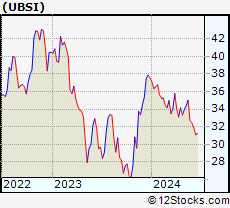

| UBSI | United Bankshares, Inc. |   | Regional - Mid-Atlantic Banks | 35.02 | 100 | 1.01% | 1.77% |

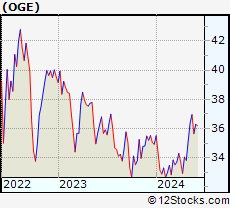

| OGE | OGE Energy Corp. |   | Electric Utilities | 36.96 | 90 | 0.35% | 1.59% |

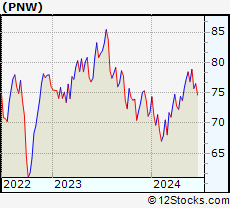

| PNW | Pinnacle West Capital Corporation |   | Electric Utilities | 78.44 | 100 | 0.80% | 1.55% |

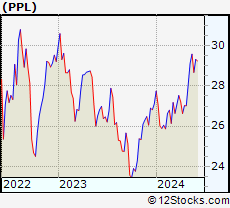

| PPL | PPL Corporation |   | Electric Utilities | 29.59 | 90 | -0.07% | 1.54% |

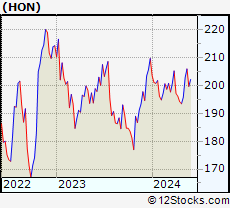

| HON | Honeywell International Inc. |   | Diversified Machinery | 205.97 | 90 | -0.31% | 1.50% |

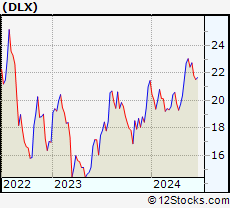

| DLX | Deluxe Corporation |   | Business Services | 23.03 | 68 | -1.71% | 1.36% |

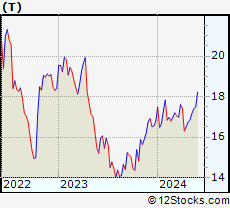

| T | AT&T Inc. |   | Telecom Services - Domestic | 17.40 | 83 | 0.58% | 1.34% |

| LLY | Eli Lilly and Company |   | Drug Manufacturers - Major | 770.00 | 73 | -0.15% | 1.32% |

| CNP | CenterPoint Energy, Inc. |   | Gas Utilities | 30.08 | 100 | 0.47% | 1.28% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Dividend Stocks |

| Dividend Technical Overview, Leaders & Laggards, Top Dividend ETF Funds & Detailed Dividend Stocks List, Charts, Trends & More |

| Dividend: Technical Analysis, Trends & YTD Performance | |

DVY Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Very Good | |

DVY Daily Chart |

|

| Short Term Trend: Good | |

| Overall Trend Score: 83 | |

| YTD Performance: 7.28% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Dividend Index Stocks | |

|

|

We try to spot trends by analyzing the performances of various stocks or

components within Dividend Index and try to find best performing

stocks. The movers and shakers. The winners and losers. The top performing Dividend stocks year to date are Mercury General [55.99%], Nu Holdings [39.81%], Eaton [37.13%], Eli Lilly [32.09%], Alphabet [25.8%], General Electric [25.28%], Flavors [23.12%], Public Service [21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%]. More Now, more recently, over last week, the top performing Dividend stocks on the move are - Valaris [5.08%], PG&E [4.32%], agilon health [4.24%], Pitney Bowes [4.15%], Alphabet [4.11%], Darden Restaurants [3.88%], ONEOK [3.2%], Arthur J. [2.73%], V.F [2.65%], Altria [2.63%], Flavors [2.58%]. More The laggards stocks in this index year to date (YTD) are agilon health [-57.23%], Leggett & Platt [-53.88%], V.F [-32.13%], Valley National [-27.07%], Universal [-19.68%], Bank of Hawaii [-17.44%], Bristol-Myers [-14.19%], Sunoco LP [-10.2%], PPG Industries [-10.1%], McDonald s [-8.14%], United Bankshares [-6.74%]. The best trending Dividend stocks currently are Cinnati Financial [1.30%], General Dynamics [1.11%], Alphabet [1.06%], United Bankshares [1.01%], PG&E [0.81%], Pinnacle West [0.80%], ONEOK [0.47%], CenterPoint Energy [0.47%], Flavors [1.90%], Arthur J. [0.84%], Edison [0.58%]. More |

| LEADING DIVIDEND STOCKS | |

| MERCURY GENERAL: 55.99% | |

| NU HOLDINGS: 39.81% | |

| EATON : 37.13% | |

| ELI LILLY: 32.09% | |

| ALPHABET : 25.8% | |

| GENERAL ELECTRIC: 25.28% | |

| FLAVORS: 23.12% | |

| PUBLIC SERVICE: 21.9% | |

| ALLSTATE : 21.1% | |

| CATERPILLAR : 20.5% | |

| 12Stocks.com: Investing in Dividend Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Dividend Index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Dividend indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Dividend Index

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Dividend Stocks | |

|

We now take in-depth look at all Dividend stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Dividend stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

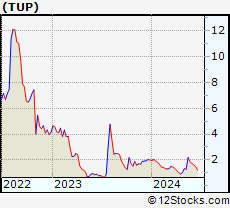

| TUP Tupperware Brands Corporation |

| Sector: Consumer Staples | |

| SubSector: Packaging & Containers | |

| MarketCap: 65.9253 Millions | |

| Recent Price: 2.20 Market Intelligence Score: 100 | |

| Day Percent Change: 32.53% Day Change: 0.54 | |

| Week Change: 70.54% Year-to-date Change: 10.0% | |

| TUP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save TUP for Review:   | |

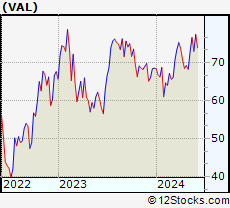

| VAL Valaris Limited |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 4520 Millions | |

| Recent Price: 76.60 Market Intelligence Score: 90 | |

| Day Percent Change: 0.05% Day Change: 0.04 | |

| Week Change: 5.08% Year-to-date Change: 11.7% | |

| VAL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VAL for Review:   | |

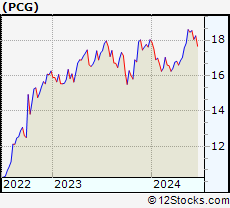

| PCG PG&E Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 5078.04 Millions | |

| Recent Price: 18.60 Market Intelligence Score: 100 | |

| Day Percent Change: 0.81% Day Change: 0.15 | |

| Week Change: 4.32% Year-to-date Change: 3.2% | |

| PCG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PCG for Review:   | |

| AGL agilon health, inc. |

| Sector: Health Care | |

| SubSector: Medical Care Facilities | |

| MarketCap: 7310 Millions | |

| Recent Price: 5.41 Market Intelligence Score: 49 | |

| Day Percent Change: -3.05% Day Change: -0.17 | |

| Week Change: 4.24% Year-to-date Change: -57.2% | |

| AGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AGL for Review:   | |

| PBI Pitney Bowes Inc. |

| Sector: Consumer Staples | |

| SubSector: Business Equipment | |

| MarketCap: 408.067 Millions | |

| Recent Price: 5.27 Market Intelligence Score: 68 | |

| Day Percent Change: -0.94% Day Change: -0.05 | |

| Week Change: 4.15% Year-to-date Change: 19.8% | |

| PBI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PBI for Review:   | |

| GOOG Alphabet Inc. |

| Sector: Technology | |

| SubSector: Internet Information Providers | |

| MarketCap: 730159 Millions | |

| Recent Price: 177.29 Market Intelligence Score: 100 | |

| Day Percent Change: 1.06% Day Change: 1.86 | |

| Week Change: 4.11% Year-to-date Change: 25.8% | |

| GOOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GOOG for Review:   | |

| DRI Darden Restaurants, Inc. |

| Sector: Services & Goods | |

| SubSector: Restaurants | |

| MarketCap: 5623.1 Millions | |

| Recent Price: 154.00 Market Intelligence Score: 49 | |

| Day Percent Change: 1.70% Day Change: 2.58 | |

| Week Change: 3.88% Year-to-date Change: -6.3% | |

| DRI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DRI for Review:   | |

| OKE ONEOK, Inc. |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 10788.7 Millions | |

| Recent Price: 82.63 Market Intelligence Score: 100 | |

| Day Percent Change: 0.47% Day Change: 0.39 | |

| Week Change: 3.2% Year-to-date Change: 17.7% | |

| OKE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save OKE for Review:   | |

| AJG Arthur J. Gallagher & Co. |

| Sector: Financials | |

| SubSector: Insurance Brokers | |

| MarketCap: 14852.2 Millions | |

| Recent Price: 257.67 Market Intelligence Score: 95 | |

| Day Percent Change: 0.84% Day Change: 2.15 | |

| Week Change: 2.73% Year-to-date Change: 14.6% | |

| AJG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AJG for Review:   | |

| VFC V.F. Corporation |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Clothing | |

| MarketCap: 23607.5 Millions | |

| Recent Price: 12.76 Market Intelligence Score: 37 | |

| Day Percent Change: -2.15% Day Change: -0.28 | |

| Week Change: 2.65% Year-to-date Change: -32.1% | |

| VFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VFC for Review:   | |

| MO Altria Group, Inc. |

| Sector: Consumer Staples | |

| SubSector: Cigarettes | |

| MarketCap: 70806.3 Millions | |

| Recent Price: 46.08 Market Intelligence Score: 95 | |

| Day Percent Change: 0.28% Day Change: 0.13 | |

| Week Change: 2.63% Year-to-date Change: 14.2% | |

| MO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save MO for Review:   | |

| IFF International Flavors & Fragrances Inc. |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 12178.7 Millions | |

| Recent Price: 99.69 Market Intelligence Score: 95 | |

| Day Percent Change: 1.90% Day Change: 1.86 | |

| Week Change: 2.58% Year-to-date Change: 23.1% | |

| IFF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save IFF for Review:   | |

| VLY Valley National Bancorp |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 2843.09 Millions | |

| Recent Price: 7.92 Market Intelligence Score: 42 | |

| Day Percent Change: 1.28% Day Change: 0.10 | |

| Week Change: 2.46% Year-to-date Change: -27.1% | |

| VLY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VLY for Review:   | |

| PFE Pfizer Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Major | |

| MarketCap: 172467 Millions | |

| Recent Price: 28.64 Market Intelligence Score: 83 | |

| Day Percent Change: -0.97% Day Change: -0.28 | |

| Week Change: 2.25% Year-to-date Change: -0.5% | |

| PFE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PFE for Review:   | |

| SON Sonoco Products Company |

| Sector: Consumer Staples | |

| SubSector: Packaging & Containers | |

| MarketCap: 4564.33 Millions | |

| Recent Price: 60.28 Market Intelligence Score: 83 | |

| Day Percent Change: 0.43% Day Change: 0.26 | |

| Week Change: 2.22% Year-to-date Change: 7.9% | |

| SON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SON for Review:   | |

| NI NiSource Inc. |

| Sector: Utilities | |

| SubSector: Diversified Utilities | |

| MarketCap: 9056.8 Millions | |

| Recent Price: 29.23 Market Intelligence Score: 88 | |

| Day Percent Change: 0.27% Day Change: 0.08 | |

| Week Change: 1.92% Year-to-date Change: 10.1% | |

| NI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save NI for Review:   | |

| EIX Edison International |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 19358.1 Millions | |

| Recent Price: 76.30 Market Intelligence Score: 95 | |

| Day Percent Change: 0.58% Day Change: 0.44 | |

| Week Change: 1.88% Year-to-date Change: 6.7% | |

| EIX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save EIX for Review:   | |

| UBSI United Bankshares, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 2286.79 Millions | |

| Recent Price: 35.02 Market Intelligence Score: 100 | |

| Day Percent Change: 1.01% Day Change: 0.35 | |

| Week Change: 1.77% Year-to-date Change: -6.7% | |

| UBSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save UBSI for Review:   | |

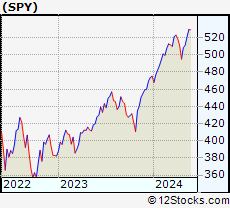

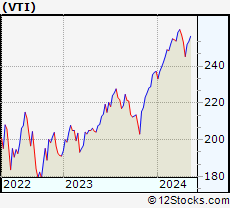

| SPY SPDR S&P 500 ETF |

| Sector: Utilities | |

| SubSector: Exchange Traded Fund | |

| MarketCap: 0 Millions | |

| Recent Price: 529.45 Market Intelligence Score: 88 | |

| Day Percent Change: 0.14% Day Change: 0.76 | |

| Week Change: 1.65% Year-to-date Change: 11.4% | |

| SPY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SPY for Review:   | |

| OGE OGE Energy Corp. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 5454.34 Millions | |

| Recent Price: 36.96 Market Intelligence Score: 90 | |

| Day Percent Change: 0.35% Day Change: 0.13 | |

| Week Change: 1.59% Year-to-date Change: 5.8% | |

| OGE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save OGE for Review:   | |

| PNW Pinnacle West Capital Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 8240.24 Millions | |

| Recent Price: 78.44 Market Intelligence Score: 100 | |

| Day Percent Change: 0.80% Day Change: 0.62 | |

| Week Change: 1.55% Year-to-date Change: 9.2% | |

| PNW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PNW for Review:   | |

| PPL PPL Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 16588.8 Millions | |

| Recent Price: 29.59 Market Intelligence Score: 90 | |

| Day Percent Change: -0.07% Day Change: -0.02 | |

| Week Change: 1.54% Year-to-date Change: 9.2% | |

| PPL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PPL for Review:   | |

| HON Honeywell International Inc. |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 91189.1 Millions | |

| Recent Price: 205.97 Market Intelligence Score: 90 | |

| Day Percent Change: -0.31% Day Change: -0.65 | |

| Week Change: 1.5% Year-to-date Change: -1.8% | |

| HON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save HON for Review:   | |

| DLX Deluxe Corporation |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 1025.82 Millions | |

| Recent Price: 23.03 Market Intelligence Score: 68 | |

| Day Percent Change: -1.71% Day Change: -0.40 | |

| Week Change: 1.36% Year-to-date Change: 7.4% | |

| DLX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DLX for Review:   | |

| T AT&T Inc. |

| Sector: Technology | |

| SubSector: Telecom Services - Domestic | |

| MarketCap: 224847 Millions | |

| Recent Price: 17.40 Market Intelligence Score: 83 | |

| Day Percent Change: 0.58% Day Change: 0.10 | |

| Week Change: 1.34% Year-to-date Change: 3.7% | |

| T Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save T for Review:   | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

|

List of Dividend Stocks

|

|

US Stock Market Performance Year-to-Date: 6% |

View More Stocks In The List

View More Stocks In The List

| Stock | Price | YTD | Week | Day% |

| TUP | 2.20 | 10.0 | 70.5 | 32.5 |

| VAL | 76.60 | 11.7 | 5.1 | 0.1 |

| PCG | 18.60 | 3.2 | 4.3 | 0.8 |

| AGL | 5.41 | -57.2 | 4.2 | -3.1 |

| PBI | 5.27 | 19.8 | 4.2 | -0.9 |

| GOOG | 177.29 | 25.8 | 4.1 | 1.1 |

| DRI | 154.00 | -6.3 | 3.9 | 1.7 |

| OKE | 82.63 | 17.7 | 3.2 | 0.5 |

| AJG | 257.67 | 14.6 | 2.7 | 0.8 |

| VFC | 12.76 | -32.1 | 2.7 | -2.2 |

| MO | 46.08 | 14.2 | 2.6 | 0.3 |

| IFF | 99.69 | 23.1 | 2.6 | 1.9 |

| VLY | 7.92 | -27.1 | 2.5 | 1.3 |

| PFE | 28.64 | -0.5 | 2.3 | -1.0 |

| SON | 60.28 | 7.9 | 2.2 | 0.4 |

| NI | 29.23 | 10.1 | 1.9 | 0.3 |

| EIX | 76.30 | 6.7 | 1.9 | 0.6 |

| UBSI | 35.02 | -6.7 | 1.8 | 1.0 |

| SPY | 529.45 | 11.4 | 1.7 | 0.1 |

| OGE | 36.96 | 5.8 | 1.6 | 0.4 |

| PNW | 78.44 | 9.2 | 1.6 | 0.8 |

| PPL | 29.59 | 9.2 | 1.5 | -0.1 |

| HON | 205.97 | -1.8 | 1.5 | -0.3 |

| DLX | 23.03 | 7.4 | 1.4 | -1.7 |

| T | 17.40 | 3.7 | 1.3 | 0.6 |

View More Stocks In The List

View More Stocks In The List

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dividend Stocks With Best Up Trends [0-bearish to 100-bullish]: Tupperware Brands[100], Cinnati Financial[100], General Dynamics[100], Alphabet [100], United Bankshares[100], PG&E [100], Pinnacle West[100], ONEOK [100], CenterPoint Energy[100], Flavors[95], Arthur J.[95]

Best Dividend Stocks Year-to-Date:

Mercury General[55.99%], Nu Holdings[39.81%], Eaton [37.13%], Eli Lilly[32.09%], Alphabet [25.8%], General Electric[25.28%], Flavors[23.12%], Public Service[21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%] Best Dividend Stocks This Week:

Tupperware Brands[70.54%], Valaris [5.08%], PG&E [4.32%], agilon health[4.24%], Pitney Bowes[4.15%], Alphabet [4.11%], Darden Restaurants[3.88%], ONEOK [3.2%], Arthur J.[2.73%], V.F [2.65%], Altria [2.63%] Best Dividend Stocks Daily:

Tupperware Brands[32.53%], Flavors[1.90%], Darden Restaurants[1.70%], Caterpillar [1.58%], Watsco [1.51%], Cinnati Financial[1.30%], Valley National[1.28%], General Dynamics[1.11%], Sunoco LP[1.07%], Alphabet [1.06%], United Bankshares[1.01%]

Mercury General[55.99%], Nu Holdings[39.81%], Eaton [37.13%], Eli Lilly[32.09%], Alphabet [25.8%], General Electric[25.28%], Flavors[23.12%], Public Service[21.9%], Allstate [21.1%], Caterpillar [20.5%], Merck [20.34%] Best Dividend Stocks This Week:

Tupperware Brands[70.54%], Valaris [5.08%], PG&E [4.32%], agilon health[4.24%], Pitney Bowes[4.15%], Alphabet [4.11%], Darden Restaurants[3.88%], ONEOK [3.2%], Arthur J.[2.73%], V.F [2.65%], Altria [2.63%] Best Dividend Stocks Daily:

Tupperware Brands[32.53%], Flavors[1.90%], Darden Restaurants[1.70%], Caterpillar [1.58%], Watsco [1.51%], Cinnati Financial[1.30%], Valley National[1.28%], General Dynamics[1.11%], Sunoco LP[1.07%], Alphabet [1.06%], United Bankshares[1.01%]

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

Login Sign Up

Login Sign Up