Best Latin America Stocks

|

|

| Quick Read: Top Latin America Stocks By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | |||

| Best Latin America Views: Quick Browse View, Summary & Slide Show | |||

| 12Stocks.com Latin America Stocks Performances & Trends Daily | |||||||||

|

|  The overall market intelligence score is 66 (0-bearish to 100-bullish) which puts Latin America index in short term neutral to bullish trend. The market intelligence score from previous trading session is 63 and an improvement of trend continues.

| ||||||||

| Here are the market intelligence trend scores of the most requested Latin America stocks at 12Stocks.com (click stock name for detailed review): | |

| Scroll down this page for most comprehensive review of Latin America stocks by performance, trends, technical analysis, charts, fund plays & more | |

| 12Stocks.com: Top Performing Latin America Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Latin America Index stocks year to date are

Now, more recently, over last week, the top performing Latin America Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Latin America Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Latin America Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Latin America Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | YTD Change% |

| PLG | Platinum |   | Materials | 1.77 | 100 | 7.93% | 55.26% |

| TGB | Taseko Mines |   | Materials | 2.92 | 100 | 7.54% | 108.93% |

| NG | NovaGold Resources |   | Materials | 3.47 | 100 | 6.12% | -7.22% |

| CCJ | Cameco |   | Materials | 52.59 | 100 | 5.53% | 22.01% |

| FSM | Fortuna Silver |   | Materials | 5.73 | 100 | 5.52% | 48.45% |

| AGI | Alamos Gold |   | Materials | 16.94 | 100 | 4.05% | 25.76% |

| PSLV | Sprott Physical |   | Financials | 10.32 | 100 | 3.82% | 27.66% |

| PAAS | Pan American |   | Materials | 21.30 | 100 | 3.37% | 30.40% |

| CEF | Sprott Physical |   | Financials | 22.98 | 100 | 2.34% | 20.03% |

| EXK | Endeavour Silver |   | Materials | 3.86 | 100 | 10.29% | 95.94% |

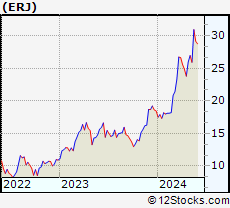

| ERJ | Embraer S.A |   | Industrials | 30.49 | 100 | 1.67% | 65.26% |

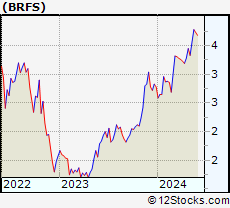

| BRFS | BRF S.A |   | Consumer Staples | 3.80 | 100 | 1.60% | 36.69% |

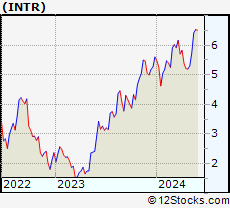

| INTR | Inter & Co |   | Financials | 6.34 | 100 | 0.63% | 13.11% |

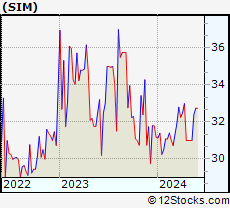

| SIM | Grupo Simec |   | Materials | 32.40 | 100 | 0.00% | 3.95% |

| AUPH | Aurinia |   | Health Care | 5.71 | 100 | -1.04% | -36.48% |

| AQN | Algonquin Power |   | Utilities | 6.72 | 100 | -0.15% | 6.33% |

| AG | First Majestic |   | Materials | 7.84 | 95 | 5.59% | 27.56% |

| EGO | Eldorado Gold |   | Materials | 15.94 | 95 | 4.25% | 22.90% |

| IAG | IAMGOLD |   | Materials | 4.58 | 95 | 3.98% | 80.83% |

| SAND | Sandstorm Gold |   | Materials | 5.89 | 95 | 3.60% | 17.20% |

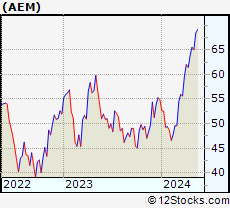

| AEM | Agnico Eagle |   | Materials | 70.23 | 95 | 2.06% | 28.04% |

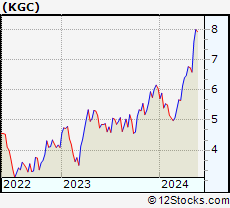

| KGC | Kinross Gold |   | Materials | 8.00 | 95 | 2.04% | 32.23% |

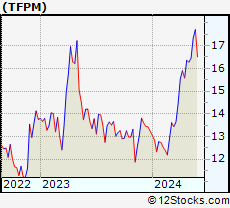

| TFPM | Triple Flag |   | Materials | 16.99 | 95 | 1.61% | 28.32% |

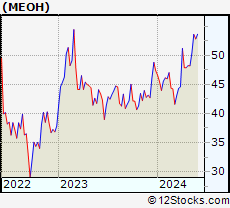

| MEOH | Methanex |   | Materials | 54.15 | 95 | 1.06% | 14.34% |

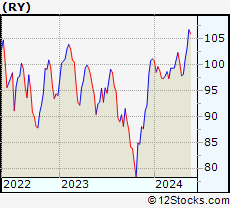

| RY | Royal Bank |   | Financials | 106.26 | 95 | 0.25% | 5.07% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Latin America Stocks |

| Latin America Technical Overview, Leaders & Laggards, Top Latin America ETF Funds & Detailed Latin America Stocks List, Charts, Trends & More |

| Latin America: Technical Analysis, Trends & YTD Performance | |

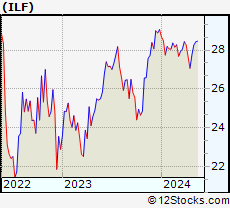

ILF Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Very Good | |

ILF Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 66 | |

| YTD Performance: -2.03% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Investing in Latin America Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors play Latin America stock market. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Latin America Index

| Ticker | ETF Name | Watchlist | Recent Price | Market Intelligence Score | Change % | Week % | Year-to-date % |

| ILF | Latin America 40 |   | 28.47 | 66 | 0.49 | 0.14 | -2.03% |

| EWC | Canada |   | 38.47 | 83 | 0.44 | 0.73 | 4.88% |

| FLN | Latin America AlphaDEX |   | 20.30 | 63 | 0.10 | 1.35 | -2.36% |

| EWZ | Brazil |   | 31.68 | 18 | -0.06 | 0.22 | -9.38% |

| EWW | Mexico |   | 69.06 | 90 | 0.54 | 0.86 | 1.78% |

| ARGT | Argentina |   | 64.11 | 76 | 0.69 | 2.92 | 24.87% |

| EWZS | Brazil Small-Cap |   | 13.78 | 52 | 0.66 | 2.61 | -8.5% |

| BRF | Brazil Small-Cap |   | 15.45 | 52 | 0.23 | 1.18 | -12.16% |

| BZQ | Short Brazil |   | 11.92 | 75 | -1.24 | -0.41 | 18.84% |

| BRZU | Brazil Bull 3X |   | 81.03 | 25 | 0.40 | 0.57 | -21.24% |

| FBZ | Brazil AlphaDEX |   | 11.81 | 55 | 0.20 | 2.07 | -3.37% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Latin America Stocks | |

|

We now take in-depth look at all Latin America stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Latin America stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

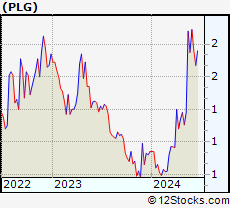

| PLG Platinum Group Metals Ltd. |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 77.591 Millions | |

| Recent Price: 1.77 Market Intelligence Score: 100 | |

| Day Percent Change: 7.93% Day Change: 0.13 | |

| Week Change: 28.26% Year-to-date Change: 55.3% | |

| PLG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PLG to Watchlist:  View: View:  Get Complete PLG Trend Analysis ➞ Get Complete PLG Trend Analysis ➞ | |

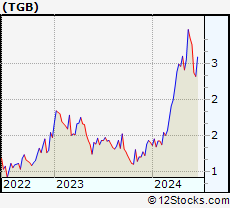

| TGB Taseko Mines Limited |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 55.991 Millions | |

| Recent Price: 2.92 Market Intelligence Score: 100 | |

| Day Percent Change: 7.54% Day Change: 0.20 | |

| Week Change: 14.71% Year-to-date Change: 108.9% | |

| TGB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TGB to Watchlist:  View: View:  Get Complete TGB Trend Analysis ➞ Get Complete TGB Trend Analysis ➞ | |

| NG NovaGold Resources Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 2499.49 Millions | |

| Recent Price: 3.47 Market Intelligence Score: 100 | |

| Day Percent Change: 6.12% Day Change: 0.20 | |

| Week Change: 22.18% Year-to-date Change: -7.2% | |

| NG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NG to Watchlist:  View: View:  Get Complete NG Trend Analysis ➞ Get Complete NG Trend Analysis ➞ | |

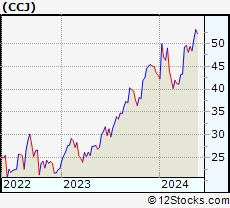

| CCJ Cameco Corporation |

| Sector: Materials | |

| SubSector: Industrial Metals & Minerals | |

| MarketCap: 2722.9 Millions | |

| Recent Price: 52.59 Market Intelligence Score: 100 | |

| Day Percent Change: 5.53% Day Change: 2.76 | |

| Week Change: 3.29% Year-to-date Change: 22.0% | |

| CCJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CCJ to Watchlist:  View: View:  Get Complete CCJ Trend Analysis ➞ Get Complete CCJ Trend Analysis ➞ | |

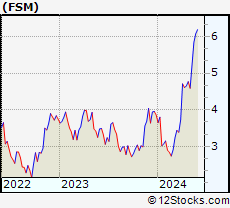

| FSM Fortuna Silver Mines Inc. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 362.256 Millions | |

| Recent Price: 5.73 Market Intelligence Score: 100 | |

| Day Percent Change: 5.52% Day Change: 0.30 | |

| Week Change: 9.98% Year-to-date Change: 48.5% | |

| FSM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FSM to Watchlist:  View: View:  Get Complete FSM Trend Analysis ➞ Get Complete FSM Trend Analysis ➞ | |

| AGI Alamos Gold Inc. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1740.39 Millions | |

| Recent Price: 16.94 Market Intelligence Score: 100 | |

| Day Percent Change: 4.05% Day Change: 0.66 | |

| Week Change: 8.24% Year-to-date Change: 25.8% | |

| AGI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AGI to Watchlist:  View: View:  Get Complete AGI Trend Analysis ➞ Get Complete AGI Trend Analysis ➞ | |

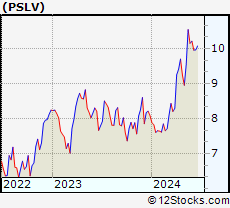

| PSLV Sprott Physical Silver Trust |

| Sector: Financials | |

| SubSector: Exchange Traded Fund | |

| MarketCap: 765.851 Millions | |

| Recent Price: 10.32 Market Intelligence Score: 100 | |

| Day Percent Change: 3.82% Day Change: 0.38 | |

| Week Change: 8.24% Year-to-date Change: 27.7% | |

| PSLV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PSLV to Watchlist:  View: View:  Get Complete PSLV Trend Analysis ➞ Get Complete PSLV Trend Analysis ➞ | |

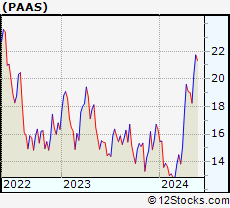

| PAAS Pan American Silver Corp. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 2832.56 Millions | |

| Recent Price: 21.30 Market Intelligence Score: 100 | |

| Day Percent Change: 3.37% Day Change: 0.70 | |

| Week Change: 4.64% Year-to-date Change: 30.4% | |

| PAAS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAAS to Watchlist:  View: View:  Get Complete PAAS Trend Analysis ➞ Get Complete PAAS Trend Analysis ➞ | |

| CEF Sprott Physical Gold and Silver Trust |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 2485.33 Millions | |

| Recent Price: 22.98 Market Intelligence Score: 100 | |

| Day Percent Change: 2.34% Day Change: 0.52 | |

| Week Change: 4.29% Year-to-date Change: 20.0% | |

| CEF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CEF to Watchlist:  View: View:  Get Complete CEF Trend Analysis ➞ Get Complete CEF Trend Analysis ➞ | |

| EXK Endeavour Silver Corp. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 204.456 Millions | |

| Recent Price: 3.86 Market Intelligence Score: 100 | |

| Day Percent Change: 10.29% Day Change: 0.36 | |

| Week Change: 16.27% Year-to-date Change: 95.9% | |

| EXK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EXK to Watchlist:  View: View:  Get Complete EXK Trend Analysis ➞ Get Complete EXK Trend Analysis ➞ | |

| ERJ Embraer S.A. |

| Sector: Industrials | |

| SubSector: Aerospace/Defense Products & Services | |

| MarketCap: 1623.71 Millions | |

| Recent Price: 30.49 Market Intelligence Score: 100 | |

| Day Percent Change: 1.67% Day Change: 0.50 | |

| Week Change: 17.63% Year-to-date Change: 65.3% | |

| ERJ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ERJ to Watchlist:  View: View:  Get Complete ERJ Trend Analysis ➞ Get Complete ERJ Trend Analysis ➞ | |

| BRFS BRF S.A. |

| Sector: Consumer Staples | |

| SubSector: Meat Products | |

| MarketCap: 2635.51 Millions | |

| Recent Price: 3.80 Market Intelligence Score: 100 | |

| Day Percent Change: 1.60% Day Change: 0.06 | |

| Week Change: 6.74% Year-to-date Change: 36.7% | |

| BRFS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BRFS to Watchlist:  View: View:  Get Complete BRFS Trend Analysis ➞ Get Complete BRFS Trend Analysis ➞ | |

| INTR Inter & Co, Inc. |

| Sector: Financials | |

| SubSector: Banks - Regional | |

| MarketCap: 1250 Millions | |

| Recent Price: 6.34 Market Intelligence Score: 100 | |

| Day Percent Change: 0.63% Day Change: 0.04 | |

| Week Change: 10.26% Year-to-date Change: 13.1% | |

| INTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add INTR to Watchlist:  View: View:  Get Complete INTR Trend Analysis ➞ Get Complete INTR Trend Analysis ➞ | |

| SIM Grupo Simec, S.A.B. de C.V. |

| Sector: Materials | |

| SubSector: Steel & Iron | |

| MarketCap: 1418.28 Millions | |

| Recent Price: 32.40 Market Intelligence Score: 100 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: 4.52% Year-to-date Change: 4.0% | |

| SIM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SIM to Watchlist:  View: View:  Get Complete SIM Trend Analysis ➞ Get Complete SIM Trend Analysis ➞ | |

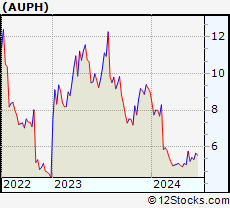

| AUPH Aurinia Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1319.75 Millions | |

| Recent Price: 5.71 Market Intelligence Score: 100 | |

| Day Percent Change: -1.04% Day Change: -0.06 | |

| Week Change: 13.75% Year-to-date Change: -36.5% | |

| AUPH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AUPH to Watchlist:  View: View:  Get Complete AUPH Trend Analysis ➞ Get Complete AUPH Trend Analysis ➞ | |

| AQN Algonquin Power & Utilities Corp. |

| Sector: Utilities | |

| SubSector: Diversified Utilities | |

| MarketCap: 5916.4 Millions | |

| Recent Price: 6.72 Market Intelligence Score: 100 | |

| Day Percent Change: -0.15% Day Change: -0.01 | |

| Week Change: 2.44% Year-to-date Change: 6.3% | |

| AQN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AQN to Watchlist:  View: View:  Get Complete AQN Trend Analysis ➞ Get Complete AQN Trend Analysis ➞ | |

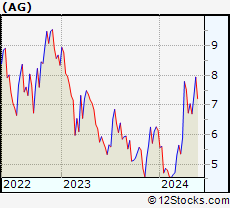

| AG First Majestic Silver Corp. |

| Sector: Materials | |

| SubSector: Silver | |

| MarketCap: 1128.56 Millions | |

| Recent Price: 7.84 Market Intelligence Score: 95 | |

| Day Percent Change: 5.59% Day Change: 0.42 | |

| Week Change: 7.61% Year-to-date Change: 27.6% | |

| AG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AG to Watchlist:  View: View:  Get Complete AG Trend Analysis ➞ Get Complete AG Trend Analysis ➞ | |

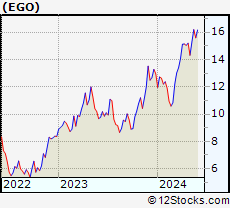

| EGO Eldorado Gold Corporation |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 982.519 Millions | |

| Recent Price: 15.94 Market Intelligence Score: 95 | |

| Day Percent Change: 4.25% Day Change: 0.65 | |

| Week Change: 4.18% Year-to-date Change: 22.9% | |

| EGO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EGO to Watchlist:  View: View:  Get Complete EGO Trend Analysis ➞ Get Complete EGO Trend Analysis ➞ | |

| IAG IAMGOLD Corporation |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 1158.09 Millions | |

| Recent Price: 4.58 Market Intelligence Score: 95 | |

| Day Percent Change: 3.98% Day Change: 0.17 | |

| Week Change: 6.4% Year-to-date Change: 80.8% | |

| IAG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IAG to Watchlist:  View: View:  Get Complete IAG Trend Analysis ➞ Get Complete IAG Trend Analysis ➞ | |

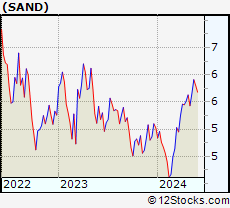

| SAND Sandstorm Gold Ltd. |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 808.119 Millions | |

| Recent Price: 5.89 Market Intelligence Score: 95 | |

| Day Percent Change: 3.60% Day Change: 0.20 | |

| Week Change: 4.15% Year-to-date Change: 17.2% | |

| SAND Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SAND to Watchlist:  View: View:  Get Complete SAND Trend Analysis ➞ Get Complete SAND Trend Analysis ➞ | |

| AEM Agnico Eagle Mines Limited |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 9491.49 Millions | |

| Recent Price: 70.23 Market Intelligence Score: 95 | |

| Day Percent Change: 2.06% Day Change: 1.42 | |

| Week Change: 2.68% Year-to-date Change: 28.0% | |

| AEM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AEM to Watchlist:  View: View:  Get Complete AEM Trend Analysis ➞ Get Complete AEM Trend Analysis ➞ | |

| KGC Kinross Gold Corporation |

| Sector: Materials | |

| SubSector: Gold | |

| MarketCap: 5389.29 Millions | |

| Recent Price: 8.00 Market Intelligence Score: 95 | |

| Day Percent Change: 2.04% Day Change: 0.16 | |

| Week Change: 5.4% Year-to-date Change: 32.2% | |

| KGC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KGC to Watchlist:  View: View:  Get Complete KGC Trend Analysis ➞ Get Complete KGC Trend Analysis ➞ | |

| TFPM Triple Flag Precious Metals Corp. |

| Sector: Materials | |

| SubSector: Other Precious Metals & Mining | |

| MarketCap: 3640 Millions | |

| Recent Price: 16.99 Market Intelligence Score: 95 | |

| Day Percent Change: 1.61% Day Change: 0.27 | |

| Week Change: 3.28% Year-to-date Change: 28.3% | |

| TFPM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TFPM to Watchlist:  View: View:  Get Complete TFPM Trend Analysis ➞ Get Complete TFPM Trend Analysis ➞ | |

| MEOH Methanex Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 894.357 Millions | |

| Recent Price: 54.15 Market Intelligence Score: 95 | |

| Day Percent Change: 1.06% Day Change: 0.57 | |

| Week Change: 7.27% Year-to-date Change: 14.3% | |

| MEOH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MEOH to Watchlist:  View: View:  Get Complete MEOH Trend Analysis ➞ Get Complete MEOH Trend Analysis ➞ | |

| RY Royal Bank of Canada |

| Sector: Financials | |

| SubSector: Money Center Banks | |

| MarketCap: 87565.4 Millions | |

| Recent Price: 106.26 Market Intelligence Score: 95 | |

| Day Percent Change: 0.25% Day Change: 0.27 | |

| Week Change: 2.96% Year-to-date Change: 5.1% | |

| RY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RY to Watchlist:  View: View:  Get Complete RY Trend Analysis ➞ Get Complete RY Trend Analysis ➞ | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Latin America Stocks With Best Up Trends [0-bearish to 100-bullish]: Endeavour Silver[100], NovaGold Resources[100], Cameco [100], Fortuna Silver[100], Alamos Gold[100], Sprott Physical[100], Pan American[100], Sprott Physical[100], Embraer S.A[100], BRF S.A[100], Inter & Co[100]

Best Latin America Stocks Year-to-Date:

Aurora Cannabis[1473.92%], Banco Macro[127.21%], Fusion [123.65%], Canopy Growth[123.39%], Grupo Financiero[113.47%], Banco BBVA[111.58%], Endeavour Silver[95.94%], Grupo Supervielle[88.67%], Hudbay Minerals[82.25%], IAMGOLD [80.83%], Embraer S.A[65.26%] Best Latin America Stocks This Week:

Canopy Growth[29.13%], Canada Goose[22.63%], NovaGold Resources[22.18%], Trilogy Metals[20.7%], Aurora Cannabis[18.03%], Embraer S.A[17.63%], Endeavour Silver[16.27%], Hudbay Minerals[14.58%], Aurinia [13.75%], Lion Electric[11.64%], Ballard Power[10.95%] Best Latin America Stocks Daily:

Endeavour Silver[10.29%], NovaGold Resources[6.12%], Equinox Gold[5.74%], First Majestic[5.59%], Cameco [5.53%], Fortuna Silver[5.52%], SSR Mining[5.08%], New Gold[5.05%], Denison Mines[5.00%], McEwen Mining[4.91%], Gold Royalty[4.37%]

Aurora Cannabis[1473.92%], Banco Macro[127.21%], Fusion [123.65%], Canopy Growth[123.39%], Grupo Financiero[113.47%], Banco BBVA[111.58%], Endeavour Silver[95.94%], Grupo Supervielle[88.67%], Hudbay Minerals[82.25%], IAMGOLD [80.83%], Embraer S.A[65.26%] Best Latin America Stocks This Week:

Canopy Growth[29.13%], Canada Goose[22.63%], NovaGold Resources[22.18%], Trilogy Metals[20.7%], Aurora Cannabis[18.03%], Embraer S.A[17.63%], Endeavour Silver[16.27%], Hudbay Minerals[14.58%], Aurinia [13.75%], Lion Electric[11.64%], Ballard Power[10.95%] Best Latin America Stocks Daily:

Endeavour Silver[10.29%], NovaGold Resources[6.12%], Equinox Gold[5.74%], First Majestic[5.59%], Cameco [5.53%], Fortuna Silver[5.52%], SSR Mining[5.08%], New Gold[5.05%], Denison Mines[5.00%], McEwen Mining[4.91%], Gold Royalty[4.37%]

Login Sign Up

Login Sign Up