|

|

subu marketcap none

-

Plain Simple: MAIN Core8 VALLT Core16 Sectors Shorts Dow S&P 100 Ex QQQ S&P 500 Midcap 400 ARKK Smallcap Cloud

Sectors: TechAll TechLarge EnergyAll EnergyLarge FinAll FinLarge RetailAll RetailLarge IndustrialAll IndustrialLarge MaterialsAll MaterialsLarge StaplesAll StaplesLarge UtilitiesAll UtilitiesLarge

Chart Type : BigDaily BigWeekly BigMonthly Daily Weekly Monthly None

150 220 250 300 400 500 680

Order By : Order MarketCap Dchange PChange PChangeDn WeekChange WeekChangeDn YTDChange Score ScoreDn NO Filter

Filters: NO Filter WeeklyorDaily + Weekly + Monthly + Daily + Weekly - Monthly - Daily - Week DMA Day DMA Weekly DMA Minus Day DMAminus

Screens: Full Half Third

| Partial Buys and Sells - start with call & put 2$ then partials and hedges | |||||||

| SPY 10 |  | SDS 100 |  | ||||

here

| NVDA |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MSFT |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AAPL |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOOG |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOOGL |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AMZN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| META |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVGO |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TSM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TSLA |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JPM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WMT |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LLY |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| V |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ORCL |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NFLX |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MA |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| XOM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JNJ |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COST |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HD |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ABBV |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PG |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BAC |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PLTR |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HDB |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CVX |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SAP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASML |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BABA |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GE |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| KO |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UNH |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TMUS |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RDS.A |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RDS.B |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

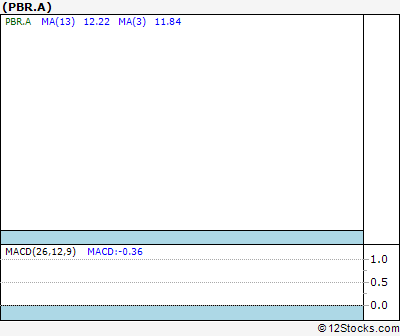

| PBR.A |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CSCO |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AZN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WFC |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NVS |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AMD |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MS |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IBM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ABT |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HSBC |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AXP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MCD |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GS |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DIS |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MRK |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BX |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RY |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PEP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CAT |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHOP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NOW |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UBER |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INTU |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VZ |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TMO |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NVO |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANET |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BLK |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BKNG |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| C |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BA |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PDD |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QCOM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TXN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISRG |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SCHW |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SPGI |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BSX |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ACN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UL |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DWDP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TJX |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CHL |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AMGN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LOW |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYK |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ADBE |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NEE |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MU |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ARM |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DHR |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SPOT |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PGR |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GILD |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SAN |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COF |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PFE |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BHP |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Totalrec =7480

| Click on following links to sort by: Market Cap or Company Size performance: Year-to-date, Week and Day | Click on following links to filter by: None performance: MoMo, MoMoDay, Dynaboth, Dyna, , Dynawk |  |

0 - 100 , 100 - 200 , 200 - 300 , 300 - 400 , 400 - 500 , 500 - 600 , 600 - 700 , 700 - 800 , 800 - 900 , 900 - 1000 , 1000 - 1100 , 1100 - 1200 , 1200 - 1300 , 1300 - 1400 , 1400 - 1500 , 1500 - 1600 , 1600 - 1700 , 1700 - 1800 , 1800 - 1900 , 1900 - 2000 , 2000 - 2100 , 2100 - 2200 , 2200 - 2300 , 2300 - 2400 , 2400 - 2500 , 2500 - 2600 , 2600 - 2700 , 2700 - 2800 , 2800 - 2900 , 2900 - 3000 , 3000 - 3100 , 3100 - 3200 , 3200 - 3300 , 3300 - 3400 , 3400 - 3500 , 3500 - 3600 , 3600 - 3700 , 3700 - 3800 , 3800 - 3900 , 3900 - 4000 , 4000 - 4100 , 4100 - 4200 , 4200 - 4300 , 4300 - 4400 , 4400 - 4500 , 4500 - 4600 , 4600 - 4700 , 4700 - 4800 , 4800 - 4900 , 4900 - 5000 , 5000 - 5100 , 5100 - 5200 , 5200 - 5300 , 5300 - 5400 , 5400 - 5500 , 5500 - 5600 , 5600 - 5700 , 5700 - 5800 , 5800 - 5900 , 5900 - 6000 , 6000 - 6100 , 6100 - 6200 , 6200 - 6300 , 6300 - 6400 , 6400 - 6500 , 6500 - 6600 , 6600 - 6700 , 6700 - 6800 , 6800 - 6900 , 6900 - 7000 , 7000 - 7100 , 7100 - 7200 , 7200 - 7300 , 7300 - 7400 , 7400 - 7500 ,

Plain Simple: MAIN Core8 VALLT Core16 Sectors Shorts Dow S&P 100 Ex QQQ S&P 500 Midcap 400 ARKK Smallcap Cloud

Daily- : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Weekly- : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Monthly- : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Daily+ : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Weekly+ : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Monthly+ : Core8 VALLT Sectors Sectors2 Dow OEFX S&P 500 Nasdaq Midcap Smallcap

Buy puts and calls ($2) 3 weeks ahead

2. Buy puts and calls on stocks IN Motion

3. Both fall on volatility - buy partials

4. But multiple stocks in different sector

5. No panic - buy in partials/no emotional - stocks emotional

6. Follow the Fucking Charts you Asshole

1. Look at blue red line

2. Look MACD - up, down, overbought, oversold, how long the trend has been

3. Lookif broken previous pivots or supports

4. You will be wrong - money management over time, small singles

5. Stick to index - tqqq, sqqq to have small positions . COMPARE UPRO vs SPXU, SPY vs SH - let it decide!!

6. See the latest candles - flat or up or down or consolidating or stuck - don't force inertia!

7. STOP - DONT DIG BIGGER HOLE. Markets will ramp - wait like tiger. Be smart money not dumb. Small positions wait longer