Best SmallCap Stocks

|

| In a hurry? Small Cap Stock Lists: Performance Trends Table, Stock Charts

Sort Small Cap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Small Cap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter Small Cap stocks list by size: All Large Medium Small and MicroCap |

| 12Stocks.com Small Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 31 (0-bearish to 100-bullish) which puts Small Cap index in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 58 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested small cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Smallcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Smallcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Smallcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| IPAR | Inter Parfums |   | Consumer Staples | 122.88 | 42 | -5.86% | -14.68% |

| HOV | Hovnanian Enterprises |   | Industrials | 141.78 | 42 | -4.66% | -8.89% |

| OPI | Office Properties |   | Financials | 1.96 | 42 | -4.63% | -73.29% |

| SPWH | Sportsman s |   | Consumer Staples | 3.22 | 42 | -3.88% | -24.41% |

| ASAN | Asana |   | Technology | 14.47 | 42 | -3.40% | -23.88% |

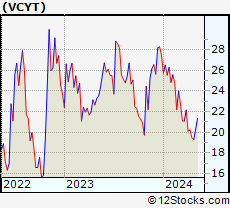

| VCYT | Veracyte |   | Health Care | 19.26 | 42 | -3.22% | -29.99% |

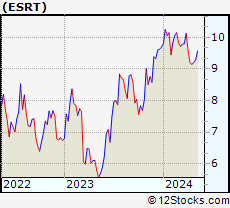

| ESRT | Empire State |   | Financials | 9.07 | 42 | -3.10% | -6.40% |

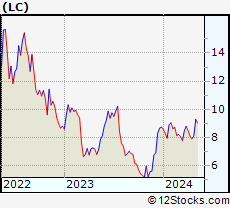

| LC | LendingClub |   | Financials | 7.95 | 42 | -2.99% | -9.10% |

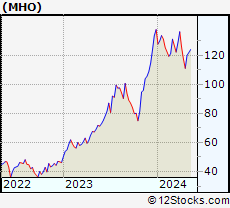

| MHO | M/I Homes |   | Industrials | 119.16 | 42 | -2.66% | -13.49% |

| PETQ | PetIQ |   | Health Care | 16.11 | 42 | -2.54% | -18.43% |

| PAX | Patria s |   | Financials | 13.64 | 42 | -2.43% | -13.07% |

| KLTR | Kaltura |   | Technology | 1.22 | 42 | -2.40% | -37.76% |

| MD | MEDNAX |   | Health Care | 9.02 | 42 | -2.38% | -3.01% |

| LCII | LCI Industries |   | Consumer Staples | 106.84 | 42 | -2.36% | -15.01% |

| FMNB | Farmers National |   | Financials | 12.09 | 42 | -2.34% | -16.33% |

| FLWS | 1-800-FLOWERS.COM |   | Services & Goods | 9.07 | 42 | -2.05% | -15.86% |

| PDCO | Patterson |   | Services & Goods | 25.67 | 42 | -1.95% | -9.77% |

| MIRM | Mirum |   | Health Care | 23.57 | 42 | -1.89% | -20.17% |

| AAN | Aaron s |   | Transports | 7.29 | 42 | -1.88% | -33.00% |

| IONQ | IonQ |   | Technology | 8.10 | 42 | -1.82% | -35.02% |

| TLYS | Tilly s |   | Services & Goods | 5.80 | 42 | -1.78% | -23.01% |

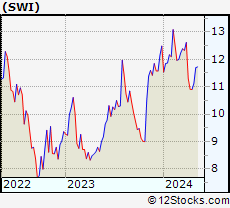

| SWI | SolarWinds |   | Technology | 11.10 | 42 | -1.73% | -11.17% |

| HAIN | Hain Celestial |   | Consumer Staples | 6.07 | 42 | -1.70% | -44.61% |

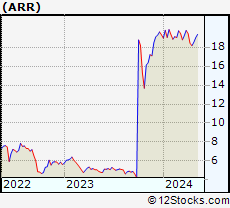

| ARR | ARMOUR Residential |   | Financials | 18.41 | 42 | -1.68% | -4.68% |

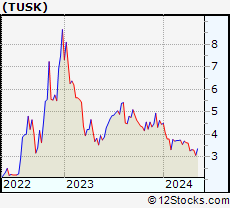

| TUSK | Mammoth Energy |   | Energy | 3.29 | 42 | -1.64% | -26.12% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 , 1250 - 1275 , 1275 - 1300 , 1300 - 1325 , 1325 - 1350 , 1350 - 1375 , 1375 - 1400 , 1400 - 1425 , 1425 - 1450 , 1450 - 1475 , 1475 - 1500 , 1500 - 1525 , 1525 - 1550 , 1550 - 1575 , 1575 - 1600 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small |

| Smallcap Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, & Medical |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of SmallCap Stocks |

| SmallCap Technical Overview, Leaders & Laggards, Top SmallCap ETF Funds & Detailed SmallCap Stocks List, Charts, Trends & More |

| Smallcap: Technical Analysis, Trends & YTD Performance | |

| SmallCap segment as represented by

IWM, an exchange-traded fund [ETF], holds basket of thousands of smallcap stocks from across all major sectors of the US stock market. The smallcap index (contains stocks like Riverbed & Sotheby's) is down by -2.82% and is currently underperforming the overall market by -7.07% year-to-date. Below is a quick view of technical charts and trends: | |

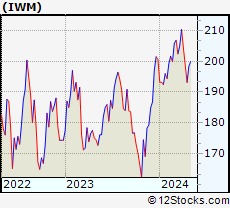

IWM Weekly Chart |

|

| Long Term Trend: Good | |

| Medium Term Trend: Not Good | |

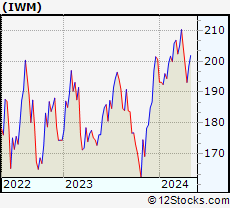

IWM Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 31 | |

| YTD Performance: -2.82% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Small Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Small Cap Index stocks year to date are

Now, more recently, over last week, the top performing Small Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Smallcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Smallcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Smallcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Smallcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IWM | iShares Russell 2000 |   | 195.06 | 31 | -1.33 | 0.99 | -2.82% |

| SBB | ProShares Short SmallCap600 |   | 16.60 | 40 | 1.41 | -1.43 | 4.21% |

| SDD | ProShares UltraShort SmallCap600 |   | 19.79 | 42 | 1.51 | -2.73 | 7.37% |

| SMLV | SPDR SSGA US Small Cap Low Volatil ETF |   | 107.56 | 73 | -0.80 | 1.39 | -4.41% |

| SAA | ProShares Ultra SmallCap600 |   | 23.01 | 58 | 0.00 | 5.55 | -7.78% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of SmallCap Stocks | |

|

We now take in-depth look at all SmallCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort SmallCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

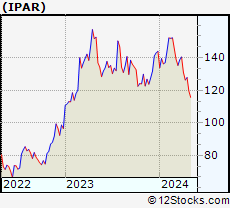

| IPAR Inter Parfums, Inc. |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 1302.55 Millions | |

| Recent Price: 122.88 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -5.86% Day Change: -7.65 | |

| Week Change: -3.91% Year-to-date Change: -14.7% | |

| IPAR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IPAR to Watchlist:  View: View:  Get Complete IPAR Trend Analysis ➞ Get Complete IPAR Trend Analysis ➞ | |

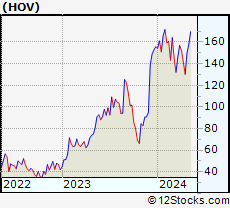

| HOV Hovnanian Enterprises, Inc. |

| Sector: Industrials | |

| SubSector: Residential Construction | |

| MarketCap: 59.9106 Millions | |

| Recent Price: 141.78 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -4.66% Day Change: -6.93 | |

| Week Change: 8.84% Year-to-date Change: -8.9% | |

| HOV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HOV to Watchlist:  View: View:  Get Complete HOV Trend Analysis ➞ Get Complete HOV Trend Analysis ➞ | |

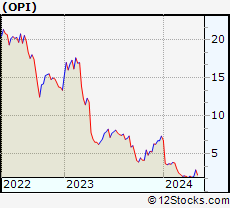

| OPI Office Properties Income Trust |

| Sector: Financials | |

| SubSector: REIT - Office | |

| MarketCap: 1245.66 Millions | |

| Recent Price: 1.96 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -4.63% Day Change: -0.09 | |

| Week Change: 3.17% Year-to-date Change: -73.3% | |

| OPI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OPI to Watchlist:  View: View:  Get Complete OPI Trend Analysis ➞ Get Complete OPI Trend Analysis ➞ | |

| SPWH Sportsman s Warehouse Holdings, Inc. |

| Sector: Consumer Staples | |

| SubSector: Sporting Goods | |

| MarketCap: 247.144 Millions | |

| Recent Price: 3.22 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -3.88% Day Change: -0.13 | |

| Week Change: 0.63% Year-to-date Change: -24.4% | |

| SPWH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SPWH to Watchlist:  View: View:  Get Complete SPWH Trend Analysis ➞ Get Complete SPWH Trend Analysis ➞ | |

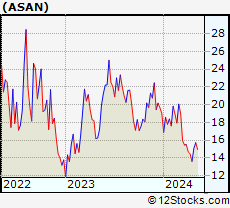

| ASAN Asana, Inc. |

| Sector: Technology | |

| SubSector: Software Application | |

| MarketCap: 45087 Millions | |

| Recent Price: 14.47 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -3.40% Day Change: -0.51 | |

| Week Change: 6.4% Year-to-date Change: -23.9% | |

| ASAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ASAN to Watchlist:  View: View:  Get Complete ASAN Trend Analysis ➞ Get Complete ASAN Trend Analysis ➞ | |

| VCYT Veracyte, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1089.05 Millions | |

| Recent Price: 19.26 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -3.22% Day Change: -0.64 | |

| Week Change: -0.98% Year-to-date Change: -30.0% | |

| VCYT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VCYT to Watchlist:  View: View:  Get Complete VCYT Trend Analysis ➞ Get Complete VCYT Trend Analysis ➞ | |

| ESRT Empire State Realty Trust, Inc. |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 1632.13 Millions | |

| Recent Price: 9.07 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -3.10% Day Change: -0.29 | |

| Week Change: -0.87% Year-to-date Change: -6.4% | |

| ESRT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ESRT to Watchlist:  View: View:  Get Complete ESRT Trend Analysis ➞ Get Complete ESRT Trend Analysis ➞ | |

| LC LendingClub Corporation |

| Sector: Financials | |

| SubSector: Credit Services | |

| MarketCap: 852.308 Millions | |

| Recent Price: 7.95 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.99% Day Change: -0.24 | |

| Week Change: 0.57% Year-to-date Change: -9.1% | |

| LC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LC to Watchlist:  View: View:  Get Complete LC Trend Analysis ➞ Get Complete LC Trend Analysis ➞ | |

| MHO M/I Homes, Inc. |

| Sector: Industrials | |

| SubSector: Residential Construction | |

| MarketCap: 437.106 Millions | |

| Recent Price: 119.16 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.66% Day Change: -3.26 | |

| Week Change: 7.26% Year-to-date Change: -13.5% | |

| MHO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MHO to Watchlist:  View: View:  Get Complete MHO Trend Analysis ➞ Get Complete MHO Trend Analysis ➞ | |

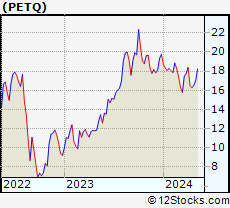

| PETQ PetIQ, Inc. |

| Sector: Health Care | |

| SubSector: Drugs - Generic | |

| MarketCap: 587.585 Millions | |

| Recent Price: 16.11 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.54% Day Change: -0.42 | |

| Week Change: -1.04% Year-to-date Change: -18.4% | |

| PETQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PETQ to Watchlist:  View: View:  Get Complete PETQ Trend Analysis ➞ Get Complete PETQ Trend Analysis ➞ | |

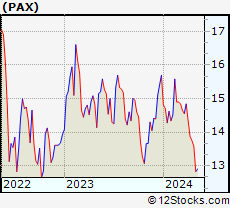

| PAX Patria Investments Limited |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 2130 Millions | |

| Recent Price: 13.64 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.43% Day Change: -0.34 | |

| Week Change: -0.8% Year-to-date Change: -13.1% | |

| PAX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PAX to Watchlist:  View: View:  Get Complete PAX Trend Analysis ➞ Get Complete PAX Trend Analysis ➞ | |

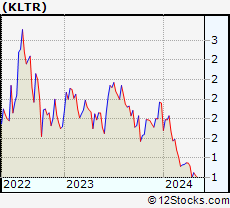

| KLTR Kaltura, Inc. |

| Sector: Technology | |

| SubSector: Software - Application | |

| MarketCap: 293 Millions | |

| Recent Price: 1.22 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.40% Day Change: -0.03 | |

| Week Change: 1.67% Year-to-date Change: -37.8% | |

| KLTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KLTR to Watchlist:  View: View:  Get Complete KLTR Trend Analysis ➞ Get Complete KLTR Trend Analysis ➞ | |

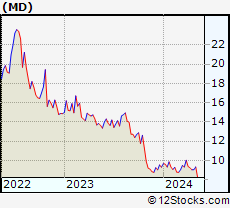

| MD MEDNAX, Inc. |

| Sector: Health Care | |

| SubSector: Specialized Health Services | |

| MarketCap: 913.656 Millions | |

| Recent Price: 9.02 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.38% Day Change: -0.22 | |

| Week Change: -0.11% Year-to-date Change: -3.0% | |

| MD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MD to Watchlist:  View: View:  Get Complete MD Trend Analysis ➞ Get Complete MD Trend Analysis ➞ | |

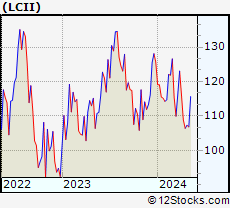

| LCII LCI Industries |

| Sector: Consumer Staples | |

| SubSector: Recreational Vehicles | |

| MarketCap: 1663.59 Millions | |

| Recent Price: 106.84 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.36% Day Change: -2.58 | |

| Week Change: 0.39% Year-to-date Change: -15.0% | |

| LCII Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LCII to Watchlist:  View: View:  Get Complete LCII Trend Analysis ➞ Get Complete LCII Trend Analysis ➞ | |

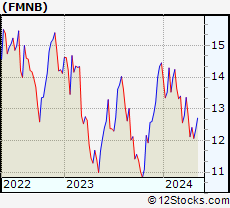

| FMNB Farmers National Banc Corp. |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 366.57 Millions | |

| Recent Price: 12.09 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.34% Day Change: -0.29 | |

| Week Change: -2.58% Year-to-date Change: -16.3% | |

| FMNB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FMNB to Watchlist:  View: View:  Get Complete FMNB Trend Analysis ➞ Get Complete FMNB Trend Analysis ➞ | |

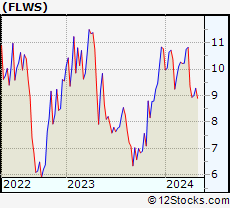

| FLWS 1-800-FLOWERS.COM, Inc. |

| Sector: Services & Goods | |

| SubSector: Specialty Retail, Other | |

| MarketCap: 940 Millions | |

| Recent Price: 9.07 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -2.05% Day Change: -0.19 | |

| Week Change: 0.78% Year-to-date Change: -15.9% | |

| FLWS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FLWS to Watchlist:  View: View:  Get Complete FLWS Trend Analysis ➞ Get Complete FLWS Trend Analysis ➞ | |

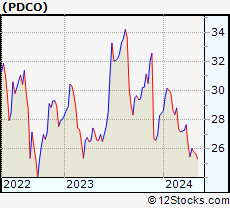

| PDCO Patterson Companies, Inc. |

| Sector: Services & Goods | |

| SubSector: Medical Equipment Wholesale | |

| MarketCap: 1672.2 Millions | |

| Recent Price: 25.67 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.95% Day Change: -0.51 | |

| Week Change: -1.35% Year-to-date Change: -9.8% | |

| PDCO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PDCO to Watchlist:  View: View:  Get Complete PDCO Trend Analysis ➞ Get Complete PDCO Trend Analysis ➞ | |

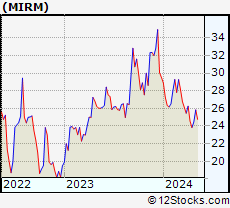

| MIRM Mirum Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 309.585 Millions | |

| Recent Price: 23.57 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.89% Day Change: -0.45 | |

| Week Change: -1.11% Year-to-date Change: -20.2% | |

| MIRM Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MIRM to Watchlist:  View: View:  Get Complete MIRM Trend Analysis ➞ Get Complete MIRM Trend Analysis ➞ | |

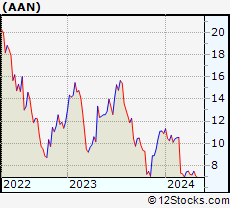

| AAN Aaron s, Inc. |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1087.04 Millions | |

| Recent Price: 7.29 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.88% Day Change: -0.14 | |

| Week Change: -2.54% Year-to-date Change: -33.0% | |

| AAN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AAN to Watchlist:  View: View:  Get Complete AAN Trend Analysis ➞ Get Complete AAN Trend Analysis ➞ | |

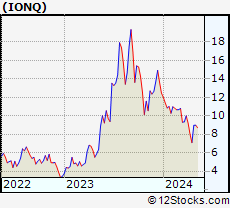

| IONQ IonQ, Inc. |

| Sector: Technology | |

| SubSector: Computer Hardware | |

| MarketCap: 2680 Millions | |

| Recent Price: 8.10 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.82% Day Change: -0.15 | |

| Week Change: 14.25% Year-to-date Change: -35.0% | |

| IONQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IONQ to Watchlist:  View: View:  Get Complete IONQ Trend Analysis ➞ Get Complete IONQ Trend Analysis ➞ | |

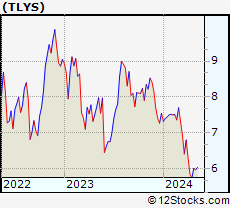

| TLYS Tilly s, Inc. |

| Sector: Services & Goods | |

| SubSector: Apparel Stores | |

| MarketCap: 127.408 Millions | |

| Recent Price: 5.80 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.78% Day Change: -0.11 | |

| Week Change: 0.96% Year-to-date Change: -23.0% | |

| TLYS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TLYS to Watchlist:  View: View:  Get Complete TLYS Trend Analysis ➞ Get Complete TLYS Trend Analysis ➞ | |

| SWI SolarWinds Corporation |

| Sector: Technology | |

| SubSector: Application Software | |

| MarketCap: 4524.62 Millions | |

| Recent Price: 11.10 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.73% Day Change: -0.19 | |

| Week Change: 1.79% Year-to-date Change: -11.2% | |

| SWI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SWI to Watchlist:  View: View:  Get Complete SWI Trend Analysis ➞ Get Complete SWI Trend Analysis ➞ | |

| HAIN The Hain Celestial Group, Inc. |

| Sector: Consumer Staples | |

| SubSector: Food Wholesale | |

| MarketCap: 2684.69 Millions | |

| Recent Price: 6.07 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.70% Day Change: -0.10 | |

| Week Change: 1.08% Year-to-date Change: -44.6% | |

| HAIN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HAIN to Watchlist:  View: View:  Get Complete HAIN Trend Analysis ➞ Get Complete HAIN Trend Analysis ➞ | |

| ARR ARMOUR Residential REIT, Inc. |

| Sector: Financials | |

| SubSector: Mortgage Investment | |

| MarketCap: 578.739 Millions | |

| Recent Price: 18.41 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.68% Day Change: -0.32 | |

| Week Change: 1.35% Year-to-date Change: -4.7% | |

| ARR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ARR to Watchlist:  View: View:  Get Complete ARR Trend Analysis ➞ Get Complete ARR Trend Analysis ➞ | |

| TUSK Mammoth Energy Services, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Drilling & Exploration | |

| MarketCap: 59.5139 Millions | |

| Recent Price: 3.29 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -1.64% Day Change: -0.06 | |

| Week Change: -1.05% Year-to-date Change: -26.1% | |

| TUSK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TUSK to Watchlist:  View: View:  Get Complete TUSK Trend Analysis ➞ Get Complete TUSK Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 , 725 - 750 , 750 - 775 , 775 - 800 , 800 - 825 , 825 - 850 , 850 - 875 , 875 - 900 , 900 - 925 , 925 - 950 , 950 - 975 , 975 - 1000 , 1000 - 1025 , 1025 - 1050 , 1050 - 1075 , 1075 - 1100 , 1100 - 1125 , 1125 - 1150 , 1150 - 1175 , 1175 - 1200 , 1200 - 1225 , 1225 - 1250 , 1250 - 1275 , 1275 - 1300 , 1300 - 1325 , 1325 - 1350 , 1350 - 1375 , 1375 - 1400 , 1400 - 1425 , 1425 - 1450 , 1450 - 1475 , 1475 - 1500 , 1500 - 1525 , 1525 - 1550 , 1550 - 1575 , 1575 - 1600 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small & MicroCap |

| Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities & Medical |

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Smallcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Ribbon [100], Diodes [100], Trustmark [100], Sanmina [100], California Water[100], NextNav [100], B. Riley[100], Third Coast[100], Northwest Natural[100], LCNB [100], Agios [100]

Best Smallcap Stocks Year-to-Date:

CareMax [572.16%], Janux [333.88%], Alpine Immune[239.52%], Longboard [218%], Super Micro[170.84%], Avidity Biosciences[159.79%], Arcutis Bio[156.19%], Vera [154.33%], Hippo [126.07%], Y-mAbs [121.85%], Stoke [115.78%] Best Smallcap Stocks This Week:

Matterport [168.39%], B. Riley[49.67%], Seres [38.35%], Ribbon [30.81%], CareMax [26.85%], ProKidney [25.74%], Riot Blockchain[25.19%], Impinj [22.93%], Cullinan Oncology[21.1%], Hibbett Sports[21%], OptiNose [18.42%] Best Smallcap Stocks Daily:

Impinj [18.26%], OptiNose [14.56%], Strategic Education[12.22%], Red Robin[8.77%], Sonic Automotive[8.63%], Intevac [7.97%], JELD-WEN Holding[7.31%], Zura Bio[6.75%], Community Health[6.44%], Seres [6.18%], Vicor [5.49%]

CareMax [572.16%], Janux [333.88%], Alpine Immune[239.52%], Longboard [218%], Super Micro[170.84%], Avidity Biosciences[159.79%], Arcutis Bio[156.19%], Vera [154.33%], Hippo [126.07%], Y-mAbs [121.85%], Stoke [115.78%] Best Smallcap Stocks This Week:

Matterport [168.39%], B. Riley[49.67%], Seres [38.35%], Ribbon [30.81%], CareMax [26.85%], ProKidney [25.74%], Riot Blockchain[25.19%], Impinj [22.93%], Cullinan Oncology[21.1%], Hibbett Sports[21%], OptiNose [18.42%] Best Smallcap Stocks Daily:

Impinj [18.26%], OptiNose [14.56%], Strategic Education[12.22%], Red Robin[8.77%], Sonic Automotive[8.63%], Intevac [7.97%], JELD-WEN Holding[7.31%], Zura Bio[6.75%], Community Health[6.44%], Seres [6.18%], Vicor [5.49%]

Login Sign Up

Login Sign Up