Best SmallCap Stocks

|

| In a hurry? Small Cap Stock Lists: Performance Trends Table, Stock Charts

Sort Small Cap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Small Cap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter Small Cap stocks list by size: All Large Medium Small and MicroCap |

| 12Stocks.com Small Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 23 (0-bearish to 100-bullish) which puts Small Cap index in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 13 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested small cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Smallcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Smallcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Smallcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| NGVT | Ingevity |   | Materials | 43.50 | 46 | -0.66 | -7.88% |

| IRON | Disc Medicine |   | Health Care | 30.09 | 17 | -0.66 | -48.13% |

| PGRE | Paramount Group |   | Financials | 4.45 | 10 | -0.67 | -13.93% |

| EAF | GrafTech |   | Industrials | 1.48 | 68 | -0.67 | -32.42% |

| MGRC | McGrath RentCorp |   | Transports | 110.77 | 18 | -0.68 | -7.40% |

| GLT | P. H. |   | Consumer Staples | 1.47 | 46 | -0.68 | -24.23% |

| BXC | BlueLinx |   | Services & Goods | 109.26 | 10 | -0.68 | -3.58% |

| AROC | Archrock |   | Energy | 18.94 | 26 | -0.68 | 22.99% |

| IOVA | Iovance Bio |   | Health Care | 11.72 | 41 | -0.68 | 44.16% |

| KOP | Koppers |   | Materials | 53.15 | 26 | -0.69 | 3.77% |

| ROCK | Gibraltar Industries |   | Materials | 71.00 | 10 | -0.69 | -10.10% |

| IESC | IES |   | Industrials | 115.90 | 36 | -0.69 | 46.30% |

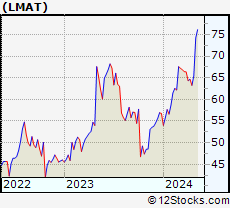

| LMAT | LeMaitre Vascular |   | Health Care | 62.60 | 26 | -0.69 | 10.30% |

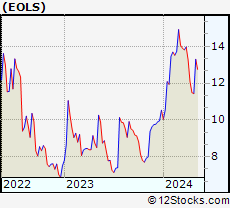

| EOLS | Evolus |   | Health Care | 11.56 | 10 | -0.69 | 9.78% |

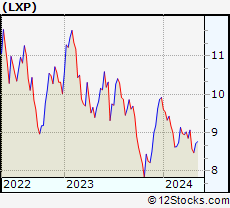

| LXP | Lexington Realty |   | Financials | 8.47 | 10 | -0.70 | -14.62% |

| BDN | Brandywine Realty |   | Financials | 4.24 | 22 | -0.70 | -21.48% |

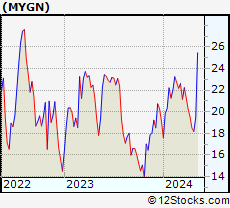

| MYGN | Myriad Genetics |   | Services & Goods | 18.51 | 10 | -0.70 | -3.29% |

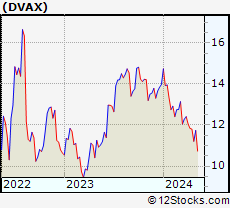

| DVAX | Dynavax |   | Health Care | 11.35 | 0 | -0.70 | -18.81% |

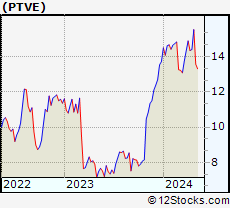

| PTVE | Pactiv Evergreen |   | Services & Goods | 14.14 | 30 | -0.70 | 3.06% |

| VRNS | Varonis Systems |   | Technology | 43.20 | 25 | -0.71 | -4.59% |

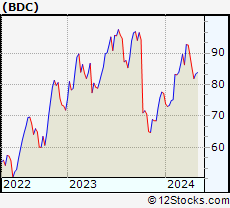

| BDC | Belden |   | Industrials | 81.74 | 46 | -0.72 | 5.81% |

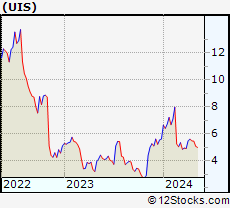

| UIS | Unisys |   | Technology | 5.49 | 57 | -0.72 | -2.31% |

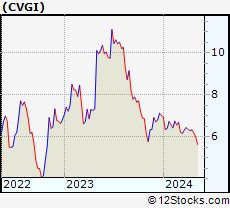

| CVGI | Commercial Vehicle |   | Services & Goods | 6.21 | 20 | -0.72 | -11.48% |

| LINC | Loln Educational |   | Services & Goods | 9.62 | 36 | -0.72 | -4.18% |

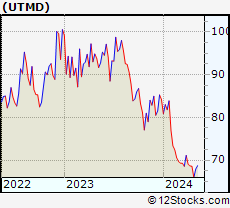

| UTMD | Utah Medical |   | Health Care | 67.13 | 20 | -0.72 | -20.29% |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small |

| Smallcap Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, & Medical |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of SmallCap Stocks |

| SmallCap Technical Overview, Leaders & Laggards, Top SmallCap ETF Funds & Detailed SmallCap Stocks List, Charts, Trends & More |

| Smallcap: Technical Analysis, Trends & YTD Performance | |

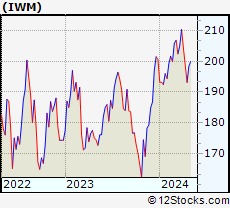

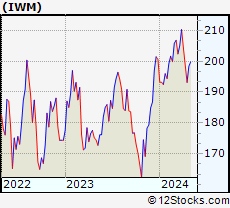

| SmallCap segment as represented by

IWM, an exchange-traded fund [ETF], holds basket of thousands of smallcap stocks from across all major sectors of the US stock market. The smallcap index (contains stocks like Riverbed & Sotheby's) is down by -3.92% and is currently underperforming the overall market by -8.11% year-to-date. Below is a quick view of technical charts and trends: | |

IWM Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Not Good | |

IWM Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 23 | |

| YTD Performance: -3.92% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Small Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Small Cap Index stocks year to date are

Now, more recently, over last week, the top performing Small Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Smallcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Smallcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Smallcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Smallcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IWM | iShares Russell 2000 |   | 192.84 | 23 | -0.08 | -2.94 | -3.92% |

| IJR | iShares Core S&P Small-Cap |   | 102.34 | 31 | 0.21 | -2.08 | -5.46% |

| VTWO | Vanguard Russell 2000 ETF |   | 77.94 | 23 | -0.14 | -2.96 | -3.9% |

| IWN | iShares Russell 2000 Value |   | 146.33 | 10 | 0.21 | -2.69 | -5.79% |

| IJS | iShares S&P Small-Cap 600 Value |   | 94.51 | 10 | 0.41 | -1.73 | -8.31% |

| IWO | iShares Russell 2000 Growth |   | 246.94 | 36 | -0.44 | -3.3 | -2.09% |

| IJT | iShares S&P Small-Cap 600 Growth |   | 121.59 | 23 | -0.21 | -2.56 | -2.84% |

| XSLV | PowerShares S&P SmallCap Low Volatil ETF |   | 41.65 | 25 | 0.56 | -1.05 | -5.66% |

| SAA | ProShares Ultra SmallCap600 |   | 21.62 | 10 | -0.18 | -4.17 | -13.35% |

| SMLV | SPDR SSGA US Small Cap Low Volatil ETF |   | 103.83 | 18 | 0.16 | -1.13 | -7.72% |

| SBB | ProShares Short SmallCap600 |   | 16.77 | 80 | -0.50 | 1.32 | 5.24% |

| SDD | ProShares UltraShort SmallCap600 |   | 20.16 | 80 | -2.14 | 1.66 | 9.41% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of SmallCap Stocks | |

|

We now take in-depth look at all SmallCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort SmallCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

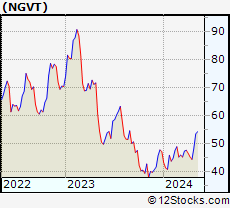

| NGVT Ingevity Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 1325.47 Millions | |

| Recent Price: 43.50 Smart Investing & Trading Score: 46 | |

| Day Percent Change: -0.66% Day Change: -0.29 | |

| Week Change: -3.91% Year-to-date Change: -7.9% | |

| NGVT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NGVT to Watchlist:  View: View:  Get Complete NGVT Trend Analysis ➞ Get Complete NGVT Trend Analysis ➞ | |

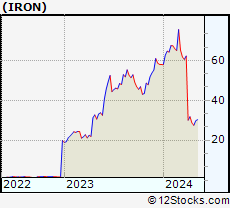

| IRON Disc Medicine Opco Inc |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 1100 Millions | |

| Recent Price: 30.09 Smart Investing & Trading Score: 17 | |

| Day Percent Change: -0.66% Day Change: -0.20 | |

| Week Change: -5.47% Year-to-date Change: -48.1% | |

| IRON Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IRON to Watchlist:  View: View:  Get Complete IRON Trend Analysis ➞ Get Complete IRON Trend Analysis ➞ | |

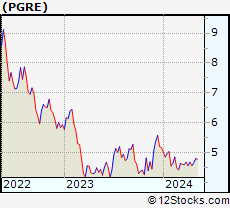

| PGRE Paramount Group, Inc. |

| Sector: Financials | |

| SubSector: Property Management | |

| MarketCap: 1722.72 Millions | |

| Recent Price: 4.45 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.67% Day Change: -0.03 | |

| Week Change: -5.12% Year-to-date Change: -13.9% | |

| PGRE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PGRE to Watchlist:  View: View:  Get Complete PGRE Trend Analysis ➞ Get Complete PGRE Trend Analysis ➞ | |

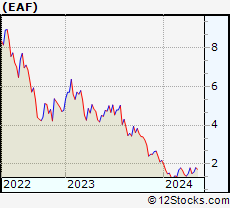

| EAF GrafTech International Ltd. |

| Sector: Industrials | |

| SubSector: Diversified Machinery | |

| MarketCap: 2084.36 Millions | |

| Recent Price: 1.48 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -0.67% Day Change: -0.01 | |

| Week Change: -17.78% Year-to-date Change: -32.4% | |

| EAF Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EAF to Watchlist:  View: View:  Get Complete EAF Trend Analysis ➞ Get Complete EAF Trend Analysis ➞ | |

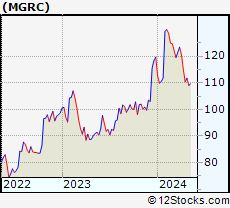

| MGRC McGrath RentCorp |

| Sector: Transports | |

| SubSector: Rental & Leasing Services | |

| MarketCap: 1289.04 Millions | |

| Recent Price: 110.77 Smart Investing & Trading Score: 18 | |

| Day Percent Change: -0.68% Day Change: -0.76 | |

| Week Change: -3.68% Year-to-date Change: -7.4% | |

| MGRC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MGRC to Watchlist:  View: View:  Get Complete MGRC Trend Analysis ➞ Get Complete MGRC Trend Analysis ➞ | |

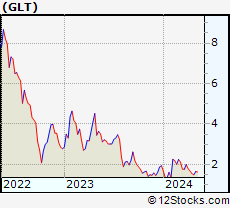

| GLT P. H. Glatfelter Company |

| Sector: Consumer Staples | |

| SubSector: Paper & Paper Products | |

| MarketCap: 525.003 Millions | |

| Recent Price: 1.47 Smart Investing & Trading Score: 46 | |

| Day Percent Change: -0.68% Day Change: -0.01 | |

| Week Change: -12.5% Year-to-date Change: -24.2% | |

| GLT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add GLT to Watchlist:  View: View:  Get Complete GLT Trend Analysis ➞ Get Complete GLT Trend Analysis ➞ | |

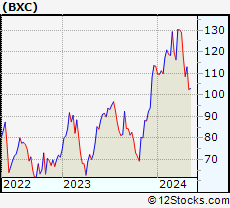

| BXC BlueLinx Holdings Inc. |

| Sector: Services & Goods | |

| SubSector: Building Materials Wholesale | |

| MarketCap: 60.7243 Millions | |

| Recent Price: 109.26 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.68% Day Change: -0.75 | |

| Week Change: -7.02% Year-to-date Change: -3.6% | |

| BXC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BXC to Watchlist:  View: View:  Get Complete BXC Trend Analysis ➞ Get Complete BXC Trend Analysis ➞ | |

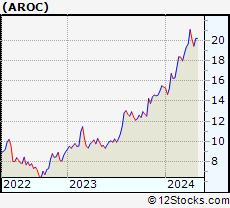

| AROC Archrock, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Equipment & Services | |

| MarketCap: 614.961 Millions | |

| Recent Price: 18.94 Smart Investing & Trading Score: 26 | |

| Day Percent Change: -0.68% Day Change: -0.13 | |

| Week Change: -5.91% Year-to-date Change: 23.0% | |

| AROC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AROC to Watchlist:  View: View:  Get Complete AROC Trend Analysis ➞ Get Complete AROC Trend Analysis ➞ | |

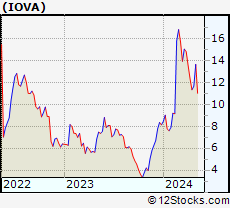

| IOVA Iovance Biotherapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 3533.35 Millions | |

| Recent Price: 11.72 Smart Investing & Trading Score: 41 | |

| Day Percent Change: -0.68% Day Change: -0.08 | |

| Week Change: -5.18% Year-to-date Change: 44.2% | |

| IOVA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IOVA to Watchlist:  View: View:  Get Complete IOVA Trend Analysis ➞ Get Complete IOVA Trend Analysis ➞ | |

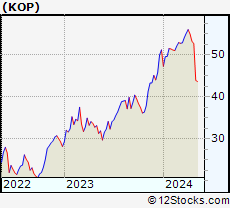

| KOP Koppers Holdings Inc. |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 232.657 Millions | |

| Recent Price: 53.15 Smart Investing & Trading Score: 26 | |

| Day Percent Change: -0.69% Day Change: -0.37 | |

| Week Change: -3.45% Year-to-date Change: 3.8% | |

| KOP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KOP to Watchlist:  View: View:  Get Complete KOP Trend Analysis ➞ Get Complete KOP Trend Analysis ➞ | |

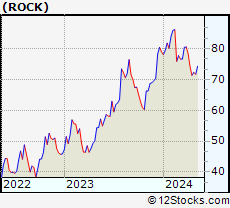

| ROCK Gibraltar Industries, Inc. |

| Sector: Materials | |

| SubSector: Steel & Iron | |

| MarketCap: 1341.08 Millions | |

| Recent Price: 71.00 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.69% Day Change: -0.50 | |

| Week Change: -4.29% Year-to-date Change: -10.1% | |

| ROCK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ROCK to Watchlist:  View: View:  Get Complete ROCK Trend Analysis ➞ Get Complete ROCK Trend Analysis ➞ | |

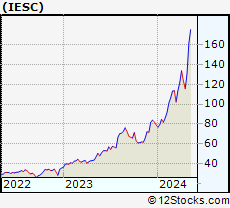

| IESC IES Holdings, Inc. |

| Sector: Industrials | |

| SubSector: General Contractors | |

| MarketCap: 380.963 Millions | |

| Recent Price: 115.90 Smart Investing & Trading Score: 36 | |

| Day Percent Change: -0.69% Day Change: -0.81 | |

| Week Change: -6.12% Year-to-date Change: 46.3% | |

| IESC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IESC to Watchlist:  View: View:  Get Complete IESC Trend Analysis ➞ Get Complete IESC Trend Analysis ➞ | |

| LMAT LeMaitre Vascular, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 522.16 Millions | |

| Recent Price: 62.60 Smart Investing & Trading Score: 26 | |

| Day Percent Change: -0.69% Day Change: -0.44 | |

| Week Change: -3.16% Year-to-date Change: 10.3% | |

| LMAT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LMAT to Watchlist:  View: View:  Get Complete LMAT Trend Analysis ➞ Get Complete LMAT Trend Analysis ➞ | |

| EOLS Evolus, Inc. |

| Sector: Health Care | |

| SubSector: Drugs - Generic | |

| MarketCap: 145.885 Millions | |

| Recent Price: 11.56 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.69% Day Change: -0.08 | |

| Week Change: -4.38% Year-to-date Change: 9.8% | |

| EOLS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EOLS to Watchlist:  View: View:  Get Complete EOLS Trend Analysis ➞ Get Complete EOLS Trend Analysis ➞ | |

| LXP Lexington Realty Trust |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 2483.43 Millions | |

| Recent Price: 8.47 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.70% Day Change: -0.06 | |

| Week Change: -6.62% Year-to-date Change: -14.6% | |

| LXP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LXP to Watchlist:  View: View:  Get Complete LXP Trend Analysis ➞ Get Complete LXP Trend Analysis ➞ | |

| BDN Brandywine Realty Trust |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 1688.13 Millions | |

| Recent Price: 4.24 Smart Investing & Trading Score: 22 | |

| Day Percent Change: -0.70% Day Change: -0.03 | |

| Week Change: -2.75% Year-to-date Change: -21.5% | |

| BDN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BDN to Watchlist:  View: View:  Get Complete BDN Trend Analysis ➞ Get Complete BDN Trend Analysis ➞ | |

| MYGN Myriad Genetics, Inc. |

| Sector: Services & Goods | |

| SubSector: Research Services | |

| MarketCap: 1051.94 Millions | |

| Recent Price: 18.51 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.70% Day Change: -0.13 | |

| Week Change: -5.32% Year-to-date Change: -3.3% | |

| MYGN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add MYGN to Watchlist:  View: View:  Get Complete MYGN Trend Analysis ➞ Get Complete MYGN Trend Analysis ➞ | |

| DVAX Dynavax Technologies Corporation |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 276.885 Millions | |

| Recent Price: 11.35 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.70% Day Change: -0.08 | |

| Week Change: -4.14% Year-to-date Change: -18.8% | |

| DVAX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DVAX to Watchlist:  View: View:  Get Complete DVAX Trend Analysis ➞ Get Complete DVAX Trend Analysis ➞ | |

| PTVE Pactiv Evergreen Inc. |

| Sector: Services & Goods | |

| SubSector: Packaging & Containers | |

| MarketCap: 33427 Millions | |

| Recent Price: 14.14 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -0.70% Day Change: -0.10 | |

| Week Change: -1.39% Year-to-date Change: 3.1% | |

| PTVE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PTVE to Watchlist:  View: View:  Get Complete PTVE Trend Analysis ➞ Get Complete PTVE Trend Analysis ➞ | |

| VRNS Varonis Systems, Inc. |

| Sector: Technology | |

| SubSector: Technical & System Software | |

| MarketCap: 1715 Millions | |

| Recent Price: 43.20 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.71% Day Change: -0.31 | |

| Week Change: -2.96% Year-to-date Change: -4.6% | |

| VRNS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VRNS to Watchlist:  View: View:  Get Complete VRNS Trend Analysis ➞ Get Complete VRNS Trend Analysis ➞ | |

| BDC Belden Inc. |

| Sector: Industrials | |

| SubSector: Industrial Electrical Equipment | |

| MarketCap: 1490.59 Millions | |

| Recent Price: 81.74 Smart Investing & Trading Score: 46 | |

| Day Percent Change: -0.72% Day Change: -0.59 | |

| Week Change: -4.13% Year-to-date Change: 5.8% | |

| BDC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BDC to Watchlist:  View: View:  Get Complete BDC Trend Analysis ➞ Get Complete BDC Trend Analysis ➞ | |

| UIS Unisys Corporation |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 803.868 Millions | |

| Recent Price: 5.49 Smart Investing & Trading Score: 57 | |

| Day Percent Change: -0.72% Day Change: -0.04 | |

| Week Change: -2.14% Year-to-date Change: -2.3% | |

| UIS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UIS to Watchlist:  View: View:  Get Complete UIS Trend Analysis ➞ Get Complete UIS Trend Analysis ➞ | |

| CVGI Commercial Vehicle Group, Inc. |

| Sector: Services & Goods | |

| SubSector: Auto Parts Wholesale | |

| MarketCap: 56.6 Millions | |

| Recent Price: 6.21 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -0.72% Day Change: -0.04 | |

| Week Change: -1.35% Year-to-date Change: -11.5% | |

| CVGI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVGI to Watchlist:  View: View:  Get Complete CVGI Trend Analysis ➞ Get Complete CVGI Trend Analysis ➞ | |

| LINC Lincoln Educational Services Corporation |

| Sector: Services & Goods | |

| SubSector: Education & Training Services | |

| MarketCap: 59.5006 Millions | |

| Recent Price: 9.62 Smart Investing & Trading Score: 36 | |

| Day Percent Change: -0.72% Day Change: -0.07 | |

| Week Change: -2.24% Year-to-date Change: -4.2% | |

| LINC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LINC to Watchlist:  View: View:  Get Complete LINC Trend Analysis ➞ Get Complete LINC Trend Analysis ➞ | |

| UTMD Utah Medical Products, Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 285.86 Millions | |

| Recent Price: 67.13 Smart Investing & Trading Score: 20 | |

| Day Percent Change: -0.72% Day Change: -0.49 | |

| Week Change: -2.23% Year-to-date Change: -20.3% | |

| UTMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add UTMD to Watchlist:  View: View:  Get Complete UTMD Trend Analysis ➞ Get Complete UTMD Trend Analysis ➞ | |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small & MicroCap |

| Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities & Medical |

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Smallcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Badger Meter[100], Cullinan Oncology[100], Oscar Health[100], NextNav [100], Richardson Electronics[100], Seneca Foods[100], Lantheus [100], Macatawa Bank[100], Geron [100], IMAX [100], Regional Management[100]

Best Smallcap Stocks Year-to-Date:

Agenus [500.31%], CareMax [417.53%], Janux [348.12%], Viking [248.9%], Alpine Immune[238.5%], Super Micro[226.74%], Longboard [194.76%], Arcutis Bio[192.57%], Vera [161.3%], Avidity Biosciences[154.87%], Hippo [128.32%] Best Smallcap Stocks This Week:

Macatawa Bank[44.53%], 23andMe Holding[33.3%], ProKidney [32%], Snap One[29.73%], Vertex Energy[23.08%], ALX Oncology[20.64%], Vanda [20.63%], Expensify [18.37%], Badger Meter[16.72%], ContextLogic [15%], Cullinan Oncology[13.89%] Best Smallcap Stocks Daily:

23andMe Holding[65.91%], Vertex Energy[30.72%], Zura Bio[17.20%], Badger Meter[16.65%], ContextLogic [15.81%], Expensify [15.23%], Montrose Environmental[12.84%], Vaxxinity [10.05%], Vuzix [9.87%], Cipher Mining[8.65%], FiscalNote [8.61%]

Agenus [500.31%], CareMax [417.53%], Janux [348.12%], Viking [248.9%], Alpine Immune[238.5%], Super Micro[226.74%], Longboard [194.76%], Arcutis Bio[192.57%], Vera [161.3%], Avidity Biosciences[154.87%], Hippo [128.32%] Best Smallcap Stocks This Week:

Macatawa Bank[44.53%], 23andMe Holding[33.3%], ProKidney [32%], Snap One[29.73%], Vertex Energy[23.08%], ALX Oncology[20.64%], Vanda [20.63%], Expensify [18.37%], Badger Meter[16.72%], ContextLogic [15%], Cullinan Oncology[13.89%] Best Smallcap Stocks Daily:

23andMe Holding[65.91%], Vertex Energy[30.72%], Zura Bio[17.20%], Badger Meter[16.65%], ContextLogic [15.81%], Expensify [15.23%], Montrose Environmental[12.84%], Vaxxinity [10.05%], Vuzix [9.87%], Cipher Mining[8.65%], FiscalNote [8.61%]

Login Sign Up

Login Sign Up