Best SmallCap Stocks

|

| In a hurry? Small Cap Stock Lists: Performance Trends Table, Stock Charts

Sort Small Cap stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Small Cap stocks list by sector: Show all, Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities and HealthCare Filter Small Cap stocks list by size: All Large Medium Small and MicroCap |

| 12Stocks.com Small Cap Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 23 (0-bearish to 100-bullish) which puts Small Cap index in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 13 and hence an improvement of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested small cap stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Smallcap Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Smallcap Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Smallcap Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | YTD Change% |

| HLNE | Hamilton Lane |   | Financials | 109.65 | 18 | -0.54% | -3.34% |

| LXP | Lexington Realty |   | Financials | 8.47 | 10 | -0.70% | -14.62% |

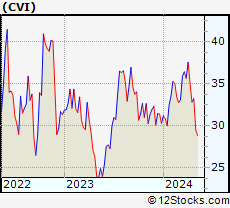

| CVI | CVR Energy |   | Energy | 32.55 | 0 | -2.57% | 7.43% |

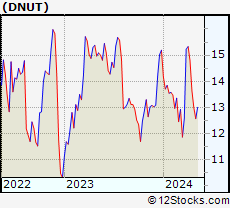

| DNUT | Krispy Kreme |   | Consumer Staples | 13.73 | 26 | -0.25% | -9.61% |

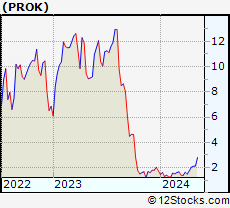

| PROK | ProKidney |   | Health Care | 2.31 | 83 | -18.37% | 32.38% |

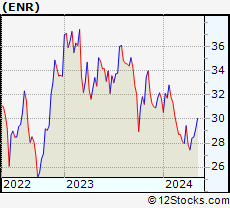

| ENR | Energizer |   | Consumer Staples | 27.97 | 42 | 1.71% | -11.71% |

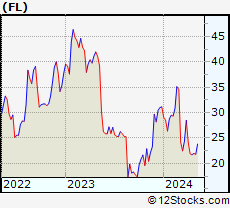

| FL | Foot Locker |   | Consumer Staples | 21.61 | 17 | -0.18% | -30.63% |

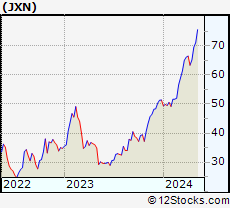

| JXN | Jackson Financial |   | Financials | 64.89 | 68 | 2.08% | 26.24% |

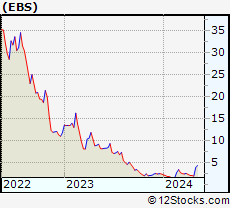

| EBS | Emergent BioSolutions |   | Health Care | 1.86 | 36 | -2.11% | -22.50% |

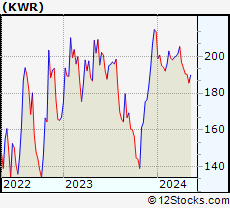

| KWR | Quaker Chemical |   | Materials | 188.00 | 10 | -0.23% | -11.91% |

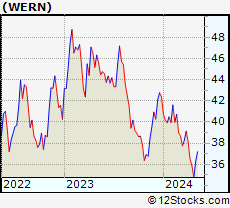

| WERN | Werner Enterprises |   | Transports | 35.26 | 0 | -0.37% | -16.78% |

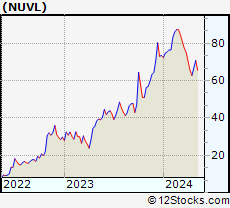

| NUVL | Nuvalent |   | Health Care | 64.23 | 17 | 0.06% | -12.60% |

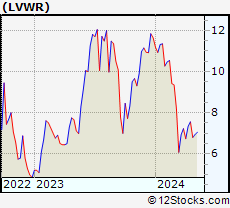

| LVWR | LiveWire Group |   | Services & Goods | 7.58 | 59 | -0.79% | -34.88% |

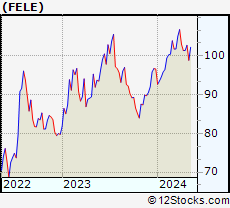

| FELE | Franklin Electric |   | Industrials | 100.51 | 51 | 0.32% | 3.99% |

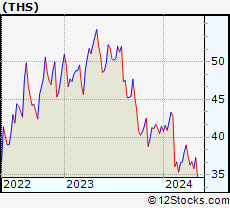

| THS | TreeHouse Foods |   | Consumer Staples | 36.63 | 52 | 2.55% | -11.63% |

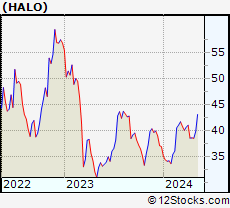

| HALO | Halozyme |   | Health Care | 37.81 | 46 | -0.55% | 2.30% |

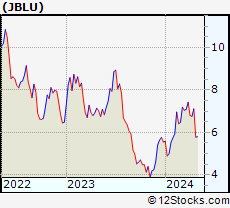

| JBLU | JetBlue Airways |   | Transports | 7.11 | 68 | 4.10% | 28.11% |

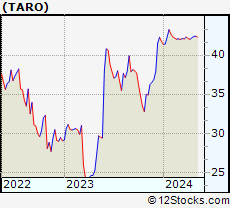

| TARO | Taro Pharmaceutical |   | Health Care | 42.19 | 49 | -0.12% | 0.98% |

| TWKS | Thoughtworks Holding |   | Technology | 2.34 | 52 | 4.00% | -51.85% |

| INDB | Independent Bank |   | Financials | 49.45 | 52 | 1.90% | -24.86% |

| ONB | Old National |   | Financials | 15.78 | 18 | 1.61% | -6.57% |

| LZ | LegalZoom.com |   | Industrials | 11.98 | 41 | -0.13% | 5.55% |

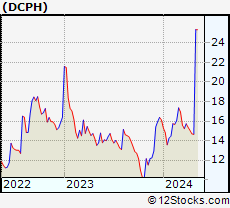

| DCPH | Deciphera |   | Health Care | 14.23 | 13 | -3.33% | -11.78% |

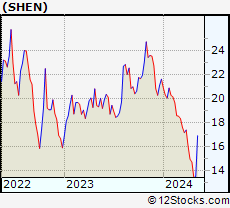

| SHEN | Shenandoah Tele |   | Technology | 14.45 | 10 | 0.49% | -33.16% |

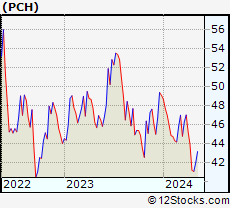

| PCH | PotlatchDeltic |   | Industrials | 40.75 | 0 | -1.02% | -17.01% |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small |

| Smallcap Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, & Medical |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of SmallCap Stocks |

| SmallCap Technical Overview, Leaders & Laggards, Top SmallCap ETF Funds & Detailed SmallCap Stocks List, Charts, Trends & More |

| Smallcap: Technical Analysis, Trends & YTD Performance | |

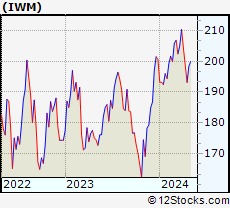

| SmallCap segment as represented by

IWM, an exchange-traded fund [ETF], holds basket of thousands of smallcap stocks from across all major sectors of the US stock market. The smallcap index (contains stocks like Riverbed & Sotheby's) is down by -3.92% and is currently underperforming the overall market by -8.11% year-to-date. Below is a quick view of technical charts and trends: | |

IWM Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Not Good | |

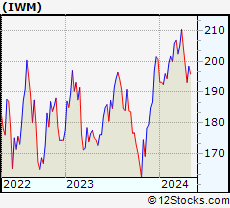

IWM Daily Chart |

|

| Short Term Trend: Not Good | |

| Overall Trend Score: 23 | |

| YTD Performance: -3.92% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Small Cap Index Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Small Cap Index stocks year to date are

Now, more recently, over last week, the top performing Small Cap Index stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Smallcap Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Smallcap index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Smallcap indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Smallcap Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| IWM | iShares Russell 2000 |   | 192.84 | 23 | -0.08 | -2.94 | -3.92% |

| IJR | iShares Core S&P Small-Cap |   | 102.34 | 31 | 0.21 | -2.08 | -5.46% |

| VTWO | Vanguard Russell 2000 ETF |   | 77.95 | 23 | -0.13 | -2.95 | -3.88% |

| IWN | iShares Russell 2000 Value |   | 146.33 | 10 | 0.21 | -2.69 | -5.79% |

| IJS | iShares S&P Small-Cap 600 Value |   | 94.51 | 10 | 0.41 | -1.73 | -8.31% |

| IWO | iShares Russell 2000 Growth |   | 246.94 | 36 | -0.44 | -3.3 | -2.09% |

| IJT | iShares S&P Small-Cap 600 Growth |   | 121.57 | 23 | -0.22 | -2.57 | -2.85% |

| XSLV | PowerShares S&P SmallCap Low Volatil ETF |   | 41.65 | 25 | 0.56 | -1.05 | -5.66% |

| SAA | ProShares Ultra SmallCap600 |   | 21.62 | 10 | -0.18 | -4.17 | -13.35% |

| SMLV | SPDR SSGA US Small Cap Low Volatil ETF |   | 103.83 | 10 | 0.16 | -1.13 | -7.72% |

| SBB | ProShares Short SmallCap600 |   | 16.98 | 95 | 0.77 | 2.62 | 6.59% |

| SDD | ProShares UltraShort SmallCap600 |   | 20.69 | 83 | 0.44 | 4.33 | 12.28% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of SmallCap Stocks | |

|

We now take in-depth look at all SmallCap stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort SmallCap stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

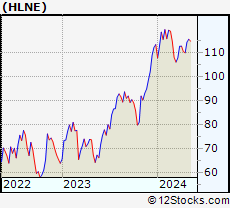

| HLNE Hamilton Lane Incorporated |

| Sector: Financials | |

| SubSector: Asset Management | |

| MarketCap: 2484.13 Millions | |

| Recent Price: 109.65 Smart Investing & Trading Score: 18 | |

| Day Percent Change: -0.54% Day Change: -0.59 | |

| Week Change: -0.8% Year-to-date Change: -3.3% | |

| HLNE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HLNE to Watchlist:  View: View:  Get Complete HLNE Trend Analysis ➞ Get Complete HLNE Trend Analysis ➞ | |

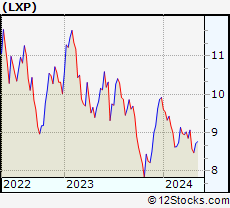

| LXP Lexington Realty Trust |

| Sector: Financials | |

| SubSector: REIT - Diversified | |

| MarketCap: 2483.43 Millions | |

| Recent Price: 8.47 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.70% Day Change: -0.06 | |

| Week Change: -6.62% Year-to-date Change: -14.6% | |

| LXP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LXP to Watchlist:  View: View:  Get Complete LXP Trend Analysis ➞ Get Complete LXP Trend Analysis ➞ | |

| CVI CVR Energy, Inc. |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 2482.14 Millions | |

| Recent Price: 32.55 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -2.57% Day Change: -0.86 | |

| Week Change: -7.37% Year-to-date Change: 7.4% | |

| CVI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CVI to Watchlist:  View: View:  Get Complete CVI Trend Analysis ➞ Get Complete CVI Trend Analysis ➞ | |

| DNUT Krispy Kreme, Inc. |

| Sector: Consumer Staples | |

| SubSector: Grocery Stores | |

| MarketCap: 2480 Millions | |

| Recent Price: 13.73 Smart Investing & Trading Score: 26 | |

| Day Percent Change: -0.25% Day Change: -0.04 | |

| Week Change: -7.2% Year-to-date Change: -9.6% | |

| DNUT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DNUT to Watchlist:  View: View:  Get Complete DNUT Trend Analysis ➞ Get Complete DNUT Trend Analysis ➞ | |

| PROK ProKidney Corp. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2470 Millions | |

| Recent Price: 2.31 Smart Investing & Trading Score: 83 | |

| Day Percent Change: -18.37% Day Change: -0.52 | |

| Week Change: 32% Year-to-date Change: 32.4% | |

| PROK Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PROK to Watchlist:  View: View:  Get Complete PROK Trend Analysis ➞ Get Complete PROK Trend Analysis ➞ | |

| ENR Energizer Holdings, Inc. |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 2469.55 Millions | |

| Recent Price: 27.97 Smart Investing & Trading Score: 42 | |

| Day Percent Change: 1.71% Day Change: 0.47 | |

| Week Change: 1.93% Year-to-date Change: -11.7% | |

| ENR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ENR to Watchlist:  View: View:  Get Complete ENR Trend Analysis ➞ Get Complete ENR Trend Analysis ➞ | |

| FL Foot Locker, Inc. |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Footwear & Accessories | |

| MarketCap: 2463.6 Millions | |

| Recent Price: 21.61 Smart Investing & Trading Score: 17 | |

| Day Percent Change: -0.18% Day Change: -0.04 | |

| Week Change: -1.41% Year-to-date Change: -30.6% | |

| FL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FL to Watchlist:  View: View:  Get Complete FL Trend Analysis ➞ Get Complete FL Trend Analysis ➞ | |

| JXN Jackson Financial Inc. |

| Sector: Financials | |

| SubSector: Insurance - Life | |

| MarketCap: 2460 Millions | |

| Recent Price: 64.89 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 2.08% Day Change: 1.33 | |

| Week Change: 2.37% Year-to-date Change: 26.2% | |

| JXN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JXN to Watchlist:  View: View:  Get Complete JXN Trend Analysis ➞ Get Complete JXN Trend Analysis ➞ | |

| EBS Emergent BioSolutions Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2417.65 Millions | |

| Recent Price: 1.86 Smart Investing & Trading Score: 36 | |

| Day Percent Change: -2.11% Day Change: -0.04 | |

| Week Change: -9.71% Year-to-date Change: -22.5% | |

| EBS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add EBS to Watchlist:  View: View:  Get Complete EBS Trend Analysis ➞ Get Complete EBS Trend Analysis ➞ | |

| KWR Quaker Chemical Corporation |

| Sector: Materials | |

| SubSector: Specialty Chemicals | |

| MarketCap: 2411.67 Millions | |

| Recent Price: 188.00 Smart Investing & Trading Score: 10 | |

| Day Percent Change: -0.23% Day Change: -0.43 | |

| Week Change: -2.98% Year-to-date Change: -11.9% | |

| KWR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add KWR to Watchlist:  View: View:  Get Complete KWR Trend Analysis ➞ Get Complete KWR Trend Analysis ➞ | |

| WERN Werner Enterprises, Inc. |

| Sector: Transports | |

| SubSector: Trucking | |

| MarketCap: 2409.65 Millions | |

| Recent Price: 35.26 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -0.37% Day Change: -0.13 | |

| Week Change: -3.45% Year-to-date Change: -16.8% | |

| WERN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add WERN to Watchlist:  View: View:  Get Complete WERN Trend Analysis ➞ Get Complete WERN Trend Analysis ➞ | |

| NUVL Nuvalent, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2400 Millions | |

| Recent Price: 64.23 Smart Investing & Trading Score: 17 | |

| Day Percent Change: 0.06% Day Change: 0.04 | |

| Week Change: -1.95% Year-to-date Change: -12.6% | |

| NUVL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NUVL to Watchlist:  View: View:  Get Complete NUVL Trend Analysis ➞ Get Complete NUVL Trend Analysis ➞ | |

| LVWR LiveWire Group, Inc. |

| Sector: Services & Goods | |

| SubSector: Auto Manufacturers | |

| MarketCap: 2400 Millions | |

| Recent Price: 7.58 Smart Investing & Trading Score: 59 | |

| Day Percent Change: -0.79% Day Change: -0.06 | |

| Week Change: 3.27% Year-to-date Change: -34.9% | |

| LVWR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LVWR to Watchlist:  View: View:  Get Complete LVWR Trend Analysis ➞ Get Complete LVWR Trend Analysis ➞ | |

| FELE Franklin Electric Co., Inc. |

| Sector: Industrials | |

| SubSector: Industrial Electrical Equipment | |

| MarketCap: 2397.89 Millions | |

| Recent Price: 100.51 Smart Investing & Trading Score: 51 | |

| Day Percent Change: 0.32% Day Change: 0.32 | |

| Week Change: -0.9% Year-to-date Change: 4.0% | |

| FELE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add FELE to Watchlist:  View: View:  Get Complete FELE Trend Analysis ➞ Get Complete FELE Trend Analysis ➞ | |

| THS TreeHouse Foods, Inc. |

| Sector: Consumer Staples | |

| SubSector: Processed & Packaged Goods | |

| MarketCap: 2392.08 Millions | |

| Recent Price: 36.63 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 2.55% Day Change: 0.91 | |

| Week Change: 0.85% Year-to-date Change: -11.6% | |

| THS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add THS to Watchlist:  View: View:  Get Complete THS Trend Analysis ➞ Get Complete THS Trend Analysis ➞ | |

| HALO Halozyme Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2383.75 Millions | |

| Recent Price: 37.81 Smart Investing & Trading Score: 46 | |

| Day Percent Change: -0.55% Day Change: -0.21 | |

| Week Change: -2.07% Year-to-date Change: 2.3% | |

| HALO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HALO to Watchlist:  View: View:  Get Complete HALO Trend Analysis ➞ Get Complete HALO Trend Analysis ➞ | |

| JBLU JetBlue Airways Corporation |

| Sector: Transports | |

| SubSector: Regional Airlines | |

| MarketCap: 2383.1 Millions | |

| Recent Price: 7.11 Smart Investing & Trading Score: 68 | |

| Day Percent Change: 4.10% Day Change: 0.28 | |

| Week Change: 5.33% Year-to-date Change: 28.1% | |

| JBLU Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add JBLU to Watchlist:  View: View:  Get Complete JBLU Trend Analysis ➞ Get Complete JBLU Trend Analysis ➞ | |

| TARO Taro Pharmaceutical Industries Ltd. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 2379.33 Millions | |

| Recent Price: 42.19 Smart Investing & Trading Score: 49 | |

| Day Percent Change: -0.12% Day Change: -0.05 | |

| Week Change: 0.36% Year-to-date Change: 1.0% | |

| TARO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TARO to Watchlist:  View: View:  Get Complete TARO Trend Analysis ➞ Get Complete TARO Trend Analysis ➞ | |

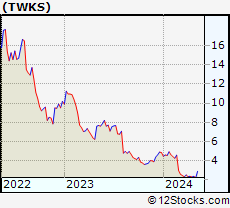

| TWKS Thoughtworks Holding, Inc. |

| Sector: Technology | |

| SubSector: Information Technology Services | |

| MarketCap: 2370 Millions | |

| Recent Price: 2.34 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 4.00% Day Change: 0.09 | |

| Week Change: -2.09% Year-to-date Change: -51.9% | |

| TWKS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TWKS to Watchlist:  View: View:  Get Complete TWKS Trend Analysis ➞ Get Complete TWKS Trend Analysis ➞ | |

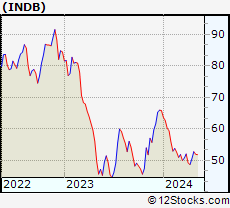

| INDB Independent Bank Corp. |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 2347.09 Millions | |

| Recent Price: 49.45 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 1.90% Day Change: 0.92 | |

| Week Change: 1.67% Year-to-date Change: -24.9% | |

| INDB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add INDB to Watchlist:  View: View:  Get Complete INDB Trend Analysis ➞ Get Complete INDB Trend Analysis ➞ | |

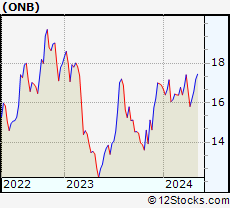

| ONB Old National Bancorp |

| Sector: Financials | |

| SubSector: Regional - Midwest Banks | |

| MarketCap: 2340.8 Millions | |

| Recent Price: 15.78 Smart Investing & Trading Score: 18 | |

| Day Percent Change: 1.61% Day Change: 0.25 | |

| Week Change: -0.19% Year-to-date Change: -6.6% | |

| ONB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ONB to Watchlist:  View: View:  Get Complete ONB Trend Analysis ➞ Get Complete ONB Trend Analysis ➞ | |

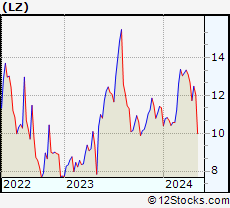

| LZ LegalZoom.com, Inc. |

| Sector: Industrials | |

| SubSector: Specialty Business Services | |

| MarketCap: 2330 Millions | |

| Recent Price: 11.98 Smart Investing & Trading Score: 41 | |

| Day Percent Change: -0.13% Day Change: -0.02 | |

| Week Change: -5.56% Year-to-date Change: 5.6% | |

| LZ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LZ to Watchlist:  View: View:  Get Complete LZ Trend Analysis ➞ Get Complete LZ Trend Analysis ➞ | |

| DCPH Deciphera Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2329.95 Millions | |

| Recent Price: 14.23 Smart Investing & Trading Score: 13 | |

| Day Percent Change: -3.33% Day Change: -0.49 | |

| Week Change: -5.45% Year-to-date Change: -11.8% | |

| DCPH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add DCPH to Watchlist:  View: View:  Get Complete DCPH Trend Analysis ➞ Get Complete DCPH Trend Analysis ➞ | |

| SHEN Shenandoah Telecommunications Company |

| Sector: Technology | |

| SubSector: Telecom Services - Domestic | |

| MarketCap: 2329.67 Millions | |

| Recent Price: 14.45 Smart Investing & Trading Score: 10 | |

| Day Percent Change: 0.49% Day Change: 0.07 | |

| Week Change: -3.22% Year-to-date Change: -33.2% | |

| SHEN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SHEN to Watchlist:  View: View:  Get Complete SHEN Trend Analysis ➞ Get Complete SHEN Trend Analysis ➞ | |

| PCH PotlatchDeltic Corporation |

| Sector: Industrials | |

| SubSector: Lumber, Wood Production | |

| MarketCap: 2314.68 Millions | |

| Recent Price: 40.75 Smart Investing & Trading Score: 0 | |

| Day Percent Change: -1.02% Day Change: -0.42 | |

| Week Change: -7.2% Year-to-date Change: -17.0% | |

| PCH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PCH to Watchlist:  View: View:  Get Complete PCH Trend Analysis ➞ Get Complete PCH Trend Analysis ➞ | |

| Too many stocks? View smallcap stocks filtered by marketcap & sector |

| Marketcap: All SmallCap Stocks (default-no microcap), Large, Mid-Range, Small & MicroCap |

| Sector: Tech, Finance, Energy, Staples, Retail, Industrial, Materials, Utilities & Medical |

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Smallcap Stocks With Best Up Trends [0-bearish to 100-bullish]: Badger Meter[100], Cullinan Oncology[100], Oscar Health[100], NextNav [100], EchoStar [100], Victory Capital[100], Macatawa Bank[100], IMAX [100], Envestnet [100], ALX Oncology[100], Argan [95]

Best Smallcap Stocks Year-to-Date:

Agenus [500.31%], CareMax [417.53%], Janux [348.12%], Viking [247.5%], Alpine Immune[238.5%], Super Micro[226.63%], Longboard [194.76%], Arcutis Bio[192.57%], Vera [161.3%], Avidity Biosciences[154.87%], Hippo [128.32%] Best Smallcap Stocks This Week:

Macatawa Bank[44.42%], 23andMe Holding[33.3%], ProKidney [32%], Snap One[29.73%], Vertex Energy[25.96%], ALX Oncology[20.64%], Vanda [20.63%], Expensify [18.37%], Badger Meter[16.72%], ContextLogic [15%], Cullinan Oncology[13.89%] Best Smallcap Stocks Daily:

23andMe Holding[65.91%], Vertex Energy[33.78%], Zura Bio[17.20%], Badger Meter[16.65%], ContextLogic [15.81%], Expensify [15.23%], Montrose Environmental[12.84%], Vaxxinity [10.05%], Cipher Mining[8.65%], FiscalNote [8.61%], Vuzix [8.15%]

Agenus [500.31%], CareMax [417.53%], Janux [348.12%], Viking [247.5%], Alpine Immune[238.5%], Super Micro[226.63%], Longboard [194.76%], Arcutis Bio[192.57%], Vera [161.3%], Avidity Biosciences[154.87%], Hippo [128.32%] Best Smallcap Stocks This Week:

Macatawa Bank[44.42%], 23andMe Holding[33.3%], ProKidney [32%], Snap One[29.73%], Vertex Energy[25.96%], ALX Oncology[20.64%], Vanda [20.63%], Expensify [18.37%], Badger Meter[16.72%], ContextLogic [15%], Cullinan Oncology[13.89%] Best Smallcap Stocks Daily:

23andMe Holding[65.91%], Vertex Energy[33.78%], Zura Bio[17.20%], Badger Meter[16.65%], ContextLogic [15.81%], Expensify [15.23%], Montrose Environmental[12.84%], Vaxxinity [10.05%], Cipher Mining[8.65%], FiscalNote [8.61%], Vuzix [8.15%]

Login Sign Up

Login Sign Up