Best Healthcare Stocks

| "Discover best trending healthcare stocks with 12Stocks.com." |

| - Subu Vdaygiri, Founder, 12Stocks.com |

| In a hurry? Healthcare Stocks Lists: Performance Trends Table, Stock Charts

Sort Healthcare stocks: Daily, Weekly, Year-to-Date, Market Cap & Trends. Filter Healthcare stocks list by size:All Healthcare Large Mid-Range Small |

| 12Stocks.com Healthcare Stocks Performances & Trends Daily | |||||||||

|

|  The overall Smart Investing & Trading Score is 38 (0-bearish to 100-bullish) which puts Healthcare sector in short term bearish to neutral trend. The Smart Investing & Trading Score from previous trading session is 52 and hence a deterioration of trend.

| ||||||||

Here are the Smart Investing & Trading Scores of the most requested Healthcare stocks at 12Stocks.com (click stock name for detailed review):

|

| 12Stocks.com: Investing in Healthcare sector with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by Smart Investing & Trading Score) of various

stocks in the Healthcare sector. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term Technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Healthcare Sector

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score | Change % | Weekly Change% |

| TEVA | Teva |   | Pharmaceutical | 13.13 | 58 | 0.88% | 2.06% |

| CUTR | Cutera |   | Equipment | 1.99 | 52 | 1.53% | 2.05% |

| BLCO | Bausch + |   | Instruments | 14.94 | 51 | 0.54% | 2.05% |

| HUMA | Humacyte |   | Biotechnology | 3.77 | 76 | -1.18% | 2.03% |

| NVO | Novo Nordisk |   | Biotechnology | 125.19 | 71 | -0.77% | 2.02% |

| BDSX | Biodesix |   | Diagnostics & Research | 1.26 | 32 | 0.00% | 2.02% |

| ITOS | iTeos |   | Biotechnology | 10.45 | 61 | -1.23% | 2.00% |

| AIQ | Alliance |   | Laboratories | 32.08 | 44 | -1.19% | 1.95% |

| NEOG | Neogen |   | Diagnostic | 11.84 | 35 | -4.32% | 1.94% |

| RARE | Ultragenyx |   | Biotechnology | 43.17 | 50 | -2.50% | 1.90% |

| IRWD | Ironwood |   | Pharmaceutical | 8.06 | 52 | -0.43% | 1.83% |

| VMD | Viemed |   | Equipment | 8.02 | 25 | -0.87% | 1.78% |

| CSTL | Castle Biosciences |   | Laboratories | 19.62 | 47 | -1.21% | 1.76% |

| BWAY | Brainsway |   | Laboratories | 4.92 | 35 | -2.19% | 1.76% |

| TLRY | Tilray |   | Pharmaceutical | 1.76 | 30 | -4.35% | 1.73% |

| OCS | Oculis Holding |   | Biotechnology | 11.98 | 47 | -0.21% | 1.66% |

| PRGO | Perrigo |   | Pharmaceutical | 31.31 | 67 | 0.24% | 1.64% |

| SENS | Senseonics |   | Equipment | 0.41 | 35 | -6.30% | 1.63% |

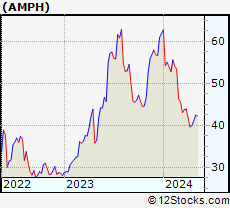

| AMPH | Amphastar |   | Pharmaceutical | 40.66 | 42 | -0.83% | 1.62% |

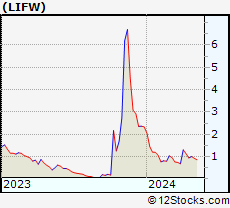

| LIFW | MSP Recovery |   | Health Information | 0.96 | 68 | -14.74% | 1.62% |

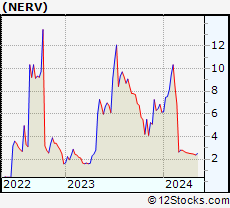

| NERV | Minerva Neurosciences |   | Biotechnology | 2.52 | 30 | 0.00% | 1.61% |

| CIVI | Civitas |   | Long-Term | 73.79 | 15 | 0.31% | 1.60% |

| BAX | Baxter |   | Instruments | 40.08 | 53 | -2.09% | 1.53% |

| XENE | Xenon |   | Biotechnology | 40.48 | 0 | 2.48% | 1.50% |

| BCLI | Brainstorm Cell |   | Biotechnology | 0.54 | 54 | -0.92% | 1.50% |

| For chart view version of above stock list: Chart View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

| Detailed Overview of Healthcare Stocks |

| Healthcare Technical Overview, Leaders & Laggards, Top Healthcare ETF Funds & Detailed Healthcare Stocks List, Charts, Trends & More |

| Healthcare Sector: Technical Analysis, Trends & YTD Performance | |

| Healthcare sector is composed of stocks

from pharmaceutical, biotech, diagnostics labs, insurance providers

and healthcare services. Healthcare sector, as represented by XLV, an exchange-traded fund [ETF] that holds basket of Healthcare stocks (e.g, Merck, Amgen) is up by 2.52% and is currently underperforming the overall market by -2.33% year-to-date. Below is a quick view of Technical charts and trends: |

|

XLV Weekly Chart |

|

| Long Term Trend: Not Good | |

| Medium Term Trend: Not Good | |

XLV Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 38 | |

| YTD Performance: 2.52% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Healthcare Sector Stocks | ||||||||||||||||||||||||||||||||||||||||||||||||

The top performing Healthcare sector stocks year to date are

Now, more recently, over last week, the top performing Healthcare sector stocks on the move are

|

||||||||||||||||||||||||||||||||||||||||||||||||

| 12Stocks.com: Investing in Healthcare Sector using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Healthcare Index. For detailed view, check out our ETF Funds section of our website. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term Technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Healthcare Index

| Ticker | ETF Name | Watchlist | Recent Price | Smart Investing & Trading Score | Change % | Week % | Year-to-date % |

| XLV | Health Care |   | 139.81 | 38 | -0.75 | 0.62 | 2.52% |

| XBI | Biotech |   | 82.08 | 25 | -2.22 | -0.91 | -8.08% |

| IBB | Biotechnology |   | 125.78 | 18 | -1.55 | 0.85 | -7.41% |

| BBH | Biotech |   | 157.33 | 49 | 0.00 | 3.26 | -4.83% |

| VHT | Health Care |   | 255.08 | 45 | -0.85 | 0.69 | 1.75% |

| IYH | Healthcare |   | 58.65 | 45 | -0.74 | 0.84 | 2.45% |

| IHF | Healthcare Providers |   | 52.11 | 55 | -0.29 | -0.19 | -0.76% |

| IHI | Medical Devices |   | 55.28 | 43 | -0.64 | 1.7 | 2.44% |

| BIB | Biotechnology |   | 50.12 | 32 | -0.12 | 3.98 | -12.15% |

| BIS | Short Biotech |   | 20.09 | 61 | 0.00 | -3.85 | 11.18% |

| XHE | Health Care Equipment |   | 81.78 | 28 | -1.72 | 0.63 | -2.94% |

| CURE | Healthcare Bull 3X |   | 105.25 | 25 | -2.41 | 1.86 | 3.45% |

| LABU | Biotech Bull 3X |   | 83.50 | 25 | -6.60 | -2.96 | -31.54% |

| LABD | Biotech Bear 3X |   | 11.04 | 75 | 6.46 | 2.22 | 13.93% |

| PSCH | SmallCap Health Care |   | 40.34 | 35 | -1.89 | 0.41 | -5.74% |

| XHS | Health Care Services |   | 87.57 | 68 | -1.27 | 0.56 | -1.55% |

| PTH | DWA Healthcare Momentum |   | 39.60 | 46 | -0.08 | 0.18 | 1.18% |

| BTEC | Principal Healthcare Innovators |   | 34.21 | 32 | 0.02 | 1.04 | -5.83% |

| RXL | Health Care |   | 94.38 | 17 | -1.69 | 1.24 | 3.26% |

| RXD | Short Health Care |   | 11.41 | 71 | 0.57 | -1.98 | -4.33% |

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Healthcare Stocks | |

|

We now take in-depth look at all Healthcare stocks including charts, multi-period performances and overall trends (as measured by Smart Investing & Trading Score). One can sort Healthcare stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily Technical stock chart and over "Weekly" to view weekly Technical stock chart. | |||||

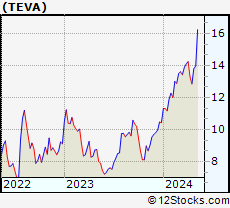

| TEVA Teva Pharmaceutical Industries Limited |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 9369.93 Millions | |

| Recent Price: 13.13 Smart Investing & Trading Score: 58 | |

| Day Percent Change: 0.88% Day Change: 0.12 | |

| Week Change: 2.06% Year-to-date Change: 25.7% | |

| TEVA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TEVA to Watchlist:  View: View:  Get Complete TEVA Trend Analysis ➞ Get Complete TEVA Trend Analysis ➞ | |

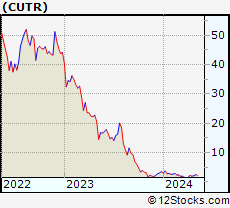

| CUTR Cutera, Inc. |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 143.68 Millions | |

| Recent Price: 1.99 Smart Investing & Trading Score: 52 | |

| Day Percent Change: 1.53% Day Change: 0.03 | |

| Week Change: 2.05% Year-to-date Change: -43.6% | |

| CUTR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CUTR to Watchlist:  View: View:  Get Complete CUTR Trend Analysis ➞ Get Complete CUTR Trend Analysis ➞ | |

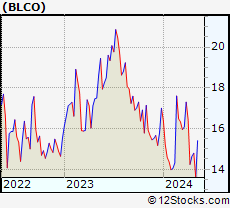

| BLCO Bausch + Lomb Corporation |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 7100 Millions | |

| Recent Price: 14.94 Smart Investing & Trading Score: 51 | |

| Day Percent Change: 0.54% Day Change: 0.08 | |

| Week Change: 2.05% Year-to-date Change: -12.1% | |

| BLCO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BLCO to Watchlist:  View: View:  Get Complete BLCO Trend Analysis ➞ Get Complete BLCO Trend Analysis ➞ | |

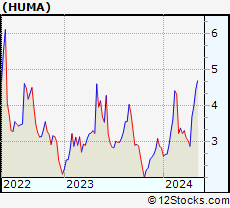

| HUMA Humacyte, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 297 Millions | |

| Recent Price: 3.77 Smart Investing & Trading Score: 76 | |

| Day Percent Change: -1.18% Day Change: -0.04 | |

| Week Change: 2.03% Year-to-date Change: 32.9% | |

| HUMA Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add HUMA to Watchlist:  View: View:  Get Complete HUMA Trend Analysis ➞ Get Complete HUMA Trend Analysis ➞ | |

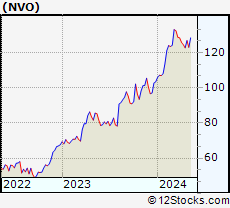

| NVO Novo Nordisk A/S |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 100744 Millions | |

| Recent Price: 125.19 Smart Investing & Trading Score: 71 | |

| Day Percent Change: -0.77% Day Change: -0.97 | |

| Week Change: 2.02% Year-to-date Change: 21.0% | |

| NVO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NVO to Watchlist:  View: View:  Get Complete NVO Trend Analysis ➞ Get Complete NVO Trend Analysis ➞ | |

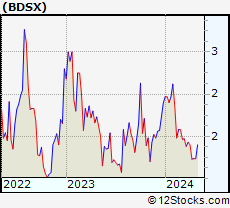

| BDSX Biodesix, Inc. |

| Sector: Health Care | |

| SubSector: Diagnostics & Research | |

| MarketCap: 41487 Millions | |

| Recent Price: 1.26 Smart Investing & Trading Score: 32 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: 2.02% Year-to-date Change: -33.7% | |

| BDSX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BDSX to Watchlist:  View: View:  Get Complete BDSX Trend Analysis ➞ Get Complete BDSX Trend Analysis ➞ | |

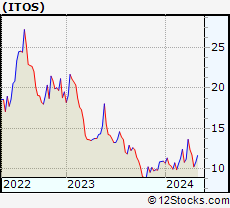

| ITOS iTeos Therapeutics, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 10487 Millions | |

| Recent Price: 10.45 Smart Investing & Trading Score: 61 | |

| Day Percent Change: -1.23% Day Change: -0.13 | |

| Week Change: 2% Year-to-date Change: -4.5% | |

| ITOS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add ITOS to Watchlist:  View: View:  Get Complete ITOS Trend Analysis ➞ Get Complete ITOS Trend Analysis ➞ | |

| AIQ Alliance Healthcare Services, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 105.79 Millions | |

| Recent Price: 32.08 Smart Investing & Trading Score: 44 | |

| Day Percent Change: -1.19% Day Change: -0.38 | |

| Week Change: 1.95% Year-to-date Change: 2.9% | |

| AIQ Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AIQ to Watchlist:  View: View:  Get Complete AIQ Trend Analysis ➞ Get Complete AIQ Trend Analysis ➞ | |

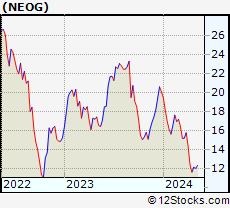

| NEOG Neogen Corporation |

| Sector: Health Care | |

| SubSector: Diagnostic Substances | |

| MarketCap: 3234.71 Millions | |

| Recent Price: 11.84 Smart Investing & Trading Score: 35 | |

| Day Percent Change: -4.32% Day Change: -0.53 | |

| Week Change: 1.94% Year-to-date Change: -41.2% | |

| NEOG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NEOG to Watchlist:  View: View:  Get Complete NEOG Trend Analysis ➞ Get Complete NEOG Trend Analysis ➞ | |

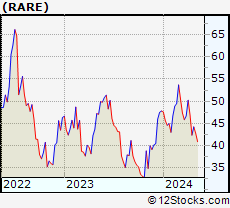

| RARE Ultragenyx Pharmaceutical Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 2373.35 Millions | |

| Recent Price: 43.17 Smart Investing & Trading Score: 50 | |

| Day Percent Change: -2.50% Day Change: -1.11 | |

| Week Change: 1.9% Year-to-date Change: -9.7% | |

| RARE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add RARE to Watchlist:  View: View:  Get Complete RARE Trend Analysis ➞ Get Complete RARE Trend Analysis ➞ | |

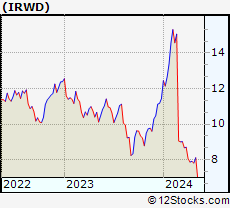

| IRWD Ironwood Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Drugs - Generic | |

| MarketCap: 1616.35 Millions | |

| Recent Price: 8.06 Smart Investing & Trading Score: 52 | |

| Day Percent Change: -0.43% Day Change: -0.04 | |

| Week Change: 1.83% Year-to-date Change: -29.5% | |

| IRWD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add IRWD to Watchlist:  View: View:  Get Complete IRWD Trend Analysis ➞ Get Complete IRWD Trend Analysis ➞ | |

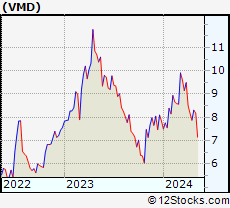

| VMD Viemed Healthcare, Inc. |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 177.28 Millions | |

| Recent Price: 8.02 Smart Investing & Trading Score: 25 | |

| Day Percent Change: -0.87% Day Change: -0.07 | |

| Week Change: 1.78% Year-to-date Change: 2.2% | |

| VMD Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add VMD to Watchlist:  View: View:  Get Complete VMD Trend Analysis ➞ Get Complete VMD Trend Analysis ➞ | |

| CSTL Castle Biosciences, Inc. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 545 Millions | |

| Recent Price: 19.62 Smart Investing & Trading Score: 47 | |

| Day Percent Change: -1.21% Day Change: -0.24 | |

| Week Change: 1.76% Year-to-date Change: -9.1% | |

| CSTL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CSTL to Watchlist:  View: View:  Get Complete CSTL Trend Analysis ➞ Get Complete CSTL Trend Analysis ➞ | |

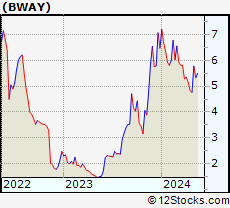

| BWAY Brainsway Ltd. |

| Sector: Health Care | |

| SubSector: Medical Laboratories & Research | |

| MarketCap: 65.03 Millions | |

| Recent Price: 4.92 Smart Investing & Trading Score: 35 | |

| Day Percent Change: -2.19% Day Change: -0.11 | |

| Week Change: 1.76% Year-to-date Change: -24.1% | |

| BWAY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BWAY to Watchlist:  View: View:  Get Complete BWAY Trend Analysis ➞ Get Complete BWAY Trend Analysis ➞ | |

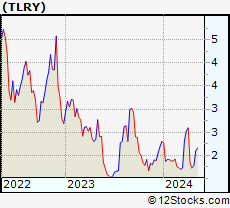

| TLRY Tilray, Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 452.533 Millions | |

| Recent Price: 1.76 Smart Investing & Trading Score: 30 | |

| Day Percent Change: -4.35% Day Change: -0.08 | |

| Week Change: 1.73% Year-to-date Change: -23.5% | |

| TLRY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add TLRY to Watchlist:  View: View:  Get Complete TLRY Trend Analysis ➞ Get Complete TLRY Trend Analysis ➞ | |

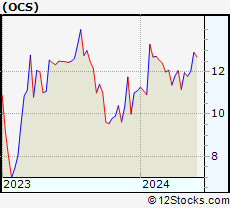

| OCS Oculis Holding AG |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 460 Millions | |

| Recent Price: 11.98 Smart Investing & Trading Score: 47 | |

| Day Percent Change: -0.21% Day Change: -0.03 | |

| Week Change: 1.66% Year-to-date Change: 7.9% | |

| OCS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add OCS to Watchlist:  View: View:  Get Complete OCS Trend Analysis ➞ Get Complete OCS Trend Analysis ➞ | |

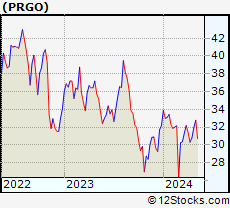

| PRGO Perrigo Company plc |

| Sector: Health Care | |

| SubSector: Drug Related Products | |

| MarketCap: 6493.93 Millions | |

| Recent Price: 31.31 Smart Investing & Trading Score: 67 | |

| Day Percent Change: 0.24% Day Change: 0.07 | |

| Week Change: 1.64% Year-to-date Change: -2.7% | |

| PRGO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add PRGO to Watchlist:  View: View:  Get Complete PRGO Trend Analysis ➞ Get Complete PRGO Trend Analysis ➞ | |

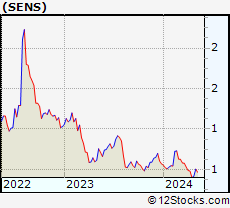

| SENS Senseonics Holdings, Inc. |

| Sector: Health Care | |

| SubSector: Medical Appliances & Equipment | |

| MarketCap: 154.38 Millions | |

| Recent Price: 0.41 Smart Investing & Trading Score: 35 | |

| Day Percent Change: -6.30% Day Change: -0.03 | |

| Week Change: 1.63% Year-to-date Change: -28.8% | |

| SENS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add SENS to Watchlist:  View: View:  Get Complete SENS Trend Analysis ➞ Get Complete SENS Trend Analysis ➞ | |

| AMPH Amphastar Pharmaceuticals, Inc. |

| Sector: Health Care | |

| SubSector: Drug Manufacturers - Other | |

| MarketCap: 655.533 Millions | |

| Recent Price: 40.66 Smart Investing & Trading Score: 42 | |

| Day Percent Change: -0.83% Day Change: -0.34 | |

| Week Change: 1.62% Year-to-date Change: -34.3% | |

| AMPH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add AMPH to Watchlist:  View: View:  Get Complete AMPH Trend Analysis ➞ Get Complete AMPH Trend Analysis ➞ | |

| LIFW MSP Recovery, Inc. |

| Sector: Health Care | |

| SubSector: Health Information Services | |

| MarketCap: 1110 Millions | |

| Recent Price: 0.96 Smart Investing & Trading Score: 68 | |

| Day Percent Change: -14.74% Day Change: -0.17 | |

| Week Change: 1.62% Year-to-date Change: -58.8% | |

| LIFW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add LIFW to Watchlist:  View: View:  Get Complete LIFW Trend Analysis ➞ Get Complete LIFW Trend Analysis ➞ | |

| NERV Minerva Neurosciences, Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 223.385 Millions | |

| Recent Price: 2.52 Smart Investing & Trading Score: 30 | |

| Day Percent Change: 0.00% Day Change: 0.00 | |

| Week Change: 1.61% Year-to-date Change: -59.0% | |

| NERV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add NERV to Watchlist:  View: View:  Get Complete NERV Trend Analysis ➞ Get Complete NERV Trend Analysis ➞ | |

| CIVI Civitas Solutions, Inc. |

| Sector: Health Care | |

| SubSector: Long-Term Care Facilities | |

| MarketCap: 625.74 Millions | |

| Recent Price: 73.79 Smart Investing & Trading Score: 15 | |

| Day Percent Change: 0.31% Day Change: 0.23 | |

| Week Change: 1.6% Year-to-date Change: 7.9% | |

| CIVI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add CIVI to Watchlist:  View: View:  Get Complete CIVI Trend Analysis ➞ Get Complete CIVI Trend Analysis ➞ | |

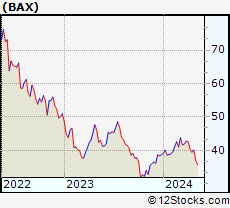

| BAX Baxter International Inc. |

| Sector: Health Care | |

| SubSector: Medical Instruments & Supplies | |

| MarketCap: 39955.8 Millions | |

| Recent Price: 40.08 Smart Investing & Trading Score: 53 | |

| Day Percent Change: -2.09% Day Change: -0.85 | |

| Week Change: 1.53% Year-to-date Change: 3.7% | |

| BAX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BAX to Watchlist:  View: View:  Get Complete BAX Trend Analysis ➞ Get Complete BAX Trend Analysis ➞ | |

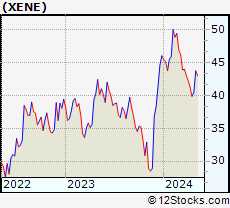

| XENE Xenon Pharmaceuticals Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 388.585 Millions | |

| Recent Price: 40.48 Smart Investing & Trading Score: 0 | |

| Day Percent Change: 2.48% Day Change: 0.98 | |

| Week Change: 1.5% Year-to-date Change: -12.1% | |

| XENE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add XENE to Watchlist:  View: View:  Get Complete XENE Trend Analysis ➞ Get Complete XENE Trend Analysis ➞ | |

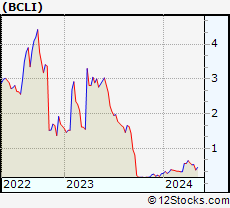

| BCLI Brainstorm Cell Therapeutics Inc. |

| Sector: Health Care | |

| SubSector: Biotechnology | |

| MarketCap: 141.285 Millions | |

| Recent Price: 0.54 Smart Investing & Trading Score: 54 | |

| Day Percent Change: -0.92% Day Change: -0.01 | |

| Week Change: 1.5% Year-to-date Change: 97.8% | |

| BCLI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Add BCLI to Watchlist:  View: View:  Get Complete BCLI Trend Analysis ➞ Get Complete BCLI Trend Analysis ➞ | |

| For tabular summary view of above stock list: Summary View ➞ 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 , 100 - 125 , 125 - 150 , 150 - 175 , 175 - 200 , 200 - 225 , 225 - 250 , 250 - 275 , 275 - 300 , 300 - 325 , 325 - 350 , 350 - 375 , 375 - 400 , 400 - 425 , 425 - 450 , 450 - 475 , 475 - 500 , 500 - 525 , 525 - 550 , 550 - 575 , 575 - 600 , 600 - 625 , 625 - 650 , 650 - 675 , 675 - 700 , 700 - 725 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

Best Stocks Today 12Stocks.com |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Healthcare Stocks With Best Up Trends [0-bearish to 100-bullish]: AstraZeneca [100], Merck [100], Annovis Bio[100], Tandem Diabetes[100], Agios [100], Boston Scientific[100], Haemonetics [100], Agenus [95], Mesoblast [95], Avadel [93], Cullinan Oncology[93]

Best Healthcare Stocks Year-to-Date:

Pieris [6273.63%], Precision BioSciences[2590.41%], Inovio [1864.71%], Assembly Biosciences[1543.7%], Aurora Cannabis[1348.97%], NuCana [1198.17%], Adverum Biotechnologies[1152.66%], Agenus [882.61%], Affimed N.V[671.2%], CareMax [572.16%], Mesoblast [464.55%] Best Healthcare Stocks This Week:

Pieris [7900%], Agenus [53.2%], VolitionRx [50.97%], BeyondSpring [35%], Seres [33.67%], Annovis Bio[30%], ProKidney [27.45%], CareMax [26.85%], Cullinan Oncology[21.1%], Mesoblast [19.19%], OptiNose [18.42%] Best Healthcare Stocks Daily:

VolitionRx [16.25%], OptiNose [14.56%], ADiTx [10.57%], Agenus [9.64%], Structure [7.74%], Merus N.V[7.33%], CASI [6.97%], LENSAR [6.92%], Community Health[6.77%], Zura Bio[6.75%], Sanofi [6.20%]

Pieris [6273.63%], Precision BioSciences[2590.41%], Inovio [1864.71%], Assembly Biosciences[1543.7%], Aurora Cannabis[1348.97%], NuCana [1198.17%], Adverum Biotechnologies[1152.66%], Agenus [882.61%], Affimed N.V[671.2%], CareMax [572.16%], Mesoblast [464.55%] Best Healthcare Stocks This Week:

Pieris [7900%], Agenus [53.2%], VolitionRx [50.97%], BeyondSpring [35%], Seres [33.67%], Annovis Bio[30%], ProKidney [27.45%], CareMax [26.85%], Cullinan Oncology[21.1%], Mesoblast [19.19%], OptiNose [18.42%] Best Healthcare Stocks Daily:

VolitionRx [16.25%], OptiNose [14.56%], ADiTx [10.57%], Agenus [9.64%], Structure [7.74%], Merus N.V[7.33%], CASI [6.97%], LENSAR [6.92%], Community Health[6.77%], Zura Bio[6.75%], Sanofi [6.20%]

Login Sign Up

Login Sign Up