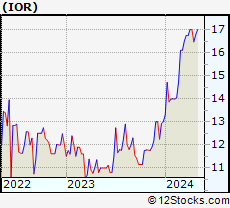

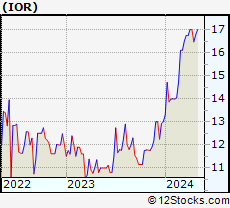

Stock Charts, Performance & Trend Analysis for IOR

Income Opportunity Realty Investors, Inc.

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Stocks Similar To Income Opportunity

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The table below shows stocks similar to Income Opportunity Realty Investors, Inc., i.e, from same subsector or sector along with year-to-date (26.6% YTD), weekly (0%) & daily performaces for comparison. Usually, stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Compare 12Stocks.com Smart Investing & Trading Scores to see which stocks in this sector are trending better currently. Click on ticker or stock name for detailed view (place cursor on ticker or stock name to view charts quickly). Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. | ||||||||||

| ||||||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Smart Investing & Trading Score [0 to 100] | Change % | Weekly Change% | YTD Change% | ||

| AMT | American Tower |   | REIT | 173.35 | 32 | -0.48 | 1.2 | -19.70% | ||

| PLD | Prologis |   | REIT | 103.18 | 18 | -1.57 | -0.3 | -22.60% | ||

| BAM | Brookfield Asset |   | REIT | 39.18 | 37 | -1.04 | 2.2 | -2.46% | ||

| EQIX | Equinix |   | REIT | 756.84 | 32 | -0.66 | 1.2 | -6.03% | ||

| PSA | Public Storage |   | REIT | 262.17 | 18 | -0.02 | 0.7 | -14.04% | ||

| DLR | Digital Realty |   | REIT | 140.61 | 55 | 1.50 | 2.8 | 4.48% | ||

| EQR | Equity Residential |   | REIT | 64.61 | 100 | 2.41 | 5.0 | 5.64% | ||

| CSGP | CoStar |   | REIT | 91.95 | 80 | 8.66 | 9.1 | 5.22% | ||

| WELL | Welltower |   | REIT | 93.70 | 80 | 0.83 | 2.6 | 3.91% | ||

| AVB | AvalonBay Communities |   | REIT | 191.34 | 100 | 1.42 | 3.9 | 2.20% | ||

| SPG | Simon Property |   | REIT | 142.81 | 51 | -0.67 | 1.7 | 0.12% | ||

| O | Realty Income |   | REIT | 53.67 | 74 | 0.52 | 1.2 | -6.53% | ||

| ARE | Alexandria Real |   | REIT | 119.65 | 35 | 0.13 | 3.4 | -5.62% | ||

| BXP | Boston Properties |   | REIT | 62.94 | 74 | 0.02 | 4.6 | -10.30% | ||

| ESS | Essex Property |   | REIT | 247.74 | 100 | 2.31 | 5.4 | -0.08% | ||

| CBRE | CBRE |   | REIT | 86.77 | 36 | -0.39 | 2.2 | -6.79% | ||

| MAA | Mid-America Apartment |   | REIT | 128.40 | 86 | 0.71 | 1.8 | -4.51% | ||

| SUI | Sun Communities |   | REIT | 120.30 | 59 | 0.22 | 2.2 | -9.99% | ||

| EXR | Extra Space |   | REIT | 134.64 | 35 | 1.02 | 1.7 | -16.02% | ||

| VTR | Ventas |   | REIT | 43.61 | 67 | 0.11 | 1.1 | -12.50% | ||

| UDR | UDR |   | REIT | 37.89 | 100 | 1.66 | 4.1 | -1.04% | ||

| INVH | Invitation Homes |   | REIT | 34.31 | 75 | 0.53 | 2.2 | 0.59% | ||

| ELS | Equity LifeStyle |   | REIT | 61.32 | 17 | -0.73 | -2.3 | -13.07% | ||

| WPC | W. P. |   | REIT | 56.46 | 60 | 0.27 | 0.4 | -12.88% | ||

| MPW | Properties |   | REIT | 4.57 | 78 | -1.51 | 3.4 | -6.92% | ||

| V | Visa |   | Credit | 275.02 | 52 | 0.33 | 1.9 | 5.63% | ||

| JPM | Chase |   | Banks | 193.08 | 70 | 0.49 | 3.9 | 13.51% | ||

| MA | Mastercard |   | Credit | 462.50 | 58 | -0.07 | 1.6 | 8.44% | ||

| BAC | Bank of America |   | Banks | 38.32 | 100 | -0.13 | 3.7 | 13.81% | ||

| IVV | Core |   | Financial | 507.97 | 63 | -0.04 | 2.1 | 6.35% | ||

| BRK.A | BERKSHIRE HTH-A |   | Finance | 611241.00 | 63 | -0.64 | 0.0 | 12.49% | ||

| WFC | Wells Fargo |   | Banks | 60.60 | 71 | -0.56 | 0.4 | 23.12% | ||

Technical Levels: For the trading inclined, the following are the key levels of resistance (ceiling) and support (floor) for IOR. Ceiling and floor levels are stock prices at which the stock trend gets resistance or support respectively. Stocks & their trends tend to pause at these levels and hence traders have an eye on them. Long term levels are more important. Stocks that have broken thru their resistance or support levels convincingly tend to have stronger trends (confirm with charts above visually). |

| Key Technical Levels for IOR | |||

| Short Term | Weekly | Long Term | |

| Resistance (Ceiling) | |||

| Support (Floor) | |||

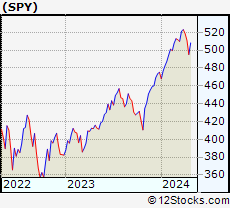

| RELATIVE PERFORMANCE OF Income Opportunity Realty Investors, Inc. Vs THE MARKET | ||||

| Relative performance of Income Opportunity Realty Investors, Inc. Compared to Overall Market | ||||

| How is IOR faring versus the market [S&P 500] ? Is it lagging or leading ? How is its relative performance ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| SPY | 0.02% | 2.21% | 5.66% | |

| IOR | -3.09% | 0.02% | 26.59% | |

IOR Chart |  S&P 500 (Market) Chart | |||

| Year to date returns, IOR is outperforming the market by 20.93% | |

| This week, IOR is underperforming the market by -2.19% | |

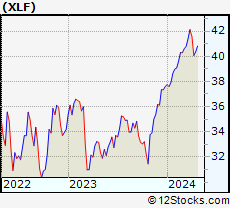

| Performance of Income Opportunity Realty Investors, Inc. vs Financials ETF | RELATIVE PERFORMANCE OF Income Opportunity Realty Investors, Inc. Vs Financials Sector | |||

| Let us compare apples to apples and compare performance of IOR with its sector ETF (contains basket of stocks of same sector) XLF [Financial SPDR] ? | ||||

| Symbol | Day Change | Week Change | Year-to-Date Change | |

| XLF | -0.02 % | 1.83 % | 9.36 % | |

| IOR | -3.09% | 0.02% | 26.59% | |

IOR Chart |  Financials Chart | |||

| Year to date, IOR is outperforming Financials sector by 17.23% | ||||

| This week, IOR is underperforming Financials sector by -1.81% | ||||

List Of ETF Funds Related To Income Opportunity Realty Investors, Inc.

The table below shows ETFs (Exchange Traded Funds) similar to Income Opportunity Realty Investors, Inc., i.e, from same sector along with year-to-date (YTD), weekly & daily performaces for comparison. Usually, ETFs and associated stocks from similar sector tend to move together but companies that have innovative products, services or good management tend to outperform. Move mouse or cursor over ETF symbol to view short-term technical chart and over ETF name to view long term chart. Click on  to add ETF symbol to your watchlist and to add ETF symbol to your watchlist and  to view watchlist. to view watchlist. | |||||||

| Ticker | Stock Name | Watchlist | Category | Recent Price | Change % | Weekly Change% | YTD Change% |

| DRN | Real Estate 3X Shares |   | Financials | 7.71 | 0.92 | 6.2 | -27.4% |

| FAS | Financial Bull 3X Shares |   | Financials | 103.20 | -0.35 | 5.38 | 24.86% |

| URE | ProShares Real Estate |   | Financials | 52.24 | 1.05 | 4.27 | -17.88% |

| UYG | ProShares Ultra Financials |   | Financials | 64.74 | 0.00 | 3.68 | 17.28% |

| XLF | Financial SPDR |   | Financials | 41.12 | -0.02 | 1.83 | 9.36% |

| DRV | Real Estate Bear 3X Shares |   | Financials | 43.78 | -1.04 | -5.83 | 27.38% |

| FAZ | Financial Bear 3X Shares |   | Financials | 10.61 | 0.28 | -5.27 | -22.38% |

| SRS | ProShares UltraShort Real Estate |   | Financials | 16.99 | -0.64 | -3.9 | 19.02% |

| SKF | ProShares UltraShort Financials |   | Financials | 12.49 | 0.32 | -3.25 | -15.1% |

| RWX | streetTRACKS Intl Real Estate |   | Financials | 24.86 | -1.27 | 1.22 | -8.9% |

| VNQ | Vanguard REIT VIPERs |   | Financials | 80.58 | 0.19 | 2 | -8.8% |

| KIE | streetTRACKS Insurance |   | Financials | 49.67 | -0.16 | 1.2 | 9.84% |

| KBE | streetTRACKS Bank ETF |   | Financials | 45.96 | 0.70 | 3.49 | -0.13% |

| IYR | iShares US Real Estate |   | Financials | 83.61 | 0.31 | 1.98 | -8.53% |

| IAI | iShares U.S. Brokers |   | Financials | 112.90 | -0.18 | 1.68 | 4.03% |

| PSP | PowerShares Private Equity |   | Financials | 63.62 | -0.85 | 2.41 | 2.28% |

| PGF | PowerShares Financial Preferred |   | Financials | 14.73 | 0.07 | 1.38 | 1.03% |

| KRE | Regional Bank SPDR |   | Financials | 49.01 | 0.57 | 3.57 | -6.52% |

| RWR | streetTRACKS REIT |   | Financials | 88.44 | -0.06 | 1.83 | -7.22% |

| IYF | iShares US Financial Sector |   | Financials | 92.96 | -0.20 | 1.82 | 8.84% |

| ICF | iShares Realty |   | Financials | 53.86 | 0.11 | 1.66 | -8.29% |

| IAT | iShares U.S. Regional Banks |   | Financials | 42.21 | 0.76 | 3.61 | 0.88% |

| WPS | iShares S&P World ex-U.S. Property Index Fund |   | Financials | 26.97 | -1.07 | 1.45 | -5.91% |

| VFH | Vanguard Financials VIPERs |   | Financials | 99.72 | -0.10 | 2.02 | 8.09% |

| KCE | streetTRACKS Capital Markets |   | Financials | 108.17 | 0.35 | 3.03 | 6.08% |

| IYG | iShares US Financial Svcs |   | Financials | 64.91 | 0.05 | 2.35 | 8.66% |

| IXG | iShares Global Financials |   | Financials | 84.46 | -0.22 | 1.93 | 7.49% |

| IAK | iShares U.S. Insurance |   | Financials | 113.17 | -0.53 | 0.41 | 13.03% |

|

Get the most comprehensive stock market coverage daily at 12Stocks.com ➞ Best Stocks Today ➞ Best Stocks Weekly ➞ Best Stocks Year-to-Date ➞ Best Stocks Trends ➞  Best Stocks Today 12Stocks.com Best Nasdaq Stocks ➞ Best S&P 500 Stocks ➞ Best Tech Stocks ➞ Best Biotech Stocks ➞ |

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Get Best Performing Stocks, Daily Market Trends & Insight

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dow Stocks With Best Current Trends [0-bearish to 100-bullish]: Coca-Cola [100], Procter & Gamble[100], Chevron [100], American Express[100], Goldman Sachs[100], Exxon Mobil[76], Chase[70], Walt Disney[68], Caterpillar [68], [67] Best S&P 500 Stocks Year-to-Date Update:

NVIDIA [60.89%], Constellation Energy[59.4%], NRG Energy[40.44%], Meta Platforms[39.4%], Targa Resources[34.57%], Marathon [34.23%], Progressive [33.22%], Western Digital[32.81%], Eaton [32.38%], Diamondback Energy[32.34%] Best Nasdaq 100 Stocks Weekly Update:

MongoDB [12.82%], Pinduoduo [12.39%], Microchip [11.02%], Tesla [10.26%], Texas [9.48%], NXP Semiconductors[9.26%], CoStar [9.13%], QQQ[8.55%], Trade Desk[8.4%], ON Semiconductor[7.94%] Today's Stock Market In A Nutshell:China [1.9%], Emerging Markets [0.4%], US Dollar [0.1%], US Mid Cap [0%], Euro [-0%], US Large Cap [-0.1%], Gold [-0.2%], Bonds [-0.3%], Oil [-0.4%], US Small Cap [-0.5%], Europe [-0.5%],

NVIDIA [60.89%], Constellation Energy[59.4%], NRG Energy[40.44%], Meta Platforms[39.4%], Targa Resources[34.57%], Marathon [34.23%], Progressive [33.22%], Western Digital[32.81%], Eaton [32.38%], Diamondback Energy[32.34%] Best Nasdaq 100 Stocks Weekly Update:

MongoDB [12.82%], Pinduoduo [12.39%], Microchip [11.02%], Tesla [10.26%], Texas [9.48%], NXP Semiconductors[9.26%], CoStar [9.13%], QQQ[8.55%], Trade Desk[8.4%], ON Semiconductor[7.94%] Today's Stock Market In A Nutshell:China [1.9%], Emerging Markets [0.4%], US Dollar [0.1%], US Mid Cap [0%], Euro [-0%], US Large Cap [-0.1%], Gold [-0.2%], Bonds [-0.3%], Oil [-0.4%], US Small Cap [-0.5%], Europe [-0.5%],

Login Sign Up

Login Sign Up