Stocks with best trends & most momentum Starts at just $9.99/Mo Subscribe ➞

| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks |

|

How does stock market work? Why do stock prices go up & down? |

| Subu Vdaygiri Technical Stragiest 12Stocks.com |

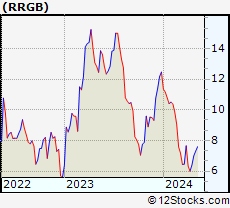

Let us take a simple example. You decide to start a hamburger restaurant and invest $50,000 of your own money. Your homestyle hamburger takes off and profits start rolling in. You want to start another restaurant to expand your business. To get funds for the new shop, you decide to issue 10 shares for your overall business (so each share represents 10% worth of your business).

Let us take a simple example. You decide to start a hamburger restaurant and invest $50,000 of your own money. Your homestyle hamburger takes off and profits start rolling in. You want to start another restaurant to expand your business. To get funds for the new shop, you decide to issue 10 shares for your overall business (so each share represents 10% worth of your business).

Four of your friends see that your restaurant business is doing great and decide to invest. So each friend buys one share (i.e 10 % stake of your business) for $10,000 (so now your company is worth $100,000). You keep six shares for yourself giving you 60% stake in the company. Both your restaurants do really great business.

It is a year since your friends invested. Now, one of them wants to sell his one share as he needs money to buy a motorboat. Another friend of yours decides to buy that one share as he notices that your restaurants are always full of people. He buys that one share i.e 10% stake for $15000 as you now have two well established restaurants (so now your company is worth $150, 000).

It is a year since your friends invested. Now, one of them wants to sell his one share as he needs money to buy a motorboat. Another friend of yours decides to buy that one share as he notices that your restaurants are always full of people. He buys that one share i.e 10% stake for $15000 as you now have two well established restaurants (so now your company is worth $150, 000).

Then your worst nightmare comes true. There is a mad cow disease scare. On top of it there are rumors that "Five Boys Burgers" will open up their shop right opposite one of yours. Your business plummets. Now, one of your friends wants out as he sees plummeting profits in the future. In absolute panic that your restaurants might go out of business, he sells his one share i.e 10% stake for just $6,000. Another friend of yours decides to buy that one share for $6,000 as he feels that your business is undervalued. He feels mad cow disease scare is temporary and folks who like your homestyle burgers will sooner or later come back.

And he is correct! Based on lab results, the mad cow disease scare proves to be false. Your profits are back and even more folks come as the neighborhood becomes popular for great burgers. Folks coming to Five Boys see your restaurant and decide to check it out too. You are making money hand over fist. Your friend who bought that share for $6,000 now sells it for $18,000 !

So the share prices of your company has gone up and down - sometimes based on fact and sometimes on rumors. The share price of your company when it went "public" (when you allowed your friends to invest in your business) was $10,000 per share. As your business expanded successfully, the share prices soared to $15,000 per share. Then there were rumors and new competition and your share price plummeted to $6,000 per share. When the rumors subsided and profits came back along with new customers, the share price immediately soared to new heights of $18,000 per share.

So the share prices of your company has gone up and down - sometimes based on fact and sometimes on rumors. The share price of your company when it went "public" (when you allowed your friends to invest in your business) was $10,000 per share. As your business expanded successfully, the share prices soared to $15,000 per share. Then there were rumors and new competition and your share price plummeted to $6,000 per share. When the rumors subsided and profits came back along with new customers, the share price immediately soared to new heights of $18,000 per share.

Stock market is basically this but with millions of players trading shares of a company everyday. The prices of the shares go up and down based on perceived value of business based on multitude of factors (like interest rates, govt changes, new products, competitors, gas prices, etc). But in essence , whether it is AAPL (Apple Computer) or your burger restaurant, profits (or future profits) drive the share prices (value) of your business over long term. The price of the shares at any given point during the day may vary by perceptions, emotions and needs of your shareholders.

Stock market is basically this but with millions of players trading shares of a company everyday. The prices of the shares go up and down based on perceived value of business based on multitude of factors (like interest rates, govt changes, new products, competitors, gas prices, etc). But in essence , whether it is AAPL (Apple Computer) or your burger restaurant, profits (or future profits) drive the share prices (value) of your business over long term. The price of the shares at any given point during the day may vary by perceptions, emotions and needs of your shareholders.

You can also read this article on Quora.com where Subu Vdaygiri answers stock market related questions.

Return to Home Page

Best Performing Stocks of 2024 Across Global Stock Markets

|

© 2014 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

Login Sign Up

Login Sign Up