Stocks with best trends & most momentum Starts at just $9.99/Mo Subscribe ➞

| Terms & Conditions | Follow @DozenStocks | 12Stocks.com - Best Performing Stocks |

|

Best Dividend Stocks & ETFs

|

|

| Related Dividend Sector Pages: Technology, Nasdaq 100 & Web/Internet Stocks |

| ||||||||||||||||||

| Quick Read: Best Dividend Stocks List By Performances & Trends: Daily, Weekly, Year-to-Date, Market Cap (Size) & Technical Trends | ||||||||||||||||||

| Best Dividend Stocks Views: Quick Browse View, Summary View and Slide Show View | ||||||||||||||||||

| ||||||||||||||||||

| Dividend Index in Brief | ||||||||||||||||||

| Year-to-date Dividend is underperforming market by -2.14%. | ||||||||||||||||||

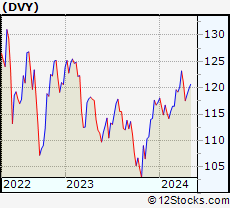

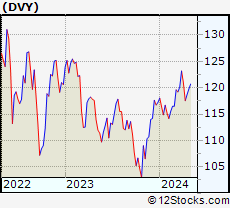

| Market Trend Chart View | ||||||||||||||||||

|

||||||||||||||||||

| Year To Date Performance: 1.24 % | ||||||||||||||||||

| Weekly Performance: 0.96 % | ||||||||||||||||||

| Daily Performance: 1.53 % | ||||||||||||||||||

| 12Stocks.com Short Term Trend Analysis for DVY | ||||||||||||||||||

| 68 | ||||||||||||||||||

| The current technical trend score is 68 in a scale where 0 is bearish and 100 is bullish. The trend score in the session before was 68. Trend score updated daily. Not to be used for investing. | ||||||||||||||||||

| 12Stocks.com: Investing in Dividend Index with Stocks | |

|

The following table helps investors and traders sort through current performance and trends (as measured by market intelligence score) of various

stocks in the Dividend Index. Quick View: Move mouse or cursor over stock symbol (ticker) to view short-term technical chart and over stock name to view long term chart. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. to view watchlist. Click on any ticker or stock name for detailed market intelligence report for that stock. |

12Stocks.com Performance of Stocks in Dividend Index

| Ticker | Stock Name | Watchlist | Category | Recent Price | Market Intelligence Score | Change % | Weekly Change% |

| AGL | agilon health, inc. |   | Medical Care Facilities | 5.72 | 59 | 9.06% | 15.56% |

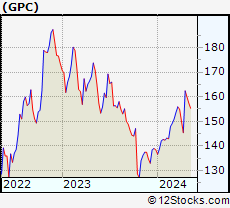

| GPC | Genuine Parts Company |   | Auto Parts Stores | 162.39 | 100 | 1.35% | 11.70% |

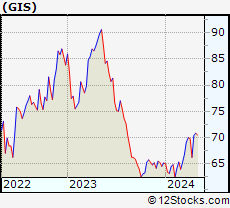

| GIS | General Mills, Inc. |   | Processed & Packaged Goods | 70.42 | 100 | 1.93% | 6.37% |

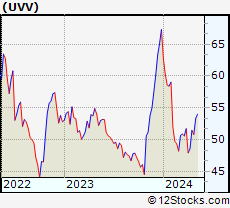

| UVV | Universal Corporation |   | Tobacco Products, Other | 51.46 | 49 | 1.90% | 5.99% |

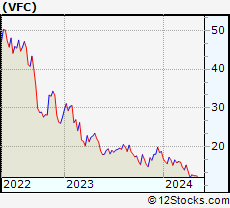

| VFC | V.F. Corporation |   | Textile - Apparel Clothing | 12.83 | 37 | 1.26% | 5.95% |

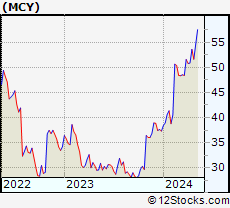

| MCY | Mercury General Corporation |   | Property & Casualty Insurance | 53.63 | 88 | 1.82% | 5.36% |

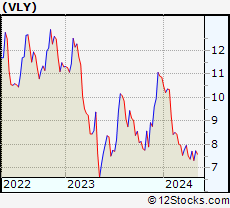

| VLY | Valley National Bancorp |   | Regional - Northeast Banks | 7.70 | 42 | 5.34% | 4.34% |

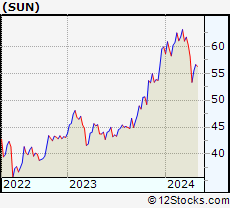

| SUN | Sunoco LP |   | Oil & Gas Refining & Marketing | 55.50 | 32 | 2.08% | 4.03% |

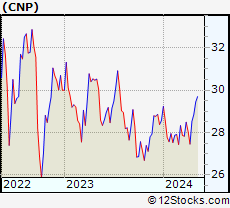

| CNP | CenterPoint Energy, Inc. |   | Gas Utilities | 28.53 | 93 | 2.08% | 3.90% |

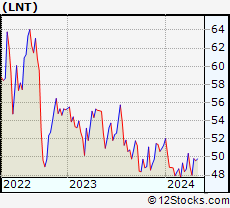

| LNT | Alliant Energy Corporation |   | Electric Utilities | 49.83 | 78 | 2.03% | 3.81% |

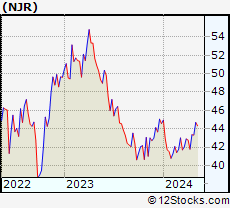

| NJR | New Jersey Resources Corporation |   | Gas Utilities | 43.36 | 93 | 2.77% | 3.76% |

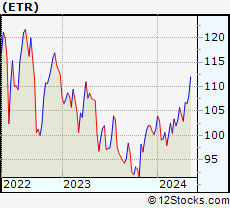

| ETR | Entergy Corporation |   | Electric Utilities | 106.77 | 100 | 2.91% | 3.75% |

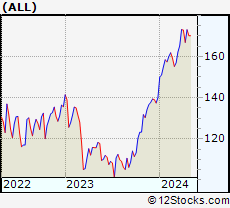

| ALL | The Allstate Corporation |   | Property & Casualty Insurance | 172.96 | 76 | 2.28% | 3.69% |

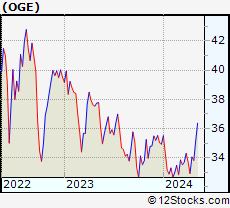

| OGE | OGE Energy Corp. |   | Electric Utilities | 34.05 | 78 | 2.71% | 3.43% |

| LEG | Leggett & Platt, Incorporated |   | Home Furnishings & Fixtures | 18.26 | 52 | 3.28% | 3.40% |

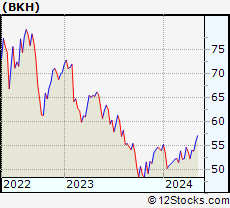

| BKH | Black Hills Corporation |   | Electric Utilities | 54.00 | 78 | 2.94% | 3.37% |

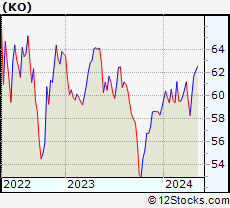

| KO | The Coca-Cola Company |   | Beverages - Soft Drinks | 60.17 | 85 | 2.14% | 3.24% |

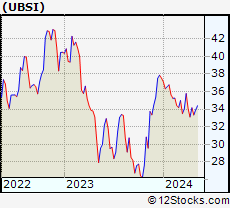

| UBSI | United Bankshares, Inc. |   | Regional - Mid-Atlantic Banks | 34.14 | 52 | 3.08% | 3.08% |

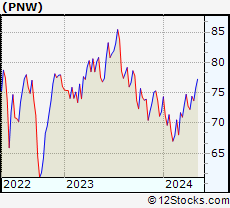

| PNW | Pinnacle West Capital Corporation |   | Electric Utilities | 74.40 | 86 | 1.96% | 2.99% |

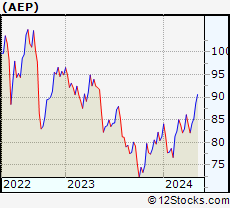

| AEP | American Electric Power Company, Inc. |   | Electric Utilities | 84.23 | 68 | 2.02% | 2.59% |

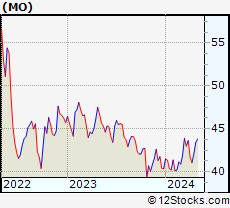

| MO | Altria Group, Inc. |   | Cigarettes | 42.09 | 68 | 1.91% | 2.53% |

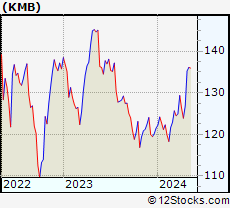

| KMB | Kimberly-Clark Corporation |   | Personal Products | 126.83 | 73 | 0.97% | 2.37% |

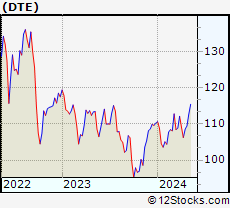

| DTE | DTE Energy Company |   | Electric Utilities | 108.57 | 68 | 1.96% | 2.18% |

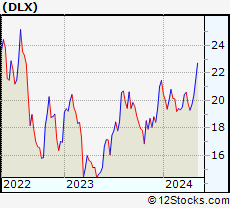

| DLX | Deluxe Corporation |   | Business Services | 19.71 | 63 | 4.01% | 2.12% |

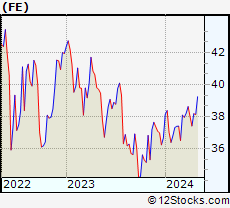

| FE | FirstEnergy Corp. |   | Electric Utilities | 38.17 | 78 | 1.44% | 2.03% |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Detailed Overview Of Dividend Stocks |

| Dividend Technical Overview, Leaders & Laggards, Top Dividend ETF Funds & Detailed Dividend Stocks List, Charts, Trends & More |

| Dividend: Technical Analysis, Trends & YTD Performance | |

DVY Weekly Chart |

|

| Long Term Trend: Very Good | |

| Medium Term Trend: Not Good | |

DVY Daily Chart |

|

| Short Term Trend: Very Good | |

| Overall Trend Score: 68 | |

| YTD Performance: 1.24% | |

| **Trend Scores & Views Are Only For Educational Purposes And Not For Investing | |

| 12Stocks.com: Top Performing Dividend Index Stocks | |

|

|

We try to spot trends by analyzing the performances of various stocks or

components within Dividend Index and try to find best performing

stocks. The movers and shakers. The winners and losers. The top performing Dividend stocks year to date are Mercury General [43.74%], Eaton [25.83%], Nu Holdings [25.66%], Eli Lilly [24.6%], Allstate [23.56%], Caterpillar [19.95%], Genuine Parts [17.25%], General Electric [16.01%], Cinnati Financial [15.94%], Steel Dynamics [15.91%], Waste Management [15.62%]. More Now, more recently, over last week, the top performing Dividend stocks on the move are - agilon health [15.56%], Genuine Parts [11.7%], General Mills [6.37%], Universal [5.99%], V.F [5.95%], Mercury General [5.36%], Valley National [4.34%], Sunoco LP [4.03%], CenterPoint Energy [3.9%], Alliant Energy [3.81%], New Jersey [3.76%]. More The laggards stocks in this index year to date (YTD) are agilon health [-54.78%], V.F [-31.76%], Leggett & Platt [-30.23%], Valley National [-29.1%], Universal [-23.56%], Bank of Hawaii [-19.4%], PPG Industries [-12.47%], Pfizer [-9.69%], Pitney Bowes [-9.32%], United Bankshares [-9.08%], McDonald s [-8.27%]. The best trending Dividend stocks currently are Entergy [2.91%], General Mills [1.93%], Genuine Parts [1.35%], New Jersey [2.77%], CenterPoint Energy [2.08%], NiSource [0.66%], Chevron [1.54%], Mercury General [1.82%], Pinnacle West [1.96%], Coca-Cola [2.14%], General Dynamics [1.17%]. More |

| LEADING DIVIDEND STOCKS | |

| MERCURY GENERAL: 43.74% | |

| EATON : 25.83% | |

| NU HOLDINGS: 25.66% | |

| ELI LILLY: 24.6% | |

| ALLSTATE : 23.56% | |

| CATERPILLAR : 19.95% | |

| GENUINE PARTS: 17.25% | |

| GENERAL ELECTRIC: 16.01% | |

| CINNATI FINANCIAL: 15.94% | |

| STEEL DYNAMICS: 15.91% | |

| 12Stocks.com: Investing in Dividend Index using Exchange Traded Funds | |

|

The following table shows list of key exchange traded funds (ETF) that

help investors track Dividend Index. The following list also includes leveraged ETF funds that track twice or thrice the daily returns of Dividend indices. Short or inverse ETF funds move in the opposite direction to the index they track and are useful during market pullbacks or during bear markets. Quick View: Move mouse or cursor over ETF symbol (ticker) to view short-term technical chart and over ETF name to view long term chart. Click on ticker or stock name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. to view watchlist. |

12Stocks.com List of ETFs that track Dividend Index

| 12Stocks.com: Charts, Trends, Fundamental Data and Performances of Dividend Stocks | |

|

We now take in-depth look at all Dividend stocks including charts, multi-period performances and overall trends (as measured by market intelligence score). One can sort Dividend stocks (click link to choose) by Daily, Weekly and by Year-to-Date performances. Also, one can sort by size of the company or by market capitalization. |

| Select Your Default Chart Type: | |||||

| |||||

Click on stock symbol or name for detailed view. Click on  to add stock symbol to your watchlist and to add stock symbol to your watchlist and  to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. to view watchlist. Quick View: Move mouse or cursor over "Daily" to quickly view daily technical stock chart and over "Weekly" to view weekly technical stock chart. | |||||

| AGL agilon health, inc. |

| Sector: Health Care | |

| SubSector: Medical Care Facilities | |

| MarketCap: 7310 Millions | |

| Recent Price: 5.72 Market Intelligence Score: 59 | |

| Day Percent Change: 9.06% Day Change: 0.47 | |

| Week Change: 15.56% Year-to-date Change: -54.8% | |

| AGL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AGL for Review:   | |

| GPC Genuine Parts Company |

| Sector: Services & Goods | |

| SubSector: Auto Parts Stores | |

| MarketCap: 8605.9 Millions | |

| Recent Price: 162.39 Market Intelligence Score: 100 | |

| Day Percent Change: 1.35% Day Change: 2.16 | |

| Week Change: 11.7% Year-to-date Change: 17.3% | |

| GPC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GPC for Review:   | |

| GIS General Mills, Inc. |

| Sector: Consumer Staples | |

| SubSector: Processed & Packaged Goods | |

| MarketCap: 34131.7 Millions | |

| Recent Price: 70.42 Market Intelligence Score: 100 | |

| Day Percent Change: 1.93% Day Change: 1.33 | |

| Week Change: 6.37% Year-to-date Change: 8.1% | |

| GIS Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save GIS for Review:   | |

| UVV Universal Corporation |

| Sector: Consumer Staples | |

| SubSector: Tobacco Products, Other | |

| MarketCap: 1107.7 Millions | |

| Recent Price: 51.46 Market Intelligence Score: 49 | |

| Day Percent Change: 1.90% Day Change: 0.96 | |

| Week Change: 5.99% Year-to-date Change: -23.6% | |

| UVV Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save UVV for Review:   | |

| VFC V.F. Corporation |

| Sector: Consumer Staples | |

| SubSector: Textile - Apparel Clothing | |

| MarketCap: 23607.5 Millions | |

| Recent Price: 12.83 Market Intelligence Score: 37 | |

| Day Percent Change: 1.26% Day Change: 0.16 | |

| Week Change: 5.95% Year-to-date Change: -31.8% | |

| VFC Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VFC for Review:   | |

| MCY Mercury General Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 2122.12 Millions | |

| Recent Price: 53.63 Market Intelligence Score: 88 | |

| Day Percent Change: 1.82% Day Change: 0.96 | |

| Week Change: 5.36% Year-to-date Change: 43.7% | |

| MCY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save MCY for Review:   | |

| VLY Valley National Bancorp |

| Sector: Financials | |

| SubSector: Regional - Northeast Banks | |

| MarketCap: 2843.09 Millions | |

| Recent Price: 7.70 Market Intelligence Score: 42 | |

| Day Percent Change: 5.34% Day Change: 0.39 | |

| Week Change: 4.34% Year-to-date Change: -29.1% | |

| VLY Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save VLY for Review:   | |

| SUN Sunoco LP |

| Sector: Energy | |

| SubSector: Oil & Gas Refining & Marketing | |

| MarketCap: 1656.34 Millions | |

| Recent Price: 55.50 Market Intelligence Score: 32 | |

| Day Percent Change: 2.08% Day Change: 1.13 | |

| Week Change: 4.03% Year-to-date Change: -7.4% | |

| SUN Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save SUN for Review:   | |

| CNP CenterPoint Energy, Inc. |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 7444.07 Millions | |

| Recent Price: 28.53 Market Intelligence Score: 93 | |

| Day Percent Change: 2.08% Day Change: 0.58 | |

| Week Change: 3.9% Year-to-date Change: -0.1% | |

| CNP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save CNP for Review:   | |

| LNT Alliant Energy Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 10678.4 Millions | |

| Recent Price: 49.83 Market Intelligence Score: 78 | |

| Day Percent Change: 2.03% Day Change: 0.99 | |

| Week Change: 3.81% Year-to-date Change: -2.9% | |

| LNT Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save LNT for Review:   | |

| NJR New Jersey Resources Corporation |

| Sector: Utilities | |

| SubSector: Gas Utilities | |

| MarketCap: 3320.27 Millions | |

| Recent Price: 43.36 Market Intelligence Score: 93 | |

| Day Percent Change: 2.77% Day Change: 1.17 | |

| Week Change: 3.76% Year-to-date Change: -2.7% | |

| NJR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save NJR for Review:   | |

| ETR Entergy Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 17545 Millions | |

| Recent Price: 106.77 Market Intelligence Score: 100 | |

| Day Percent Change: 2.91% Day Change: 3.02 | |

| Week Change: 3.75% Year-to-date Change: 5.5% | |

| ETR Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save ETR for Review:   | |

| ALL The Allstate Corporation |

| Sector: Financials | |

| SubSector: Property & Casualty Insurance | |

| MarketCap: 25916.6 Millions | |

| Recent Price: 172.96 Market Intelligence Score: 76 | |

| Day Percent Change: 2.28% Day Change: 3.85 | |

| Week Change: 3.69% Year-to-date Change: 23.6% | |

| ALL Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save ALL for Review:   | |

| OGE OGE Energy Corp. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 5454.34 Millions | |

| Recent Price: 34.05 Market Intelligence Score: 78 | |

| Day Percent Change: 2.71% Day Change: 0.90 | |

| Week Change: 3.43% Year-to-date Change: -2.5% | |

| OGE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save OGE for Review:   | |

| LEG Leggett & Platt, Incorporated |

| Sector: Consumer Staples | |

| SubSector: Home Furnishings & Fixtures | |

| MarketCap: 3634.45 Millions | |

| Recent Price: 18.26 Market Intelligence Score: 52 | |

| Day Percent Change: 3.28% Day Change: 0.58 | |

| Week Change: 3.4% Year-to-date Change: -30.2% | |

| LEG Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save LEG for Review:   | |

| BKH Black Hills Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 3666.94 Millions | |

| Recent Price: 54.00 Market Intelligence Score: 78 | |

| Day Percent Change: 2.94% Day Change: 1.54 | |

| Week Change: 3.37% Year-to-date Change: 0.1% | |

| BKH Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save BKH for Review:   | |

| KO The Coca-Cola Company |

| Sector: Consumer Staples | |

| SubSector: Beverages - Soft Drinks | |

| MarketCap: 182046 Millions | |

| Recent Price: 60.17 Market Intelligence Score: 85 | |

| Day Percent Change: 2.14% Day Change: 1.26 | |

| Week Change: 3.24% Year-to-date Change: 2.1% | |

| KO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save KO for Review:   | |

| UBSI United Bankshares, Inc. |

| Sector: Financials | |

| SubSector: Regional - Mid-Atlantic Banks | |

| MarketCap: 2286.79 Millions | |

| Recent Price: 34.14 Market Intelligence Score: 52 | |

| Day Percent Change: 3.08% Day Change: 1.02 | |

| Week Change: 3.08% Year-to-date Change: -9.1% | |

| UBSI Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save UBSI for Review:   | |

| PNW Pinnacle West Capital Corporation |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 8240.24 Millions | |

| Recent Price: 74.40 Market Intelligence Score: 86 | |

| Day Percent Change: 1.96% Day Change: 1.43 | |

| Week Change: 2.99% Year-to-date Change: 3.6% | |

| PNW Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save PNW for Review:   | |

| AEP American Electric Power Company, Inc. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 38380 Millions | |

| Recent Price: 84.23 Market Intelligence Score: 68 | |

| Day Percent Change: 2.02% Day Change: 1.67 | |

| Week Change: 2.59% Year-to-date Change: 3.7% | |

| AEP Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save AEP for Review:   | |

| MO Altria Group, Inc. |

| Sector: Consumer Staples | |

| SubSector: Cigarettes | |

| MarketCap: 70806.3 Millions | |

| Recent Price: 42.09 Market Intelligence Score: 68 | |

| Day Percent Change: 1.91% Day Change: 0.79 | |

| Week Change: 2.53% Year-to-date Change: 4.3% | |

| MO Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save MO for Review:   | |

| KMB Kimberly-Clark Corporation |

| Sector: Consumer Staples | |

| SubSector: Personal Products | |

| MarketCap: 44300.5 Millions | |

| Recent Price: 126.83 Market Intelligence Score: 73 | |

| Day Percent Change: 0.97% Day Change: 1.22 | |

| Week Change: 2.37% Year-to-date Change: 4.4% | |

| KMB Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save KMB for Review:   | |

| DTE DTE Energy Company |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 18218.1 Millions | |

| Recent Price: 108.57 Market Intelligence Score: 68 | |

| Day Percent Change: 1.96% Day Change: 2.09 | |

| Week Change: 2.18% Year-to-date Change: -1.5% | |

| DTE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DTE for Review:   | |

| DLX Deluxe Corporation |

| Sector: Services & Goods | |

| SubSector: Business Services | |

| MarketCap: 1025.82 Millions | |

| Recent Price: 19.71 Market Intelligence Score: 63 | |

| Day Percent Change: 4.01% Day Change: 0.76 | |

| Week Change: 2.12% Year-to-date Change: -8.1% | |

| DLX Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save DLX for Review:   | |

| FE FirstEnergy Corp. |

| Sector: Utilities | |

| SubSector: Electric Utilities | |

| MarketCap: 20754.1 Millions | |

| Recent Price: 38.17 Market Intelligence Score: 78 | |

| Day Percent Change: 1.44% Day Change: 0.54 | |

| Week Change: 2.03% Year-to-date Change: 4.1% | |

| FE Links: Profile News Message Board | |

| Charts:- Daily , Weekly | |

Save FE for Review:   | |

| To view more stocks, click on Next / Previous arrows or select different range: 0 - 25 , 25 - 50 , 50 - 75 , 75 - 100 | ||

| Click To Change The Sort Order: By Market Cap or Company Size Performance: Year-to-date, Week and Day |  |

| Select Chart Type: | ||

|

List of Dividend Stocks

|

|

US Stock Market Performance Year-to-Date: 6% |

View More Stocks In The List

View More Stocks In The List

| Stock | Price | YTD | Week | Day% |

| AGL | 5.72 | -54.8 | 15.6 | 9.1 |

| GPC | 162.39 | 17.3 | 11.7 | 1.4 |

| GIS | 70.42 | 8.1 | 6.4 | 1.9 |

| UVV | 51.46 | -23.6 | 6.0 | 1.9 |

| VFC | 12.83 | -31.8 | 6.0 | 1.3 |

| MCY | 53.63 | 43.7 | 5.4 | 1.8 |

| VLY | 7.70 | -29.1 | 4.3 | 5.3 |

| SUN | 55.50 | -7.4 | 4.0 | 2.1 |

| CNP | 28.53 | -0.1 | 3.9 | 2.1 |

| LNT | 49.83 | -2.9 | 3.8 | 2.0 |

| NJR | 43.36 | -2.7 | 3.8 | 2.8 |

| ETR | 106.77 | 5.5 | 3.8 | 2.9 |

| ALL | 172.96 | 23.6 | 3.7 | 2.3 |

| OGE | 34.05 | -2.5 | 3.4 | 2.7 |

| LEG | 18.26 | -30.2 | 3.4 | 3.3 |

| BKH | 54.00 | 0.1 | 3.4 | 2.9 |

| KO | 60.17 | 2.1 | 3.2 | 2.1 |

| UBSI | 34.14 | -9.1 | 3.1 | 3.1 |

| PNW | 74.40 | 3.6 | 3.0 | 2.0 |

| AEP | 84.23 | 3.7 | 2.6 | 2.0 |

| MO | 42.09 | 4.3 | 2.5 | 1.9 |

| KMB | 126.83 | 4.4 | 2.4 | 1.0 |

| DTE | 108.57 | -1.5 | 2.2 | 2.0 |

| DLX | 19.71 | -8.1 | 2.1 | 4.0 |

| FE | 38.17 | 4.1 | 2.0 | 1.4 |

View More Stocks In The List

View More Stocks In The List

One More Thing ... Get Best Stocks Delivered Daily!

Never Ever Miss A Move With Our Top Ten Stocks Lists

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Find Best Stocks In Any Market - Bull or Bear Market

Take A Peek At Our Top Ten Stocks Lists: Daily, Weekly, Year-to-Date & Top Trends

Dividend Stocks With Best Up Trends [0-bearish to 100-bullish]: Entergy [100], General Mills[100], Genuine Parts[100], New Jersey[93], CenterPoint Energy[93], NiSource [93], Chevron [88], Mercury General[88], Pinnacle West[86], Coca-Cola [85], General Dynamics[83]

Best Dividend Stocks Year-to-Date:

Mercury General[43.74%], Eaton [25.83%], Nu Holdings[25.66%], Eli Lilly[24.6%], Allstate [23.56%], Caterpillar [19.95%], Genuine Parts[17.25%], General Electric[16.01%], Cinnati Financial[15.94%], Steel Dynamics[15.91%], Waste Management[15.62%] Best Dividend Stocks This Week:

agilon health[15.56%], Genuine Parts[11.7%], General Mills[6.37%], Universal [5.99%], V.F [5.95%], Mercury General[5.36%], Valley National[4.34%], Sunoco LP[4.03%], CenterPoint Energy[3.9%], Alliant Energy[3.81%], New Jersey[3.76%] Best Dividend Stocks Daily:

agilon health[9.06%], Valley National[5.34%], Deluxe [4.01%], Trustmark [3.81%], Bank of Hawaii[3.58%], Leggett & Platt[3.28%], United Bankshares[3.08%], Black Hills[2.94%], Entergy [2.91%], F.N.B [2.90%], New Jersey[2.77%]

Mercury General[43.74%], Eaton [25.83%], Nu Holdings[25.66%], Eli Lilly[24.6%], Allstate [23.56%], Caterpillar [19.95%], Genuine Parts[17.25%], General Electric[16.01%], Cinnati Financial[15.94%], Steel Dynamics[15.91%], Waste Management[15.62%] Best Dividend Stocks This Week:

agilon health[15.56%], Genuine Parts[11.7%], General Mills[6.37%], Universal [5.99%], V.F [5.95%], Mercury General[5.36%], Valley National[4.34%], Sunoco LP[4.03%], CenterPoint Energy[3.9%], Alliant Energy[3.81%], New Jersey[3.76%] Best Dividend Stocks Daily:

agilon health[9.06%], Valley National[5.34%], Deluxe [4.01%], Trustmark [3.81%], Bank of Hawaii[3.58%], Leggett & Platt[3.28%], United Bankshares[3.08%], Black Hills[2.94%], Entergy [2.91%], F.N.B [2.90%], New Jersey[2.77%]

© 2024 12Stocks.com Terms & Conditions Privacy Contact Us

All Information Provided Only For Education And Not To Be Used For Investing or Trading. See Terms & Conditions

Login Sign Up

Login Sign Up